1. Summary

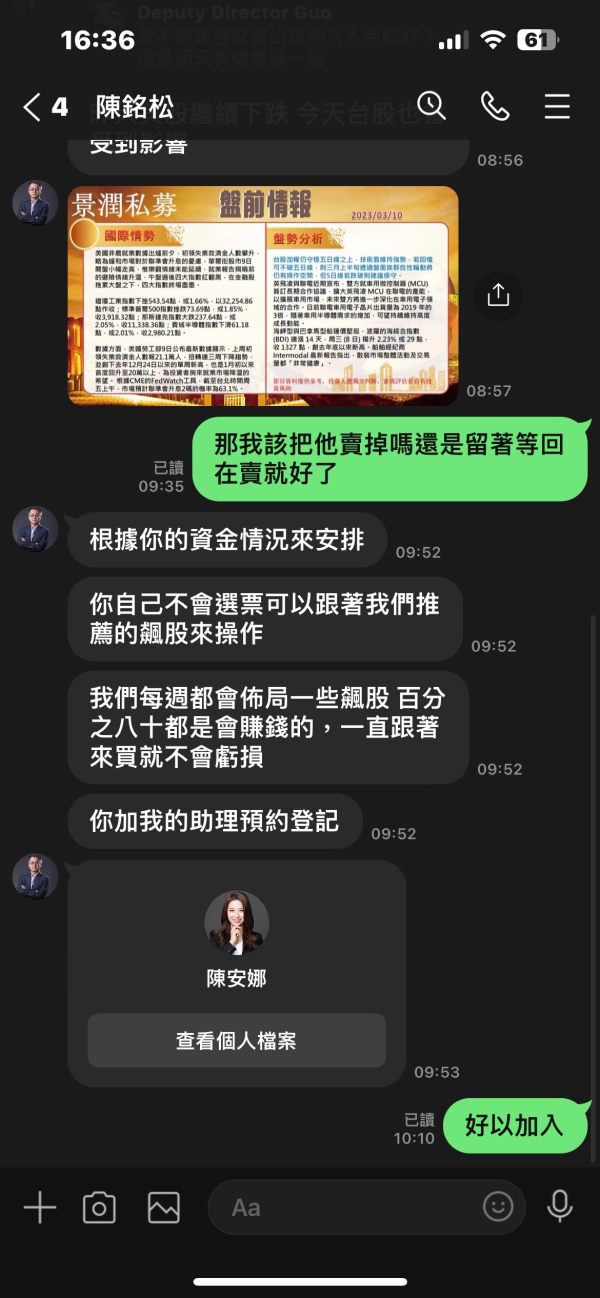

In this illuminati markets limited review, we analyze a broker that has raised serious concerns about its trustworthiness and reliability. This forex trading platform was founded in 2023 and offers a minimum deposit requirement of only $100 with high leverage of up to 1:500, which might initially seem attractive for those looking to enter the forex arena. However, the broker has been flagged as high risk and is suspected of fraudulent practices despite these appealing features. Different sources, including reports from TraderKnows and Fundevity Research Department, indicate that potential investors should exercise extreme caution when dealing with this platform. The account conditions allow entry-level traders to participate, but the noted absence of detailed regulatory oversight and transparency raises significant red flags. The primary audience for this platform appears to be investors who are willing to accept high risk for the lure of potentially high returns. The negative reputation overshadows these trading conditions.

2. Notice

It is important to note that the information provided here does not specify any concrete regulatory body overseeing operations. This creates cross-jurisdictional legal risks for traders. This illuminati markets limited review is based on a comprehensive collection of user feedback and related sources, where details such as trading platforms and deposit methods remain scarce or ambiguous. Potential investors must conduct their own due diligence and exercise caution before proceeding as a result. Different sources have noted inconsistencies, and the data may reflect varying interpretations of the available information.

3. Score Framework

4. Broker Overview

Illuminati Markets Limited was founded in 2023 and entered the forex trading landscape with a focus on providing trading services for forex instruments. The company's background is not clearly detailed in available sources. This leaves potential customers with limited insight into its corporate history and the expertise behind its operations. While the broker's business model centers on providing forex trading services, the absence of detailed information about ownership, financial backing, or affiliations with well-known financial institutions raises significant concerns. According to various sources, this illuminati markets limited review underscores the need for further clarity regarding the firm's operational credibility and transparency.

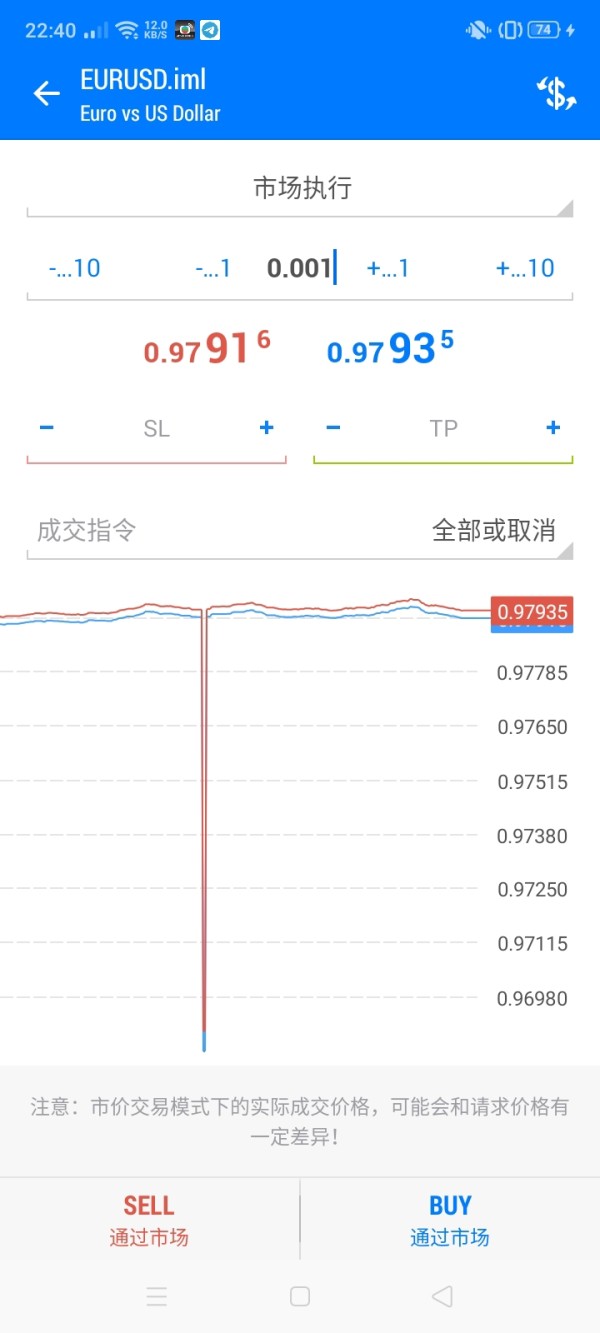

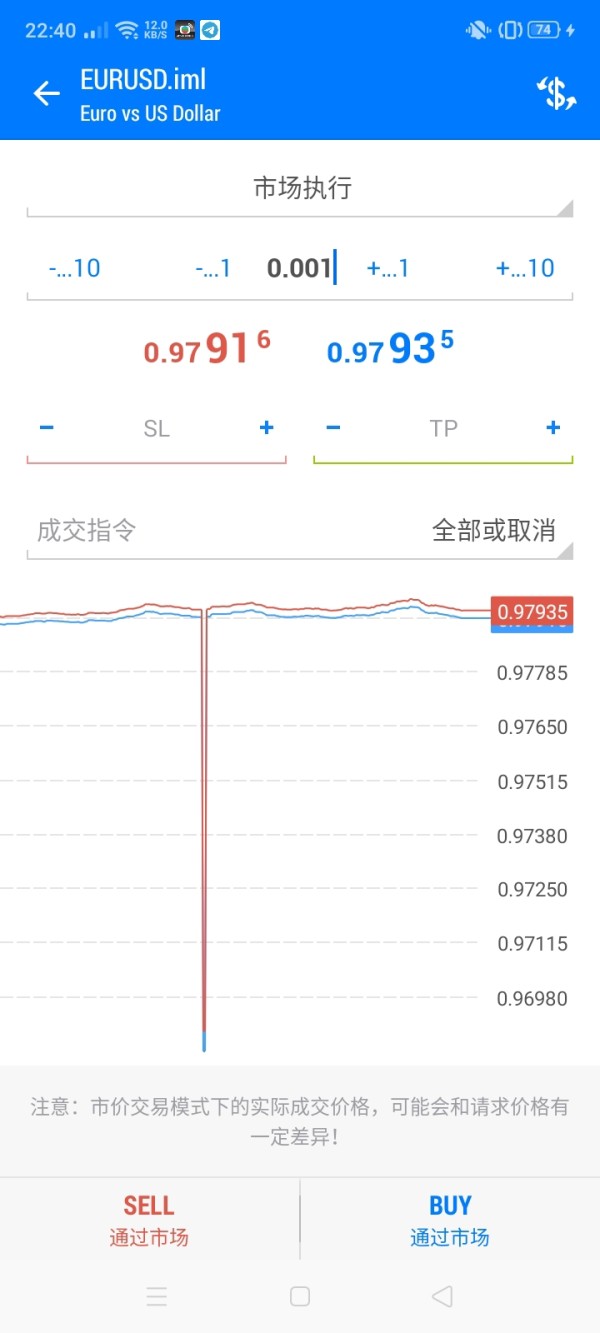

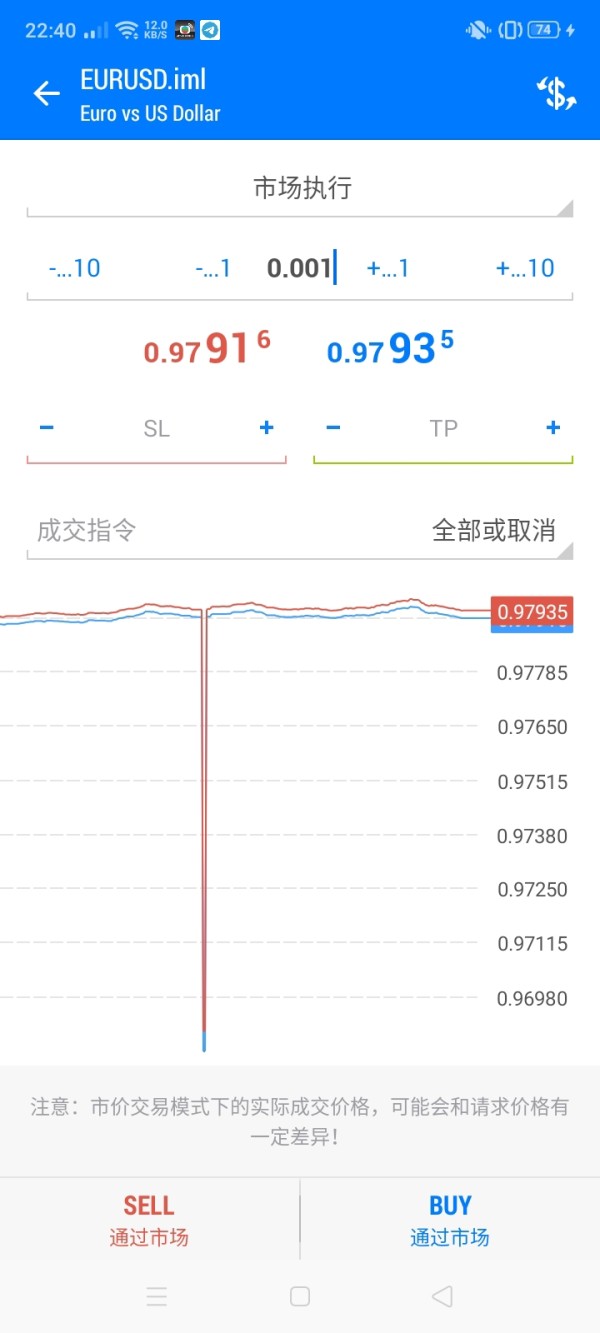

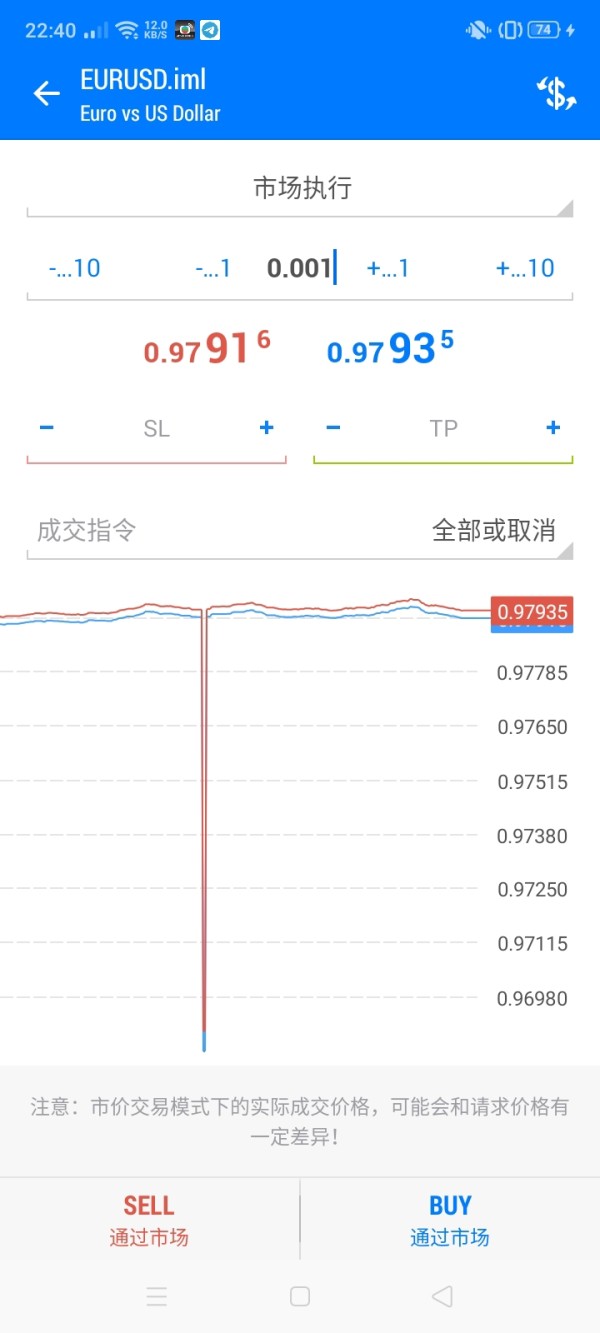

We will now examine the core aspects of its trading environment in detail. The platform is designed primarily for forex trading, with its asset offering seemingly restricted to this market segment. Specific details regarding the trading platform software or any proprietary technological developments are not provided in the summary. Additionally, while some indicators mention the involvement of regulatory bodies such as the Financial Conduct Authority in passing references, no formal verification of regulatory oversight is explicitly noted. This lack of concrete regulatory endorsement leaves investors with unresolved questions about financial security and compliance.

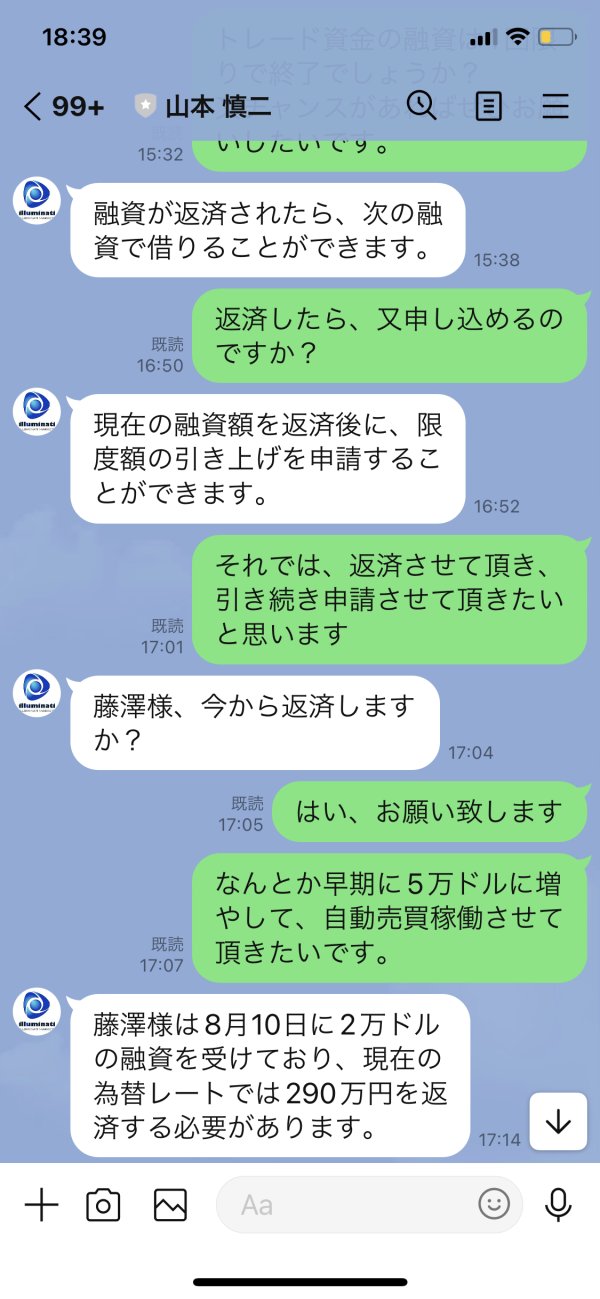

The regulatory oversight for Illuminati Markets Limited remains unclear according to available sources, with no specific regulatory body or license number clearly identified. Deposits and withdrawals details are not explained in the collected data, which is concerning for any investor prioritizing transparency and efficiency in fund management. The minimum deposit is stated as $100, making it relatively accessible for novice traders. Bonus or promotional offers are not disclosed at all. Tradeable assets are limited strictly to forex, which limits diversification opportunities for traders.

The cost structure indicates that spreads start from 0.4 points with zero commission, which might appeal to cost-conscious traders. However, the lack of details concerning additional fees such as rollover or inactivity fees remains a significant omission. The platform offers a high maximum leverage of 1:500, aligning with the broker's appeal to risk-tolerant traders. Information on platform choices and specific trading software is not provided, leaving practitioners to speculate about the technological standards in place. Regional restrictions and customer service language options are also not clearly mentioned, contributing to the overall uncertainty.

6. Detailed Score Analysis

6.1 Account Conditions Analysis

Several factors have been considered in evaluating the account conditions offered by Illuminati Markets Limited. The broker's minimum deposit of $100 appears to be a reasonable entry point for new traders, as it allows a lower barrier to entry. The possibility of high leverage at 1:500 is an attractive feature for those looking to amplify their trading positions. However, the absence of information on different account types, specifically whether there are specialized accounts like Islamic accounts or accounts with additional benefits, casts uncertainty on the overall offering. The account opening process is also not clearly outlined. This may be a point of concern for users who expect a streamlined and transparent onboarding procedure. While the basic trading conditions such as zero commission are a positive attribute, the lack of context about potential hidden fees or administrative charges cannot be overlooked. User feedback does not offer substantial positive insights regarding the ease or reliability of the account management experience. Although the low initial deposit and significant leverage could benefit risk-tolerant traders, the overall account conditions warrant caution.

The analysis of the tools and resources available from Illuminati Markets Limited reveals several notable deficiencies. Detailed information about the trading platform is conspicuously absent, leaving traders in the dark regarding execution speeds, platform stability, and available charting tools or analytical software. In terms of research materials, educational resources, and automated trading options, no concrete evidence suggests that these were provided to enhance the trading experience. This lack of transparency extends to any resources aimed at aiding decision-making or risk management. Without clear insights into the quality and variety of trading tools, investors are left to wonder about the platform's overall technological competence and commitment to providing a comprehensive trading ecosystem. User reviews have not provided significant positive feedback on the platform's technological features or the depth of its research support. While the potential for basic trading may be present, the overall lack of robust tools and supplementary resources places Illuminati Markets Limited at a significant disadvantage compared to more established brokers.

6.3 Customer Service and Support Analysis

The available data indicates several shortcomings when assessing the customer service and support aspect of Illuminati Markets Limited. The review does not provide any detailed breakdown of the channels through which support is available, such as live chat, email, or telephone. There is no evidence that suggests a multi-lingual support system exists, which can be a critical factor for international clientele. Response times and service quality remain unclear, with no conclusive user testimonials to either commend or criticize the support structure. The limited scope of the data means that essential aspects — such as the efficiency of issue resolution and the competence of service representatives — remain unverified. This uncertainty particularly concerns potential traders who depend on timely and effective customer service for troubleshooting and guidance. Instances of unresolved issues and the absence of detailed user feedback contribute to a lower score in this dimension. The customer service framework appears to fall short when compared to industry standards, indicating a need for improvement and greater transparency.

6.4 Trading Experience Analysis

A closer look at the trading experience offered by Illuminati Markets Limited reveals both potential advantages and significant drawbacks. The broker offers relatively competitive spreads, starting at 0.4 points, which is a positive indicator for cost-conscious traders. The high leverage of 1:500 also creates an environment where traders can maximize gains—albeit at a correspondingly higher risk. However, the review lacks crucial details regarding the overall stability of the trading platform, including order execution speeds and platform uptime. These aspects are vital for fast-paced trading environments. There is no detailed information on the mobile experience or whether there are dedicated applications that could enhance on-the-go trading capabilities. The design and navigability of the interface remain unreported, so users might face challenges when attempting to execute trades or access analytical tools intuitively. While some traders might welcome the low trading costs, the absence of comprehensive information on the user interface, speed, and functionality creates a less than optimal trading experience overall. The gap between what is promised and what is substantiated by actual user or expert feedback is clear.

6.5 Trustworthiness Analysis

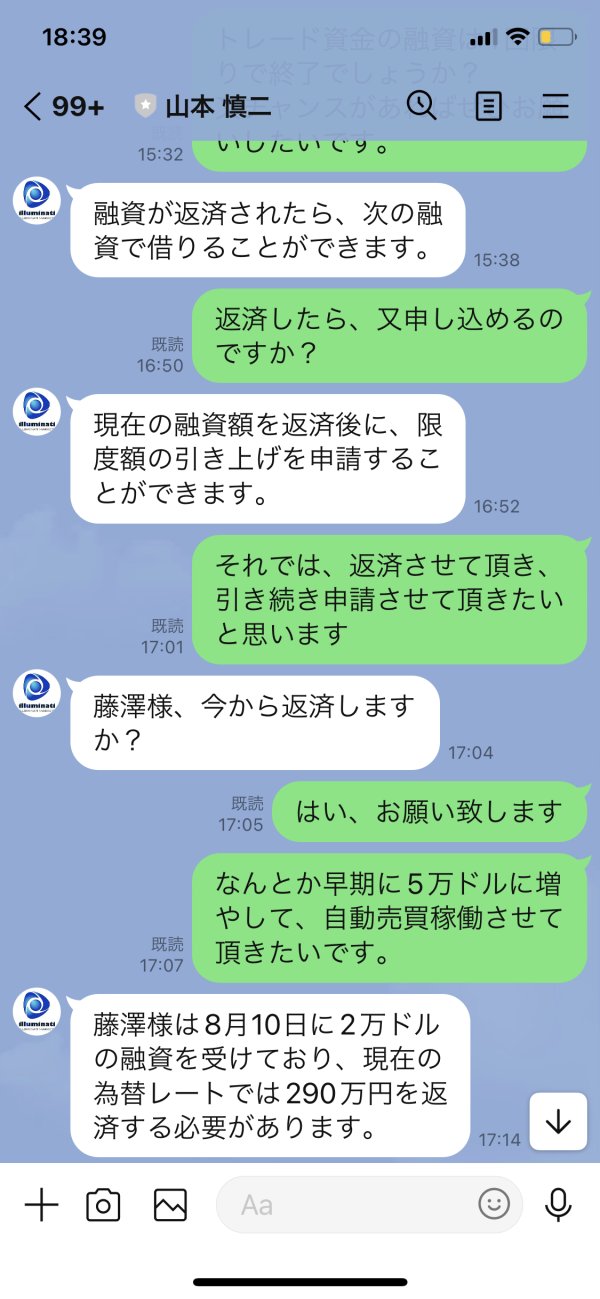

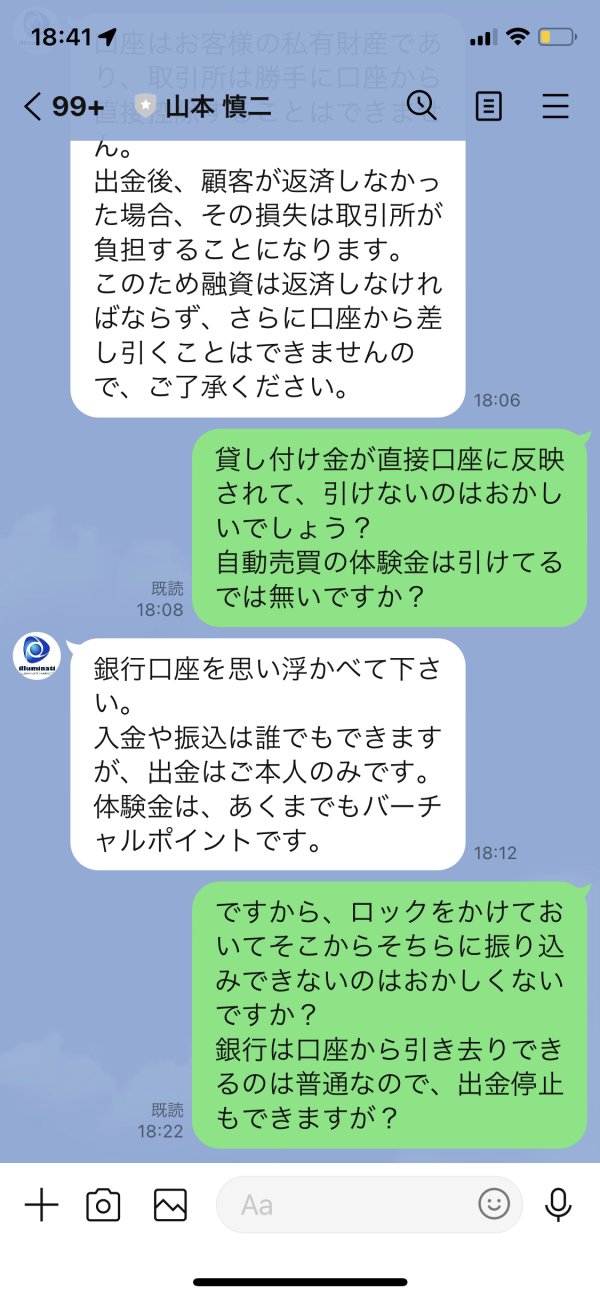

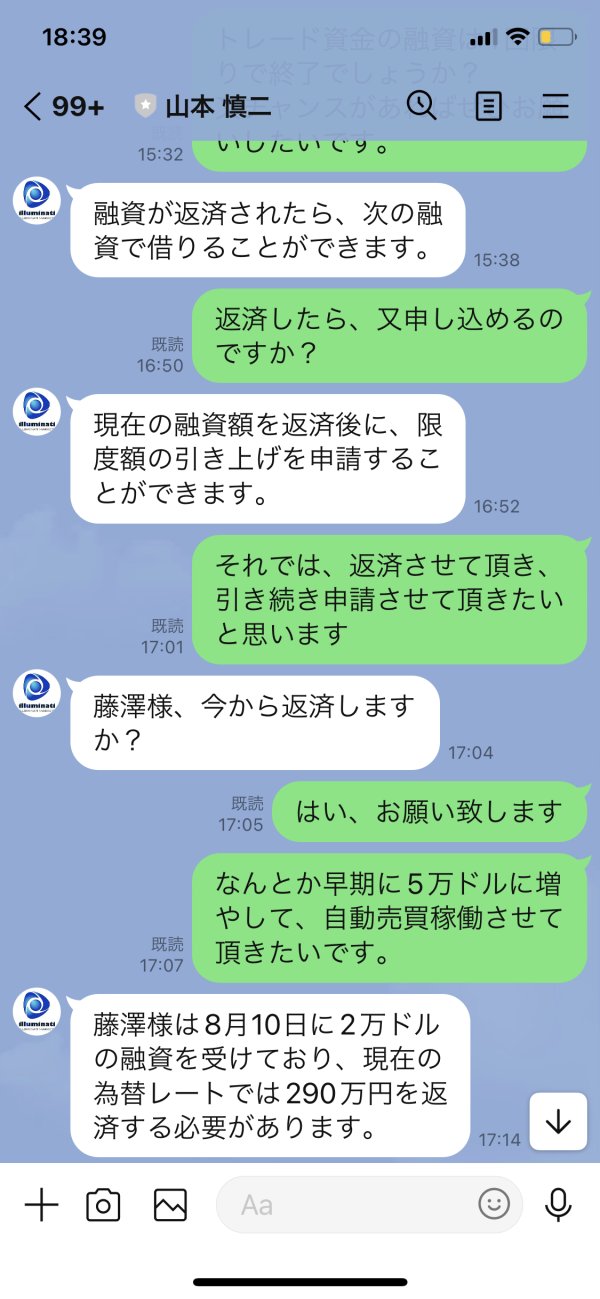

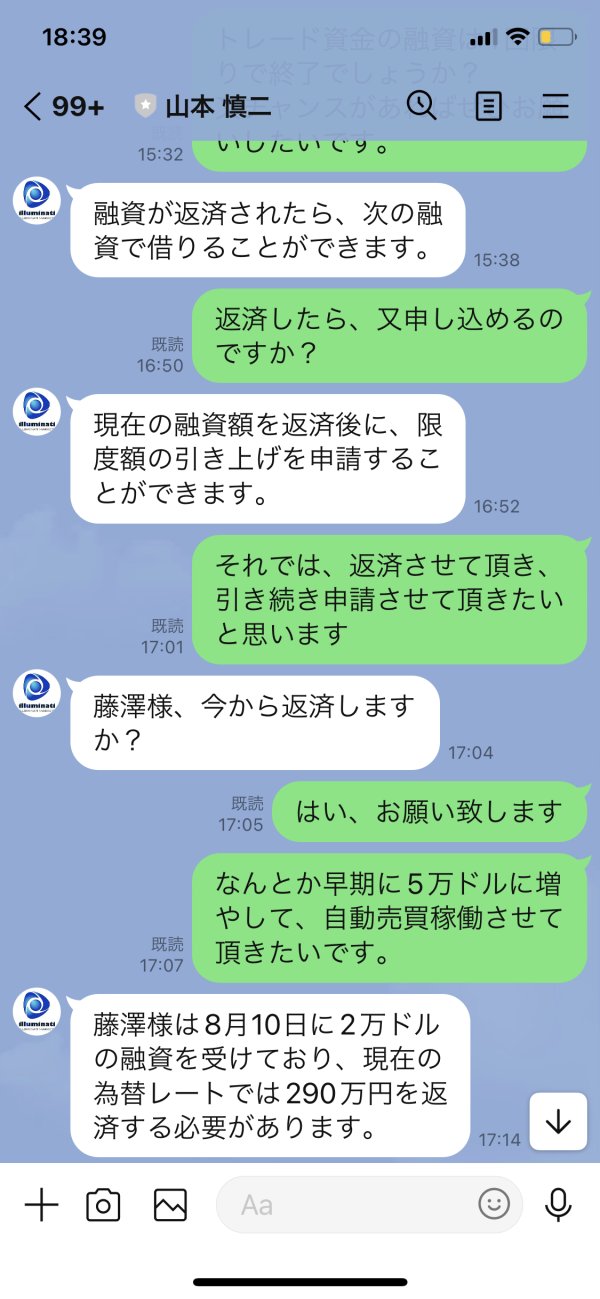

Trustworthiness is a critical aspect in evaluating any broker, and in the case of Illuminati Markets Limited, serious concerns prevail. The broker has been consistently rated as high risk in multiple reports, and there are widespread suspicions of fraudulent activity. Specific details regarding regulatory licenses or oversight are entirely absent, which further undermines investor confidence. Despite passing occasional mentions of regulatory bodies such as the FCA in some discussions, no formal or verifiable evidence has been provided to confirm compliance or to ensure that customer funds are safeguarded by established protocols. The overall lack of transparency in company background, coupled with marked warnings from watchdog sources, contributes immensely to its low trust score. Potential red flags include unclear risk warnings and a significant gap in publicly available financial security measures. This raises serious doubts about the firm's commitment to maintaining high industry standards. Investors are advised to exercise extreme caution when considering this broker due to its questionable reputation and the notable absence of robust regulatory validation.

6.6 User Experience Analysis

The overall user experience with Illuminati Markets Limited is another area of concern that merits a detailed discussion. The broker's offering of a low minimum deposit and high leverage might initially appear attractive to users with a high-risk tolerance, but several elements of the user journey remain poorly defined. The platform's user interface has not been described in detail, leaving questions about ease of navigation and overall design quality. The registration and verification processes lack documented clarity, potentially leading to usability challenges. Feedback specific to fund management, such as deposit and withdrawal procedures, is notably absent, further complicating the user experience. The absence of information regarding intuitive features that aid in executing trades or managing risk adds to user frustration. Reports from various sources note significant concerns about the platform's reliability and potential security issues. While the broker might cater to a niche demographic that is comfortable with uncertainty, the overall user experience is critically undermined by sparse details and negative risk assessments from multiple independent reviews.

7. Conclusion

The illuminati markets limited review clearly indicates that this broker poses significant high-risk factors and potential fraudulent behavior. While its low account entry barrier of $100 and high leverage of 1:500 may attract traders willing to take risks, the extensive lack of regulatory transparency, inadequate trading tools, and questionable customer support make it a less reliable option. This broker may only suit a very niche segment of investors who can cope with elevated risk. Prospective traders are strongly advised to exercise extreme caution before engaging with Illuminati Markets Limited.