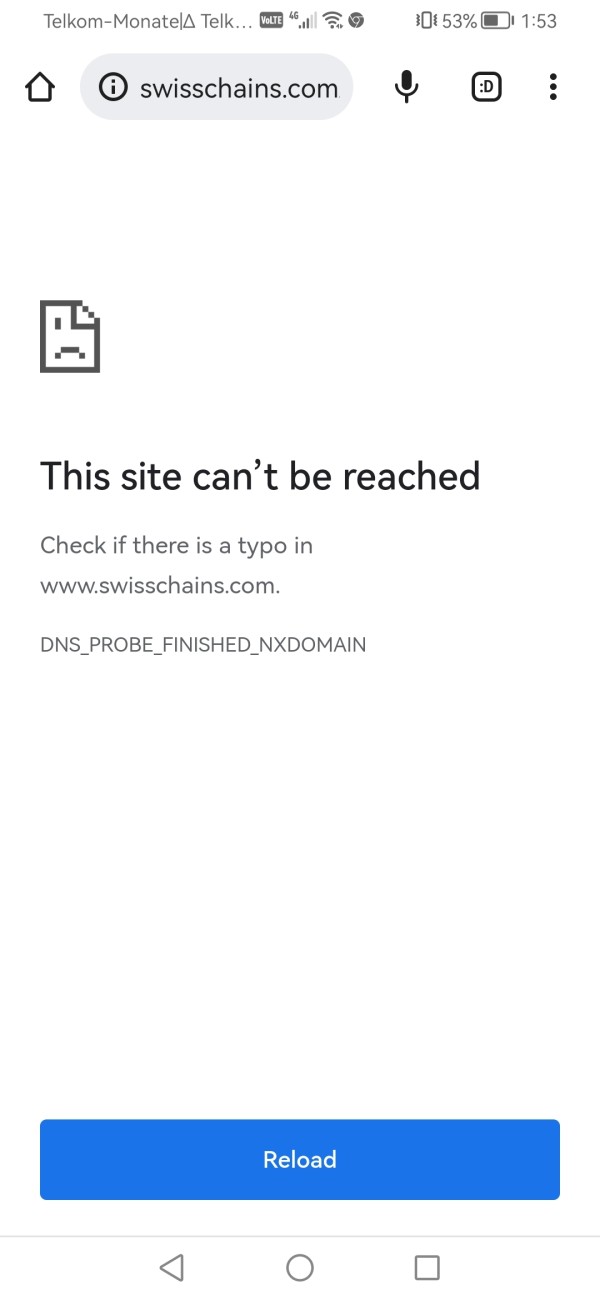

Swiss Option 2025 Review: Everything You Need to Know

Executive Summary

Swiss Option has positioned itself as a notable player in the binary options trading market. The platform attracts both novice and experienced traders with its promise of high returns and quick trading opportunities. This swiss option review reveals that while the platform offers certain appealing features, significant concerns about transparency and regulatory clarity cast doubt on its overall credibility.

The broker stands out with its maximum profit potential of up to 80%. It also supports ultra-short-term trading options, including 30-second, 60-second, and 120-second trades. These features particularly appeal to traders seeking rapid-fire trading opportunities and substantial returns on their investments.

The platform is operated by CAPITALSPOT TRADING LTD, which is registered in Cyprus and claims oversight by the Financial Commission. However, our analysis reveals substantial gaps in publicly available information regarding crucial trading conditions, regulatory details, and operational transparency.

The absence of specific data about minimum deposits, spreads, trading platforms, and customer service channels raises questions about the broker's commitment to transparency. While Swiss Option targets traders interested in fast-paced, high-reward trading scenarios, potential users should exercise considerable caution due to the limited verifiable information available about the company's operations and regulatory standing.

Important Notice

Due to Swiss Option's registration in Cyprus under CAPITALSPOT TRADING LTD, the broker may face varying regulatory requirements across different jurisdictions. Traders should independently verify their local laws and regulations regarding binary options trading.

These instruments are restricted or banned in many countries. This review is based exclusively on publicly available information and market feedback.

No user reviews or complaint data were available for analysis at the time of this assessment. The evaluation reflects the current state of accessible information about Swiss Option's services and should not be considered as investment advice or a recommendation to trade with this broker.

Rating Framework

Broker Overview

Swiss Option launched in 2013. The platform established itself as a binary options trading service that claims to serve both newcomers to trading and seasoned professionals.

The company presents itself as a leading platform in the binary options space, though specific details about its market position and competitive advantages remain limited in publicly available information. The broker operates under the corporate entity CAPITALSPOT TRADING LTD.

This company maintains its registration in Cyprus, a jurisdiction known for hosting numerous financial services companies. The platform's primary business model centers around binary options trading.

It offers traders the opportunity to speculate on price movements of various underlying assets through simplified yes-or-no propositions. Swiss Option emphasizes its appeal to traders seeking quick profits through short-term trading strategies.

The platform positions itself as a solution for those who prefer rapid market engagement over traditional long-term investment approaches. This swiss option review finds that while the company has been operating for over a decade, the lack of detailed operational information raises questions about its commitment to transparency and customer education.

Regulatory Status: Swiss Option operates under the oversight of the Financial Commission. Its parent company CAPITALSPOT TRADING LTD is registered in Cyprus.

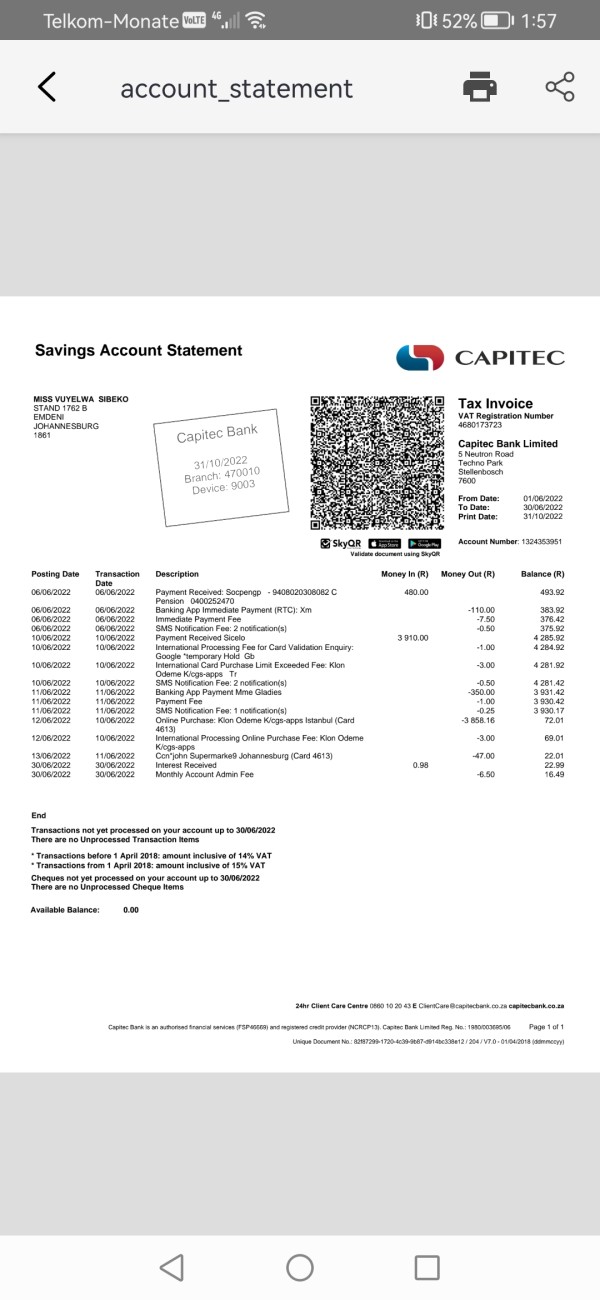

However, specific regulatory numbers and detailed compliance information are not readily available in public documentation. Deposit and Withdrawal Methods: Specific information regarding supported payment methods, processing times, and associated fees for deposits and withdrawals is not detailed in available source materials.

Minimum Deposit Requirements: The platform has not disclosed specific minimum deposit amounts or account funding requirements in accessible documentation. Bonus and Promotions: Details about welcome bonuses, promotional offers, or loyalty programs are not specified in available information sources.

Tradeable Assets: Swiss Option focuses primarily on binary options trading. The specific underlying assets, markets, and instruments available for trading are not comprehensively detailed.

Cost Structure: Information regarding spreads, commissions, overnight fees, and other trading costs is not provided in available materials. This makes it difficult to assess the platform's competitiveness.

Leverage Options: Leverage ratios and margin requirements are not specified in the source materials reviewed for this swiss option review. Platform Selection: Specific details about the trading platform technology, features, and capabilities are not available in current documentation.

Regional Restrictions: Geographic limitations and restricted territories are not clearly outlined in accessible information. Customer Service Languages: Available customer support languages and communication options are not specified in source materials.

Detailed Rating Analysis

Account Conditions Analysis

The assessment of Swiss Option's account conditions proves challenging due to the significant lack of publicly available information about fundamental trading parameters. Without specific details about account types, minimum deposit requirements, or account tier structures, potential traders cannot adequately evaluate whether the platform meets their financial capabilities or trading objectives.

The absence of information about account opening procedures, verification requirements, and funding options creates uncertainty about the user onboarding experience. Professional traders typically require detailed information about account specifications, including leverage options, margin requirements, and position sizing capabilities.

None of these details are clearly outlined in available materials. Furthermore, the lack of transparency regarding account maintenance fees, inactivity charges, or withdrawal conditions prevents traders from making informed decisions about the total cost of maintaining an account with Swiss Option.

This information gap significantly impacts the platform's credibility and makes it difficult to recommend the service to traders who prioritize transparency and clear terms of service. This swiss option review cannot provide a meaningful rating for account conditions due to insufficient available data.

The evaluation of Swiss Option's trading tools and educational resources reveals a concerning absence of detailed information about the platform's capabilities and trader support systems. Without specific data about chart analysis tools, technical indicators, or market research resources, it becomes impossible to assess whether the platform provides adequate support for informed trading decisions.

Educational resources play a crucial role in trader development, particularly for newcomers to binary options trading. However, no information is available about tutorials, webinars, market analysis, or educational materials that might help traders improve their skills and understanding of market dynamics.

This lack of educational support could be particularly problematic for novice traders who require guidance to navigate the complexities of binary options trading. Advanced trading tools such as automated trading systems, signal services, or risk management features are not described in available documentation.

Professional traders often rely on sophisticated analytical tools and automation capabilities to execute their strategies effectively. The absence of information about such features suggests either a basic platform offering or poor communication of available capabilities.

The platform's research and analysis capabilities remain unclear, with no mention of market news, economic calendars, or fundamental analysis resources that traders typically expect from a comprehensive trading platform.

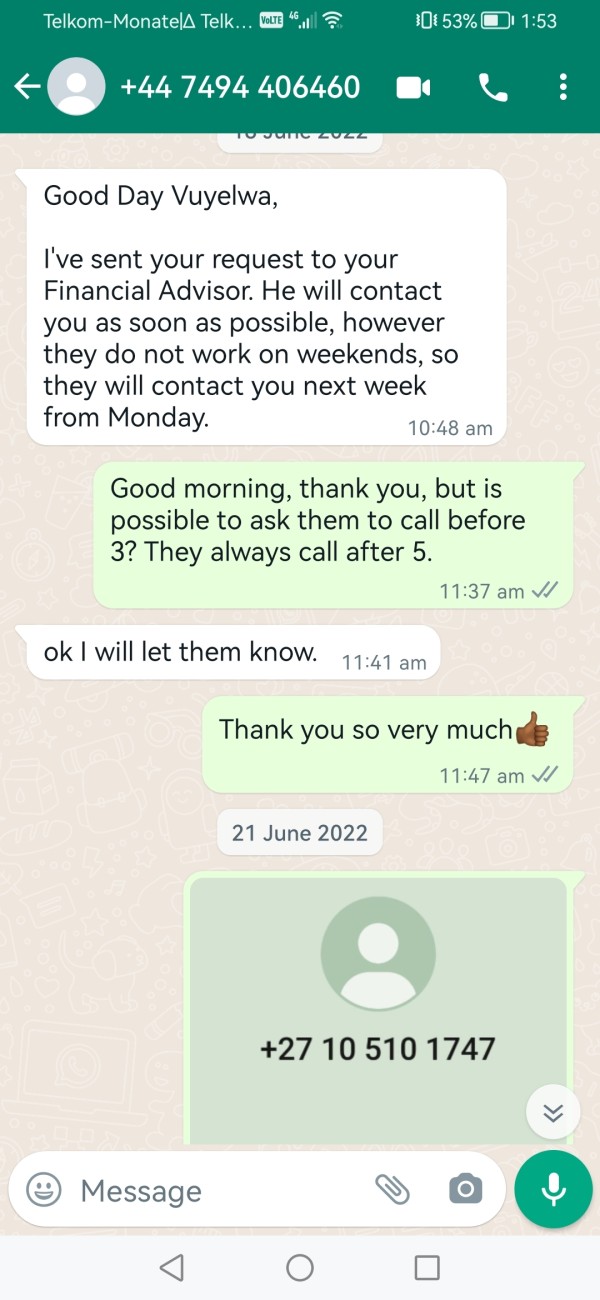

Customer Service and Support Analysis

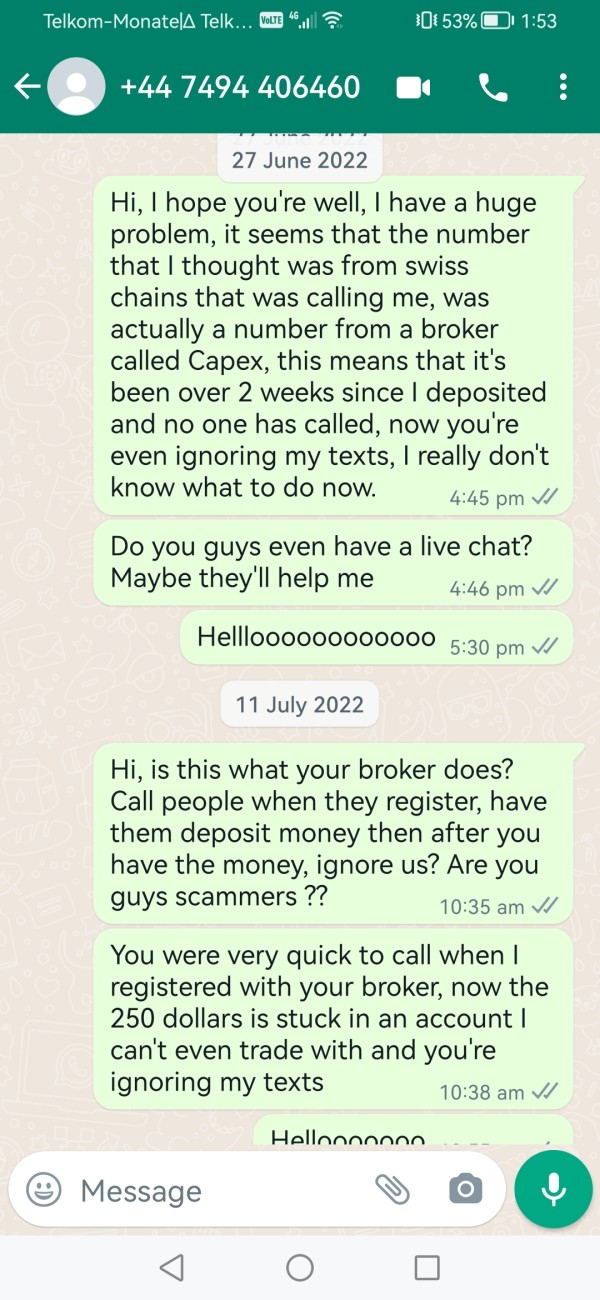

Customer service quality represents a critical factor in trader satisfaction and platform reliability. Yet Swiss Option provides no publicly available information about its support infrastructure.

The absence of details regarding customer service channels, operating hours, and response times creates significant uncertainty about the level of support traders can expect when issues arise. Professional traders require reliable access to technical support, particularly during active trading hours when platform issues could result in financial losses.

Without information about phone support, live chat availability, email response times, or help desk capabilities, potential users cannot assess whether the platform provides adequate support for their trading activities. Multi-language support often indicates a broker's commitment to serving international clients.

However, Swiss Option has not disclosed information about the languages supported by its customer service team. This lack of transparency could be particularly concerning for non-English speaking traders who require support in their native language.

The absence of information about account management services, educational support, or technical assistance suggests either limited customer service capabilities or poor communication of available services. Quality customer support typically includes not only reactive problem-solving but also proactive trader education and account optimization assistance.

Trading Experience Analysis

Assessing the trading experience on Swiss Option proves extremely difficult due to the complete absence of information about platform functionality, execution quality, and user interface design. The trading platform represents the core of any broker's service offering.

Yet no details are available about the technology infrastructure, platform stability, or trading execution capabilities. Order execution speed and accuracy are paramount in binary options trading, where precise timing can significantly impact profitability.

However, no information is available about execution speeds, slippage rates, or platform reliability during high-volume trading periods. This lack of transparency makes it impossible to evaluate whether the platform can meet the demands of active traders.

Mobile trading capabilities have become essential for modern traders who require access to markets while away from their primary trading setups. Swiss Option has not provided information about mobile applications, responsive web platforms, or mobile-specific features that would enable effective trading on smartphones or tablets.

Platform customization options, chart analysis capabilities, and user interface design significantly impact the overall trading experience. Without details about these fundamental platform features, this swiss option review cannot adequately assess the quality of the trading environment that Swiss Option provides to its users.

Trust and Safety Analysis

Swiss Option's trust and safety profile presents a mixed picture, with some regulatory oversight but significant transparency concerns. The platform operates under the Financial Commission's supervision, which provides a basic level of regulatory framework.

However, this organization is not considered equivalent to major financial regulators like the FCA, CySEC, or ASIC. The parent company CAPITALSPOT TRADING LTD is registered in Cyprus, which offers some corporate structure legitimacy.

However, the absence of specific regulatory license numbers, detailed compliance information, or clear regulatory disclosures raises questions about the depth of regulatory oversight and the platform's commitment to meeting international financial service standards. Fund security measures, including client money segregation, deposit insurance, and withdrawal protection policies, are not detailed in available information.

These protections are crucial for trader confidence and are typically highlighted by reputable brokers as key safety features. The lack of such information suggests either inadequate protections or poor communication of existing safeguards.

Company transparency regarding ownership structure, financial statements, and operational procedures remains limited. Reputable financial service providers typically maintain high levels of disclosure about their operations, regulatory status, and corporate governance.

Swiss Option's limited transparency in these areas contributes to concerns about its overall trustworthiness and regulatory compliance.

User Experience Analysis

The user experience evaluation for Swiss Option is severely hampered by the complete absence of user feedback, reviews, and satisfaction data in available source materials. Without access to actual user experiences, it becomes impossible to assess real-world platform performance, customer satisfaction levels, or common user concerns.

Interface design and platform usability significantly impact trader effectiveness and satisfaction. Yet no information is available about the platform's user interface, navigation structure, or ease of use.

Modern traders expect intuitive, responsive platforms that facilitate quick decision-making and efficient trade execution. The registration and account verification process represents the first interaction between traders and the platform, setting expectations for the overall service quality.

However, no details are available about account opening procedures, document requirements, verification timeframes, or user onboarding support. Deposit and withdrawal experiences often determine long-term user satisfaction with a trading platform.

Without information about funding processes, withdrawal procedures, processing times, or associated costs, potential users cannot evaluate whether the platform provides convenient and reliable financial transaction services.

Conclusion

This comprehensive swiss option review reveals a platform that presents significant transparency challenges despite its claims of serving traders since 2013. While Swiss Option offers potentially attractive features such as high profit margins up to 80% and ultra-short trading timeframes, the substantial lack of detailed information about core operational aspects severely undermines its credibility and appeal to serious traders.

The platform may suit traders specifically seeking binary options exposure with quick turnaround times. However, the absence of crucial details about trading conditions, regulatory compliance, customer support, and platform capabilities makes it difficult to recommend Swiss Option to any category of trader.

The primary advantages appear to be the high profit potential and rapid trading options, while the significant disadvantages include poor transparency, limited regulatory information, and absence of detailed operational disclosures. Potential users should exercise extreme caution and conduct thorough independent research before considering Swiss Option for their trading activities.

This is particularly important given the regulatory complexities surrounding binary options trading in many jurisdictions.