Excentral 2025 Review: Everything You Need to Know

Executive Summary

This Excentral review looks at a CFD broker from Cyprus that ran from 2019 until it stopped working. eXcentral was an online broker that focused on CFD trading across many types of assets like Forex, crypto, and stocks. Mount Nico Corp Ltd owned the company and kept it legal through approval from the Cyprus Securities and Exchange Commission.

Even though it had proper licenses, eXcentral gets bad reviews mainly because it shut down. The broker had a web trading platform called TraderSoft and said it followed European CFD trading rules. The platform was made for both investors and day traders who wanted to trade different instruments, including several cryptocurrencies.

Since the company is not running anymore, traders should be very careful and look at other brokers that are still helping clients. The fact that it stopped working really hurts how good this broker looks for current trading needs.

Important Notice

This review uses available legal information and past business models from eXcentral. Different countries may have different legal rules that could change user experience, especially since eXcentral is not working now. Traders should know that following rules in one area does not promise service availability or quality everywhere.

Our review method uses documented legal filings, available business information, and the broker's past working framework. Since the broker stopped working, current user feedback and real-time service quality checks are not available.

Rating Framework

Broker Overview

eXcentral started in June 2019 as an international CFD broker that focused on giving trading access to many different financial instruments. The company specialized in CFD trading services that followed European regulations and positioned itself as a customer-focused platform for both retail investors and professional day traders. Mount Nico Corp Ltd owned the brokerage brand, which worked under the regulatory watch of the Cyprus Securities and Exchange Commission.

The broker's business model centered on offering multi-asset CFD trading capabilities that included foreign exchange pairs, cryptocurrency contracts for difference, and stock CFDs. eXcentral followed the latest European regulations governing CFD trading, which was designed to ensure clear services and strong security measures for its client base. However, the company is no longer working, which significantly impacts its current market importance.

The primary trading structure was built around the TraderSoft platform, a web-based CFD trading solution designed for ease of use. This Excentral review notes that the platform was specifically built to help traders seeking exposure to various asset classes without requiring extensive technical trading knowledge. The regulatory framework under CySEC provided a level of legitimacy that aligned with European financial standards.

Regulatory Jurisdiction: eXcentral worked under the regulatory authority of the Cyprus Securities and Exchange Commission, ensuring compliance with European Union financial regulations and providing a framework for investor protection within the European Economic Area.

Deposit and Withdrawal Methods: Specific information regarding deposit and withdrawal methods is not detailed in available materials.

Minimum Deposit Requirements: Minimum deposit information is not specified in available documentation.

Bonus and Promotional Offers: Details about bonus structures and promotional campaigns are not mentioned in available resources.

Tradable Assets: The broker provided access to CFD trading across multiple asset categories including foreign exchange currency pairs, cryptocurrency contracts for difference, and equity-based CFDs, offering traders diversified exposure to global markets.

Cost Structure and Fees: Specific information about trading costs, spreads, and fee structures is not detailed in available materials.

Leverage Ratios: Leverage information is not specified in available documentation.

Platform Options: TraderSoft served as the primary trading platform, offering a web-based interface designed for CFD trading across the broker's available instrument range.

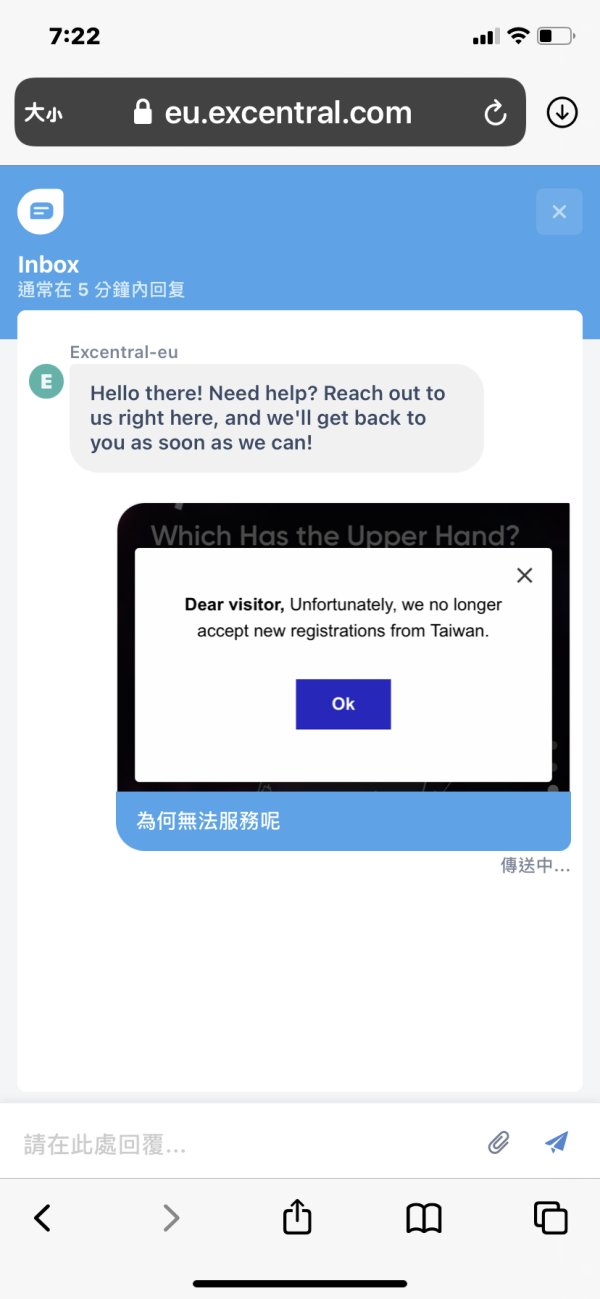

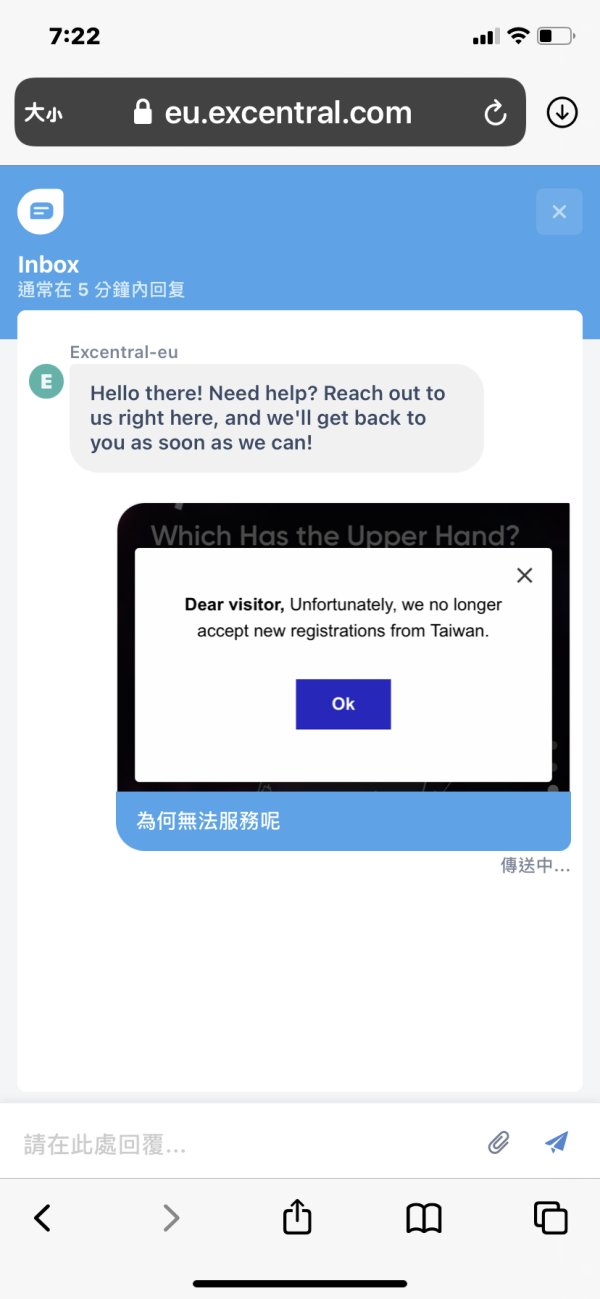

Geographic Restrictions: Information about specific geographic limitations is not detailed in available materials.

Customer Support Languages: Details about multilingual support options are not specified in available documentation.

This Excentral review emphasizes that the lack of detailed operational information reflects the broker's current non-operational status.

Account Conditions Analysis

The specific account structures and conditions offered by eXcentral are not detailed in available materials, which significantly limits the ability to provide a complete assessment of their account offerings. This information gap is particularly concerning given the broker's ceased operations, as it suggests limited transparency in their historical service documentation.

Without access to information about account types, minimum deposit requirements, or special account features such as Islamic accounts, potential traders cannot make informed decisions about the suitability of eXcentral's offerings. The absence of detailed account opening procedures and verification processes further complicates any assessment of user accessibility.

The lack of available information about account conditions in this Excentral review reflects broader concerns about the broker's operational transparency. Professional traders typically require detailed information about account structures, trading conditions, and special features to evaluate whether a broker meets their specific needs.

Given the broker's current non-operational status, the unavailability of account condition details serves as an additional red flag for traders considering this platform. The combination of ceased operations and limited available account information suggests that eXcentral may not have maintained complete service documentation or transparent communication about their offerings.

eXcentral provided access to multiple CFD trading instruments spanning foreign exchange, cryptocurrency, and stock markets, offering traders diversified exposure across major asset classes. The broker's tool selection appeared designed to accommodate various trading strategies and risk preferences through its multi-asset approach.

The TraderSoft platform served as the primary trading interface, though specific details about advanced trading tools, technical analysis capabilities, and automated trading features are not documented in available materials. This limitation in available information makes it difficult to assess the platform's competitive position relative to industry standards.

Research and analytical resources, educational materials, and market analysis tools are not detailed in available documentation. The absence of information about these critical trading support features raises questions about the broker's commitment to trader education and market insight provision.

The lack of documented information about advanced trading tools, algorithmic trading support, and third-party platform integrations suggests limited technological infrastructure. Professional traders often require sophisticated analytical tools and automated trading capabilities that may not have been adequately provided by eXcentral's platform ecosystem.

Customer Service and Support Analysis

Customer service information for eXcentral is not detailed in available materials, creating significant uncertainty about the quality and accessibility of support services. The absence of documented customer service channels, response times, and service quality metrics makes it impossible to evaluate this critical aspect of broker operations.

Information about multilingual support capabilities, customer service hours, and available communication methods is not specified in available documentation. This lack of transparency regarding support infrastructure raises concerns about the broker's commitment to customer service excellence.

The unavailability of user feedback regarding customer service experiences, problem resolution effectiveness, and support team responsiveness further complicates any assessment of service quality. Professional traders typically require reliable, knowledgeable support teams that can address technical and account-related issues promptly.

Given eXcentral's current non-operational status, the lack of documented customer service information becomes particularly problematic for users who may have had accounts or unresolved issues with the platform. The combination of ceased operations and undocumented support structures suggests significant limitations in customer protection and service continuity.

Trading Experience Analysis

The trading experience evaluation for eXcentral is severely limited by the lack of available information about platform performance, execution quality, and user interface functionality. While the broker utilized the TraderSoft platform, specific details about system stability, order execution speed, and trading environment quality are not documented.

Platform functionality completeness, mobile trading capabilities, and advanced trading features are not detailed in available materials. This information gap makes it impossible to assess whether eXcentral provided a competitive trading environment compared to industry standards.

Technical performance data, including execution speeds, slippage rates, and platform uptime statistics, are not available for analysis. These metrics are crucial for evaluating the quality of trading infrastructure and determining platform suitability for different trading styles.

The absence of user feedback about trading experiences, platform reliability, and execution quality in this Excentral review reflects the broader challenge of assessing a broker that is no longer operational. Without current user testimonials or performance data, traders cannot make informed decisions about platform capabilities.

The combination of ceased operations and limited documented trading experience information suggests that eXcentral may not have maintained complete performance records or transparent reporting about their trading infrastructure quality.

Trustworthiness Analysis

eXcentral's trustworthiness assessment presents a mixed picture, with regulatory compliance providing some legitimacy while operational cessation significantly undermines confidence. The broker maintained authorization from the Cyprus Securities and Exchange Commission, which provided a regulatory framework consistent with European Union financial standards.

The CySEC regulatory status indicated compliance with investor protection measures and operational standards required within the European Economic Area. However, the broker's ceased operations represent a significant negative factor that overshadows the positive aspects of regulatory compliance.

Information about fund safety measures, segregated account policies, and investor compensation schemes is not detailed in available materials. These critical trust factors are essential for evaluating broker reliability and client fund protection capabilities.

Company transparency regarding ownership structure, financial reporting, and operational procedures is limited in available documentation. The lack of detailed corporate information raises questions about the broker's commitment to transparency and accountability.

The cessation of operations represents the most significant trust-related concern, as it indicates potential business model sustainability issues or market challenges that prevented continued service provision. This factor alone substantially impacts the overall trustworthiness evaluation for potential users.

User Experience Analysis

User experience evaluation for eXcentral is severely constrained by the absence of available user feedback, satisfaction surveys, and experience documentation. The lack of current user testimonials makes it impossible to assess overall satisfaction levels or identify common user concerns.

Interface design quality, platform usability, and navigation efficiency are not detailed in available materials. These factors are crucial for determining whether the trading environment was accessible to both novice and experienced traders.

Registration and account verification processes, fund operation experiences, and general platform accessibility are not documented in available resources. The absence of this information limits the ability to evaluate user onboarding effectiveness and operational convenience.

Common user complaints, satisfaction ratings, and experience-based recommendations are not available for analysis. This information gap represents a significant limitation in providing complete guidance about platform suitability for different user types.

The combination of ceased operations and limited user experience documentation suggests that eXcentral may not have maintained complete user feedback systems or transparent communication about user satisfaction metrics.

Conclusion

This Excentral review reveals a broker with limited positive attributes overshadowed by significant operational concerns. While eXcentral maintained CySEC regulatory compliance, providing some legitimacy within European financial frameworks, the broker's ceased operations represent a fundamental barrier to recommendation.

The broker is not suitable for new users seeking active trading services, and existing relationships should be carefully evaluated given the operational status. Traders should prioritize active, well-documented brokers with transparent operational records and current service availability.

The primary advantage of eXcentral was its regulatory compliance under CySEC oversight, which provided European-standard investor protections. However, the disadvantages significantly outweigh this benefit, including ceased operations, limited available information about services and conditions, and absence of user feedback or performance documentation.