Is Graphene Fx safe?

Business

License

Is Graphene FX Safe or Scam?

Introduction

Graphene FX is a forex broker that has emerged in the highly competitive landscape of online trading. Positioned as a provider of various trading instruments, including forex currency pairs, CFDs on stocks, indices, commodities, and cryptocurrencies, Graphene FX aims to attract traders with its diverse offerings and trading platforms. However, the forex market is fraught with risks, and traders must exercise caution when evaluating brokers. The potential for scams and unregulated entities is significant, making it essential for traders to conduct thorough due diligence before committing their funds. This article aims to assess the safety and legitimacy of Graphene FX by examining its regulatory status, company background, trading conditions, customer safety measures, user experiences, and potential risks. The analysis is based on a comprehensive review of various sources, including user feedback, regulatory records, and expert evaluations.

Regulation and Legitimacy

The regulatory environment is a critical factor when determining whether a broker is safe for trading. Regulation serves as a safeguard for traders, ensuring that brokers adhere to specific standards and practices that protect client funds and promote fair trading. In the case of Graphene FX, the broker claims to be regulated by several authorities, including the Australian Securities and Investments Commission (ASIC) and the Financial Services Authority (FSA) of St. Vincent and the Grenadines. However, the legitimacy of these claims warrants scrutiny.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | 001293538 | Australia | Unverified |

| SVG FSA | 26164 | St. Vincent | Unverified |

Despite Graphene FX's assertions of regulatory compliance, numerous reviews indicate that the broker may not be properly regulated. The FSA of St. Vincent and the Grenadines has been noted for its lack of oversight in the forex sector, leading to concerns about the authenticity of Graphene FX's claims. Furthermore, the ASIC license appears to be questionable, with some sources labeling it as a "suspicious clone." The absence of credible regulatory oversight raises significant red flags regarding the safety of trading with Graphene FX.

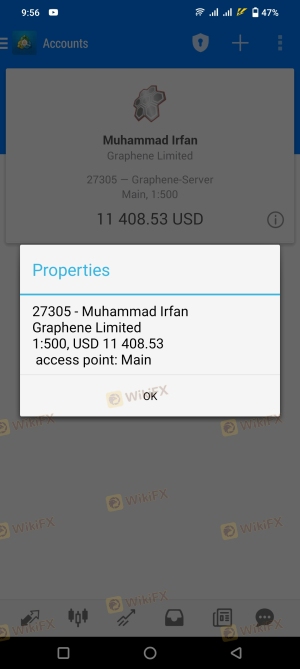

Company Background Investigation

Graphene FX's company history and ownership structure are vital components of its legitimacy. The broker claims to have been established in 2009, with its headquarters purportedly located in the United Kingdom and additional offices in Australia. However, the lack of transparency regarding its ownership and management team limits the ability to verify these claims.

The management team's professional background is another crucial factor in assessing the broker's reliability. A well-experienced team can enhance a broker's credibility, while an obscure or inexperienced team may indicate potential risks. Unfortunately, Graphene FX has not provided sufficient information about its management or operational practices, which further complicates the evaluation of its safety.

The level of transparency regarding company operations and information disclosure is concerning. Traders are entitled to know who they are dealing with, and a lack of clarity can often be a precursor to fraudulent activities. Overall, the insufficient information about Graphene FX's ownership and management raises questions about its legitimacy and safety.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is essential for evaluating its overall value proposition. Graphene FX presents a range of trading accounts, each with varying minimum deposits and fee structures. However, the overall cost structure and any unusual fee policies warrant careful examination.

| Fee Type | Graphene FX | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | 0.4 pips | 0.1-0.5 pips |

| Commission Model | Varies | Varies |

| Overnight Interest Range | Not specified | 0.5%-3% |

The spread on major currency pairs offered by Graphene FX starts at 0.4 pips, which is within industry norms but may not be competitive compared to other brokers. Additionally, the commission structure is not clearly defined, which can lead to unexpected costs for traders. The lack of transparency in fee disclosure raises concerns about the broker's commitment to fair trading practices.

Moreover, the absence of clear information regarding overnight interest rates is problematic. Traders should be aware of any potential costs associated with holding positions overnight, as these can significantly impact profitability. Overall, the trading conditions at Graphene FX appear to lack the clarity and competitiveness that traders typically seek in a reliable broker.

Customer Fund Safety

The safety of customer funds is paramount when assessing a broker's credibility. Graphene FX claims to implement various safety measures, including segregated accounts and investor protection policies. However, the effectiveness of these measures is questionable given the broker's regulatory status.

A detailed examination of Graphene FX's fund safety measures reveals several areas of concern. The absence of clear policies on fund segregation and negative balance protection raises significant red flags. Traders should be cautious, as the lack of such protections can expose them to substantial risks, especially in volatile market conditions.

Historically, there have been reports of funds being withheld or delayed in withdrawal processes, which further exacerbates concerns about the safety of customer deposits. If traders encounter difficulties in accessing their funds, it can lead to significant financial distress and loss of trust in the broker. Therefore, potential clients must weigh these risks carefully before engaging with Graphene FX.

Customer Experience and Complaints

Customer feedback is a valuable indicator of a broker's reliability and service quality. Analyzing user experiences with Graphene FX reveals a mixed bag of reviews, with several complaints surfacing regarding withdrawal issues and lack of responsive customer support.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Lack of Customer Support | Medium | Average |

| Misleading Information | High | Poor |

Common complaints include difficulties in withdrawing funds, with users reporting long processing times and unresponsive support teams. These issues can significantly impact the overall trading experience and raise doubts about the broker's reliability. Additionally, the prevalence of misleading information regarding fees and services has led to frustration among clients.

One notable case involved a trader who attempted to withdraw funds after a profitable trading period but faced repeated delays and inadequate explanations from customer service. This lack of responsiveness and transparency can erode trust and deter potential clients from engaging with the broker.

Platform and Trade Execution

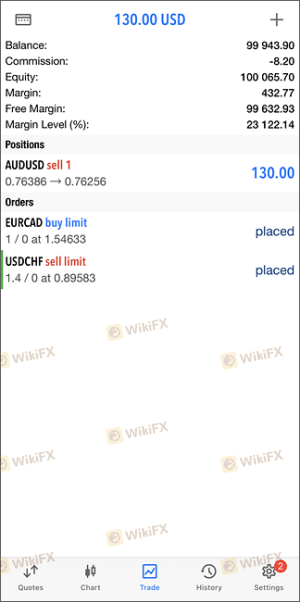

A broker's trading platform is a critical component of the overall trading experience. Graphene FX offers the widely-used MetaTrader 4 (MT4) platform, which is known for its robustness and user-friendly interface. However, an assessment of the platform's performance and execution quality is necessary to determine its reliability.

User experiences with Graphene FX's platform reveal mixed feedback, with some traders reporting satisfactory execution speeds and minimal slippage. However, others have noted instances of order rejections and execution delays, which are concerning for active traders who rely on timely trade execution. The presence of these issues can lead to missed opportunities and financial losses, highlighting the importance of a reliable trading platform.

Additionally, there are no significant indications of platform manipulation, but the reported execution issues raise questions about the broker's operational integrity. Traders should approach Graphene FX with caution, particularly if they prioritize fast and reliable execution.

Risk Assessment

Using Graphene FX involves several inherent risks that potential clients should consider. The lack of proper regulation, unclear fee structures, and withdrawal issues contribute to a higher risk profile for this broker.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Compliance | High | Unverified regulatory status |

| Fund Security | High | Lack of clear protection measures |

| Customer Support | Medium | Reports of poor response times |

To mitigate these risks, traders should consider the following recommendations:

- Conduct Thorough Research: Before engaging with any broker, perform comprehensive research to understand their regulatory status, user experiences, and overall reputation.

- Start with a Demo Account: If available, use a demo account to familiarize yourself with the platform and trading conditions before committing real funds.

- Limit Initial Deposits: Begin with a minimal deposit to assess the broker's performance and reliability before increasing your investment.

Conclusion and Recommendations

In conclusion, the evidence suggests that Graphene FX may not be a safe trading option. The broker's regulatory status is dubious, with claims of oversight that lack verification. Additionally, the company's transparency issues, unclear fee structures, and negative user experiences raise significant concerns about its legitimacy and reliability.

Traders should exercise caution and consider alternative brokers with solid regulatory credentials and positive user feedback. Recommended alternatives include well-regulated brokers with a proven track record, such as those licensed by reputable authorities like ASIC or FCA. Ultimately, ensuring the safety of your investments should be the top priority when selecting a forex broker.

Is Graphene Fx a scam, or is it legit?

The latest exposure and evaluation content of Graphene Fx brokers.

Graphene Fx Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Graphene Fx latest industry rating score is 1.51, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.51 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.