Is THE RIDGE safe?

Business

License

Is The Ridge Safe or a Scam?

Introduction

The Ridge, a forex broker, has garnered attention in the trading community due to its claims of offering competitive trading conditions and a variety of financial instruments. As the forex market continues to expand, traders are increasingly drawn to platforms that promise high returns and low barriers to entry. However, it is crucial for traders to exercise caution and thoroughly evaluate the legitimacy and safety of any brokerage before committing their funds. This article aims to provide a comprehensive analysis of The Ridge, examining its regulatory status, company background, trading conditions, customer experiences, and overall safety profile. The investigation draws upon various online sources, user reviews, and expert analyses to ensure a well-rounded assessment.

Regulation and Legitimacy

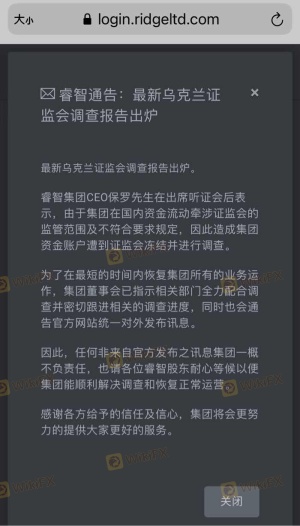

The regulatory status of a forex broker is a key factor in determining its safety and reliability. Brokers that are regulated by reputable financial authorities are generally held to strict standards that protect investors. Unfortunately, The Ridge has been found to lack regulation from any top-tier authority, raising significant concerns about its legitimacy.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Unregulated |

The absence of oversight from established regulatory bodies such as the FCA (Financial Conduct Authority) in the UK, ASIC (Australian Securities and Investments Commission), or the SEC (Securities and Exchange Commission) in the US is alarming. Traders should be aware that without regulation, there is no safety net to protect their investments, and funds may be at risk. Furthermore, the lack of compliance history raises questions about the broker's operational integrity and commitment to ethical trading practices. Therefore, it is essential for potential clients to consider these factors seriously when asking, "Is The Ridge safe?"

Company Background Investigation

The Ridge is relatively new to the forex market, with its operations reportedly based out of Ukraine. The company claims to offer a range of trading services, including forex, CFDs, and cryptocurrencies. However, the lack of transparency surrounding its ownership structure and management team is concerning.

While many reputable brokers provide detailed information about their founders and management, The Ridge's website lacks such disclosures. This absence of information can lead to distrust among potential clients, as it raises questions about who is behind the operations and their qualifications. Furthermore, the companys history shows no significant milestones or achievements that would establish credibility in the industry.

In an industry where trust is paramount, the opacity of The Ridges corporate structure and its lack of a well-documented history make it difficult to ascertain whether it is a trustworthy broker or a potential scam. In light of these factors, it is prudent to remain skeptical and consider the question, "Is The Ridge safe?"

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is crucial for traders looking to maximize their profitability. The Ridge advertises competitive spreads and a variety of account types, but it is essential to scrutinize these claims.

| Fee Type | The Ridge | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.0 pips | 0.6 - 1.0 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | Varies | Varies |

While The Ridge claims to have spreads starting from 1.0 pips, which is competitive, traders should be cautious of hidden fees that may not be immediately apparent. Reports from users indicate that the broker may impose additional charges that could significantly affect profitability. Moreover, the absence of a commission structure raises questions about how the broker generates revenue and whether this could lead to conflicts of interest in trade execution.

Overall, while The Ridge presents itself as a cost-effective option for traders, the lack of transparency regarding its fee structure and the potential for hidden costs should make traders question, "Is The Ridge safe?"

Client Fund Security

The safety of client funds is a primary concern for any trader. A reputable broker should implement robust measures to ensure the security of its clients' investments. Unfortunately, The Ridge does not appear to have adequate safeguards in place.

Reports indicate that The Ridge does not segregate client funds from its operational capital, which poses a significant risk in the event of financial difficulties. Additionally, there are no clear policies regarding investor protection or negative balance protection, which further exacerbates the risk for traders. Historical complaints from users suggest that there have been instances where clients struggled to withdraw their funds, raising alarms about the broker's reliability and trustworthiness.

Given these factors, potential clients should seriously consider whether their funds would be safe with The Ridge and reflect on the question, "Is The Ridge safe?"

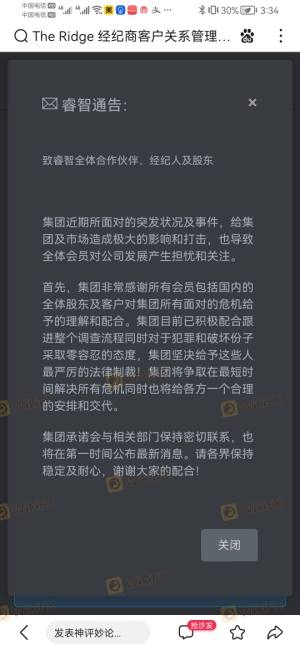

Customer Experience and Complaints

Customer feedback is a critical component of evaluating a broker's reliability. An analysis of reviews and complaints about The Ridge reveals a concerning trend of negative experiences among traders.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Misleading Promotions | Medium | Poor |

| Customer Support Delays | High | Poor |

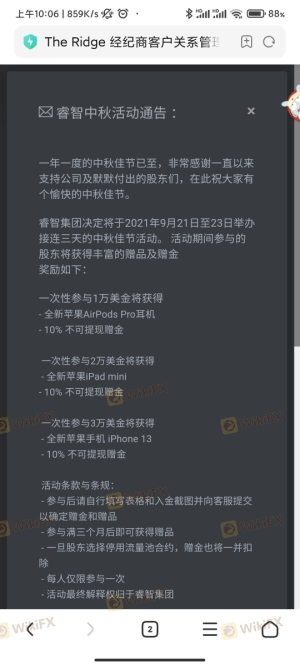

Common complaints include difficulties in withdrawing funds, misleading promotional offers, and inadequate customer support. Many users have reported that their withdrawal requests were either delayed or outright denied, which is a significant red flag for any broker. Additionally, the company's response to complaints appears to be lacking, further diminishing trust among its client base.

For instance, one trader reported that after depositing funds, they faced numerous obstacles when attempting to withdraw their earnings, leading to frustration and financial loss. Such experiences raise serious concerns about the brokers operational practices and commitment to customer service. As a result, it is crucial for potential clients to weigh these negative experiences when considering the question, "Is The Ridge safe?"

Platform and Trade Execution

The quality of a trading platform can significantly impact a trader's experience. The Ridge offers access to popular platforms like MetaTrader 4 and 5, which are known for their reliability and user-friendly interfaces. However, the overall performance and execution quality of trades on The Ridge's platform require careful evaluation.

Users have reported issues related to order execution, including slippage and rejections, which can hinder trading performance. Such problems can be particularly detrimental in a fast-paced trading environment where every second counts. Furthermore, there are concerns about potential platform manipulation, which could compromise the integrity of trades.

As traders assess whether to engage with The Ridge, it is vital to consider the platform's reliability and execution quality. This leads to the important inquiry, "Is The Ridge safe?"

Risk Assessment

Engaging with any forex broker entails inherent risks, and The Ridge is no exception. A comprehensive risk assessment can help traders understand the potential pitfalls associated with this broker.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated status poses significant risk. |

| Withdrawal Risk | High | Reports of difficulties in fund withdrawal. |

| Transparency Risk | Medium | Lack of information on management and operations. |

Given the high regulatory risk and the troubling history of withdrawal issues, traders should approach The Ridge with caution. It is advisable to consider alternative brokers that are regulated and have a proven track record of customer satisfaction.

To mitigate these risks, traders should conduct thorough research and possibly seek brokers that offer better transparency and regulatory oversight. This leads to the critical consideration of whether "Is The Ridge safe?"

Conclusion and Recommendations

In conclusion, the evidence presented raises serious concerns about the safety and reliability of The Ridge as a forex broker. The lack of regulation, transparency issues, and negative customer feedback suggest that traders should exercise extreme caution when considering this broker.

For those seeking a secure trading environment, it may be prudent to explore alternative brokers that are regulated by reputable authorities and have established positive reputations in the trading community. Options such as Forex.com, IG, or OANDA can provide a safer trading experience with better customer support and transparency.

Ultimately, the question "Is The Ridge safe?" leans towards a negative response based on the current findings. Traders are encouraged to prioritize their financial security and choose brokers that offer robust regulatory protection and a commitment to ethical trading practices.

Is THE RIDGE a scam, or is it legit?

The latest exposure and evaluation content of THE RIDGE brokers.

THE RIDGE Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

THE RIDGE latest industry rating score is 1.53, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.53 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.