Regarding the legitimacy of SunLong forex brokers, it provides HKGX and WikiBit, .

Is SunLong safe?

Pros

Cons

Is SunLong markets regulated?

The regulatory license is the strongest proof.

HKGX Precious Metals Trading (AGN)

Hong Kong Gold Exchange

Hong Kong Gold Exchange

Current Status:

RegulatedLicense Type:

Precious Metals Trading (AGN)

Licensed Entity:

旭隆金業(香港)有限公司

Effective Date:

--Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

https://www.slgold88.comExpiration Time:

--Address of Licensed Institution:

九龍海濱道133號萬兆豐中心17樓A室Phone Number of Licensed Institution:

39779288Licensed Institution Certified Documents:

Is Sunlong Safe or Scam?

Introduction

Sunlong is a forex broker that has positioned itself primarily in the precious metals trading market since its inception in 2018. Registered in Hong Kong, it claims to offer a platform for trading various financial instruments, albeit with a strong focus on precious metals. As the forex market continues to attract both novice and seasoned traders, it is crucial for prospective clients to thoroughly evaluate the legitimacy and safety of brokers like Sunlong. This evaluation is necessary to avoid potential scams and ensure the protection of their investments. This article employs a comprehensive investigation methodology, utilizing data from various regulatory sources, user reviews, and industry analysis to assess whether Sunlong is safe or potentially a scam.

Regulation and Legitimacy

Regulation plays a vital role in determining the safety and reliability of a forex broker. Sunlong is regulated by the Chinese Gold & Silver Exchange Society (CGSE) under a Type AA license. This regulatory status indicates that Sunlong is subject to certain oversight, although it is essential to note that the CGSE is not as stringent as some of the top-tier regulators found in other jurisdictions.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Chinese Gold & Silver Exchange Society | 157 | Hong Kong | Regulated |

While Sunlong's regulatory status provides a layer of legitimacy, it is important to scrutinize the quality of oversight. The CGSE is primarily focused on the gold and silver trading market, which may not offer the same level of protection as regulators like the FCA or ASIC. Additionally, reports indicate a high potential risk associated with Sunlong's business practices, suggesting that traders should approach with caution. Historical compliance issues have also been noted, with several complaints lodged against the broker regarding its operational practices. Thus, while Sunlong is regulated, the level of protection it offers may not be sufficient to ensure a completely safe trading environment.

Company Background Investigation

Sunlong, officially known as 旭隆金业(香港)有限公司, has been operational for approximately five to ten years. The company focuses primarily on precious metals trading, and its headquarters are located in Kwun Tong, Hong Kong. The management team comprises individuals with varying degrees of experience in the financial sector, although detailed information about their professional backgrounds is limited.

The company has made efforts to be transparent, providing contact details and operational information on its website. However, the lack of comprehensive disclosures regarding its ownership structure and the qualifications of its management team raises concerns about accountability. Transparency is crucial in the forex industry, as it allows traders to understand the entities they are dealing with. Given the limited information available, potential clients may find it challenging to assess the reliability of the management team, which could further complicate the question of whether Sunlong is safe.

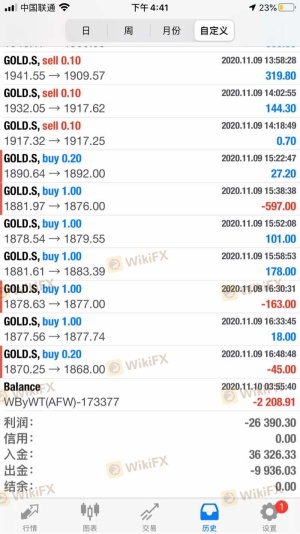

Trading Conditions Analysis

Sunlong's trading conditions are an important consideration when evaluating its safety. The broker offers a minimum deposit requirement of $100 and supports the MetaTrader 4 (MT4) trading platform, which is popular among traders for its user-friendly interface and analytical tools. However, Sunlong has been criticized for its limited range of tradable instruments, focusing mainly on precious metals and lacking offerings in forex, commodities, and other asset classes.

The fee structure at Sunlong is another area of scrutiny. While the broker claims to waive transaction execution fees, it imposes a storage fee of HK$40 per ounce per month. This fee could accumulate quickly for traders holding significant positions, which may not be clearly communicated upfront.

| Fee Type | Sunlong | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | Varies |

| Commission Model | None | Varies |

| Overnight Interest Range | N/A | Varies |

The absence of clear information regarding spreads and commissions raises concerns about transparency. Traders should be wary of any hidden fees that could impact their profitability. Overall, while Sunlong offers a low entry barrier for new traders, the potential for unexpected costs and limited trading options may suggest that it is not the most favorable choice, leading to questions about whether Sunlong is safe.

Client Funds Safety

The safety of client funds is a paramount concern when evaluating any forex broker. Sunlong claims to implement several measures to protect client funds, including the segregation of client accounts. This practice is crucial as it ensures that client funds are kept separate from the broker's operational funds, reducing the risk of loss in case of insolvency.

However, the broker's lack of comprehensive investor protection measures raises red flags. Unlike brokers regulated by top-tier authorities, Sunlong does not appear to offer negative balance protection or a compensation scheme for clients. This lack of safeguards could leave traders vulnerable in the event of significant market volatility or operational issues within the brokerage.

Moreover, there have been reports of past issues concerning fund withdrawals, with clients alleging that their withdrawal requests were either ignored or delayed. Such incidents can severely undermine trust and raise concerns about the overall safety of trading with Sunlong. As a result, prospective clients should carefully consider these factors when evaluating whether Sunlong is safe for their trading activities.

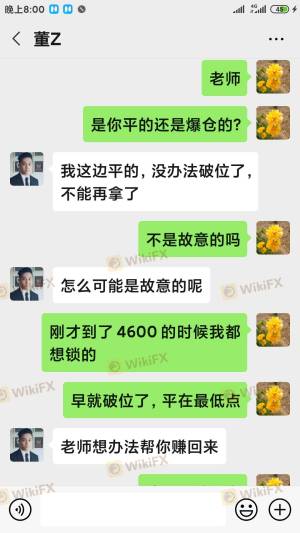

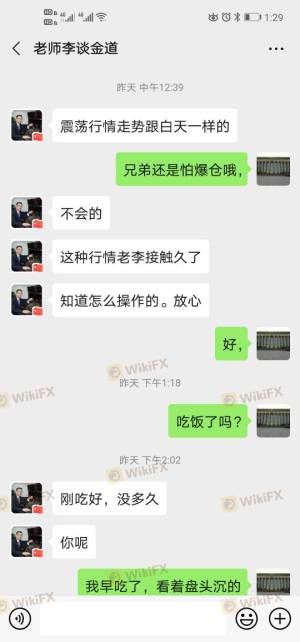

Client Experience and Complaints

Client feedback is a critical component in assessing the reliability of any broker. Reviews of Sunlong indicate a mixed experience among users. While some clients report satisfactory trading conditions, others have raised significant complaints regarding the broker's practices.

Common complaints include issues with fund withdrawals, alleged slippage during trades, and a lack of responsive customer support. The following table summarizes the primary complaint types and their severity:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Largely unresponsive |

| Slippage | Medium | Minimal acknowledgment |

| Customer Support | High | Slow response times |

For instance, one user reported being unable to withdraw funds after multiple attempts, leading to frustration and distrust. Another client mentioned experiencing significant slippage, where their stop-loss orders were executed at unfavorable prices, resulting in unexpected losses. Such patterns of complaints may indicate underlying operational issues, suggesting that traders should exercise caution when dealing with Sunlong.

Platform and Trade Execution

The performance of the trading platform and the quality of trade execution are vital for a positive trading experience. Sunlong utilizes the MT4 platform, which is known for its reliability and user-friendly features. However, user reviews suggest that there may be issues with order execution quality, including instances of slippage and rejected orders.

Clients have reported experiencing delays in trade execution, which can be particularly detrimental in the fast-paced forex market. These issues could indicate potential manipulation or inadequate infrastructure, leading to further concerns about whether Sunlong is safe for trading. Traders should be aware of these potential pitfalls and consider them when deciding whether to open an account with this broker.

Risk Assessment

When evaluating the overall risk of trading with Sunlong, several factors must be considered. The following risk assessment table summarizes the key risk areas associated with this broker:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | Medium | Limited oversight by CGSE |

| Fund Security | High | Lack of investor protection measures |

| Trading Conditions | Medium | Potential for hidden fees and slippage |

| Customer Service | High | Poor responsiveness to complaints |

Given the identified risks, traders should approach Sunlong with caution. It is advisable to conduct thorough research and consider alternative brokers that offer more robust regulatory protection and better client support. Additionally, traders should implement risk management strategies to protect their investments, such as setting stop-loss orders and diversifying their portfolios.

Conclusion and Recommendations

In conclusion, while Sunlong is a regulated broker, several factors raise concerns about its safety and reliability. Issues related to fund security, customer complaints, and potential hidden fees suggest that traders should exercise caution when considering this broker. The mixed feedback from clients and the lack of comprehensive investor protection measures further complicate the assessment of whether Sunlong is safe.

For traders looking for a more secure trading environment, it is advisable to explore alternatives that are regulated by top-tier authorities and have a proven track record of positive client experiences. Brokers such as OANDA, IG, or Forex.com may offer better regulatory oversight and enhanced client protections. Ultimately, due diligence is essential for any trader, and understanding the risks associated with a broker like Sunlong is crucial for safeguarding investments.

Is SunLong a scam, or is it legit?

The latest exposure and evaluation content of SunLong brokers.

SunLong Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

SunLong latest industry rating score is 6.25, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 6.25 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.