Han Ba 2025 Review: Everything You Need to Know

Executive Summary

Han Ba Ltd presents a concerning case in the forex brokerage landscape. Our comprehensive han ba review reveals significant red flags that potential traders should carefully consider. This relatively new forex platform was established in 2023 and has quickly garnered attention for all the wrong reasons, being classified as a high-risk entity with suspected fraudulent activities. Despite positioning itself as a multi-service forex broker, Han Ba Ltd faces serious credibility issues. These problems overshadow any potential trading opportunities it might offer.

The broker operates from its registered address at 96 WADSWORTH BLVD NUM 127-3255 LAKEWOOD, CO 800226 in the United States. It claims to provide various trading services to forex market participants. However, the lack of transparent information about its operations raises substantial concerns about its legitimacy and operational integrity. Multiple risk warnings from industry monitors add to these concerns.

Our analysis indicates that while Han Ba Ltd targets investors seeking forex trading opportunities, the platform's high-risk classification makes it unsuitable for most traders. This is particularly true for those prioritizing capital safety and regulatory compliance. The broker's brief operational history and absence of clear regulatory oversight further compound these concerns.

Important Notice

This han ba review is based on available information from multiple sources and user feedback as of 2024. Forex brokers operate under different regulatory frameworks across various jurisdictions. The regulatory landscape can vary significantly between regions. Traders should independently verify the regulatory status of any broker in their specific jurisdiction before engaging in trading activities.

Our evaluation methodology incorporates data from industry monitoring services, user testimonials, and publicly available information about the broker's operations. Given the limited transparency surrounding Han Ba Ltd's operations, some aspects of this review rely on indirect indicators. We also use risk assessment protocols commonly used in the forex industry for evaluating broker credibility and operational safety.

Rating Overview

Broker Overview

Han Ba Ltd entered the forex brokerage market in 2023. It established its corporate presence in the United States with registered operations from Colorado. The company positions itself as a forex broker offering multiple trading services, though specific details about its service portfolio remain notably sparse in publicly available documentation. The broker's rapid emergence in the competitive forex market coincided with immediate concerns about its operational practices and business model transparency.

According to available records, Han Ba Ltd operates from 96 WADSWORTH BLVD NUM 127-3255 LAKEWOOD, CO 800226. This suggests a US-based operational structure. However, the company's brief operational history and limited market presence raise questions about its established infrastructure. Long-term viability in the highly regulated forex industry also remains questionable.

The broker's business model appears to focus on forex trading services. The absence of detailed information about specific offerings, trading conditions, and operational procedures creates significant transparency gaps. This lack of clarity becomes particularly concerning when combined with the high-risk classification assigned by industry monitoring services. It suggests potential issues with the broker's fundamental business practices and regulatory compliance standards.

Regulatory Status: While Han Ba Ltd claims US-based operations, specific regulatory authorization details remain unclear in available documentation. The absence of clear regulatory information represents a significant concern for potential traders seeking properly licensed brokerage services.

Deposit and Withdrawal Methods: Specific information about funding methods, processing times, and associated fees is not detailed in available materials. This creates uncertainty about transaction procedures and costs.

Minimum Deposit Requirements: The broker has not clearly specified minimum deposit thresholds for different account types. This makes it difficult for potential traders to understand entry requirements.

Promotional Offers: No specific bonus programs or promotional campaigns are mentioned in available broker information. This suggests either absence of such offerings or lack of transparency in marketing practices.

Trading Assets: Han Ba Ltd primarily focuses on forex trading services. The specific currency pairs, exotic options, and market depth available through the platform remain unspecified in publicly available materials.

Cost Structure: Critical information about spreads, commissions, overnight fees, and other trading costs is notably absent from available documentation. This prevents accurate cost analysis for potential traders.

Leverage Ratios: Specific leverage offerings and risk management parameters are not clearly outlined in accessible broker materials.

Platform Options: The trading platform technology, software partnerships, and technical infrastructure details are not comprehensively detailed in available information.

Geographic Restrictions: Specific information about service availability across different jurisdictions is not clearly specified.

Customer Support Languages: Multi-language support capabilities and communication channels are not detailed in available materials.

Detailed Rating Analysis

Account Conditions Analysis (3/10)

The account conditions evaluation for Han Ba Ltd reveals significant concerns stemming from the broker's high-risk classification and limited transparency regarding account structures. The absence of detailed information about account types, their respective features, and associated terms creates substantial uncertainty for potential traders attempting to understand what services they might receive.

Without clear specification of minimum deposit requirements, account tier benefits, or trading condition variations across different account levels, traders cannot make informed decisions about which account type might suit their needs. This information gap becomes particularly problematic when combined with the broker's suspected fraudulent activity classification. It suggests either inadequate operational infrastructure or deliberate opacity in business practices.

The han ba review process has been hampered by the lack of accessible documentation about account opening procedures, verification requirements, and ongoing account management protocols. User feedback indicates general dissatisfaction with account-related experiences, though specific details about problematic areas remain limited due to the broker's brief operational history.

Compared to established brokers in the forex industry, Han Ba Ltd's account condition transparency falls significantly below standard expectations. This contributes to its low rating in this critical evaluation area.

Han Ba Ltd's offering in terms of trading tools and educational resources appears severely limited based on available information. The absence of detailed descriptions about analytical tools, market research provisions, or educational content suggests either minimal investment in trader support infrastructure or inadequate communication about available resources.

Professional forex trading typically requires access to technical analysis tools, fundamental analysis resources, economic calendars, and educational materials to support informed decision-making. The lack of clear information about such resources raises concerns about the broker's commitment to supporting trader success and professional development.

User feedback regarding tools and resources has been notably negative, with traders expressing disappointment about the limited support available for market analysis and trading education. This deficiency becomes particularly concerning for newer traders who rely heavily on broker-provided educational content and analytical tools to develop their trading skills.

The absence of information about automated trading support, API access, or third-party tool integration further limits the platform's appeal to more sophisticated traders. These traders require advanced functionality for their trading strategies.

Customer Service and Support Analysis (4/10)

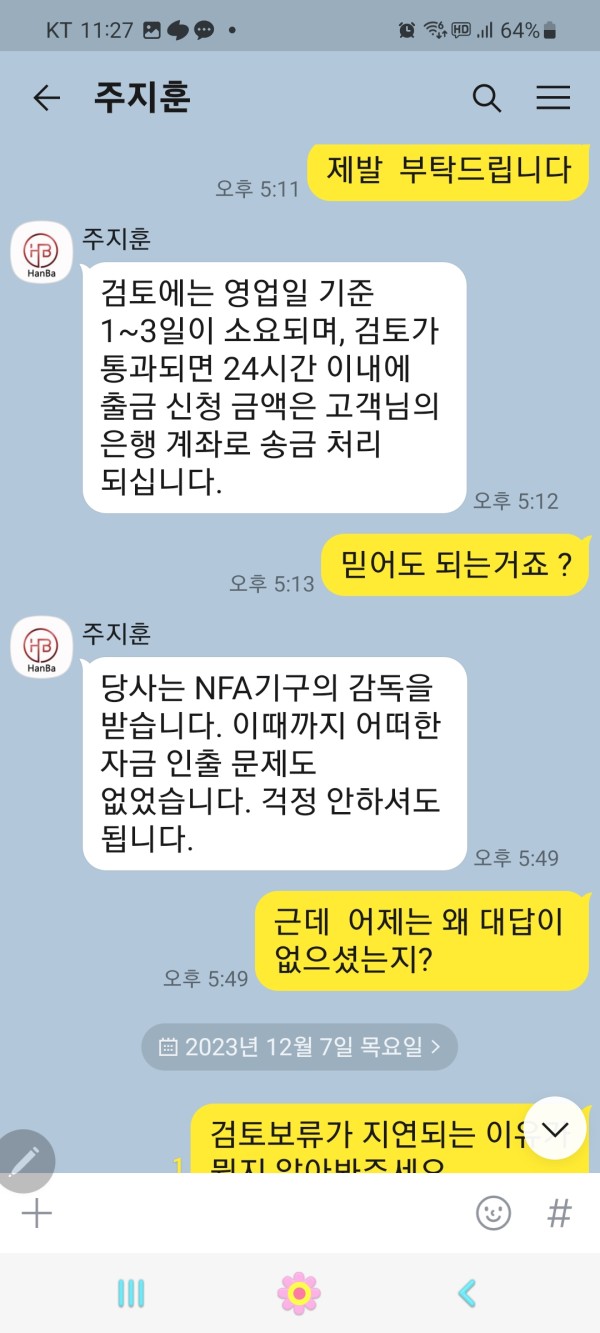

Customer service evaluation for Han Ba Ltd faces significant challenges due to limited information about support channels, availability hours, and service quality standards. The broker's brief operational history provides insufficient data for comprehensive service quality assessment. Available user feedback suggests notable deficiencies in support responsiveness and problem resolution.

The absence of clear information about supported communication channels creates uncertainty about how traders can access assistance when needed. This includes whether support is available through live chat, email, phone support, or social media. This communication gap becomes particularly problematic during urgent situations requiring immediate broker intervention or technical support.

User testimonials indicate frustration with response times and service quality, though the limited volume of feedback makes it difficult to establish consistent patterns of service delivery issues. The lack of multilingual support information also raises questions about the broker's ability to serve international clients effectively.

Given the high-risk classification and suspected fraudulent activities, the customer service concerns take on additional significance. Reliable support becomes crucial when traders encounter problems with their accounts or transactions.

Trading Experience Analysis (3/10)

The trading experience evaluation for Han Ba Ltd is significantly hampered by the lack of detailed information about platform stability, execution quality, and overall trading environment. Without clear specifications about the trading platform technology, server infrastructure, or execution protocols, it becomes difficult to assess the technical quality of the trading experience.

Platform stability and execution speed are critical factors in forex trading success, particularly for strategies requiring precise timing or during high-volatility market conditions. The absence of performance data, uptime statistics, or execution quality metrics prevents accurate assessment of these crucial technical aspects.

User feedback regarding trading experience has been predominantly negative, with concerns raised about overall platform reliability and trading conditions. However, the limited volume of detailed user testimonials makes it challenging to identify specific technical issues or systemic problems with the trading infrastructure.

The han ba review process reveals particular concerns about mobile trading capabilities, advanced order types, and professional trading tools that experienced traders typically require for effective market participation. These deficiencies contribute to the platform's low rating in trading experience quality.

Trust and Safety Analysis (2/10)

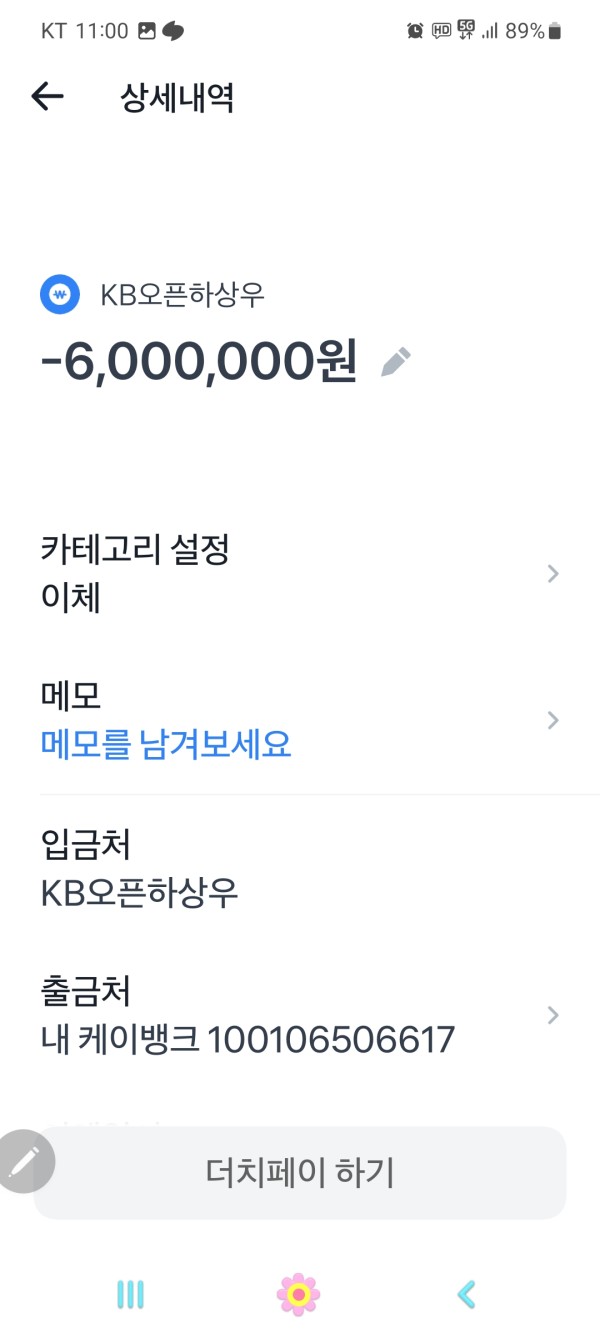

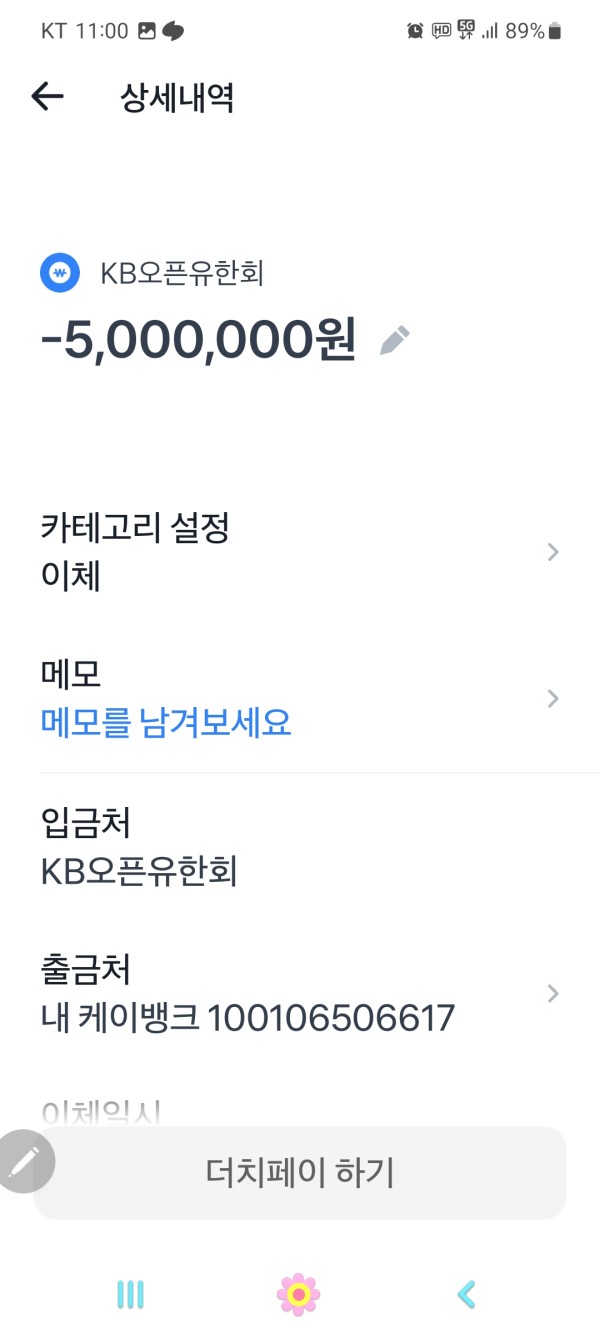

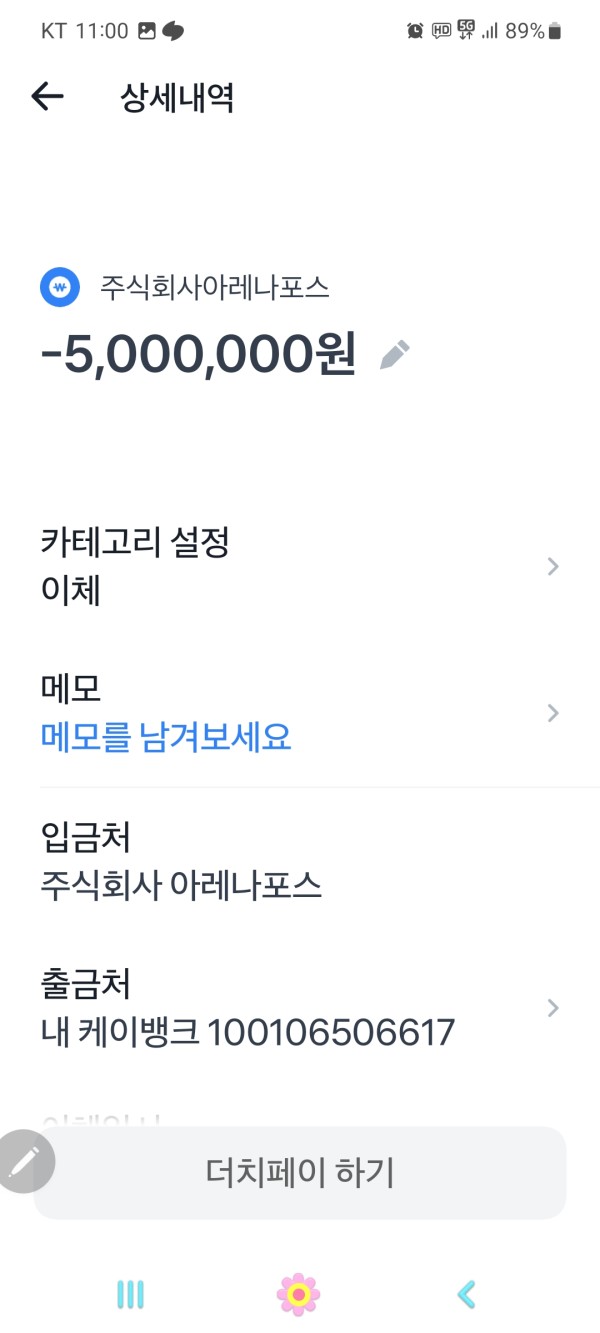

Trust and safety represent the most concerning aspects of Han Ba Ltd's operations, with the broker receiving a high-risk classification that includes suspected fraudulent activities. This classification fundamentally undermines the platform's credibility and raises serious questions about capital safety for potential traders.

The regulatory status ambiguity, despite claims of US-based operations, creates additional trust concerns. Legitimate forex brokers typically provide clear regulatory information, license numbers, and compliance documentation to demonstrate their authorization to provide financial services. The absence of such transparency represents a significant red flag for potential traders.

Industry monitoring services have flagged Han Ba Ltd as a high-risk entity, suggesting that professional risk assessment protocols have identified concerning patterns in the broker's operations or business practices. Such classifications are not assigned lightly and typically indicate serious operational or compliance issues.

The combination of suspected fraudulent activity, regulatory ambiguity, and limited operational transparency creates a trust profile that falls well below industry standards for reputable forex brokers. These factors contribute to the extremely low rating in this critical evaluation category.

User Experience Analysis (3/10)

User experience evaluation for Han Ba Ltd reveals predominantly negative feedback from the limited pool of traders who have engaged with the platform. The overall user satisfaction appears significantly below industry standards. Particular concerns exist about platform reliability and service quality.

The broker's brief operational history limits the available user feedback volume, though existing testimonials consistently highlight concerns about the trading environment and overall service delivery. Users have expressed particular frustration with the lack of transparency and unclear operational procedures.

Interface design and platform usability information is notably absent from available materials, preventing assessment of the user-friendly features and navigation quality that modern traders expect. The absence of detailed onboarding process descriptions also raises questions about new user experience and account setup procedures.

Common user complaints center around the high-risk nature of the platform and concerns about capital safety, reflecting the broader trust issues that characterize the broker's market reputation. These consistent negative themes contribute to the low rating in user experience quality.

Conclusion

Our comprehensive han ba review reveals a forex broker that presents significant risks and concerns for potential traders. Han Ba Ltd's high-risk classification, suspected fraudulent activities, and lack of operational transparency create a profile that falls well below industry standards for reputable forex brokerage services.

While the broker may appeal to extremely risk-tolerant traders willing to navigate uncertain regulatory and operational environments, the overwhelming evidence suggests that most traders would benefit from choosing more established alternatives. Properly regulated alternatives with clearer operational transparency and stronger trust credentials would serve most traders better.

The combination of limited service information, negative user feedback, and industry risk warnings creates a compelling case for extreme caution when considering Han Ba Ltd for forex trading activities. Traders prioritizing capital safety and reliable service delivery should carefully evaluate these concerns before making any engagement decisions.