GIB Capital Group 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive GIB Capital Group review provides an in-depth analysis of one of the region's notable financial services providers. GIB Capital Group was established in 2008 as a wholly-owned subsidiary of Gulf International Bank and operates under the regulatory oversight of the Capital Markets Authority. The firm offers a range of investment services across multiple asset classes including equity indices, commodities, forex, and cryptocurrencies.

The firm presents itself as a stable and secure trading platform backed by an experienced management team with deep regional expertise. With assets under management reaching $64 billion as of 2021, GIB Capital demonstrates significant market presence. The company primarily serves clients across the Asia-Pacific region. The company's core services include corporate finance, asset management, debt and equity capital markets, and financial advisory services.

For traders seeking diversified investment opportunities in the Asia-Pacific markets, GIB Capital Group offers a regulated environment with substantial backing. However, potential clients should note that specific details regarding trading conditions, account features, and customer support infrastructure require further investigation. These elements are not fully detailed in available public information.

Important Notice

This review acknowledges that regulatory frameworks and operational conditions may vary significantly across different jurisdictions where GIB Capital Group operates. The Capital Markets Authority's regulatory requirements directly impact the firm's operational methodology and client service delivery standards.

This evaluation is compiled based on available user feedback, official company information, and regulatory data. The assessment aims to provide traders with a comprehensive overview while recognizing that individual trading experiences may vary. These variations depend on specific account types, geographic location, and market conditions. Prospective clients are advised to verify current terms and conditions directly with the firm.

Rating Framework

Broker Overview

GIB Capital Group emerged in 2008 as a strategic subsidiary of Gulf International Bank. The firm positioned itself as a comprehensive financial services provider in the Middle East and Asia-Pacific regions. The firm's establishment reflected the parent bank's commitment to expanding its investment banking and capital markets capabilities beyond traditional banking services. As a fully-owned subsidiary, GIB Capital benefits from the financial strength and regional expertise of its parent institution. The parent bank has operated in the Gulf region for several decades.

The company's business model centers on providing sophisticated financial services to institutional and high-net-worth individual clients. Their core offerings span corporate finance, asset management, debt and equity capital markets, and financial advisory services. This diversified approach allows the firm to serve various client needs while maintaining expertise across multiple financial sectors.

GIB Capital operates through a stable and secure trading platform that supports multiple asset classes. However, specific platform details are not extensively documented in available materials. The firm's asset coverage includes equity indices, commodities, foreign exchange, and cryptocurrency markets. This positioning allows it to serve clients seeking diversified investment opportunities. Under the regulatory oversight of the Capital Markets Authority, the firm maintains compliance with regional financial services standards. This provides clients with regulatory protection and operational transparency.

Regulatory Jurisdiction: GIB Capital Group operates under the supervision of the Capital Markets Authority. This ensures compliance with regional financial services regulations and provides client protection through established regulatory frameworks.

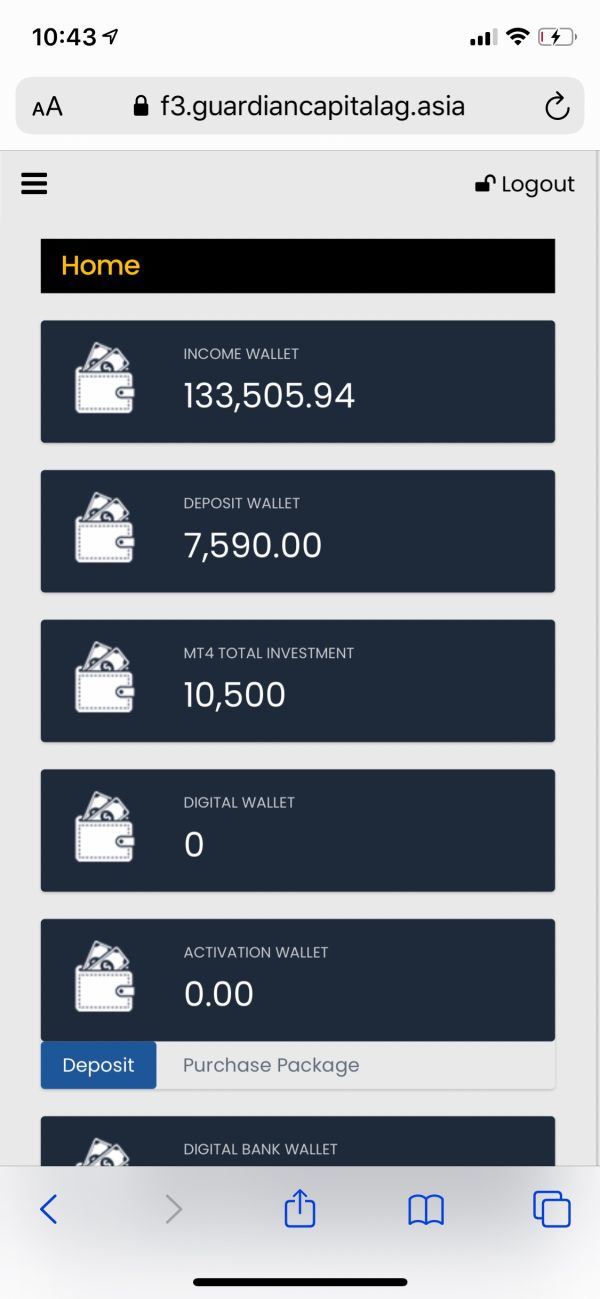

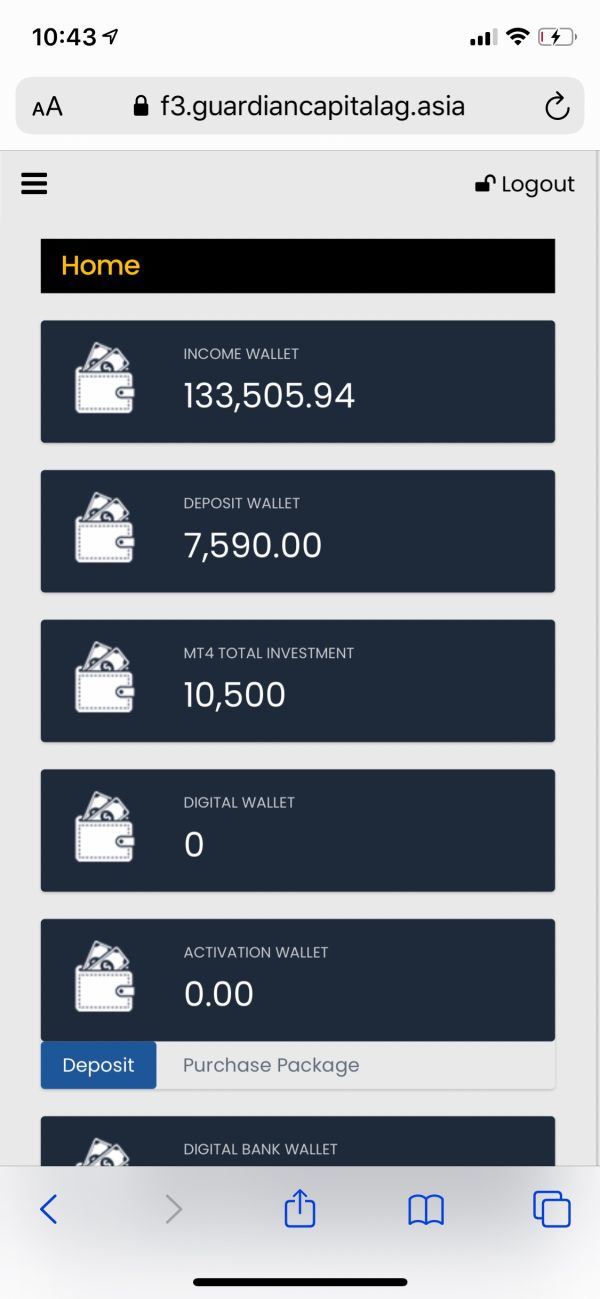

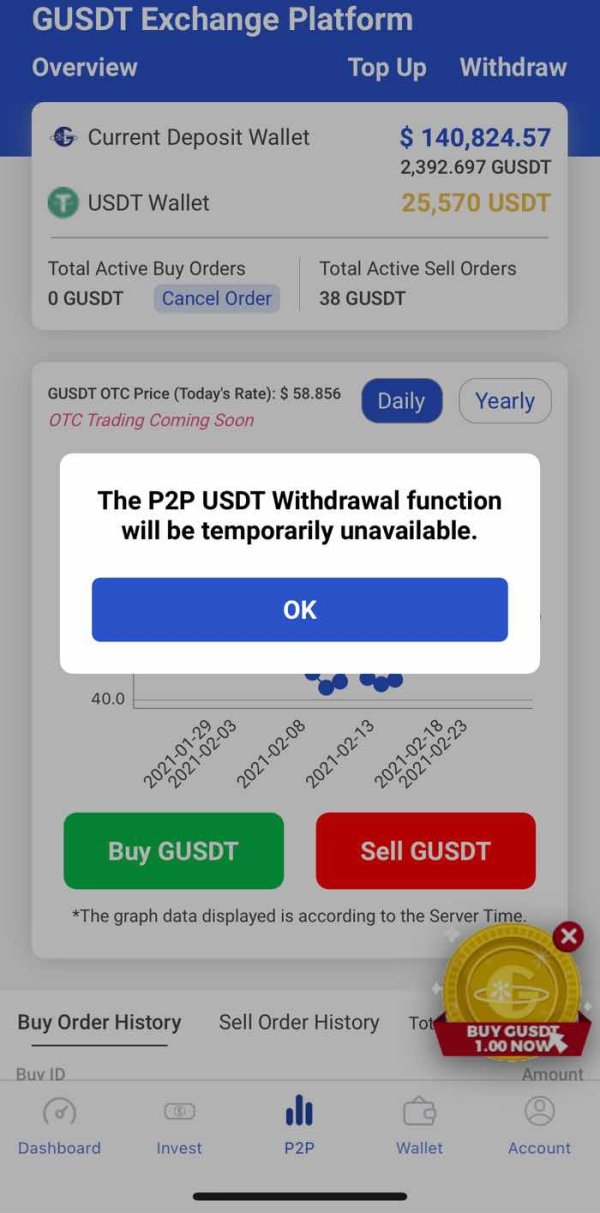

Deposit and Withdrawal Methods: Specific information regarding funding methods is not detailed in available materials. This requires direct inquiry with the firm for current options and processing procedures.

Minimum Deposit Requirements: Current minimum deposit thresholds are not specified in available documentation. This necessitates direct contact with the firm for account opening requirements.

Bonus and Promotional Offers: Details regarding promotional incentives or bonus programs are not outlined in available materials. This suggests either absence of such programs or limited public disclosure.

Tradeable Assets: The platform supports trading across equity indices, commodities, foreign exchange markets, and cryptocurrencies. This provides clients with diversified investment opportunities across major asset classes.

Cost Structure: Specific information regarding spreads, commissions, and fee structures is not detailed in available materials. This requires direct verification with the firm for current pricing models.

Leverage Ratios: Current leverage offerings are not specified in available documentation. These likely vary based on asset class, account type, and regulatory requirements.

Platform Options: The firm provides what is described as a stable and secure trading platform. However, specific platform names, features, and technological specifications require direct inquiry for detailed information.

Geographic Restrictions: Specific regional limitations are not detailed in available materials. However, the firm's focus on Asia-Pacific markets suggests primary service concentration in these regions.

Customer Service Languages: Available support languages are not specified in current documentation. This requires direct contact to determine multilingual support capabilities.

This GIB Capital Group review highlights the need for prospective clients to engage directly with the firm for detailed operational information.

Detailed Rating Analysis

Account Conditions Analysis

The assessment of GIB Capital Group's account conditions faces limitations due to insufficient publicly available information regarding specific account types, features, and requirements. This GIB Capital Group review cannot provide detailed analysis of account varieties, minimum deposit thresholds, or special account features such as Islamic trading accounts. The absence of comprehensive documentation creates this limitation.

Available information suggests that the firm caters primarily to institutional and high-net-worth individual clients. This typically implies higher minimum deposit requirements and more sophisticated account features compared to retail-focused brokers. However, without specific details regarding account opening procedures, verification requirements, or tiered account structures, potential clients must engage directly with the firm. This direct engagement is necessary to understand available options.

The regulatory oversight by the Capital Markets Authority suggests that account opening procedures likely adhere to regional know-your-customer and anti-money laundering standards. This regulatory framework provides some assurance regarding account security and compliance procedures. However, specific implementation details require direct verification.

The lack of detailed account condition information represents a significant gap for potential clients seeking to compare GIB Capital Group with other market participants. This emphasizes the importance of direct consultation during the evaluation process.

GIB Capital Group's trading infrastructure is characterized by what the firm describes as a stable and secure trading platform. However, specific technological details and feature sets are not comprehensively documented in available materials. The platform's support for multiple asset classes including equity indices, commodities, forex, and cryptocurrencies indicates a reasonably sophisticated technological foundation. This foundation is capable of handling diverse trading requirements.

The firm's focus on institutional and high-net-worth clients suggests that trading tools and resources are likely designed to meet sophisticated investor needs. However, specific features such as advanced charting capabilities, technical analysis tools, or algorithmic trading support are not detailed in available documentation. The substantial assets under management of $64 billion as of 2021 implies that the firm maintains adequate technological infrastructure. This infrastructure supports significant trading volumes and client demands.

Research and analysis resources, educational materials, and market commentary availability are not specified in current documentation. These represent areas where prospective clients would need to inquire directly. The firm's corporate finance and advisory services background suggests potential access to institutional-grade research and market analysis. However, retail client access to such resources remains unclear.

The absence of detailed platform specifications and tool descriptions limits the ability to provide comprehensive evaluation. This highlights the need for direct platform demonstration and feature review during the client onboarding process.

Customer Service and Support Analysis

The evaluation of GIB Capital Group's customer service capabilities is constrained by limited publicly available information regarding support channels, availability, and service quality metrics. This aspect of our GIB Capital Group review relies primarily on the firm's positioning as a provider serving institutional and high-net-worth clients. This positioning typically implies more personalized and responsive service standards.

The firm's regulatory status under the Capital Markets Authority suggests adherence to regional standards for client communication and complaint handling procedures. However, specific service level agreements, response time commitments, or available communication channels are not detailed in available materials.

Given the firm's focus on sophisticated clients and substantial assets under management, customer service is likely structured around relationship management rather than high-volume retail support models. This approach typically provides more personalized service but may involve different contact procedures and availability compared to retail-focused brokers.

The absence of specific information regarding multilingual support, service hours, or problem resolution procedures represents a significant information gap. Prospective clients should directly verify service capabilities before committing to the platform. This verification should particularly focus on language support and availability during their primary trading hours.

Trading Experience Analysis

The assessment of trading experience at GIB Capital Group faces significant limitations due to insufficient detailed information regarding platform performance, execution quality, and user interface characteristics. The firm's description of providing a stable and secure trading platform suggests focus on reliability. However, specific performance metrics, execution speeds, or platform stability data are not available in current documentation.

The support for multiple asset classes including equity indices, commodities, forex, and cryptocurrencies indicates platform versatility. However, specific execution models, order types, or advanced trading features remain unspecified. The firm's substantial assets under management suggest adequate infrastructure to handle significant trading volumes. However, retail client experience may differ from institutional trading conditions.

Mobile trading capabilities, platform customization options, and user interface design details are not documented in available materials. These represent important considerations for active traders. The regulatory oversight by the Capital Markets Authority provides some assurance regarding fair execution practices and trade reporting standards.

Without specific user feedback regarding platform performance, execution quality, or trading environment characteristics, this GIB Capital Group review cannot provide detailed trading experience evaluation. Prospective clients should request platform demonstrations and trial access to assess suitability for their trading requirements and preferences.

Trust and Reliability Analysis

GIB Capital Group demonstrates strong institutional credibility through its regulatory status under the Capital Markets Authority and substantial assets under management reaching $64 billion as of 2021. The firm's establishment as a wholly-owned subsidiary of Gulf International Bank provides additional financial backing and institutional stability. This contributes positively to overall trustworthiness assessment.

The regulatory oversight by the CMA ensures compliance with regional financial services standards. These standards include client fund protection measures, operational transparency requirements, and regular regulatory reporting. This regulatory framework provides essential safeguards for client assets and trading activities. However, specific fund segregation procedures and insurance coverage details are not detailed in available materials.

The firm's significant assets under management and institutional client focus suggest established market reputation and operational competency. The longevity since 2008 establishment and continued growth indicate sustained business viability and market confidence. However, specific information regarding negative incidents, regulatory actions, or dispute resolution history is not available in current documentation.

The combination of regulatory oversight, substantial asset management scale, and institutional backing supports a positive trust assessment. However, prospective clients should verify current regulatory status and any recent developments that might impact reliability evaluation.

User Experience Analysis

The evaluation of user experience at GIB Capital Group is significantly limited by the absence of detailed information regarding client satisfaction metrics, platform usability, and operational procedures. The firm's positioning toward institutional and high-net-worth clients suggests a focus on sophisticated users. These users may have different experience expectations compared to retail traders.

The geographic focus on Asia-Pacific markets indicates specialization in serving regional clients. This potentially provides advantages in local market access, regulatory understanding, and cultural alignment. However, specific user interface design, registration procedures, or account management processes are not detailed in available materials.

The lack of comprehensive user feedback or satisfaction surveys in available documentation prevents detailed user experience analysis. The firm's substantial client base implied by $64 billion in managed assets suggests some level of client satisfaction and retention. However, specific metrics or testimonials are not available.

Prospective clients should directly evaluate user experience elements including platform navigation, account management procedures, and overall service delivery through direct consultation and potential trial access. The absence of detailed user experience information represents a significant evaluation gap requiring direct investigation.

Conclusion

This comprehensive GIB Capital Group review reveals a financially substantial and regulated financial services provider with significant market presence, particularly in the Asia-Pacific region. The firm's regulatory oversight by the Capital Markets Authority and substantial assets under management of $64 billion provide strong indicators of institutional credibility and operational capacity.

GIB Capital Group appears most suitable for institutional clients and high-net-worth individuals seeking diversified investment opportunities across equity indices, commodities, forex, and cryptocurrency markets within a regulated environment. The firm's backing by Gulf International Bank and focus on sophisticated financial services positions it as a potentially attractive option for clients requiring institutional-grade service levels.

However, the significant lack of detailed information regarding account conditions, trading costs, platform specifications, and customer support represents a substantial limitation for comprehensive evaluation. Prospective clients must engage in extensive direct consultation to obtain essential operational details before making informed decisions about platform suitability.