Executive Summary

Decho Capital Limited is a new forex broker that started in 2023. The company has its headquarters in Australia, and it has received mixed feedback from users who have tried their services. According to WikiFX monitor data, Decho Capital Limited has received 1 positive review, 1 neutral review, and 4 exposure reviews from real users, which shows that people have different opinions about this trading platform.

The broker offers many different types of investments. You can trade forex pairs, stocks, commodities, stock indices, and major cryptocurrencies through their platform, which gives traders lots of options to choose from. One thing they focus on is providing educational resources to help users make smart investment choices, and they also have a mobile app that works but could use more features.

This decho capital limited review is for traders who want different trading options and educational help. However, people thinking about using this broker should know that there isn't much clear information about account conditions, regulatory status, and how they operate day-to-day.

Important Disclaimers

Decho Capital Limited is new to the market, so regulatory information isn't clearly available. Users should be careful because different countries have different legal requirements that could affect how they trade, and the lack of clear regulatory oversight might create extra risks for people who want to use their services.

This review uses information that anyone can find, user feedback, and market analysis from 2025. The way we evaluated them includes looking at user reviews from different sources, checking out what features the broker offers, and comparing them to what other brokers in the industry provide, but readers should do their own research before making any investment decisions.

Rating Framework

Broker Overview

Decho Capital Limited started in 2023 in Australia's forex market. The company is new to the competitive foreign exchange world, and it has set itself up as a platform where people can trade many different types of financial products including forex pairs, stocks, commodities, major stock indices, and cryptocurrency markets that are becoming more popular.

The company focuses on education along with trading services because they know that traders who understand the market make better decisions. This educational approach seems to be one of the things that makes them different from other brokers in a crowded marketplace, and according to what we can find, Decho Capital Limited lets people trade forex pairs, stocks, commodities, stock indices, and major virtual currencies.

However, this decho capital limited review has to point out that we don't have clear details about their trading platforms. The broker's regulatory status and compliance rules aren't clearly explained in the information we can access, which is something important for people who want to know if their services are safe and legitimate.

Regulatory Jurisdiction: We don't have detailed information about which regulators watch over them, and this raises important questions about compliance and how they protect clients.

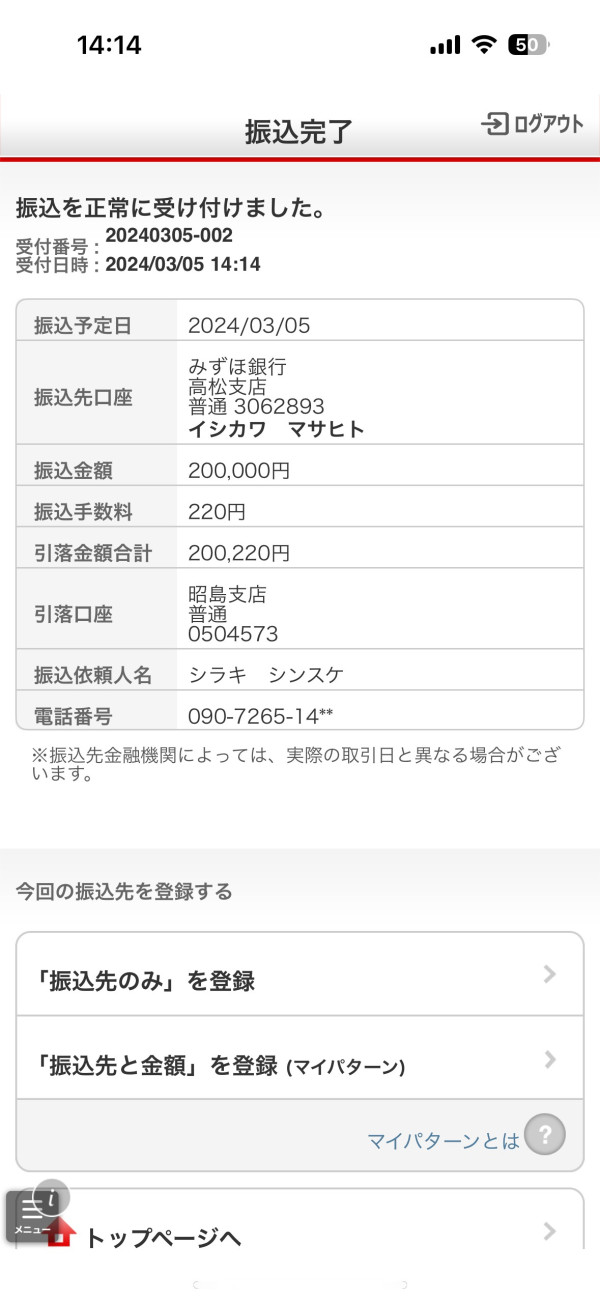

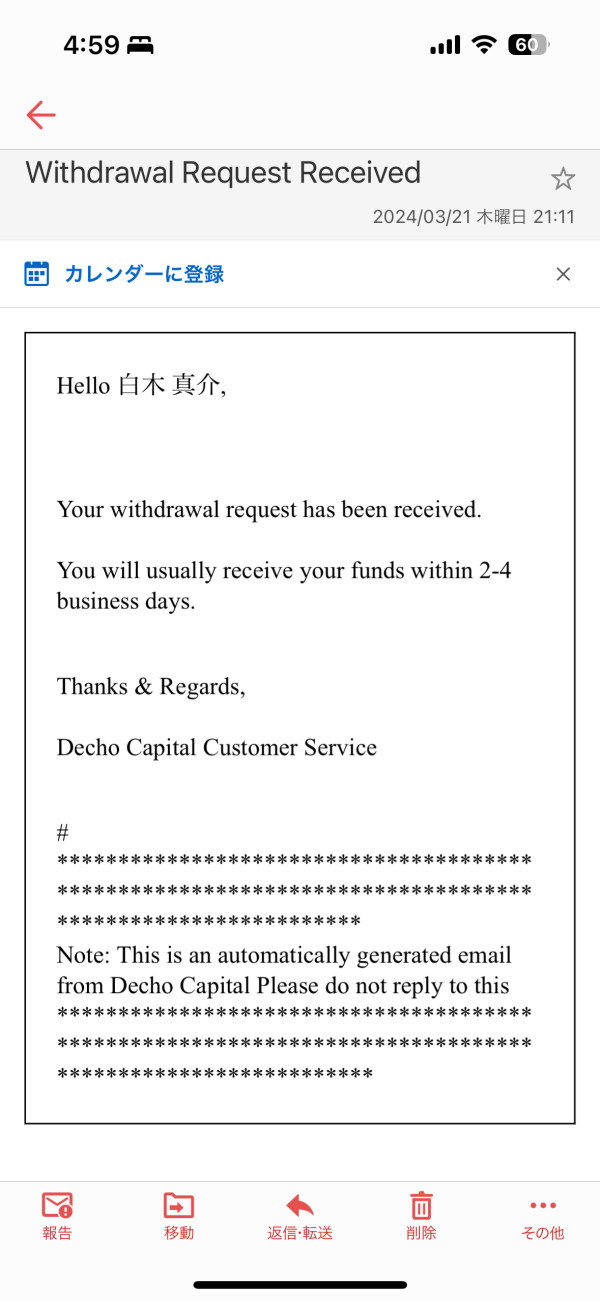

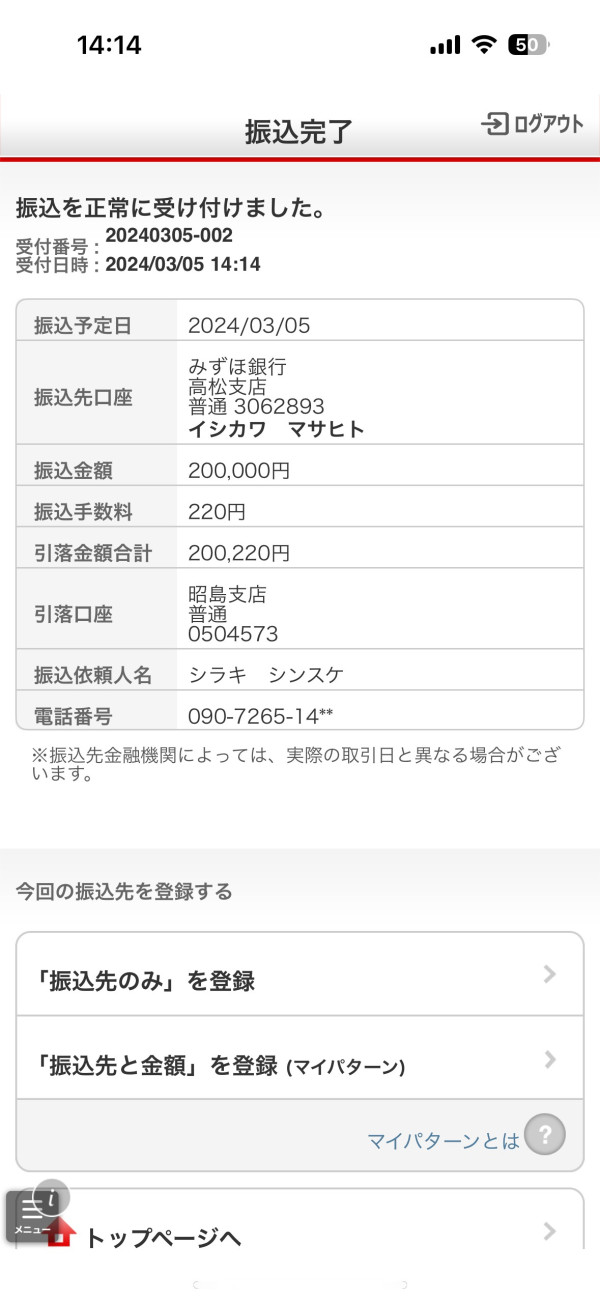

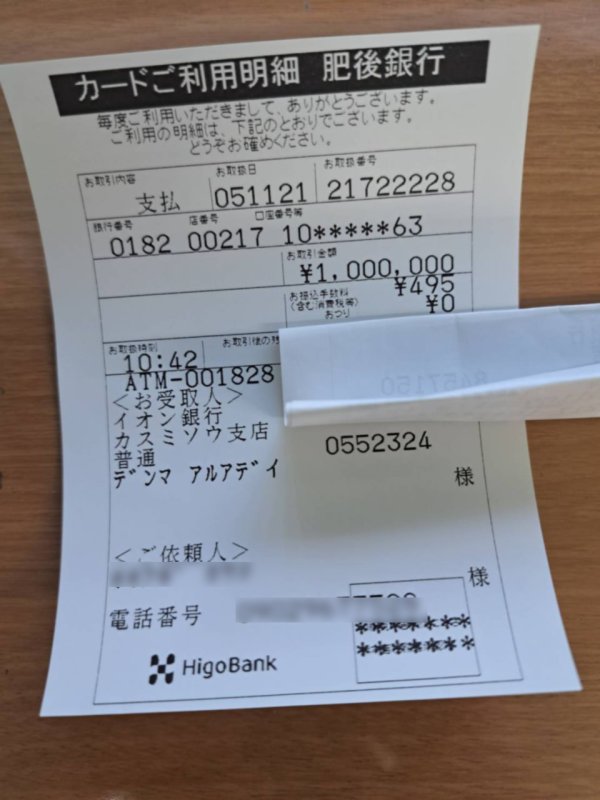

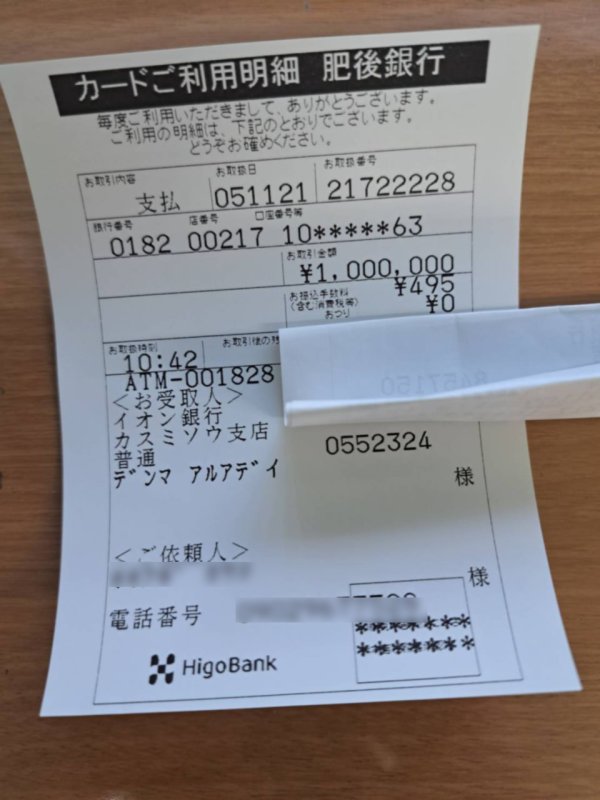

Deposit and Withdrawal Methods: The information about how you can fund your account and take money out isn't clearly explained in the materials we can find.

Minimum Deposit Requirements: They don't tell us how much money you need to start an account with Decho Capital Limited.

Bonuses and Promotions: We don't see any details about special offers or bonus programs in the information we can access.

Tradeable Assets: The broker lets you access forex pairs, stocks, commodities, stock indices, and major cryptocurrencies, so traders can invest in different markets. However, they don't clearly explain their commission structures and fee schedules in the current documentation we found.

Cost Structure: The information we have says that spreads depend on which currency pairs you're trading.

Leverage Ratios: The broker offers maximum leverage of up to 1:100, which is normal for retail forex trading. We don't have comprehensive details about specific trading platforms in the sources we can find, but they do mention having a mobile application.

Platform Options: Information about which regions can't use their services isn't listed in current documentation.

Geographic Restrictions: We don't have details about what language options are available for customer service.

Customer Support Languages: This decho capital limited review shows that they need to be more transparent about how they operate and make client information easier to find.

Detailed Rating Analysis

Account Conditions Analysis (Score: 4/10)

The account conditions that Decho Capital Limited offers have several problems mainly because they don't provide clear information. Account type varieties and characteristics aren't clearly explained in the documentation we can find, so potential clients can't understand what options they have available to them, and this lack of clarity really hurts how accessible and user-friendly the broker is.

Minimum deposit requirements are another area where information is missing. Traders can't plan their investment strategies properly or figure out if the broker fits their budget when they don't know the deposit thresholds, and this information gap is especially bad for new traders who need to understand what it costs to get started.

The account opening process isn't detailed in available sources, so potential clients don't know about verification requirements, what documents they need, and how long it takes to activate an account. Special account features like Islamic accounts, VIP levels, or institutional offerings aren't mentioned in current documentation either.

User feedback about account conditions is limited in the sources we can find, so it's hard to know what real-world experiences are like with account setup and management. The lack of comprehensive information about account structures and conditions really impacts this decho capital limited review and shows an area where the broker needs to improve transparency and client communication a lot.

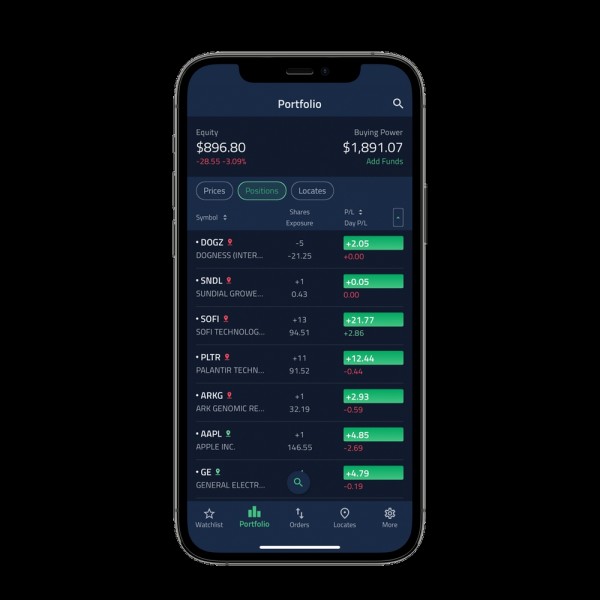

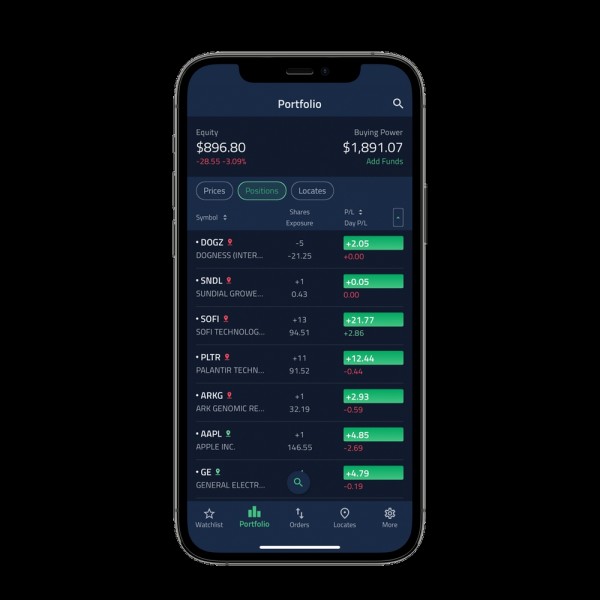

Decho Capital Limited's trading tools and resources show both good points and areas that need big improvements. Trading tool variety and quality seem to be basic, with users describing the mobile application as functional but missing additional features that could make trading better, which suggests that while you can do core trading, the platform might not have the advanced tools that experienced traders usually want.

Research and analysis resources aren't specifically detailed in available documentation, and this is a big gap for traders who need market analysis, economic calendars, or technical indicators to make trading decisions. Modern forex trading depends more and more on comprehensive analytical tools, so the apparent lack of detailed research resources might make the platform less appealing to serious traders.

Educational resources are one of the features the broker highlights, with the company emphasizing that it wants to help users make informed investment decisions. However, we don't have comprehensive details about the scope, quality, and format of these educational materials in available sources.

Automated trading support and algorithmic trading capabilities aren't mentioned in current documentation, which might make the platform less appealing to traders who use expert advisors or automated trading strategies. The mobile application works, but reports say it could benefit from additional features to compete effectively with more established brokers in the market.

Customer Service and Support Analysis (Score: 6/10)

Customer service and support at Decho Capital Limited show moderate performance based on available user feedback, but we don't have comprehensive details about support infrastructure. Customer service channels and availability aren't specifically outlined in accessible documentation, so it's hard to assess how accessible and responsive their support team is.

Response times and service quality metrics aren't detailed in current sources, though having both positive and neutral user reviews suggests that some clients have had satisfactory experiences with the broker's support services. The mixed nature of user feedback shows that service quality might be inconsistent or depend on specific circumstances.

Service quality seems to vary based on user experiences, with WikiFX monitoring data showing 1 positive review and 1 neutral review alongside 4 exposure reviews. This distribution suggests that while some users have had acceptable experiences, there are notable concerns that have led to negative feedback from other clients.

Multilingual support capabilities and customer service hours aren't specified in available documentation, which might impact international clients who need support in their native languages or help outside standard business hours. The lack of detailed support information is an area where greater transparency would benefit potential clients making platform decisions.

Trading Experience Analysis (Score: 5/10)

The trading experience that Decho Capital Limited offers has several uncertain areas because of limited detailed feedback and platform information. Platform stability and speed aren't comprehensively addressed in available user reviews, so it's difficult to assess the technical reliability that traders can expect during market hours or high-volatility periods.

Order execution quality isn't specifically detailed in current documentation or user feedback, and this is a critical gap since execution speed and accuracy directly impact trading profitability. Professional traders especially need detailed information about slippage, requotes, and execution speeds to evaluate if a platform is suitable for them.

Platform functionality completeness remains unclear based on available sources, though the mention of a mobile application suggests that the broker has invested in mobile trading capabilities. However, user feedback shows that the mobile app is functional but could benefit from additional features, which suggests that current functionality might be basic compared to industry standards.

Mobile trading experience appears to be a focus area for the broker, with a dedicated mobile application available. User reviews suggest that while the app works, it lacks advanced features that could enhance the trading experience, and this shows potential for improvement in mobile platform development.

Trading environment characteristics, including the spread structure that depends on currency pairs, suggest a variable cost model. However, without detailed information about typical spread ranges, commission structures, or market making versus ECN models, this decho capital limited review cannot provide comprehensive assessment of the trading conditions traders can expect.

Trust and Security Analysis (Score: 4/10)

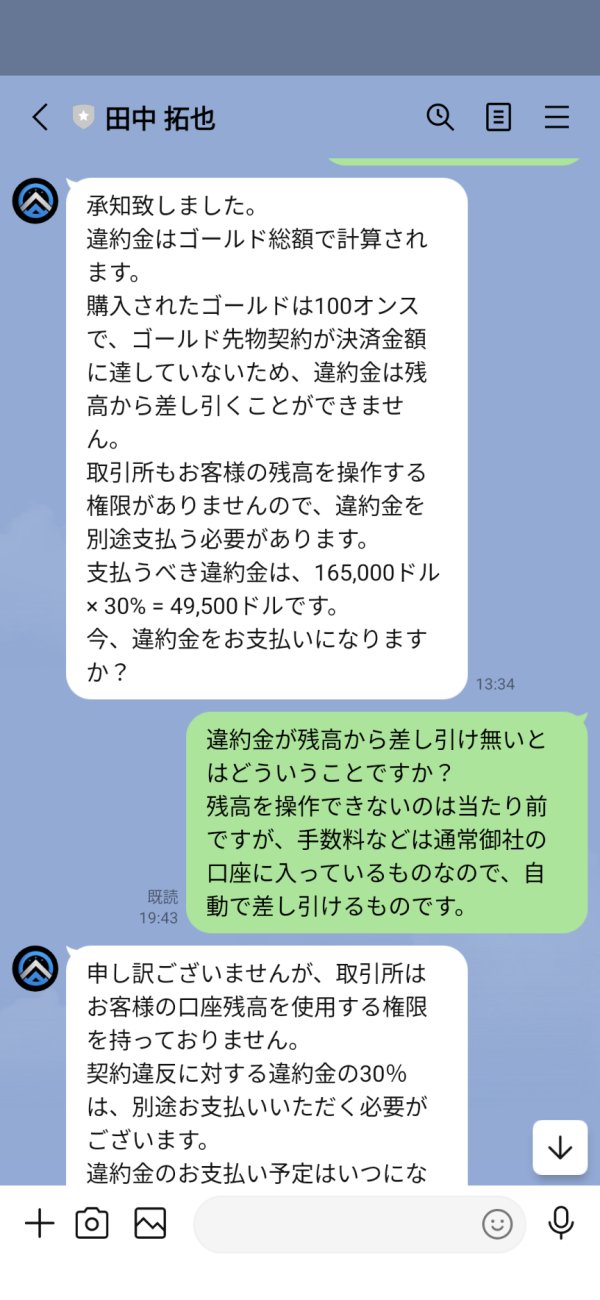

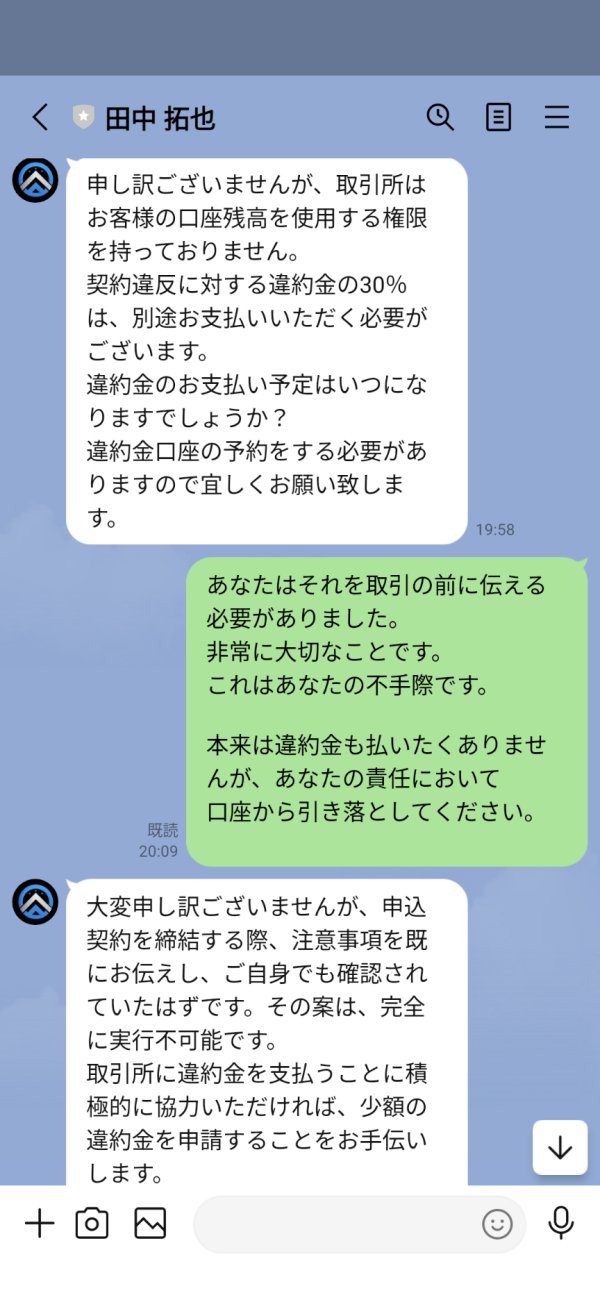

Trust and security are big areas of concern for Decho Capital Limited, mainly because there's limited transparency about regulatory oversight and client protection measures. Regulatory credentials aren't clearly specified in available documentation, and this is particularly concerning for a financial services provider where regulatory compliance is fundamental to client protection and operational legitimacy.

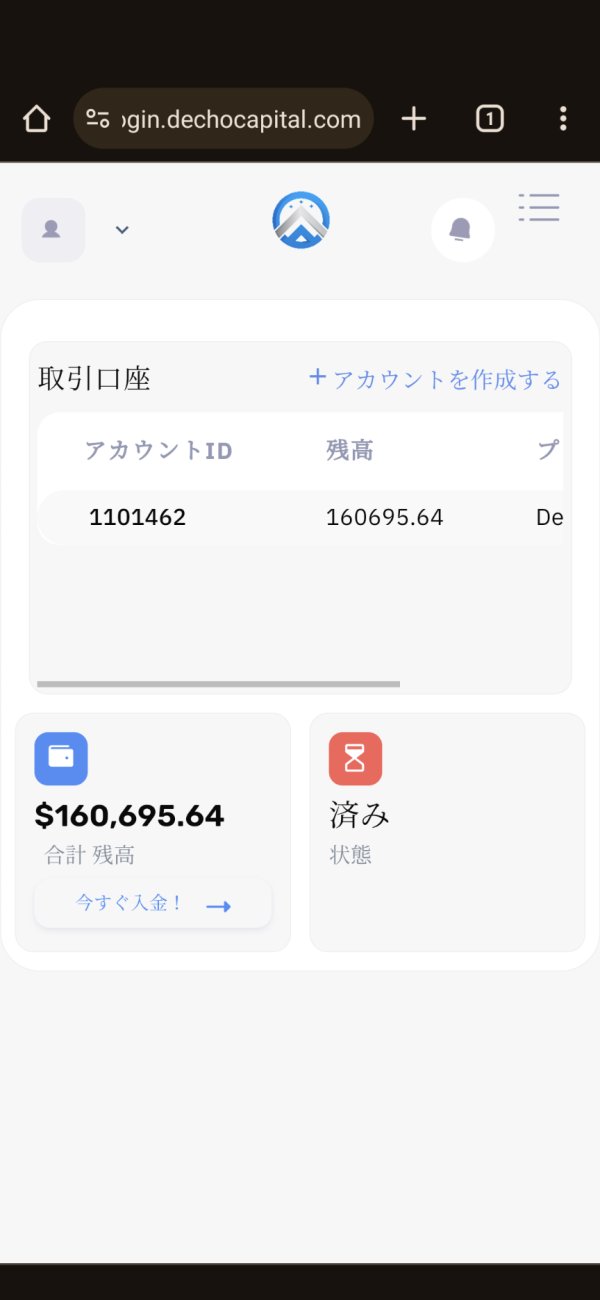

Fund safety measures aren't detailed in current sources, so potential clients don't know about segregation of client funds, insurance coverage, or protection schemes that might safeguard their investments. This lack of transparency about client fund protection is a major consideration for traders evaluating platform safety.

Company transparency is limited based on available information, with key operational details, regulatory status, and corporate governance information not readily accessible. Transparency is crucial in financial services, and the current information gaps may concern potential clients seeking comprehensive due diligence.

Industry reputation is still developing since the company recently started in 2023. As a new market participant, Decho Capital Limited hasn't had enough time to build the track record and industry standing that established brokers have, and the mixed user feedback, including 4 exposure reviews alongside positive and neutral reviews, suggests that reputation building is still a work in progress.

Negative event handling capabilities can't be adequately assessed based on available information, though the presence of exposure reviews suggests that some users have experienced issues that warranted public reporting. How the company addresses and resolves such concerns will be crucial for long-term reputation development.

User Experience Analysis (Score: 5/10)

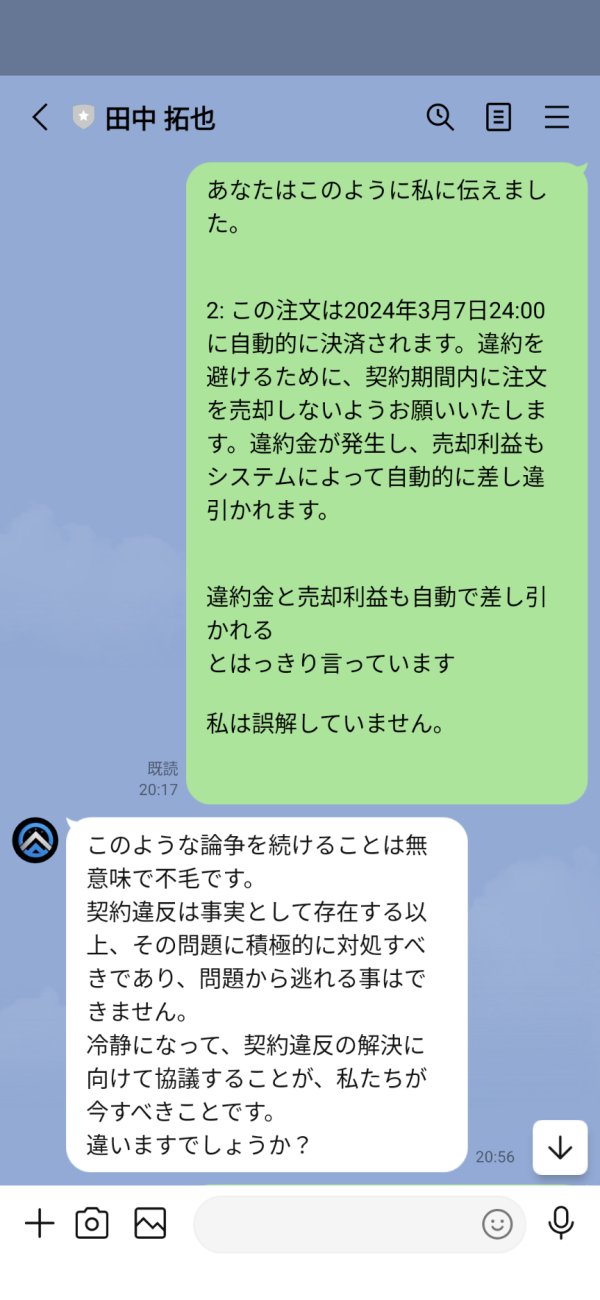

User experience with Decho Capital Limited shows a mixed picture based on available feedback and documented features. Overall user satisfaction appears varied, with WikiFX data showing 1 positive review, 1 neutral review, and 4 exposure reviews, which means that user experiences have been inconsistent across different clients and situations.

Interface design and usability aren't comprehensively detailed in available sources, though the existence of a mobile application suggests some attention to user interface development. However, feedback showing that the mobile app could benefit from additional features suggests that current design may not meet all user expectations or industry standards.

Registration and verification processes aren't specifically outlined in accessible documentation, so it's difficult for potential clients to understand what to expect during account opening. Clear, streamlined onboarding processes are crucial for positive initial user experiences.

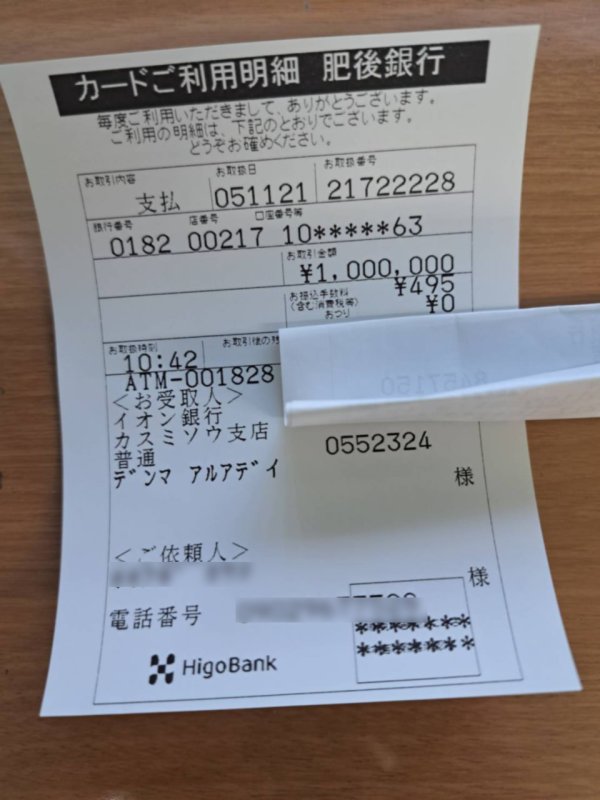

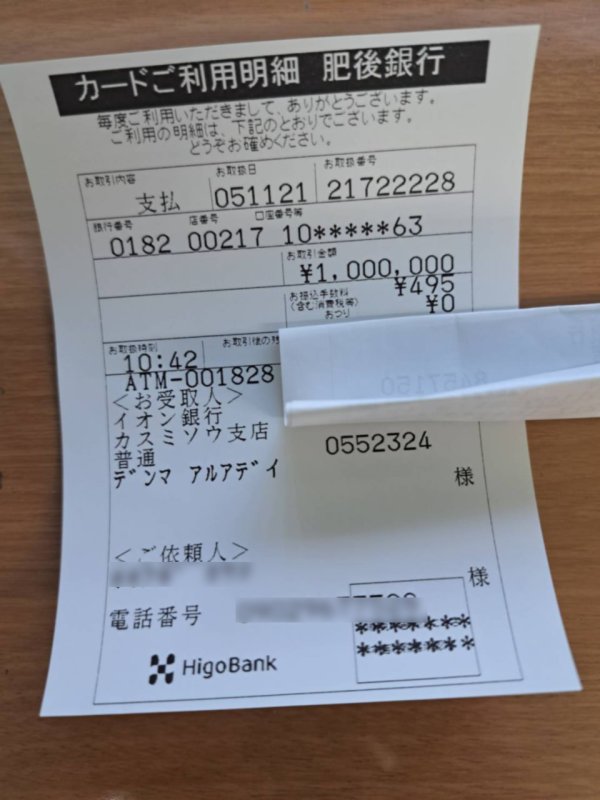

Fund operation experience regarding deposits, withdrawals, and account management isn't detailed in current sources, and this represents a significant information gap for users who need to understand the practical aspects of account funding and money management.

Common user complaints appear to be reflected in the exposure reviews mentioned in WikiFX data, though we don't have comprehensive details about these specific concerns in available sources. The presence of negative feedback alongside positive reviews suggests that user experience quality may be inconsistent or dependent on individual circumstances and expectations.

Conclusion

This decho capital limited review reveals a broker that shows potential but faces significant challenges in transparency and client communication. As an emerging forex broker established in 2023, Decho Capital Limited offers diversified asset selection including forex, stocks, commodities, indices, and cryptocurrencies, along with educational resources to support trader development, but the lack of clear regulatory information, limited transparency regarding account conditions, and mixed user feedback present important considerations for potential clients.

The broker appears most suitable for traders seeking diversified trading opportunities and educational support, particularly those who value access to multiple asset classes within a single platform. However, traders prioritizing regulatory transparency, comprehensive platform features, or established track records may want to consider more established alternatives.

Key advantages include asset diversity and educational resource availability, while primary disadvantages center on limited transparency regarding account conditions, regulatory oversight, and operational details. Potential clients should carefully evaluate their priorities and risk tolerance before engaging with this relatively new market participant.