Regarding the legitimacy of NYGCM/NYFX forex brokers, it provides SERC, FCA and WikiBit, (also has a graphic survey regarding security).

Is NYGCM/NYFX safe?

Business

License

Is NYGCM/NYFX markets regulated?

The regulatory license is the strongest proof.

SERC Derivatives Trading License (EP)

Securities and Exchange Regulator of Cambodia

Securities and Exchange Regulator of Cambodia

Current Status:

RevokedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

NYFX Co., Ltd.

Effective Date:

--Email Address of Licensed Institution:

nyfxcambodia@gmail.comSharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

#The Fortune Tower, 22nd Floor, Office-G-2201, Sangkat Veal Vong, Khan 7 Makara, Phnom Penh.Phone Number of Licensed Institution:

061 81 81 90Licensed Institution Certified Documents:

FCA Forex Execution License (STP)

Financial Conduct Authority

Financial Conduct Authority

Current Status:

UnverifiedLicense Type:

Forex Execution License (STP)

Licensed Entity:

Cresco Capital Markets (UK) Ltd

Effective Date:

2017-08-01Email Address of Licensed Institution:

compliance@crescofx.comSharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

2022-12-09Address of Licensed Institution:

21 ArlinGTon STreeT London SW1A 1RN UNITED KINGDOM, 21 Arlington Street London SW1A 1RNPhone Number of Licensed Institution:

442079526822Licensed Institution Certified Documents:

Is NYGCM NYFX A Scam?

Introduction

NYGCM NYFX is a relatively new player in the forex market, having been established in 2020. As an online brokerage, it offers a range of trading instruments, including forex pairs, commodities, indices, stocks, and cryptocurrencies. However, the rise of online trading has also seen a surge in fraudulent activities, making it crucial for traders to carefully evaluate the legitimacy and safety of brokers before committing their funds. This article aims to provide an objective analysis of NYGCM NYFX, focusing on its regulatory status, company background, trading conditions, customer safety, user experiences, platform performance, risk assessment, and ultimately, whether it is safe or a scam.

The investigation is based on a comprehensive review of available online resources, including user testimonials, regulatory databases, and expert analyses. By employing a structured framework, we aim to offer a balanced perspective on NYGCM NYFXs operations and its standing in the forex trading community.

Regulation and Legitimacy

The regulatory status of a broker is one of the most critical factors in determining its legitimacy. NYGCM NYFX claims to be regulated by the Financial Conduct Authority (FCA) in the United Kingdom and the Securities and Exchange Regulator of Cambodia (SERC). However, investigations have raised significant concerns regarding the validity of these claims.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FCA | 764353 | United Kingdom | Suspicious Clone |

| SERC | 032 | Cambodia | Revoked |

The FCA is known for its stringent regulations and oversight in the financial sector. However, the license number associated with NYGCM NYFX has been flagged as a suspicious clone, suggesting that the broker may be misrepresenting its regulatory status. Furthermore, the SERC license has been revoked, indicating that NYGCM NYFX has not met the necessary regulatory requirements in Cambodia. This lack of credible regulation raises significant red flags about the broker's operations and its commitment to maintaining industry standards.

Company Background Investigation

NYGCM NYFX operates under the name NY FX Financial Services LLC, registered in the United States. While the company is relatively new, its ownership structure and management team have not been thoroughly disclosed, which raises concerns about transparency. The absence of clear information regarding the company's history and the professional backgrounds of its management team can make it difficult for traders to assess the broker's reliability.

Moreover, the broker's limited transparency regarding its operational history contributes to the uncertainty surrounding its legitimacy. A well-established broker typically provides comprehensive information about its ownership, management, and operational practices, which fosters trust among potential clients. In this case, the lack of such disclosures further complicates the evaluation of whether NYGCM NYFX is safe or a scam.

Trading Conditions Analysis

When evaluating a broker, the overall cost structure is a vital component that can significantly impact traders' profitability. NYGCM NYFX offers a variety of account types, including variable, fixed, ECN, and VIP accounts, but the specifics regarding spreads and commissions are somewhat opaque.

| Cost Type | NYGCM NYFX | Industry Average |

|---|---|---|

| Major Currency Pair Spread | From 1.0 pips | 1.2 pips |

| Commission Model | $7 for FX, $12 for metals | $5 for FX, $10 for metals |

| Overnight Interest Range | Not specified | 0.5% to 2% |

The spreads offered by NYGCM NYFX start at 1.0 pips for major currency pairs, which is competitive compared to the industry average. However, the commission structure appears to be higher than average, particularly for forex trades. Additionally, the lack of clarity regarding overnight interest rates may deter traders who prefer transparency in their cost structures. Such opaque policies can lead to unexpected costs, making it essential for traders to conduct thorough due diligence before engaging with this broker.

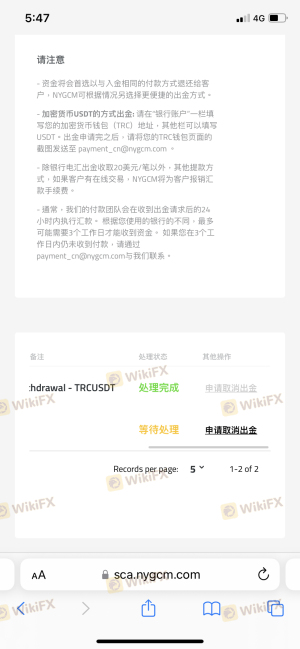

Customer Funds Safety

The safety of customer funds is paramount when assessing a broker's credibility. NYGCM NYFX claims to implement various security measures, but detailed information on fund segregation, investor protection, and negative balance protection is lacking.

A reputable broker typically maintains client funds in segregated accounts to ensure that they are not used for operational expenses. Furthermore, mechanisms such as negative balance protection safeguard clients from incurring debts beyond their account balances. However, the absence of clear information on these policies raises concerns about whether NYGCM NYFX is taking adequate steps to protect its clients' investments.

Historical issues related to fund safety, such as withdrawal complaints and fund mismanagement, can also impact a broker's reputation. Given the significant number of complaints against NYGCM NYFX, traders should be cautious when considering this broker, as unresolved safety issues could lead to severe financial consequences.

Customer Experience and Complaints

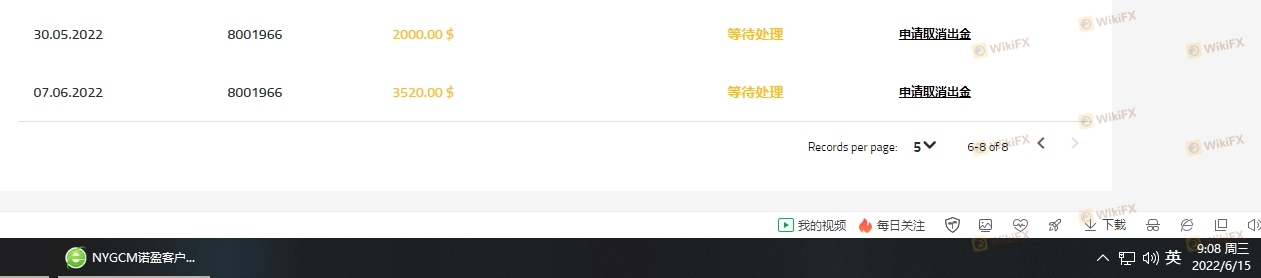

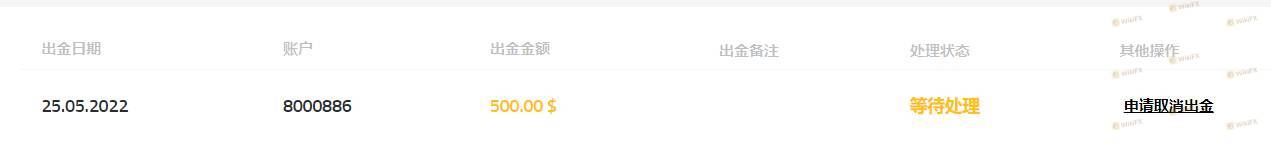

Customer feedback is an invaluable resource for assessing a broker's reliability. NYGCM NYFX has received a notable number of complaints, particularly regarding withdrawal issues, with many users reporting difficulties in accessing their funds.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service Delays | Medium | Average |

| Account Management | High | Poor |

The most common complaint revolves around the inability to withdraw funds, which is a significant red flag for any broker. Users have reported delays and lack of communication from the company's support team, indicating a potential lack of professionalism and reliability. In one case, a trader reported applying for a withdrawal that remained unprocessed for an extended period, demonstrating a concerning trend that could indicate deeper operational issues.

Platform and Execution

The trading platform is another critical aspect of a broker's service. NYGCM NYFX offers access to popular platforms like MetaTrader 4 and MetaTrader 5, which are known for their robust features and user-friendly interfaces. However, user experiences with execution quality, slippage, and order rejections have raised concerns.

Traders have reported instances of slippage during volatile market conditions, which can significantly impact trading outcomes. Moreover, some users have alleged that their orders were rejected without clear explanations, suggesting potential issues with the platform's reliability. Such experiences can lead to frustration and financial losses, further questioning whether NYGCM NYFX is safe for trading.

Risk Assessment

Using NYGCM NYFX presents several risks that traders should be aware of. The lack of regulation, combined with numerous complaints regarding fund withdrawals and customer service, significantly elevates the risk profile of this broker.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Compliance | High | Unregulated status raises concerns. |

| Fund Security | High | Lack of transparency in fund safety. |

| Customer Service | Medium | Poor response to complaints. |

To mitigate these risks, traders should conduct thorough research before engaging with NYGCM NYFX. It is advisable to start with a small investment or consider alternative brokers with established reputations and regulatory oversight.

Conclusion and Recommendations

In conclusion, the evidence suggests that NYGCM NYFX operates in a high-risk environment with significant concerns regarding its legitimacy and safety. The lack of credible regulation, numerous customer complaints, and opaque trading conditions indicate that traders should exercise extreme caution when considering this broker.

For those seeking reliable trading platforms, it may be wise to explore alternatives that are regulated by reputable authorities and have a proven track record of customer satisfaction. Brokers such as OANDA, IG, and Forex.com are examples of well-established firms that provide secure trading environments and transparent operations.

Ultimately, while NYGCM NYFX may offer attractive trading conditions, the potential risks associated with its operations make it essential for traders to carefully evaluate their options before proceeding.

Is NYGCM/NYFX a scam, or is it legit?

The latest exposure and evaluation content of NYGCM/NYFX brokers.

NYGCM/NYFX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

NYGCM/NYFX latest industry rating score is 1.53, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.53 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.