SunLong Review 10

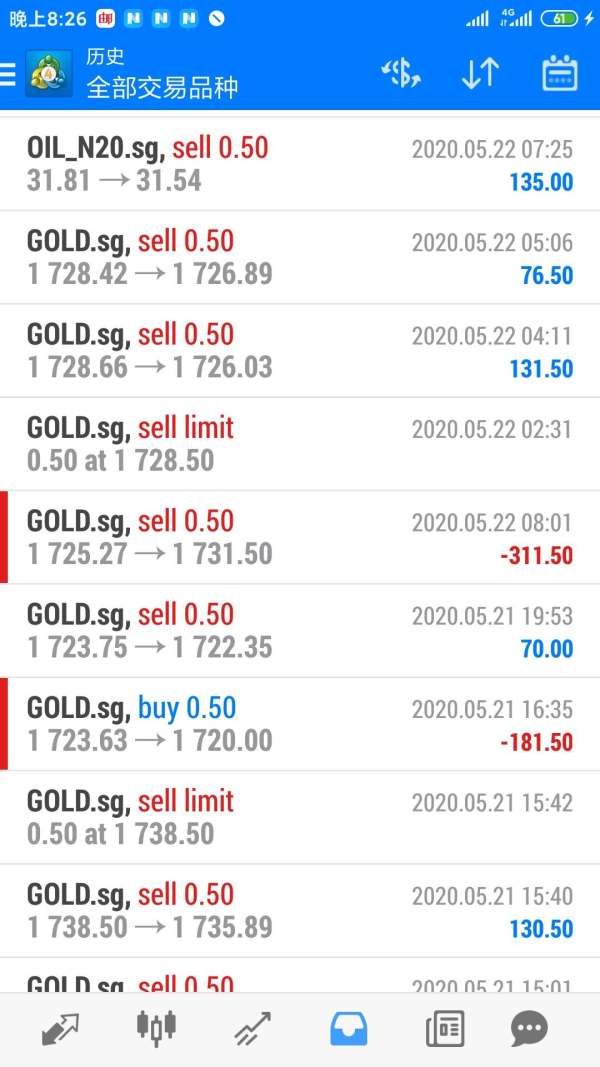

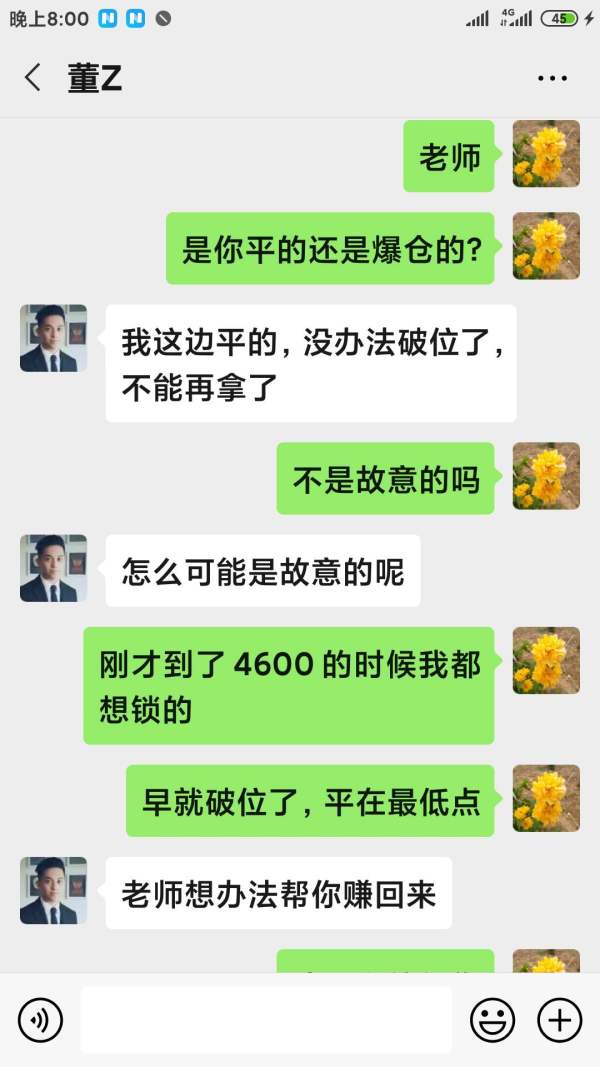

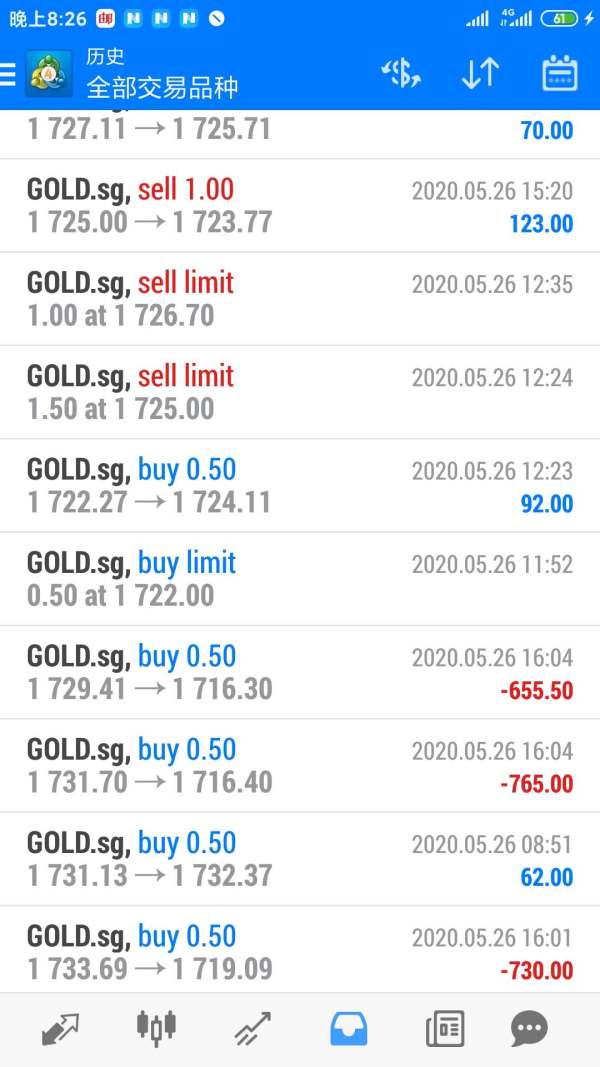

Analyst is the agent of the platform. They cheat customers together and embezzle customers' losses. I trusted the analyst so I gave him my account while my account was wiped out. Then I locked my positions and there was equity in my account while the platform closed my positions

The fraud Dong, who made my position liquidated within days, is so heinous.

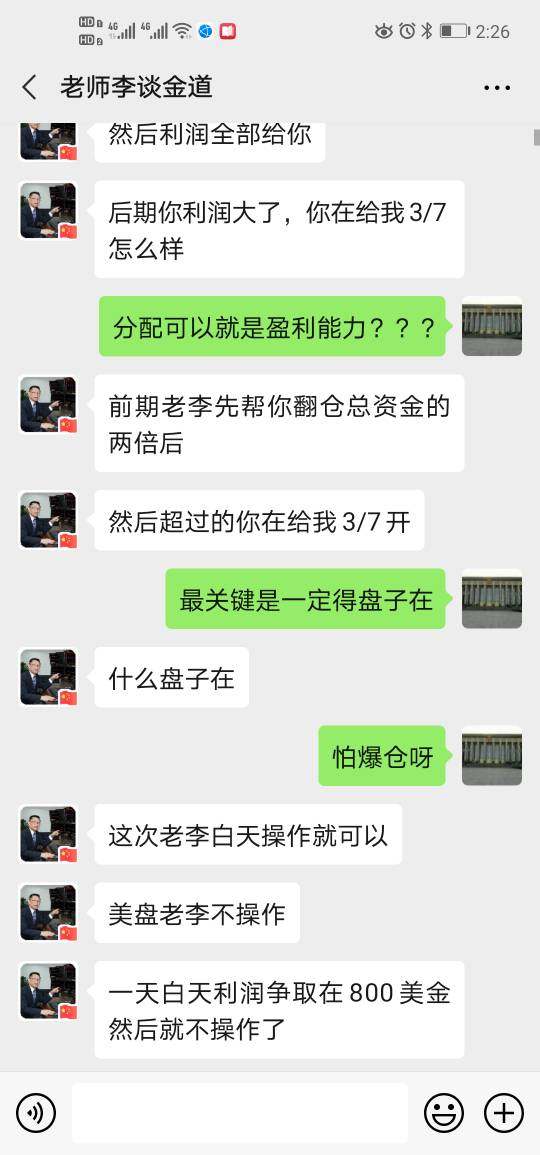

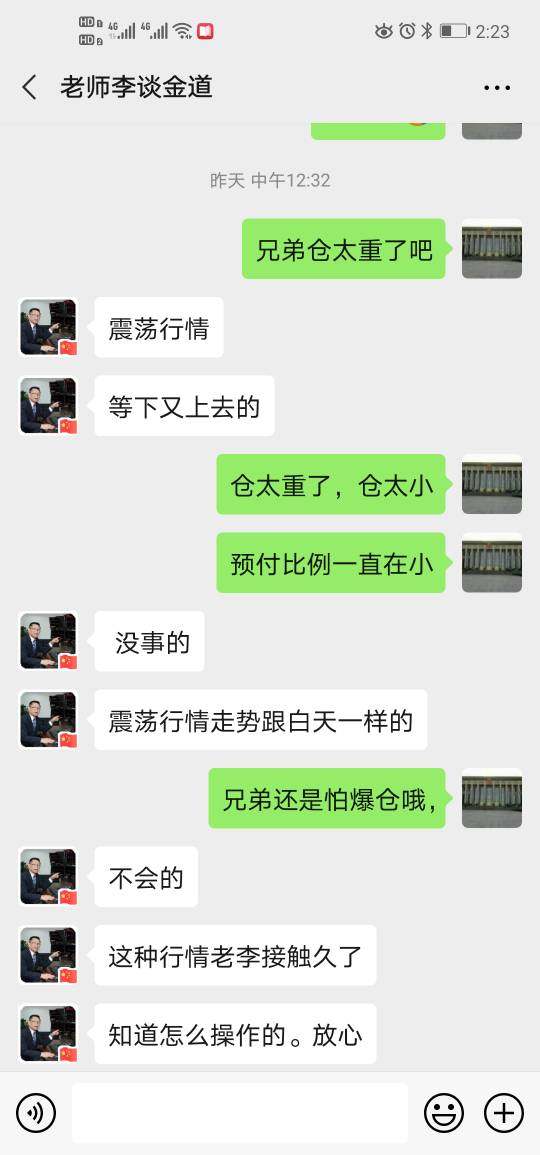

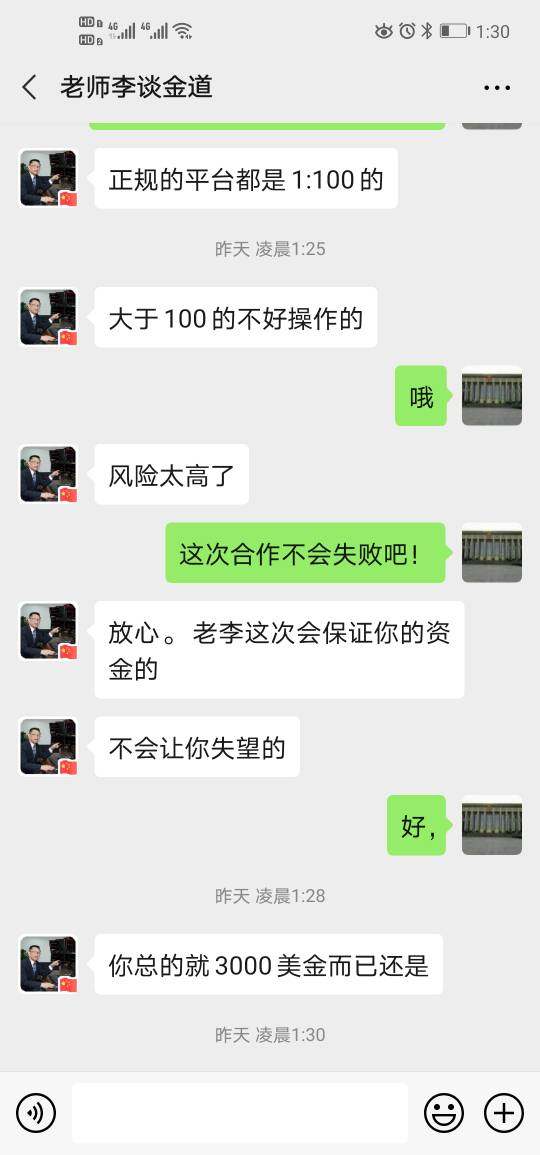

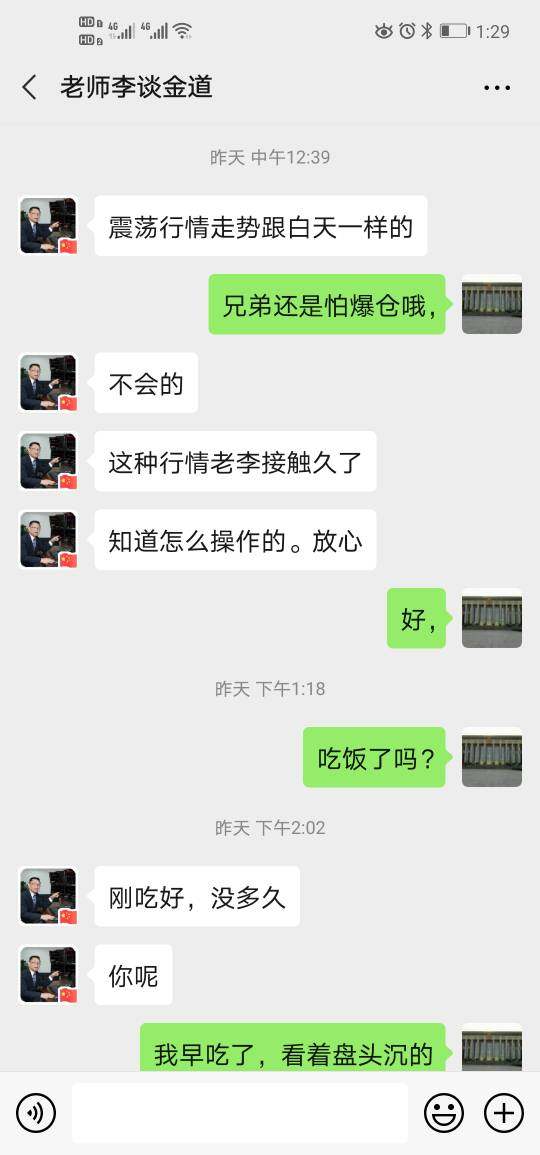

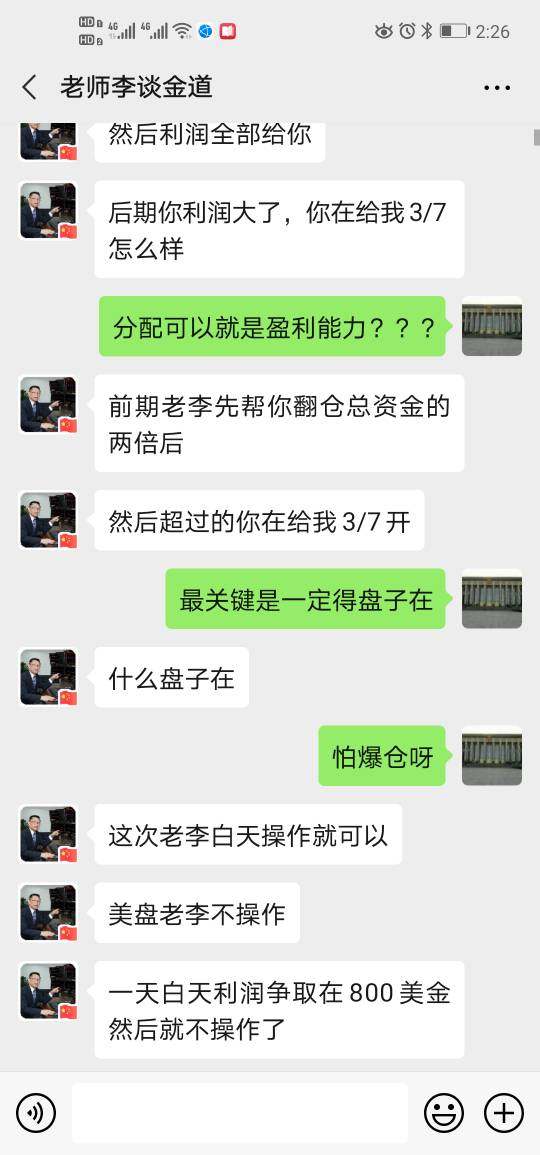

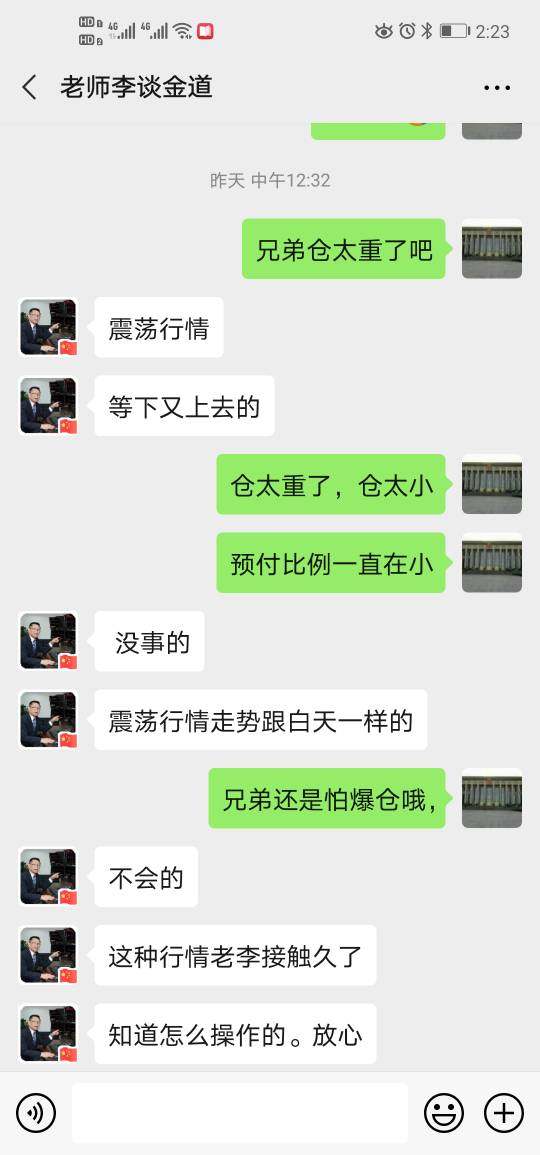

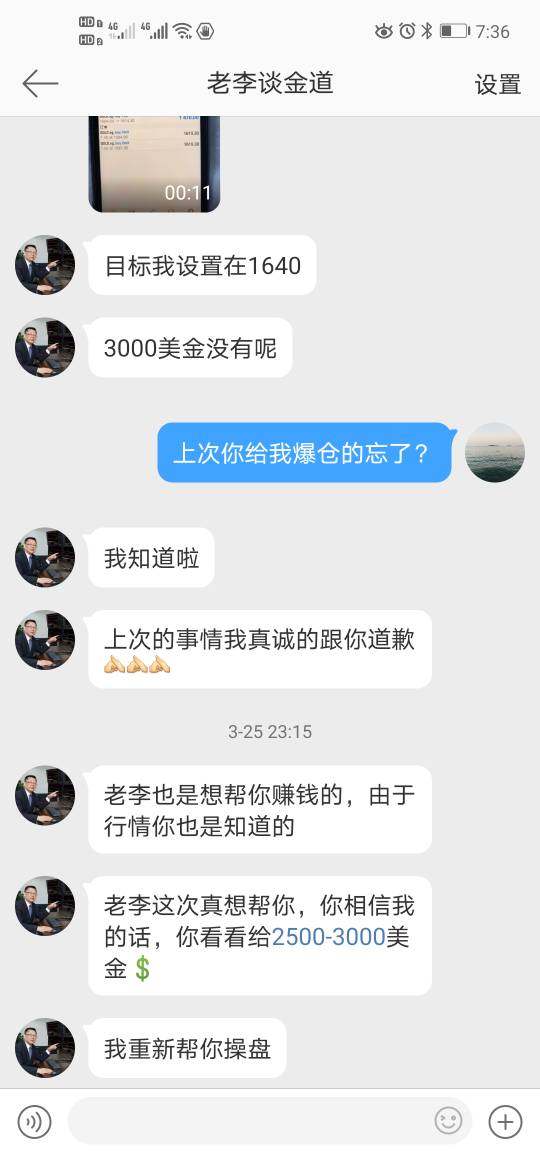

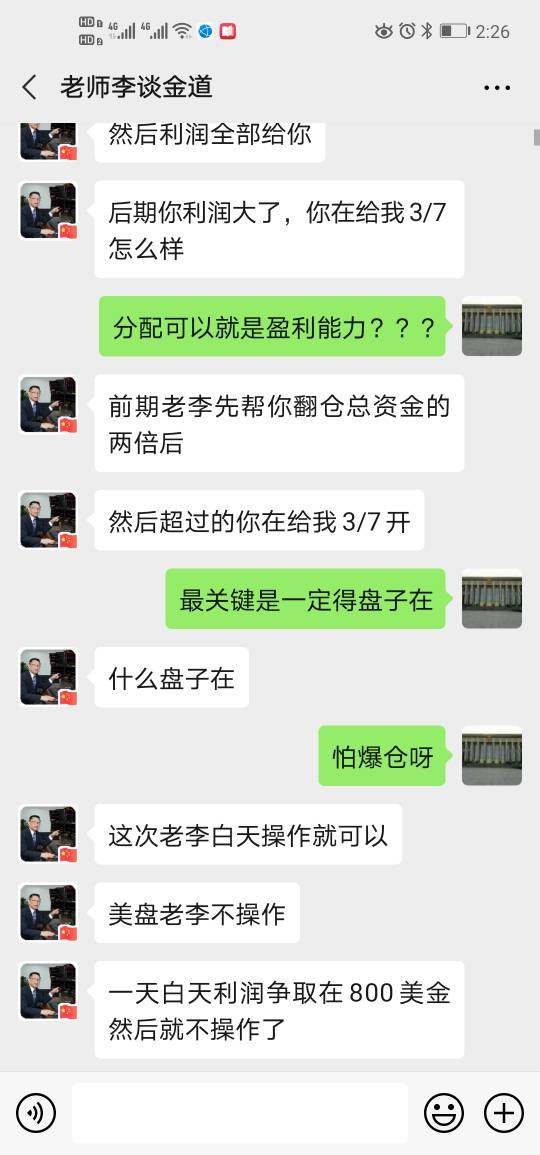

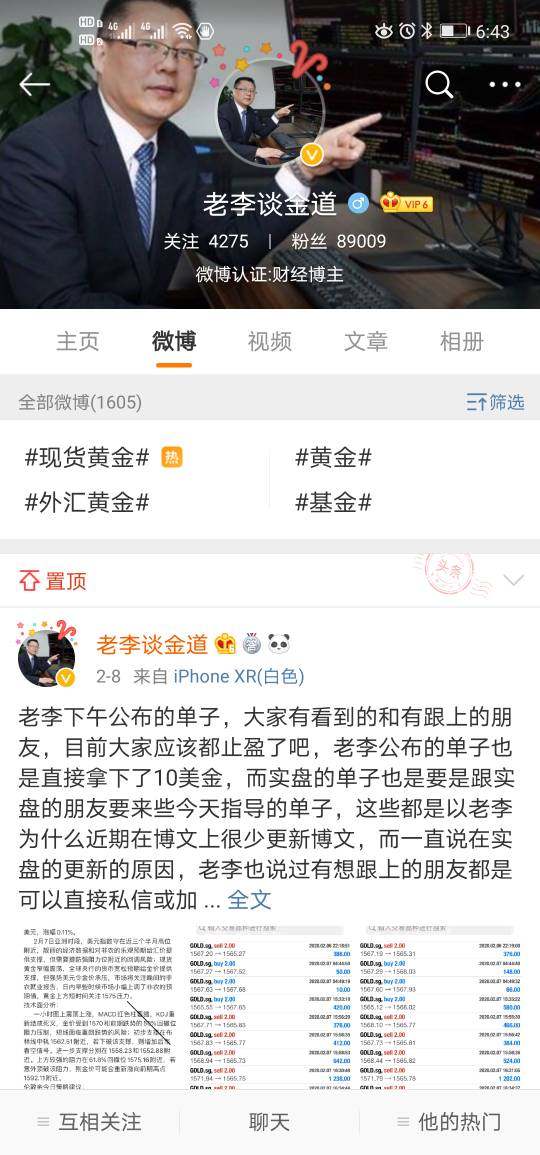

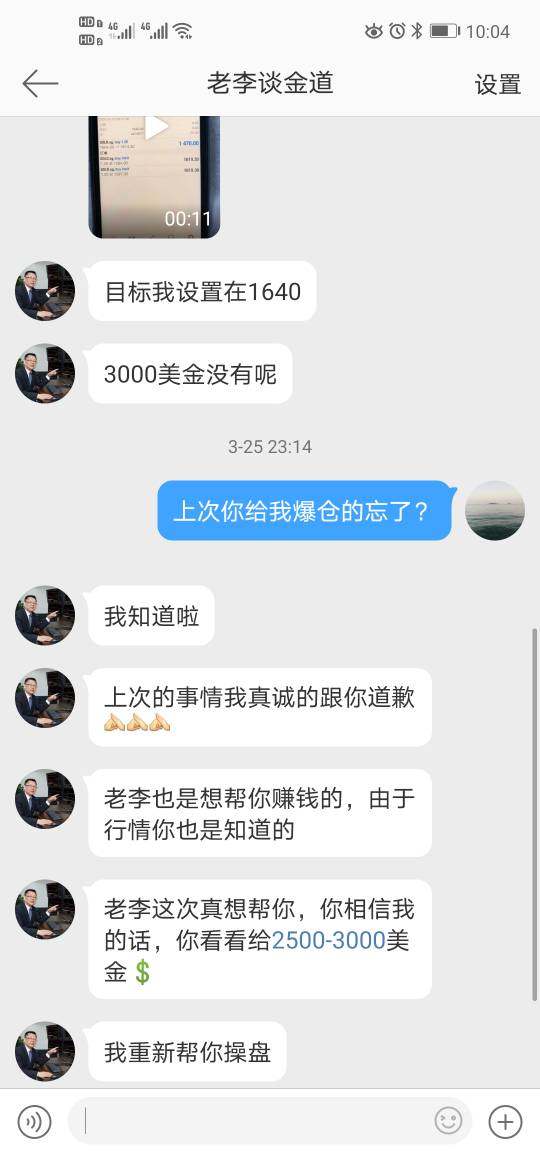

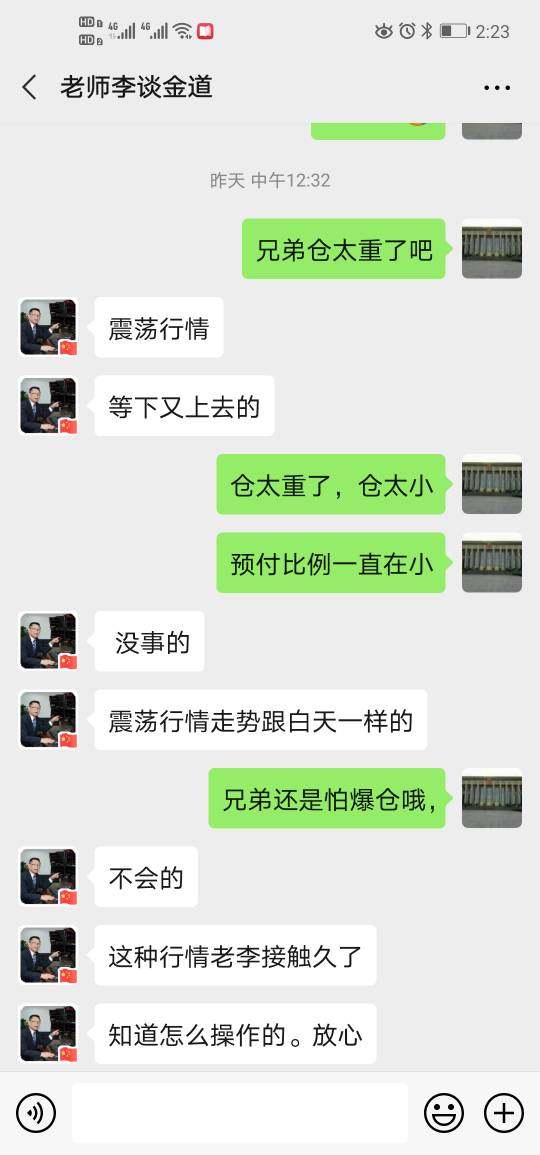

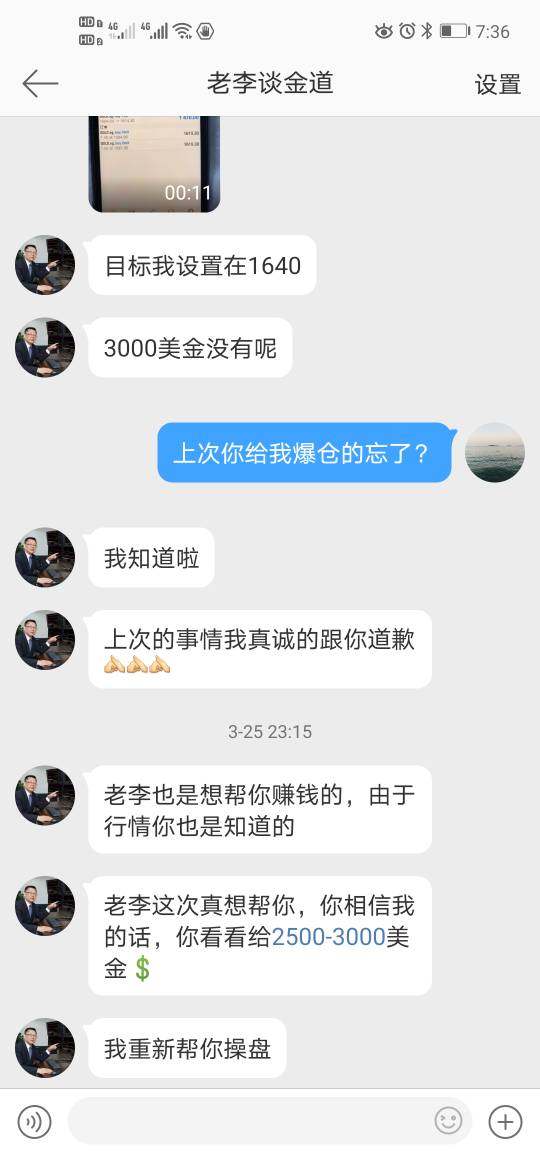

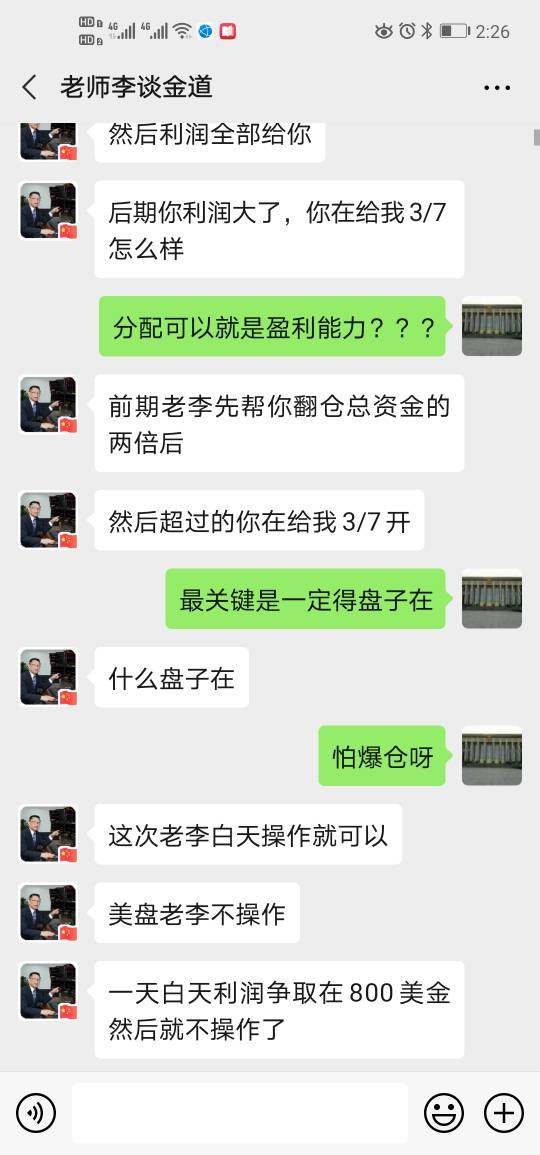

The person I knew on WeiBo, named Li Lunjindao, inveigled clients to open account and caused their accounts liquidated within 2 days by giving adverse recommendation.

Li, together with SunLong ,nveigled clients to deposit fund and make clients’ accounts liquidated within the day.

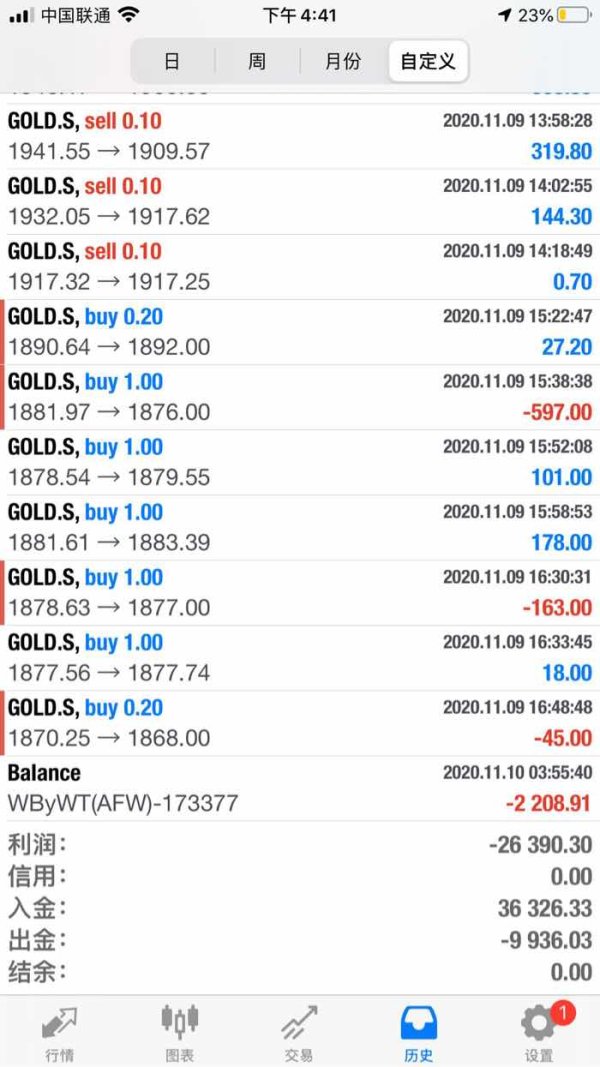

On November 5, someone added Mr.Yu through Wechat. At first he thought it was one of his friends and passed the request. He learned through chat that this netizen is doing financial investment. Recently, she invested in SunLong and earned more than 300,000 RMB a month. She said it is a good way to make money and wanted to invite Yu to participate.At first Yu didn't believe it and paid no attention to her. Later in a long time, this netizen kept sending posts of traveling, food, etc., in Wechat moments. She told Yu that the reason for her traveling everywhere is the money she earned through investment, Occasionally, she would also send he some screenshots of making money. She has a tongue in her head. They became friends unconsciously then. Later, she invited Yu to join in the investment of Xintouzaixian. He agreed and invested at the very day. She then invited he to a group, where there is an investment advisor who teaches everyone how to operate. Many people in the group said they are making money.This netizen helped Yu to follow the instructions of the advisor. As a result, he earned a few at first. The advisor said that everyone’s funds for the operation are not up to the requirements. He wanted to help everyone earn 400,000 RMB a month, which requires at least 300,000 RMB deposit for each person. And it is expected to double in one month. Many people in the group believe in the advisor and added the fund.Seeing so many members joining, Yu also followed.Unexpectedly,there was a forced liquidation because of teacher’s order recommendation.Yu has made all losses within these days.The the netizen comforted him,saying that the gains and losses were common in the market.Yu was moved and added fund to recover losses.He lost all his hard-earned money of several hundred thousand yuan again,which made him despaired. Exposure platform: SunLong Teacher: Ya Nan, Wang Xu, Hong Yi and Jin Long Assistant: Qiao Er Product:HK Share, London XAU/USD and XAG/USD Method: Through group, live-broadcasting room and one-to-one instruction

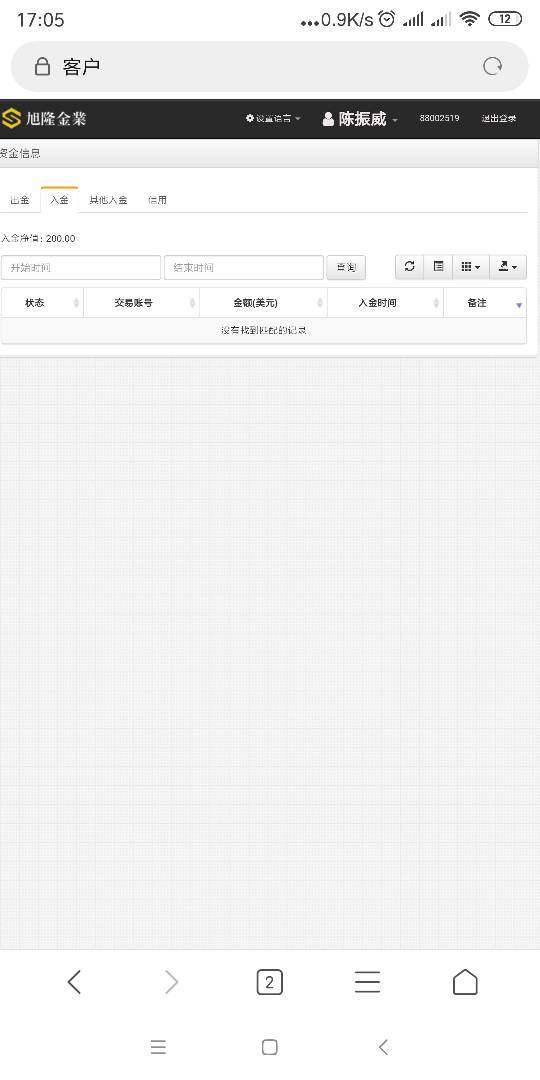

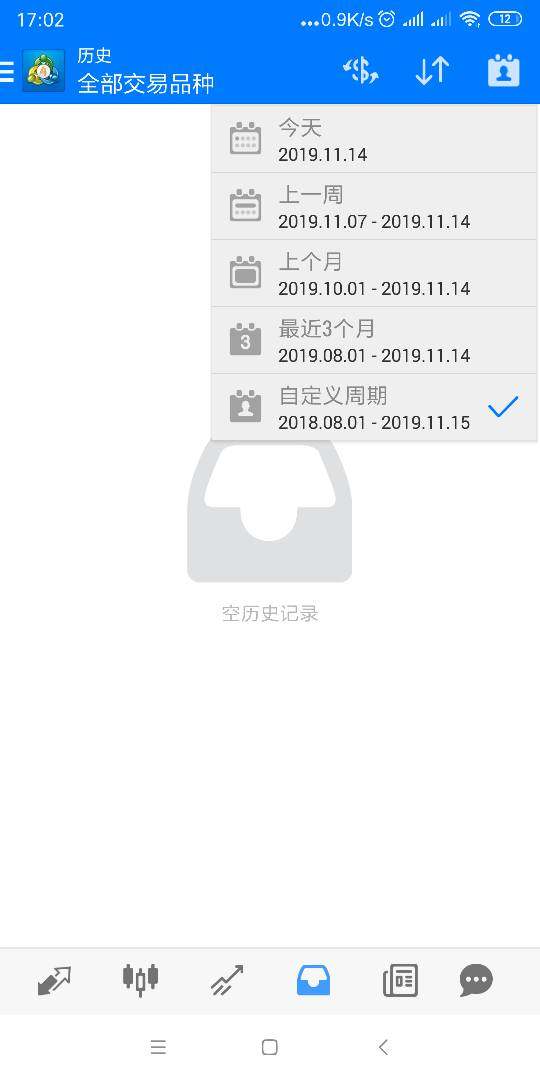

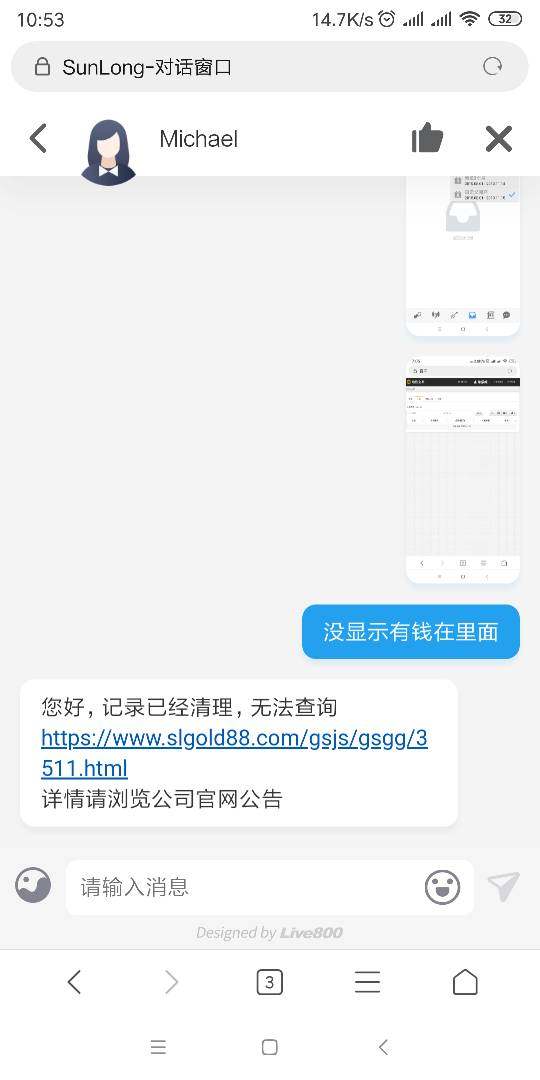

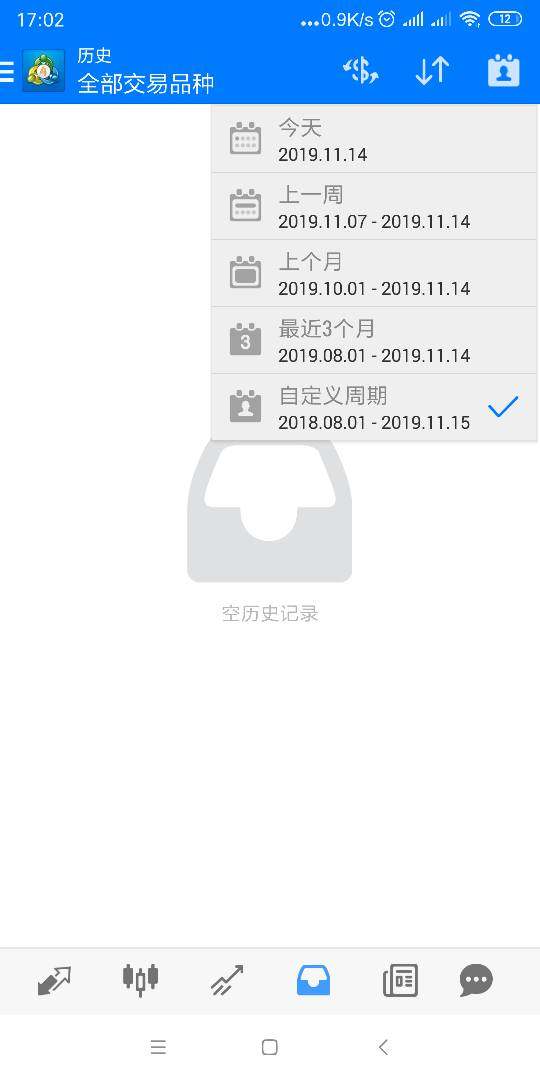

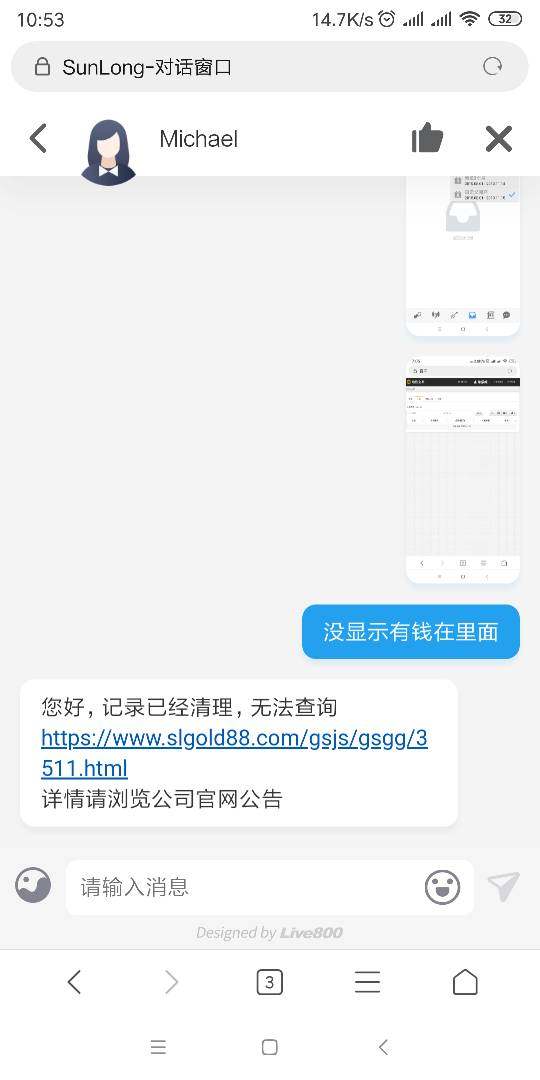

The funding hasn’t been processed into the account.The customer service deleted the record.

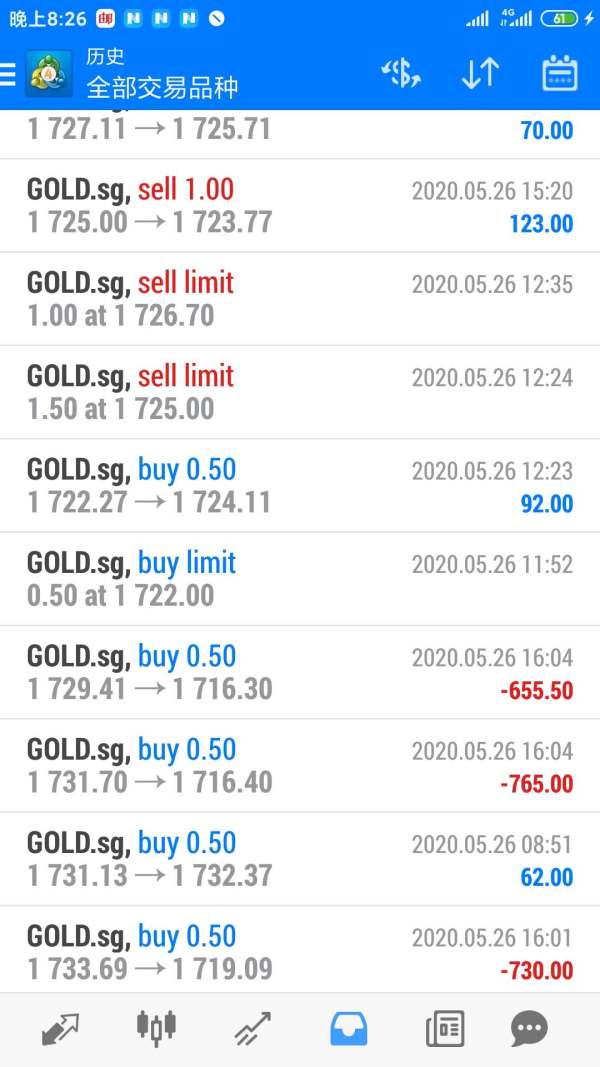

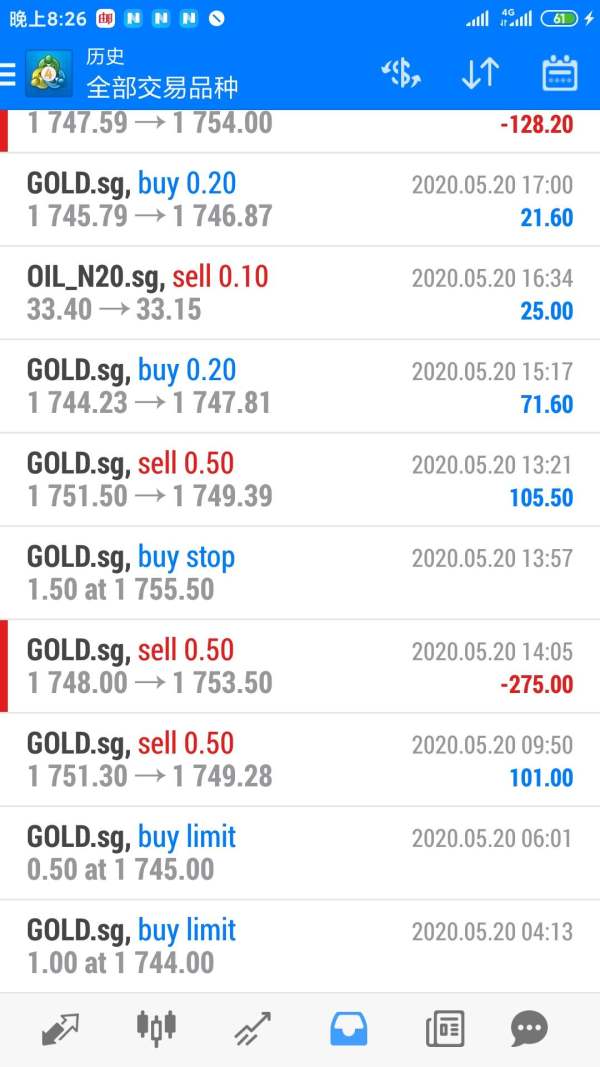

Severe slippage, the short order was set to stop loss at 1239.6, but it turned out to be stopped loss at 1241.6. When I turn to the customer service personnel, they simply ignore me

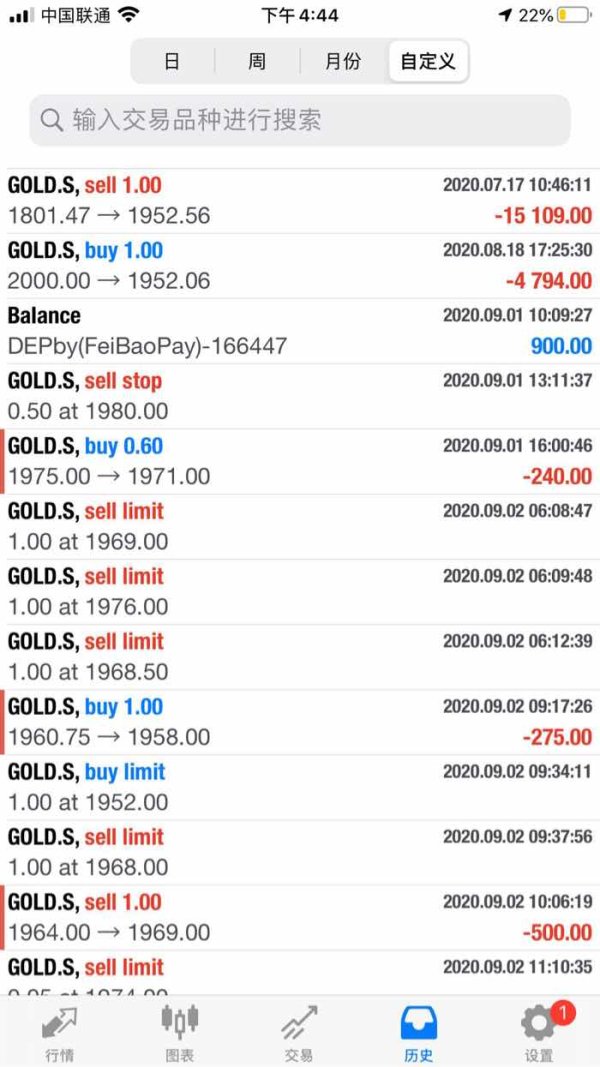

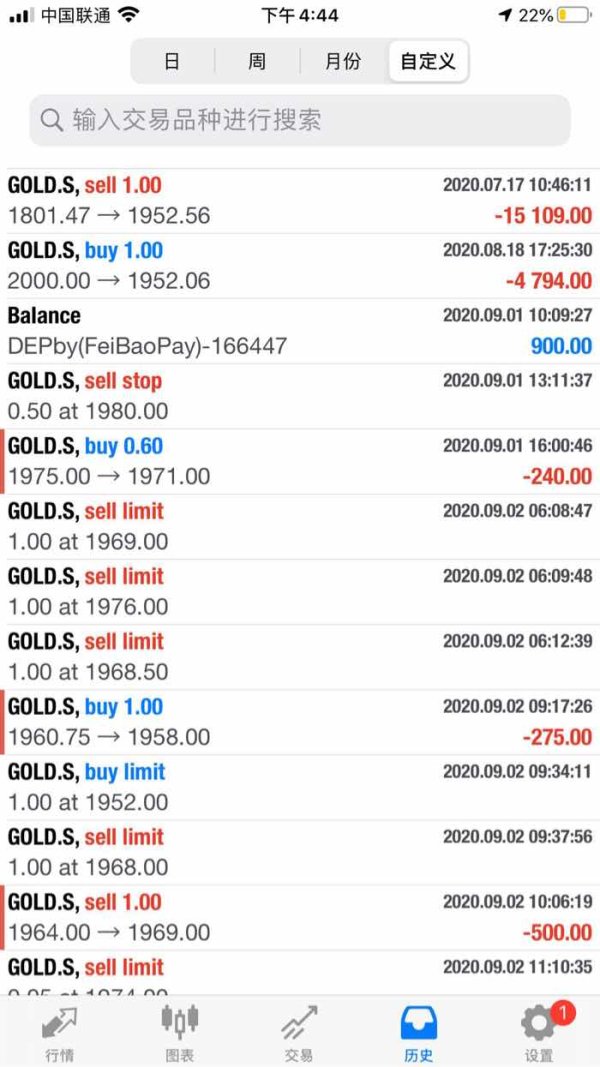

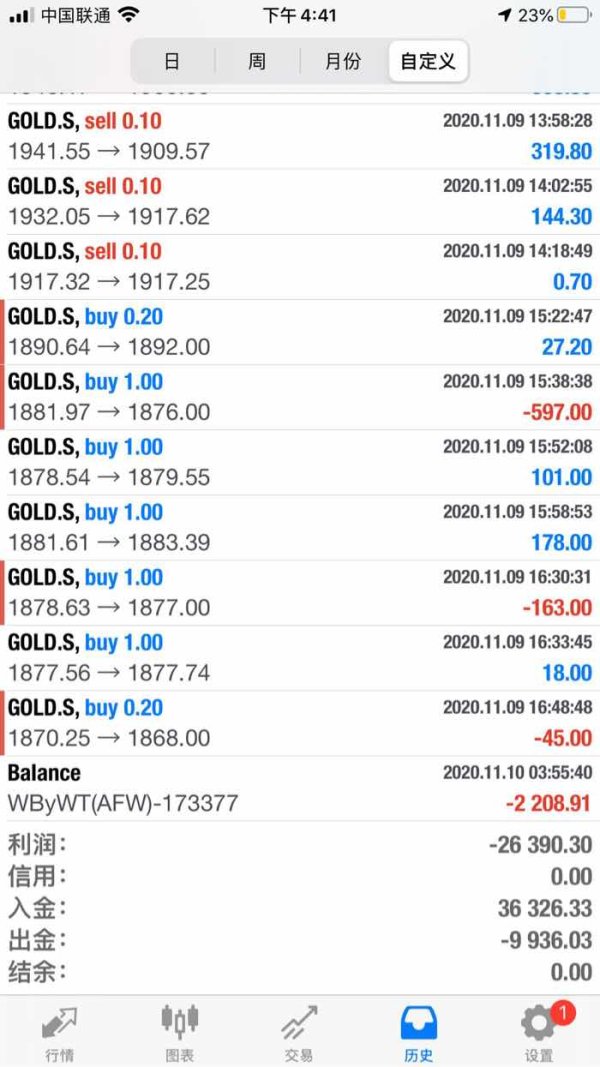

teacher induction operation, serious loss received an email on QQ mail on July 18 years , open on see is gold exchange file, see a lot of gold inside profit figure, out of curiosity added QQ2477974069 inside (net: gold capital), after contact, the capital said his side guide operating gold income is good, and let me contact assistant to add his QQ number (1695345392) to open into the gold and keep up with his actions,Sunlong (https://client.slgold88.com/register?R =2067) this platform operated spot gold, and asked me to add any operational problems of teacher WeChat qmhc888666 to directly send me the entry point of gold in the evening. At the beginning, there was a small profit, but after that day, all the losses in the following days, later I deleted all the contact information of gold capital.To open an account of the time I can't work also are all remote assistant help me with including input password, later to make up for my loss, can be returned to the operating spread to me, I'm xu long open the account in the platform, operation process, xu long this platform has serious slippage phenomenon appears, and platform and gold assistant many times feedback, after platform give me feedback is Sunlong without slippage phenomenon occurred, then let me register account return commission to me, afterwards, I continuously in the process of operating losses, and all losses within one month after the 1.43 million yuan.After that, I found the supervision of trading license on the WIKIFX, but I complained to the platform without any reply from anyone.