Is AXFX safe?

Pros

Cons

Is AXFX Safe or Scam?

Introduction

AXFX, a forex broker established in 2017, positions itself within the competitive landscape of online trading by offering a variety of financial instruments, including forex, CFDs, and commodities. As traders increasingly seek online platforms to manage their investments, it is crucial to evaluate the credibility and reliability of these brokers. With the rise of scams and fraudulent activities in the financial sector, traders must exercise caution and conduct thorough research before committing their funds to any platform. This article aims to assess whether AXFX is a safe trading option or a potential scam by examining its regulatory status, company background, trading conditions, client experiences, and overall risk profile.

Regulation and Legitimacy

The regulatory status of a brokerage is one of the most critical factors in determining its credibility. AXFX was initially regulated by the Australian Securities and Investments Commission (ASIC), a reputable authority known for its strict oversight of financial institutions. However, recent reports indicate that AXFX's regulatory license has been revoked, raising significant concerns about its operational legitimacy.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | 001287576 | Australia | Revoked |

The revocation of AXFX's license suggests a failure to comply with regulatory standards, which could expose traders to heightened risks. Regulatory bodies like ASIC enforce stringent rules to ensure brokers maintain transparency, protect client funds, and adhere to ethical trading practices. The absence of valid regulation means that traders have limited recourse in the event of disputes or financial losses.

Traders should remain vigilant and conduct additional research on AXFX's reputation within the trading community, as the lack of regulation significantly diminishes the broker's credibility. Furthermore, the absence of a regulatory framework may allow AXFX to operate with less oversight, potentially leading to unethical practices.

Company Background Investigation

AXFX is registered in Australia, with its headquarters reportedly located in St. Vincent and the Grenadines. The company's ownership structure and management team play a crucial role in establishing trust with clients. However, information regarding the founders or key management personnel of AXFX is scarce, which raises questions about the broker's transparency and accountability.

A reputable brokerage typically provides detailed information about its management team, including their professional backgrounds and experience in the financial industry. This transparency helps build trust with clients, as it demonstrates a commitment to ethical practices and regulatory compliance. In the case of AXFX, the lack of information about its leadership may contribute to skepticism among potential traders.

Moreover, the company's history and development trajectory are essential for assessing its reliability. While AXFX has been operational for several years, the revocation of its regulatory license indicates that it may have faced challenges in maintaining compliance with industry standards. This situation underscores the importance of due diligence when considering trading with AXFX.

Trading Conditions Analysis

A comprehensive understanding of a broker's trading conditions is vital for traders looking to maximize their investment potential. AXFX offers various account types, including standard and advanced accounts, with varying minimum deposit requirements. However, the overall fee structure and trading costs associated with AXFX raise concerns that warrant further scrutiny.

| Fee Type | AXFX | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.8 pips | 1.0 - 1.5 pips |

| Commission Model | Not disclosed | Varies |

| Overnight Interest Range | Not specified | Varies |

AXFX's spreads, particularly for major currency pairs, are higher than the industry average, which could adversely affect traders' profitability. Additionally, the lack of transparency regarding commission structures and overnight interest rates raises red flags. Traders should be cautious about hidden fees that could erode their returns.

Moreover, the absence of a clear commission model may indicate a lack of competitive pricing, which is essential for traders seeking favorable trading conditions. It is crucial for potential clients to inquire about any additional fees that may apply, as these can significantly impact overall trading costs.

Client Funds Security

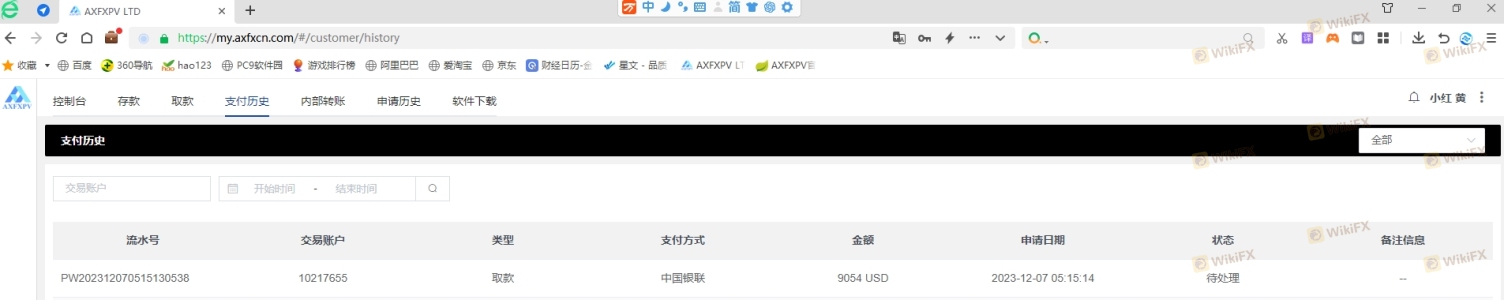

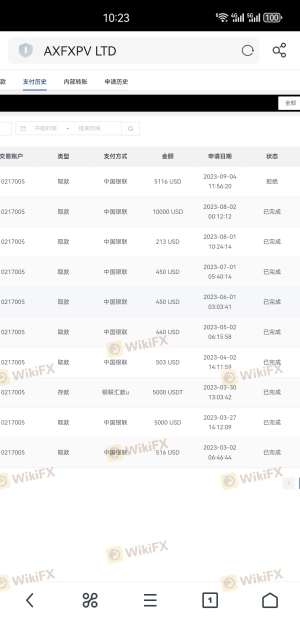

The safety of client funds is a paramount concern for traders when selecting a broker. AXFX's commitment to safeguarding client funds is essential for building trust and credibility. However, the revocation of its regulatory license raises questions about the effectiveness of its security measures.

Traders should look for brokers that implement robust fund protection mechanisms, such as segregated accounts and investor protection schemes. Segregated accounts ensure that client funds are kept separate from the broker's operational funds, providing an additional layer of security in case of insolvency. However, there is limited information available regarding AXFX's policies on fund segregation and investor protection.

Additionally, traders should assess whether AXFX offers negative balance protection, which prevents clients from losing more than their initial investment. The absence of such a policy could expose traders to significant financial risks, particularly in volatile market conditions.

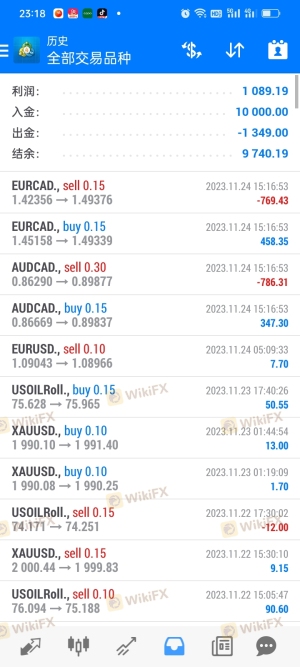

Client Experience and Complaints

Understanding the experiences of existing clients is crucial for assessing the reliability of any broker. Feedback from traders who have interacted with AXFX can provide valuable insights into the broker's operational practices and customer service quality. However, reports of client dissatisfaction have emerged, indicating potential issues that warrant attention.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Account Blocking | Medium | Inconsistent |

| High Spreads | Low | No action taken |

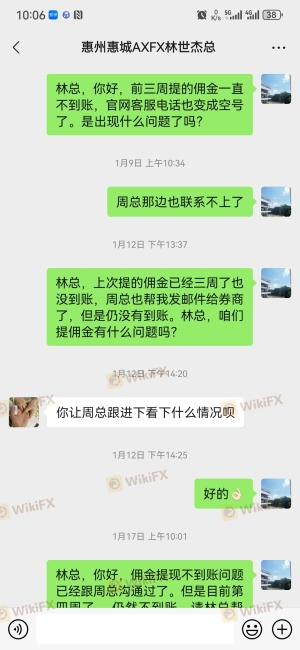

Common complaints include difficulties in processing withdrawals, account blocking, and dissatisfaction with trading conditions. These issues can significantly impact a trader's experience and raise concerns about the broker's reliability.

For example, some clients have reported delays in withdrawing their funds, leading to frustration and distrust. Inconsistent responses from customer support regarding account issues have further exacerbated these concerns.

Platform and Trade Execution

The performance of a trading platform is critical for ensuring a seamless trading experience. AXFX offers the widely used MetaTrader 4 platform, known for its user-friendly interface and comprehensive trading tools. However, the quality of order execution, slippage, and rejection rates are essential factors to consider.

Traders should evaluate whether AXFX provides reliable order execution without significant delays or slippage, as these factors can affect trading outcomes. Reports of platform manipulation or technical issues should also be taken into account, as they can hinder a trader's ability to make informed decisions.

Risk Assessment

Engaging with AXFX involves inherent risks that traders must consider before proceeding. The lack of regulation, coupled with reports of client complaints and withdrawal issues, creates a concerning risk profile for potential clients.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | License revoked by ASIC |

| Financial Risk | Medium | Potential for hidden fees |

| Operational Risk | High | Complaints about withdrawals |

To mitigate these risks, traders are advised to conduct thorough research, seek alternative brokers with robust regulatory oversight, and remain vigilant regarding their trading activities.

Conclusion and Recommendations

In conclusion, while AXFX presents itself as a forex broker with a range of trading options, the evidence suggests that it may not be a safe choice for traders. The revocation of its regulatory license, coupled with reports of client complaints and concerns about trading conditions, raises significant red flags.

Traders should exercise caution and consider alternative brokers that offer better regulatory protection, transparent fee structures, and positive client feedback. Reliable options include brokers with strong regulatory frameworks and a proven track record of customer satisfaction. Ultimately, the decision to engage with AXFX should be made with careful consideration of the risks involved and a thorough understanding of the broker's operational practices.

In summary, is AXFX safe? The current evidence leans towards a cautious approach, highlighting the need for traders to prioritize safety and transparency in their trading endeavors.

Is AXFX a scam, or is it legit?

The latest exposure and evaluation content of AXFX brokers.

AXFX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

AXFX latest industry rating score is 1.53, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.53 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.