Regarding the legitimacy of GIB Capital Group forex brokers, it provides ASIC and WikiBit, (also has a graphic survey regarding security).

Is GIB Capital Group safe?

Pros

Cons

Is GIB Capital Group markets regulated?

The regulatory license is the strongest proof.

ASIC Derivatives Trading License (MM)

Australia Securities & Investment Commission

Australia Securities & Investment Commission

Current Status:

UnverifiedLicense Type:

Derivatives Trading License (MM)

Licensed Entity:

S.A.M. FINANCIAL GROUP (AUSTRALIA) PTY LTD

Effective Date:

2009-08-31Email Address of Licensed Institution:

jr@samfingroup.com.auSharing Status:

No SharingWebsite of Licensed Institution:

www.samfingroup.com.auExpiration Time:

2022-10-17Address of Licensed Institution:

ASHURST AUSTRALIA, Level 16, 80 Collins Street South Tower MELBOURNE VIC 3000Phone Number of Licensed Institution:

0280040234Licensed Institution Certified Documents:

Is GIB Capital Group Safe or Scam?

Introduction

GIB Capital Group is a brokerage firm that has emerged in the forex market, claiming to offer a range of trading services to investors. Founded in 2020 and based in Australia, GIB Capital Group positions itself as a platform for forex trading, but potential investors need to exercise caution. The forex market is rife with opportunities, but it also harbors numerous risks, particularly from unregulated or poorly regulated brokers. This article aims to provide a comprehensive analysis of GIB Capital Group, assessing its legitimacy, regulatory status, customer experiences, and overall safety. Our evaluation is based on a thorough review of online sources, user feedback, and regulatory information.

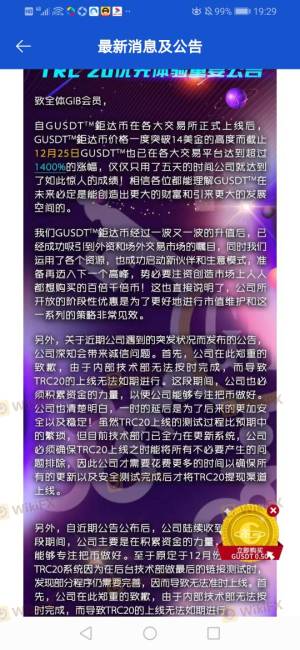

Regulatory and Legitimacy

The regulatory environment is a crucial aspect of evaluating any forex broker, as it provides a framework for investor protection and operational transparency. GIB Capital Group claims to be regulated under the Australian Securities and Investments Commission (ASIC), but its actual regulatory status raises significant concerns. The following table summarizes the core regulatory information for GIB Capital Group:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | N/A | Australia | Suspicious Clone |

| FCA | N/A | United Kingdom | Revoked |

The lack of a valid regulatory license is alarming. According to multiple sources, GIB Capital Group is categorized as a "suspicious clone" of legitimate ASIC-regulated firms, which indicates that it may not be operating under the appropriate legal framework. Furthermore, there have been numerous complaints about the broker, suggesting a pattern of unprofessional conduct. The absence of a credible regulatory body overseeing its operations significantly heightens the risks associated with trading with GIB Capital Group. Therefore, it is essential to consider these factors when asking, "Is GIB Capital Group safe?"

Company Background Investigation

GIB Capital Group's history is relatively short, having been established in 2020. This limited operational history can be a red flag, as newer brokers may not have proven their resilience through various market cycles. The ownership structure of GIB Capital Group is not transparently disclosed, raising questions about its accountability and governance. A well-established management team with relevant experience is vital for building trust, but GIB Capital Group's management details are scarce, making it difficult for potential investors to assess their credibility.

Furthermore, the company‘s website has been reported to be under maintenance, limiting access to critical information about its services and operations. Transparency is a cornerstone of trust in the financial services industry, and GIB Capital Group’s lack of clear information on its management and operational practices is concerning. For traders considering their options, the question remains: Is GIB Capital Group safe? The evidence suggests that potential investors should approach with caution.

Trading Conditions Analysis

When analyzing GIB Capital Groups trading conditions, it is vital to consider the overall fee structure and any unusual policies that could impact traders. The absence of detailed information regarding spreads, commissions, and overnight interest rates adds to the uncertainty surrounding this broker. The following table summarizes the core trading costs based on available data:

| Fee Type | GIB Capital Group | Industry Average |

|---|---|---|

| Major Currency Pair Spreads | N/A | 1.0 - 2.0 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The lack of transparency in trading costs can be a significant disadvantage for traders. If a broker does not disclose its fees clearly, it may indicate hidden charges that could erode profits. Moreover, the absence of competitive pricing structures compared to industry standards raises further questions about the broker's reliability. Therefore, potential clients should carefully consider these factors while evaluating whether GIB Capital Group is safe for their trading activities.

Client Fund Safety

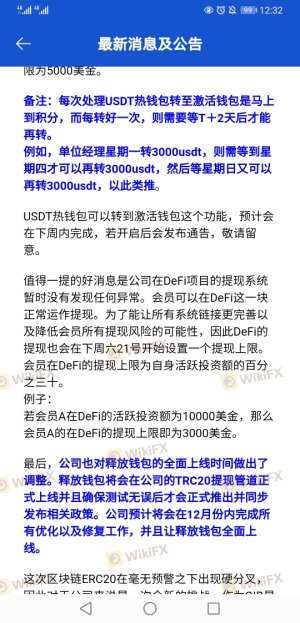

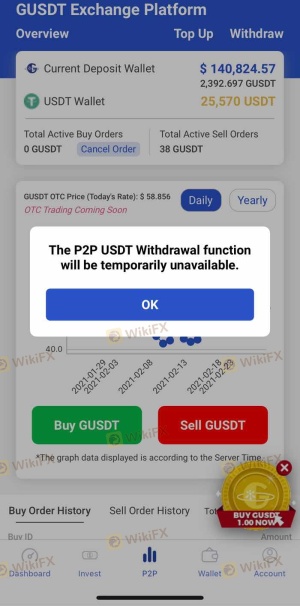

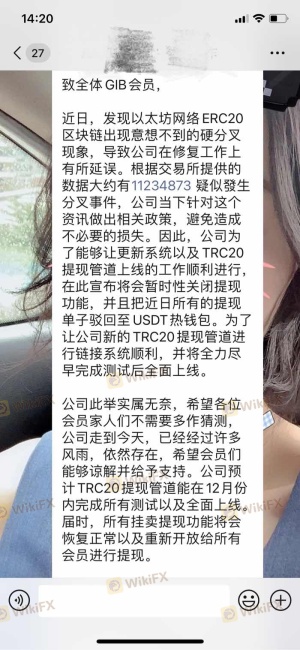

The safety of client funds is paramount when choosing a forex broker. GIB Capital Group's policies regarding fund security are not well-documented, which is concerning. Effective fund segregation and investor protection mechanisms are essential for safeguarding client investments. However, without clear policies in place, it is difficult to ascertain how GIB Capital Group manages client funds.

There are reports of users facing withdrawal issues, which is a serious red flag. A broker's failure to allow clients to access their funds can indicate deeper financial problems or even fraudulent practices. Historical controversies regarding fund security can severely damage a broker's reputation and trustworthiness. Therefore, when asking, "Is GIB Capital Group safe?" the answer leans towards caution due to the lack of clarity on fund safety measures.

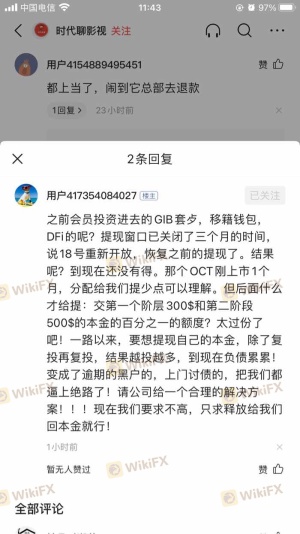

Customer Experience and Complaints

Analyzing customer feedback is essential for understanding the quality of service provided by GIB Capital Group. Numerous complaints have been reported, with users citing difficulties in withdrawing funds and a lack of responsive customer support. The following table summarizes the main types of complaints and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support Availability | Medium | Slow |

| Transparency Concerns | High | Nonexistent |

Typical cases include users stating they have been unable to withdraw their funds for extended periods, leading to frustration and distrust. The companys poor response to these complaints further exacerbates the situation. For traders contemplating their options, it is crucial to weigh these experiences heavily when considering whether GIB Capital Group is safe.

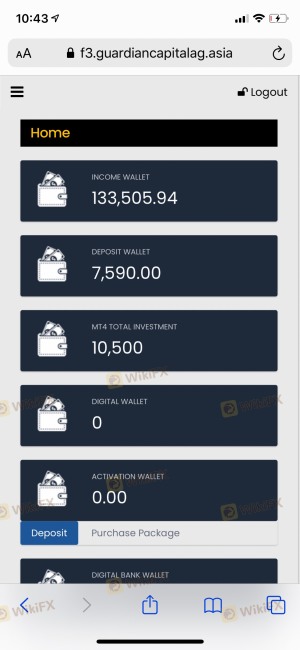

Platform and Trade Execution

The trading platform is a critical component of the trading experience. GIB Capital Group reportedly offers the popular MetaTrader 4 platform, known for its reliability and user-friendly interface. However, the quality of execution, including slippage and order rejection rates, remains uncertain due to the lack of accessible data.

If traders encounter frequent slippage or rejected orders, it could indicate underlying issues with the broker's liquidity or operational integrity. Such issues can significantly affect trading performance and profitability. As potential clients assess their options, they must consider the platform's reliability and execution quality in determining if GIB Capital Group is safe for trading.

Risk Assessment

Overall, using GIB Capital Group carries inherent risks that potential investors must consider. The following risk assessment summarizes the key risk areas associated with this broker:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Compliance | High | No valid regulatory oversight |

| Fund Safety | High | Reports of withdrawal issues |

| Transparency | High | Lack of information and clarity |

| Customer Support | Medium | Poor response to complaints |

Given these risks, it is advisable for traders to be cautious. Engaging with a broker that lacks regulatory oversight or has a history of customer complaints can lead to significant financial losses. To mitigate these risks, traders should consider diversifying their investments and opting for brokers with a solid regulatory framework and positive user reviews.

Conclusion and Recommendations

In conclusion, the evidence suggests that GIB Capital Group is not a safe option for forex trading. The lack of valid regulatory oversight, combined with numerous complaints about withdrawal issues and poor customer support, raises significant red flags. Potential investors should be wary of engaging with this broker and consider alternative options that offer greater transparency and reliability.

For traders seeking safer alternatives, consider established brokers with strong regulatory backing, proven track records, and positive customer reviews. Some reputable options include brokers regulated by ASIC, FCA, or CySEC, which provide a higher level of protection for investors. Always conduct thorough research and due diligence before choosing a forex broker to ensure a secure trading experience.

Is GIB Capital Group a scam, or is it legit?

The latest exposure and evaluation content of GIB Capital Group brokers.

GIB Capital Group Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

GIB Capital Group latest industry rating score is 1.53, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.53 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.