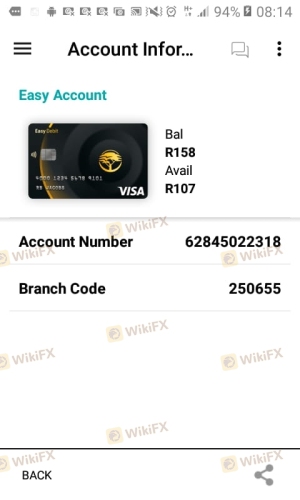

Regarding the legitimacy of Tate Prime forex brokers, it provides ASIC, CYSEC, FSA and WikiBit, (also has a graphic survey regarding security).

Is Tate Prime safe?

Business

License

Is Tate Prime markets regulated?

The regulatory license is the strongest proof.

ASIC Market Making License (MM)

Australia Securities & Investment Commission

Australia Securities & Investment Commission

Current Status:

Clone FirmLicense Type:

Market Making License (MM)

Licensed Entity:

INTERNATIONAL CAPITAL MARKETS PTY. LTD.

Effective Date: Change Record

2009-07-02Email Address of Licensed Institution:

compliance@icmarkets.com.auSharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

INTERNATIONAL CAPITAL MARKETS PTY U 2 L 6 50 CARRINGTON ST SYDNEY NSW 2000Phone Number of Licensed Institution:

0280144280Licensed Institution Certified Documents:

CYSEC Derivatives Trading License (MM)

Cyprus Securities and Exchange Commission

Cyprus Securities and Exchange Commission

Current Status:

Clone FirmLicense Type:

Derivatives Trading License (MM)

Licensed Entity:

IC Markets (EU) Ltd

Effective Date:

2018-06-25Email Address of Licensed Institution:

compliance@icmarkets.euSharing Status:

No SharingWebsite of Licensed Institution:

www.icmarkets.euExpiration Time:

--Address of Licensed Institution:

86 Franklinou Roosvelt, 4th floor, Office 401, 3011 Omonoia, Limassol, CyprusPhone Number of Licensed Institution:

+357 25 761 455Licensed Institution Certified Documents:

FSA Derivatives Trading License (EP)

The Seychelles Financial Services Authority

The Seychelles Financial Services Authority

Current Status:

UnverifiedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

Raw Trading Ltd

Effective Date:

--Email Address of Licensed Institution:

support@icmarkets.comSharing Status:

No SharingWebsite of Licensed Institution:

https://www.icmarkets.sc, https://www.icmarkets.comExpiration Time:

--Address of Licensed Institution:

Eden House, Floor, Eden Island, Mahe, SeychellesPhone Number of Licensed Institution:

(+248) 4346816Licensed Institution Certified Documents:

Is Tate Prime A Scam?

Introduction

Tate Prime is a relatively new player in the forex market, established in 2019. Positioned as an online broker, it claims to offer a range of trading services, including forex, commodities, and indices. However, the influx of online trading platforms has made it essential for traders to evaluate the legitimacy and safety of brokers like Tate Prime before committing their funds. The forex industry is rife with scams, and traders must navigate this landscape with caution to avoid potential losses. This article aims to provide an objective analysis of Tate Prime by investigating its regulatory status, company background, trading conditions, customer experience, and safety measures. The findings are derived from a comprehensive review of available online resources, including user feedback and expert evaluations.

Regulation and Legitimacy

Regulation is a critical aspect when assessing the safety of a forex broker. A regulated broker is subject to oversight by financial authorities, which helps ensure that it operates fairly and transparently. Tate Prime claims to be regulated by multiple authorities, including the Cyprus Securities and Exchange Commission (CySEC) and the Australian Securities and Investments Commission (ASIC). However, numerous sources have flagged Tate Prime as a potential clone firm, raising questions about its legitimacy.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | N/A | Australia | Not Verified |

| CySEC | 362/18 | Cyprus | Clone Firm |

| FSA | SD 018 | Seychelles | Not Verified |

The assessment of Tate Prime's regulatory status reveals significant concerns. The claims regarding its regulation by ASIC and CySEC have been disputed, suggesting that the broker may not be authorized to operate under these licenses. The lack of a verified license raises red flags, as it indicates that Tate Prime may be operating outside the bounds of legal oversight. Traders should be particularly cautious when dealing with brokers who have unclear or questionable regulatory backgrounds, as this could expose them to higher risks of fraud.

Company Background Investigation

Tate Prime is registered under International Capital Markets Pty Ltd, which is said to operate out of Australia. However, investigations have shown that the company may not have a physical presence at its claimed address in Sydney. This lack of transparency regarding its office location and operational history is concerning.

The management team behind Tate Prime has not been thoroughly disclosed, and details about their professional backgrounds are scarce. This lack of information is a significant drawback, as it hinders potential clients from evaluating the expertise and reliability of those managing their investments. Transparency in company ownership and management is crucial for building trust, and the absence of such information could indicate a lack of accountability.

Trading Conditions Analysis

When evaluating a forex broker, understanding their trading conditions is essential. Tate Prime offers various account types and claims to provide competitive spreads and leverage options. However, a closer look at their fee structure reveals potential issues.

| Fee Type | Tate Prime | Industry Average |

|---|---|---|

| Major Currency Pair Spread | From 0.0 pips | 1.0-2.0 pips |

| Commission Model | N/A | $5-$10 per lot |

| Overnight Interest Range | Varies | Varies |

While Tate Prime advertises low spreads, the lack of transparency regarding commissions and other potential fees is alarming. Some users have reported unexpected charges that were not disclosed upfront, which could significantly impact trading profitability. This hidden fee structure is a common tactic among scam brokers, making it essential for traders to scrutinize any broker that lacks clear and transparent pricing.

Customer Funds Security

The safety of customer funds is paramount in the forex trading environment. Tate Prime claims to implement measures for fund security, such as segregated accounts and investor protection policies. However, the effectiveness of these measures remains unverified due to the broker's questionable regulatory status.

Traders should be aware that if a broker is not regulated, there may be no guarantees regarding the safety of their funds. Reports of Tate Prime withholding withdrawals and imposing excessive fees for fund access further exacerbate concerns regarding its credibility. A history of unresolved complaints related to fund security is a significant indicator that the broker may not prioritize the safety of its clients' investments.

Customer Experience and Complaints

Customer feedback is another critical aspect of evaluating a broker's reliability. A substantial number of complaints have been lodged against Tate Prime, with many users reporting difficulties in withdrawing their funds. Common complaints include:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Hidden Fees | Medium | Poor |

| Poor Customer Support | High | Poor |

The most severe complaints revolve around the inability to withdraw funds, with users alleging that Tate Prime imposes unreasonable conditions for accessing their money. Additionally, the company's customer support has been criticized for being unresponsive and evasive. These patterns of complaints are indicative of a broker that may not be operating in good faith, raising further questions about its legitimacy.

Platform and Trade Execution

The trading platform offered by Tate Prime is based on the widely used MetaTrader 4 (MT4) software. While MT4 is known for its user-friendly interface and robust features, the performance of the platform can vary significantly between brokers. Reports from users indicate mixed experiences regarding trade execution quality, with some experiencing slippage and rejected orders during volatile market conditions.

In the forex market, the speed and reliability of order execution are crucial. Any signs of manipulation or consistent issues with executing trades can be red flags that warrant further investigation. The lack of transparency in Tate Prime's trading practices raises concerns about the integrity of its platform.

Risk Assessment

Using Tate Prime presents several risks that potential traders should consider. A summary of the key risks associated with this broker is as follows:

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Compliance | High | Unverified regulatory claims |

| Fund Security | High | Reports of withheld withdrawals |

| Customer Support | Medium | Poor response to complaints |

Given the high-risk factors associated with Tate Prime, traders are advised to exercise extreme caution. It is essential to conduct thorough due diligence and consider alternative brokers with verified regulatory status and a proven track record of customer satisfaction.

Conclusion and Recommendations

In conclusion, the evidence suggests that Tate Prime exhibits several characteristics commonly associated with scam brokers. The lack of verified regulatory oversight, combined with numerous complaints regarding fund withdrawals and hidden fees, raises significant concerns about its legitimacy.

Potential traders should approach Tate Prime with caution and consider seeking out more reputable alternatives that offer clear regulatory oversight and positive customer feedback. Brokers such as IG, OANDA, and Forex.com are recommended as safer options for those looking to engage in forex trading. Ultimately, the safety and security of your investments should be the top priority, making it crucial to choose a broker with a solid reputation in the industry.

As for the question, "Is Tate Prime safe?"—the overwhelming consensus from the available evidence suggests that it is not.

Is Tate Prime a scam, or is it legit?

The latest exposure and evaluation content of Tate Prime brokers.

Tate Prime Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Tate Prime latest industry rating score is 1.54, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.54 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.