Regarding the legitimacy of TRADE.COM forex brokers, it provides CYSEC, FSCA, FCA and WikiBit, (also has a graphic survey regarding security).

Is TRADE.COM safe?

Pros

Cons

Is TRADE.COM markets regulated?

The regulatory license is the strongest proof.

CYSEC Market Making License (MM) 17

Cyprus Securities and Exchange Commission

Cyprus Securities and Exchange Commission

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

Trade Capital Markets (TCM) Ltd

Effective Date:

2014-02-17Email Address of Licensed Institution:

info@tradecapitalmarkets.comSharing Status:

Website of Licensed Institution:

www.tradecapitalmarkets.com, www.trade.com, www.heromarkets.comExpiration Time:

--Address of Licensed Institution:

Λεωφόρος Στροβόλου 148, 1ος Όροφος, Στρόβολος 2048, Λευκωσία ΚύπροςPhone Number of Licensed Institution:

+357 22 030 446Licensed Institution Certified Documents:

FSCA Derivatives Trading License (EP)

Financial Sector Conduct Authority

Financial Sector Conduct Authority

Current Status:

RegulatedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

TRADE CAPITAL MARKETS (TCM) LTD

Effective Date:

2019-02-05Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

329 MAIN STREETGX11 1AAGIBRAL TAR0Phone Number of Licensed Institution:

+357 22 030 446Licensed Institution Certified Documents:

FCA Forex Execution License (STP)

Financial Conduct Authority

Financial Conduct Authority

Current Status:

UnverifiedLicense Type:

Forex Execution License (STP)

Licensed Entity:

Trade Capital UK (TCUK) Ltd

Effective Date:

2017-01-17Email Address of Licensed Institution:

info@tradecapitaluk.com, hassan.a@tradecapitaluk.comSharing Status:

No SharingWebsite of Licensed Institution:

http://www.tradecapitaluk.comExpiration Time:

--Address of Licensed Institution:

Spaces Victoria, 25 Wilton Road London Westminster SW1V 1LW UNITED KINGDOMPhone Number of Licensed Institution:

+44 2031502385Licensed Institution Certified Documents:

Is Trade.com A Scam?

Introduction

Trade.com is a prominent online forex and CFD broker, established in 2009 and headquartered in Cyprus. It positions itself as a multi-asset brokerage, offering a wide range of financial instruments, including forex, commodities, stocks, and cryptocurrencies. As the forex market continues to grow, traders must exercise caution when selecting a broker, given the prevalence of scams and fraudulent activities in the industry. Thus, evaluating the legitimacy and reliability of trading platforms is essential for safeguarding investments and ensuring a secure trading environment.

This article employs a comprehensive evaluation framework that encompasses regulatory compliance, company background, trading conditions, customer fund safety, client experiences, platform performance, and risk assessment. By analyzing these aspects, we aim to provide a balanced overview of whether Trade.com is a safe trading option or a potential scam.

Regulation and Legitimacy

A broker's regulatory status is paramount in determining its credibility and safety. Trade.com operates under the auspices of several regulatory authorities, which is a positive indicator of its legitimacy. The following table summarizes the core regulatory information regarding Trade.com:

| Regulatory Authority | License Number | Regulated Region | Verification Status |

|---|---|---|---|

| Cyprus Securities and Exchange Commission (CySEC) | 227/14 | Cyprus | Verified |

| Financial Conduct Authority (FCA) | 738538 | United Kingdom | Verified |

| Financial Sector Conduct Authority (FSCA) | 47857 | South Africa | Verified |

| Financial Services Commission (FSC) | C119023948 | Mauritius | Verified |

Trade.com is regulated by CySEC, which ensures compliance with the European Union's Markets in Financial Instruments Directive (MiFID II) and anti-money laundering legislation. This regulation mandates that client funds are kept in segregated accounts, enhancing the safety of traders' investments. Furthermore, the FCA provides additional consumer protection, including the Financial Services Compensation Scheme (FSCS), which protects client deposits up to £85,000.

However, it's essential to note that Trade.com has been flagged with a "suspicious clone" status under the FCA and FSCA, which raises concerns about its authorization and identity. While this does not automatically imply fraudulent activity, it necessitates caution from potential clients. Overall, Trade.com's regulatory framework is robust, but traders should remain aware of the implications of its clone status.

Company Background Investigation

Trade.com is operated by Lead Capital Markets Ltd., a company that has established a reputation in the online trading industry. Founded in 2009, the broker has expanded its offerings over the years, catering to a diverse clientele. The ownership structure is transparent, with Lead Capital Markets Ltd. being the parent company, which also operates under various other trading names.

The management team at Trade.com comprises experienced professionals with backgrounds in finance and trading. This expertise is critical for ensuring that the broker adheres to industry standards and provides quality services to its clients. The company maintains a commitment to transparency, with information about its operations and regulatory compliance readily available on its website.

Moreover, Trade.com provides a demo account for potential clients, allowing them to explore the platform without financial risk. This feature is beneficial for traders looking to familiarize themselves with the broker's offerings before committing real capital. Overall, Trade.com presents a solid company background that supports its legitimacy in the forex trading market.

Trading Conditions Analysis

When evaluating a broker, understanding its trading conditions is crucial. Trade.com offers competitive trading fees, but it is essential to scrutinize its overall fee structure for potential hidden costs. The following table compares Trade.com's core trading costs with industry averages:

| Fee Type | Trade.com | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | 1 pip | 1.5 pips |

| Commission Model | 0.20% | 0.25% |

| Overnight Interest Range | Varies | Varies |

Trade.com features a variable spread model, which can be advantageous for traders who prefer lower initial costs. The average spread for major currency pairs, such as EUR/USD, is around 1 pip, which is competitive compared to the industry average of 1.5 pips. Additionally, the commission structure is relatively low, with a charge of 0.20% per trade, making it an appealing option for active traders.

However, it is important to highlight that Trade.com imposes an inactivity fee of $50 after 90 days of inactivity, which is a common practice among brokers but can be a drawback for traders who do not trade frequently. Moreover, the broker charges overnight fees, also known as swap rates, which can add to the overall trading costs. Therefore, while Trade.com presents competitive trading conditions, traders should be aware of the potential for increased costs due to inactivity and overnight fees.

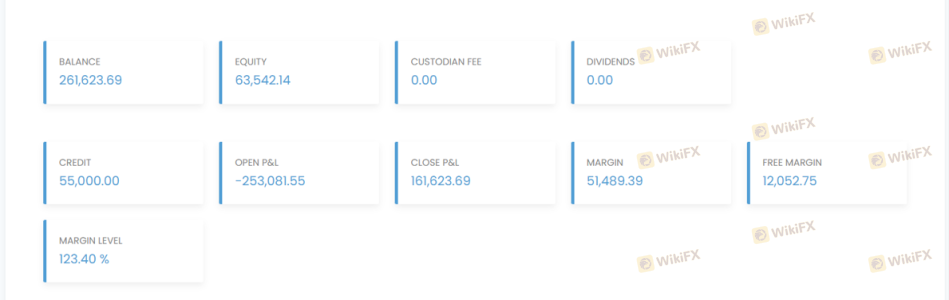

Customer Fund Safety

The safety of customer funds is a primary concern for any trader. Trade.com implements several security measures to ensure the protection of client funds. The broker maintains segregated accounts for client deposits, ensuring that these funds are kept separate from the company's operational funds. This practice is crucial in safeguarding traders' investments, especially in the event of insolvency.

Furthermore, Trade.com participates in the Cyprus Investor Compensation Fund, which protects client deposits up to €20,000. This compensation scheme provides an additional layer of security for traders, enhancing their confidence in the broker's reliability. Additionally, Trade.com offers negative balance protection, ensuring that traders cannot lose more than their deposited amount.

While Trade.com has not reported any significant incidents related to fund safety or security breaches, the presence of a "suspicious clone" status under the FCA may raise concerns for some traders. It is essential for potential clients to weigh these factors carefully when considering whether to engage with the broker.

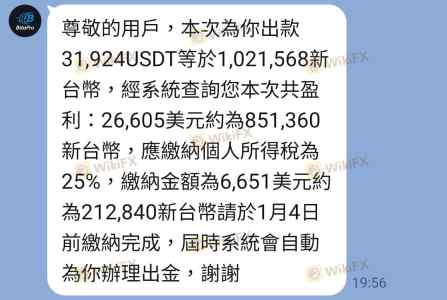

Customer Experience and Complaints

Customer feedback is a valuable indicator of a broker's reliability. Reviews of Trade.com generally reflect a mix of positive and negative experiences. Many users appreciate the broker's responsive customer support and the range of available trading instruments. However, common complaints include issues related to withdrawal delays and the high minimum deposit requirements for certain account types.

The following table summarizes the primary complaint types and their severity assessment:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | Moderate | Timely responses but occasional delays |

| High Minimum Deposits | Low | Acknowledged but part of account structure |

| Inactivity Fees | Moderate | Clearly stated in terms of service |

One notable case involves a trader who experienced delays in processing withdrawals, leading to frustration. While the customer support team responded promptly, the issue took longer to resolve than expected. Such experiences highlight the importance of having efficient withdrawal processes in place.

Platform and Trade Execution

Evaluating the trading platform's performance is vital for assessing a broker's reliability. Trade.com offers multiple platforms, including its proprietary web-based platform and the widely used MetaTrader 4 and 5. Users generally report a smooth trading experience, with the platforms providing essential features such as advanced charting tools and real-time data.

However, concerns have been raised regarding order execution quality. Some traders have reported instances of slippage and rejected orders during high volatility periods. While these issues are not uncommon in the trading industry, they warrant attention as they can significantly impact trading outcomes.

Risk Assessment

Engaging with any broker carries inherent risks. Trade.com presents several risk factors that potential clients should consider. The following risk assessment summarizes key risk areas:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | Medium | Suspicious clone status under FCA and FSCA |

| Withdrawal Risk | Medium | Reports of delayed withdrawals |

| Trading Cost Risk | Medium | Potential hidden fees impacting profitability |

To mitigate these risks, traders should conduct thorough research and maintain a clear understanding of the broker's fee structures and policies. Additionally, it is advisable to start with a smaller investment to gauge the broker's reliability before committing larger sums.

Conclusion and Recommendations

In conclusion, Trade.com is not a scam; it operates under multiple regulatory authorities and offers a wide range of trading instruments. However, potential clients should remain cautious due to its "suspicious clone" status under the FCA and FSCA, as well as reports of withdrawal delays. While the broker provides competitive trading conditions and robust fund safety measures, its high minimum deposit requirements and inactivity fees may deter some traders.

For novice traders or those with limited capital, it may be prudent to explore alternative options that offer more favorable terms. Recommended alternatives include brokers with a strong reputation, lower minimum deposits, and comprehensive educational resources. Ultimately, traders should carefully evaluate their options and choose a broker that aligns with their trading goals and risk tolerance.

Is TRADE.COM a scam, or is it legit?

The latest exposure and evaluation content of TRADE.COM brokers.

TRADE.COM Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

TRADE.COM latest industry rating score is 5.08, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 5.08 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.