Is Properfly safe?

Business

License

Is Properfly Safe or a Scam?

Introduction

Properfly is a relatively new entrant in the forex market, positioning itself as a trading platform that offers a wide range of financial instruments, including forex, indices, commodities, and cryptocurrencies. As with any broker, especially in the volatile world of forex trading, it's crucial for traders to carefully evaluate the legitimacy and safety of the platform before committing their funds. The forex market is rife with scams and unregulated brokers, making it essential for traders to conduct thorough due diligence. This article aims to provide a comprehensive analysis of Properfly by examining its regulatory status, company background, trading conditions, customer experience, and overall risk profile. Our investigation is based on multiple credible sources and reviews, ensuring an objective assessment of whether Properfly is safe or a potential scam.

Regulation and Legitimacy

Regulation is a key indicator of a broker's legitimacy and reliability. A properly regulated broker is subject to oversight by financial authorities, which helps protect traders' interests and funds. In the case of Properfly, it claims to be registered with the National Futures Association (NFA) in the United States. However, our investigation reveals significant concerns regarding its regulatory status.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| NFA | 0555487 | United States | Unverified |

Despite being registered with the NFA, there are no substantial records or evidence supporting Properfly's claims of compliance with regulatory standards. The absence of a valid license from recognized authorities raises red flags about the broker's operational legitimacy. Moreover, the lack of transparency regarding its regulatory status could indicate that Properfly may not adhere to the strict guidelines that reputable brokers are required to follow. This lack of oversight places traders at significant risk, as they may not have legal recourse in case of disputes or fund mismanagement.

Company Background Investigation

Understanding a broker's history, ownership structure, and management team is vital in assessing its reliability. Properfly Limited, as stated on its website, is based in the United States. However, detailed information regarding its history and ownership is scarce. The company's claims of having multiple offices across various continents lack substantiation, contributing to doubts about its credibility.

The management team behind Properfly is also shrouded in mystery, with little information available about their professional backgrounds and expertise. This lack of transparency raises concerns about the broker's commitment to ethical practices and customer service. A reputable broker typically provides detailed information about its management and operational history, which is essential for building trust with potential clients. In Properfly's case, the absence of such information may indicate a lack of accountability and transparency that traders should be wary of.

Trading Conditions Analysis

Traders need to be aware of the costs associated with trading on any platform. Properfly claims to offer competitive trading conditions; however, the lack of transparency regarding fees and spreads is concerning. Traders have reported difficulties in accessing clear information about account types, spreads, and commissions, which can significantly impact their trading profitability.

| Fee Type | Properfly | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Not Specified | 1.0 - 2.0 pips |

| Commission Model | Not Specified | Varies by broker |

| Overnight Interest Range | Not Specified | Varies by broker |

The absence of specific information on spreads and commissions suggests that traders may encounter hidden fees or unfavorable trading conditions. Additionally, the lack of clarity in the fee structure can lead to unexpected costs, diminishing overall trading profitability. This opacity is a common tactic among less reputable brokers, raising concerns about whether Properfly is prioritizing profit over transparency.

Client Fund Security

The safety of client funds is paramount when choosing a broker. Properfly claims to implement various measures to ensure the security of client funds, including segregated accounts and negative balance protection. However, the lack of regulatory oversight means that these claims cannot be independently verified.

Traders should be cautious of brokers that do not provide clear policies regarding fund security. Properfly's ambiguous statements about fund segregation and investor protection raise concerns about the actual safety of client deposits. Furthermore, historical issues related to fund security or client complaints can be indicative of a broker's reliability. Without a proven track record, traders may find themselves at risk of losing their investments.

Customer Experience and Complaints

Customer feedback is a valuable indicator of a broker's reliability and service quality. Reviews and testimonials for Properfly are largely negative, with many users reporting issues related to fund withdrawals, poor customer support, and high-pressure sales tactics.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Unresponsive |

| High-Pressure Sales | Medium | Limited Response |

| Account Closure | High | No Explanation |

Many traders have expressed frustration over their inability to withdraw funds, with reports of accounts being blocked or closed without prior notice. The lack of effective communication and support from Properfly exacerbates these issues, leaving clients feeling helpless. Such patterns of complaints are indicative of potentially fraudulent practices and should serve as a warning to prospective traders.

Platform and Trade Execution

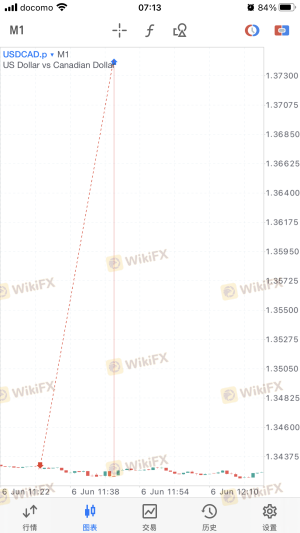

A broker's trading platform is crucial for user experience and trade execution quality. Properfly claims to offer the popular MetaTrader 5 (MT5) platform, which is known for its advanced features and user-friendly interface. However, there are concerns about the platform's performance, including execution speed, slippage, and order rejection rates.

Traders have reported issues with delayed order execution and frequent slippage, which can negatively impact trading outcomes. Additionally, any signs of platform manipulation or unfair practices should be taken seriously, as they can indicate a lack of integrity in the broker's operations.

Risk Assessment

The overall risk of trading with Properfly is significant, given the various concerns outlined in this analysis.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Lack of valid regulation |

| Fund Security Risk | High | Unverified fund safety |

| Operational Risk | Medium | Poor customer support |

| Execution Risk | Medium | Issues with order execution |

To mitigate these risks, traders should consider using regulated brokers with a proven track record of transparency and reliability. Conducting thorough research and seeking out user reviews can help identify potential issues before committing funds.

Conclusion and Recommendations

In conclusion, the evidence gathered suggests that Properfly is not a safe trading option. The absence of proper regulation, coupled with a lack of transparency regarding trading conditions and fund security, raises significant red flags. Traders should be particularly cautious of the numerous complaints regarding fund withdrawals and customer support.

For those seeking to engage in forex trading, it is advisable to consider alternative brokers that are well-regulated and have a solid reputation for customer service and fund safety. Some reliable alternatives include brokers like IG, OANDA, and Forex.com, which offer comprehensive trading conditions and robust regulatory oversight.

In summary, if you're asking, "Is Properfly safe?" the answer leans towards no. It is crucial for traders to prioritize safety and transparency in their trading endeavors to avoid potential losses and scams.

Is Properfly a scam, or is it legit?

The latest exposure and evaluation content of Properfly brokers.

Properfly Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Properfly latest industry rating score is 1.40, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.40 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.