Is TDFX safe?

Pros

Cons

Is TDFX A Scam?

Introduction

TDFX is a forex brokerage that positions itself as a low-cost trading platform, appealing to a wide range of traders by offering high leverage and low spreads. However, it is essential for traders to exercise caution and conduct thorough evaluations of forex brokers before committing their funds. The forex market, while offering significant opportunities, also harbors risks, especially with unregulated or poorly regulated brokers. This article aims to assess the legitimacy of TDFX by examining its regulatory status, company background, trading conditions, customer fund safety, and user experiences. The evaluation will draw from various sources, including user reviews, regulatory databases, and financial analysis platforms.

Regulation and Legitimacy

The regulatory status of a forex broker is a critical factor in determining its safety and reliability. TDFX operates without a significant regulatory framework, raising concerns about its legitimacy. Below is a summary of the core regulatory information regarding TDFX:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | 001287717 | Australia | Revoked |

TDFX was previously registered under the Australian Securities and Investments Commission (ASIC) but has since had its license revoked. This revocation indicates serious compliance issues and suggests that TDFX may not adhere to the regulatory standards expected of reputable brokers. The absence of a valid license can expose traders to various risks, including the potential for fraud and mismanagement of funds.

Furthermore, TDFX claims to be regulated by the local Financial Services Authority in Saint Vincent and the Grenadines. However, this assertion is misleading, as the government of SVG has explicitly stated that it does not oversee forex trading. This lack of credible regulation significantly heightens the risk associated with trading through TDFX, making it imperative for potential clients to consider these factors seriously.

Company Background Investigation

TDFX is operated by Tiran Forex, a company registered in Saint Vincent and the Grenadines, a jurisdiction known for its lax regulatory environment. The company has been in operation for a few years, but detailed information regarding its ownership structure and history is scarce. This lack of transparency can be a red flag for potential investors.

The management team behind TDFX appears to lack significant experience in the financial services sector, which raises questions about the firm's ability to manage client funds responsibly. A reputable broker typically has a management team with a strong background in finance, trading, or regulatory compliance. The absence of such qualifications at TDFX contributes to the skepticism surrounding its operations.

Moreover, TDFX's website offers limited information about its corporate structure and management team. This opacity can hinder a trader's ability to make informed decisions about whether to trust the broker with their investments. The lack of transparency regarding key personnel and their professional backgrounds is a concerning aspect of TDFX's business model.

Trading Conditions Analysis

TDFX markets itself as a broker with competitive trading conditions, including low spreads and high leverage. However, the overall fee structure warrants careful examination. Below is a comparison of key trading costs associated with TDFX:

| Fee Type | TDFX | Industry Average |

|---|---|---|

| Major Currency Pairs Spread | 0.1 pips | 1-2 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | Not disclosed | Varies |

While TDFX advertises spreads as low as 0.1 pips, such figures may not reflect actual trading conditions. Many brokers offer attractive spreads on demo accounts that do not translate to real trading scenarios. Moreover, the lack of transparency regarding overnight interest rates and potential hidden fees raises concerns. Traders should be wary of brokers that do not clearly outline their fee structures, as this can lead to unexpected costs that diminish profitability.

The absence of a commission model could also indicate that TDFX might incorporate these costs into wider spreads or through other fees, which is a common practice among brokers operating in less regulated environments. Given these factors, traders must critically assess whether TDFX's trading conditions are as favorable as they appear.

Customer Fund Safety

The safety of customer funds is paramount when selecting a forex broker. TDFX claims to implement measures to protect client funds, but the effectiveness of these measures is questionable. The broker does not provide clear information about the segregation of client funds or any investor protection schemes in place.

In regulated environments, brokers are typically required to keep client funds in segregated accounts, ensuring that these funds are not used for operational expenses. Additionally, reputable brokers often participate in compensation schemes that protect clients in the event of insolvency. TDFX's lack of regulatory oversight means that clients have limited recourse if issues arise.

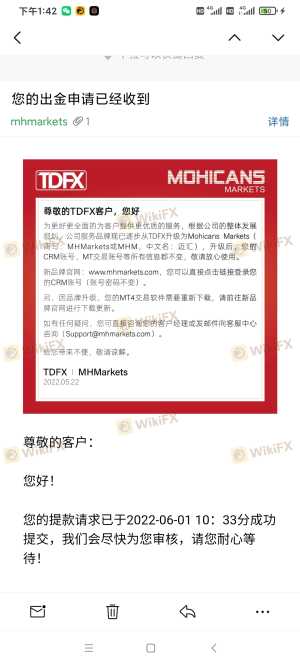

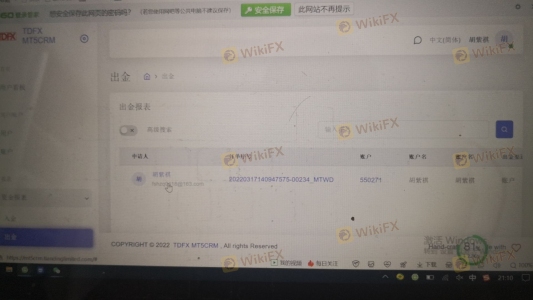

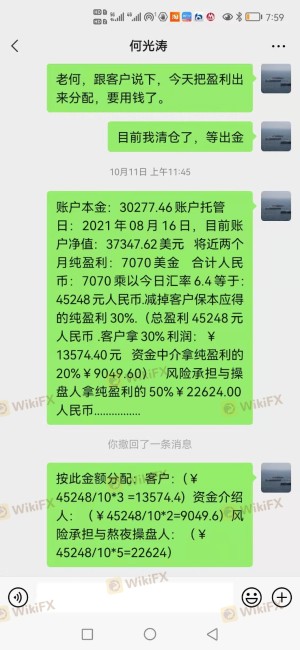

Historically, there have been complaints regarding the withdrawal of funds from TDFX, with several users reporting difficulties in accessing their money. These complaints highlight potential risks associated with trading with TDFX, as clients may face challenges in retrieving their investments.

Customer Experience and Complaints

User feedback is a crucial indicator of a broker's reliability and service quality. TDFX has received a mix of reviews, with several users expressing dissatisfaction with their experiences. Common complaints include delays in fund withdrawals, unresponsive customer support, and issues with trade execution.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow response |

| Poor Customer Support | Medium | Inconsistent |

| Trade Execution Issues | High | No resolution |

For instance, one user reported that after initiating a withdrawal request, they faced significant delays, with funds taking weeks to arrive. Another trader experienced difficulties in contacting customer support, leading to frustration and dissatisfaction. These patterns of complaints suggest systemic issues within TDFX's operations, raising concerns about its overall reliability.

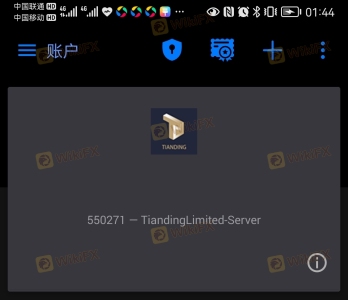

Platform and Trade Execution

TDFX provides access to popular trading platforms like MetaTrader 4 (MT4), which is widely regarded for its user-friendly interface and advanced trading features. However, the performance and reliability of the platform are critical factors in a trader's experience. Users have reported instances of slippage and execution delays, which can significantly impact trading outcomes.

The quality of trade execution is vital for traders, especially in a market where every pip counts. Reports of rejected orders and slow execution times can indicate potential manipulation or inefficiencies within the trading environment. Such issues further contribute to the skepticism surrounding TDFX's operations and its commitment to providing a fair trading experience.

Risk Assessment

Engaging with TDFX carries inherent risks that traders should be aware of before opening an account. Below is a summary of the key risk areas associated with trading with this broker:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Lack of regulation increases potential for fraud. |

| Fund Safety Risk | High | Unclear fund protection measures and withdrawal issues. |

| Execution Risk | Medium | Reports of slippage and execution delays. |

To mitigate these risks, traders should consider diversifying their investments across multiple brokers, particularly those with strong regulatory oversight and proven track records. Additionally, conducting thorough research and utilizing demo accounts can help traders better understand the trading environment before committing significant capital.

Conclusion and Recommendations

In conclusion, the evidence suggests that TDFX operates in a high-risk environment, primarily due to its lack of credible regulation and transparency. The numerous complaints regarding fund withdrawals, customer support, and trade execution raise significant red flags. While TDFX may appeal to traders seeking low spreads and high leverage, the potential for fraud and mismanagement of funds cannot be overlooked.

For traders considering whether to engage with TDFX, it is advisable to proceed with caution. Those who prioritize safety and regulatory compliance should explore alternative brokers with strong regulatory frameworks, such as those regulated by the FCA in the UK or ASIC in Australia. Overall, the question remains: Is TDFX safe? The consensus leans toward skepticism, urging traders to be vigilant and prioritize their financial security.

Is TDFX a scam, or is it legit?

The latest exposure and evaluation content of TDFX brokers.

TDFX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

TDFX latest industry rating score is 1.50, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.50 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.