Regarding the legitimacy of KVB Kunlun forex brokers, it provides SFC and WikiBit, (also has a graphic survey regarding security).

Is KVB Kunlun safe?

Pros

Cons

Is KVB Kunlun markets regulated?

The regulatory license is the strongest proof.

SFC Derivatives Trading License (AGN)

Securities and Futures Commission of Hong Kong

Securities and Futures Commission of Hong Kong

Current Status:

RevokedLicense Type:

Derivatives Trading License (AGN)

Licensed Entity:

KVB Kunlun Securities (HK) Limited

Effective Date:

2008-07-02Email Address of Licensed Institution:

hksec@kvbkunlun.comSharing Status:

No SharingWebsite of Licensed Institution:

www.kvbsec.comExpiration Time:

--Address of Licensed Institution:

香港九龍柯士甸道西1號環球貿易廣場68樓6801室Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is KVB Kunlun A Scam?

Introduction

KVB Kunlun is a financial services provider that positions itself as a multi-asset broker in the forex market, offering a range of trading instruments including forex, commodities, and indices. Established in Hong Kong, KVB Kunlun has expanded its operations globally, aiming to cater to both retail and institutional traders. However, with the proliferation of online trading platforms, it is crucial for traders to carefully assess the legitimacy and reliability of their chosen brokers. The forex market is fraught with risks, and engaging with a broker that lacks proper oversight can lead to significant financial losses. This article utilizes a comprehensive approach, analyzing KVB Kunlun's regulatory status, company background, trading conditions, client fund safety, customer experiences, and risk factors to determine whether KVB Kunlun is a safe trading option or a potential scam.

Regulation and Legitimacy

The regulatory status of a broker is a pivotal factor in assessing its legitimacy. KVB Kunlun is regulated by several notable authorities, including the Australian Securities and Investments Commission (ASIC) and the Securities and Futures Commission (SFC) of Hong Kong. Regulatory oversight is essential as it mandates brokers to adhere to strict operational guidelines, thereby providing a degree of security to traders. Below is a summary of KVB Kunlun's key regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | 334293 | Australia | Active |

| SFC | AQG 528 | Hong Kong | Active |

| FMA | 488226 | New Zealand | Active |

| MSB | M08934674 | Canada | Active |

The quality of regulation is paramount. ASIC is known for its rigorous standards, which include maintaining adequate capital reserves and implementing measures to protect client funds. The SFC also imposes strict requirements on brokers operating within its jurisdiction. However, there have been concerns regarding KVB Kunlun's compliance history, particularly with regards to its operations in the past. While it currently holds valid licenses, traders should remain vigilant and conduct thorough research regarding any past compliance issues.

Company Background Investigation

KVB Kunlun has a rich history, having been founded in 2001, and has grown to establish a robust presence in the financial services sector. The company operates through various subsidiaries across multiple jurisdictions, including New Zealand, Australia, and Canada. This international footprint enhances its credibility and allows it to cater to a diverse clientele. The management team at KVB Kunlun comprises seasoned professionals with extensive experience in finance and trading, which contributes positively to the firm's reputation.

In terms of transparency, KVB Kunlun provides a reasonable amount of information about its operations and regulatory compliance on its website. However, potential clients should assess whether this information is sufficient to build trust. The company has made efforts to maintain transparency in its dealings, but the absence of independent reviews and accolades may raise questions for some traders.

Trading Conditions Analysis

KVB Kunlun's trading conditions are an important aspect for traders to consider. The broker employs a commission-based model, with spreads that vary based on account types. Generally, the trading costs associated with KVB Kunlun are competitive, but they may not be the lowest in the market. Below is a comparison of KVB Kunlun's core trading costs with industry averages:

| Cost Type | KVB Kunlun | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | 1.3 pips | 1.0 pips |

| Commission Model | $2 per lot | $1 per lot |

| Overnight Interest Range | Varies | Varies |

While KVB Kunlun offers a competitive trading environment, the spreads can be higher than some of its competitors, which may impact the overall profitability for traders. Additionally, the broker's policy on overnight interest and potential hidden fees can be points of concern. Traders should carefully review the terms and conditions to ensure they are fully aware of any costs that may apply.

Client Fund Safety

The safety of client funds is a critical consideration when evaluating a broker. KVB Kunlun employs several measures to ensure the security of client deposits. Client funds are held in segregated accounts, which means that they are kept separate from the broker's operational funds. This practice is essential for protecting clients' money in the event of the broker facing financial difficulties.

Furthermore, KVB Kunlun claims to utilize tier-1 banks for holding client funds, which adds an additional layer of security. The broker also offers negative balance protection, ensuring that clients cannot lose more than their invested capital. However, it is essential to investigate any historical issues related to fund security or disputes that may have arisen in the past. Transparency in fund safety measures is vital, and potential clients should seek clarity on these aspects before proceeding.

Customer Experience and Complaints

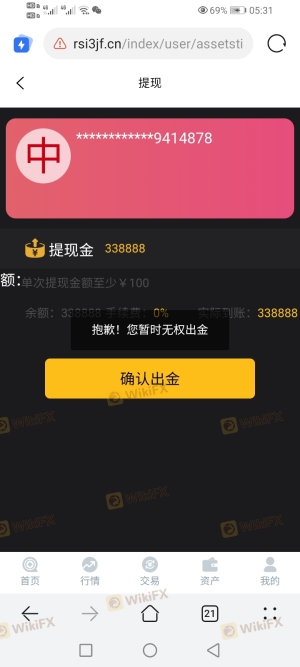

Customer feedback can provide valuable insights into a broker's reliability. KVB Kunlun has received mixed reviews from users, with some praising its trading conditions and customer service, while others have reported issues related to withdrawals and account management. Common complaints include difficulties in accessing funds and delayed responses from customer support. Below is a summary of the main types of complaints received:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Account Management Problems | Medium | Average response |

| Customer Support Delays | Medium | Mixed response |

One notable case involved a trader who experienced significant delays in withdrawing funds, leading to frustration and concerns about the broker's reliability. Another user reported being pressured to increase their deposit to access certain trading features, raising red flags about the broker's practices. These incidents highlight the importance of assessing customer experiences when evaluating whether KVB Kunlun is a safe trading option.

Platform and Execution

KVB Kunlun offers its proprietary trading platform, Forex Star, which is based on the popular MetaTrader 4 technology. The platform is designed to provide traders with a user-friendly interface and essential trading tools. However, the performance and stability of the platform are critical factors for traders. User reviews indicate that while the platform is functional, there are occasional reports of slippage and execution delays.

The quality of order execution is another area of concern. Traders have reported instances of orders being rejected or executed at unfavorable prices, which can significantly impact trading outcomes. There are no substantial indications of market manipulation, but traders should remain vigilant and monitor their trades closely.

Risk Assessment

Engaging with KVB Kunlun involves several risks that potential traders should be aware of. Below is a summary of the key risk areas associated with trading through this broker:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Compliance | Medium | Regulatory status has been revoked in the past. |

| Fund Security | Medium | While funds are segregated, historical issues may exist. |

| Customer Support | High | Mixed reviews on responsiveness and resolution quality. |

| Trading Conditions | Medium | Higher spreads compared to industry averages. |

To mitigate these risks, traders should conduct thorough due diligence before opening an account. It is advisable to start with a demo account to familiarize oneself with the platform and trading conditions without risking real capital.

Conclusion and Recommendations

Based on the comprehensive analysis, KVB Kunlun presents a mixed picture. While it is regulated by reputable authorities, concerns regarding its past compliance issues and customer feedback merit caution. The broker's trading conditions are competitive, but the higher spreads and withdrawal issues reported by users are points of concern.

In conclusion, while KVB Kunlun is not classified as a scam, potential traders should approach with caution. It is essential to thoroughly assess personal trading needs and risk tolerance before engaging with this broker. For traders seeking alternatives, consider brokers with a stronger reputation for customer service and lower trading costs, such as [Broker A] and [Broker B], both of which have consistently received positive reviews for their trading environments and regulatory compliance.

Is KVB Kunlun a scam, or is it legit?

The latest exposure and evaluation content of KVB Kunlun brokers.

KVB Kunlun Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

KVB Kunlun latest industry rating score is 1.53, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.53 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.