RXCF 2025 Review: Everything You Need to Know

Executive Summary

RXCF shows a mixed picture in the competitive forex brokerage world. This rxcf review reveals serious problems that potential clients cannot ignore, leading to an overall neutral assessment due to significant negative user feedback that raises major concerns about the company's business practices and legitimacy.

The broker tries to serve both new and experienced traders through easy entry requirements. It offers a relatively low minimum deposit of just $100, making it accessible to traders with limited starting capital. However, many user complaints about the company's legitimacy have appeared, creating serious red flags that potential clients must consider carefully before making any decisions.

RXCF operates under dual regulatory oversight from the Financial Conduct Authority in the United Kingdom and the Australian Securities and Investments Commission in Australia. This regulatory framework provides some level of institutional oversight and theoretical client protection. Despite having this regulatory presence, user feedback shows serious concerns about RXCF's business practices, with some clients making allegations of fraudulent activities that cannot be dismissed lightly.

The low barrier to entry may attract new traders who want to begin their forex journey without substantial initial capital requirements. However, the negative reputation issues and concerning user reports suggest that even experienced traders should exercise extreme caution when considering this broker for their trading activities.

Important Disclaimers

Regional Entity Differences: RXCF operates under different regulatory jurisdictions, including FCA and ASIC oversight, which may result in varying service offerings, protections, and operational standards depending on your geographical location. Clients should verify which specific entity serves their region. They must also understand the applicable regulatory protections that may or may not be available to them based on their location and the specific RXCF entity they would be dealing with.

Review Methodology: This evaluation is based on available user feedback, regulatory information, and publicly accessible data about RXCF's services. Given the limited comprehensive information available and the presence of concerning user complaints, readers should conduct additional due diligence before making any trading decisions. The assessment reflects current available information and may not capture all aspects of the broker's operations or recent changes to their service offerings.

Overall Rating Framework

Broker Overview

RXCF entered the forex brokerage market in 2015. The company positioned itself as a service provider for currency market trading, attempting to establish a presence in the highly competitive forex industry by offering trading services primarily focused on foreign exchange markets.

Since its inception, RXCF has tried to build a client base that spans from newcomers to the forex world to more seasoned trading professionals. However, its success in maintaining client satisfaction appears questionable based on available feedback from users who have actually traded with the platform. The broker's track record over nearly a decade in operation shows mixed results at best.

The broker's business model centers exclusively on forex market trading. RXCF operates as a dedicated currency exchange platform, suggesting an intention to develop expertise specifically in forex services rather than diversifying across multiple asset classes like stocks, commodities, or cryptocurrencies. This specialized focus could theoretically be an advantage for traders seeking forex-specific expertise.

However, the lack of detailed information about trading platforms, specific service offerings, and comprehensive features raises serious questions about the depth and quality of services actually provided to clients. RXCF maintains regulatory relationships with two significant financial authorities: the Financial Conduct Authority in the United Kingdom and the Australian Securities and Investments Commission in Australia. This regulatory oversight theoretically provides some level of client protection and operational standards, though this rxcf review reveals that regulatory presence alone may not guarantee satisfactory service quality or protect clients from all potential issues.

Regulatory Coverage: RXCF operates under dual regulatory oversight from the FCA and ASIC. This provides some level of institutional oversight across major English-speaking markets, though the effectiveness of this oversight in practice remains questionable given user complaints.

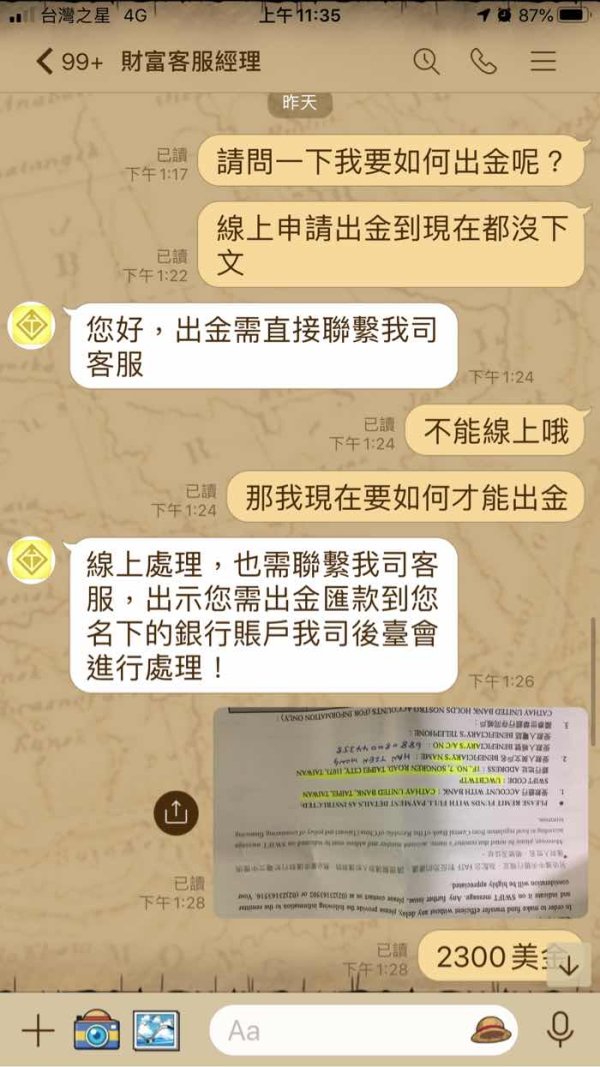

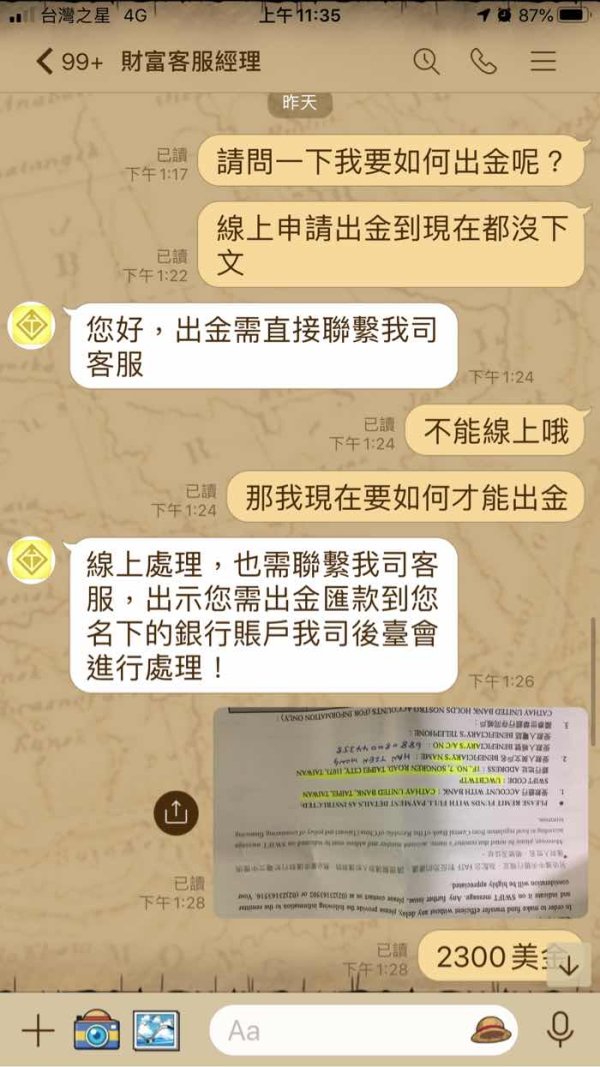

Deposit and Withdrawal Methods: Specific information about available deposit and withdrawal methods was not detailed in available sources. This represents a significant transparency gap that potential clients should investigate directly with the broker before opening any accounts or committing funds.

Minimum Deposit Requirements: The broker sets its minimum deposit threshold at $100. This positioning makes it accessible to traders with limited initial capital, though low minimums alone do not guarantee quality service.

Promotional Offerings: Current bonus structures and promotional campaigns are not detailed in available information. This suggests either limited promotional activity or poor communication of such offers to potential clients.

Available Trading Assets: RXCF focuses primarily on forex market instruments. However, specific currency pairs and market depth information remains unclear, creating uncertainty about actual trading opportunities.

Cost Structure: Critical information about spreads, commissions, and other trading costs is not readily available. This creates significant transparency concerns for cost-conscious traders who need to understand their total trading expenses.

Leverage Options: Leverage ratios and margin requirements are not specified in available documentation. This lack of clarity makes it impossible for traders to properly assess risk and position sizing capabilities.

Platform Technology: Specific trading platform details, including software providers and platform features, are not clearly communicated. Modern traders require reliable, feature-rich platforms for effective market participation.

Geographic Restrictions: Information about regional trading restrictions and availability is not comprehensively detailed. Potential clients should verify service availability in their specific location before proceeding.

Customer Support Languages: Available support languages are not specified in current documentation. This rxcf review suggests investigating language support thoroughly before account opening, especially for non-English speaking traders.

Comprehensive Rating Analysis

Account Conditions Analysis (5/10)

RXCF's account conditions present a mixed picture that reflects both accessibility and concerning information gaps. The broker's most notable feature is its $100 minimum deposit requirement. This positions it favorably for traders with limited initial capital who may be hesitant to commit larger amounts while learning market dynamics.

However, the lack of detailed information about different account types, their specific features, and progression pathways raises significant concerns about service depth. Professional brokers typically offer multiple account tiers with varying features, benefits, and requirements that cater to different trader experience levels and capital amounts. The absence of clear information about account opening procedures, verification requirements, and timeline expectations creates uncertainty for potential clients who need to plan their trading setup.

Additionally, no information is available about specialized account features such as Islamic accounts for traders requiring Shariah-compliant trading conditions. VIP accounts for high-volume traders are also not mentioned, nor are demo accounts for practice purposes clearly described. User feedback suggests that even the basic account opening process may involve complications, with some clients reporting difficulties in establishing accounts or accessing services after making their initial deposits.

When compared to industry standards, while the low minimum deposit appears competitive, the lack of transparency about account features and progression options falls short of what experienced traders typically expect. This creates a situation where the initial appeal of low entry requirements may be offset by limitations in account functionality and service quality. This rxcf review indicates that potential clients should request comprehensive account information directly from the broker before committing any funds to ensure their specific needs can be met.

RXCF's offering in terms of trading tools and educational resources appears significantly limited based on available information. The broker has not demonstrated a clear commitment to providing comprehensive analytical tools, market research, or educational materials that modern forex traders typically require for informed decision-making. This absence of detailed tool information suggests either a basic service offering or poor communication of existing resources to potential clients.

Professional forex trading typically requires access to technical analysis tools, economic calendars, market news feeds, and research reports. The lack of specific information about such resources raises serious concerns about whether RXCF provides adequate support for serious trading activities that require comprehensive market analysis. Additionally, no information is available about automated trading support, expert advisors, or API access for algorithmic trading strategies that many experienced traders consider essential.

User feedback indicates dissatisfaction with the tools and resources available, suggesting that what is provided may not meet trader expectations for quality or comprehensiveness. The absence of educational materials is particularly concerning for a broker that claims to serve novice traders. New forex participants typically require substantial educational support to develop trading skills safely and effectively without risking significant losses due to inexperience.

Without comprehensive tools and resources, traders may find themselves at a serious disadvantage in the competitive forex market. Modern trading requires access to real-time data, analysis tools, and educational content to make informed decisions. The limited offering in this area suggests that RXCF may not provide the foundation necessary for successful trading activities, regardless of trader experience level.

Customer Service and Support Analysis (4/10)

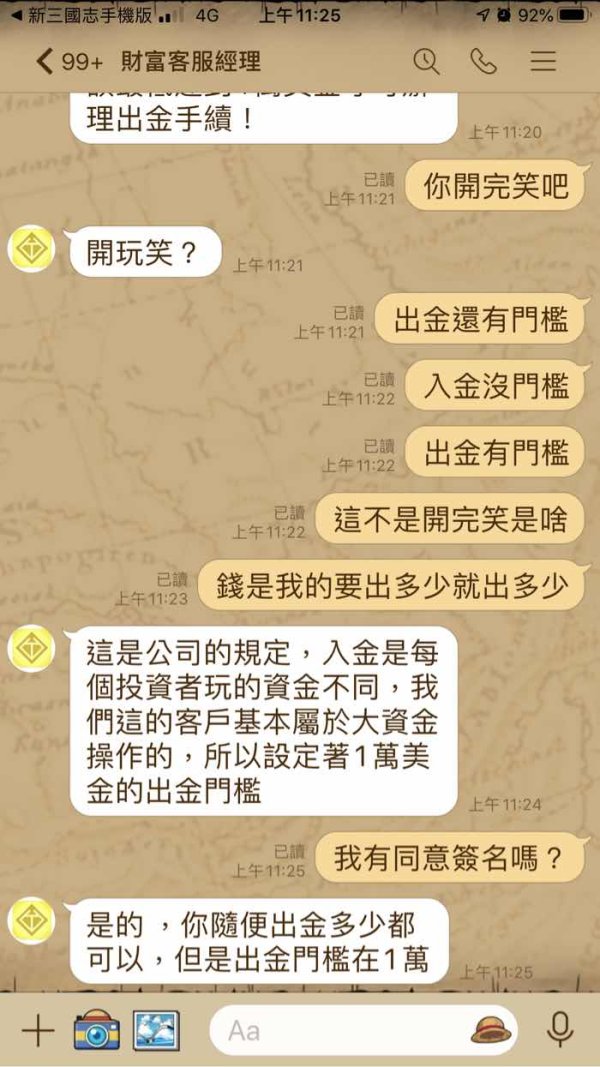

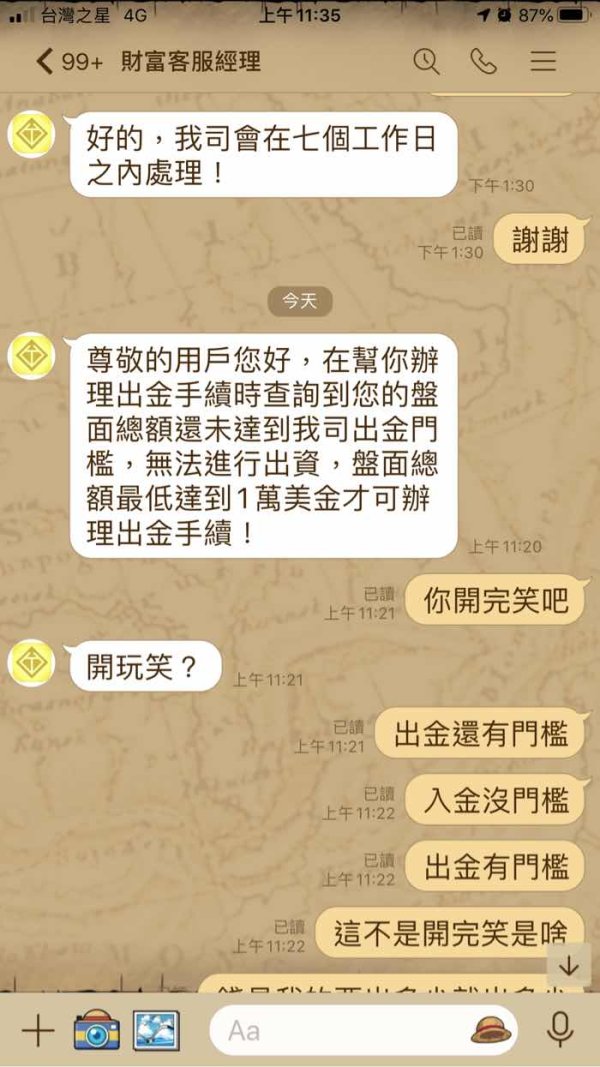

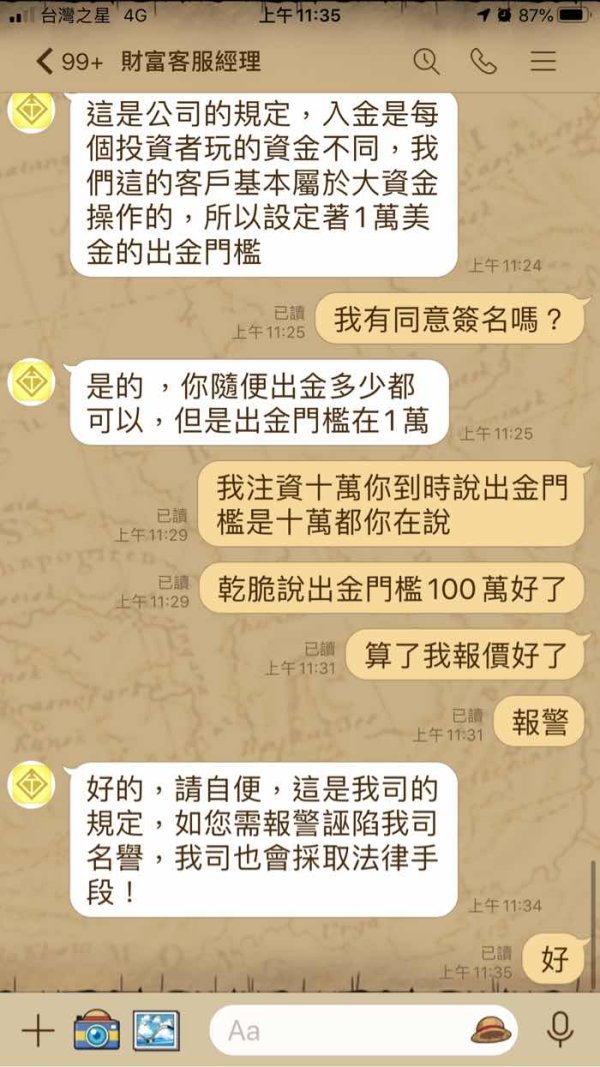

Customer service represents one of RXCF's most problematic areas, with user feedback revealing significant concerns about support quality and responsiveness. Available reports suggest that clients experience substantial delays in receiving assistance. They may also encounter difficulties in resolving account-related issues that should be handled promptly and professionally.

The lack of clearly communicated support channels, operating hours, and response time commitments creates additional uncertainty for potential clients who need to know they can get help when needed. Professional forex brokers typically provide multiple contact methods including live chat, telephone support, email assistance, and sometimes social media engagement with clearly defined response times and availability schedules. The absence of detailed information about RXCF's support infrastructure suggests either limited availability or poor communication of existing services to clients.

User complaints indicate that when support is available, the quality may not meet industry standards for professionalism and problem resolution. Reports suggest unresolved issues and inadequate responses to client concerns that should be addressed promptly and effectively. In the fast-paced forex market, delayed or inadequate customer support can result in significant financial consequences for traders who need immediate assistance with technical issues, account problems, or trading concerns.

The negative feedback pattern suggests systemic issues with RXCF's customer service approach rather than isolated incidents. This indicates that potential clients should carefully consider their support requirements and expectations before engaging with this broker. Traders who require reliable, responsive customer service may find RXCF's offering insufficient for their needs.

Trading Experience Analysis (4/10)

The trading experience offered by RXCF appears to suffer from significant limitations and user dissatisfaction based on available feedback. Platform stability and execution quality are fundamental requirements for successful forex trading. Yet user reports suggest serious concerns in these critical areas that directly impact trading performance and profitability.

Without specific information about trading platforms, execution speeds, or slippage rates, potential clients cannot adequately assess whether RXCF can provide the technical foundation necessary for effective trading. Modern forex trading requires reliable platform performance, fast order execution, minimal slippage, and comprehensive charting capabilities that allow traders to analyze markets and execute strategies effectively. The absence of detailed platform information and negative user feedback suggests that RXCF may not meet these essential requirements.

Additionally, no information is available about mobile trading capabilities, which are increasingly important for active traders who need market access across multiple devices. Mobile trading has become a standard expectation in the industry, allowing traders to monitor positions and react to market movements regardless of their location. The lack of clear mobile trading information represents another gap in service transparency.

User reports indicate problems with overall trading experience, though specific technical details are limited in available feedback. The lack of transparency about execution models, liquidity providers, and platform technology creates significant uncertainty about actual trading conditions that clients will experience. This rxcf review suggests that serious traders should thoroughly test any platform through demo accounts and carefully evaluate execution quality before committing significant capital to ensure the platform meets their specific trading requirements.

Trustworthiness Analysis (3/10)

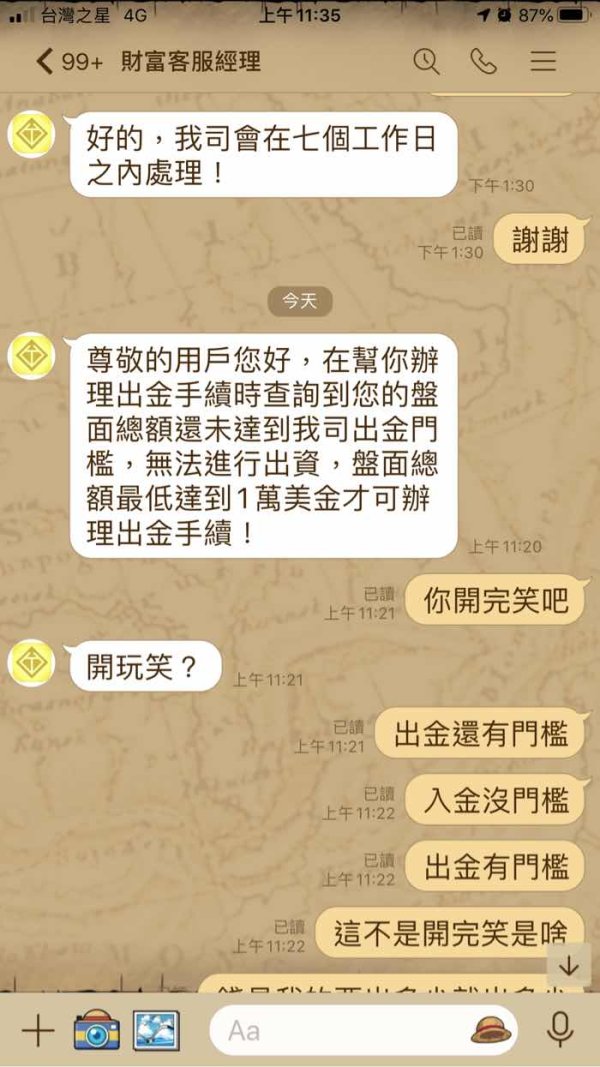

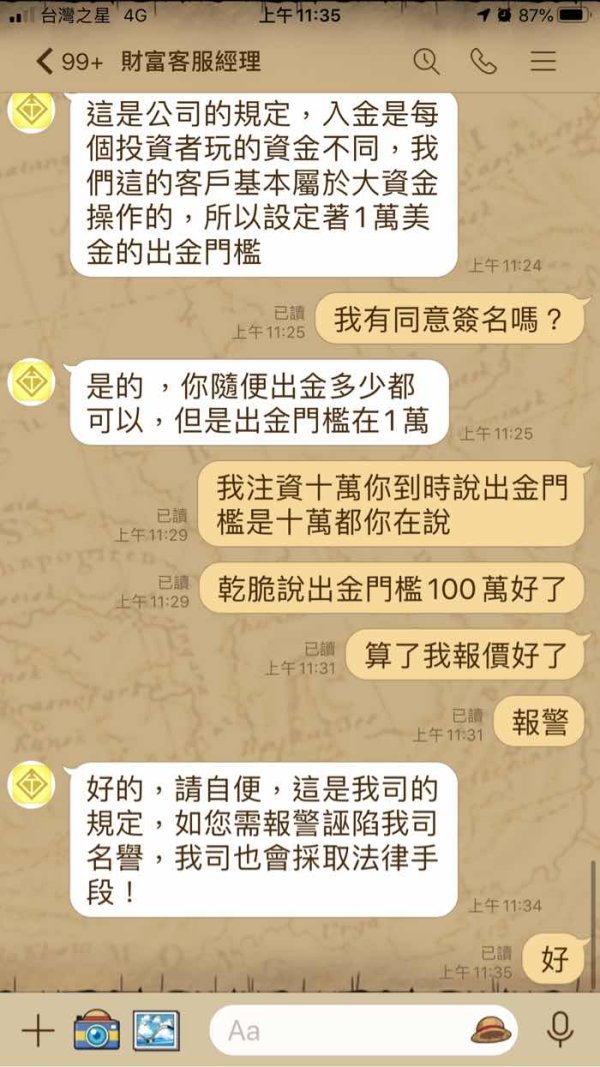

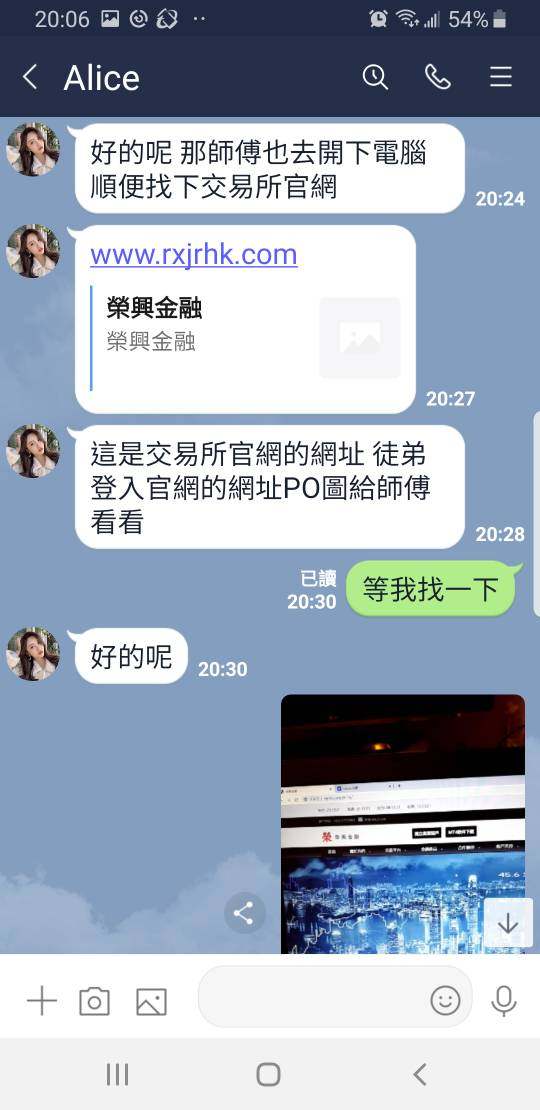

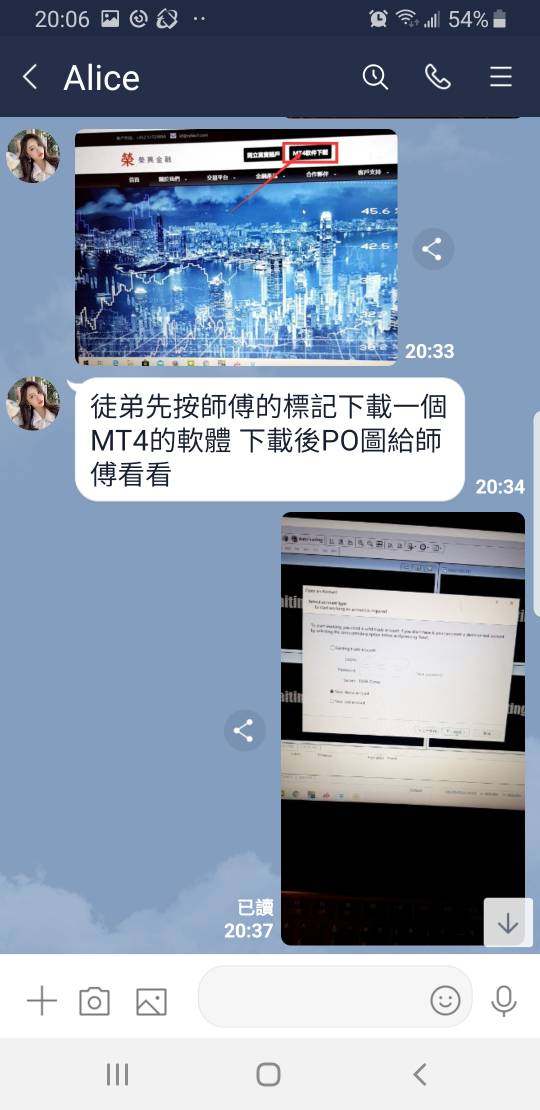

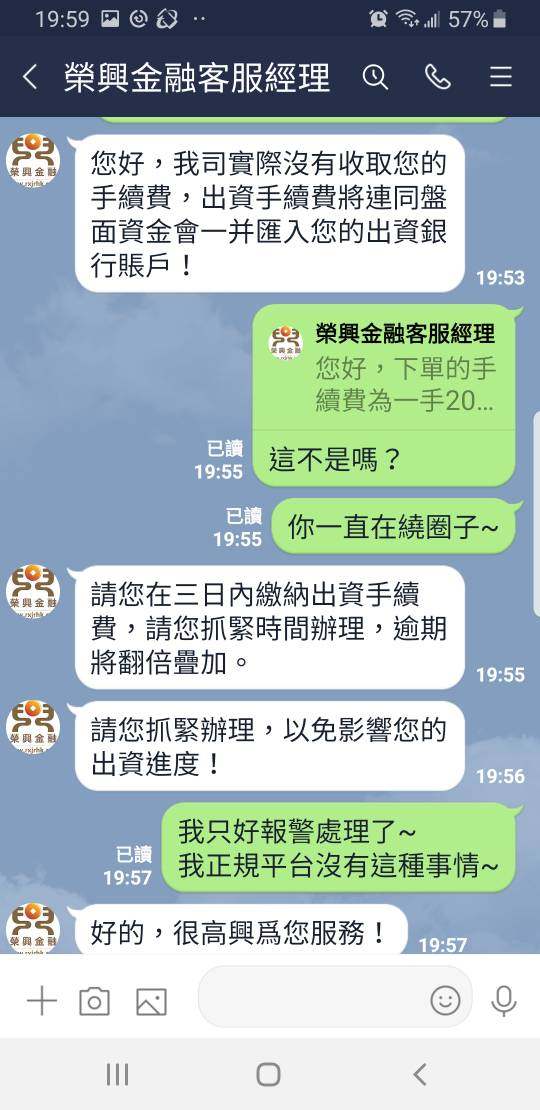

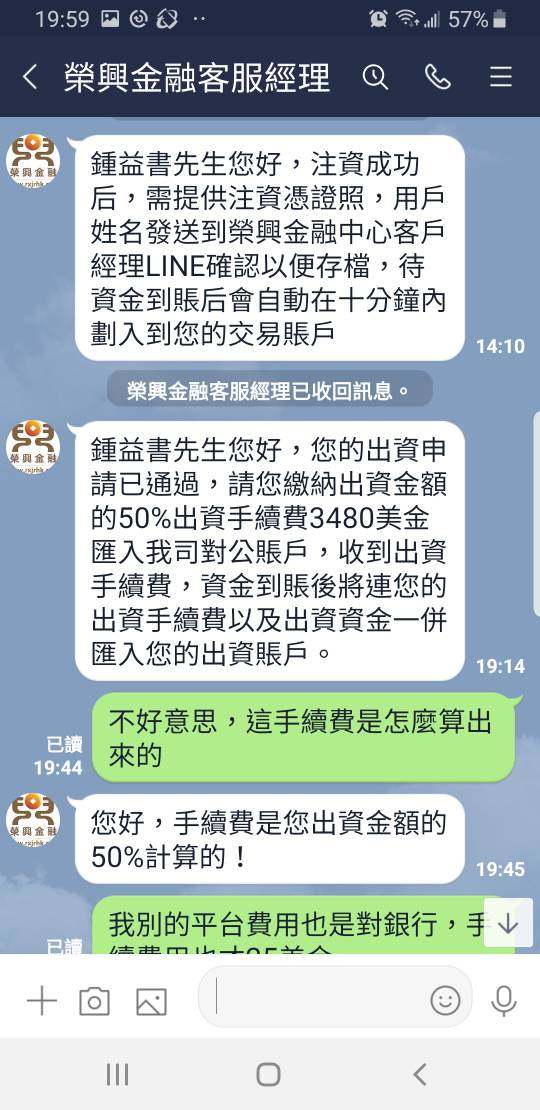

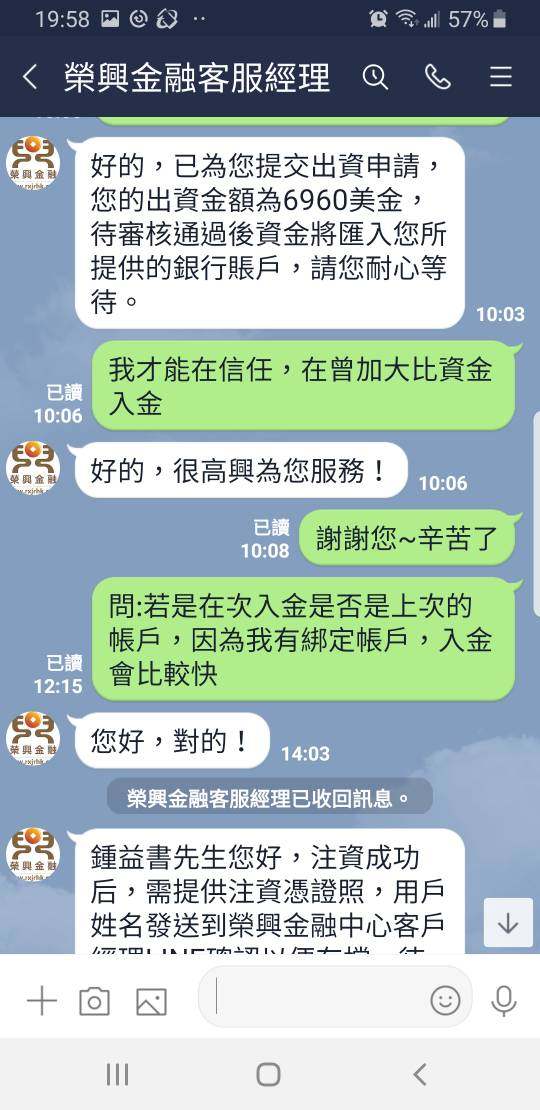

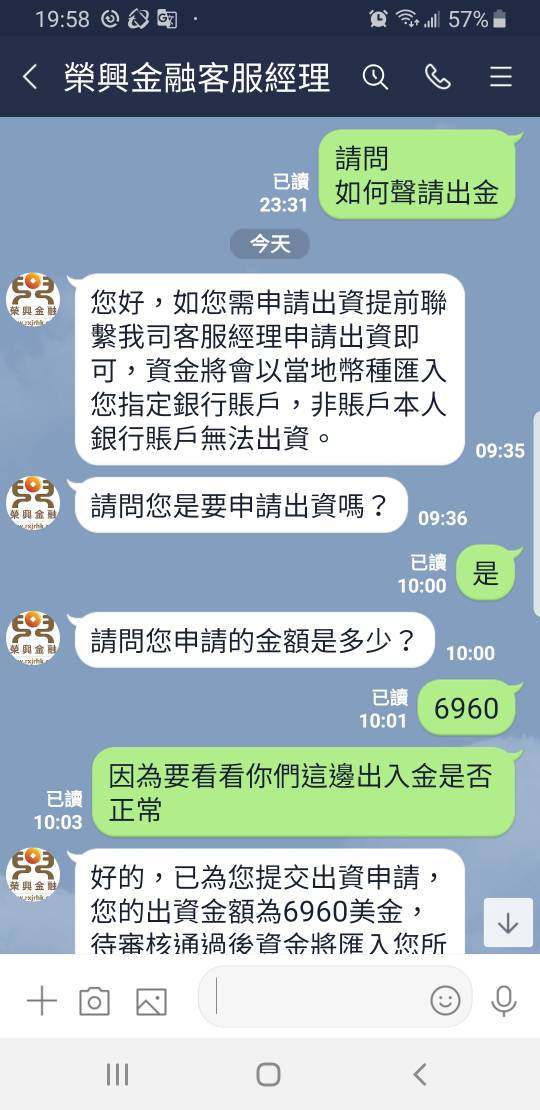

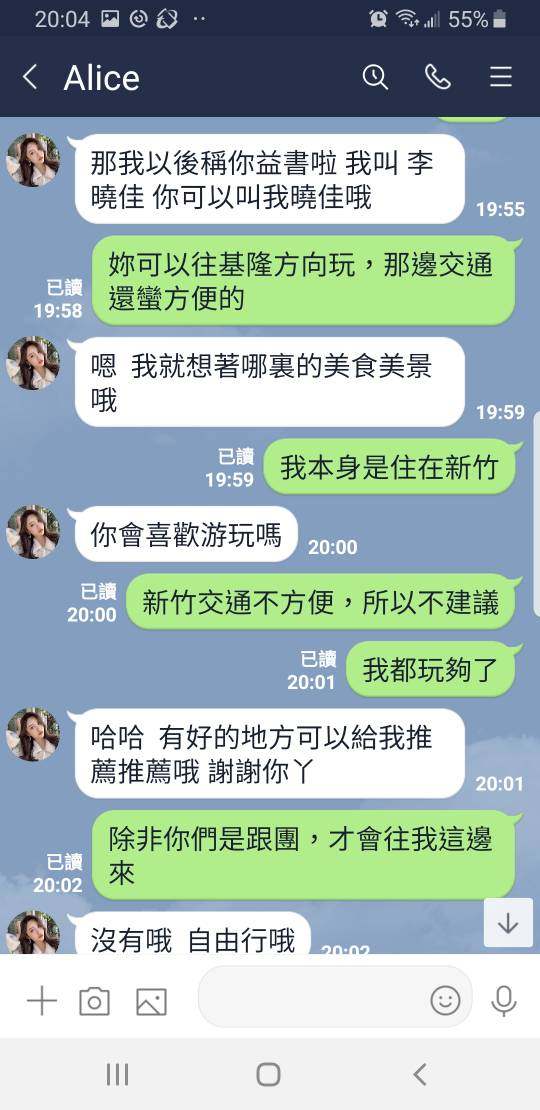

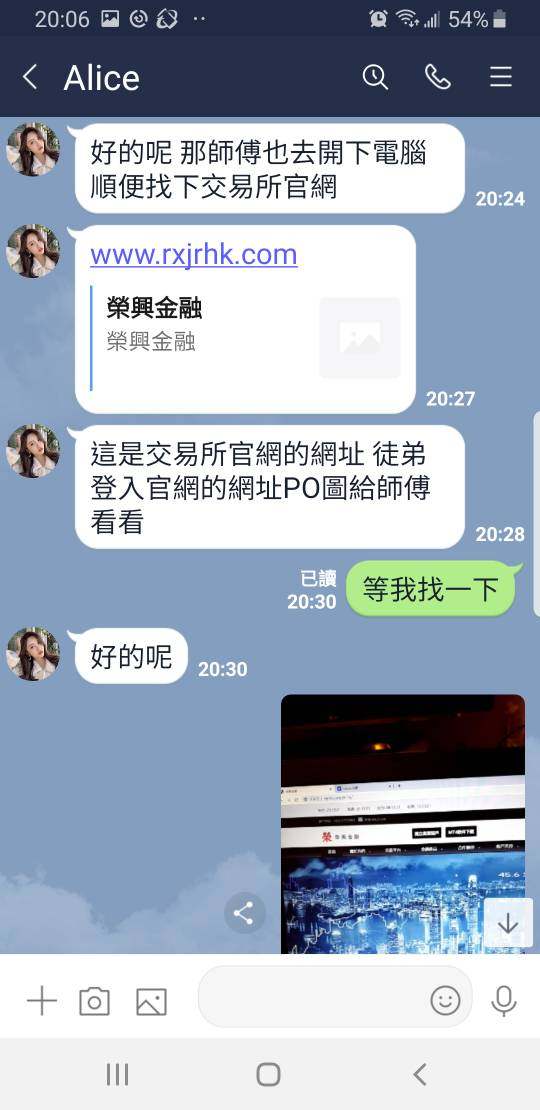

Trustworthiness represents RXCF's most concerning area, with serious user allegations that cannot be ignored in any comprehensive evaluation. While the broker maintains regulatory relationships with both FCA and ASIC, these regulatory connections have not prevented the emergence of significant client complaints about business practices. User reports include allegations of fraudulent activity, which represent the most serious concerns possible in broker evaluation and cannot be dismissed lightly.

The presence of FCA and ASIC oversight should theoretically provide client protections and operational standards that ensure fair treatment and proper business conduct. Yet the negative feedback suggests that regulatory presence alone may not guarantee satisfactory service delivery or protect clients from all potential issues. The effectiveness of regulatory oversight depends on enforcement and the specific protections available to clients in different jurisdictions.

The lack of detailed information about fund segregation, insurance coverage, and transparency measures further compounds trustworthiness concerns. Professional brokers typically provide clear, detailed information about client fund protection measures, regulatory compliance procedures, and transparency initiatives that demonstrate their commitment to client safety. The absence of such information creates uncertainty about actual client protections.

User trust feedback reveals a pattern of dissatisfaction that extends beyond normal service complaints to more serious allegations about business integrity. While regulatory authorities provide some oversight, the presence of fraud allegations requires potential clients to exercise extreme caution and conduct thorough due diligence. The combination of regulatory oversight and serious user complaints creates a contradictory situation that demands careful investigation before any financial commitment.

User Experience Analysis (4/10)

Overall user experience with RXCF appears problematic based on available feedback, with satisfaction levels falling significantly below industry expectations. The combination of service limitations, support issues, and trustworthiness concerns creates a challenging environment for both novice and experienced traders. User feedback suggests that even basic trading activities may involve complications that detract from the overall experience and make trading more difficult than it should be.

The broker's target demographic of both new and experienced traders faces different challenges with RXCF's service delivery. New traders require comprehensive education, reliable support, and stable platforms to develop skills safely without risking significant losses due to inexperience or poor service quality. Experienced traders need advanced tools, competitive conditions, and professional service levels that allow them to implement sophisticated trading strategies effectively.

Available evidence suggests that RXCF may not adequately serve either group's requirements. The lack of educational resources disadvantages new traders, while the absence of advanced tools and transparency issues create problems for experienced traders. This creates a situation where the broker fails to meet the needs of its stated target market effectively.

Common user complaints center on service quality, support responsiveness, and business practice concerns that affect the fundamental trading experience. The pattern of negative feedback suggests systemic issues rather than isolated problems, indicating that user experience problems may be inherent to RXCF's operational approach. Potential clients should carefully weigh these user experience concerns against any perceived benefits before deciding to engage with this broker, as poor user experience can significantly impact trading success and satisfaction.

Conclusion

RXCF presents a concerning profile that requires careful consideration by potential clients, particularly given the serious nature of user complaints and allegations. While the broker offers an accessible entry point with its $100 minimum deposit and maintains regulatory relationships with respected authorities, these positive elements are significantly overshadowed by major red flags. The red flags include fraud allegations, poor user satisfaction, and systemic service quality issues that cannot be ignored.

The broker may initially appear suitable for novice traders due to its low minimum deposit requirement that makes forex trading accessible without substantial initial capital. However, the combination of limited educational resources, poor customer support, and serious trustworthiness concerns makes it a risky choice for new traders. New traders need reliable guidance, comprehensive education, and dependable support to develop trading skills safely, none of which appear to be RXCF's strengths based on available evidence.

Experienced traders are likely to find the service limitations and transparency gaps unacceptable for professional trading activities that require reliable execution, comprehensive tools, and transparent business practices. The lack of detailed information about trading conditions, platform capabilities, and cost structures creates uncertainty that professional traders typically cannot accept. Advanced traders need sophisticated tools and reliable service that RXCF does not appear to provide based on current evidence.

The primary advantage of low initial capital requirements is significantly outweighed by serious disadvantages including negative user feedback, limited transparency, inadequate customer support, and grave allegations about business practices. Potential clients should exercise extreme caution and strongly consider alternative brokers with stronger reputations and more comprehensive service offerings. The forex market offers many broker options, and traders should prioritize safety, reliability, and service quality over low minimum deposits when selecting a trading partner for their financial activities.