TDFX 2025 Review: Everything You Need to Know

Executive Summary

This tdfx review looks at a broker that worries many traders. TDFX, also known as Tadawul FX, says it helps people trade forex and cryptocurrency no matter how much experience they have. But many users and market watchers have found serious problems that new clients need to know about.

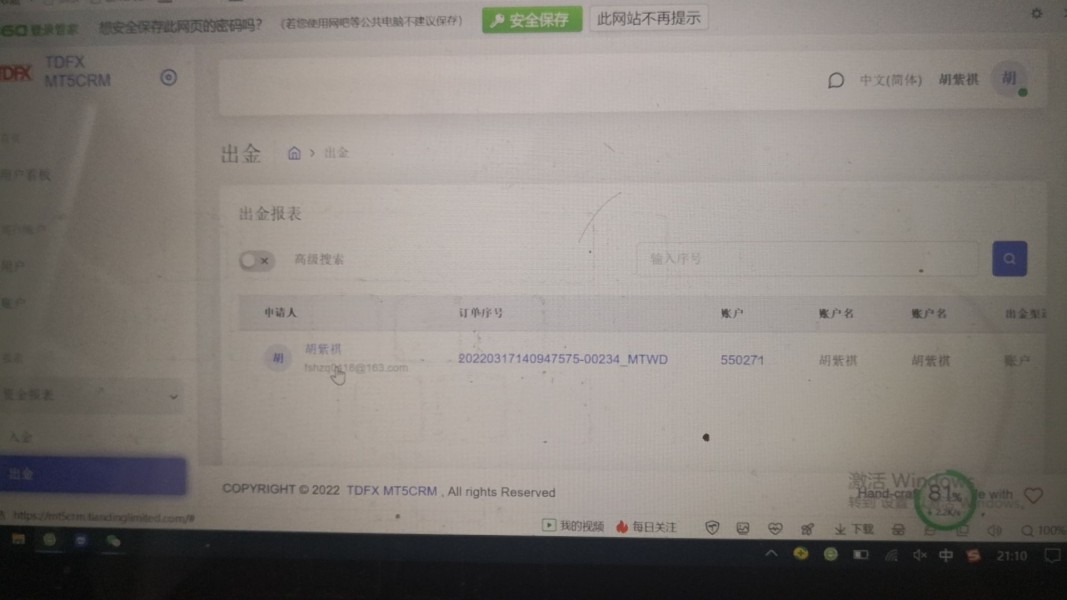

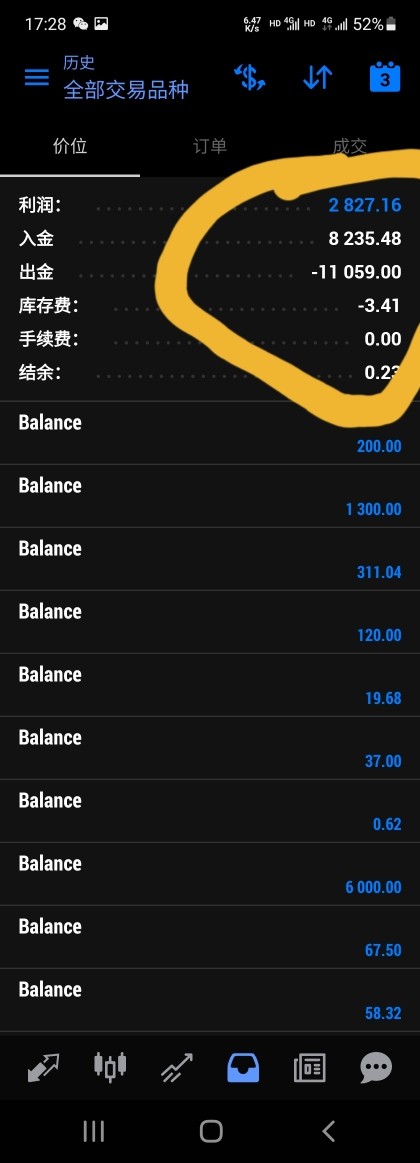

The broker lets you use high leverage up to 1:500 and says you can trade forex, gold, oil, indices, and stocks through MetaTrader 4. You only need $100 to start, which seems good for regular traders. However, many sources and user stories keep saying this broker might be fake, with lots of reports about scams and bad customer service.

Based on what we found and user feedback, TDFX acts like brokers you can't trust. They don't share clear information about regulations, and many users have bad experiences, which should worry potential investors. This review gives traders important information to make smart choices about their trading partners.

Important Notice

This review uses public information, user feedback, and market observations from 2025. We could not find information about regional regulatory entities for TDFX, which makes us worry about the broker's honesty and rule-following.

Our assessment uses user stories, industry reports, and what we can see about broker practices. But the lack of regulatory information that we can verify makes it hard to give a complete regulatory assessment. Traders should be very careful when thinking about any broker with unclear or missing regulatory credentials.

Rating Framework

Broker Overview

TDFX uses the full name Tadawul FX and says it's a complete trading platform for forex and cryptocurrency markets. The broker claims it helps traders at all levels, from beginners to experts. But the company's background information is very limited, with no clear dates when it started or details about how the company is set up through normal industry sources.

The broker's business focuses on giving access to multiple financial markets through online trading platforms. TDFX talks about how easy it is to start with low entry barriers and high leverage options, targeting regular traders who want to access different markets. But the lack of clear company information right away makes us worry about whether the broker is real and operates properly.

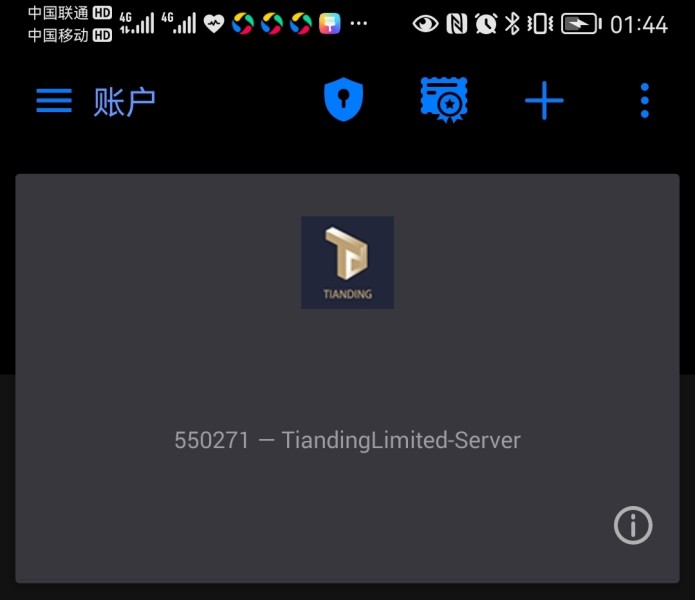

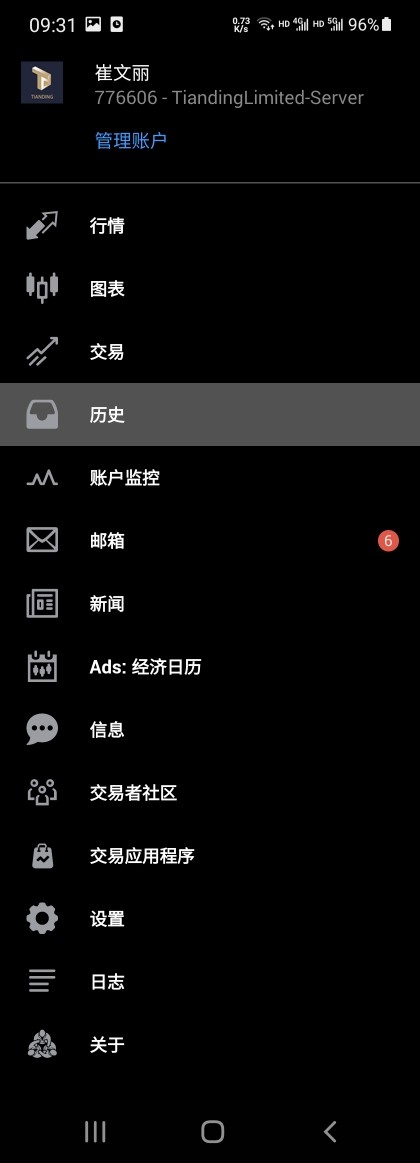

For platform setup, TDFX uses the MetaTrader 4 platform for trade execution and market access. The broker advertises access to different types of assets including major and minor forex pairs, precious metals like gold, energy commodities such as oil, global indices, and individual stocks. This tdfx review notes that while the variety of assets looks good on paper, the actual trading conditions and how well trades execute are questionable based on user feedback.

The regulatory situation around TDFX creates big concerns, as we could not find specific regulatory authority information in accessible sources. This lack of clear regulatory oversight is a major red flag for potential clients, as real brokers usually clearly show their regulatory credentials and compliance information.

Regulatory Status: The available information does not name any regulatory authorities watching over TDFX operations, which is a big concern for trader protection and fund security.

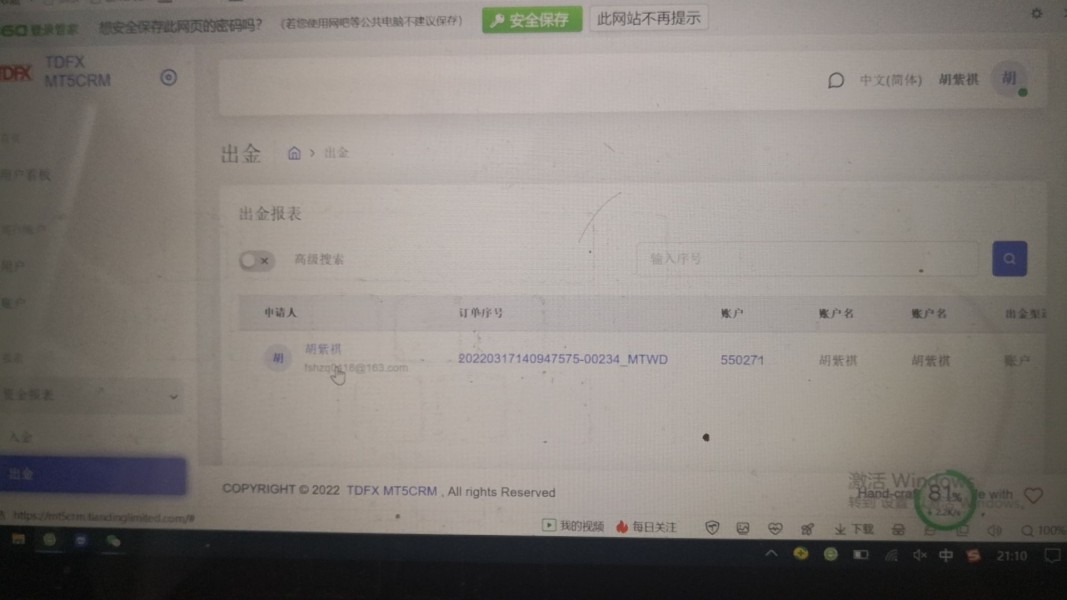

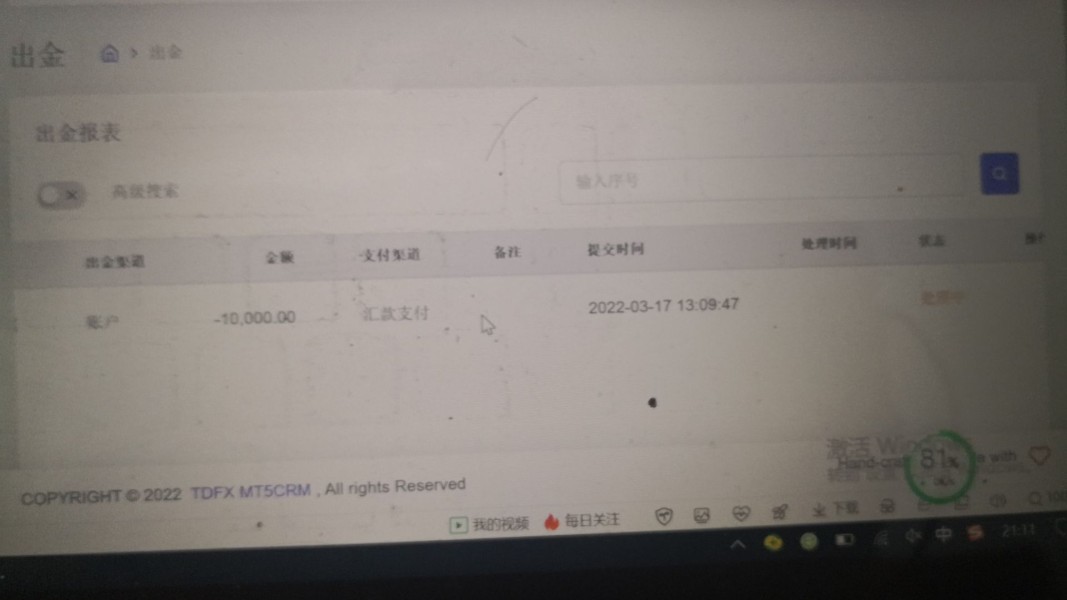

Deposit and Withdrawal Methods: We did not find specific information about available deposit and withdrawal methods in the source materials, though real brokers should easily provide this basic information.

Minimum Deposit Requirements: TDFX sets its minimum deposit at $100, which looks competitive compared to industry standards but may be used to attract unsuspecting traders.

Bonus and Promotional Offers: We did not find details about promotional offers, welcome bonuses, or ongoing incentive programs in available materials.

Tradeable Assets: The broker claims to offer forex pairs, gold, oil, indices, and stocks, providing what looks like a diverse trading portfolio across multiple asset classes.

Cost Structure: We could not find specific information about spreads, commissions, and fee structures in the source materials, making it impossible to judge how competitive the broker is for trading costs.

Leverage Ratios: TDFX offers maximum leverage of 1:500, which is quite high and may appeal to traders seeking amplified market exposure, though such high leverage also increases risk significantly.

Platform Options: The broker uses MetaTrader 4 as its main trading platform, which is a widely recognized and established platform in the forex industry.

Geographic Restrictions: We did not find information about specific regional restrictions or availability in the accessible materials.

Customer Support Languages: We did not find details about multilingual support options in the available information.

This tdfx review emphasizes that the lack of detailed, easily available information about basic broker services shows a concerning pattern that potential clients should carefully consider.

Detailed Rating Analysis

Account Conditions Analysis (Score: 3/10)

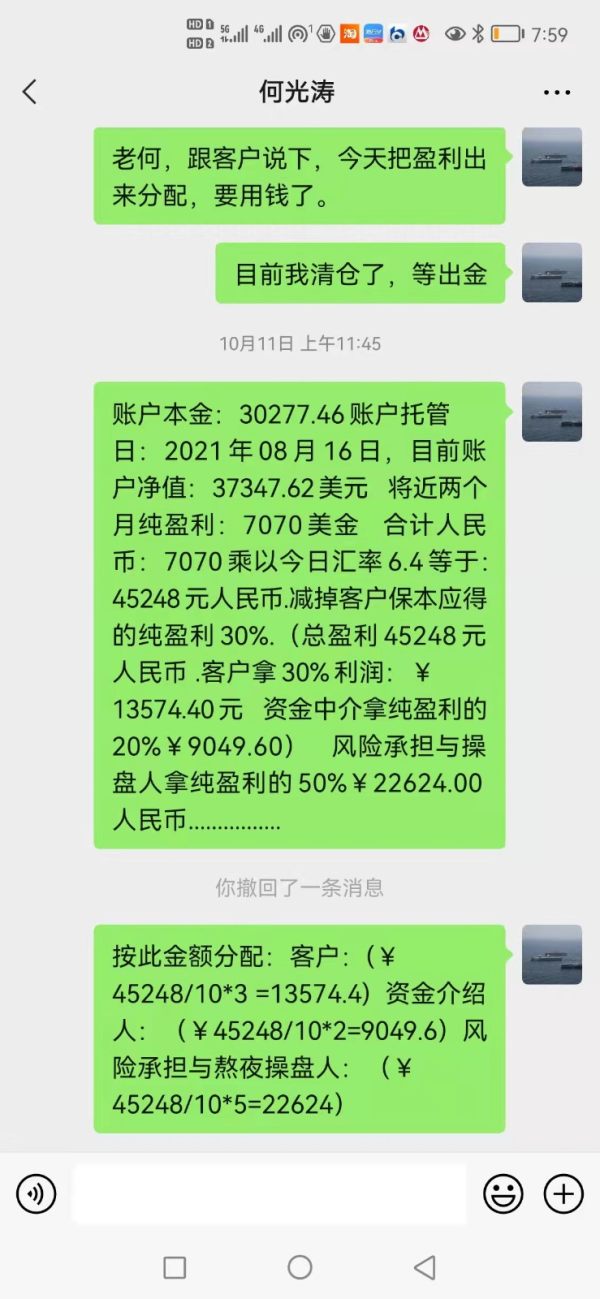

The account conditions that TDFX offers have several concerning aspects that contribute to its poor rating in this category. While the broker advertises a fairly low minimum deposit of $100, making it seem accessible to retail traders, user feedback consistently shows dissatisfaction with overall account terms and conditions.

The lack of detailed information about different account types is a big transparency issue. Real brokers typically offer clear differences between account tiers, each with specific benefits, features, and requirements. TDFX's failure to provide complete account type information suggests either poor communication standards or intentionally vague terms designed to mislead potential clients.

User stories consistently describe TDFX as operating with characteristics typical of fake brokers. These reports include difficulties with account verification processes, unexpected changes to trading conditions after deposit, and problems accessing account features that were initially promised. The absence of information about specialized account features, such as Islamic accounts for traders requiring swap-free trading, further shows limited service sophistication.

The account opening process, based on user reports, appears designed more for rapid client acquisition than for proper due diligence and client protection. This tdfx review notes that real brokers typically implement thorough know-your-customer procedures, while questionable operators often streamline these processes to speed up deposits while creating barriers to withdrawals.

TDFX's tools and resources get a moderate rating mainly because it uses the MetaTrader 4 platform, which provides a standard level of functionality regardless of the broker's own capabilities. MT4 offers complete charting tools, technical indicators, and automated trading capabilities that many traders find familiar and effective.

The platform choice represents one of the few positive aspects of TDFX's offering, as MetaTrader 4 is widely respected within the trading community for its stability, functionality, and extensive customization options. Traders can access advanced charting capabilities, implement expert advisors for automated trading, and use the platform's complete technical analysis tools.

However, the broker's own contribution to trading resources appears limited. We could not find information about proprietary research materials, market analysis, educational content, or additional trading tools in the source materials. Real brokers typically supplement platform capabilities with original research, daily market commentary, economic calendars, and educational resources to support trader development.

The absence of detailed information about research and analysis resources suggests that TDFX relies entirely on the MetaTrader 4 platform's built-in capabilities without adding significant value through proprietary content or specialized tools. This limitation becomes particularly concerning when combined with other negative aspects of the broker's service offering.

Customer Service Analysis (Score: 2/10)

Customer service represents one of TDFX's most critically rated areas, with user feedback consistently reporting poor experiences across multiple service dimensions. The extremely low rating reflects widespread user dissatisfaction and concerning patterns typical of problematic brokers.

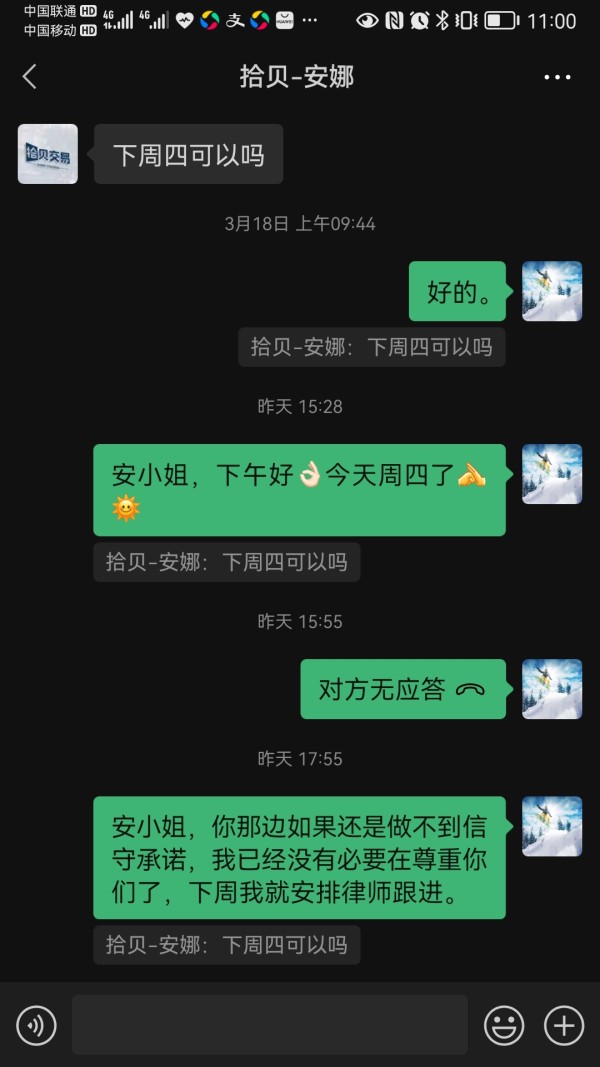

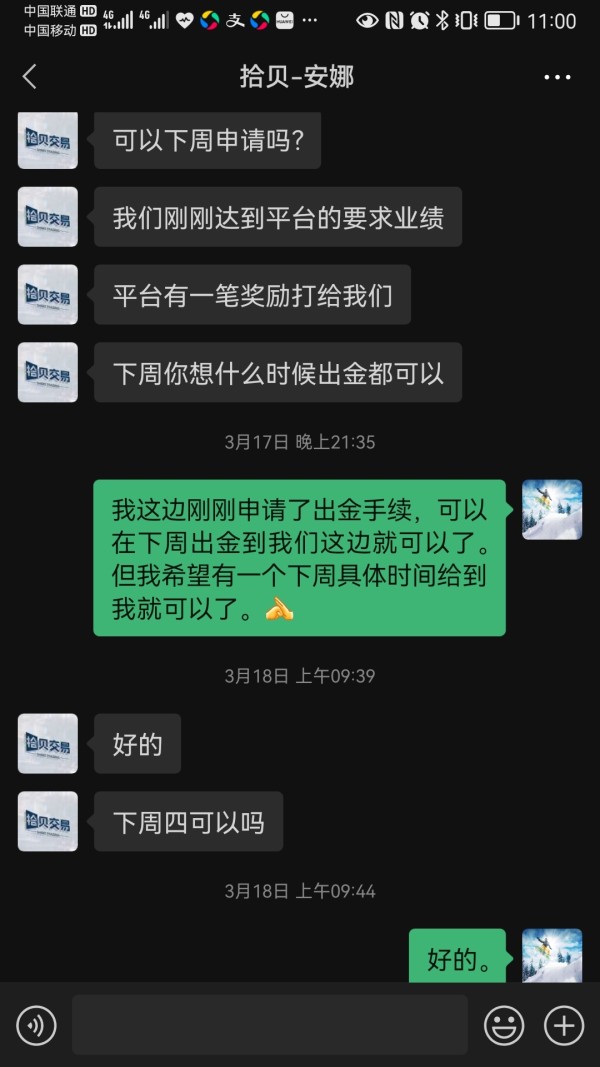

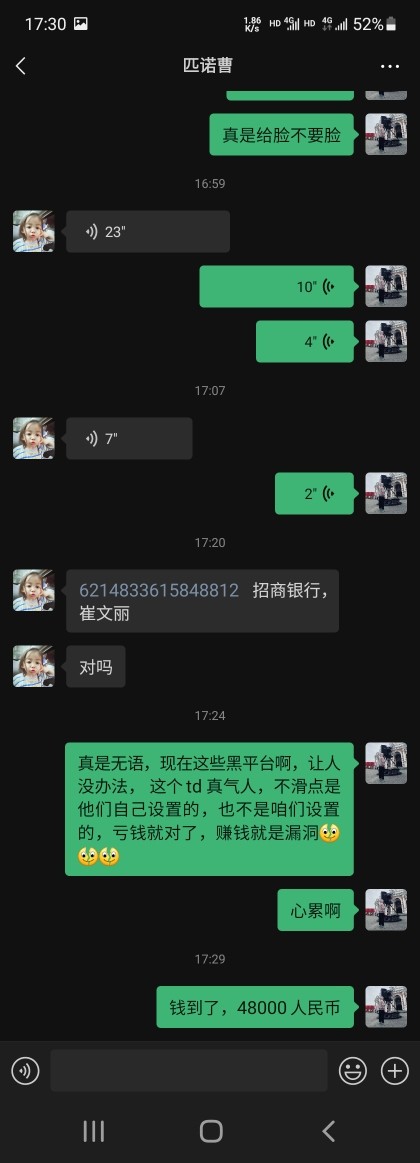

User stories frequently mention extended response times, unhelpful support staff, and difficulty reaching customer service representatives when issues arise. These problems become particularly serious when traders encounter account access issues, withdrawal problems, or technical difficulties requiring immediate assistance.

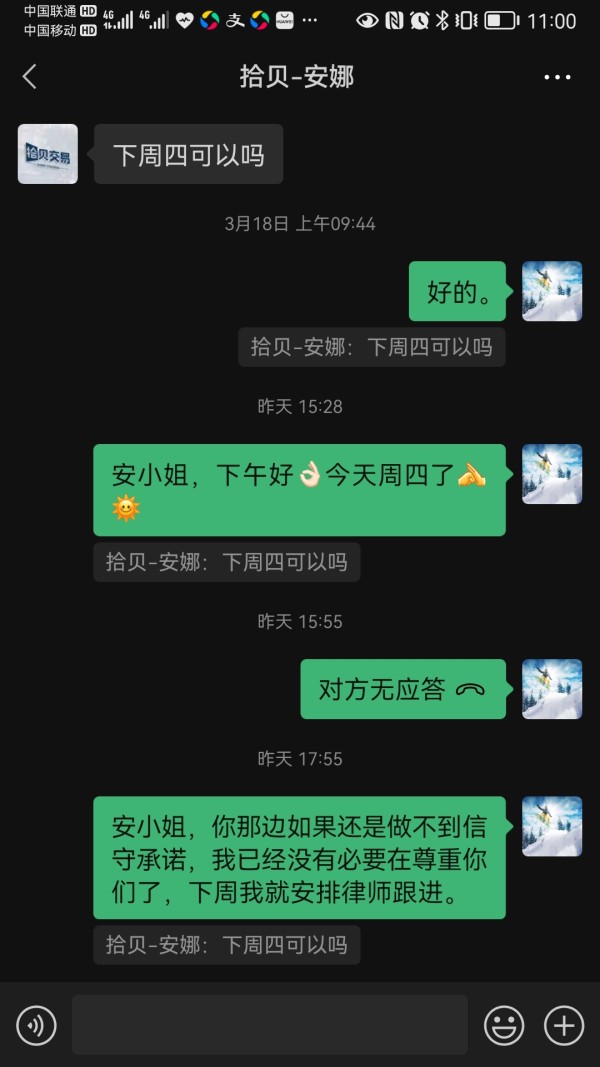

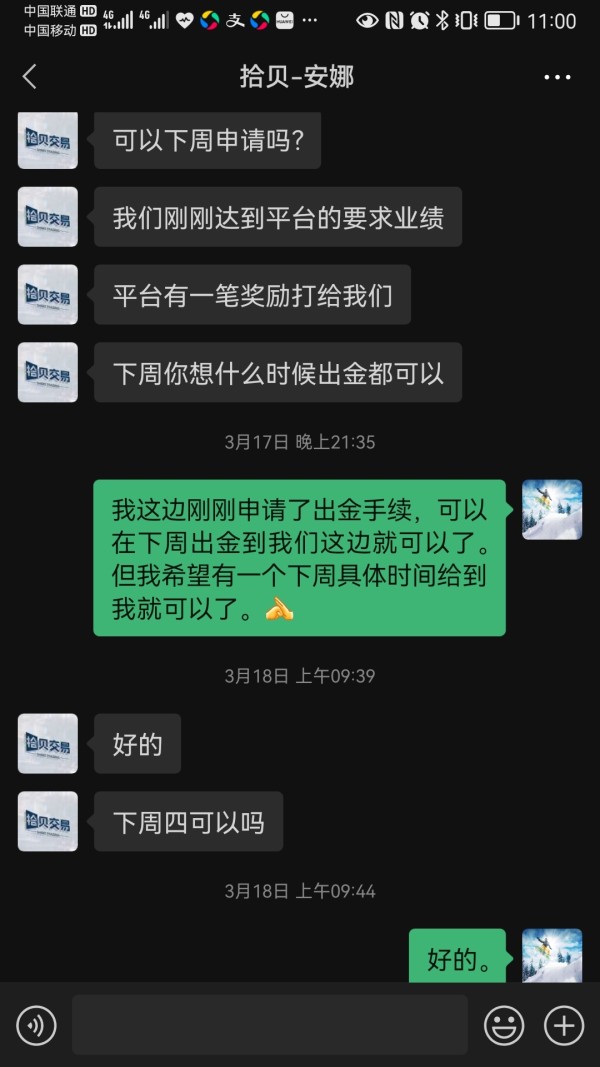

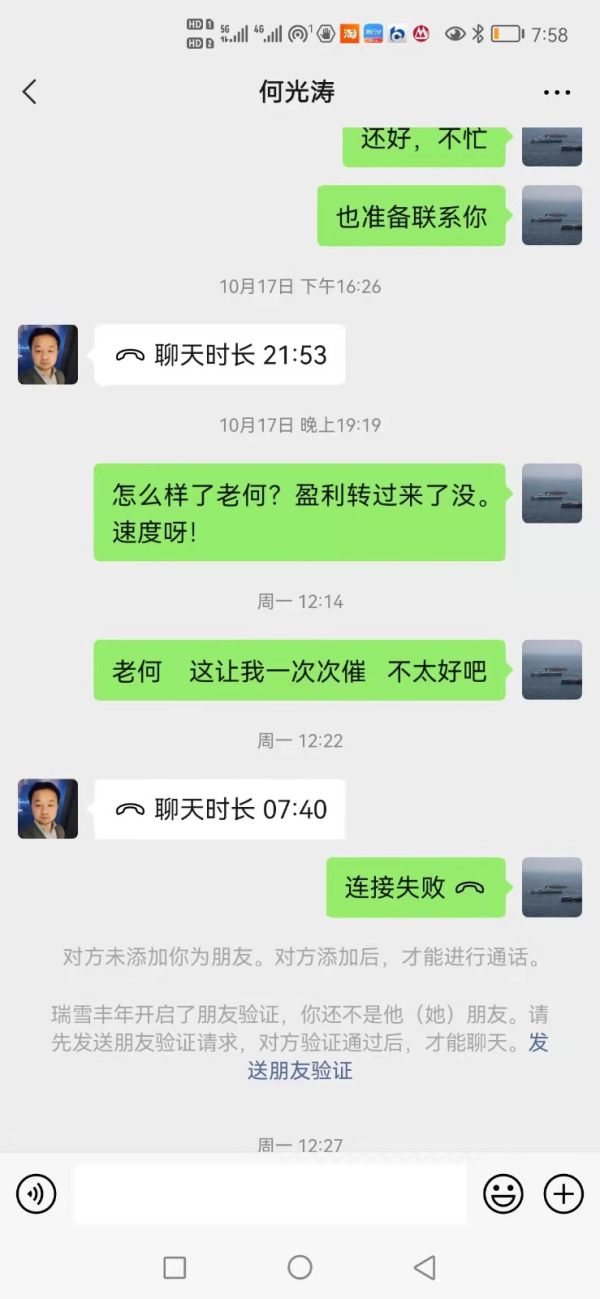

The quality of service interactions, based on user reports, appears to prioritize client retention over genuine problem resolution. Many users describe experiences where customer service representatives provide vague responses, make unfulfilled promises about issue resolution, or become unresponsive when clients express concerns about account problems or withdrawal requests.

We could not find communication channels and availability information in the available materials, which itself represents a service deficiency. Professional brokers typically provide multiple contact methods, clearly stated service hours, and guaranteed response timeframes. The lack of transparent customer service information suggests operational standards that fall well below industry expectations for real brokers.

Trading Experience Analysis (Score: 4/10)

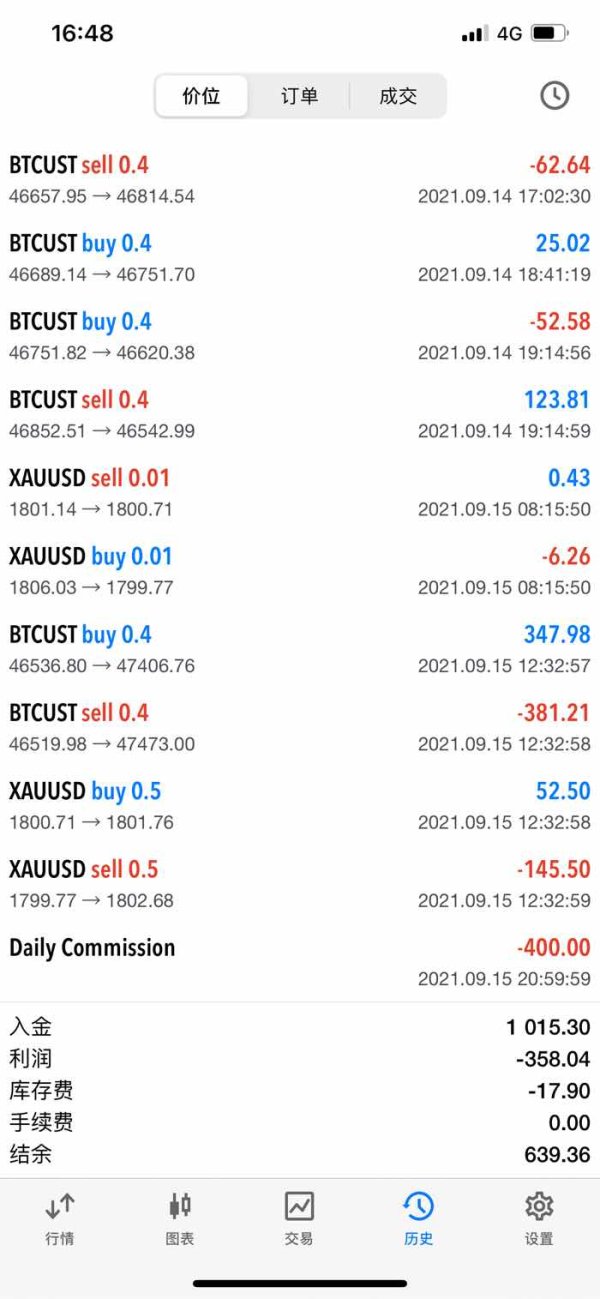

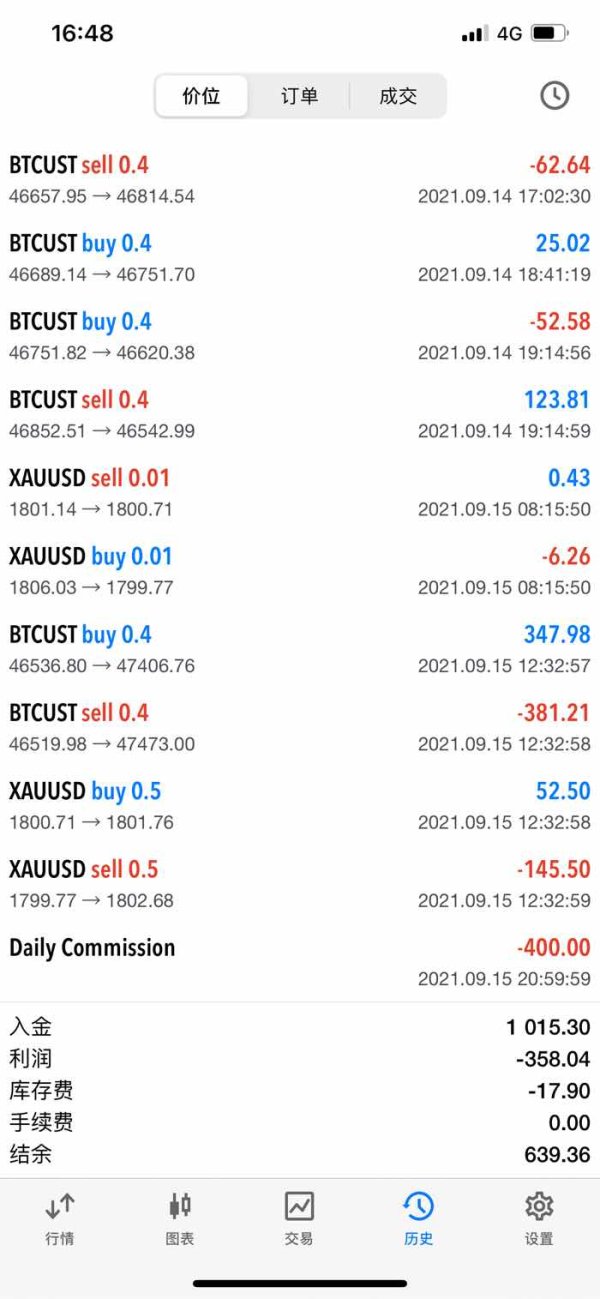

The overall trading experience with TDFX gets a below-average rating due to user feedback showing various operational issues that negatively impact trade execution and platform performance. While the MetaTrader 4 platform provides a solid foundation, broker-specific implementation appears problematic.

User reports suggest concerns about platform stability, with some traders experiencing connectivity issues and execution delays during important market periods. These technical problems can significantly impact trading outcomes, particularly for strategies requiring precise timing or during high-volatility market conditions.

Order execution quality represents another area of concern, though we could not find specific information about slippage rates, execution speeds, and requoting frequency in the source materials. However, user feedback patterns suggest that execution conditions may not meet the standards that traders expect from professional brokers.

We could not find mobile trading experience information in available sources, though mobile accessibility has become increasingly important for active traders who require platform access across multiple devices. The absence of complete mobile platform information suggests potential limitations in this area.

This tdfx review notes that trading environment factors such as liquidity provision, server infrastructure, and technical support for platform issues appear inadequate based on user feedback patterns, contributing to the overall poor trading experience rating.

Trustworthiness Analysis (Score: 1/10)

Trustworthiness represents TDFX's most critically concerning area, receiving the lowest possible rating due to multiple red flags that suggest potential fake operations. The absence of verifiable regulatory oversight represents the primary concern, as real brokers operate under strict regulatory frameworks designed to protect client interests.

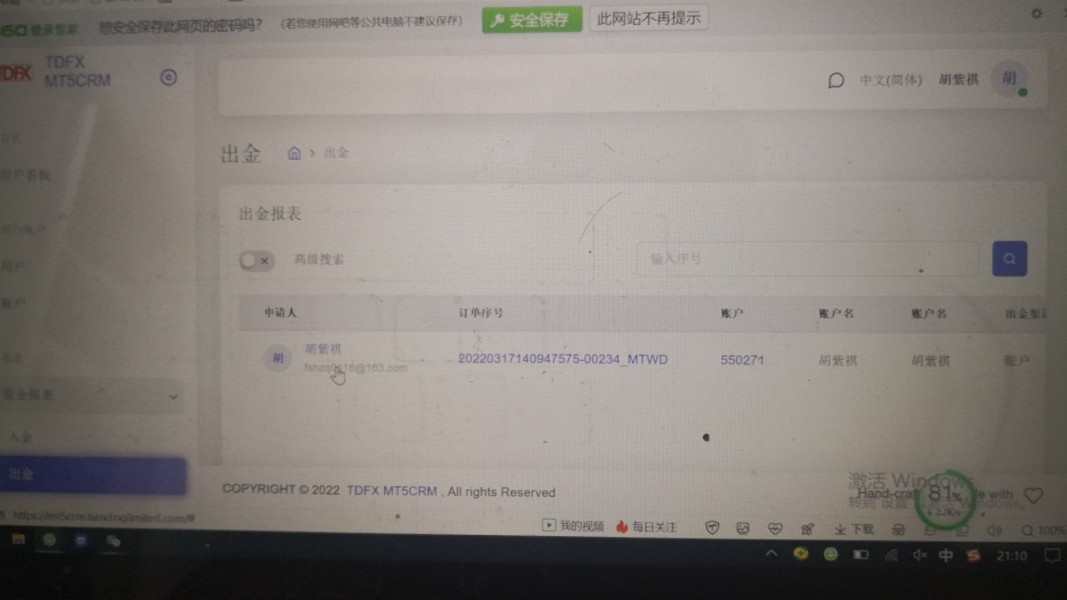

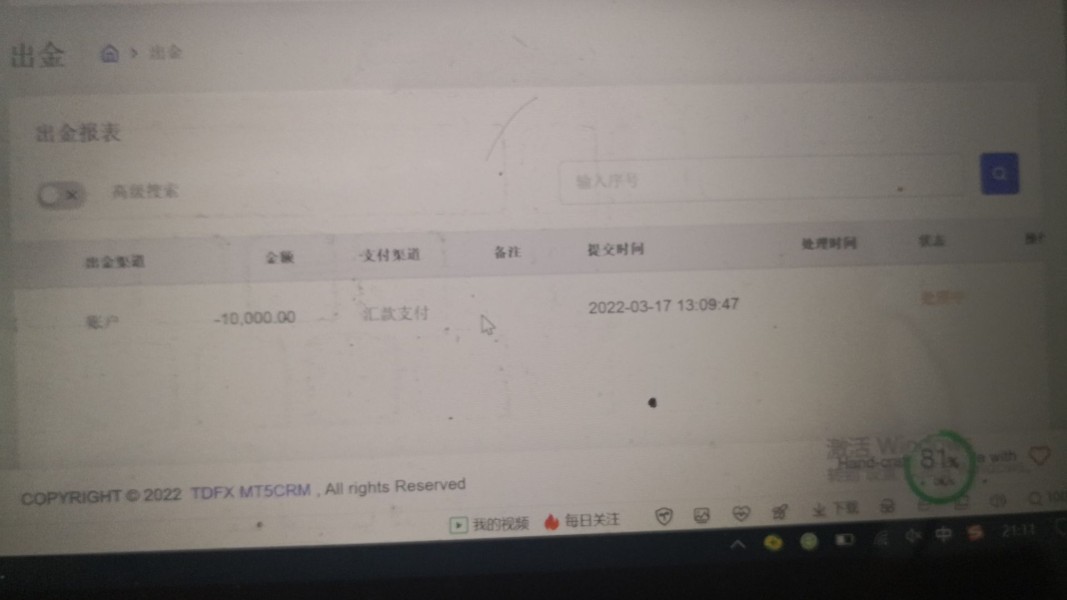

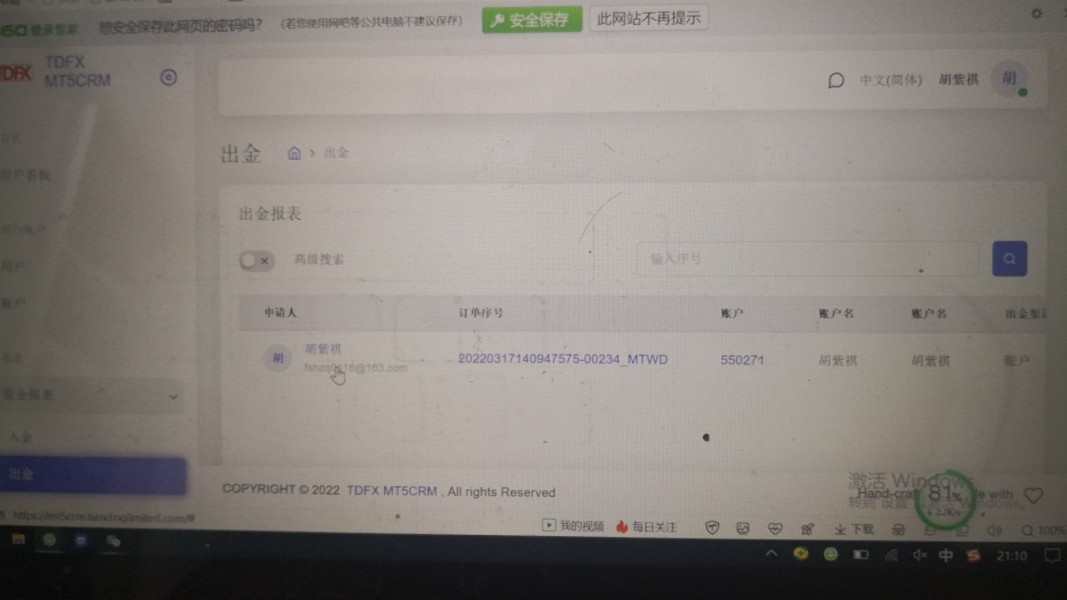

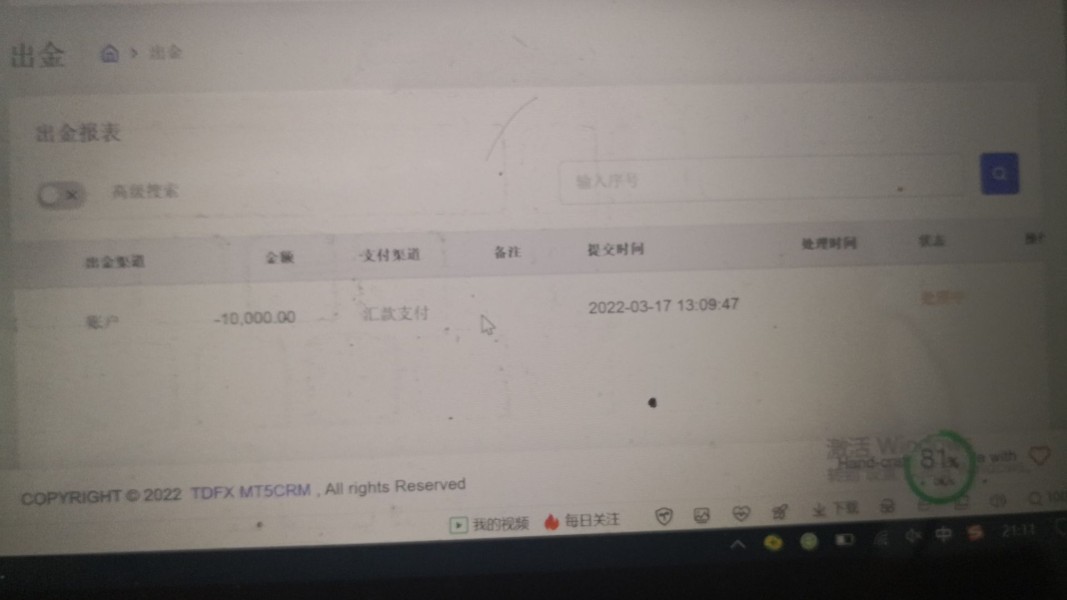

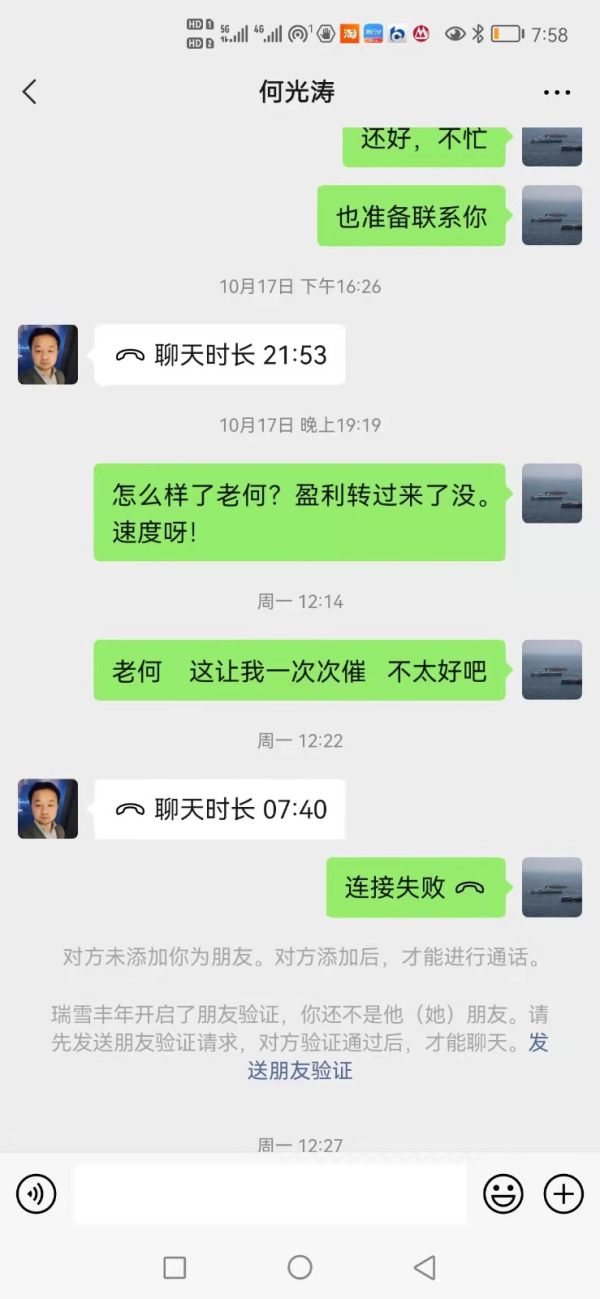

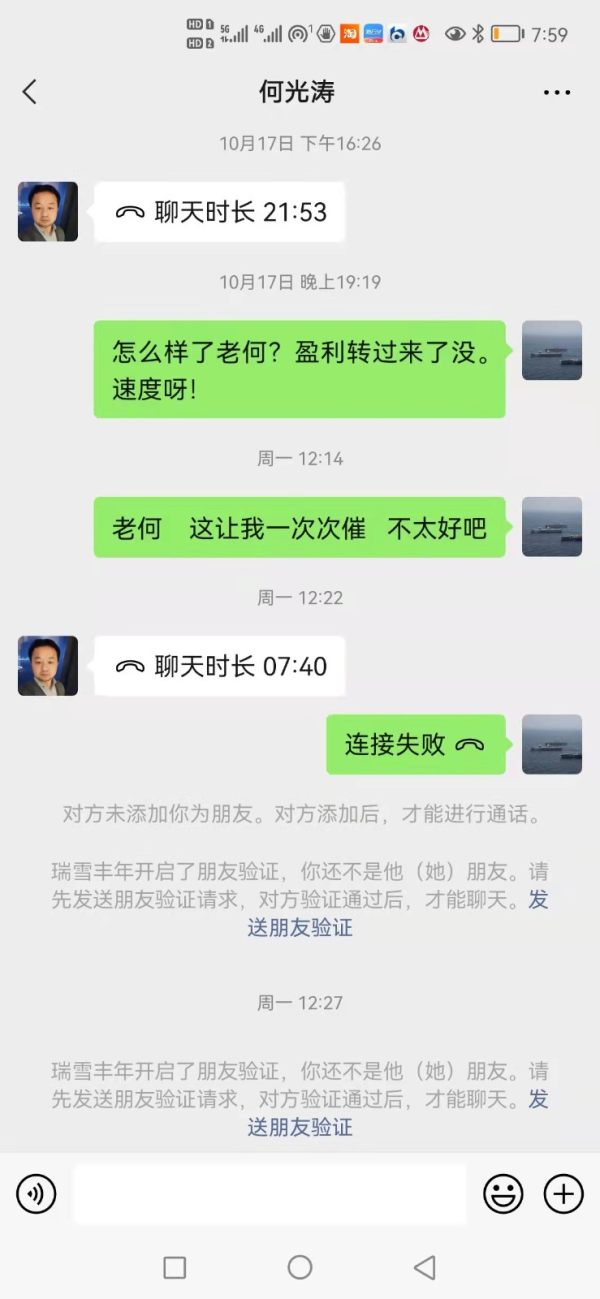

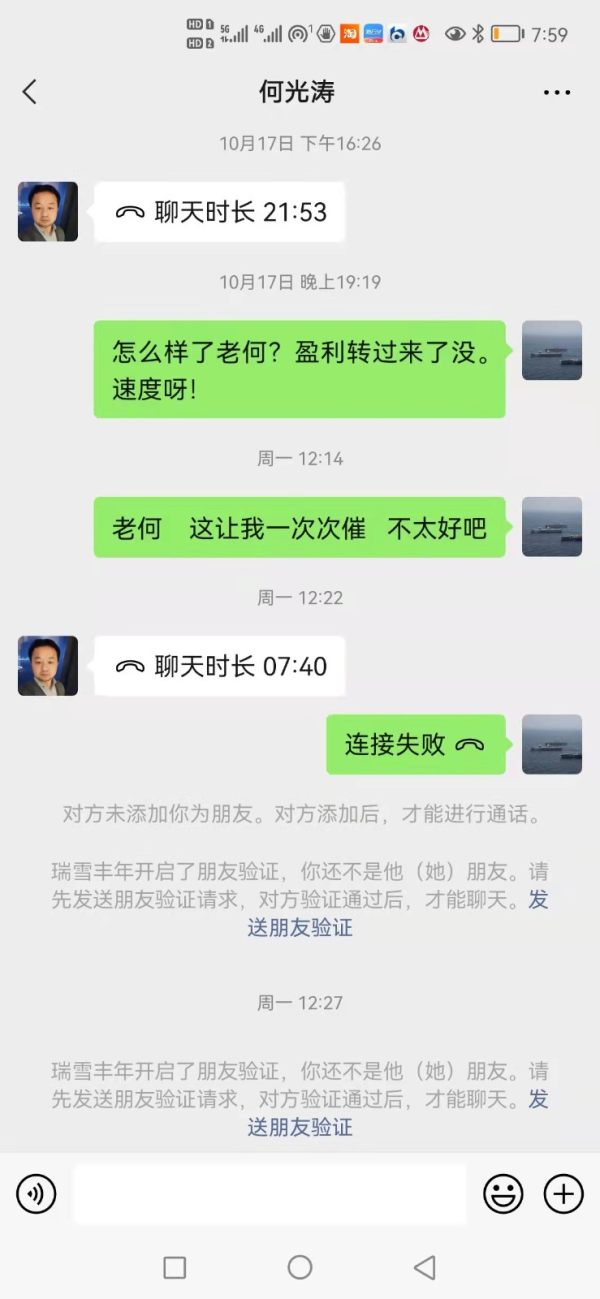

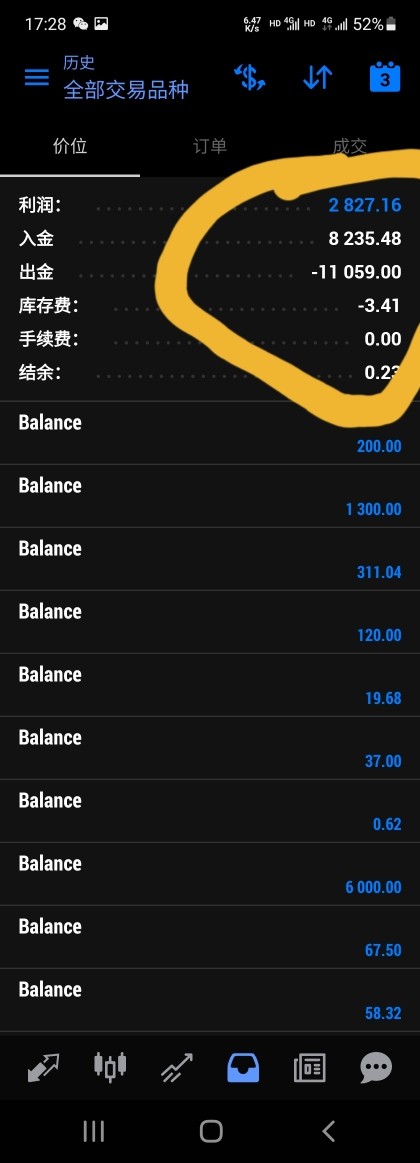

Multiple sources and user stories consistently identify TDFX as potentially fake, with reports describing characteristics typical of scam operations. These include difficulties with withdrawal processing, unexpected account restrictions, and communication patterns designed to delay or prevent fund recovery rather than facilitate real trading activities.

The lack of transparent company information, including corporate registration details, regulatory licenses, and operational history, creates an environment where client fund security cannot be adequately assessed or verified. Professional brokers typically provide complete corporate transparency, including audit reports, regulatory filings, and clear corporate structure information.

We could not find fund safety measures, such as segregated client accounts, deposit insurance, or regulatory compensation schemes, in available materials. These protections represent fundamental requirements for real broker operations, and their absence suggests that client funds may be at significant risk.

Industry reputation analysis reveals consistent negative feedback across multiple review platforms and trading communities, with warnings about potential scam activities appearing regularly in trader discussions about TDFX.

User Experience Analysis (Score: 3/10)

Overall user satisfaction with TDFX remains consistently poor across multiple experience dimensions, reflecting systematic operational issues that impact client relationships. User feedback patterns show widespread dissatisfaction with various aspects of the broker's service delivery.

The registration and verification process, based on user reports, appears designed more for rapid client onboarding than for proper due diligence and client protection. While this might initially seem convenient, it often shows operational standards that prioritize quick deposits over complete client service and protection.

We could not find interface design and usability information specific to TDFX's implementation in available sources, though the MetaTrader 4 platform provides a standardized user interface regardless of broker-specific customizations. However, user feedback suggests that overall platform experience may be compromised by broker-related technical issues.

Fund management experiences represent a particularly concerning area, with user reports showing difficulties with withdrawal processing and account access restrictions that appear designed to prevent rather than facilitate client fund management. Common user complaints focus on communication issues, technical problems, and concerns about fund security that create an overall negative experience for traders attempting to use TDFX services. The pattern of complaints suggests systematic issues rather than isolated incidents, showing fundamental operational problems that affect the majority of users.

Conclusion

This complete tdfx review reveals significant concerns that strongly advise against using this broker for trading activities. TDFX shows multiple characteristics commonly associated with fake operations, including lack of regulatory transparency, poor customer service, and widespread negative user feedback showing potential scam activities.

The broker is not recommended for traders of any experience level due to the substantial risks associated with fund security and operational reliability. While TDFX offers some potentially attractive features such as high leverage ratios and diverse asset classes, these benefits are overshadowed by fundamental trustworthiness concerns that make the platform unsuitable for serious trading activities.

The main advantages include access to MetaTrader 4 platform and fairly low entry requirements, but these are significantly outweighed by critical disadvantages including absence of regulatory oversight, poor customer support, questionable business practices, and consistent user reports of fake behavior. Traders seeking reliable broker partnerships should prioritize properly regulated alternatives with transparent operations and positive user feedback patterns.