Is Han Ba safe?

Pros

Cons

Is Han Ba Safe or a Scam?

Introduction

Han Ba is a forex broker that has emerged in the competitive landscape of the foreign exchange market, targeting both novice and experienced traders. As the forex market continues to grow, it becomes increasingly vital for traders to assess the legitimacy and reliability of brokers like Han Ba. With numerous reports of scams and fraudulent activities in the forex industry, traders must exercise caution and conduct thorough research before investing their hard-earned money. This article aims to provide an objective evaluation of Han Ba, utilizing various sources and analytical frameworks to determine whether it is safe or potentially a scam.

Regulation and Legitimacy

The regulatory status of a forex broker is one of the most critical aspects to consider when evaluating its safety. A well-regulated broker is generally seen as more trustworthy, as regulatory bodies enforce strict standards to protect investors. Han Ba claims to be regulated, but there are discrepancies regarding its licensing and operational legitimacy.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FinCEN | N/A | United States | Regulated |

Although Han Ba asserts compliance with regulatory standards, it is essential to note that the broker does not hold a license from a top-tier regulator, such as the FCA (UK) or ASIC (Australia). Instead, it operates under less stringent regulations that may not provide the same level of investor protection. The lack of a robust regulatory framework raises concerns about the broker's operational practices and potential risks for traders.

Company Background Investigation

Han Ba's history and corporate structure offer further insight into its legitimacy. Established recently, the broker has quickly gained attention but lacks a transparent history that would typically inspire confidence. The ownership structure remains ambiguous, with limited information available about its founders or management team.

The management teams background is crucial in assessing the broker's credibility. Unfortunately, there is scant information regarding the expertise and experience of those at the helm of Han Ba. This lack of transparency can be a red flag for potential investors, as it raises questions about the broker's commitment to ethical practices and customer service.

Trading Conditions Analysis

Understanding the trading conditions offered by Han Ba is essential for evaluating its overall value proposition. The broker presents a variety of trading accounts, each with different fee structures. However, the overall cost of trading with Han Ba can be concerning.

| Fee Type | Han Ba | Industry Average |

|---|---|---|

| Spread on Major Pairs | Variable | 1.0 pips |

| Commission Structure | N/A | Varies |

| Overnight Interest Range | High | Moderate |

While Han Ba claims to offer competitive spreads, the absence of a clear commission structure may lead to unexpected costs for traders. Additionally, the overnight interest rates appear to be higher than the industry average, which could impact long-term trading strategies. Traders should proceed with caution and thoroughly review all fees before committing to this broker.

Client Fund Safety

The safety of client funds is paramount when assessing any forex broker. Han Ba's measures for securing client funds are not well-documented, leading to concerns regarding investor protection.

The broker's website does not provide clear information on whether client funds are kept in segregated accounts or whether there are any investor protection schemes in place. This lack of clarity is alarming, especially considering the history of financial disputes involving forex brokers.

Moreover, there have been no reported incidents of fund security breaches or disputes with Han Ba, but the absence of transparency regarding its safety measures is a significant concern for potential clients.

Customer Experience and Complaints

Customer feedback is an invaluable resource for assessing the overall experience with a broker. Initial reviews of Han Ba indicate a mix of positive and negative experiences among traders.

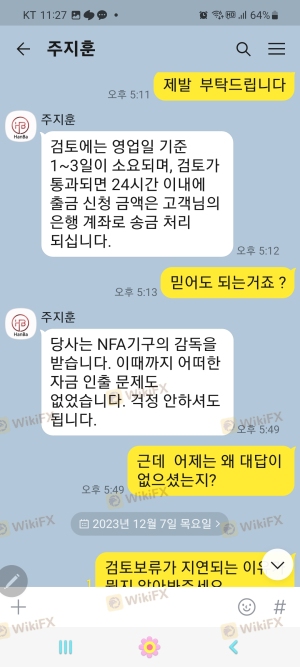

Common complaints include difficulties in withdrawing funds and unresponsive customer service. These issues can significantly impact a trader's experience and raise questions about the broker's operational integrity.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow Response |

| Customer Service Quality | Medium | Mixed Reviews |

One notable case involved a trader who struggled to withdraw funds after a series of positive trading experiences. The broker's slow response and lack of clear communication left the trader feeling frustrated and concerned about the legitimacy of Han Ba. Such complaints underscore the importance of evaluating customer service quality when considering whether Han Ba is safe.

Platform and Trade Execution

The trading platform is another critical aspect of evaluating Han Ba. The broker provides access to industry-standard trading software, but user experiences vary.

Many users report that while the platform is user-friendly, it can be clunky compared to competitors. Additionally, concerns about order execution quality, including slippage and rejected orders, have been raised. These issues can negatively affect a trader's performance and profitability, leading to further skepticism regarding Han Ba's reliability.

Risk Assessment

Evaluating the risks associated with using Han Ba is essential for prospective traders.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Lack of top-tier regulation |

| Financial Risk | Medium | High overnight interest rates |

| Operational Risk | Medium | Customer service issues |

The overall risk profile of Han Ba suggests that potential traders should approach with caution. The high regulatory risk stemming from the broker's questionable licensing status is particularly concerning. To mitigate risks, traders should consider starting with a small investment and closely monitoring their experiences.

Conclusion and Recommendations

After a thorough evaluation of Han Ba, it is evident that while the broker offers some attractive features, significant concerns about its regulatory status, customer service, and overall transparency persist.

In conclusion, is Han Ba safe? The evidence suggests that potential traders should exercise caution. The lack of robust regulatory oversight and transparency raises red flags that could indicate a higher risk of encountering issues. For traders seeking a more secure trading environment, it may be prudent to explore alternative brokers with reputable regulatory standings and proven track records.

In summary, if you are considering trading with Han Ba, ensure you conduct your due diligence and consider starting with a minimal investment. Additionally, explore other brokers that are well-regulated and have a strong reputation in the industry to ensure a safer trading experience.

Is Han Ba a scam, or is it legit?

The latest exposure and evaluation content of Han Ba brokers.

Han Ba Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Han Ba latest industry rating score is 1.37, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.37 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.