The Ridge 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive the ridge review presents a neutral assessment of what appears to be a complex entity with multiple business facets. Based on available information, The Ridge operates both as a wallet manufacturer known for minimalist design and as a realty group with over 17 years of industry experience. The ridge Wallet has gained attention for its sleek, hard-case construction specifically designed for minimalists who prioritize durability and functionality over traditional leather wallets.

The primary user base appears to be individuals seeking premium, efficient storage solutions and those interested in real estate services. However, our evaluation reveals significant information gaps regarding trading conditions, regulatory frameworks, and specific service offerings that would typically be expected from a comprehensive financial services provider. The ridge Wallet component demonstrates strong design principles and user satisfaction in the minimalist wallet market. Meanwhile, the realty division showcases extensive market experience with memorable property transactions.

Without detailed trading platform information, regulatory documentation, or comprehensive service descriptions, this the ridge review maintains a cautious stance on the overall service quality and reliability for potential financial services users.

Important Disclaimers

Potential clients should be aware that this evaluation is based on limited available information and does not include comprehensive regulatory verification across different jurisdictions. The ridge entities may operate under varying legal frameworks depending on geographical location. Users should independently verify regulatory compliance in their respective regions.

This assessment methodology relies on publicly available information and user feedback compilation rather than direct trading experience or comprehensive platform testing. The absence of detailed regulatory information in source materials suggests potential compliance variations that warrant individual investigation before engagement.

Rating Framework

Company Overview

The ridge represents a unique market presence that spans multiple industries, though specific founding details and comprehensive corporate background remain unclear from available sources. The organization appears to operate with a focus on premium product design in the wallet manufacturing sector. At the same time, it maintains real estate operations through the ridge Realty Group. The business model suggests a diversified approach to market engagement, though the connection between these different operational segments requires clarification.

The ridge Realty Group component brings substantial industry experience, with over 17 years of market presence that has witnessed significant market evolution and change. Their portfolio includes notable properties such as homes featuring Brunswick bowling alleys with four lanes, complete scoreboards, music systems, and disco lighting. This indicates engagement with luxury and unique property markets.

Without specific information regarding trading platform types, asset class offerings, or primary regulatory oversight, this the ridge review cannot provide definitive categorization of the financial services component. The available information suggests a complex organizational structure that may require individual investigation to understand the full scope of services and regulatory compliance frameworks.

Regulatory Regions: Specific regulatory information was not detailed in available materials, suggesting potential variations in compliance frameworks across different operational jurisdictions that require individual verification.

Deposit and Withdrawal Methods: Available materials do not specify the range of financial transaction methods supported. This indicates a need for direct inquiry regarding payment processing capabilities and supported banking relationships.

Minimum Deposit Requirements: Specific minimum deposit thresholds are not mentioned in available documentation, suggesting variable requirements that may depend on account types or service categories.

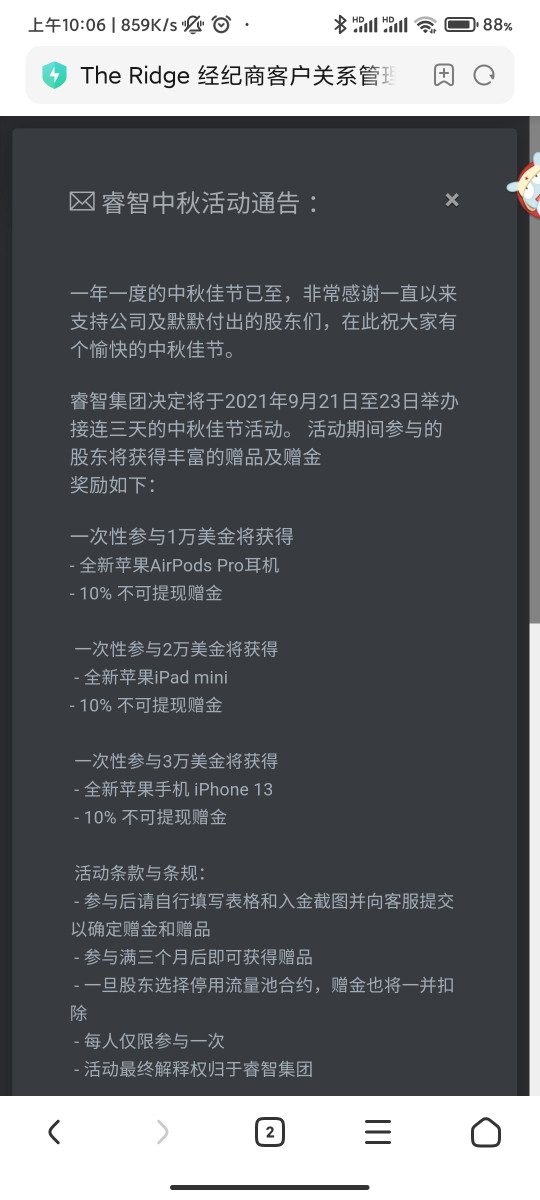

Bonus and Promotional Offers: Current promotional structures and bonus offerings are not detailed in source materials. This indicates either absence of such programs or limited public disclosure of incentive structures.

Tradeable Assets: The range of available trading instruments and asset classes remains unspecified in available information, preventing comprehensive assessment of market access and investment opportunities.

Cost Structure: Detailed fee schedules, commission structures, and ongoing costs are not outlined in available materials. This represents a significant information gap for potential service evaluation and comparison purposes.

Leverage Ratios: Specific leverage offerings and risk management parameters are not mentioned in source documentation.

Platform Options: Available trading platforms and technological infrastructure details are not specified in current materials.

Regional Restrictions: Geographic limitations on service availability are not detailed in available sources.

Customer Service Languages: Supported languages for customer communication are not specified in available materials. However, this the ridge review notes this as a standard consideration for international service providers.

Comprehensive Analysis

Account Conditions Analysis

The evaluation of account conditions remains significantly limited due to insufficient information regarding account type varieties, structural differences, and specific features offered across different service tiers. Available materials do not provide clarity on minimum deposit requirements, which typically serve as a primary consideration for potential clients evaluating service accessibility and initial investment commitments.

Account opening procedures and verification processes are not detailed in source materials, preventing assessment of user experience during onboarding phases. Special account accommodations, such as Islamic trading accounts or region-specific compliance structures, are not mentioned in available documentation. This suggests either absence of such offerings or limited public disclosure of specialized services.

The lack of comprehensive account condition information represents a significant evaluation challenge, as these factors typically influence user satisfaction and service accessibility. Without detailed terms and conditions, fee structures, or account maintenance requirements, potential clients cannot make informed comparisons with alternative service providers. They also cannot assess long-term cost implications of account ownership.

Assessment of available trading tools and analytical resources cannot be completed based on current information availability. Traditional expectations for financial services providers include comprehensive charting capabilities, technical analysis tools, fundamental research resources, and educational materials to support informed decision-making processes.

The absence of detailed tool descriptions, third-party integrations, or proprietary software capabilities prevents meaningful evaluation of technological competitiveness and user support infrastructure. Educational resources, which often distinguish premium service providers from basic offerings, are not mentioned in available materials. This suggests either limited educational support or inadequate public documentation of available learning materials.

Automated trading support, algorithmic trading capabilities, and API access for advanced users remain unspecified in source documentation. These technical capabilities increasingly represent standard expectations for modern trading platforms. Their absence from available information raises questions about technological sophistication and competitive positioning within the broader financial services marketplace.

Customer Service and Support Analysis

Customer service evaluation remains incomplete due to insufficient information regarding support channel availability, response time commitments, and service quality metrics. Effective customer support typically includes multiple communication channels such as live chat, telephone support, email correspondence, and potentially social media engagement for modern service providers.

Response time expectations and service level agreements are not detailed in available materials, preventing assessment of support reliability and problem resolution efficiency. Multi-language support capabilities, which often indicate international service commitment and accessibility, are not specified in current documentation. However, this represents a standard consideration for globally-oriented financial services.

Operating hours for customer support, regional support variations, and escalation procedures for complex issues are not outlined in available sources. The absence of customer service information significantly impacts overall service evaluation, as support quality often determines user satisfaction and long-term client retention in competitive financial services markets.

Trading Experience Analysis

Platform stability, execution speed, and overall trading environment assessment cannot be completed based on available information. Modern trading platforms typically provide real-time market data, efficient order execution, comprehensive charting capabilities, and mobile accessibility to meet contemporary user expectations and competitive market standards.

Order execution quality, including fill rates, slippage management, and price improvement opportunities, are not detailed in source materials. These technical performance factors significantly influence trading outcomes and user satisfaction, particularly for active traders who depend on reliable execution for strategy implementation and risk management.

Mobile trading experience and cross-platform synchronization capabilities are not specified in available documentation. Given the increasing importance of mobile accessibility for modern traders, the absence of mobile platform information represents a significant evaluation gap that potential users should investigate independently before service commitment.

This the ridge review notes that comprehensive trading experience evaluation requires detailed platform testing and user feedback compilation, neither of which are available in current source materials.

Trust Factor Analysis

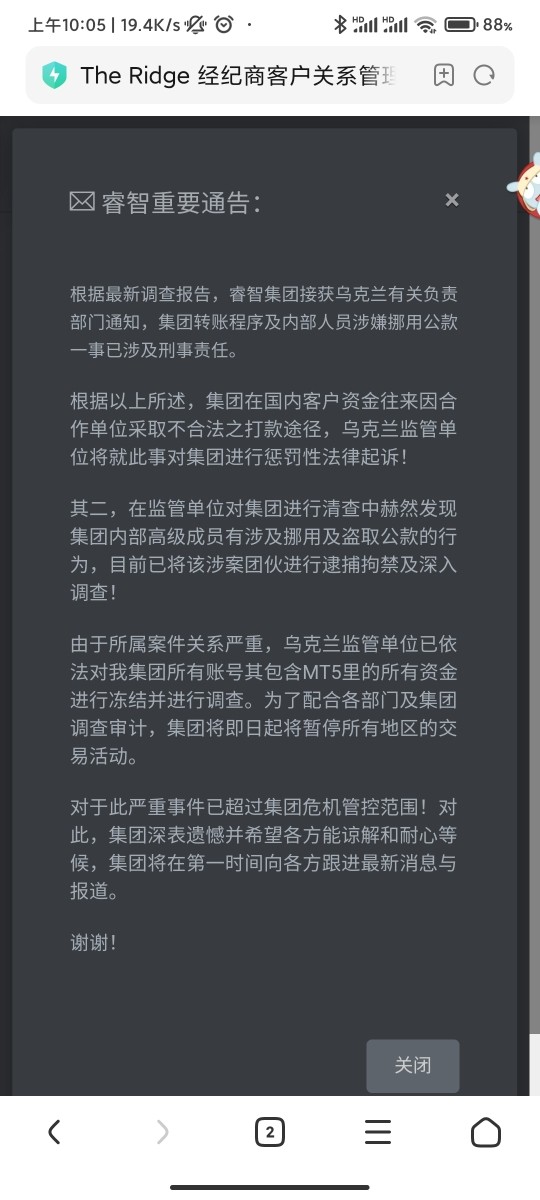

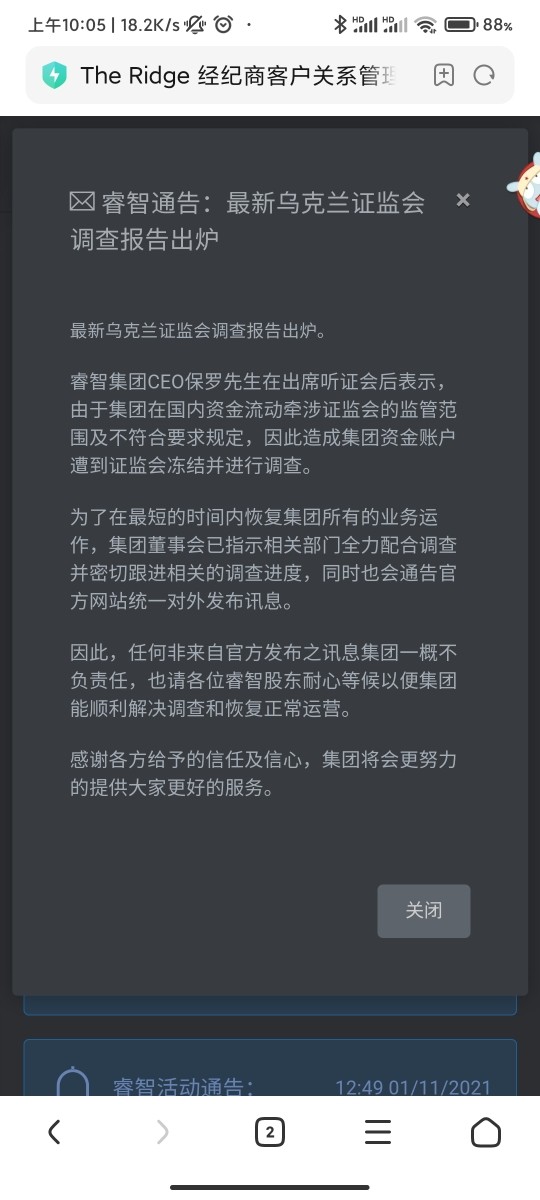

Regulatory compliance verification cannot be completed due to insufficient information regarding licensing authorities, regulatory oversight, and compliance frameworks governing service operations. Trust assessment typically relies on verifiable regulatory registration, transparent business practices, and established industry reputation built through consistent service delivery and regulatory adherence.

Fund security measures, including segregated account structures, insurance coverage, and third-party auditing practices, are not detailed in available materials. These security frameworks represent fundamental trust factors that potential clients typically evaluate when selecting financial services providers, particularly for long-term investment relationships and significant capital commitments.

Corporate transparency, including ownership structure, financial reporting, and business practice disclosure, cannot be assessed based on current information availability. Industry reputation and third-party evaluations from recognized financial services rating organizations are not referenced in available sources. This limits independent verification of service quality and reliability claims.

User Experience Analysis

Overall user satisfaction assessment remains incomplete due to limited feedback compilation and user experience documentation in available materials. Comprehensive user experience evaluation typically includes interface design assessment, navigation efficiency, feature accessibility, and overall satisfaction metrics gathered from diverse user populations across different service categories.

Registration and verification process efficiency, which significantly impacts initial user experience and onboarding satisfaction, are not detailed in current sources. Financial transaction experience, including deposit and withdrawal procedures, processing times, and fee transparency, cannot be evaluated based on available information. However, these factors typically influence long-term user satisfaction and service retention.

Common user concerns and complaint resolution effectiveness are not documented in available materials, preventing assessment of service responsiveness and continuous improvement practices. User demographic analysis and satisfaction segmentation across different service categories would typically inform potential clients about service suitability for their specific needs and expectations.

Conclusion

This comprehensive evaluation reveals significant information limitations that prevent definitive service quality assessment and recommendation formulation. The ridge entities demonstrate interesting market positioning with the wallet manufacturing component showing clear design focus and user appeal for minimalist preferences. Meanwhile, the realty division brings substantial industry experience and unique property portfolio engagement.

However, the absence of detailed trading conditions, regulatory compliance documentation, and comprehensive service descriptions creates substantial evaluation challenges for potential financial services clients. The neutral assessment reflects these information gaps rather than negative service indicators. Prospective users should conduct independent verification of regulatory compliance and service capabilities before engagement.

The ridge appears most suitable for users seeking minimalist design solutions in the wallet market and those interested in experienced real estate services. However, comprehensive financial services evaluation requires additional information gathering and direct provider consultation to ensure alignment with individual needs and regulatory requirements.