Varot 2025 In-Depth Review: Opportunity or Trap?

Executive Summary

Varot Financial Limited, operating out of Hong Kong, positions itself as a trading platform for Forex and CFDs, attracting both novice and experienced traders. However, its unregulated status raises critical concerns regarding the safety of funds and overall trustworthiness. With a minimum deposit requirement ranging from $1,000 to $5,000, the broker appeals primarily to experienced traders who can handle higher risk levels and seek to benefit from high leverage options. This review aims to clarify the advantages and serious drawbacks of trading with Varot Financial, emphasizing the significant risks posed by its lack of regulatory oversight.

While low minimum deposits may attract some traders, the repeated warnings and negative user experiences about withdrawal issues should deter investors who prioritize safety and regulatory compliance. Hence, seasoned traders should approach cautiously, weighing these risks against the potential trading gains available on this platform.

⚠️ Important Risk Advisory & Verification Steps

WARNING: Trading with Varot Financial Limited involves significant risks.

- Unregulated Status: Varot Financial lacks licenses from regulated financial authorities, raising concerns about the protection of your funds.

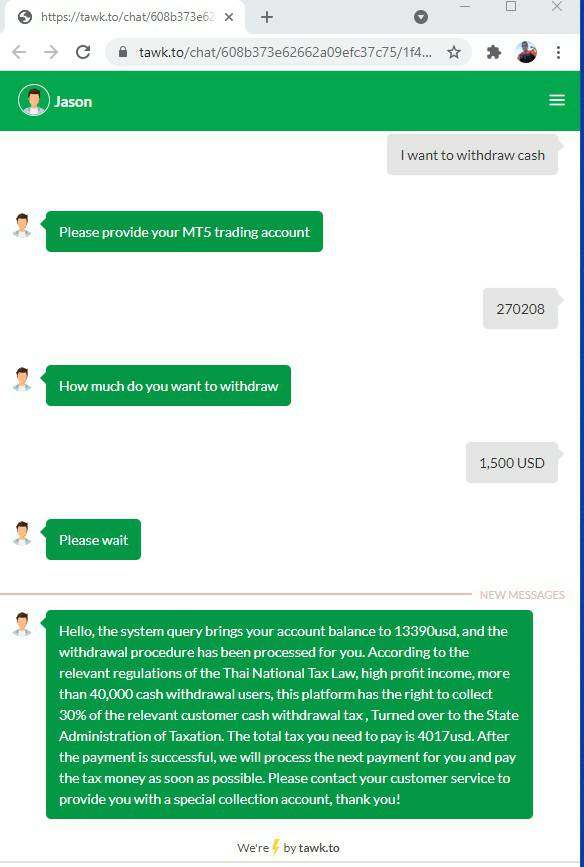

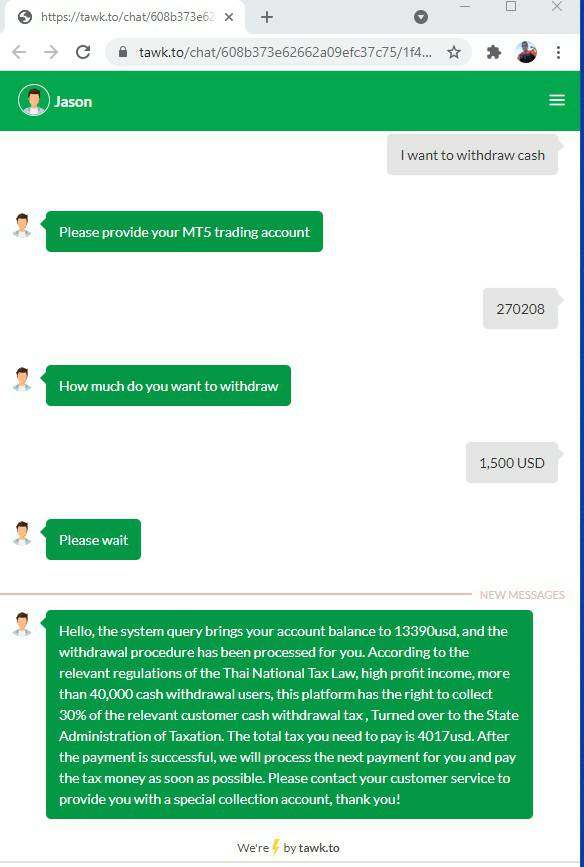

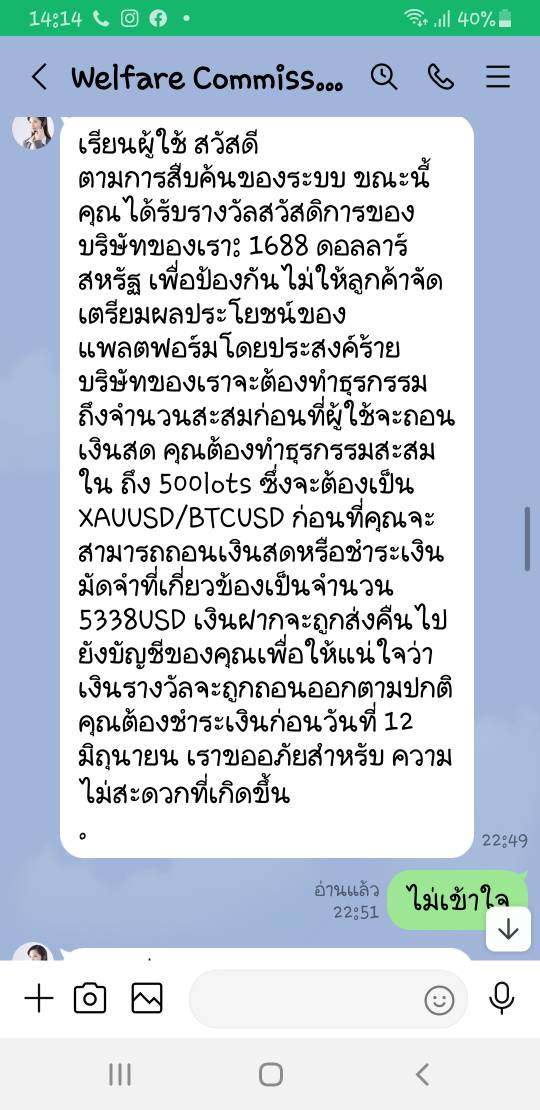

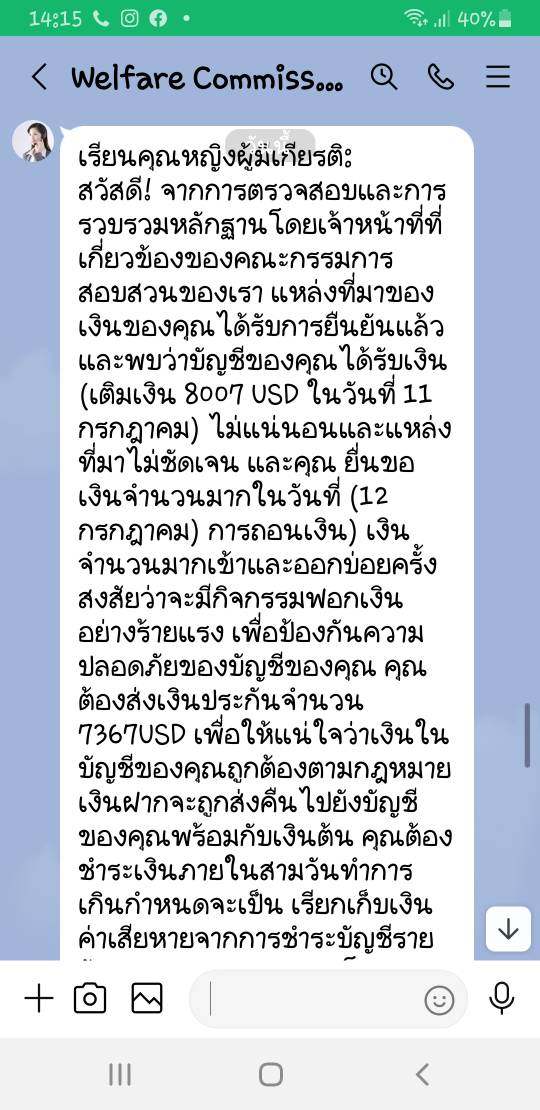

- User Complaints: Numerous negative reviews indicate systemic issues, particularly concerning funds withdrawal and overall transparency.

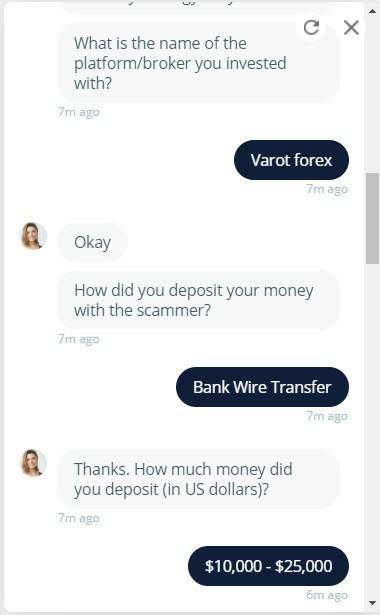

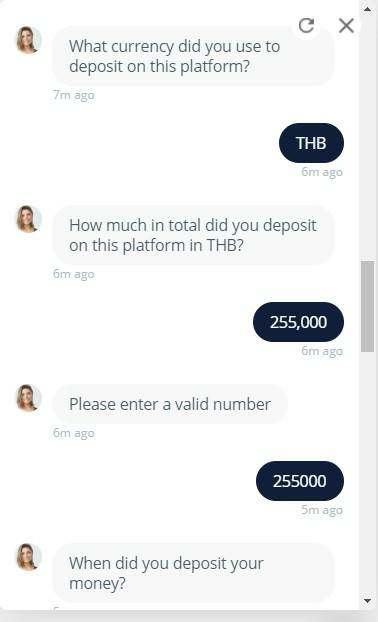

- High Minimum Deposits: With initial deposits ranging from $1,000 to $5,000, this is considerably high compared to other established brokers.

Self-Verification Steps:

- Check Regulatory Status: Visit the websites of recognized regulatory bodies such as the Hong Kong Securities and Futures Commission (SFC) to confirm the broker's legitimacy.

- Research User Experiences: Look for trader reviews and feedback on independent platforms to gain insight into the broker's reputation.

- Look for Licensing Proof: Ensure that brokers provide clear documentation of their operating licenses.

Rating Framework

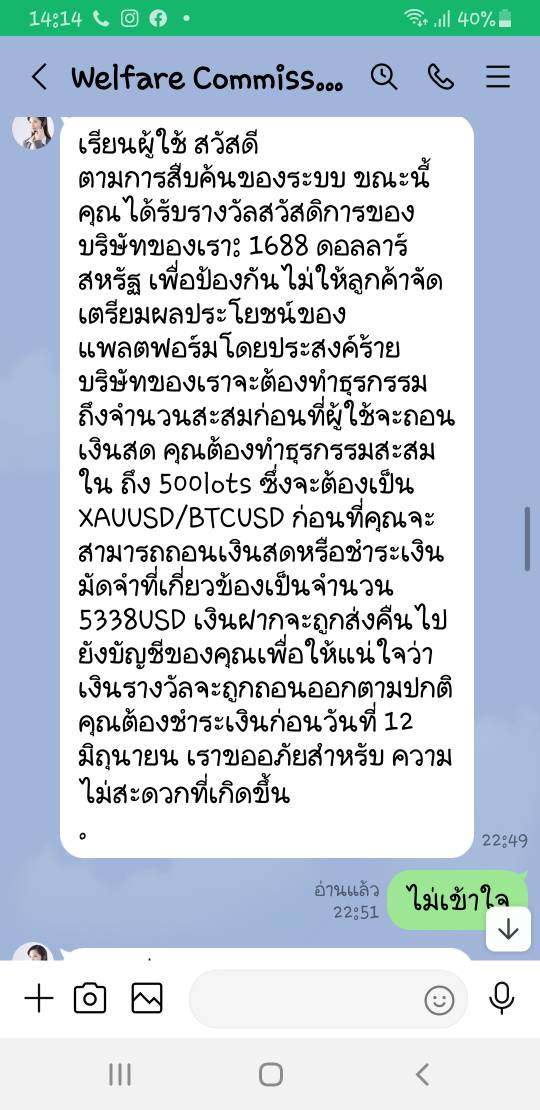

Broker Overview

Company Background and Positioning

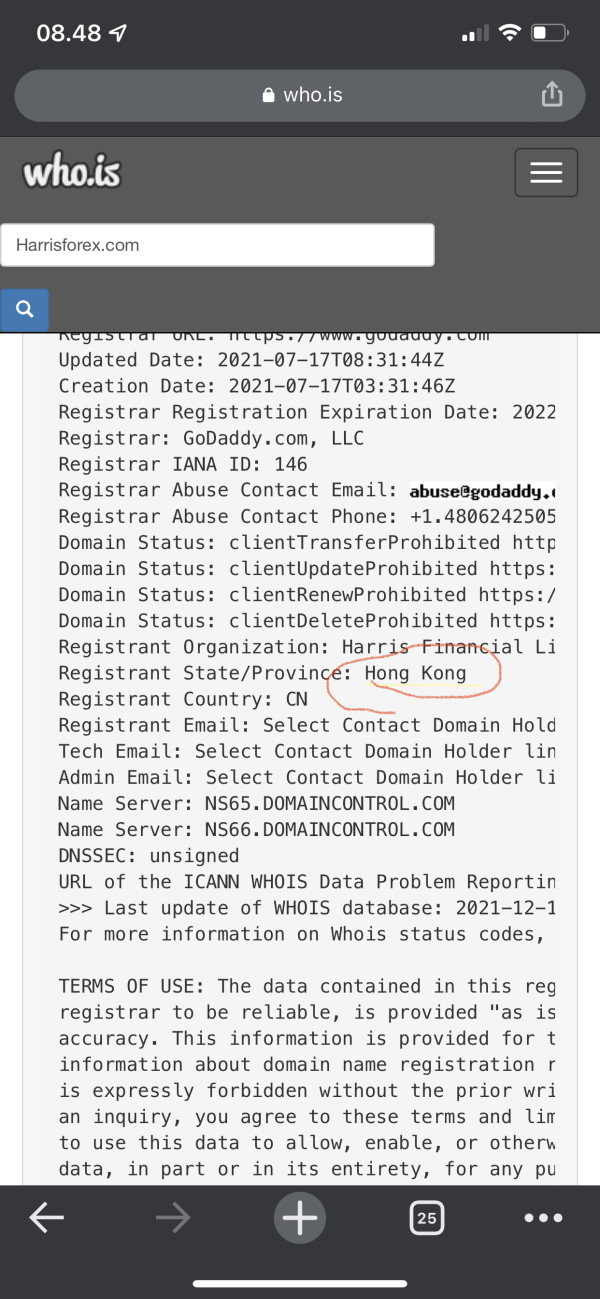

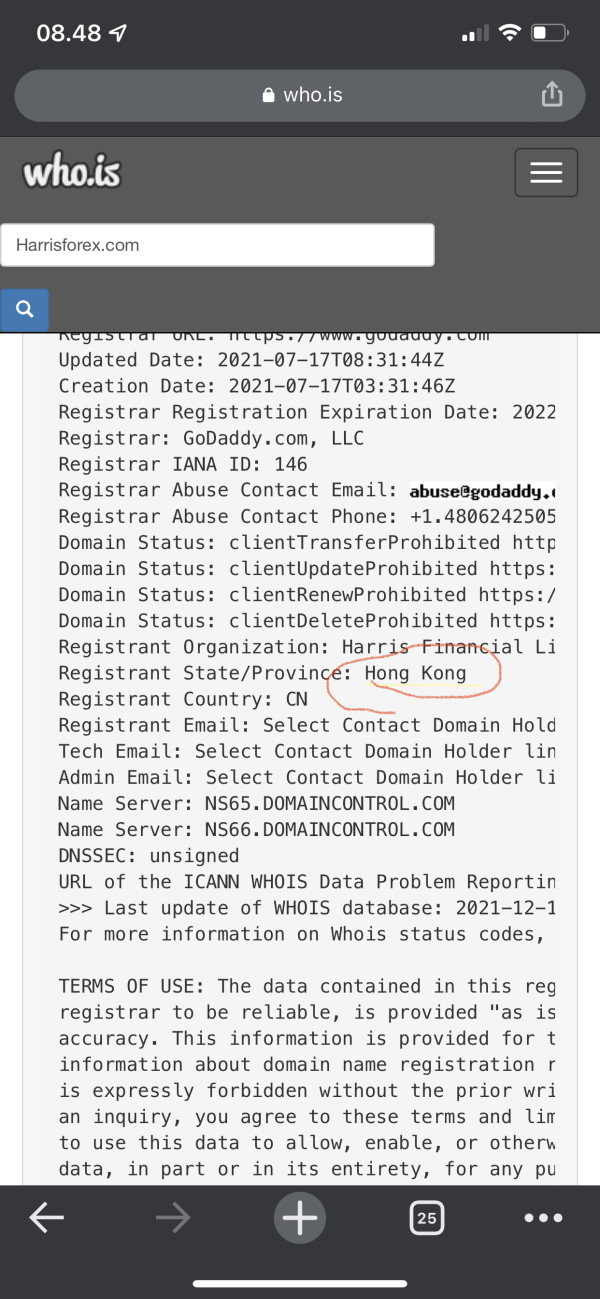

Varot Financial Limited began operations in 2015, claiming its headquarters in Hong Kong. However, essential details such as the identities of the directors and the physical address remain obscured. The lack of transparency regarding its operations is worrisome. Despite offering Forex and CFD trading, the unregulated status suggests that the broker exists in a dubious position, aiming to lure clients with claims of high trade potential while obscuring the inherent risks.

Core Business Overview

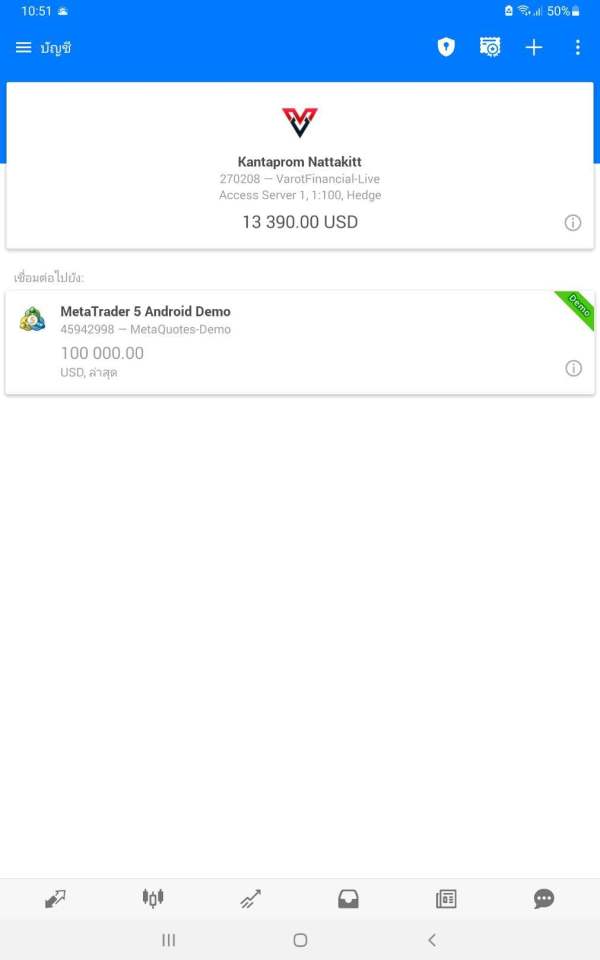

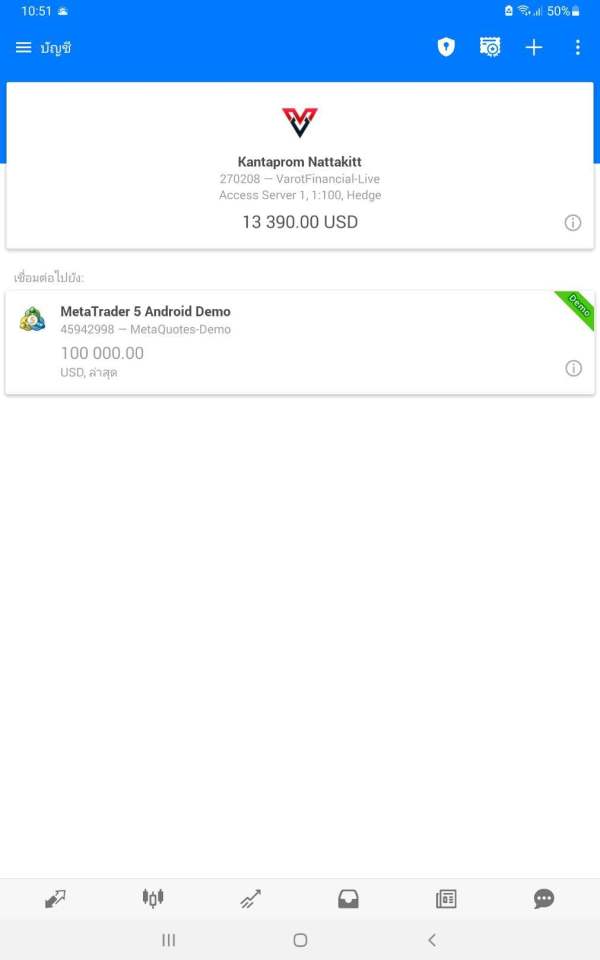

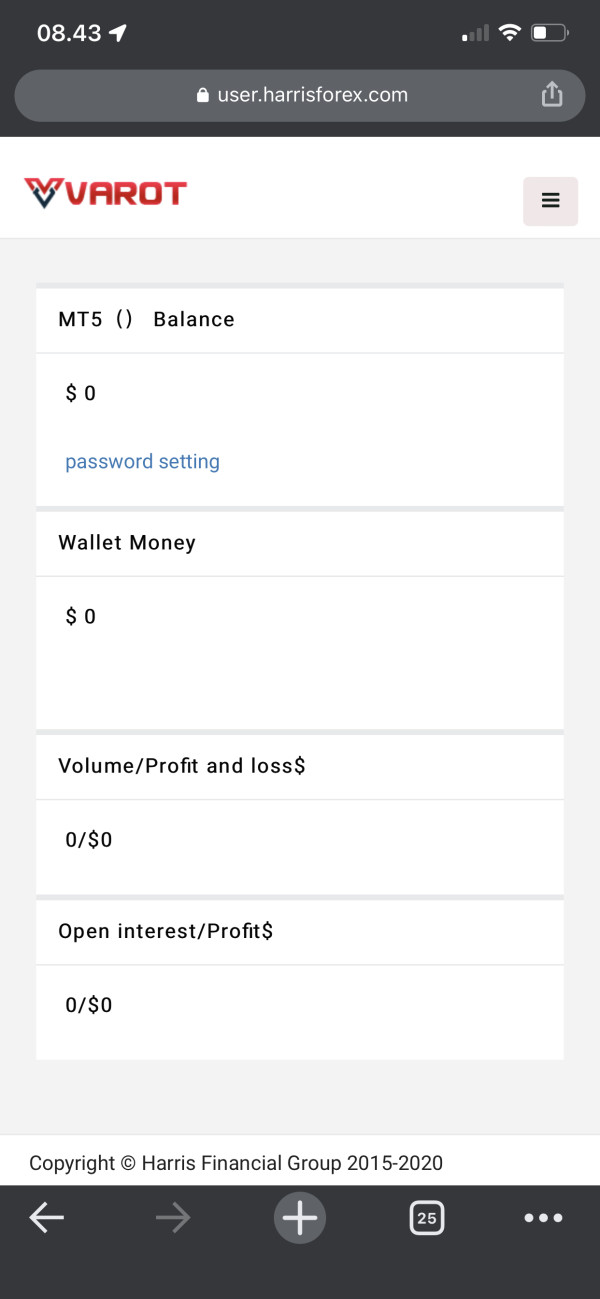

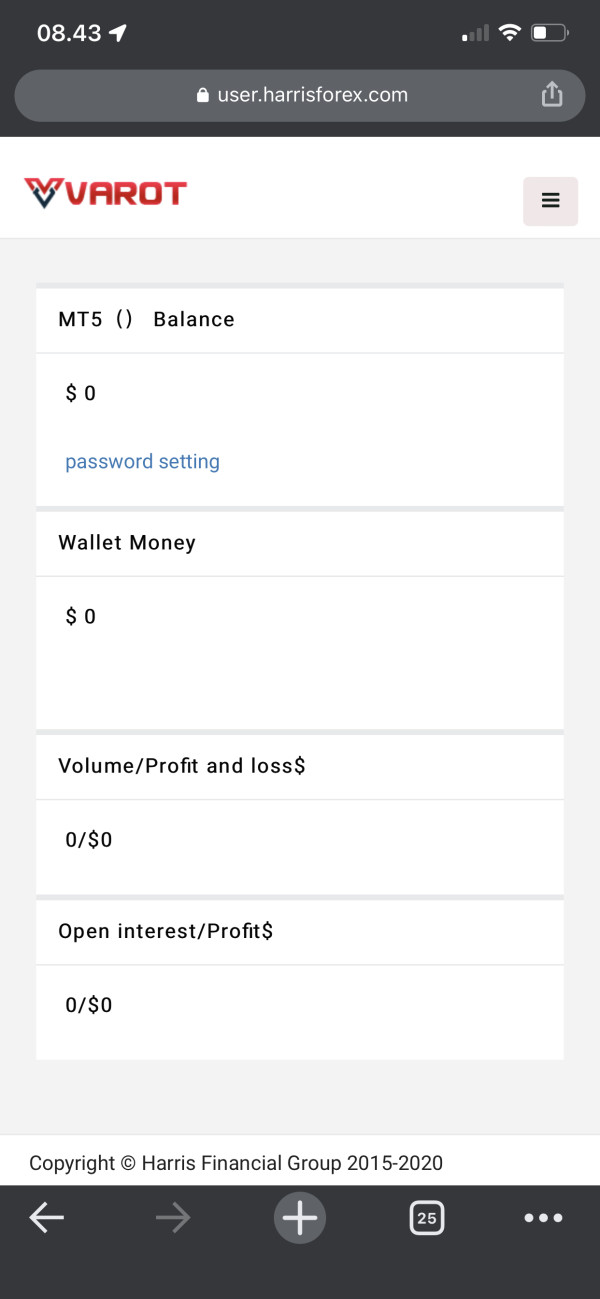

Varot Financial specializes in Forex trading and contracts for difference (CFDs). With a single type of account—the standard account—traders are required to deposit a minimum of $1,000 to access its services. The broker promises leverage of up to 1:200, and the MT5 platform serves as its primary trading software, projecting a modern image in the forex brokerage arena. However, Varot Financial does not provide documentation or mention any affiliations with recognized regulatory bodies, further dulling its credibility.

Quick-Look Details Table

In-depth Analysis of Each Dimension

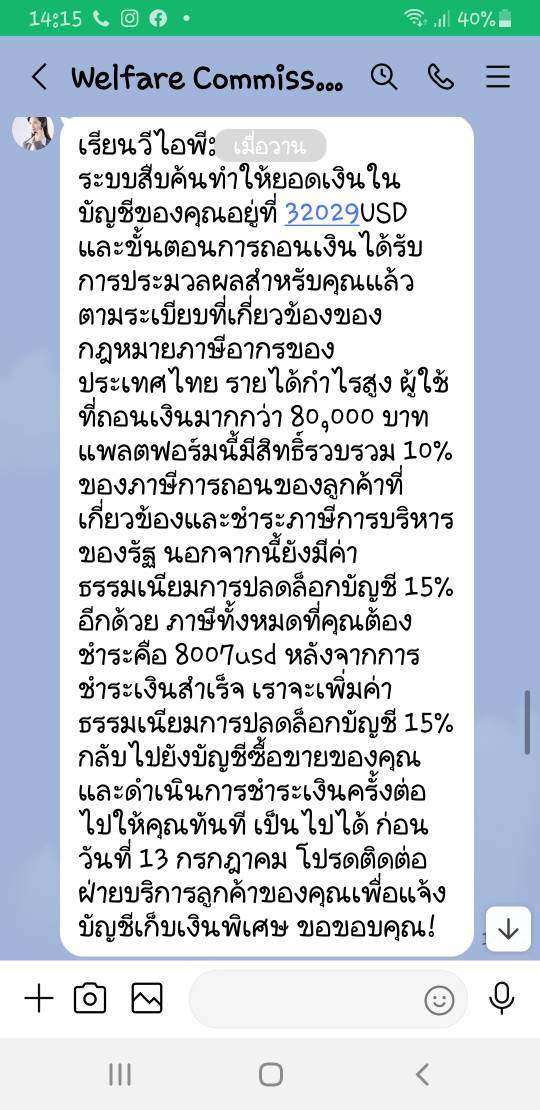

Trustworthiness Analysis

Varot Financial operates without a valid license from a recognized authority, putting traders' funds at high risk. The Hong Kong SFC has officially blacklisted Varot, warning that it falsely claims to possess regulatory approvals. These factors significantly undermine its trustworthiness.

2. User Self-Verification Guide

- Visit the SFC website and access the blacklist section.

- Enter "Varot Financial Limited" into the search function.

- Review the status and any related warnings issued by the SFC.

- Check for any formal complaints filed against the broker through trusted channels.

- Document and save this information for your records.

3. Industry Reputation and Summary

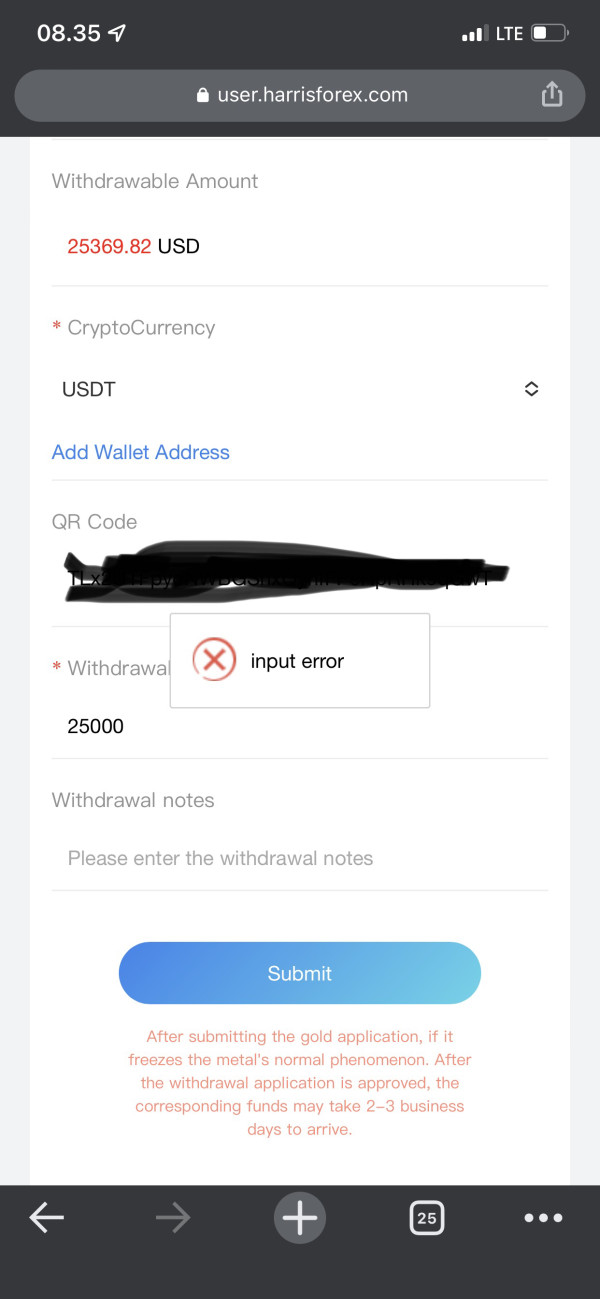

Many users have reported substantial issues with fund withdrawals and poor customer service, indicating an inherent distrust in the operations of Varot Financial.

“We consider it to be an unsafe, unreliable company and we do not recommend it.” (Source Material 1)

Trading Costs Analysis

1. Advantages in Commissions

Varot advertises low commission rates for trading operations, presenting itself as a competitive option for experienced investors.

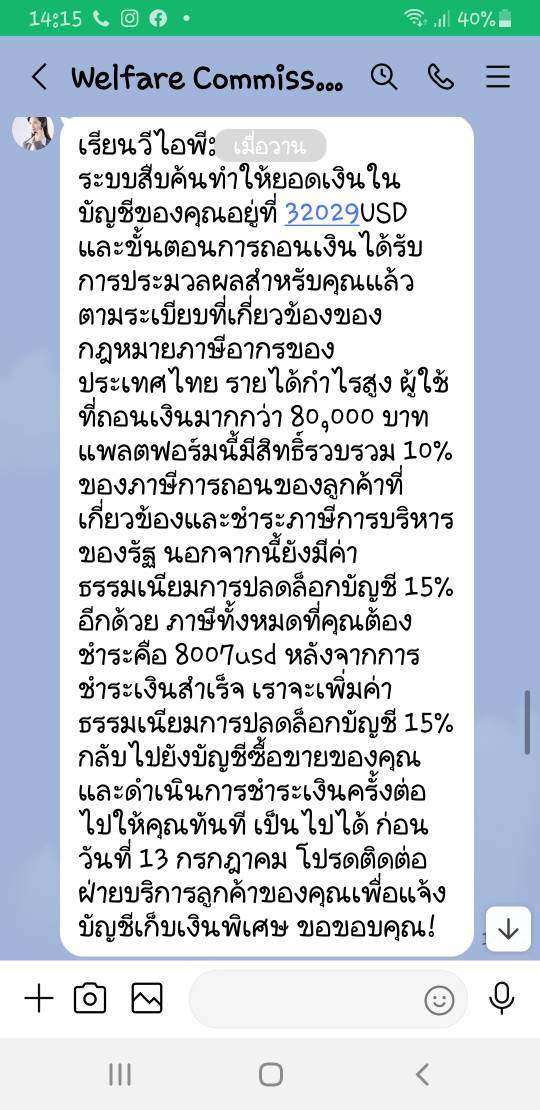

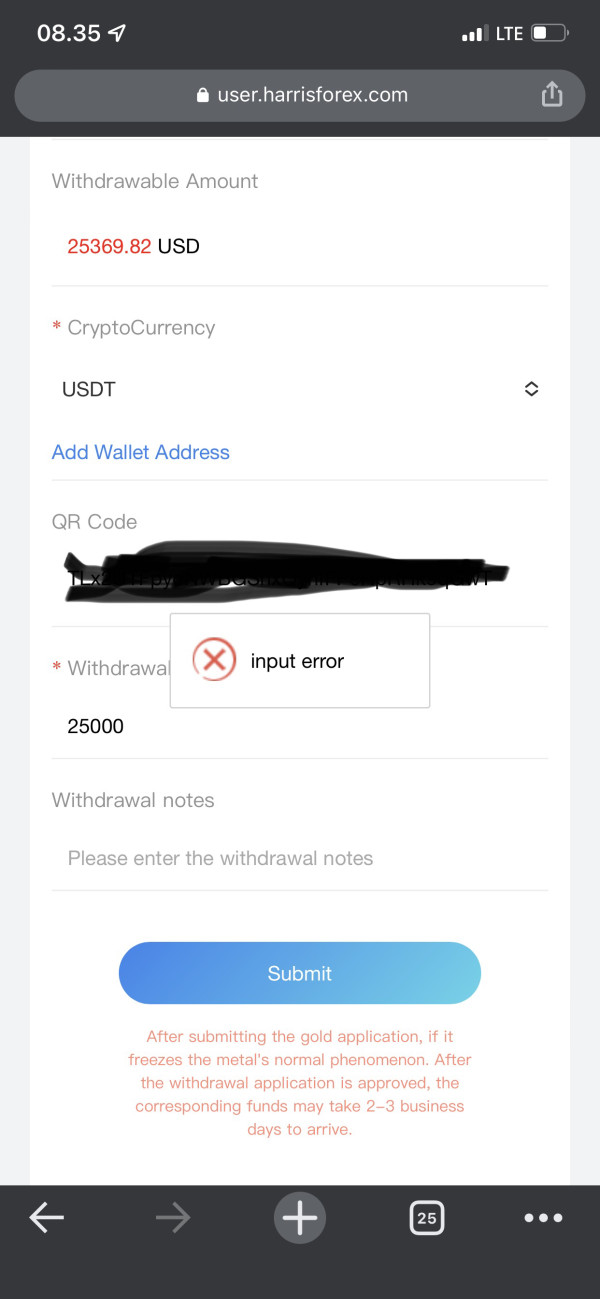

2. The "Traps" of Non-Trading Fees

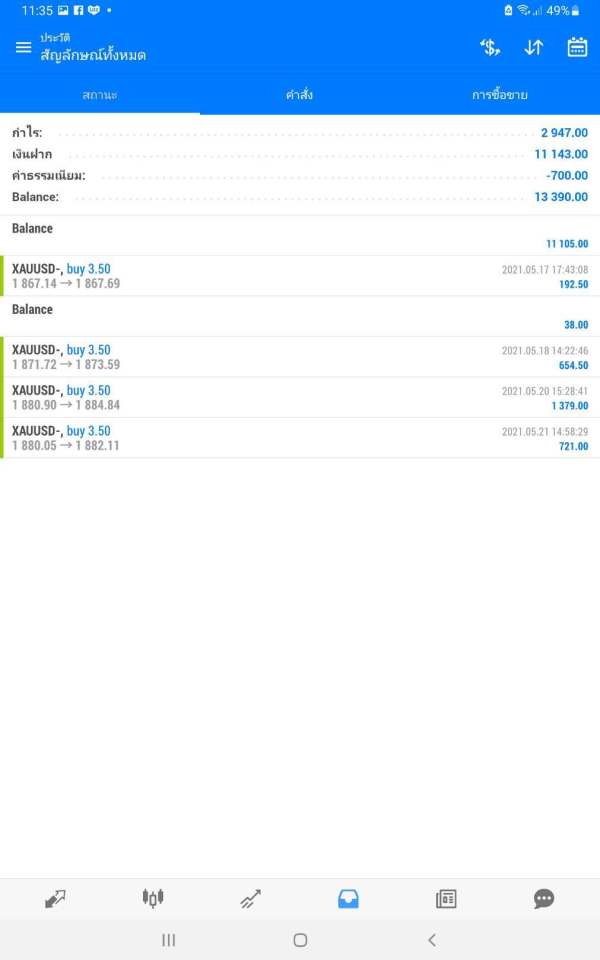

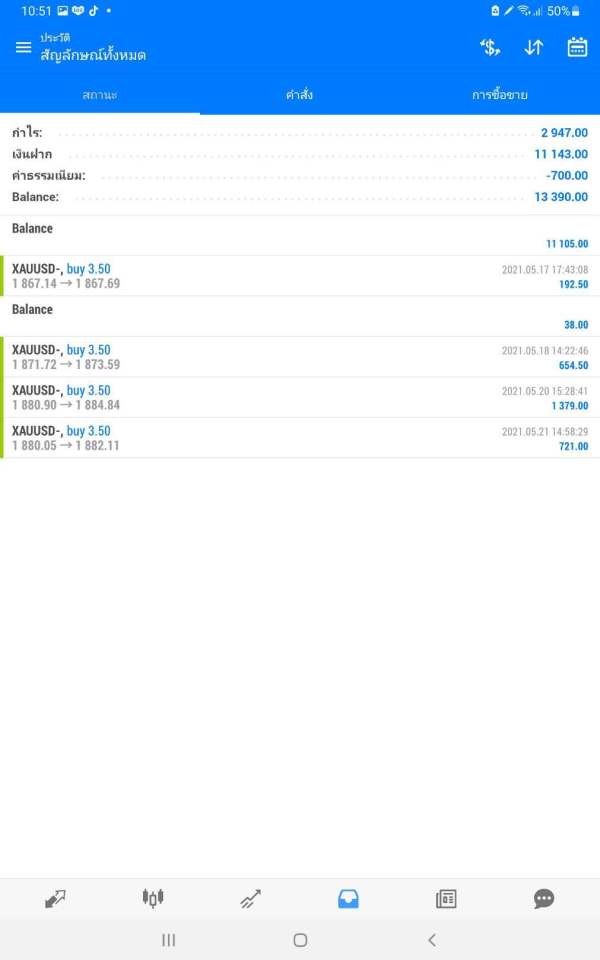

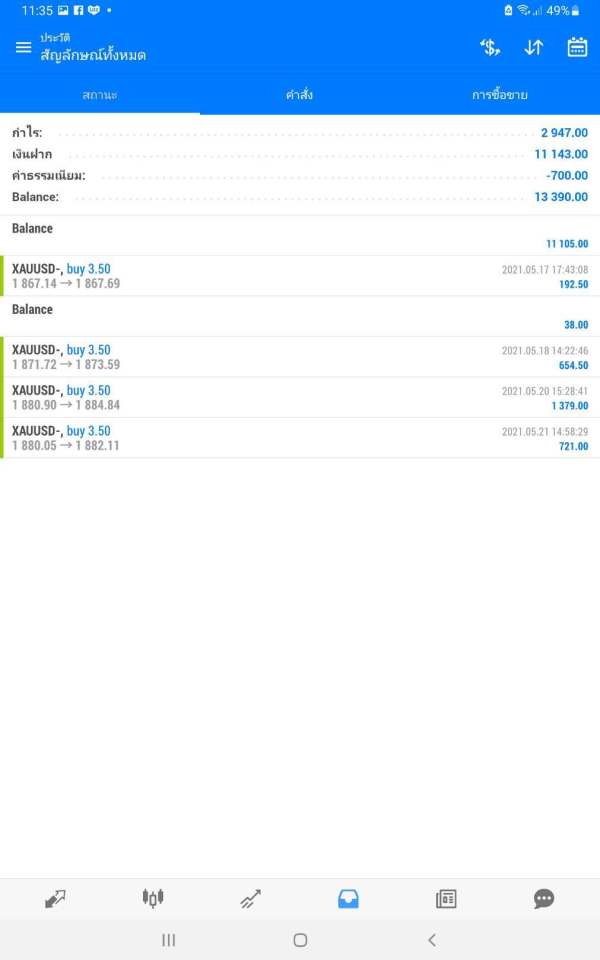

However, users have cited considerable withdrawal fees that can reach up to $30, alongside high spreads, with documentation noting that spreads can reach 3 pips on EUR/USD, substantially higher than industry standards. This discrepancy raises concerns about the overall cost-effectiveness of trading with Varot Financial.

“Customers could expect to spend $30 per lot EUR/USD, although the industry standard is $10 or less.” (Source Material 2)

3. Cost Structure Summary

While low trading commissions may seem appealing, the hidden fees and poor withdrawal policies create a scenario where (especially new traders) could face hidden losses, rendering these benefits moot.

Varot primarily utilizes the MT5 platform, which is well-regarded for its sophisticated tools and user-friendly interface. Despite the claims of a modern trading environment, the overall experience is marred by user complaints about the technical support and platform stability.

The educational resources offered are minimal, and the tools integrated into the platform lack significant enhancements that could provide an edge for traders.

Users have expressed frustration with usability, pointing out issues with the platform's response time and reliability.

“The site clearly indicates the dangers involved.” (Source Material 2)

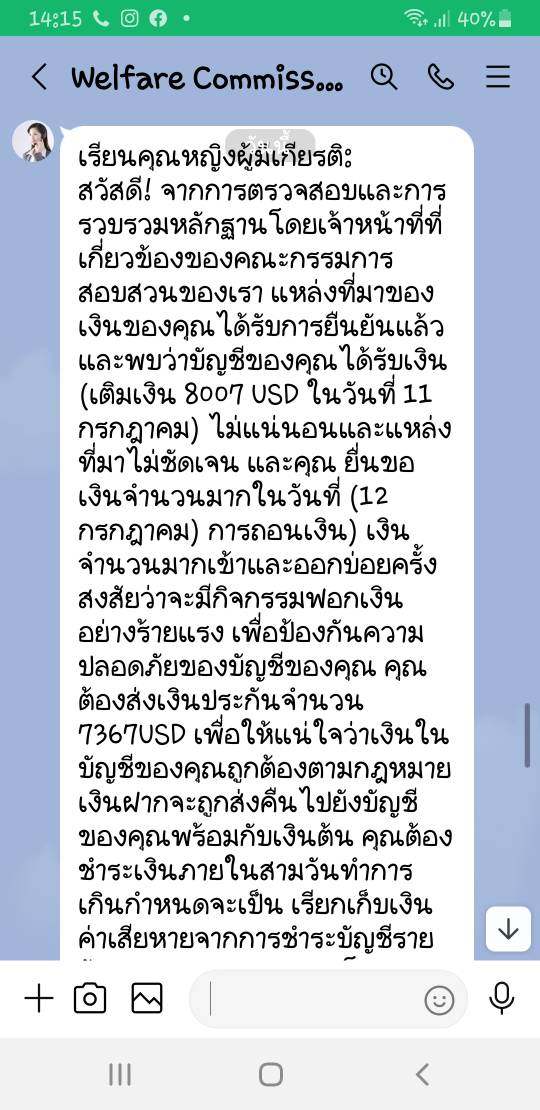

User Experience Analysis

1. Onboarding and Usage

The registration process is straightforward, but the continued complaints regarding withdrawal procedures suggest a potentially harrowing user experience post-registration.

2. Overall Engagement

User engagement appears to deteriorate after onboarding due to issues with responding to inquiries and addressing complaints about payments and withdrawals.

Customer Support Analysis

1. Accessibility of Support

Varot's limited customer support channels, primarily through email, lead to slow response times that deter users from seeking necessary assistance, resulting in further frustrations.

2. Responsiveness Review

With reports of delayed responses and dissatisfaction from users highlighting lack of direct communication, the overall effectiveness of Varots customer support is alarmingly low.

Account Conditions Analysis

1. General Account Setup

The broker offers a single account option with a steep minimum deposit. In contrast, many other brokers provide a variable range of accounts, catering to different trader needs. Users should be aware that the significant minimum deposit may lock out potential clients.

2. Additional Conditions

Varot Financial's terms surrounding leverage and lot sizes may attract experienced traders, but pose inherent risks given the lack of regulatory protection.

Conclusion

In summary, Varot Financial Limited embodies a high-risk trading environment due to its unregulated status, high minimum deposit requirements, and pervasive negative feedback from users. While there may exist opportunities for seasoned traders who are adept at managing risk, the potential pitfalls highlighted through various complaints underscore the necessity for caution. For most investors who prioritize safety and oversight, it might be prudent to explore alternative brokers with established regulations and proven track records of client satisfaction.

Recommendation

Traders considering Varot Financial Limited should perform due diligence and explore safer, regulated alternatives before deciding to invest. Always remember: a well-informed decision is the cornerstone of effective trading.