Regarding the legitimacy of Inceptial forex brokers, it provides NBRB and WikiBit, (also has a graphic survey regarding security).

Is Inceptial safe?

Pros

Cons

Is Inceptial markets regulated?

The regulatory license is the strongest proof.

NBRB Forex Trading License (EP)

National Bank of the Republic of Belarus

National Bank of the Republic of Belarus

Current Status:

RevokedLicense Type:

Forex Trading License (EP)

Licensed Entity:

Growth Capital Limited Liability company

Effective Date:

2020-01-27Email Address of Licensed Institution:

Gr.Capital.FX@gmail.comSharing Status:

No SharingWebsite of Licensed Institution:

www.inceptial.by, www.Inceptial.comExpiration Time:

--Address of Licensed Institution:

223050, Minsk region, , Minskaya St. 69а-2, office 35Phone Number of Licensed Institution:

+375293117730Licensed Institution Certified Documents:

Is Inceptial A Scam?

Introduction

Inceptial is a forex broker that has positioned itself in the competitive landscape of online trading, offering a variety of financial instruments including forex pairs, commodities, and cryptocurrencies. Established in 2020 and based in Belarus, Inceptial claims to provide a user-friendly trading experience supported by advanced trading platforms. However, the rise of online trading has also led to an increase in fraudulent activities, making it essential for traders to conduct thorough evaluations of their chosen brokers. This article aims to assess whether Inceptial is a safe platform for trading or a potential scam. Our investigation is based on a comprehensive analysis of various sources, including regulatory information, customer feedback, and the broker's operational practices.

Regulation and Legitimacy

Understanding the regulatory status of a broker is crucial for assessing its legitimacy and safety. Inceptial asserts that it is regulated by the National Bank of Belarus, which is responsible for overseeing financial institutions in the country. However, the quality of regulation in Belarus is often viewed as less stringent compared to major financial jurisdictions like the UK or the US.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| National Bank of Belarus | 193301847 | Belarus | Verified |

While the broker's regulation by the National Bank of Belarus provides a level of legitimacy, it is essential to note that this regulatory body may not offer the same level of investor protection as more established regulators. Furthermore, there have been warnings from the Spanish financial regulator, CNMV, advising against trading with Inceptial due to concerns about its operational practices. This raises significant red flags regarding the broker's compliance history and the potential risks for traders.

Company Background Investigation

Inceptial is operated by Growth Capital LLC, a company registered in Belarus. The broker's establishment in 2020 makes it relatively new in the industry, which often raises concerns about its stability and reliability. The ownership structure of Inceptial is somewhat opaque, with limited information available about its management team and their professional backgrounds. This lack of transparency can be alarming for potential investors, as it complicates the assessment of the broker's credibility.

Moreover, the company has received numerous complaints from users regarding its operational practices. While some customers report satisfactory experiences, others have highlighted issues such as difficulties in withdrawing funds and unresponsive customer service. This inconsistency in user experiences further complicates the assessment of whether Inceptial is safe.

Trading Conditions Analysis

Inceptial offers a minimum deposit of $250, which is relatively low compared to industry standards. However, the overall cost structure and trading conditions warrant closer examination. The broker provides various account types, each with different spreads and leverage options.

| Fee Type | Inceptial | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 2.5 pips | 1.5 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | 0.5% - 2% | 0.5% - 1.5% |

The spreads offered by Inceptial are higher than the industry average, which could significantly impact traders' profitability. Additionally, the absence of a clear commission model raises questions about hidden fees or charges that could be applied to traders' accounts. This lack of transparency in pricing is a potential indicator of a scam, as it may lead to unexpected costs for traders.

Client Funds Safety

When it comes to the safety of client funds, Inceptial claims to implement measures such as segregated accounts and negative balance protection. However, the specifics of how these measures are enforced remain unclear.

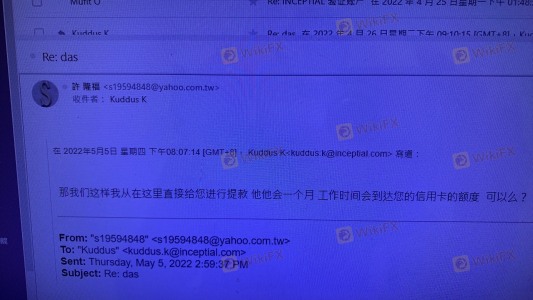

Many traders express concerns regarding the lack of investor protection, especially given the broker's regulatory status in Belarus. The absence of a compensation scheme for clients in the event of insolvency is another significant risk factor. Historical complaints indicate that some users have experienced difficulties in withdrawing funds, raising questions about the actual safety of their investments with Inceptial.

Customer Experience and Complaints

Customer feedback is a valuable indicator of a broker's reliability. Inceptial has received mixed reviews from users, with some praising the platform's functionality and customer service, while others report negative experiences.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Unresponsive Support | Medium | Limited engagement |

| Misleading Promotions | High | No clear response |

Common complaints include issues related to withdrawal delays and unresponsive customer support. For instance, one user reported being unable to withdraw their funds for several weeks, while another mentioned that their account manager was unhelpful. Such complaints are serious and could indicate a pattern of behavior that suggests Inceptial may not be a safe broker.

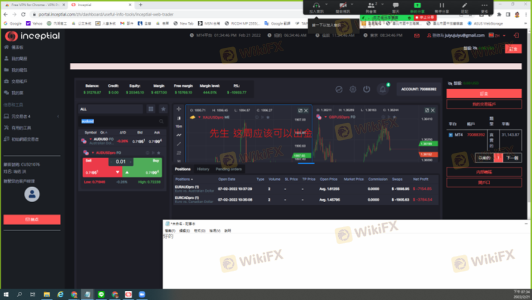

Platform and Trade Execution

Inceptial offers two trading platforms: a proprietary web trader and the widely used MetaTrader 4 (MT4). While MT4 is known for its reliability and user-friendly interface, the performance of Inceptial's proprietary platform has been called into question. Users have reported issues with order execution, including slippage and rejected orders, which can significantly affect trading outcomes.

The quality of trade execution is a critical factor for traders, and any signs of manipulation or operational inefficiencies can be a cause for concern. Given the mixed reports regarding execution quality, potential traders should exercise caution.

Risk Assessment

Engaging with Inceptial carries several risks, primarily due to its regulatory status and customer feedback.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Weak regulatory oversight in Belarus. |

| Fund Security Risk | High | Lack of investor protection and historical withdrawal issues. |

| Execution Risk | Medium | Reports of slippage and order rejections. |

To mitigate these risks, it is advisable for potential traders to consider using smaller amounts for initial trades and to thoroughly assess the broker's responsiveness and transparency before committing larger sums.

Conclusion and Recommendations

Based on the evidence presented, it is clear that potential traders should approach Inceptial with caution. The broker's regulatory status, coupled with numerous complaints regarding fund withdrawals and customer service, raises significant concerns about its legitimacy. While Inceptial is technically regulated, the quality of that regulation is questionable, and the lack of investor protection is alarming.

For traders seeking a reliable forex broker, it is advisable to consider alternatives that are regulated by more stringent authorities, such as the FCA or ASIC. These brokers typically offer better investor protection and have a proven track record of compliance with industry standards. In summary, while Inceptial may offer an appealing trading platform, the risks associated with trading through this broker suggest that it may not be a safe choice for your investments.

Is Inceptial a scam, or is it legit?

The latest exposure and evaluation content of Inceptial brokers.

Inceptial Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Inceptial latest industry rating score is 1.53, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.53 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.