Is WCM safe?

Pros

Cons

Is WCM Safe or a Scam?

Introduction

WCM, known as Wealth Compound Management, has emerged as a player in the forex market, attracting the attention of both seasoned traders and newcomers. As the financial landscape continues to evolve, the influx of brokers like WCM prompts traders to exercise caution before investing their hard-earned money. The importance of conducting thorough research on forex brokers cannot be overstated, as the potential for scams and fraudulent activities lurks in the shadows of the trading world. This article aims to provide an objective analysis of WCM, exploring its regulatory status, company background, trading conditions, customer safety, user experiences, and overall risk assessment. The investigation draws on a range of credible sources, including regulatory databases and user reviews, to offer a comprehensive evaluation of whether WCM is safe or a potential scam.

Regulation and Legitimacy

One of the primary factors determining the safety of a forex broker is its regulatory status. Regulation serves as a safeguard for traders, ensuring that brokers adhere to strict operational standards and provide a level of consumer protection. WCM claims to operate under the regulatory framework of the United Kingdom; however, its actual regulatory status raises significant concerns.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Regulated |

WCM is not registered with any top-tier regulatory authority, such as the FCA (Financial Conduct Authority) in the UK or ASIC (Australian Securities and Investments Commission) in Australia. This lack of oversight is a major red flag. Regulatory bodies are crucial in monitoring brokers for compliance with financial laws and protecting clients' interests. The absence of regulation means that traders have limited recourse in the event of disputes or issues with fund withdrawals. Furthermore, warnings from various financial authorities indicate that WCM may not be operating legally, further solidifying the notion that WCM is not safe.

Company Background Investigation

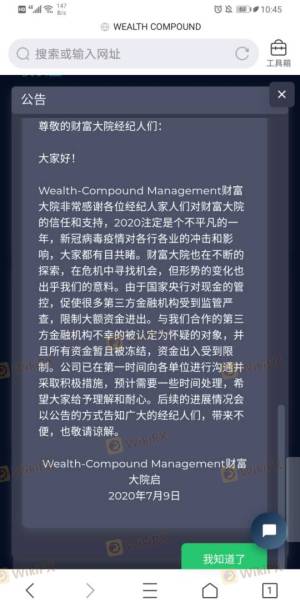

WCM's operational history is relatively short, having been established in 2020. The company claims to provide a range of financial services, but a deeper dive reveals a lack of transparency regarding its ownership structure and management team. The founders' credentials have been called into question, with reports suggesting that their backgrounds may have been fabricated. This lack of verifiable information about the company's leadership raises concerns about its legitimacy.

Moreover, WCM's website has faced issues, including periods of downtime, which is often indicative of operational instability. A company that is not forthcoming about its history, management, and operational status should be approached with caution. The absence of clear communication and transparency in a financial services firm is a significant warning sign that WCM may not be safe for potential investors.

Trading Conditions Analysis

WCM presents a variety of trading conditions that may initially appear attractive to traders. However, a closer examination reveals potential pitfalls. The broker's fee structure is not clearly outlined, leading to ambiguity regarding trading costs. This lack of clarity can often result in unexpected charges, which are common in unregulated environments.

| Fee Type | WCM | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 3 pips | 1-2 pips |

| Commission Model | Unclear | Varies |

| Overnight Interest Range | High | Moderate |

The spreads offered by WCM are significantly higher than the industry average, which can erode trading profits. Additionally, the absence of a clear commission model raises questions about hidden fees that could affect overall trading costs. Traders should be wary of brokers that do not provide transparent information about their fee structures, as this is often a tactic used to exploit unsuspecting clients. This ambiguity further supports the argument that WCM is not a safe option for traders seeking a reliable and transparent trading environment.

Customer Funds Safety

The safety of customer funds is paramount when evaluating any forex broker. WCM claims to implement measures to protect client funds; however, the lack of regulation severely undermines these claims. Without oversight from a recognized regulatory body, there are no guarantees that client funds are kept in segregated accounts or that they are protected by investor compensation schemes.

Traders must be particularly cautious about the safety of their funds with WCM, as the absence of regulatory protection means that in the event of financial difficulties or fraudulent activities, recovering lost funds may be nearly impossible. Furthermore, reports of past issues related to fund withdrawals from similar unregulated brokers raise concerns about WCM's ability to safeguard client investments. Consequently, it is critical for potential investors to consider the risks associated with entrusting their funds to a broker with such dubious safety measures, leading to the conclusion that WCM is not safe.

Customer Experience and Complaints

Analyzing customer feedback is essential in assessing the reliability of a broker. Reviews from WCM clients reveal a mixed bag of experiences, with many users expressing dissatisfaction over withdrawal delays and unresponsive customer service. Common complaints include the following:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Unresponsive Support | Medium | Poor |

| Misleading Information | High | Unclear |

One notable case involved a trader who reported significant delays in withdrawing funds, which is a common red flag in the forex industry. The company's lack of responsiveness to customer inquiries exacerbated the situation, leading to frustration and financial losses for the trader. Such patterns of complaints suggest that WCM may not be a reliable broker for those seeking a trustworthy trading experience.

Platform and Trade Execution

The trading platform offered by WCM is touted as advanced and user-friendly; however, user reviews indicate that the platform's performance may not meet expectations. Issues such as slippage, order rejections, and system downtime have been reported by traders, which can significantly impact trading outcomes.

A thorough evaluation of order execution quality is crucial for traders, as poor execution can lead to missed opportunities and financial losses. Any signs of manipulation or irregularities in trade execution should raise alarms for potential clients. The platform's reliability is a critical factor in determining whether WCM is safe, and the reported issues suggest that it may not be the most dependable choice.

Risk Assessment

Engaging with WCM presents several risks that traders should be aware of. The following risk assessment summarizes the most critical areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated broker |

| Financial Risk | High | Potential for fund loss |

| Operational Risk | Medium | Platform performance issues |

| Customer Service Risk | High | Poor support response |

Given the high levels of regulatory and financial risk associated with WCM, traders must exercise extreme caution. It is advisable to seek alternative brokers with solid regulatory backing and proven track records in customer service and fund security.

Conclusion and Recommendations

In conclusion, the evidence gathered throughout this analysis strongly indicates that WCM is not safe for traders. The lack of regulation, questionable company background, ambiguous trading conditions, and negative customer experiences all point to a high level of risk associated with engaging in trading activities through this broker.

For traders seeking a more secure and reliable trading environment, it is recommended to consider brokers that are regulated by top-tier authorities and have a proven track record of positive customer feedback. Some reputable alternatives include brokers regulated by the FCA, ASIC, or other recognized financial authorities. By prioritizing safety and transparency, traders can better protect their investments and enhance their trading experiences.

Is WCM a scam, or is it legit?

The latest exposure and evaluation content of WCM brokers.

WCM Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

WCM latest industry rating score is 1.54, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.54 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.