Is Smart Global safe?

Pros

Cons

Is Smart Global A Scam?

Introduction

Smart Global is a forex broker that claims to offer a range of trading services, including foreign exchange, precious metals, crude oil, indices, and cryptocurrencies. Established in the United States, Smart Global aims to cater to both individual and institutional investors. However, in an industry rife with scams and unreliable brokers, it is crucial for traders to conduct thorough due diligence before engaging with any financial service provider. This article investigates Smart Global by examining its regulatory status, company background, trading conditions, customer experiences, and overall risk profile. Our analysis is based on data collected from various reputable financial websites and user reviews to provide a comprehensive overview of Smart Global's credibility.

Regulatory and Legitimacy

The regulatory environment is a vital aspect of any forex broker's legitimacy. A broker's regulatory status not only signifies adherence to industry standards but also provides a level of investor protection. Smart Global claims to operate under a license from the National Futures Association (NFA), with an associated license number. However, investigations reveal that Smart Global is not a member of the NFA and lacks proper regulation from any recognized authority. Instead, it holds a license from the U.S. Money Services Business (MSB), which does not provide the same level of oversight or investor protection.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| National Futures Association (NFA) | 0561418 | United States | Not a member |

| U.S. Money Services Business (MSB) | 31000263262302 | United States | Valid but limited oversight |

The lack of regulation from a reputable authority like the NFA raises serious concerns about Smart Global's credibility. Without stringent regulatory oversight, investors may be more vulnerable to potential fraud or mismanagement of funds. Furthermore, the discrepancies between the claimed and actual regulatory status diminish the broker's trustworthiness. Therefore, it is advisable for traders to exercise extreme caution when considering Smart Global as their forex broker.

Company Background Investigation

Smart Global was founded in 2023, and its operational history is relatively short compared to more established brokers. The company claims to be located at 7th Street, 40 E 7th St, New York, NY 10003, but searches in the New York State Department of Business reveal no registration information for Smart Global. This raises concerns about the authenticity of the company's claims and its overall transparency.

The management team behind Smart Global has not been publicly disclosed, which further complicates the assessment of the company's credibility. A lack of information about the management's professional experience and qualifications can lead to skepticism about the broker's operational integrity. Transparency is essential in the financial services sector, and Smart Global's failure to provide adequate information about its ownership and management team is a significant red flag.

Trading Conditions Analysis

Smart Global advertises a variety of trading instruments, including forex, precious metals, and cryptocurrencies. However, it lacks clarity regarding its fee structure and trading conditions. The absence of detailed information about account types, leverage, and spreads makes it difficult for potential investors to assess the overall cost of trading on the platform.

| Fee Type | Smart Global | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Not disclosed | 1-3 pips |

| Commission Model | Not disclosed | Varies by broker |

| Overnight Interest Range | Not disclosed | Varies by broker |

The lack of transparency regarding trading costs is concerning, as it may lead to unexpected fees that can erode trading profits. Furthermore, the absence of a clear commission structure raises questions about the broker's overall trading model. Traders should be wary of brokers that do not provide comprehensive information about their trading conditions, as it may indicate a lack of professionalism or a hidden agenda.

Client Fund Safety

The safety of client funds is paramount when selecting a forex broker. Smart Global claims to implement various security measures, but specific details about fund segregation, investor protection, and negative balance protection are not readily available on its website. The absence of this critical information raises concerns about the safety of client funds and the broker's commitment to safeguarding investor interests.

Historically, there have been no reported incidents of fund mismanagement or security breaches involving Smart Global, but the lack of transparency leaves investors in the dark regarding the broker's operational practices. Traders must prioritize brokers that provide clear information about their fund safety measures and have a robust track record of protecting client assets.

Customer Experience and Complaints

Customer feedback is an important indicator of a broker's reliability and service quality. Reviews for Smart Global reveal a mix of experiences, with several users expressing concerns over withdrawal issues and lack of responsiveness from customer support. Common complaints include delays in processing withdrawals and insufficient communication regarding account status.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal delays | High | Poor |

| Lack of communication | Medium | Poor |

| Account management issues | High | Poor |

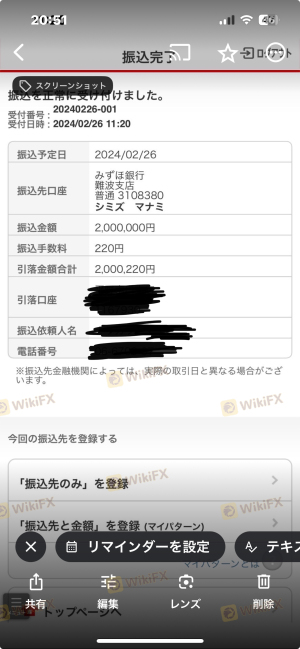

One notable case involves a user who reported being unable to withdraw funds after claiming significant profits. The broker allegedly cited a lack of time since the account was opened as the reason for the withdrawal denial. Such experiences indicate potential operational issues and highlight the importance of choosing a broker with a solid reputation for customer service.

Platform and Trade Execution

Smart Global offers the ST5 trading platform, which is designed for forex and CFD trading. However, there is limited information available regarding the platform's performance, stability, and user experience. Traders generally expect a reliable platform with fast order execution and minimal slippage, but the lack of detailed reviews or performance metrics for ST5 raises concerns about its reliability.

There are no documented instances of platform manipulation or execution issues, but the absence of user feedback makes it difficult to gauge the platform's effectiveness. Traders should be cautious when using a platform that lacks a proven track record and comprehensive user reviews.

Risk Assessment

Using Smart Global as a forex broker presents several risks that potential investors should consider. The following risk assessment summarizes the key risk areas associated with this broker:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Lack of regulation from reputable authorities |

| Financial Transparency | High | Insufficient information about fees and trading conditions |

| Customer Support | Medium | Reports of poor response times and withdrawal issues |

| Platform Reliability | Medium | Limited user feedback on platform performance |

To mitigate these risks, traders should conduct thorough research and consider alternative brokers with better regulatory oversight and proven track records. It is essential to prioritize brokers that provide transparent information about their operations and have a solid reputation in the industry.

Conclusion and Recommendations

In conclusion, Smart Global raises numerous red flags that suggest it may not be a trustworthy forex broker. The lack of regulation from recognized authorities, coupled with insufficient transparency regarding trading conditions and customer support, creates a concerning picture for potential investors. Additionally, the mixed customer feedback and reports of withdrawal issues further exacerbate the concerns surrounding Smart Global's credibility.

Traders should exercise extreme caution when considering Smart Global and may want to explore alternative brokers with better regulatory oversight and a more transparent operational framework. Some reputable alternatives include brokers regulated by the NFA or FCA, which provide a higher level of investor protection and service quality. Always prioritize due diligence and ensure that your chosen broker aligns with your trading needs and risk tolerance.

Is Smart Global a scam, or is it legit?

The latest exposure and evaluation content of Smart Global brokers.

Smart Global Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Smart Global latest industry rating score is 1.43, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.43 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.