DNA Markets 2025 Review: Everything You Need to Know

Summary: DNA Markets is a relatively new broker that has garnered mixed reviews from users and experts alike. While it offers competitive trading conditions on popular platforms like MT4 and MT5, there are concerns regarding its operational history and the regulatory framework for non-Australian clients. Key features include a minimum deposit of $100 and a wide range of tradable assets.

Note: It's important to consider that DNA Markets operates under different entities based on geographic location, which affects regulatory protections and service quality.

Ratings Overview

We assess brokers based on a combination of user reviews, expert opinions, and factual data from various sources.

Broker Overview

Founded in 2023, DNA Markets operates under the trading name of Focus Markets Pty Ltd and is regulated by the Australian Securities and Investments Commission (ASIC). The broker provides access to a wide array of financial instruments, including forex, commodities, indices, stocks, and cryptocurrencies. Trading is facilitated through the well-known MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, which are favored for their user-friendly interfaces and advanced trading features.

Detailed Breakdown

Regulatory Regions

DNA Markets is primarily regulated by ASIC for Australian clients. However, non-Australian clients are onboarded under an unregulated entity based in Saint Vincent and the Grenadines, raising concerns about investor protection. This dual structure necessitates caution, especially for traders outside Australia.

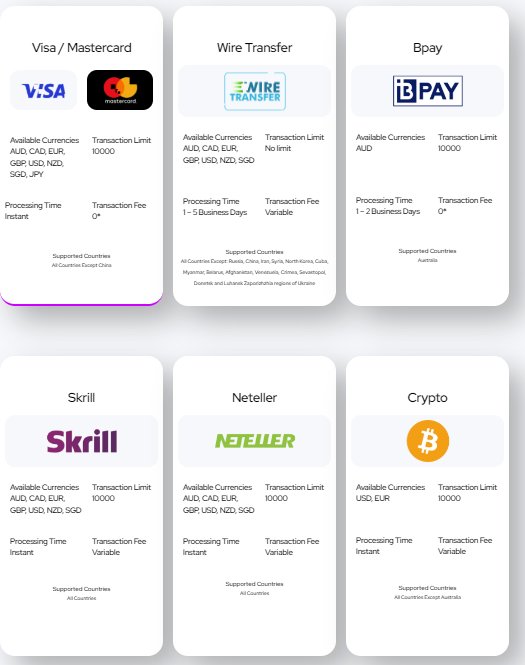

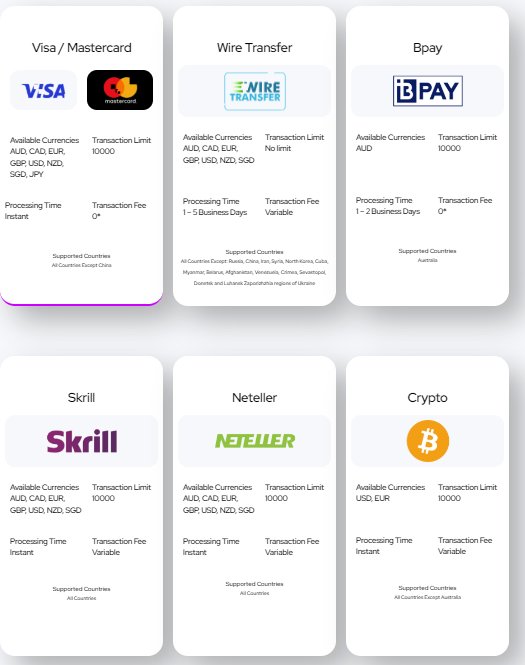

Deposit/Withdrawal Currencies

The broker supports multiple currencies for deposits and withdrawals, including AUD, USD, EUR, GBP, NZD, CAD, and SGD. Additionally, it accepts cryptocurrencies such as Bitcoin and Ethereum, offering a diverse range of funding options.

Minimum Deposit

The minimum deposit required to open an account with DNA Markets is $100, which is competitive compared to many other brokers in the industry.

While specific promotions were not highlighted in the sources, DNA Markets does offer a three-month free subscription to the Signal Start copy trading platform for new clients. This feature is particularly beneficial for those looking to engage in copy trading without upfront costs.

Tradable Asset Classes

DNA Markets provides access to over 800 financial instruments, including:

- Forex: Over 40 currency pairs.

- Commodities: Gold, silver, oil, and more.

- Indices: Major global indices.

- Cryptocurrencies: A selection of popular digital currencies.

Costs (Spreads, Fees, Commissions)

The trading costs vary depending on the account type. The raw account features spreads starting from 0.0 pips with a commission of $3 per lot, while the standard account has spreads starting from 1.0 pips with no commission. This pricing structure is competitive, especially for active traders.

Leverage

DNA Markets offers leverage up to 1:500 for global clients, while Australian clients are limited to a maximum of 1:30 in accordance with local regulations. This flexibility allows traders to choose their risk exposure based on their experience and trading strategy.

The broker supports both MT4 and MT5, which are renowned for their robust functionalities. However, there is no proprietary trading app available, which some users may find limiting.

Restricted Areas

While specific restricted regions were not detailed in the sources, DNA Markets is not available in certain jurisdictions due to regulatory constraints.

Available Customer Support Languages

DNA Markets provides customer support in multiple languages, primarily focusing on English. Support is available 24/5 through various channels, including email, live chat, and phone.

Repeated Ratings Overview

Detailed Analysis of Ratings

Account Conditions (6.5/10)

DNA Markets offers two types of accounts: raw and standard. Both require a minimum deposit of $100 and allow for micro lot trading. The raw account is particularly beneficial for high-frequency traders seeking tight spreads, while the standard account is more suited for beginners due to its straightforward pricing structure. However, concerns about transparency and the lack of educational resources may deter some potential clients.

The broker lacks comprehensive educational materials and market analysis tools, which can be limiting for novice traders. While it offers access to the Signal Start copy trading service, the overall absence of research and educational support is a significant drawback.

Customer Service & Support (4.0/10)

Customer support is available 24/5, and users have reported generally positive experiences. However, there are mentions of slow response times and a lack of an FAQ section, which could hinder quick resolutions for common queries.

Trading Experience (5.5/10)

The trading experience on MT4 and MT5 is generally favorable, with fast execution speeds and a variety of order types. However, the absence of a dedicated mobile app may limit accessibility for some traders.

Trustworthiness (4.5/10)

While DNA Markets is regulated by ASIC, the dual entity structure raises questions about the security of funds for non-Australian clients. Mixed reviews regarding customer experiences further complicate the trust evaluation.

User Experience (4.0/10)

Overall user experience is influenced by the platform's ease of use and the quality of customer support. While many users appreciate the trading conditions, the lack of educational resources and potential withdrawal issues noted in reviews may impact overall satisfaction.

In conclusion, DNA Markets presents a viable option for traders looking for competitive pricing and a diverse range of tradable assets. However, potential clients should weigh the benefits against the concerns regarding regulatory oversight and customer support before making a decision.