Is RXCF safe?

Pros

Cons

Is RXCF Safe or Scam?

Introduction

In the vast and often turbulent world of forex trading, brokers play a pivotal role in facilitating trades and managing client funds. One such broker is RXCF, which has garnered attention for its offerings in the forex market. However, as with any financial service provider, it is crucial for traders to exercise caution and conduct thorough evaluations before committing their funds. The forex market is rife with potential scams and unscrupulous brokers, making it essential for traders to understand the legitimacy and safety of the brokers they engage with.

This article aims to provide a comprehensive analysis of RXCF, utilizing a systematic approach to assess its regulatory standing, company background, trading conditions, client fund safety, customer experiences, platform performance, and associated risks. By synthesizing information from various credible sources, this evaluation seeks to answer the pressing question: Is RXCF safe or a scam?

Regulation and Legitimacy

The regulatory status of a forex broker is one of the most critical factors in determining its legitimacy. A regulated broker is required to adhere to strict guidelines and standards set by financial authorities, which helps protect traders' interests. In the case of RXCF, it is essential to investigate whether it operates under a reputable regulatory framework.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Not Listed | N/A | N/A | Unverified |

The absence of a regulatory license from a recognized authority such as the FCA (Financial Conduct Authority) or ASIC (Australian Securities and Investments Commission) raises significant red flags. Without regulatory oversight, brokers may engage in unethical practices without accountability, leaving traders vulnerable to fraud and mismanagement of funds.

Moreover, the quality of regulation is paramount. Top-tier regulators enforce stringent compliance measures, ensuring that brokers maintain transparency and fairness in their operations. In contrast, brokers that are unregulated or overseen by low-tier authorities may present higher risks to clients. Thus, the lack of regulation for RXCF strongly suggests caution; it is advisable for traders to consider more reputable options.

Company Background Investigation

Understanding a broker's history and ownership structure can provide insights into its credibility. RXCF's company history, development trajectory, and ownership details are crucial to evaluating its reliability. Unfortunately, RXCF does not present a transparent history, which is concerning for potential clients.

The management team behind a broker often reflects its operational integrity. A team with substantial experience in the financial sector can indicate a commitment to ethical practices and customer service. However, details regarding RXCF's management team are scarce, which can be indicative of a lack of transparency.

Furthermore, a broker's information disclosure level is essential. Reliable brokers typically provide comprehensive details about their operations, including financial reports and compliance records. The absence of such information for RXCF further complicates the assessment of its safety. In light of these factors, traders should approach RXCF with caution, as the company background does not inspire confidence.

Trading Conditions Analysis

Analyzing trading conditions is vital for understanding the overall cost of engaging with a broker. RXCF's fee structure and trading conditions must be scrutinized to determine their competitiveness and fairness.

The following table summarizes RXCF's trading costs compared to industry averages:

| Fee Type | RXCF | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 3 pips | 1-2 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | 2% | 0.5-1% |

The spread on major currency pairs at RXCF is notably higher than the industry average, which can significantly impact trading profitability. Additionally, the lack of clarity regarding commission structures raises concerns about potential hidden fees. Traders should be wary of brokers that do not provide transparent pricing models, as this can lead to unexpected costs.

Moreover, any unusual fees or conditions should be carefully evaluated, as they may indicate a broker's attempt to exploit traders. In this case, RXCF's trading conditions do not align well with industry standards, suggesting that it may not be the most favorable choice for traders seeking competitive pricing.

Client Fund Safety

The safety of client funds is paramount when evaluating a broker's trustworthiness. Traders need to ensure that their investments are protected against potential fraud or mismanagement. RXCF's measures concerning fund safety must be examined.

A reliable broker typically employs stringent security protocols, including segregated accounts for client funds and investor protection mechanisms. However, RXCF does not provide sufficient information regarding its fund safety measures. The absence of details on fund segregation and negative balance protection policies raises significant concerns about the safety of traders' investments.

Historical issues related to fund security can also be telling. If a broker has faced controversies or complaints regarding fund mismanagement, it should be a major warning sign for potential clients. Unfortunately, there is limited information available on RXCF's track record in this regard, further complicating the assessment of its safety.

Customer Experience and Complaints

Customer feedback and experiences can offer valuable insights into a broker's reliability. Analyzing common complaint patterns and the broker's responsiveness to issues can help gauge overall client satisfaction.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

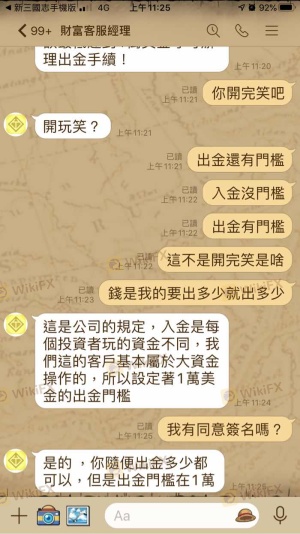

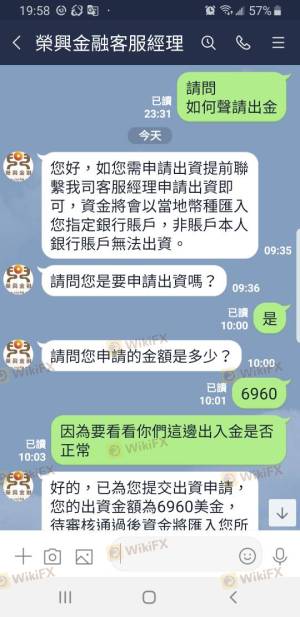

| Withdrawal Issues | High | Slow Response |

| Poor Customer Support | Medium | Unresponsive |

| Misleading Information | High | No Acknowledgment |

Common complaints against RXCF include difficulties with fund withdrawals and inadequate customer support. The severity of these issues indicates potential systemic problems within the broker's operations. Furthermore, a slow or unresponsive company reaction to complaints can exacerbate frustrations for clients, leading to a negative overall experience.

Two typical cases illustrate these issues:

- Withdrawal Delays: Several users reported significant delays in processing withdrawal requests, leading to frustration and loss of trust in the broker.

- Poor Support: Customers have expressed dissatisfaction with the quality of customer service, citing unhelpful responses and long wait times for assistance.

These complaints highlight substantial concerns regarding RXCF's commitment to client satisfaction and transparency.

Platform and Execution

The performance and reliability of a trading platform are crucial for a seamless trading experience. Evaluating RXCF's platform stability, order execution quality, and overall user experience is essential.

Traders have reported mixed experiences with RXCF's platform, with some noting issues related to stability and execution speed. Slippage and rejections of orders have also been reported, which can significantly affect trading outcomes.

Furthermore, any signs of platform manipulation should be investigated thoroughly. If a broker's platform consistently exhibits issues that disadvantage traders, it can be a serious indicator of unethical practices. In RXCF's case, the reported execution problems raise questions about its integrity and reliability.

Risk Assessment

Engaging with any broker involves inherent risks, and assessing these risks is essential for informed decision-making.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Lack of regulation |

| Fund Security Risk | High | Insufficient protection |

| Customer Service Risk | Medium | Poor response to issues |

| Execution Risk | High | Slippage and rejections |

The overall risk profile for RXCF indicates significant concerns, particularly regarding regulatory compliance and fund security. Traders should be particularly cautious and consider these risks when deciding whether to engage with this broker.

To mitigate risks, it is advisable to conduct thorough research, start with small investments, and maintain regular oversight of trading activities.

Conclusion and Recommendations

In summary, the investigation into RXCF reveals several red flags that suggest it may not be a safe option for traders. The absence of regulatory oversight, coupled with concerns regarding trading conditions, client fund safety, and customer service, paints a troubling picture.

For traders seeking a reliable and trustworthy forex broker, it is advisable to consider alternatives that are regulated by reputable authorities and demonstrate a commitment to transparency and customer support. Brokers with strong regulatory backgrounds, clear pricing structures, and positive customer feedback should be prioritized.

In conclusion, is RXCF safe? The evidence suggests that it is prudent for traders to exercise caution and consider other options before engaging with this broker.

Is RXCF a scam, or is it legit?

The latest exposure and evaluation content of RXCF brokers.

RXCF Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

RXCF latest industry rating score is 1.54, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.54 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.