Is IsandisoFX safe?

Pros

Cons

Is IsandisoFX A Scam?

Introduction

IsandisoFX is a forex broker based in South Africa, offering a range of trading services in foreign exchange, commodities, indices, and contracts for difference (CFDs). As the forex market continues to expand, traders are increasingly seeking reliable platforms to engage in trading activities. However, the proliferation of online brokers also raises concerns about potential scams and fraudulent practices. Therefore, it is crucial for traders to conduct thorough evaluations of forex brokers before committing their funds. This article aims to assess the credibility of IsandisoFX by analyzing its regulatory status, company background, trading conditions, customer safety measures, user feedback, and overall risk profile.

Regulation and Legitimacy

The regulatory framework within which a broker operates is a critical factor in determining its legitimacy. IsandisoFX claims to be regulated by the Financial Sector Conduct Authority (FSCA) in South Africa, which is responsible for overseeing financial institutions and ensuring compliance with market conduct regulations. The FSCA's role is to protect financial customers and promote fair treatment by financial institutions. Below is a summary of IsandisoFX's regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FSCA | 52985 | South Africa | Verified |

While IsandisoFX is indeed registered with the FSCA, it is essential to note that this regulatory body is not considered a top-tier regulator compared to authorities such as the UKs Financial Conduct Authority (FCA) or the US Commodity Futures Trading Commission (CFTC). Additionally, there are concerns regarding the broker's compliance history, with reports indicating that its license may have been canceled or is under scrutiny. This raises red flags about the broker's operational legitimacy and adherence to regulatory standards.

Company Background Investigation

IsandisoFX operates under the ownership of Isandiso Sethu Investments (Pty) Ltd., which was established in 2021. The company is headquartered in Umhlanga Rocks, Durban, South Africa. Despite its relatively short history, the broker claims to offer a robust trading environment with advanced trading technology and a user-friendly interface. However, the limited operational history raises questions regarding the company's experience and stability in the highly competitive forex market.

The management team's background is another crucial aspect to consider. Unfortunately, detailed information about the team‘s qualifications and industry experience is scarce. Transparency in disclosing the management team’s expertise is vital for building trust among potential clients. The lack of comprehensive information about the company's ownership structure and management raises concerns about its transparency and accountability.

Trading Conditions Analysis

IsandisoFX provides various trading conditions, including multiple account types with different minimum deposit requirements. The broker claims to offer competitive spreads starting from 1.2 pips and leverage of up to 1:400. However, traders should be cautious about the overall fee structure, as some brokers may impose hidden fees that can significantly affect trading profitability. Below is a comparison of IsandisoFX's core trading costs:

| Fee Type | IsandisoFX | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.2 pips | 1.0 - 1.5 pips |

| Commission Structure | None | Varies |

| Overnight Interest Range | Varies | Varies |

While the broker advertises a zero-commission model, traders should remain vigilant for any unusual fee policies that may arise, particularly concerning withdrawal fees or inactivity charges. An analysis of the overall trading costs suggests that IsandisoFX may not be as competitive as other brokers in the industry, which could impact traders' overall profitability.

Client Fund Safety

The safety of client funds is paramount when selecting a forex broker. IsandisoFX claims to implement measures to safeguard client deposits, including segregating client funds from the company's operational funds. This practice is essential for ensuring that client funds are protected in case of financial difficulties faced by the broker. However, the broker's transparency regarding its investor protection policies is limited, which raises concerns about the adequacy of these safety measures.

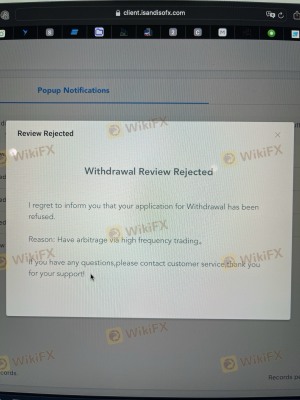

Furthermore, there is no clear indication that IsandisoFX offers negative balance protection, which is a critical feature that prevents clients from losing more money than they have deposited. Historical complaints regarding fund withdrawals and potential security breaches have also been noted, indicating that traders should exercise caution when considering depositing funds with this broker.

Customer Experience and Complaints

Customer feedback is an essential component in evaluating a broker's reliability. Reviews of IsandisoFX indicate a mixed bag of experiences, with some users praising the trading platform's user interface and execution speed, while others have raised concerns about withdrawal issues and lack of responsive customer support. Below is a summary of common complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Lack of Support | Medium | Fair |

| Account Verification Issues | High | Poor |

Several users have reported difficulties in withdrawing their funds, claiming that requests were either delayed or unprocessed. Such issues are particularly alarming, as they can lead to significant financial losses for traders. Additionally, the company's response to customer complaints appears to be inadequate, further eroding trust among existing and potential clients.

Platform and Trade Execution

IsandisoFX utilizes the MetaTrader 5 (MT5) trading platform, which is widely recognized for its advanced features and user-friendly interface. The platform allows traders to access various financial instruments and provides tools for technical analysis and automated trading. However, user experiences regarding order execution quality vary, with some traders reporting instances of slippage and rejected orders.

Concerns about potential platform manipulation have also surfaced, particularly regarding the broker's claims of zero fees and spreads. Traders should remain vigilant and conduct thorough testing of the platform to ensure that it meets their trading needs without unexpected issues.

Risk Assessment

Assessing the overall risk associated with trading with IsandisoFX is crucial for informed decision-making. The following risk assessment summarizes key risk areas:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Compliance | High | Potential issues with FSCA compliance |

| Fund Safety | Medium | Lack of clarity on protection measures |

| Customer Support | High | Frequent complaints about responsiveness |

| Trading Conditions | Medium | Higher spreads compared to industry standards |

To mitigate risks, traders should consider diversifying their trading portfolio and not investing more than they can afford to lose. Additionally, conducting further research into alternative brokers with better regulatory standing and customer support may be prudent.

Conclusion and Recommendations

In conclusion, while IsandisoFX presents itself as a legitimate forex broker regulated by the FSCA, several red flags warrant caution. The broker's limited operational history, mixed customer feedback, and potential issues with fund safety and withdrawal processes raise concerns about its overall reliability. Traders should be particularly wary of the reported withdrawal delays and the broker's lack of transparency regarding fees and investor protection measures.

For traders seeking a more secure and trustworthy trading environment, it may be advisable to explore alternative brokers with robust regulatory oversight and positive customer reviews. Reputable options include brokers regulated by top-tier authorities like the FCA or ASIC, which offer enhanced security for client funds and better overall trading conditions.

Is IsandisoFX a scam, or is it legit?

The latest exposure and evaluation content of IsandisoFX brokers.

IsandisoFX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

IsandisoFX latest industry rating score is 1.37, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.37 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.