Is Sentinel Market safe?

Business

License

Is Sentinel Market Safe or a Scam?

Introduction

Sentinel Market positions itself as a financial services provider specializing in forex trading and derivatives. As a broker operating in the highly volatile foreign exchange market, it is crucial for traders to exercise caution and thoroughly evaluate the legitimacy and reliability of brokers before committing their funds. The forex market is rife with scams and unregulated entities that can lead to significant financial loss. This article aims to provide a comprehensive analysis of Sentinel Market, examining its regulatory status, company background, trading conditions, customer experience, and overall safety. The investigation is based on data gathered from various online sources, including user reviews, regulatory bodies, and financial analysis platforms.

Regulation and Legitimacy

Regulation is a key indicator of a broker's legitimacy and trustworthiness. A well-regulated broker is typically subject to stringent oversight, ensuring that it adheres to financial laws and protects client funds. Sentinel Market claims to be regulated by the Financial Conduct Authority (FCA) in the UK; however, this claim has been proven false, with the FCA blacklisting the broker as a clone firm. The following table summarizes the core regulatory information for Sentinel Market:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FCA | N/A | UK | Blacklisted |

The lack of valid regulatory oversight raises significant concerns regarding the safety of funds deposited with Sentinel Market. The broker has also been linked to various complaints alleging fraudulent activities, including the inability to withdraw funds and misrepresentation of investment returns. Given these factors, it is imperative for potential clients to exercise extreme caution when considering whether Sentinel Market is safe for trading.

Company Background Investigation

Sentinel Market has a relatively obscure history, with limited information available about its origins and ownership structure. The broker claims to have been operational for several years; however, the legitimacy of its claims is questionable given the lack of regulatory backing. The management team behind Sentinel Market remains largely anonymous, which is a red flag in the financial services industry. A transparent brokerage should offer information about its founders, management, and operational history.

The company's website lacks essential information regarding its operational framework and does not provide binding legal documents that outline the broker's obligations to its clients. Transparency is crucial in establishing trust, and the absence of clear information raises doubts about the broker's intentions and reliability. Given these considerations, it is prudent for traders to question whether Sentinel Market is safe for their investments.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is essential for evaluating its overall value proposition. Sentinel Market has been noted for its high minimum deposit requirements, with the basic account demanding an initial investment of $15,000. This figure is significantly higher than the industry average, which typically ranges from $100 to $250. The following table summarizes the core trading costs associated with Sentinel Market:

| Cost Type | Sentinel Market | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | N/A | 1-3 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The broker has not disclosed specific information regarding spreads or commissions, which is a common practice among fraudulent brokers. The lack of transparency regarding trading costs can lead to unexpected charges, further complicating the trading experience. Potential clients should carefully consider whether the trading conditions offered by Sentinel Market align with their trading objectives and risk tolerance.

Customer Funds Security

The security of customer funds is a critical aspect of any brokerage's operations. Sentinel Market's claims regarding fund protection and segregation of client accounts are unverified, raising concerns about the safety of deposits. A reputable broker should provide clear information about its fund protection measures, including whether client funds are held in segregated accounts and if there are any investor compensation schemes in place.

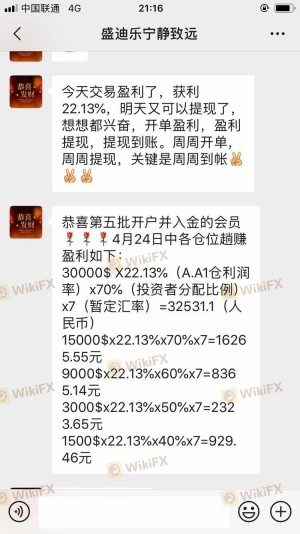

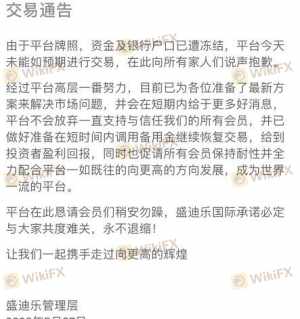

Historically, there have been numerous complaints against Sentinel Market, with users reporting difficulties in withdrawing funds and allegations of the broker absconding with client money. These incidents underscore the potential risks associated with trading through unregulated brokers. Given the alarming reports surrounding the broker, it is essential for traders to assess whether Sentinel Market is safe before making any financial commitments.

Customer Experience and Complaints

Analyzing customer feedback provides valuable insights into a broker's reliability and service quality. Reviews of Sentinel Market reveal a pattern of negative experiences, with many users expressing frustration over unresponsive customer service and difficulties in processing withdrawals. The following table outlines the main types of complaints associated with Sentinel Market:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service Delays | Medium | Poor |

| Misleading Promotions | High | Poor |

One notable case involved a user who deposited a significant amount only to find that their withdrawal requests were consistently denied. This pattern of behavior aligns with allegations that Sentinel Market operates as a scam, raising serious questions about the broker's integrity. As such, potential clients should be wary of the experiences shared by others when considering whether Sentinel Market is safe for trading.

Platform and Execution

The trading platform's performance is vital for a smooth trading experience. Reviews indicate that Sentinel Market offers a platform that lacks stability and user-friendliness. Issues such as slippage, order rejections, and slow execution times have been reported, further diminishing the trading experience. Traders expect reliable execution and minimal interruptions, and any signs of manipulation or poor performance can significantly impact their trading outcomes.

Given the concerns surrounding the platform's reliability, it is essential for traders to evaluate whether the execution quality meets their standards. The potential for high slippage and rejected orders raises red flags regarding the broker's operational integrity, leading to further questions about whether Sentinel Market is safe for trading.

Risk Assessment

Engaging with any broker carries inherent risks, and it is crucial to assess these risks before proceeding. The following risk assessment summarizes the key areas of concern regarding Sentinel Market:

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated and blacklisted by FCA |

| Financial Risk | High | High minimum deposit and unclear fee structure |

| Operational Risk | Medium | Reports of poor customer service and withdrawal issues |

To mitigate these risks, traders should conduct thorough research and consider diversifying their investments across multiple, well-regulated brokers. It is advisable to avoid brokers with a history of complaints and negative user experiences, as this can lead to significant financial losses.

Conclusion and Recommendations

In conclusion, the evidence gathered raises serious concerns about the legitimacy and safety of trading with Sentinel Market. The lack of regulatory oversight, coupled with numerous complaints regarding customer service and withdrawal issues, suggests that the broker may not be a trustworthy option for traders.

For those considering entering the forex market, it is advisable to seek out well-regulated brokers that provide transparent information about their services and maintain a solid reputation within the trading community. Alternatives such as brokers regulated by the FCA or ASIC should be prioritized, as they offer a higher level of security and investor protection.

Ultimately, potential clients should exercise extreme caution and carefully weigh the risks associated with trading through Sentinel Market before making any financial commitments. The question remains: Is Sentinel Market safe? Based on the available evidence, the answer appears to be a resounding "no."

Is Sentinel Market a scam, or is it legit?

The latest exposure and evaluation content of Sentinel Market brokers.

Sentinel Market Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Sentinel Market latest industry rating score is 1.55, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.55 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.