Regarding the legitimacy of Sky Alliance Markets forex brokers, it provides ASIC and WikiBit, (also has a graphic survey regarding security).

Is Sky Alliance Markets safe?

Business

License

Is Sky Alliance Markets markets regulated?

The regulatory license is the strongest proof.

ASIC Forex Execution License (STP)

Australia Securities & Investment Commission

Australia Securities & Investment Commission

Current Status:

Clone FirmLicense Type:

Forex Execution License (STP)

Licensed Entity:

BKS MARKETS PTY LTD

Effective Date: Change Record

2005-11-17Email Address of Licensed Institution:

service.twfg@gmail.comSharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

SE 1403 L 14 219-227 ELIZABETH ST SYDNEY NSW 2000Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is Sky Alliance Markets A Scam?

Introduction

Sky Alliance Markets is an online forex and CFD broker that claims to provide a range of trading services to clients globally. Established in Sydney, Australia, the broker positions itself as a provider of diverse financial instruments, including forex pairs, commodities, indices, and cryptocurrencies. However, as with any financial service provider, it is crucial for traders to conduct thorough due diligence before engaging with a broker. The forex market is rife with unregulated entities and scams, making it essential for traders to evaluate the legitimacy and reliability of brokers like Sky Alliance Markets. This article will utilize a comprehensive research methodology, including reviews from reputable financial websites, regulatory information, and user feedback, to assess whether Sky Alliance Markets is a trustworthy broker or a potential scam.

Regulation and Legitimacy

Regulation is a critical factor in determining the legitimacy of any trading broker. Sky Alliance Markets claims to be regulated by the Australian Securities and Investments Commission (ASIC), a reputable regulatory body known for its stringent oversight of financial services. However, it is important to note that the broker's license has reportedly been revoked, raising serious concerns about its operational legitimacy.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | 292464 | Australia | Revoked |

The revocation of its license indicates that Sky Alliance Markets may not be complying with the necessary regulations, which could expose traders to significant risks. Regulatory bodies like ASIC enforce strict guidelines to protect investors, including requirements for segregating client funds and maintaining adequate capital reserves. The lack of a valid license means that clients may have limited recourse in the event of disputes or financial losses. Furthermore, the broker's claims of regulatory compliance should be approached with skepticism, given the current status of its license.

Company Background Investigation

Sky Alliance Markets operates under the ownership of Sky Alliance Markets Pty Ltd, which is based in Sydney, Australia. The company was founded in 2005, positioning itself as a player in the competitive forex and CFD market. However, the absence of detailed information regarding its management team and operational history raises concerns about its transparency.

A thorough assessment of the company's ownership structure reveals a lack of publicly available information about its key executives and their professional backgrounds. This opacity can be a red flag for potential investors, as a reputable broker typically provides clear information about its leadership and their qualifications. Transparency in company operations is crucial for building trust with clients, and the lack of such information may indicate underlying issues.

Trading Conditions Analysis

When evaluating a broker, understanding the trading conditions, including fees and spreads, is essential. Sky Alliance Markets offers various account types, including standard and ECN accounts, with minimum deposit requirements starting at $100. However, the broker's fee structure is somewhat opaque, with reports indicating that traders may encounter unexpected charges.

| Fee Type | Sky Alliance Markets | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.0 pips | 0.6 - 1.0 pips |

| Commission Model | $3.5 per lot (ECN) | $3.0 - $5.0 per lot |

| Overnight Interest Range | Varies | Varies |

The spreads offered by Sky Alliance Markets appear to be on par with industry averages for standard accounts, but the ECN account's commission structure may be higher than some competitors. Additionally, the absence of clear information regarding overnight interest rates can lead to confusion for traders, particularly those holding positions long-term. This lack of clarity can be detrimental, especially for new traders who may not fully understand the implications of these costs.

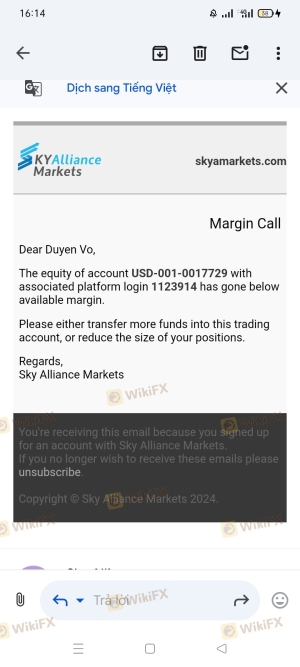

Customer Fund Safety

The safety of client funds is paramount when considering a broker. Sky Alliance Markets claims to adhere to industry standards for fund security, including segregating client funds from company operating capital. However, the broker's revoked license raises questions about the effectiveness of these measures.

A comprehensive analysis of the broker's fund safety protocols reveals that while they may have stated policies in place, there have been reports of clients experiencing difficulties withdrawing funds. The absence of investor protection schemes, such as those provided by regulated brokers, further compounds these concerns. Historical data shows that some clients have reported being unable to access their funds, which can be indicative of broader operational issues within the brokerage.

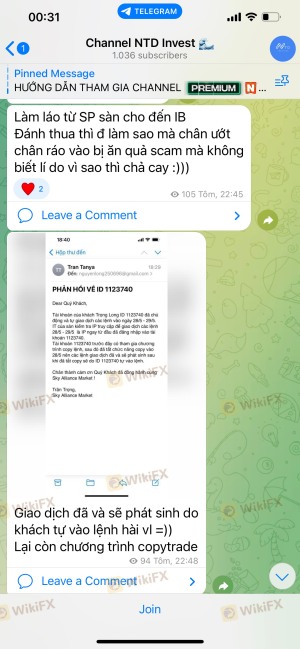

Customer Experience and Complaints

Customer feedback is a vital component in assessing a broker's reliability. Reviews of Sky Alliance Markets reveal a mixed bag of experiences, with numerous complaints centering around withdrawal issues and inadequate customer support.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Poor Customer Support | Medium | Inadequate |

| Inaccurate Fee Disclosure | High | Poor |

Typical cases include clients reporting extended delays in withdrawal requests, often with little to no communication from the broker regarding the status of their funds. This lack of responsiveness can lead to frustration and distrust among clients. The overall sentiment from user reviews suggests a pattern of dissatisfaction, particularly regarding the broker's handling of client concerns.

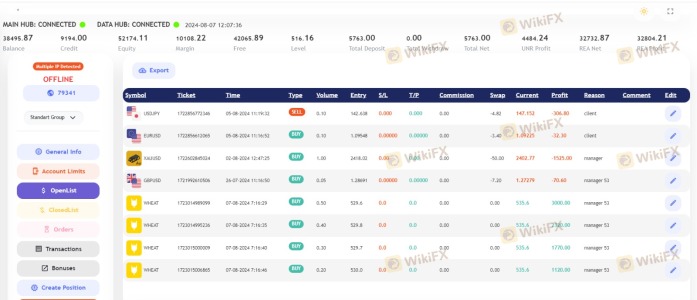

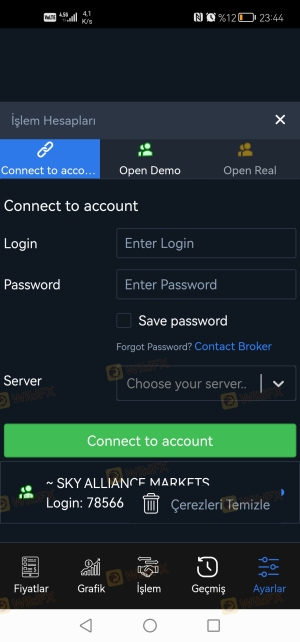

Platform and Trade Execution

Sky Alliance Markets utilizes the popular MetaTrader 4 (MT4) platform, which is known for its user-friendly interface and robust trading capabilities. However, user experiences indicate that the platform may suffer from stability issues, leading to concerns about order execution quality.

Traders have reported instances of slippage and rejected orders, which can significantly impact trading outcomes. While MT4 is generally regarded as a reliable platform, the performance issues reported by Sky Alliance Markets users suggest that there may be underlying technical challenges that need to be addressed.

Risk Assessment

Engaging with Sky Alliance Markets comes with inherent risks, particularly given its regulatory status and customer feedback.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Compliance | High | Revoked license raises serious concerns. |

| Fund Withdrawal Issues | High | Reports of clients unable to access funds. |

| Customer Support Quality | Medium | Inadequate response to client inquiries. |

To mitigate these risks, potential traders should consider using a demo account to familiarize themselves with the platform before committing real funds. Additionally, it is advisable to set strict risk management parameters and only invest capital that they can afford to lose.

Conclusion and Recommendations

Based on the comprehensive evaluation of Sky Alliance Markets, it is evident that the broker presents several red flags that warrant caution. The revoked regulatory license, coupled with numerous client complaints regarding fund withdrawals and poor customer service, indicates a lack of reliability.

While the broker offers competitive trading conditions and utilizes a well-regarded platform, the overall sentiment surrounding its operations suggests that potential traders should exercise extreme caution. For those seeking a trustworthy trading environment, it may be prudent to consider alternative brokers with robust regulatory oversight and positive user feedback. Recommended alternatives include brokers like IC Markets or FP Markets, which have established reputations and regulatory compliance that offer greater peace of mind to traders.

Is Sky Alliance Markets a scam, or is it legit?

The latest exposure and evaluation content of Sky Alliance Markets brokers.

Sky Alliance Markets Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Sky Alliance Markets latest industry rating score is 1.53, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.53 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.