Sky Alliance Markets 2025 Review: Everything You Need to Know

Executive Summary

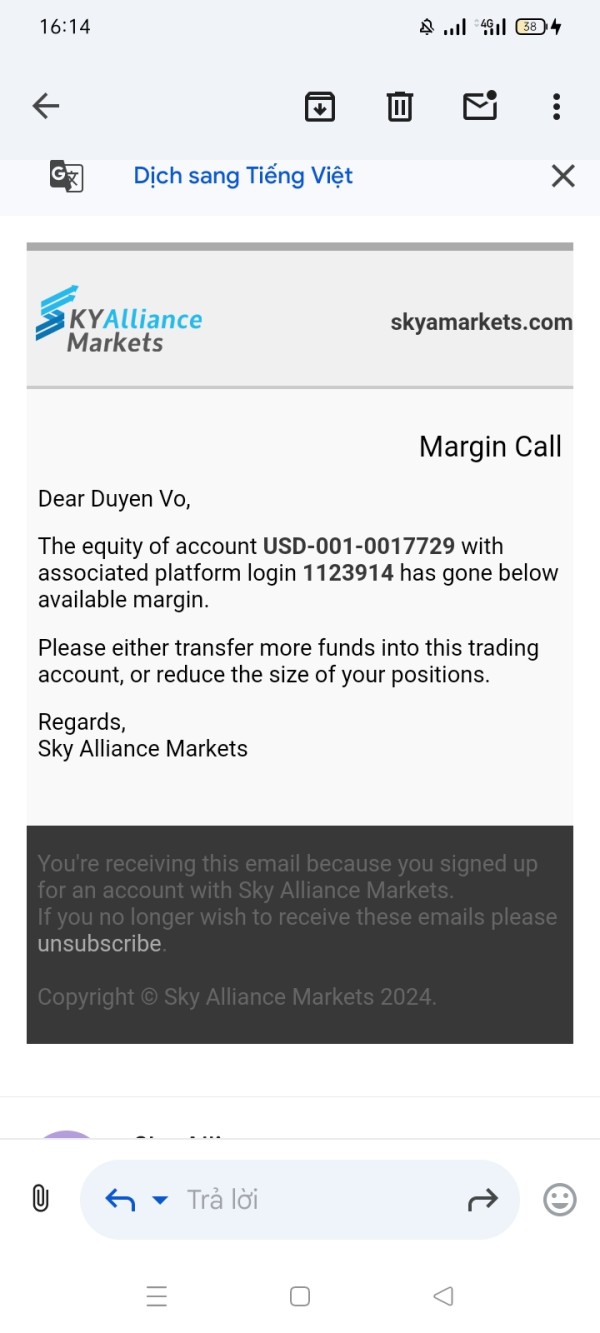

Sky Alliance Markets is an Australian-based forex broker that has been operating since 1989. The company positions itself as a provider of no dealing desk (NDD) trading services across multiple financial instruments. This sky alliance markets review reveals a broker with mixed credentials - while it maintains regulatory oversight through the Australian Securities and Investments Commission (ASIC) via an Authorised Representative licence, user feedback indicates significant concerns regarding customer support quality and service delivery.

The broker offers trading access through industry-standard MT4 and MT5 platforms. It provides leverage up to 1:400 and a relatively accessible minimum deposit requirement of $100 USD. Sky Alliance Markets caters to a diverse range of tradeable assets including forex pairs, precious metals, company stocks, and cryptocurrencies. However, our analysis suggests that while the broker may appear suitable for small to medium-sized investors seeking diversified trading opportunities, potential clients should carefully consider the reported service limitations and mixed user experiences before committing funds.

The overall assessment positions Sky Alliance Markets as a neutral option in the competitive forex brokerage landscape. There is room for significant improvement in customer service delivery and transparency.

Important Disclaimer

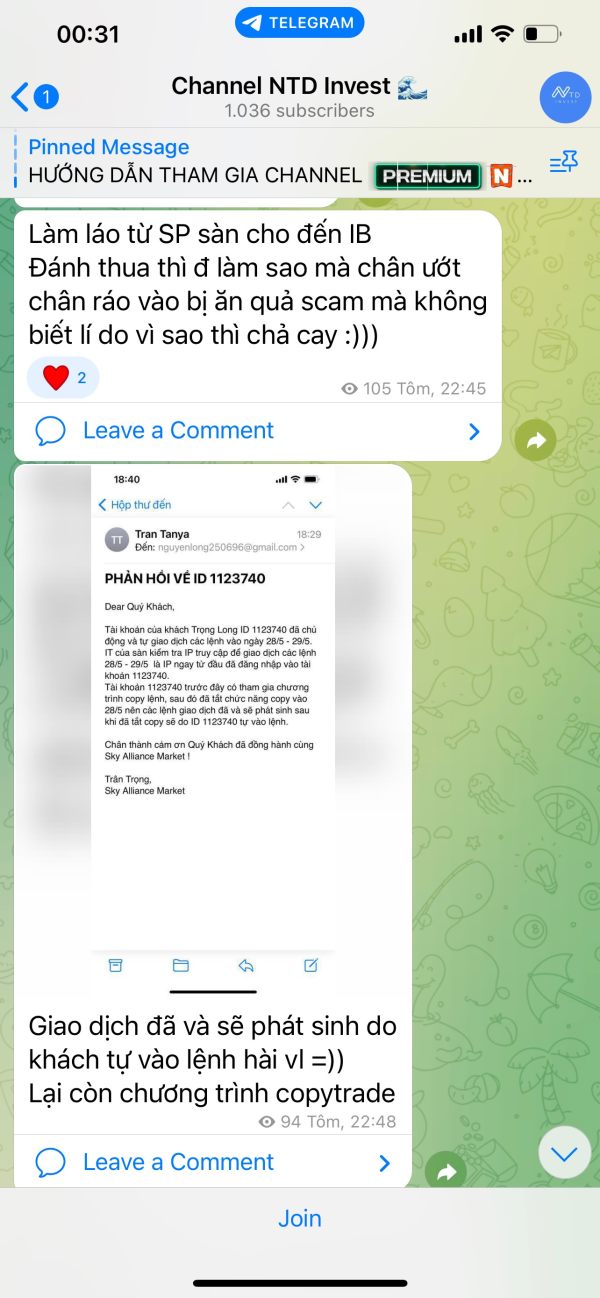

This sky alliance markets review is based on publicly available information and user feedback collected from various sources. Prospective traders should note that Sky Alliance Markets operates through multiple entities, specifically Sky Alliance Markets Limited and Sky Alliance Markets Pty Ltd, which may create confusion regarding corporate structure and regulatory responsibilities. The regulatory oversight is provided through Sky Alliance Markets Pty Ltd's Authorised Representative licence with ASIC, rather than direct regulation of the primary trading entity.

Our evaluation methodology incorporates official regulatory documentation, user testimonials, and publicly disclosed trading conditions. However, trading conditions and service quality may vary. Potential clients are strongly advised to conduct independent verification of all claims and thoroughly test services through demo accounts before live trading.

Rating Framework

Broker Overview

Sky Alliance Markets was established in 1989. It operates as Sky Alliance Markets (AU) Pty Ltd from its Australian headquarters. The company positions itself as a no dealing desk (NDD) broker, claiming to provide direct market access without intervention in client trades. According to official company information, Sky Alliance Markets focuses on delivering transparent trading conditions across multiple asset classes while maintaining regulatory compliance through Australian financial authorities.

The broker's business model centers on NDD execution. This approach theoretically ensures that client orders are passed directly to liquidity providers without dealer intervention. This approach is designed to minimize conflicts of interest between the broker and its clients, though the effectiveness of this model depends heavily on the quality of liquidity partnerships and execution infrastructure.

Sky Alliance Markets provides access to forex trading, precious metals including gold, company stocks, cryptocurrencies, and other financial instruments through their MT4 and MT5 platform offerings. The broker operates under the regulatory supervision of the Australian Securities and Investments Commission (ASIC), with Sky Alliance Markets Pty Ltd holding an Authorised Representative licence. This regulatory framework provides a foundation of consumer protection, though the specific terms and coverage may differ from full ASIC licensing arrangements.

Regulatory Jurisdiction: Sky Alliance Markets operates under Australian regulatory oversight through ASIC's Authorised Representative licensing framework. This provides baseline consumer protections, though clients should understand the differences between AR licensing and direct ASIC regulation.

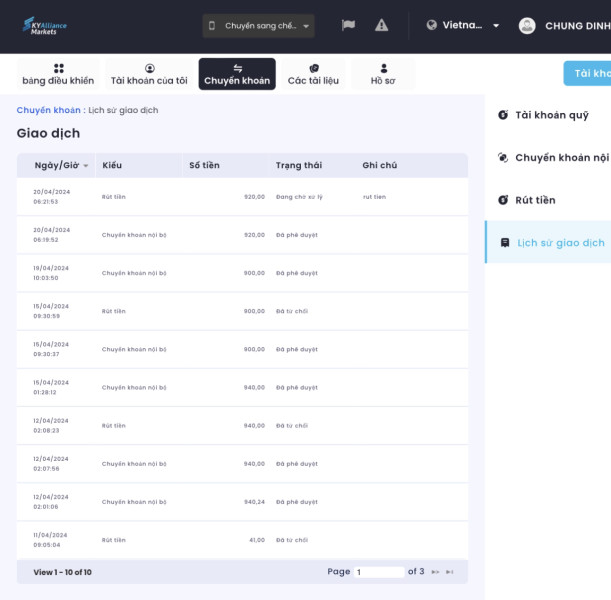

Deposit and Withdrawal Methods: Specific information regarding deposit and withdrawal methods was not detailed in available documentation. Prospective clients should verify available payment options and processing times directly with the broker.

Minimum Deposit Requirements: The broker maintains an accessible minimum deposit threshold of $100 USD. This makes it suitable for entry-level traders and those seeking to test services with limited initial capital commitment.

Bonus and Promotional Offers: Available documentation does not provide specific information about current bonus structures or promotional campaigns. Traders interested in such offerings should inquire directly with the broker.

Tradeable Assets: Sky Alliance Markets offers a comprehensive range of trading instruments including major and minor forex pairs, gold and precious metals, company stocks from various markets, and cryptocurrency trading options. This diversity allows for portfolio diversification across multiple asset classes.

Cost Structure: Detailed information regarding spreads, commissions, and other trading costs was not available in the reviewed materials. This lack of transparency represents a significant concern for cost-conscious traders who require clear fee structures for informed decision-making.

Leverage Ratios: The broker offers maximum leverage of 1:400. This aligns with industry standards while remaining within Australian regulatory limits for retail clients.

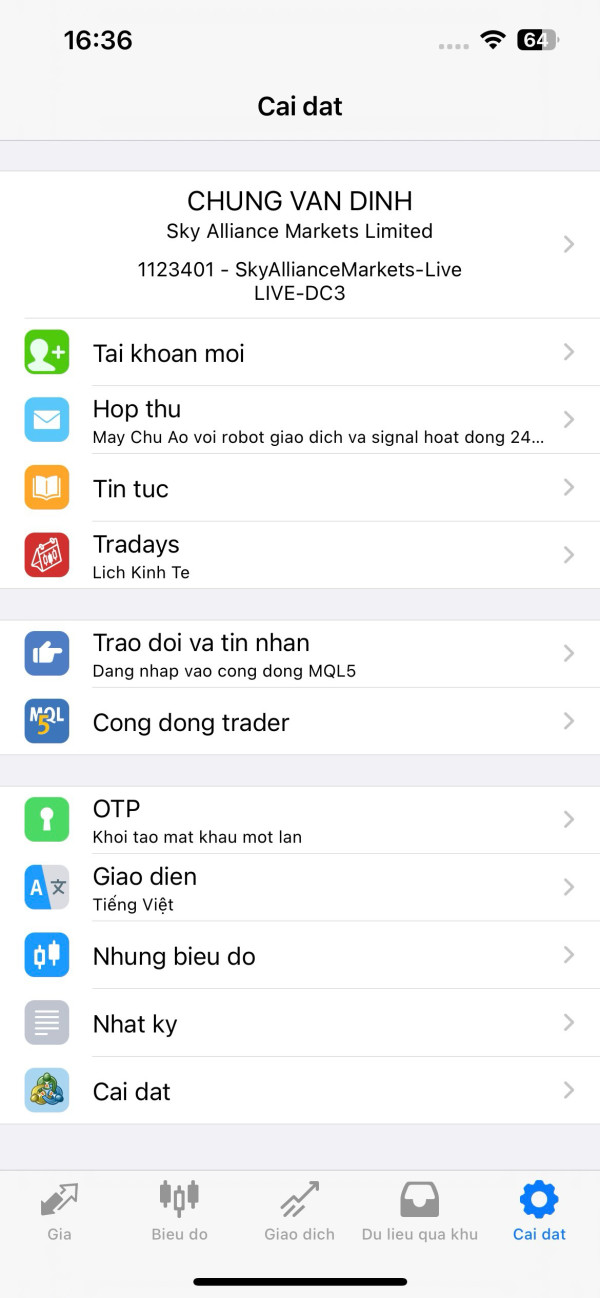

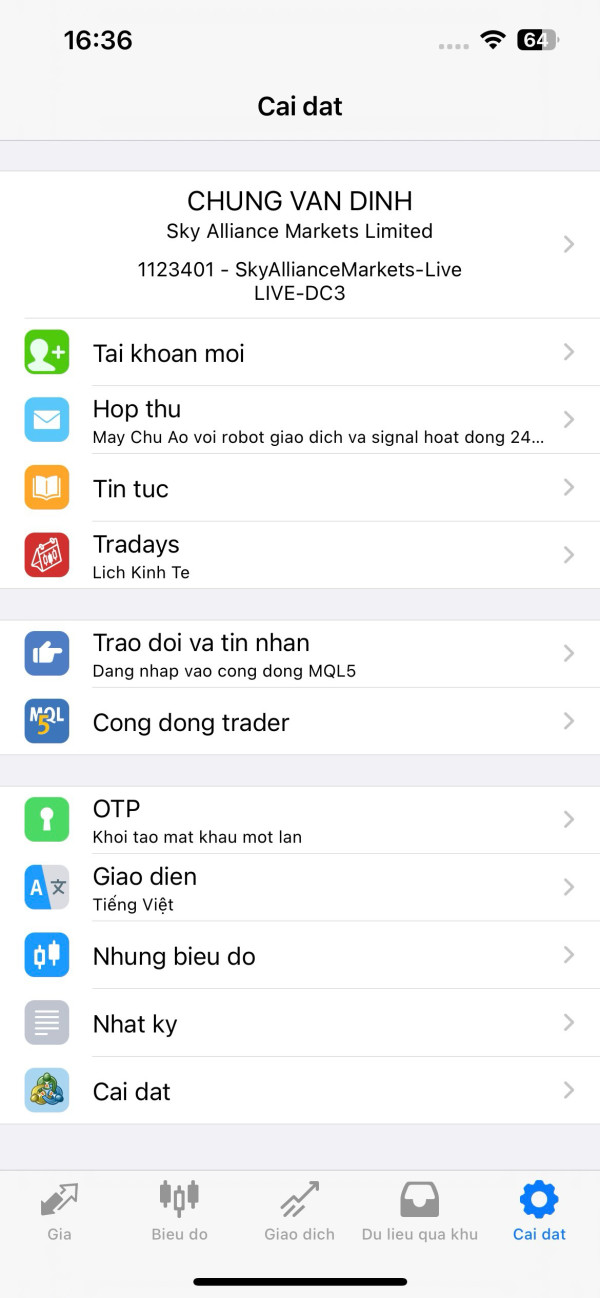

Platform Options: Trading is facilitated through MetaTrader 4 and MetaTrader 5 platforms. Both are industry-standard options that provide comprehensive charting tools, technical indicators, and automated trading capabilities.

Geographic Restrictions: Specific information about geographic restrictions or service limitations was not detailed in available sources.

Customer Service Languages: Available documentation does not specify the range of languages supported by customer service teams.

Detailed Rating Analysis

Account Conditions Analysis (Score: 6/10)

Sky Alliance Markets presents a mixed picture regarding account conditions. The sky alliance markets review reveals that while the broker offers an accessible entry point with a $100 minimum deposit, significant information gaps exist regarding account types and their specific features. The low minimum deposit requirement positions the broker favorably for beginning traders or those seeking to test services without substantial initial commitment.

However, the lack of detailed information about different account tiers, their respective benefits, and associated cost structures represents a transparency concern. Available sources do not provide clarity on whether the broker offers specialized accounts such as Islamic accounts, professional trader accounts, or other customized solutions that are common in the industry.

The account opening process details are not well-documented in available materials. This makes it difficult to assess the efficiency and user-friendliness of client onboarding procedures. This information gap could indicate either streamlined processes or potential complications that prospective clients should investigate directly.

Without comprehensive details about account-specific benefits, trading conditions variations, or tier-based advantages, the account conditions receive a moderate rating. This reflects both the positive aspect of low barrier to entry and concerns about transparency and detailed offering structure.

The broker demonstrates strength in platform provision, offering both MetaTrader 4 and MetaTrader 5 platforms. These represent industry-standard trading environments with robust functionality. These platforms provide comprehensive charting capabilities, extensive technical indicator libraries, and support for automated trading strategies through Expert Advisors.

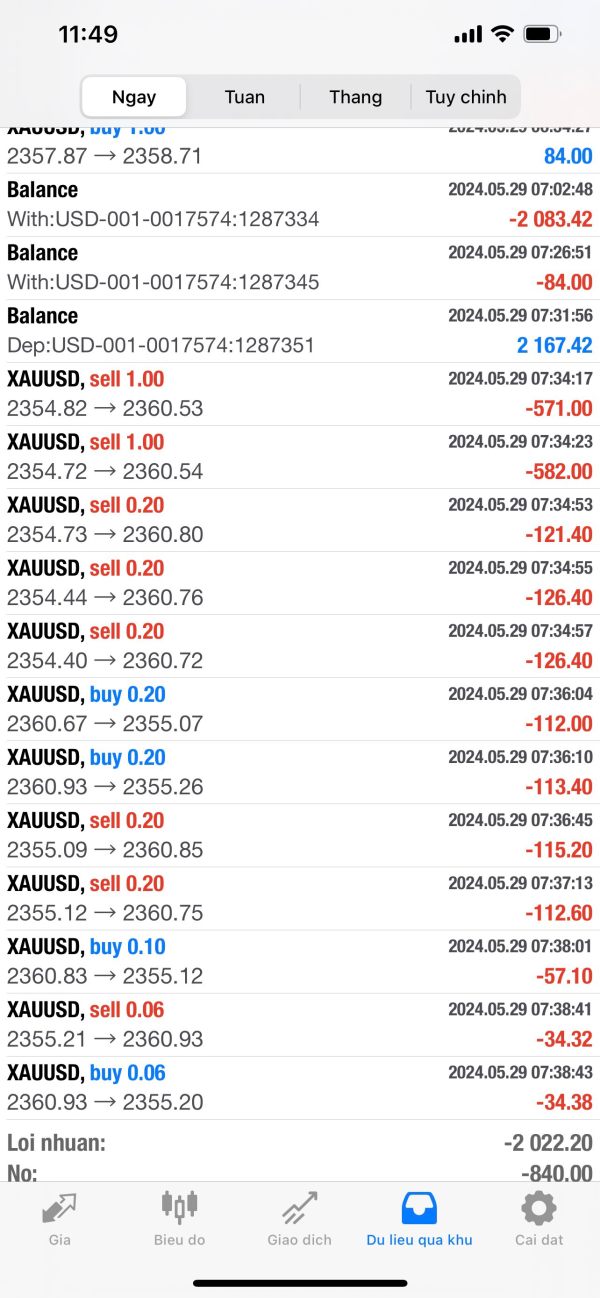

Sky Alliance Markets enhances its offering through copy trading capabilities. This allows less experienced traders to replicate the strategies of successful traders within their network. This feature adds significant value for traders seeking to learn from others or diversify their approach through social trading elements.

The availability of demo accounts provides prospective clients with the opportunity to test platform functionality and trading conditions without financial risk. This is a standard but important feature that supports proper evaluation before live trading commitment.

However, available information does not detail the breadth of research and analysis resources provided by the broker. Educational materials, market analysis, economic calendars, and other supporting tools are not well-documented, representing a potential gap in comprehensive trader support.

The absence of detailed information about proprietary tools, advanced analytics, or unique trading resources limits the assessment of the broker's competitive advantage in this category.

Customer Service and Support Analysis (Score: 4/10)

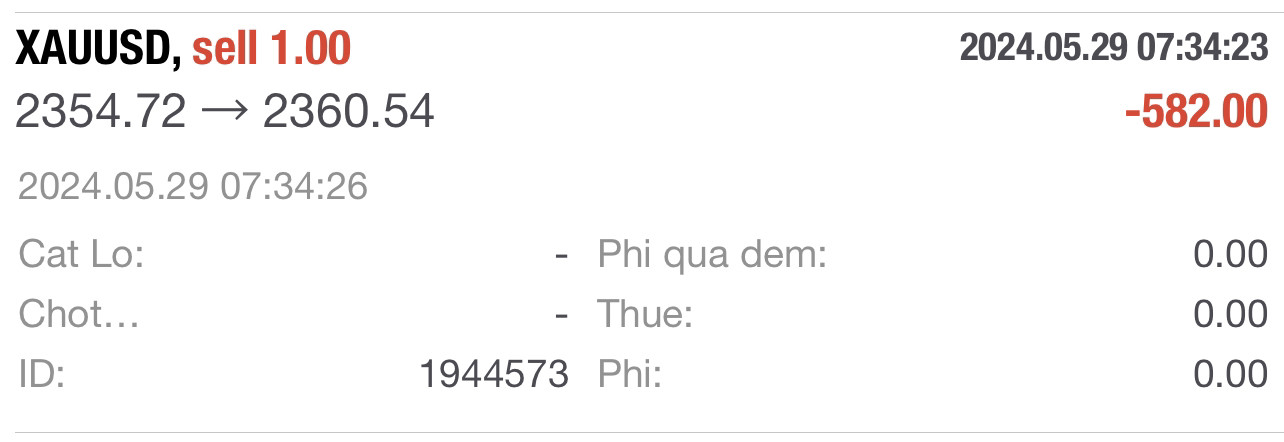

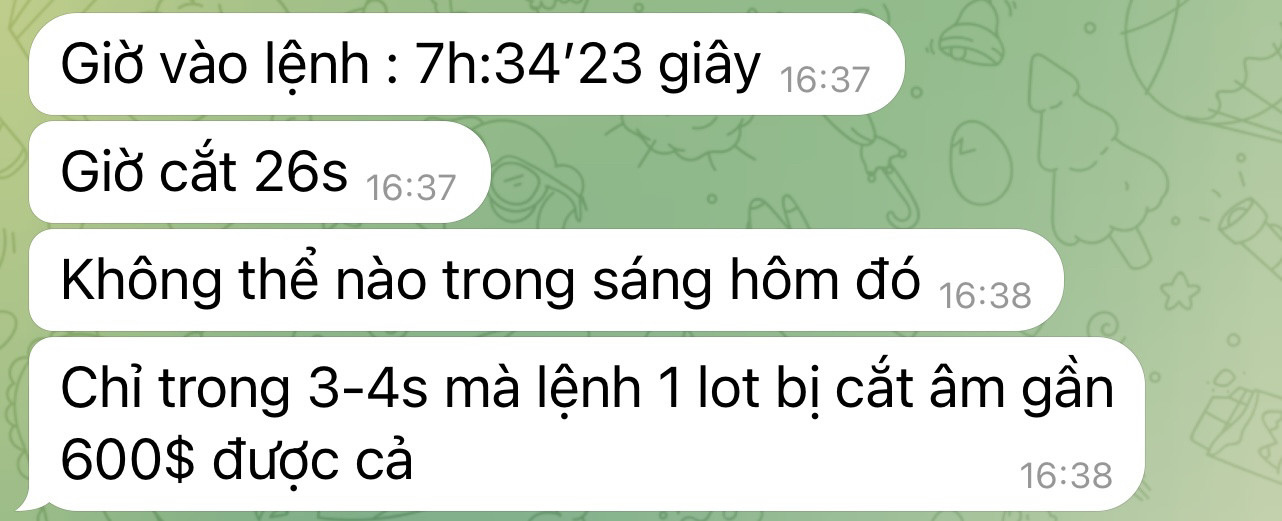

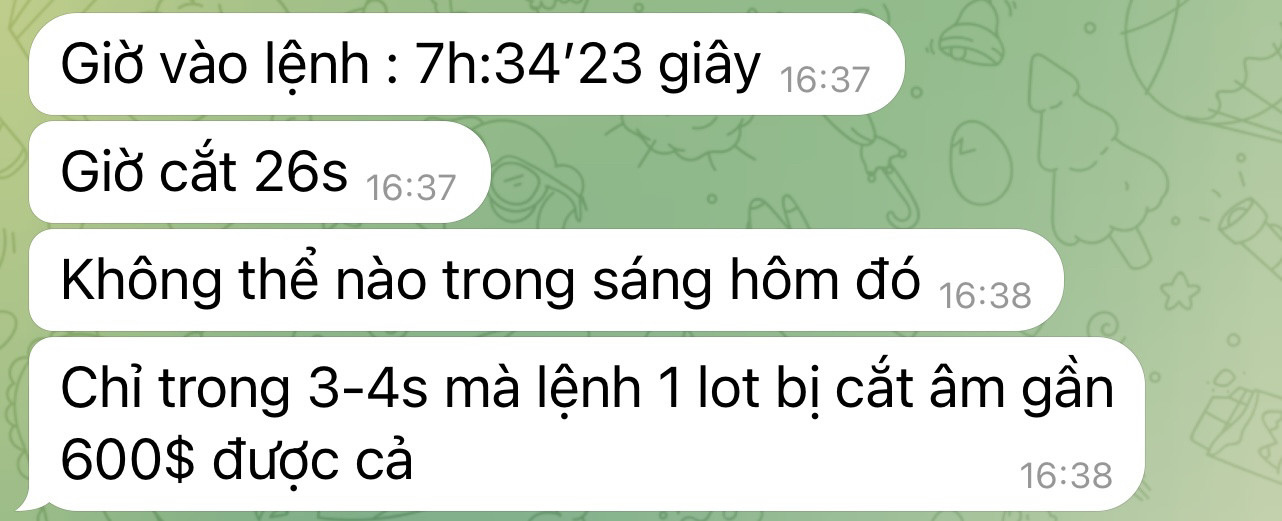

Customer service emerges as a significant weakness in this sky alliance markets review. User feedback consistently highlights poor support experiences. Available testimonials indicate that response times are inadequate and that support staff often lack the expertise or authority to resolve client issues effectively.

The quality of problem resolution appears to be a particular concern. Users report frustration over unresolved issues and inadequate communication from support teams. This creates significant challenges for traders who require timely assistance, especially during volatile market conditions when quick resolution of technical or account issues becomes critical.

Available documentation does not provide clear information about supported communication channels, support team availability hours, or escalation procedures for complex issues. This lack of transparency in support structure compounds the concerns raised by user feedback.

The absence of detailed information about multilingual support capabilities may also limit accessibility for international clients. However, this cannot be definitively assessed without additional information.

The consistently negative feedback regarding customer support quality represents a major concern for potential clients. Reliable support is essential for successful trading operations.

Trading Experience Analysis (Score: 6/10)

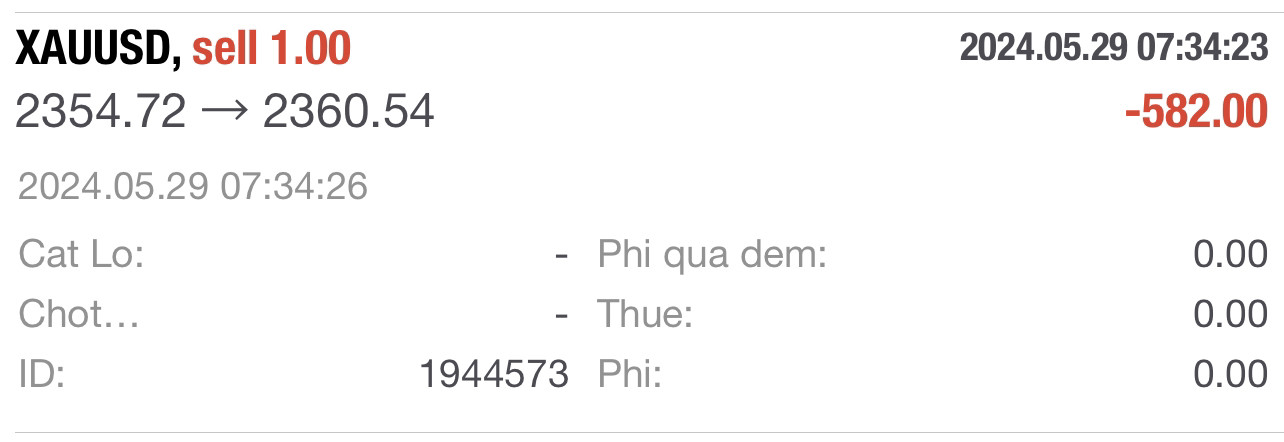

Sky Alliance Markets operates on a No Dealing Desk (NDD) model. This theoretically provides direct market access and reduces conflicts of interest between the broker and clients. However, the actual effectiveness of this execution model cannot be thoroughly assessed due to limited available performance data.

The sky alliance markets review reveals that specific information about order execution quality, including average execution speeds, slippage rates, and requote frequency, is not readily available. This data gap makes it difficult for traders to assess the practical trading environment they would experience.

Platform stability and performance metrics are not detailed in available sources. The use of established MT4 and MT5 platforms suggests baseline functionality should meet industry standards. However, the broker's implementation and server infrastructure quality remain unclear.

Mobile trading capabilities through MetaTrader mobile applications are presumably available. Specific performance characteristics and feature completeness on mobile platforms are not documented.

The trading environment assessment is further complicated by the lack of detailed information about spreads, liquidity provision, and market depth. All of these factors significantly impact actual trading experience quality.

Trust and Security Analysis (Score: 5/10)

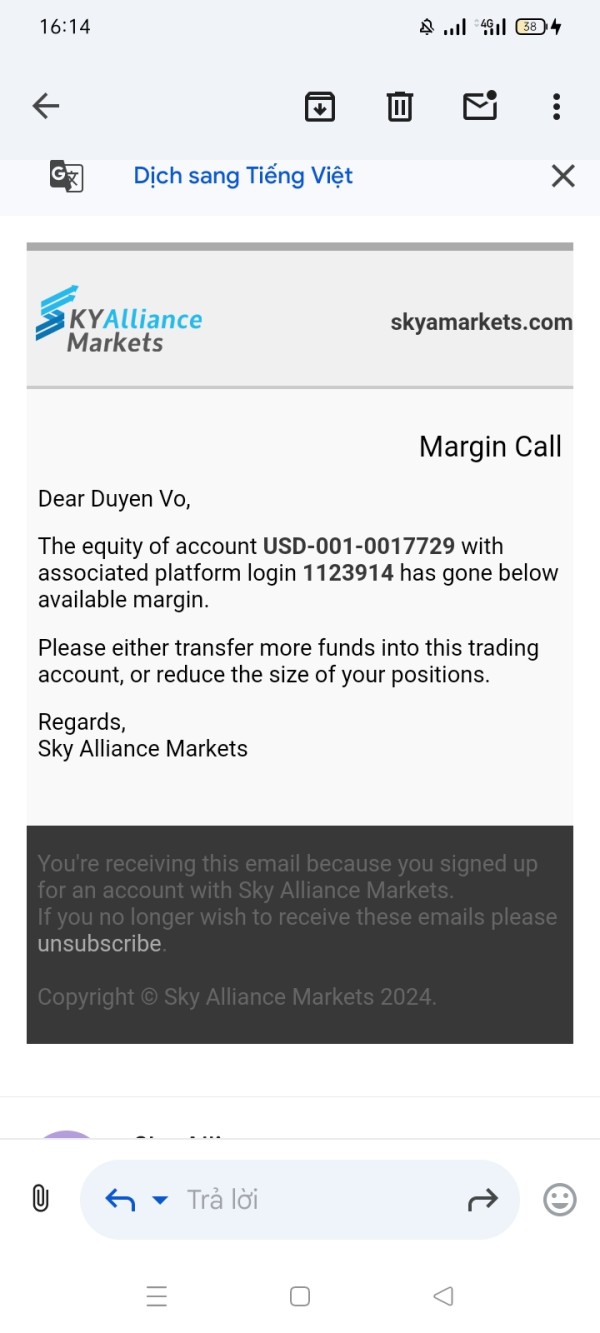

Sky Alliance Markets operates under ASIC regulatory oversight through an Authorised Representative licence held by Sky Alliance Markets Pty Ltd. While this provides some regulatory framework and consumer protection, the AR licence structure may offer different protections compared to direct ASIC regulation, which prospective clients should understand.

The regulatory structure involving multiple entities (Sky Alliance Markets Limited and Sky Alliance Markets Pty Ltd) creates complexity that may affect transparency and accountability. This corporate structure arrangement requires careful consideration by potential clients seeking clear regulatory protection.

Available information does not provide details about client fund segregation practices, deposit protection schemes, or other specific security measures that protect client assets. This represents a significant transparency gap for security-conscious traders.

The broker's financial stability and background are not well-documented in available sources. This makes it difficult to assess long-term operational reliability. Company financial reports, audited statements, or third-party financial ratings are not readily accessible.

Industry reputation and recognition through awards, certifications, or professional acknowledgments are not evident in available materials. This may indicate limited industry standing or simply insufficient public information.

User Experience Analysis (Score: 5/10)

Overall user satisfaction with Sky Alliance Markets appears mixed. Particular concerns are concentrated around customer support quality overshadowing other aspects of the service. The sky alliance markets review indicates that while some users appreciate the platform accessibility and trading options, support-related issues significantly impact overall satisfaction.

Platform interface design and usability benefit from the established MetaTrader ecosystem. This provides familiar and functional trading environments for most users. However, broker-specific customizations or enhancements are not well-documented.

The account registration and verification process efficiency is not clearly detailed in available sources. This makes it difficult to assess onboarding experience quality. This represents an important aspect of initial user experience that requires direct investigation.

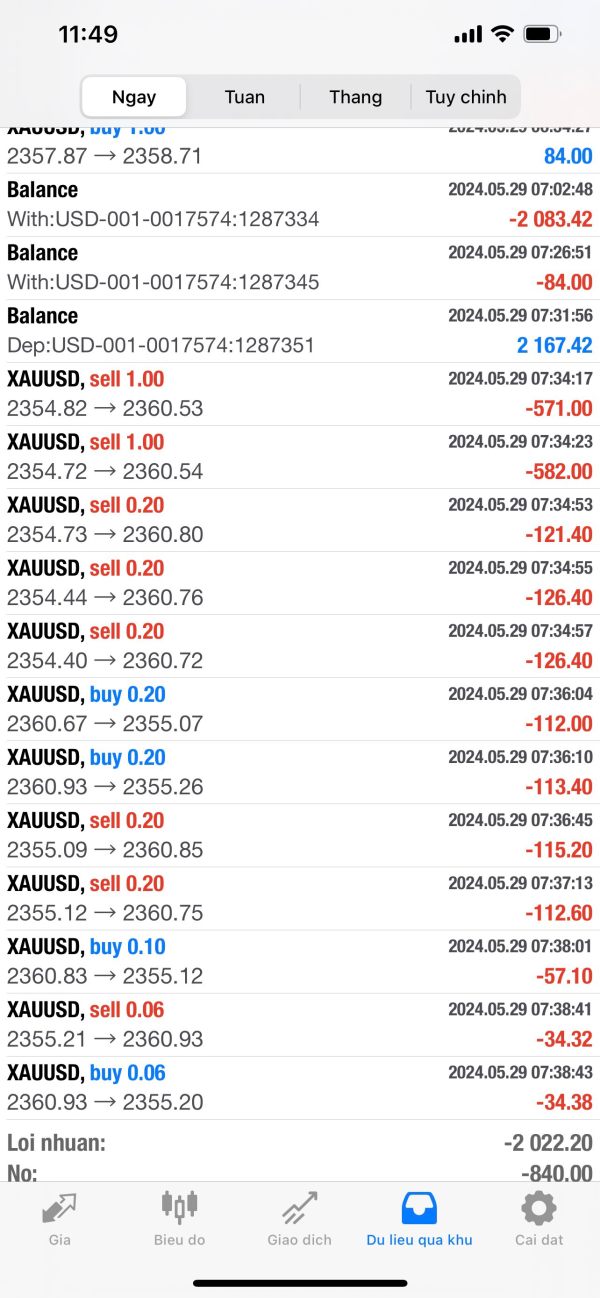

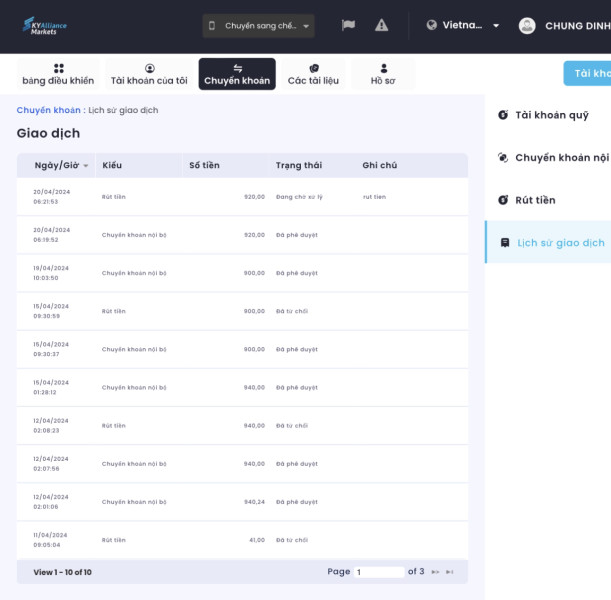

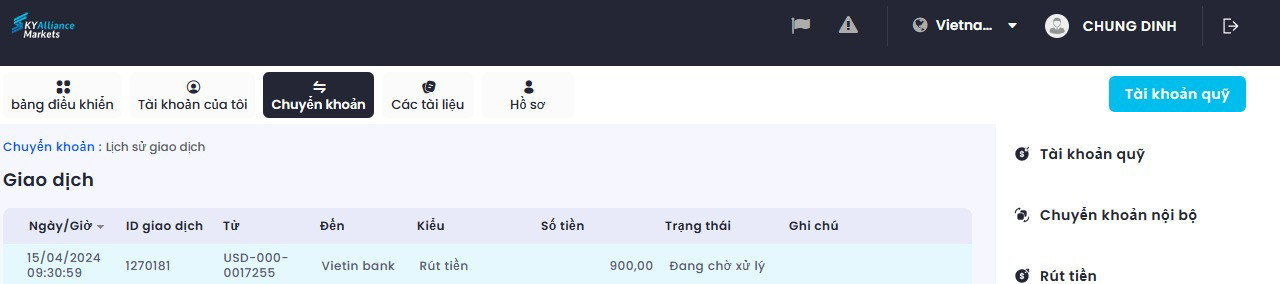

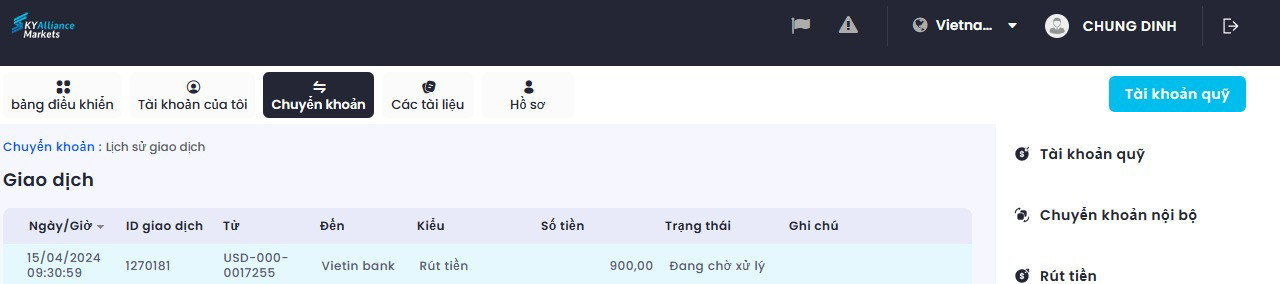

Fund management operations, including deposit and withdrawal processes, timelines, and associated costs, are not comprehensively documented. User feedback about these critical operational aspects is limited in available sources.

Common user complaints center primarily on customer support responsiveness and effectiveness. Some users express frustration about problem resolution timelines and communication quality. These concerns suggest systematic issues that may affect user experience across multiple service areas.

The broker appears most suitable for small to medium-sized investors who prioritize platform functionality and asset diversity over premium support services. This assessment should be verified through direct testing.

Conclusion

This comprehensive sky alliance markets review reveals a broker with mixed strengths and notable weaknesses. While Sky Alliance Markets offers accessible entry conditions with a $100 minimum deposit and provides industry-standard trading platforms through MT4 and MT5, significant concerns exist regarding customer support quality and overall service transparency.

The broker may be suitable for cost-conscious traders seeking basic trading functionality across diverse asset classes. This particularly applies to those who require minimal support interaction. However, traders who prioritize responsive customer service, comprehensive educational resources, or premium trading conditions should carefully consider alternatives.

Key advantages include low minimum deposits, established trading platforms, and regulatory oversight through ASIC's AR framework. Primary disadvantages center on poor customer support feedback, limited cost transparency, and gaps in detailed service information that affect informed decision-making.

Prospective clients should conduct thorough due diligence, including extensive demo testing and direct verification of all trading conditions, before committing funds to Sky Alliance Markets.