AXFX 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive axfx review examines a relatively new forex broker that has entered the competitive online trading market. AXFX operates as an Australian-based forex broker under ASIC regulation, positioning itself as a mid-tier service provider in the retail trading space. The broker offers leverage up to 1:400 and spreads starting from 1 pip. It targets primarily novice and intermediate traders seeking accessible entry points into forex markets.

AXFX's regulatory framework under the Australian Securities and Investments Commission provides a foundation of legitimacy. However, the broker's recent establishment means limited historical performance data is available. The platform focuses on delivering essential trading services through the popular MT4 platform. It offers access to major forex pairs, precious metals, and CFDs. With a minimum deposit requirement of $100, AXFX positions itself as an entry-level option for traders beginning their forex journey.

However, the broker's limited operational history and modest user rating of 5/10 suggest areas requiring improvement. This review provides an in-depth analysis of AXFX's offerings, helping potential traders make informed decisions about whether this broker aligns with their trading objectives and risk tolerance.

Important Notice

AXFX operates as an Australian-regulated online broker. Traders should be aware that regulatory requirements and protections may vary significantly across different jurisdictions. The Australian Securities and Investments Commission regulatory framework provides specific investor protections that may differ from those available in other regions.

This evaluation is based on publicly available information and user feedback collected from various sources. The assessment aims to provide potential clients with objective insights into AXFX's services. However, individual trading experiences may vary. Traders are encouraged to conduct their own due diligence and consider their specific trading needs before selecting any broker.

Rating Framework

Broker Overview

Company Background and Establishment

AXFX entered the forex brokerage market in 2022. The company establishes itself as a new player in the Australian financial services sector. The company positions itself as an online forex broker headquartered in Australia, focusing on providing accessible trading solutions for retail investors. As a relatively new entity, AXFX aims to capture market share by offering competitive trading conditions and leveraging established trading platforms to serve its client base.

The broker's business model centers on providing online brokerage services across multiple asset classes. It has particular emphasis on foreign exchange, precious metals, and contracts for difference. AXFX's approach reflects the modern trend toward digital-first brokerage services, targeting traders who prefer online platforms over traditional brick-and-mortar financial institutions.

Trading Infrastructure and Asset Coverage

AXFX delivers its trading services primarily through the MetaTrader 4 platform. This is one of the industry's most widely recognized trading interfaces. This axfx review notes that the broker's asset coverage includes major and minor currency pairs, precious metals such as gold and silver, various CFD instruments, and stock indices from major global markets.

The broker operates under ASIC regulation. This provides a regulatory framework ensuring compliance with Australian financial services standards. This regulatory oversight offers traders certain protections regarding fund segregation, dispute resolution, and operational transparency. However, the broker's recent establishment means limited track record for evaluating long-term regulatory compliance.

Regulatory Environment

AXFX operates under the supervision of the Australian Securities and Investments Commission. This provides regulatory oversight ensuring compliance with Australian financial services legislation. This regulatory framework offers traders protections including segregated client funds and access to dispute resolution mechanisms.

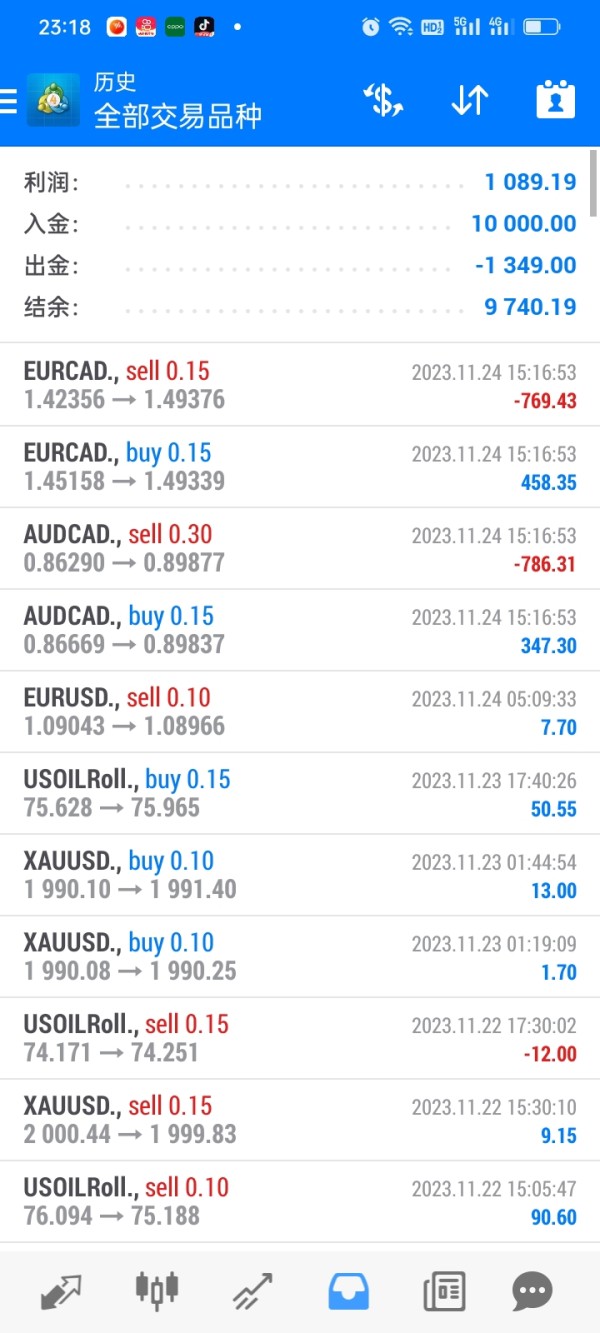

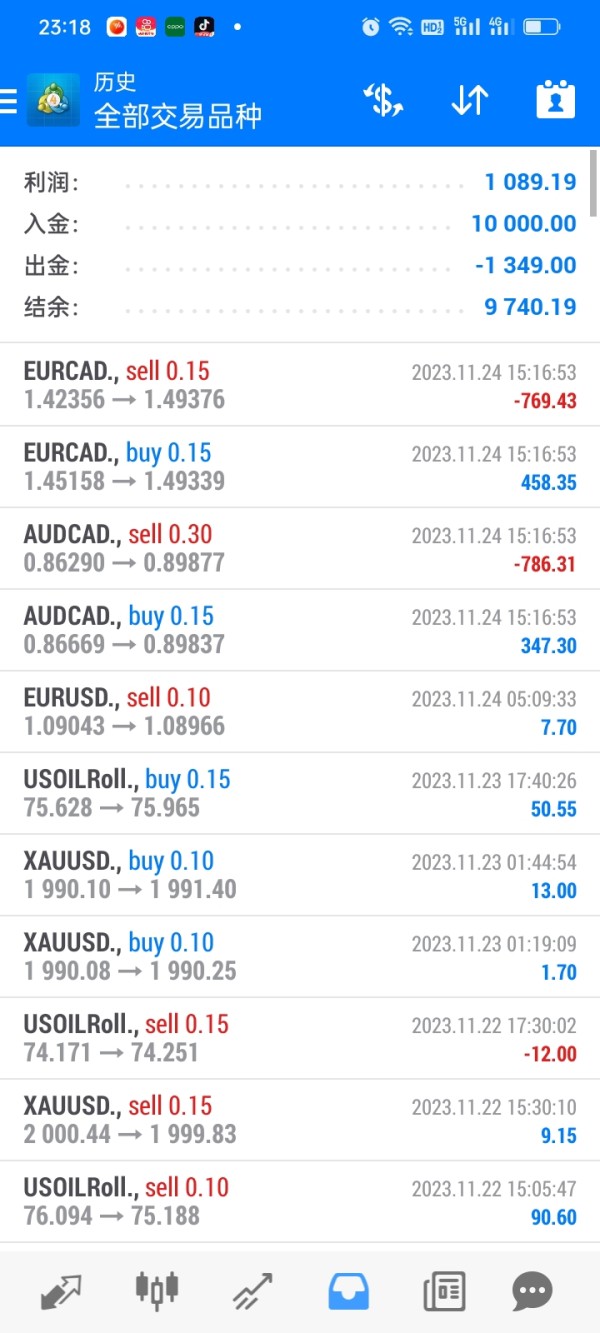

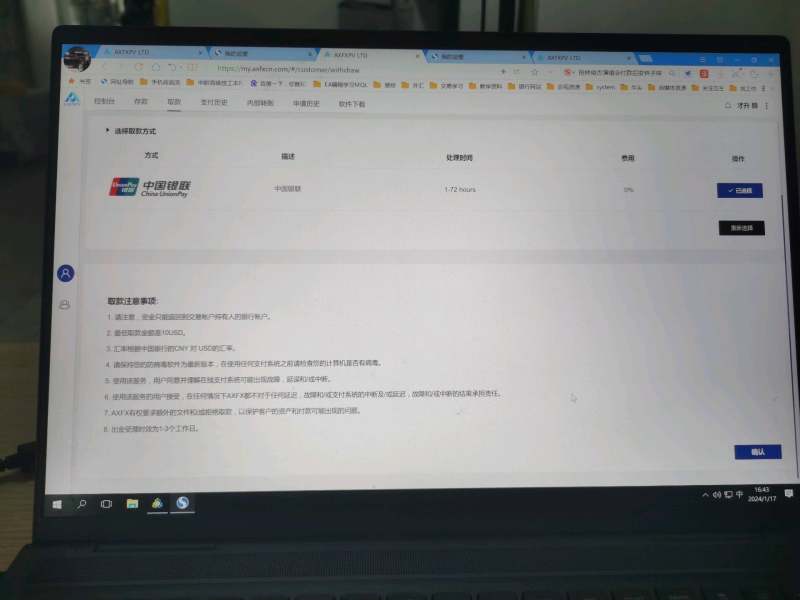

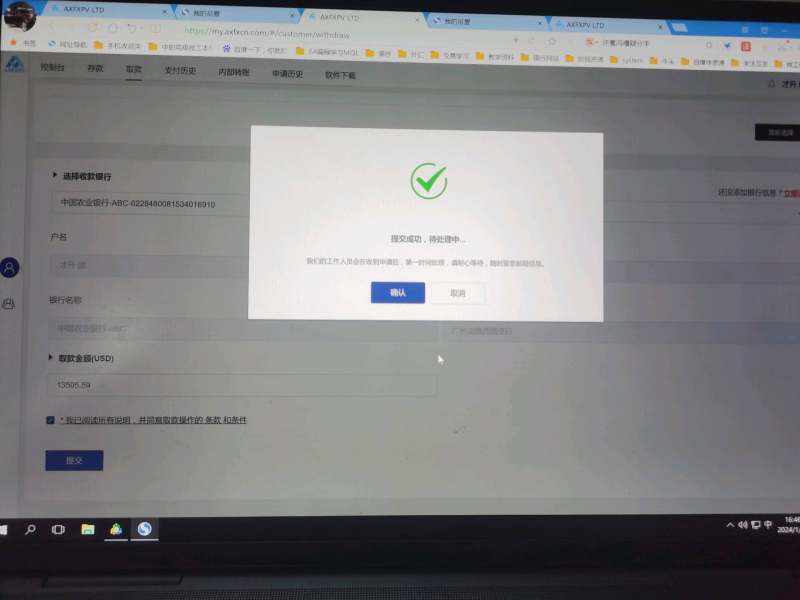

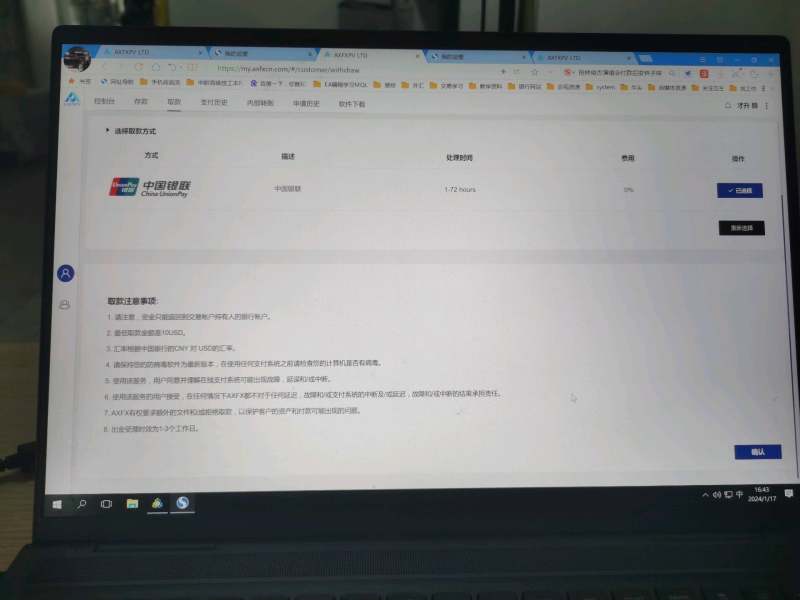

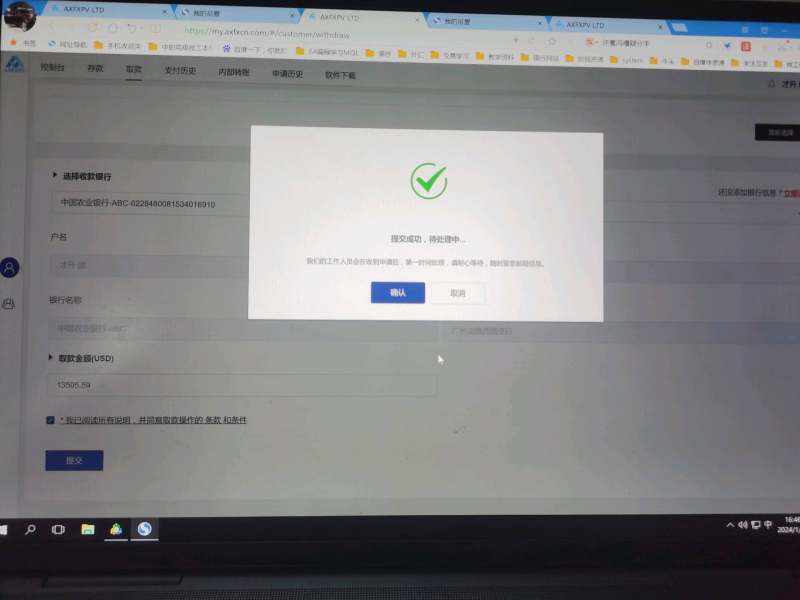

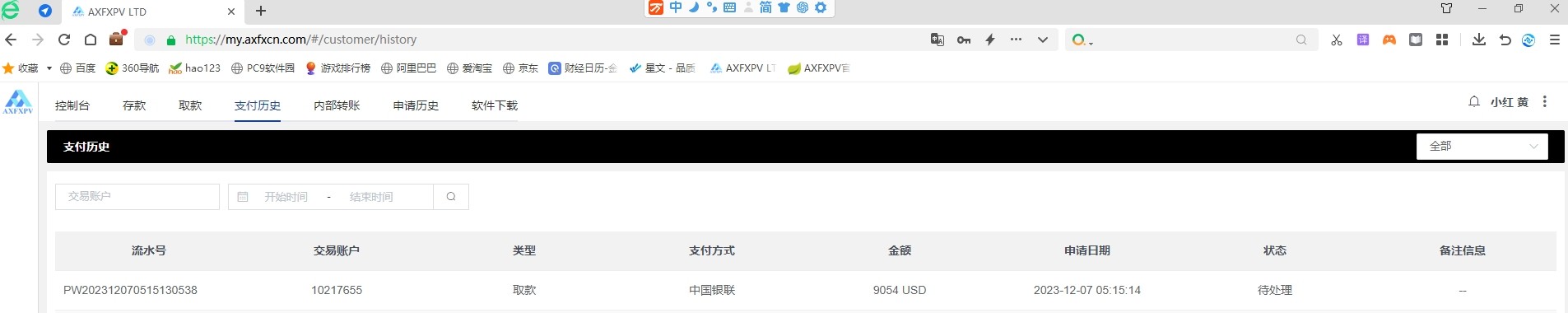

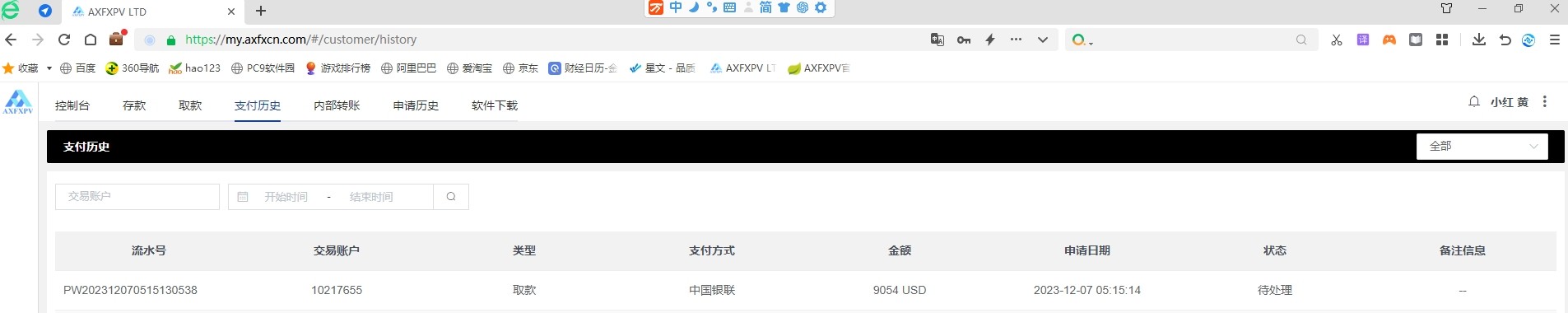

Funding and Withdrawal Methods

Specific information regarding deposit and withdrawal methods was not detailed in available materials. Potential clients need to contact the broker directly for comprehensive funding options and processing procedures.

Minimum Capital Requirements

The broker sets its minimum deposit requirement at $100. This makes it accessible for novice traders and those with limited initial capital. This low entry threshold aligns with AXFX's positioning as a beginner-friendly brokerage option.

Promotional Offerings

Current promotional activities and bonus structures were not specified in available documentation. This suggests either limited promotional campaigns or lack of detailed marketing information disclosure.

Tradeable Instruments

AXFX provides access to foreign exchange pairs, precious metals including gold and silver, contracts for difference across various underlying assets, and major stock market indices from global financial markets.

Cost Structure Analysis

The broker advertises spreads beginning from 1 pip. However, comprehensive commission structures and additional fees require further clarification through direct broker consultation for complete cost transparency.

Leverage Provisions

Maximum leverage reaches 1:400. This provides significant capital amplification opportunities while requiring careful risk management due to the increased exposure potential inherent in high-leverage trading.

Platform Technology

Trading operations utilize the MetaTrader 4 platform. This offers traders access to established charting tools, technical indicators, and automated trading capabilities through Expert Advisors.

Geographic Restrictions

Specific regional limitations and service availability were not detailed in available materials. This requires verification for traders in particular jurisdictions.

Customer Support Languages

Available customer service language options were not specified in accessible documentation. This necessitates direct inquiry for multilingual support capabilities.

Comprehensive Rating Analysis

Account Conditions Assessment

AXFX demonstrates reasonable accessibility through its axfx review of account offerings. It has multiple account types designed to accommodate various trader profiles and experience levels. The $100 minimum deposit requirement represents a competitive entry point compared to many established brokers who often require significantly higher initial investments. This low threshold particularly benefits novice traders who wish to begin with smaller capital commitments while learning market dynamics.

The broker's account structure appears designed to provide flexibility. However, specific details regarding different account tiers, their respective features, and any premium account benefits were not comprehensively outlined in available materials. The account opening process specifics, including required documentation and verification timeframes, require direct consultation with the broker for complete understanding.

User feedback reflecting a 5/10 satisfaction rating suggests that while account conditions may be accessible, overall service delivery or feature sets may not fully meet trader expectations. This moderate rating indicates potential areas for improvement in account management services, feature offerings, or customer communication regarding account benefits and limitations.

The broker's tools and resources offering centers primarily around the MetaTrader 4 platform. This provides a solid foundation for technical analysis and trade execution. However, this axfx review identifies limited information regarding additional analytical tools, research resources, or proprietary trading instruments that might enhance the trading experience beyond standard MT4 functionality.

Educational resources, market analysis, and research materials were not detailed in available documentation. This represents a significant gap for traders who rely on broker-provided educational content and market insights. Modern traders increasingly expect comprehensive educational libraries, webinars, market commentary, and analytical tools as standard broker offerings.

The absence of detailed information about automated trading support, advanced charting packages, or third-party tool integrations suggests either limited additional resources or insufficient marketing communication about available tools. This limitation particularly affects intermediate and advanced traders who require sophisticated analytical capabilities for their trading strategies.

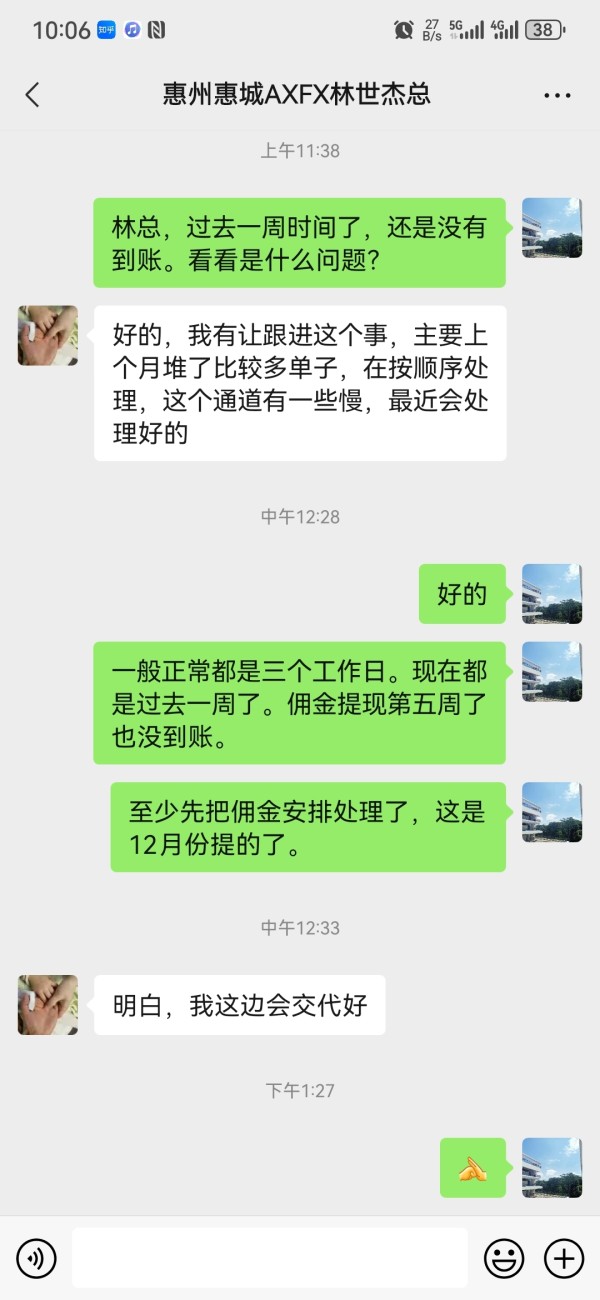

Customer Service and Support Analysis

Customer service evaluation reveals limited publicly available information about support channels, response times, and service quality metrics. The lack of detailed customer service information raises concerns about the broker's commitment to comprehensive client support and communication infrastructure.

Standard support channels such as phone, email, live chat availability, and their respective operating hours were not clearly specified in accessible materials. This information gap makes it difficult for potential clients to assess whether the broker can provide adequate support during critical trading periods or resolve issues efficiently.

The moderate user rating of 5/10 may partially reflect customer service experiences. However, without specific user feedback regarding support quality, response times, or problem resolution effectiveness, it's challenging to identify particular service strengths or weaknesses. This uncertainty represents a significant consideration for traders who prioritize responsive customer support.

Trading Experience Assessment

Trading experience evaluation focuses on execution quality, platform stability, and overall trading conditions offered by AXFX. The broker advertises spreads starting from 1 pip, which represents competitive pricing for major currency pairs. However, specific spread ranges across different instruments and market conditions require further clarification.

Order execution quality, including slippage rates, requote frequency, and fill speeds, was not detailed in available materials. These factors significantly impact trading profitability, particularly for scalpers and high-frequency traders who depend on precise execution timing and minimal slippage.

Platform stability and mobile trading capabilities represent crucial components of trading experience. Yet specific performance metrics, uptime statistics, or mobile app functionality were not comprehensively addressed. The reliance on MT4 provides a stable foundation. However, broker-specific implementation quality and server performance remain unclear without detailed user feedback or performance testing data.

Trust and Security Analysis

AXFX's trust profile benefits from ASIC regulation. This provides fundamental regulatory oversight and compliance requirements. The Australian Securities and Investments Commission maintains strict standards for financial services providers, including client fund segregation requirements and operational transparency obligations.

However, the broker's recent establishment in 2022 means limited operational history for evaluating long-term reliability, crisis management capabilities, or consistent regulatory compliance over extended periods. This axfx review notes that newer brokers inherently carry higher uncertainty regarding their long-term stability and service consistency.

Fund security measures, including client money protection schemes, insurance coverage, and segregated account arrangements, were not detailed in available documentation. These security features represent critical considerations for traders evaluating broker trustworthiness and fund safety protocols. The absence of detailed transparency regarding company ownership, financial backing, or operational infrastructure adds to uncertainty about long-term viability.

User Experience Evaluation

Overall user experience assessment reveals moderate satisfaction levels. The 5/10 user rating indicates significant room for improvement across various service aspects. This rating suggests that while basic trading functionality may be adequate, the overall client experience falls short of expectations in key areas.

Interface design, platform usability, and account management functionality contribute significantly to user experience. However, specific feedback regarding these elements was not available in accessible materials. Modern traders expect intuitive interfaces, streamlined account management, and efficient navigation across all platform features.

The registration and verification process efficiency, fund deposit and withdrawal convenience, and general platform responsiveness all impact user satisfaction. Without detailed user feedback highlighting specific pain points or positive experiences, it's difficult to identify particular areas requiring improvement or existing strengths that enhance the trading experience.

Conclusion

This comprehensive axfx review reveals a broker with fundamental market entry credentials but significant areas requiring development and improvement. AXFX's ASIC regulation and competitive basic offerings provide a foundation for legitimate brokerage operations. However, the limited operational history and moderate user satisfaction ratings indicate substantial room for service enhancement.

The broker appears most suitable for novice and intermediate traders seeking accessible entry points into forex markets. It particularly serves those comfortable with standard MT4 platform functionality and basic service offerings. The low minimum deposit requirement and high leverage availability cater to traders with limited initial capital or those seeking significant position sizing flexibility.

However, potential clients should carefully consider the broker's limited transparency, insufficient information disclosure, and moderate user satisfaction levels. The lack of detailed information about customer service, additional tools, and comprehensive trading conditions suggests either limited service depth or inadequate communication about available features and support systems.