Regarding the legitimacy of eXcentral forex brokers, it provides FSCA and WikiBit, .

Is eXcentral safe?

Pros

Cons

Is eXcentral markets regulated?

The regulatory license is the strongest proof.

FSCA Derivatives Trading License (EP)

Financial Sector Conduct Authority

Financial Sector Conduct Authority

Current Status:

RevokedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

OM BRIDGE (PTY) LTD

Effective Date:

2017-06-06Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

UNIT 6C3,159 RIVONIA ROAD SINOSTEEL PLAZA,MORNINGSIDE EXT 39 SANDTON, Unit 6C3, 159 Rivonia Rd, Sinosteel Plaza, Morningside Ext 39, Sandton, Gauteng, 2146, South AfricaPhone Number of Licensed Institution:

27072 216 2542Licensed Institution Certified Documents:

Is Excentral A Scam?

Introduction

Excentral is a forex and CFD broker that has gained attention in the trading community since its establishment in 2019. Based in Cyprus and regulated by the Cyprus Securities and Exchange Commission (CySEC), Excentral aims to provide traders with a comprehensive platform for trading various financial instruments, including forex pairs, commodities, indices, and cryptocurrencies. However, as with any financial service, it is crucial for traders to evaluate the credibility and reliability of a broker before committing their funds. The forex market is rife with both reputable and dubious brokers, making it essential for traders to conduct thorough due diligence.

This article investigates whether Excentral is a scam or a legitimate trading platform. Our analysis is based on a review of the broker's regulatory status, company background, trading conditions, customer feedback, and overall user experience. By employing a structured evaluation framework, we aim to provide potential traders with the necessary insights to make informed decisions about their trading endeavors with Excentral.

Regulation and Legitimacy

One of the primary indicators of a broker's credibility is its regulatory status. Excentral operates under the supervision of two regulatory bodies: the Cyprus Securities and Exchange Commission (CySEC) and the Financial Sector Conduct Authority (FSCA) in South Africa. Regulation by these authorities is crucial as it ensures that brokers adhere to strict operational standards designed to protect traders.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| CySEC | 226/14 | Cyprus | Verified |

| FSCA | 48296 | South Africa | Verified |

The CySEC is known for its stringent regulatory framework, requiring brokers to maintain client funds in segregated accounts and submit regular financial reports. Additionally, brokers under CySEC are members of the Investor Compensation Fund (ICF), which offers compensation to traders in case of broker insolvency, up to €20,000. The FSCA also imposes similar requirements, ensuring that client funds are protected.

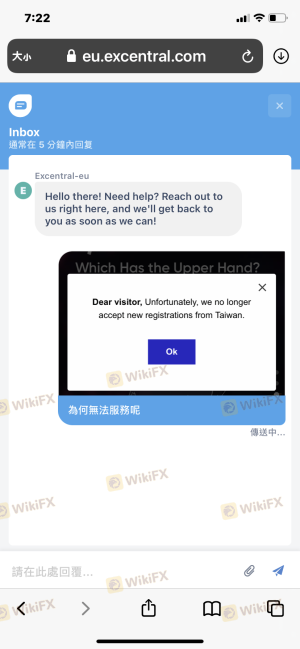

Despite these regulatory safeguards, there have been reports of complaints against Excentral, particularly regarding withdrawal issues and aggressive sales tactics by account managers. These issues raise questions about the broker's operational practices and adherence to regulatory standards. Therefore, while Excentral is regulated, potential traders should remain cautious and aware of the complaints associated with this broker.

Company Background Investigation

Excentral is operated by Mount Nico Corp Ltd, a company registered in Cyprus. The broker has positioned itself as a provider of forex and CFD trading services, primarily targeting clients in the European Economic Area (EEA) and South Africa. The company's ownership structure and management team play a crucial role in its operations and reputation.

The management team behind Excentral has experience in financial services; however, specific details about their backgrounds are not widely disclosed. This lack of transparency can be concerning for potential traders, as understanding the expertise and track record of a broker's management team is vital for assessing its reliability. Additionally, Excentral's website does not provide comprehensive information regarding its corporate governance or operational history, which may lead to skepticism about its legitimacy.

In terms of transparency, Excentral has made some efforts to provide educational resources for its clients, including webinars and trading guides. However, the overall lack of detailed information about the company's operations and management raises questions about its commitment to transparency. As a result, traders should consider these factors when evaluating whether Excentral is a safe platform for trading.

Trading Conditions Analysis

The trading conditions offered by Excentral are an essential aspect of its appeal to potential traders. The broker provides a variety of account types, including Classic, Silver, Gold, and VIP accounts, each with different features and minimum deposit requirements. The minimum deposit to open an account is set at $250, which may be considered high for beginner traders.

Excentral's fee structure includes spreads and commissions, which can significantly impact trading profitability. The spreads for major currency pairs, such as EUR/USD, start at 2.5 pips for Classic and Silver accounts, while Gold and VIP accounts offer lower spreads of 1.8 pips and 0.9 pips, respectively. However, these spreads are higher than the industry average, which typically ranges from 0.6 to 1.2 pips for similar brokers.

| Fee Type | Excentral | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 2.5 pips | 1.2 pips |

| Commission Model | None for forex | Varies |

| Overnight Interest Range | High | Competitive |

Additionally, Excentral charges a monthly maintenance fee of $10 and an inactivity fee that escalates from $80 after two months of inactivity to $500 after one year. These fees can accumulate, particularly for traders who do not actively engage in trading, and may deter potential clients from using the platform. The high trading costs and fee structures are critical factors to consider when assessing whether Excentral is a safe and viable trading option.

Client Fund Safety

The safety of client funds is a paramount concern for any trader. Excentral implements several measures to ensure the security of client funds, including the segregation of client deposits from the company's operating funds. This practice is a regulatory requirement that helps protect traders in the event of the broker's insolvency.

Moreover, Excentral offers negative balance protection, which ensures that traders cannot lose more than their deposited amount. This feature is particularly important for leveraged trading, where market fluctuations can lead to significant losses. However, there have been reports of withdrawal issues and delays, which raise concerns about the actual implementation of these safety measures.

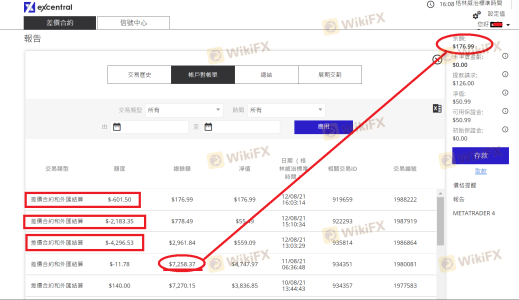

Historically, some traders have experienced difficulties in retrieving their funds from Excentral, with complaints indicating that the withdrawal process can be cumbersome and fraught with challenges. These issues underscore the importance of conducting thorough research before committing funds to any broker, including Excentral.

Customer Experience and Complaints

Customer feedback provides valuable insights into the overall experience of trading with Excentral. While some users report positive experiences, highlighting the availability of educational resources and responsive customer support, there are numerous complaints regarding withdrawal difficulties and aggressive sales tactics employed by account managers.

Common complaint patterns include:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response time |

| Aggressive Sales Tactics | Medium | Unresolved |

| Account Management Issues | High | Poor communication |

For instance, one trader reported that after attempting to withdraw funds, they faced numerous hurdles, including requests for additional documentation and delays in processing. Another user expressed frustration over relentless calls from account managers urging them to deposit more funds, leading to a negative trading experience.

These complaints raise concerns about Excentral's customer service practices and the overall treatment of clients. While some traders may find the broker satisfactory, the prevalence of negative feedback suggests that potential clients should approach with caution.

Platform and Trade Execution

The trading platforms offered by Excentral include the widely-used MetaTrader 4 (MT4) and a proprietary web-based platform. MT4 is well-regarded for its user-friendly interface and robust analytical tools, making it a popular choice among traders. However, some users have reported issues with the proprietary platform, citing a lack of advanced features compared to competitors.

In terms of order execution, Excentral claims to offer fast execution speeds; however, user experiences vary. Reports of slippage and rejected orders have surfaced, particularly during volatile market conditions. These issues can significantly impact trading outcomes and raise questions about the broker's reliability.

Risk Assessment

Engaging with Excentral involves certain risks that traders should be aware of. The following risk assessment summarizes key risk areas associated with this broker:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Compliance | Medium | Complaints about withdrawal issues |

| Trading Costs | High | Higher than average spreads and fees |

| Customer Support | Medium | Mixed feedback on response quality |

| Platform Reliability | Medium | Reports of execution issues |

To mitigate these risks, it is advisable for traders to thoroughly review all terms and conditions, actively engage with customer support, and consider starting with a demo account to familiarize themselves with the platform before making significant investments.

Conclusion and Recommendations

After assessing the evidence, it is evident that while Excentral is a regulated broker, there are considerable concerns regarding its operational practices and customer experiences. The combination of high trading costs, withdrawal difficulties, and aggressive sales tactics suggests that traders should exercise caution when considering this broker.

For those who are new to trading or seeking a reliable platform, it may be prudent to explore alternative options that offer better transparency, lower fees, and a more favorable reputation. Brokers such as eToro or IG may provide more robust trading conditions and customer support.

In summary, while Excentral is not outright a scam, the potential risks and complaints associated with this broker warrant careful consideration. Traders should prioritize their safety and ensure that they are comfortable with the broker's practices before committing their funds.

Is eXcentral a scam, or is it legit?

The latest exposure and evaluation content of eXcentral brokers.

eXcentral Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

eXcentral latest industry rating score is 1.54, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.54 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.