Is Decho Capital Limited safe?

Business

License

Is Decho Capital Limited A Scam?

Introduction

Decho Capital Limited is a relatively new player in the forex market, established in Australia in 2023. As a broker offering a variety of trading instruments, including forex pairs, stocks, commodities, and cryptocurrencies, it aims to provide traders with diverse investment opportunities. However, the financial landscape is fraught with risks, and traders must exercise caution when selecting a broker. This article aims to assess whether Decho Capital Limited is a trustworthy broker or if it raises red flags that potential investors should be aware of. Our analysis is based on a comprehensive review of its regulatory status, company background, trading conditions, customer feedback, and overall risk profile.

Regulation and Legitimacy

The regulatory status of a broker is crucial in determining its legitimacy and safety for traders. Decho Capital Limited claims to be regulated by the Australian Securities and Investments Commission (ASIC) under an appointed representative license. However, some sources indicate that its license status is revoked, which raises concerns about its regulatory compliance.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | 001307575 | Australia | Revoked |

The revocation of a license can indicate serious compliance issues, making it imperative for traders to be cautious. ASIC is known for its stringent regulatory framework, which is designed to protect investors and ensure fair trading practices. The revocation of Decho Capital's license suggests that it may not be adhering to these standards, which could expose traders to heightened risks.

In addition to its Australian regulations, Decho Capital is also noted to have an unauthorized status with the National Futures Association (NFA) in the United States. This raises significant concerns about its operational legitimacy, particularly for traders based in the U.S. who require a broker to be fully compliant with local regulations.

Company Background Investigation

Decho Capital Limited is a newly established entity in the financial services sector, and as such, it has a limited operational history. The company claims to have been founded by financial professionals with extensive experience in the industry. However, the lack of detailed information about its ownership structure and management team raises questions about its transparency.

A thorough background check on the management team is essential to assess their qualifications and experience. While Decho Capital emphasizes its professional foundation, the absence of publicly available profiles or credentials for key personnel limits the ability to verify these claims. Transparency in ownership and management is vital for building trust with clients, and the current lack of information may deter potential investors.

Trading Conditions Analysis

When evaluating a broker, understanding the trading conditions they offer is crucial. Decho Capital Limited presents a range of trading instruments but has been criticized for its fee structure, particularly regarding spreads and commissions.

| Fee Type | Decho Capital Limited | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.6 - 1 pips | 0.3 - 0.5 pips |

| Commission Model | $11 per 100,000 units | $7 - $10 per 100,000 units |

| Overnight Interest Range | Varies | Varies |

While the spreads for major currency pairs are somewhat competitive, they are higher than the industry average, which can significantly impact trading profitability. Additionally, the commission structure appears to be on the higher side, especially when compared to established brokers. Traders should be cautious about any hidden fees or unusual policies that may not be immediately apparent.

Customer Funds Safety

The safety of customer funds is paramount when selecting a broker. Decho Capital Limited claims to implement measures such as segregated accounts and investor protection policies. However, given the revocation of its ASIC license, the effectiveness of these measures is questionable.

Segregated accounts are designed to protect client funds by keeping them separate from the broker's operational funds. This is a crucial feature that helps ensure that traders can access their funds even in the event of the broker's insolvency. However, without a valid regulatory framework, the enforcement of such protections becomes problematic.

Moreover, the absence of a robust investor protection scheme raises concerns about the potential risks involved in trading with Decho Capital. Historical incidents of fund misappropriation or mishandling amplify the need for thorough due diligence before committing capital.

Customer Experience and Complaints

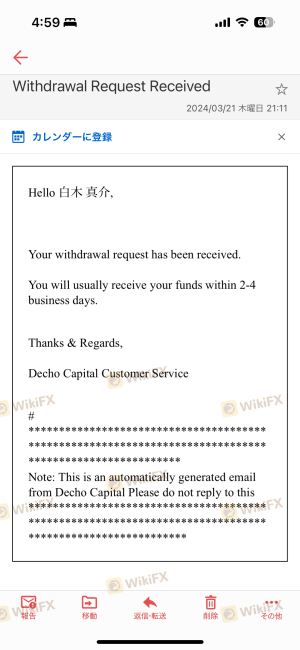

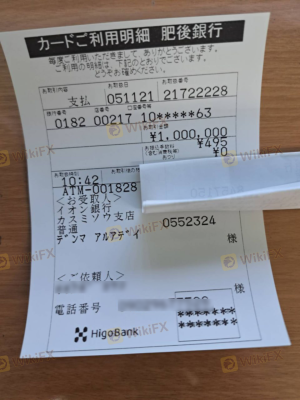

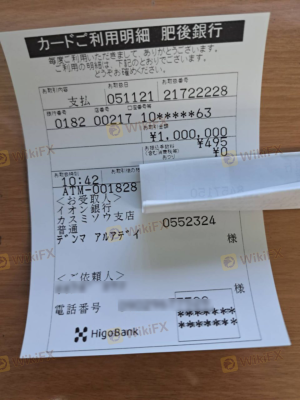

Customer feedback is a vital indicator of a broker's reliability and service quality. Reviews about Decho Capital Limited reveal a mixed bag of experiences. While some traders appreciate the variety of instruments offered, others have reported difficulties with withdrawals and customer support responsiveness.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Customer Support Delay | Medium | Unresponsive |

| High Fees | Low | Acknowledged |

Many complaints center around withdrawal issues, with some users claiming they were unable to access their funds after making requests. Slow response times from customer support further exacerbate these issues, leaving traders feeling frustrated and unvalued. The lack of live chat or phone support options may contribute to these delays, as users are left relying solely on email communication.

Platform and Trade Execution

The trading platform offered by Decho Capital Limited is another critical aspect to evaluate. Users have reported mixed experiences regarding platform stability and execution quality.

Several traders have noted instances of slippage and order rejections, which can significantly affect trading outcomes. A reliable broker should provide a seamless trading experience with minimal disruptions. Any signs of platform manipulation or inconsistencies in order execution should raise red flags for potential investors.

Risk Assessment

Engaging with Decho Capital Limited involves several risks that traders should be aware of.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | Revoked ASIC license raises compliance concerns. |

| Financial Risk | Medium | Higher spreads and commissions than industry average. |

| Operational Risk | High | Reports of withdrawal issues and slow customer support. |

To mitigate these risks, traders should consider starting with a small investment and thoroughly researching alternative brokers with better regulatory standings and reputation.

Conclusion and Recommendations

In conclusion, Decho Capital Limited presents several red flags that warrant caution. The revocation of its ASIC license, coupled with reports of withdrawal issues and high fees, raises significant concerns about its legitimacy and reliability. While it offers a range of trading instruments, the overall risk profile suggests that traders should proceed with caution.

For traders seeking a more secure trading environment, it may be advisable to consider alternative brokers with stronger regulatory oversight and a proven track record of reliability. Brokers such as IG, OANDA, or Forex.com are examples of platforms that offer robust regulatory frameworks and positive user feedback. Ultimately, thorough due diligence is essential to ensure a safe trading experience.

Is Decho Capital Limited a scam, or is it legit?

The latest exposure and evaluation content of Decho Capital Limited brokers.

Decho Capital Limited Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Decho Capital Limited latest industry rating score is 1.34, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.34 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.