Is Swiss Option safe?

Business

License

Is Swiss Option A Scam?

Introduction

Swiss Option is a binary options broker that positions itself as a prominent player in the financial markets, particularly in the realm of binary options trading. With claims of offering high returns and a user-friendly platform, it attracts both novice and experienced traders. However, the rise of fraudulent brokers in the online trading space necessitates that traders carefully evaluate the legitimacy of any broker before committing their funds. This article investigates whether Swiss Option is a scam or a safe trading platform. Our evaluation is based on a thorough analysis of regulatory compliance, company background, trading conditions, customer feedback, and overall risk assessment.

Regulation and Legitimacy

The regulatory status of a broker is paramount in determining its legitimacy. Swiss Option claims to be licensed by the Financial Commission, which is a self-regulatory organization. However, the lack of oversight from top-tier regulators such as the FCA (UK) or ASIC (Australia) raises questions about the broker's credibility. Below is a summary of the regulatory information related to Swiss Option:

| Regulatory Body | License Number | Regulated Region | Verification Status |

|---|---|---|---|

| Financial Commission | N/A | Cyprus | Unverified |

The absence of a valid regulatory license from a recognized authority suggests that Swiss Option may not adhere to the strict compliance standards expected in the financial industry. Furthermore, the Financial Commission's oversight is often considered less robust than that of government-backed regulatory bodies. This raises concerns regarding the broker's operational transparency and adherence to industry best practices. Historical compliance issues or regulatory warnings against similar brokers further amplify these concerns, leading to the question, is Swiss Option safe?

Company Background Investigation

Swiss Option operates under the ownership of Capital Spot Trading Ltd, a company registered in Cyprus. The broker claims to have been in operation since 2013, but the opacity surrounding its ownership structure and operational history warrants scrutiny. The management team‘s background is crucial in assessing the broker’s reliability. Unfortunately, detailed information about the teams qualifications and experience is scarce, which diminishes the broker's credibility.

Moreover, the level of transparency in the company's disclosures is lacking. Potential clients should be able to access information about the company's financial health, trading history, and management profiles. The absence of such information raises red flags about the broker's commitment to maintaining a trustworthy business environment. As a result, traders must question the safety of their investments with Swiss Option.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is essential for evaluating its overall value proposition to traders. Swiss Option presents various account types with differing deposit requirements and trading features. However, the overall fee structure requires careful examination. Heres a breakdown of the core trading costs associated with Swiss Option:

| Fee Type | Swiss Option | Industry Average |

|---|---|---|

| Major Currency Pair Spreads | 1.5 pips | 1.2 pips |

| Commission Model | 3% on withdrawals | 1-2% |

| Overnight Interest Range | Varies | 0.5-1% |

The spreads offered by Swiss Option appear to be higher than the industry average, which could significantly impact profitability, especially for high-frequency traders. Additionally, the commission on withdrawals is concerning, as many reputable brokers offer lower or no withdrawal fees. These factors contribute to the question of whether Swiss Option is safe for traders looking for competitive trading conditions.

Customer Funds Security

The safety of client funds is a critical aspect of any trading platform. Swiss Option claims to implement measures to protect clients' funds, including the segregation of client accounts and the use of secure payment methods. However, the specifics of these security measures are not thoroughly documented on their website.

Investors should be aware of the importance of fund segregation, which ensures that client funds are kept separate from the broker's operational funds. This practice protects clients in the event of the broker's insolvency. Additionally, the presence of investor protection schemes can provide an extra layer of security. However, without a robust regulatory framework backing these measures, there remains a level of uncertainty regarding the safety of funds with Swiss Option. This leads to further questioning of is Swiss Option safe?

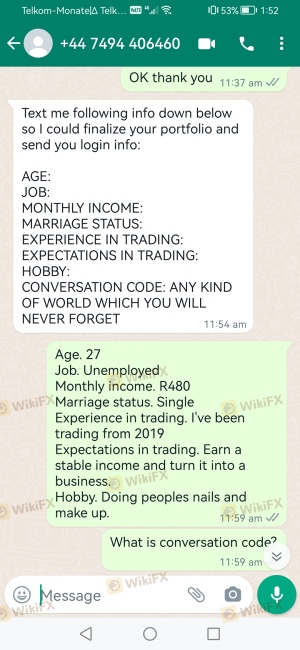

Customer Experience and Complaints

Analyzing customer feedback provides valuable insights into a broker's reliability. Reports from users of Swiss Option reflect mixed experiences, with several complaints regarding withdrawal issues and customer service responsiveness. Below is a summary of common complaint types and their severity:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow response |

| Poor Customer Service | Medium | Inconsistent |

| Account Management Issues | High | Negligent |

Typical cases involve clients experiencing prolonged withdrawal processes, leading to frustration and distrust. Additionally, some users have reported difficulty in reaching customer support, which is a significant concern for traders who may require immediate assistance. These issues raise doubts about the overall customer experience and contribute to the perception that Swiss Option may not be entirely safe.

Platform and Trade Execution

The performance of the trading platform is essential for a smooth trading experience. Swiss Option claims to offer a user-friendly interface, but reviews indicate that users have faced stability issues, including occasional outages and slow execution times. The quality of order execution is equally important; traders need to know that their trades will be executed promptly without excessive slippage or rejections.

There are also concerns about potential platform manipulation, which can occur if a broker alters prices to benefit its interests at the expense of traders. This aspect is critical when evaluating whether is Swiss Option safe for trading.

Risk Assessment

Using Swiss Option comes with inherent risks that traders must consider. The following risk assessment summarizes key risk areas:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Compliance | High | Lack of oversight from top-tier regulators. |

| Withdrawal Issues | High | Frequent complaints regarding delays. |

| Platform Stability | Medium | Reports of outages and slow execution. |

To mitigate these risks, traders should conduct thorough research, utilize demo accounts, and consider diversifying their investments across more reputable platforms. Understanding the risks involved in trading with Swiss Option is essential for making informed decisions.

Conclusion and Recommendations

In conclusion, the evidence suggests that Swiss Option may not be the safest choice for traders. The lack of robust regulatory oversight, mixed customer feedback, and concerns regarding trading conditions and platform stability raise significant red flags. While it is not outrightly labeled a scam, potential investors should exercise caution and consider alternative options.

For those seeking reliable trading platforms, brokers like Pocket Option and IQ Option, which are regulated by respected authorities and offer competitive trading conditions, may be more suitable choices. As always, traders should conduct their due diligence before committing funds to any trading platform to ensure a secure trading experience.

Is Swiss Option a scam, or is it legit?

The latest exposure and evaluation content of Swiss Option brokers.

Swiss Option Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Swiss Option latest industry rating score is 1.56, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.56 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.