rayz liquidity corp 2025 Review: Everything You Need to Know

1. Summary

Rayz Liquidity Corp was established in 2022 and is headquartered in the British Virgin Islands. This company presents itself as a multi-asset trading provider offering services across forex, stocks, commodities, cryptocurrencies, and indices on its MT5 White Label platform. However, our initial findings in this rayz liquidity corp review reveal significant concerns. The broker remains unregulated, which highlights inherent fraud risks and undermines any claim to a secure trading environment.

The promise of diverse asset classes and the use of a reputable trading platform may attract traders seeking variety in their portfolios. Yet the absence of regulatory oversight raises serious doubts among potential clients. Despite the broad range of instruments available, the lack of transparent operational details and comprehensive user safeguards makes it a high-risk option. This summary is based on publicly available data and user feedback. We emphasize that caution is warranted when considering this broker for trading purposes.

2. Notes

This review is compiled from publicly available information and user feedback. It is important to note that several details remain unclear or undisclosed in the available sources, particularly regarding trading conditions such as account specifications, deposit and withdrawal processes, bonus promotions, and cost structures. Consequently, our analysis must rely on the data present, even though crucial information is omitted.

Moreover, while this evaluation addresses the global nature of the broker's offerings, it does not differentiate between potential cross-regional variations. The analysis is strictly based on open-source reports and submissions from early users. The regulatory status, a major aspect of due diligence, was not detailed in the source materials. Therefore, the risk assessment in this review is primarily driven by the absence of regulation and instances of potential fraud as reported by users and compiled online.

3. Scoring Framework

4. Broker Overview

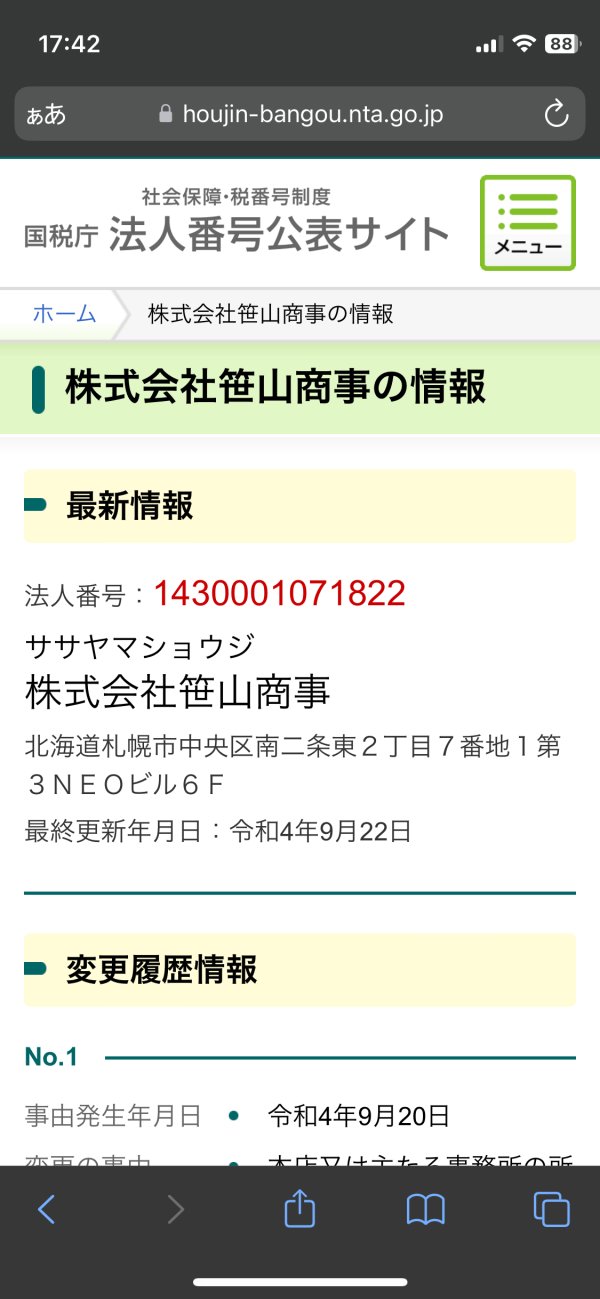

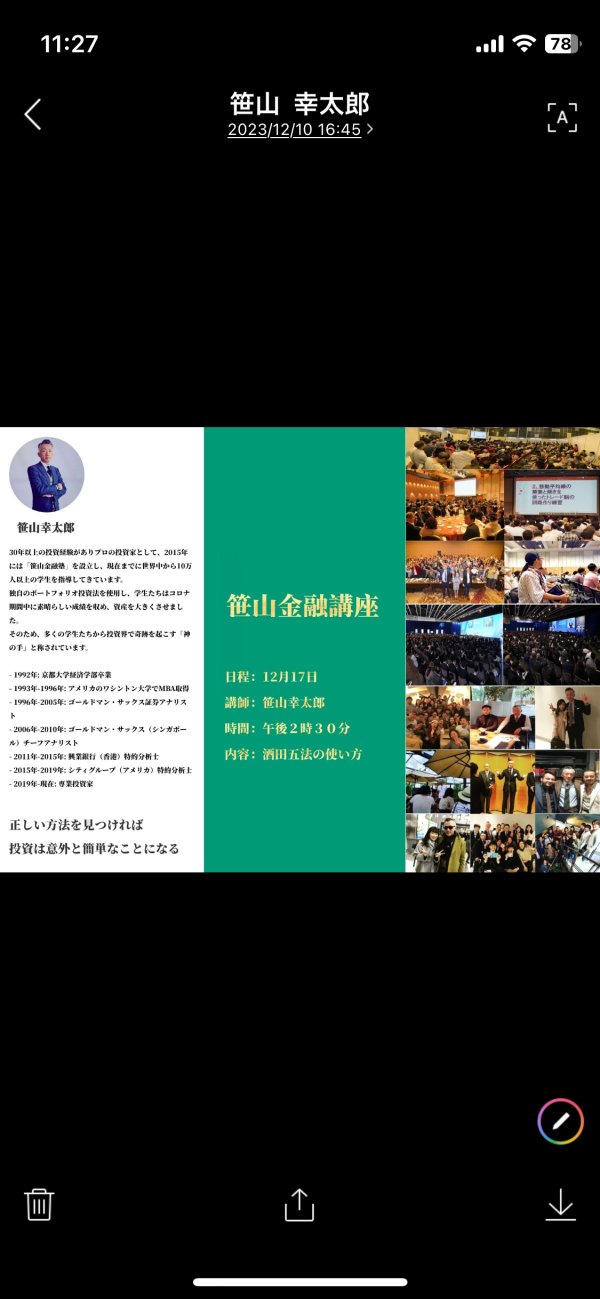

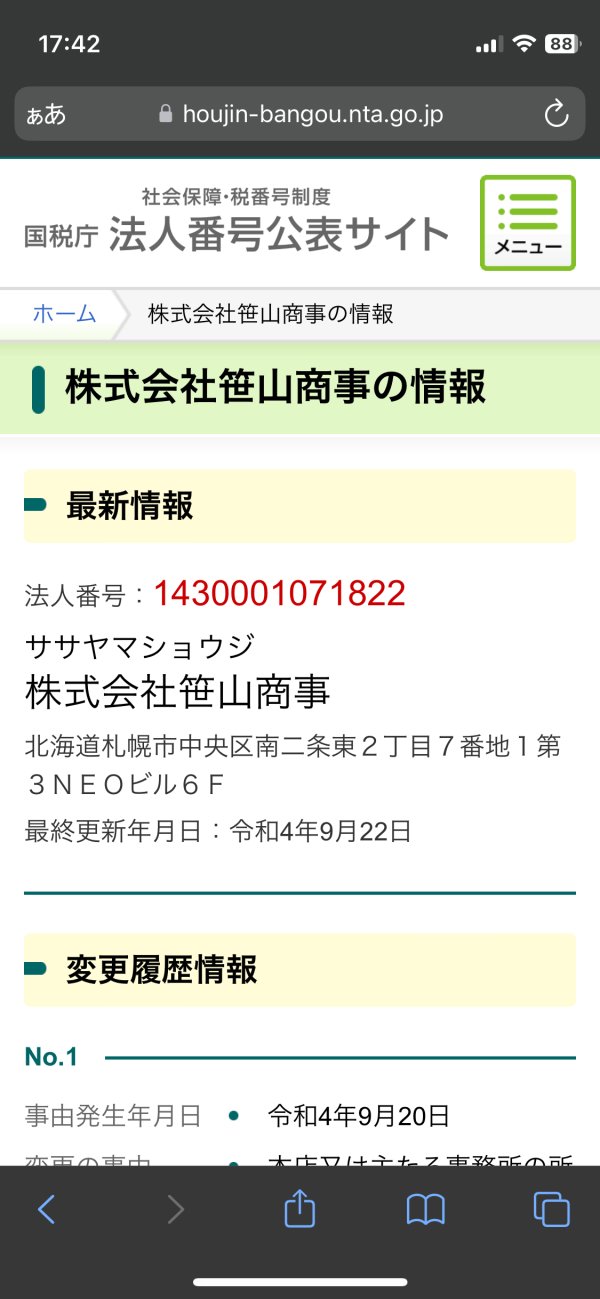

Rayz Liquidity Corp was founded in 2022 and is registered in the British Virgin Islands. From its inception, the company has positioned itself as a forex broker that provides a broad spectrum of trading services. With ambitions to cater to a global clientele, it offers access to multiple markets including forex, stocks, commodities, and cryptocurrencies.

However, despite its varied offerings, the fact remains that the broker is unregulated, which is an essential consideration for risk-conscious traders. This lack of transparent regulatory oversight raises serious questions about fund security and overall business integrity. The firm's background, marked by its recent establishment, further underscores the need for cautious evaluation. Longevity and established reputation often play critical roles in building client trust.

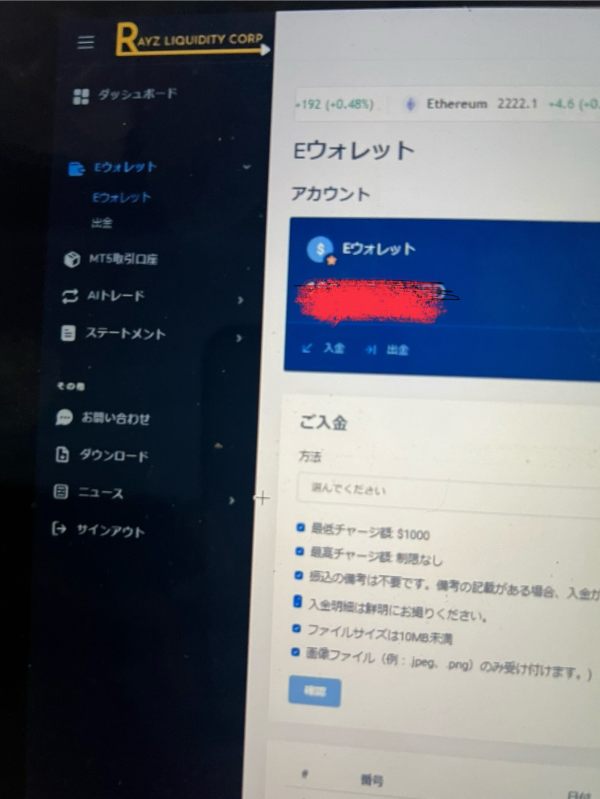

In addition, the broker employs the MT5 White Label platform—an industry-standard system that is known for its robust performance and versatility in trading multiple asset classes. The platform allows for efficient trading execution and provides a familiar interface for seasoned traders. Rayz Liquidity Corp promotes a diverse asset base that includes forex, stocks, commodities, cryptocurrencies, and indices, aiming to serve traders who prefer a multi-dimensional approach.

However, it is important to note that the regulatory status and detailed operational policies are not clearly communicated. As emphasized in this rayz liquidity corp review, while the asset diversification might be appealing, the overall uncertainty regarding regulation may significantly impact the broker's credibility.

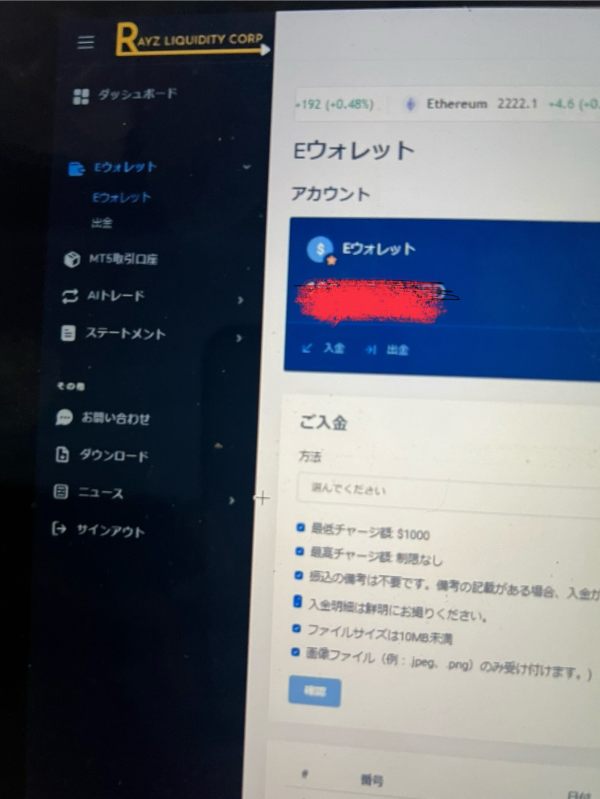

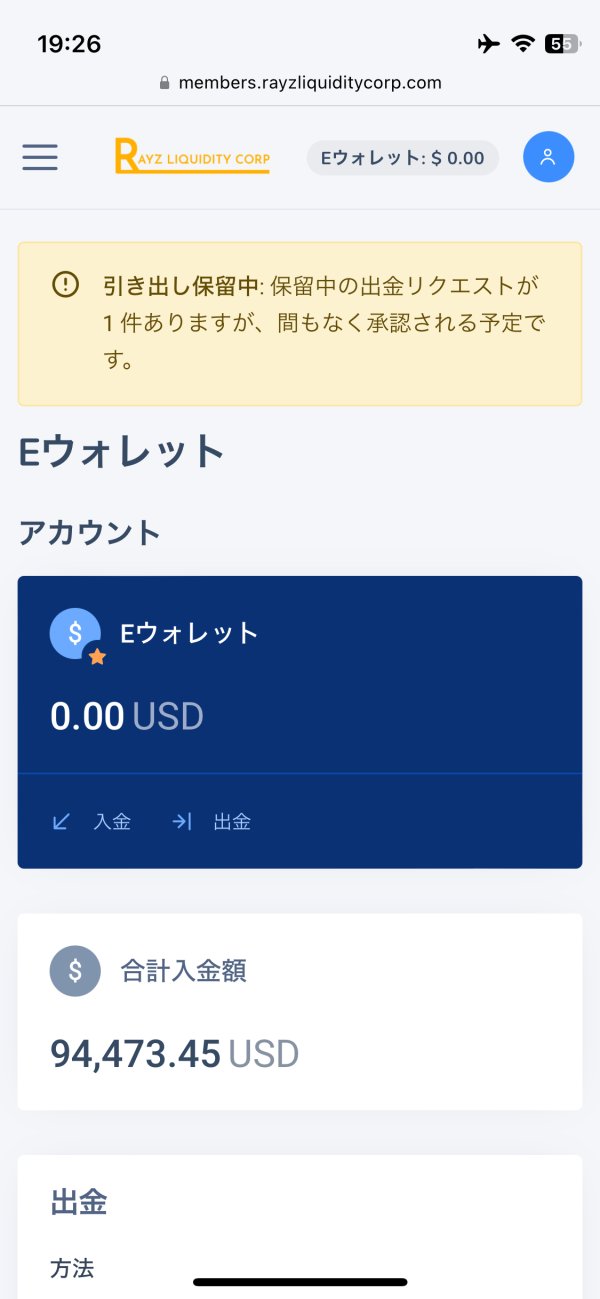

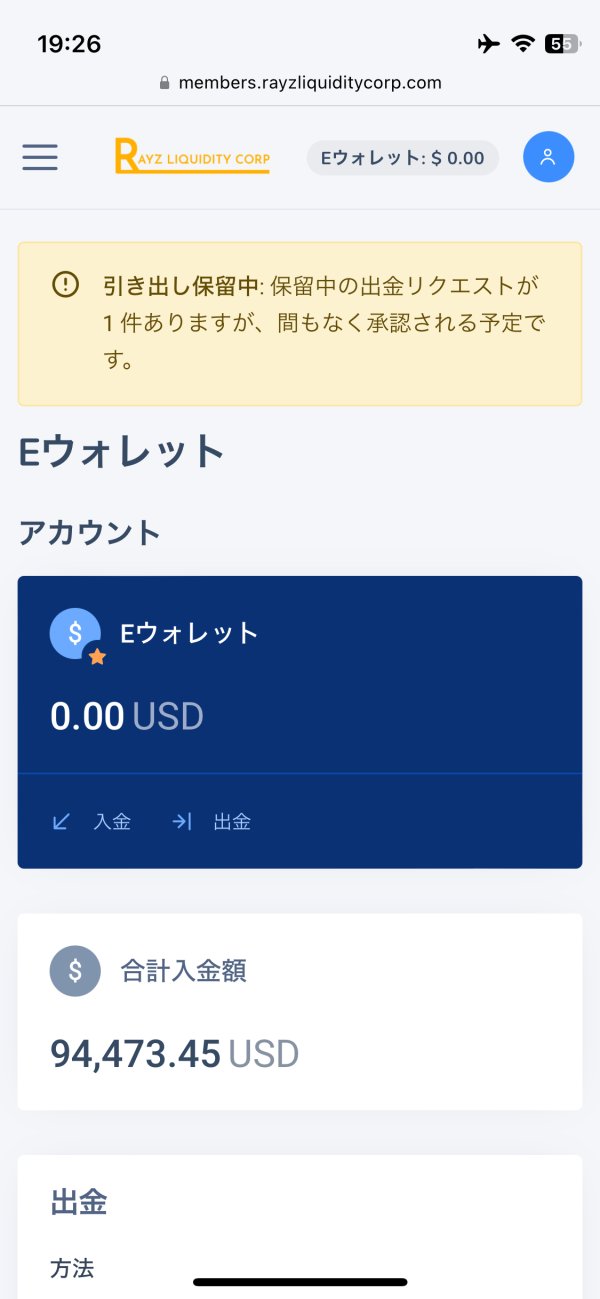

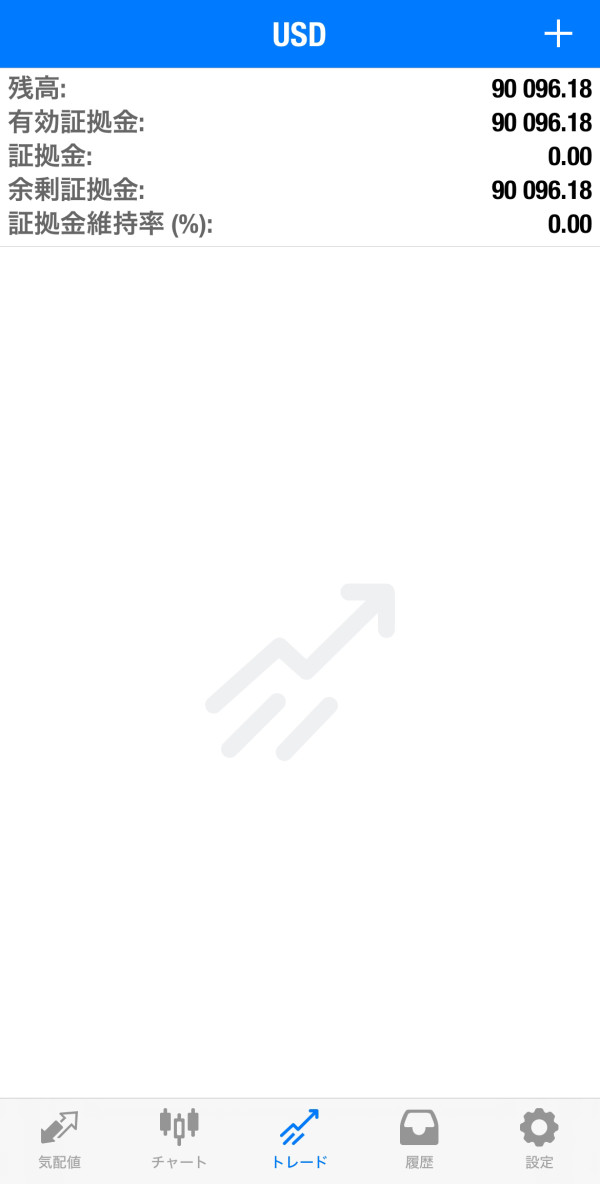

Drawing from the information available, several aspects about Rayz Liquidity Corp remain ambiguous. Regarding regulatory regions, the broker is not under the supervision of any specific regulatory body, leaving investors without clear recourse in case of irregularities. The deposit and withdrawal methods are not detailed in the existing sources, which leaves potential clients uncertain about the ease and security of fund transfers.

There is no explicit information on a minimum deposit requirement, and similarly, bonus promotions and cost structures such as spreads or commissions are not disclosed. In terms of asset coverage, Rayz Liquidity Corp facilitates trading in a variety of instruments including forex, stocks, commodities, cryptocurrencies, and indices. Despite this asset diversity, the detailed pricing and fee models are not provided, making it hard to evaluate the true trading costs.

The broker offers the MT5 White Label trading platform, a well-recognized tool in the industry. While this suggests a certain level of technological competence, it does not compensate for the lack of regulatory transparency. Additionally, information regarding leverage options, regional restrictions, or the range of languages supported for customer service remains unspecified.

Overall, while the platform choice is robust, detailed operational protocols and client service specifics are lacking, as reiterated in this rayz liquidity corp review. This information gap is significant for those who prioritize complete clarity over cost and trading versatility.

6. Detailed Rating Analysis

6.1 Account Conditions Analysis

The evaluation of account conditions for Rayz Liquidity Corp is hindered by the significant absence of crucial data. Specific account types, minimum deposit requirements, and detailed account features were not provided in the source materials. As a result, potential investors are left without knowledge of whether the broker offers standard, mini, or managed account options that could align with diverse trading needs.

The account opening process, including the verification requirements and overall ease of account setup, remains unaddressed in the available information. Consequently, this lack of transparency makes it challenging to assess the relevance or suitability of the accounts provided by Rayz Liquidity Corp. Comparisons with other industry players are impossible when such fundamental details are missing.

The unavailability of account-specific information contributes to the high-risk perception for traders looking for comprehensive, user-focused services. This gap in essential details further undermines the broker's reliability. Overall, with no indications of special account functionalities or deviations from standard practices, the account conditions part of this rayz liquidity corp review leaves much to be desired.

More clarity and elaboration on these aspects would be necessary for any thorough evaluation.

Rayz Liquidity Corp has taken the step of integrating the MT5 White Label platform, a respected system recognized across the trading community for its functionality. This platform provides users with a familiar interface and a robust set of trading tools which can support the execution of various automated strategies. Beyond the platform, the broker offers access to multiple asset classes including forex, stocks, commodities, cryptocurrencies, and indices—an appealing suite for traders seeking diversification.

However, while the platform's technical capabilities are a plus, there is limited information on supporting research tools, educational materials, or comprehensive market analysis resources. The absence of detailed insights regarding automated trading support and additional analysis tools means that traders may have to look elsewhere for a holistic trading environment. Despite these gaps, the core competence of the MT5 system does give the broker an edge in terms of technological infrastructure.

Yet, the overall quality of research and instructional support remains ambiguous. This analysis suggests that while the technical tools are solid, a more expansive offering of resources would be beneficial for traders at all experience levels.

6.3 Customer Service and Support Analysis

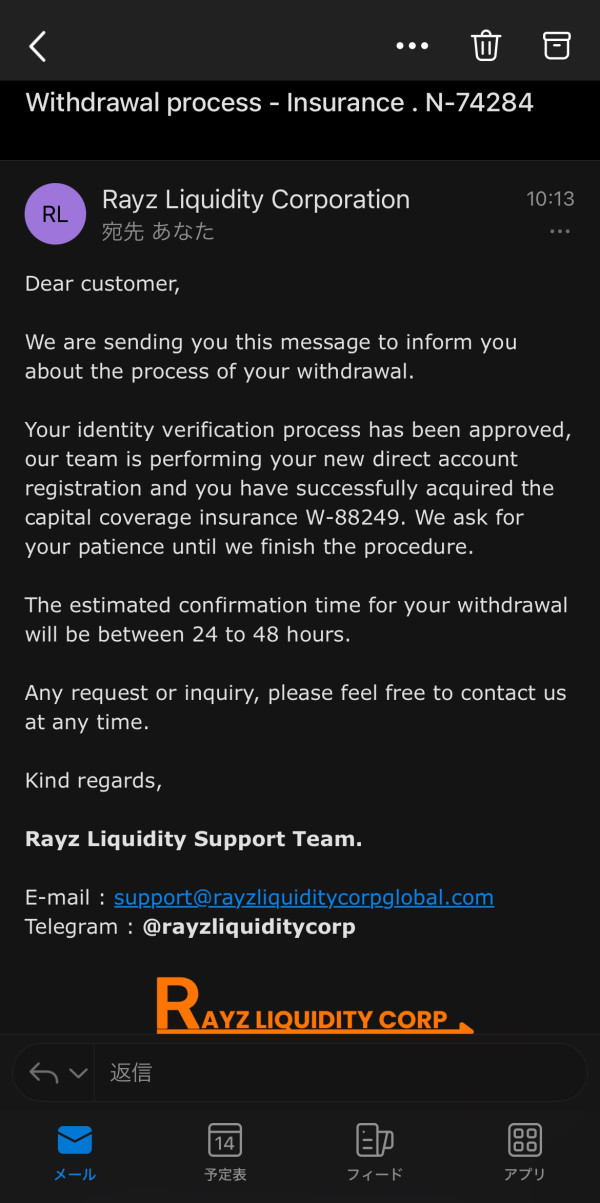

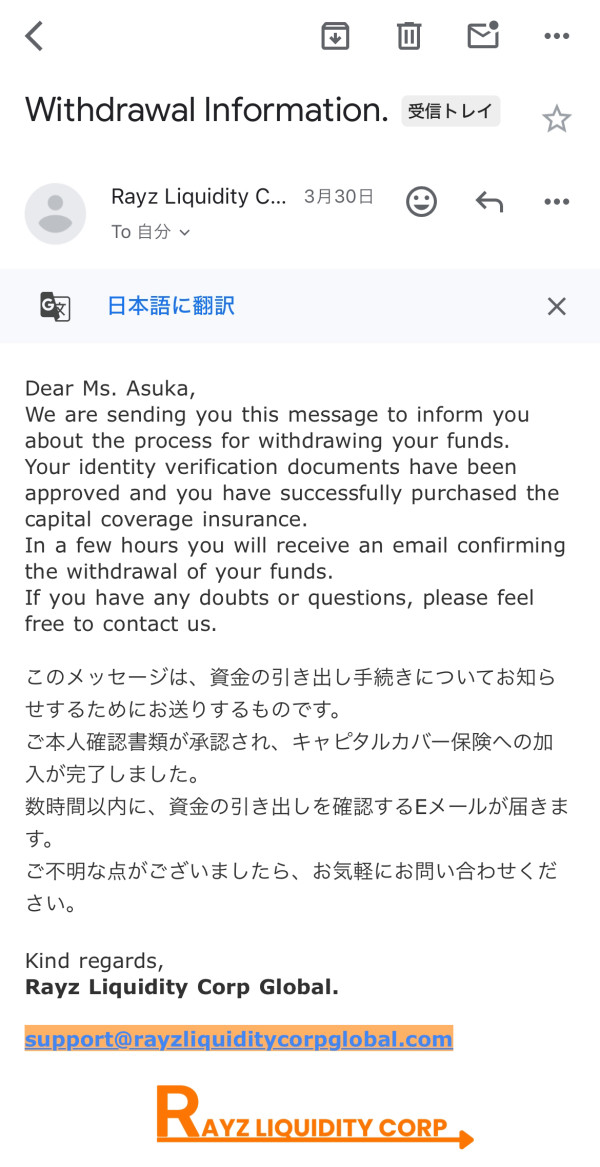

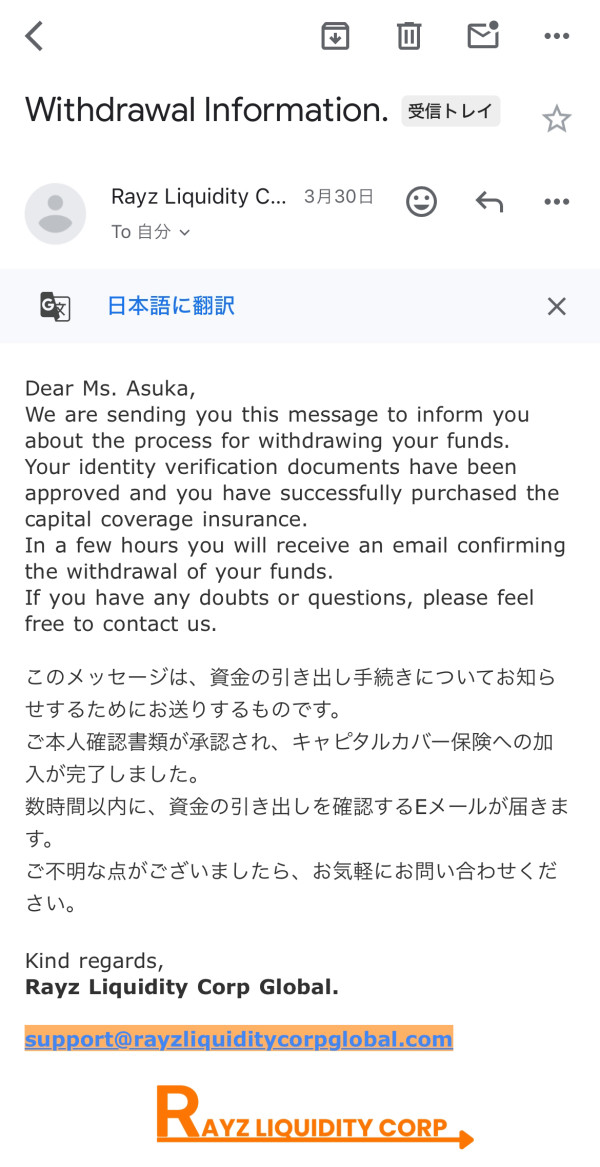

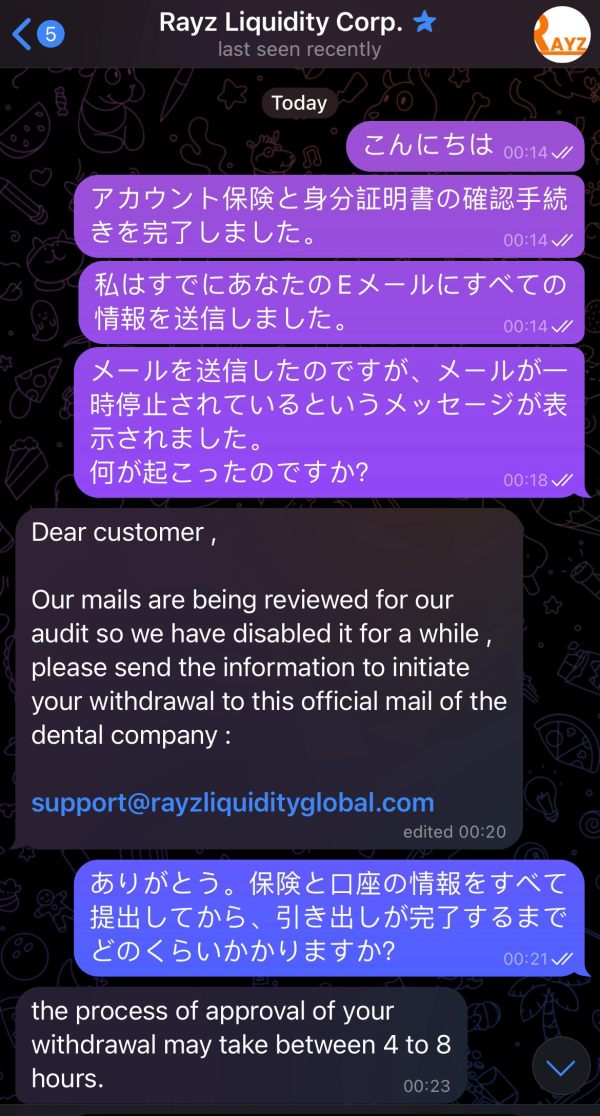

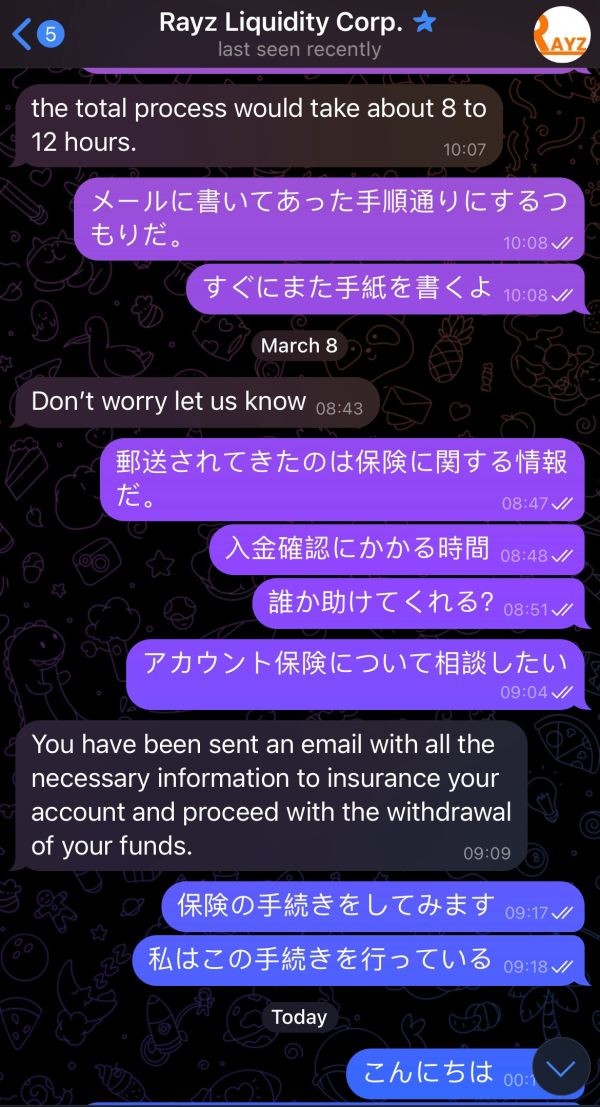

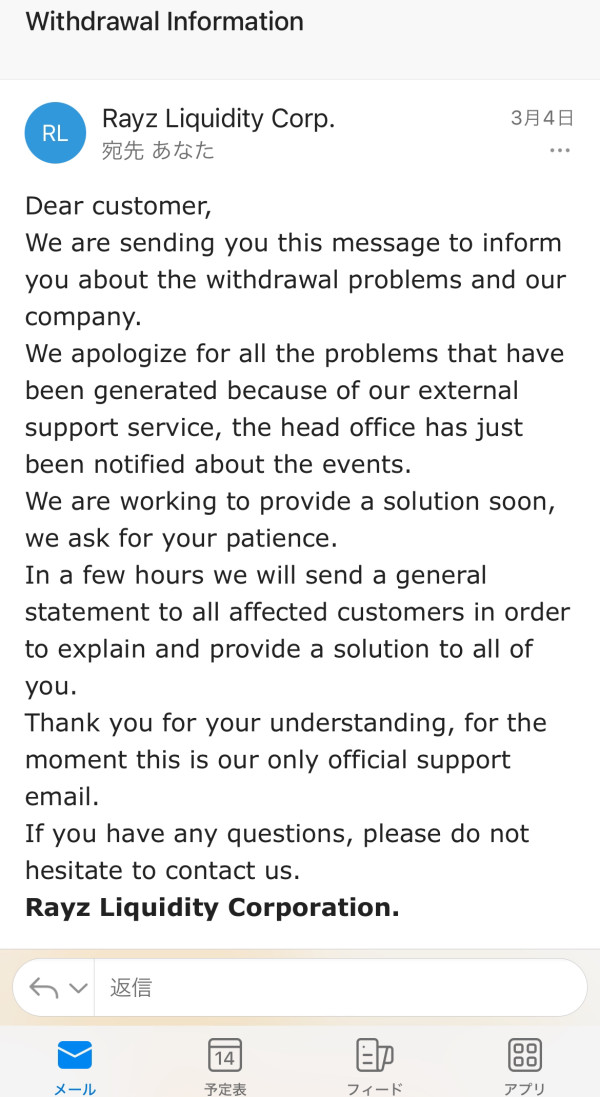

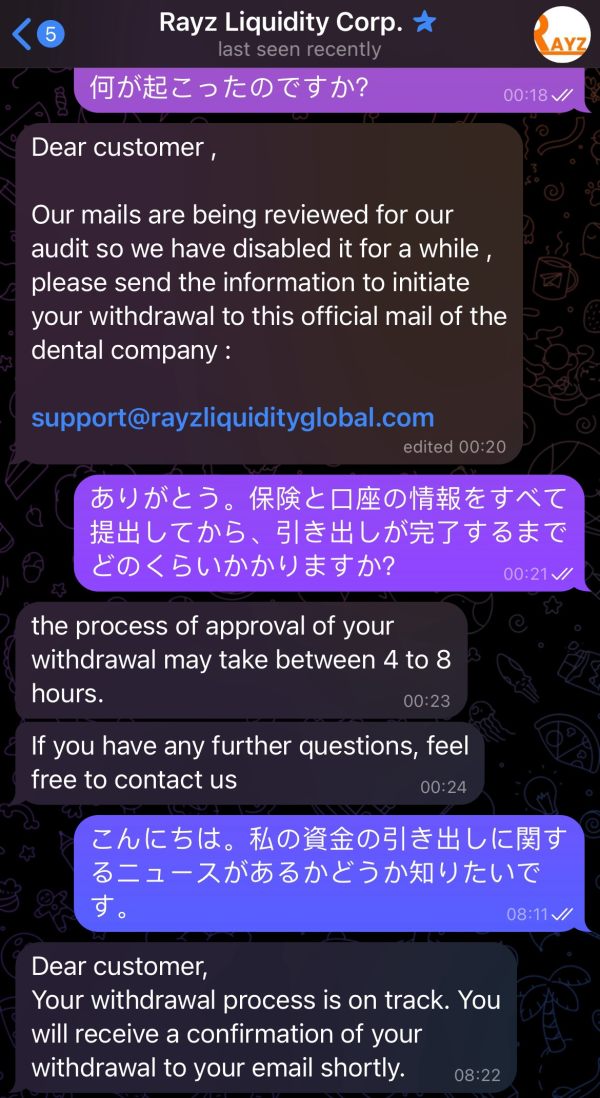

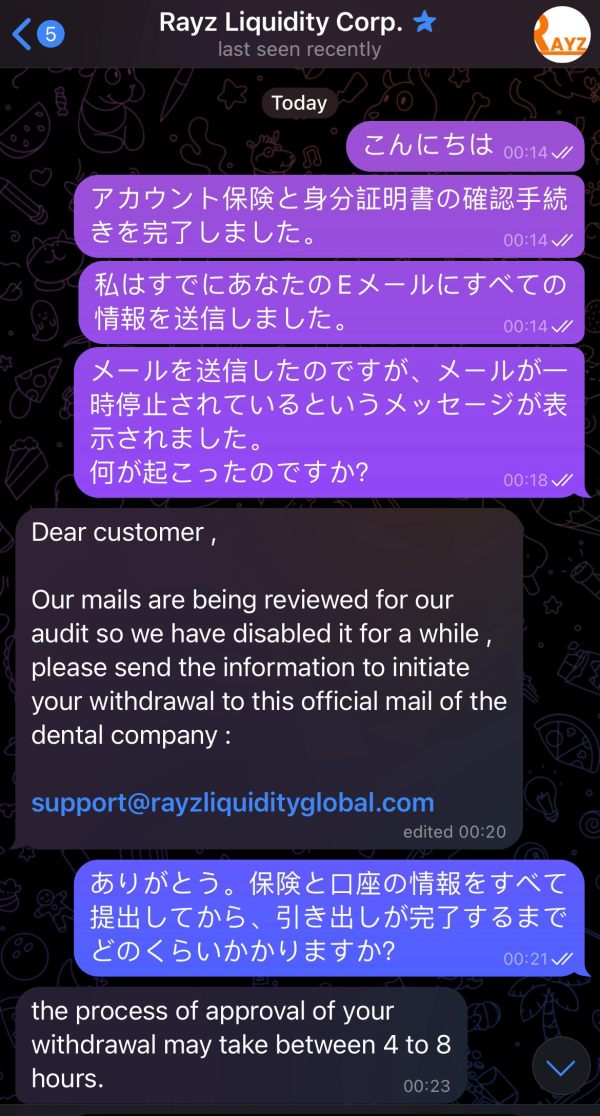

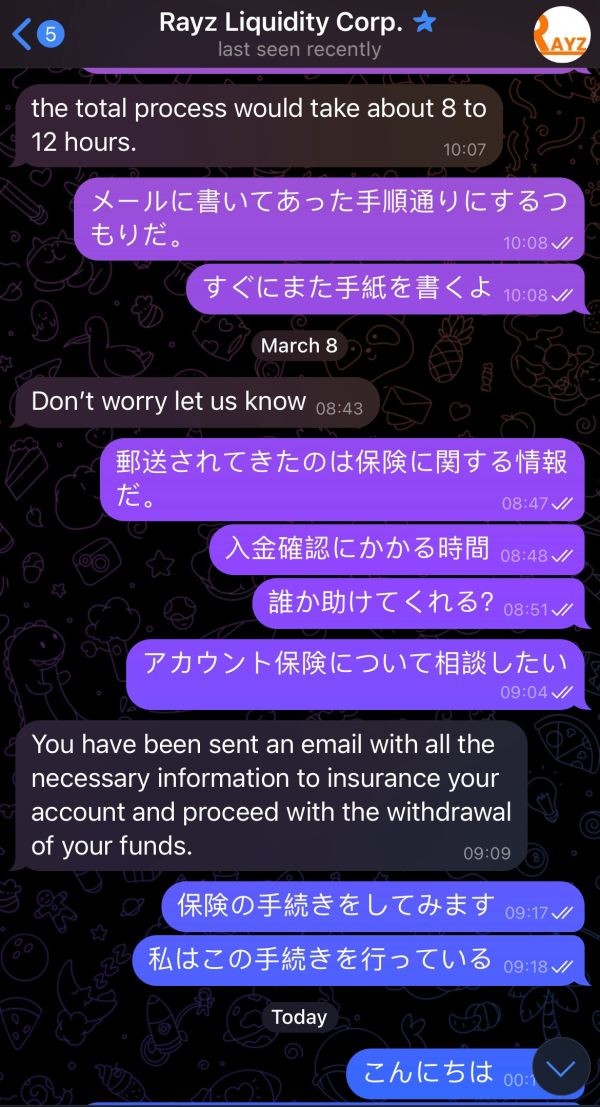

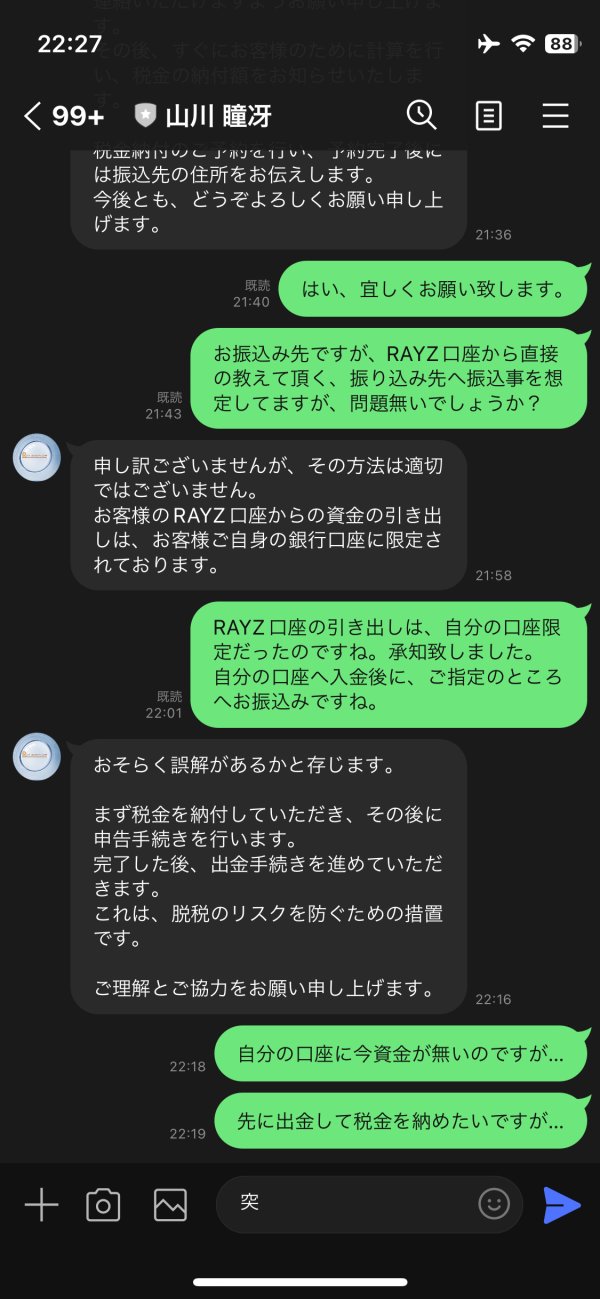

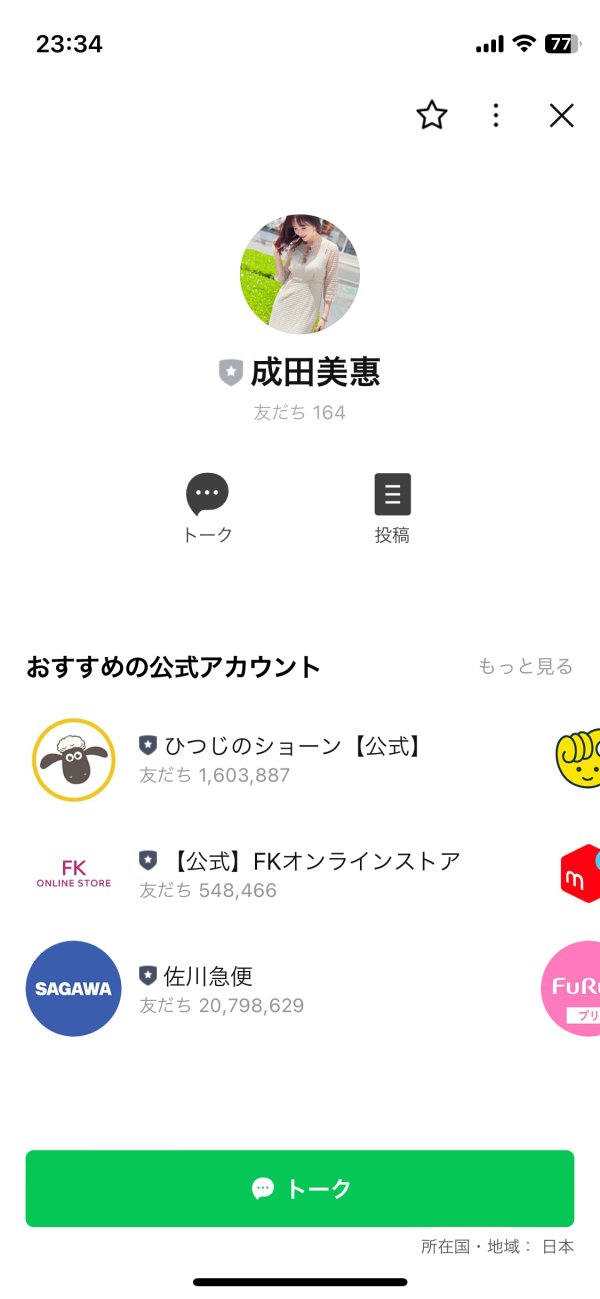

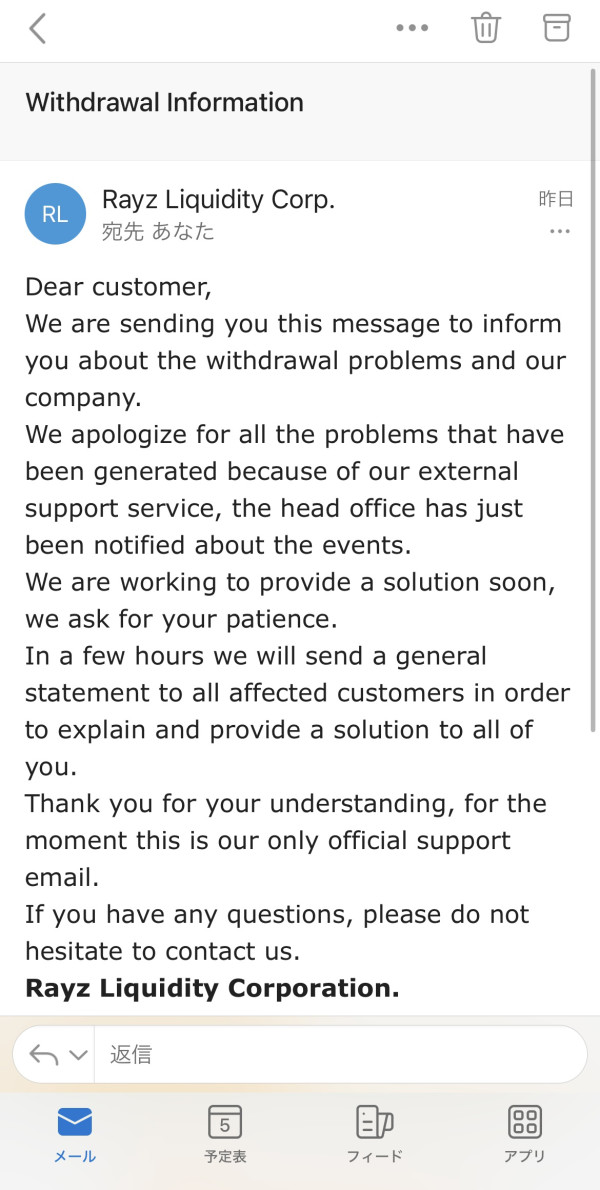

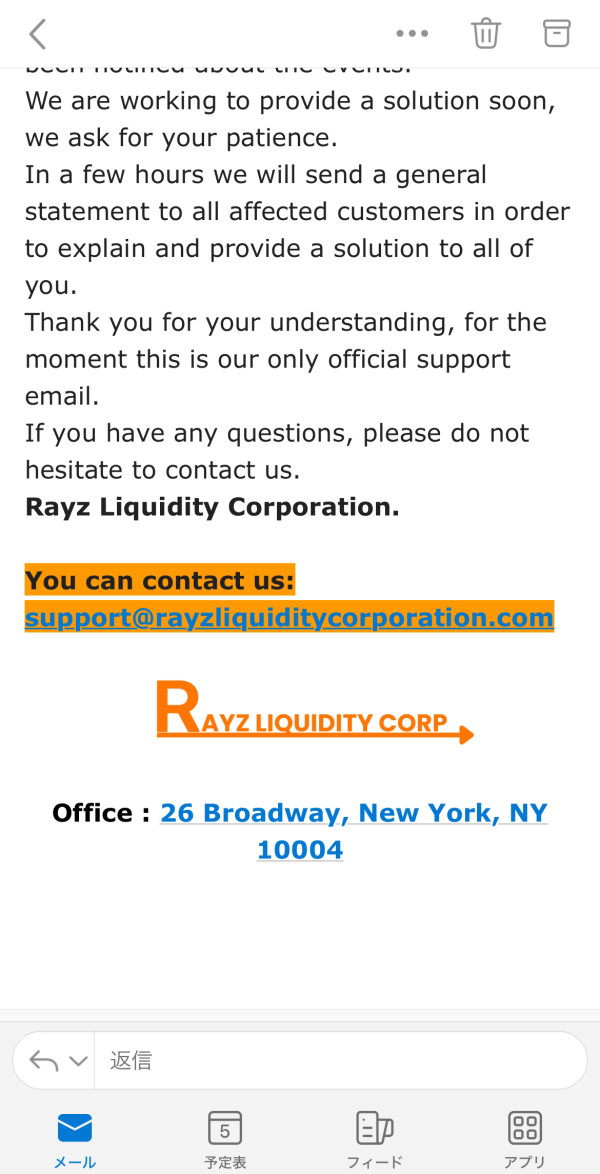

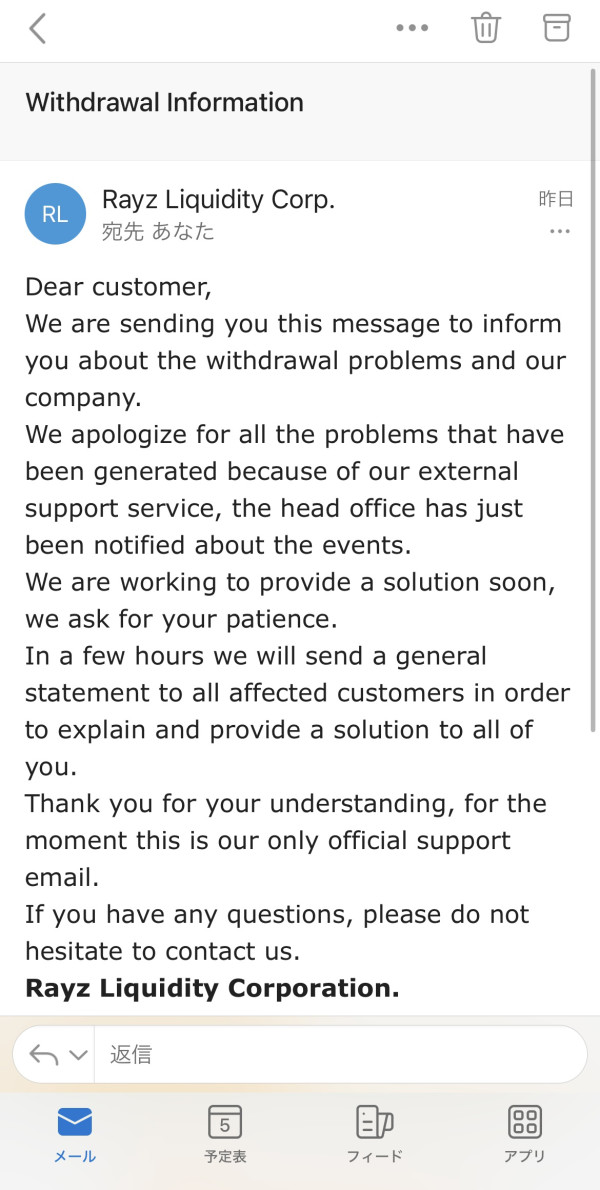

Customer service at Rayz Liquidity Corp raises significant concerns due to the persistent doubts about the broker's support infrastructure. The information provided on available customer service channels, such as email support, live chat, or telephone services, is minimal and lacks detail. There is no clear indication of response times or the availability of multilingual support, which can be crucial for a global client base.

Reported user experiences indicate that the quality and reliability of customer service may be below industry standards, contributing to overall mistrust. The lack of detailed information on service quality, operating hours, and documented resolution of client issues adds to the ambiguity surrounding the broker's support framework. Given the importance of responsive and transparent customer service in building trust, the inadequacies in this department significantly impact the overall evaluation.

Disappointed users have mentioned unresponsiveness and delays that compound existing concerns about regulatory oversight and fund security. Such lapses in customer service further amplify the negative perception, making it one of the weakest areas of Rayz Liquidity Corp's offering.

6.4 Trading Experience Analysis

In terms of trading experience, Rayz Liquidity Corp offers a platform that is technically robust, principally through its adoption of the MT5 White Label system. This platform is known for its stability and advanced functionality, which, in theory, supports a broad range of trading activities. However, in practice, user feedback suggests that the execution quality and overall trading environment remain only average.

While the platform's feature set—including technical analysis tools and automated trading capabilities—is commendable, there are also reports of inconsistent performance and occasional delays in order execution. This discrepancy between the platform's theoretical capabilities and actual user experiences creates uncertainty. In addition, several users have reported that the trading environment feels underdeveloped given the lack of supplementary trading analytics and real-time support.

This gap detracts from the overall efficiency and satisfaction of executing trades, ultimately lowering the perceived value. Thus, this rayz liquidity corp review reflects a trading experience that, while backed by a reputable platform, is marred by execution inconsistencies and insufficient supportive features that traders expect today.

6.5 Trust Analysis

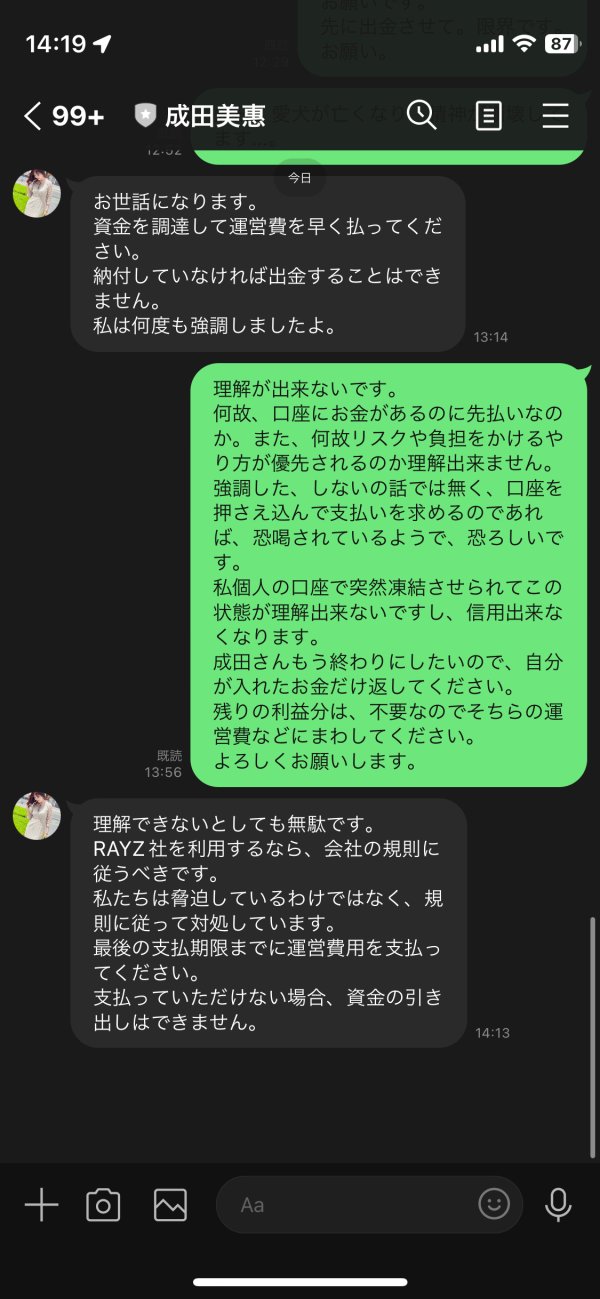

Trust is the cornerstone of any financial service provider, and for Rayz Liquidity Corp, this aspect is severely compromised by the broker's lack of regulatory oversight. The inability to verify the broker against any recognized regulatory bodies makes the safety of client funds a significant concern. With no evidence of stringent compliance procedures or third-party audits, investors are left in a vulnerable position should any discrepancies arise.

Moreover, the available sources underscore potential fraud risks, as warnings have been noted regarding the company's legitimacy. This absence of transparency and regulatory accountability is further exacerbated by an overall poor reputation in the market. Clients have expressed deep reservations about depositing funds into an environment where no authoritative oversight exists.

Such perceptions are critical in an industry where trust is paramount, and the risk of fraud becomes a deterrent for both new and experienced traders. The current evidence suggests that Rayz Liquidity Corp might be more concerned with appearing as a full-service broker rather than meeting the high standards expected for secure financial operations. The resulting trust deficit is perhaps the most significant issue identified in this review.

6.6 User Experience Analysis

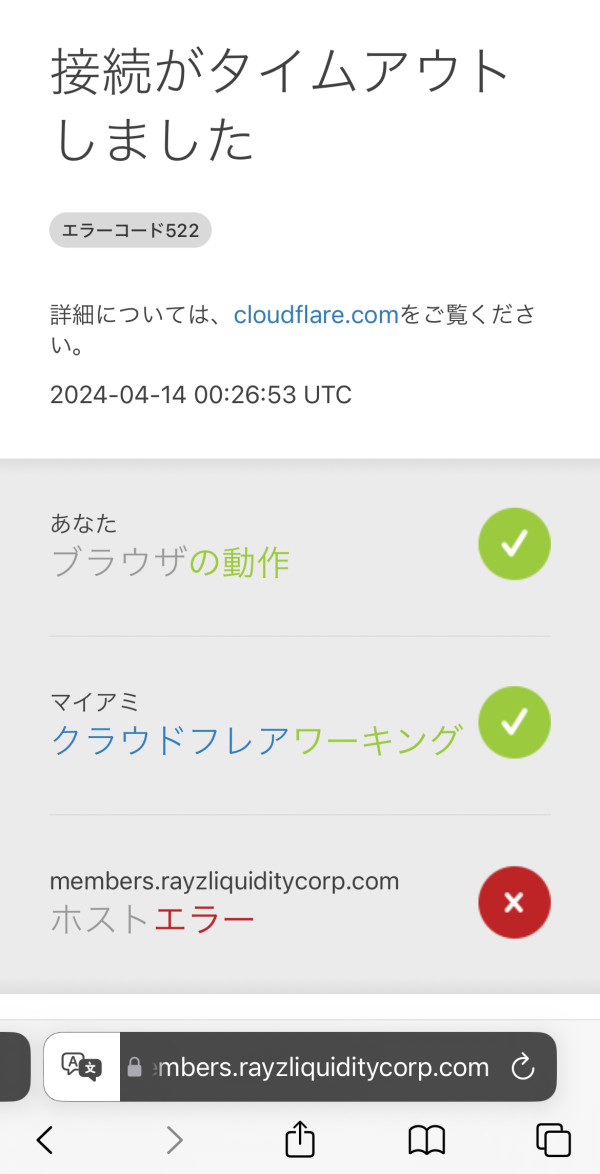

Overall user experience for Rayz Liquidity Corp appears to be unsatisfactory based on the scant available data. The platform interface, while built on the robust MT5 system, suffers from a lack of clear, user-friendly features that facilitate efficient trading operations. Registrations and account verifications processes are not detailed, indicating potential friction points for new users.

Moreover, the absence of explicit information related to ease of transactions—such as deposit and withdrawal mechanisms—further detracts from the overall user experience. Many users have expressed frustration with the opaque nature of the broker's services, which has culminated in extremely low satisfaction ratings. The interface does not seem to offer the intuitive design or comprehensive support systems expected in the contemporary trading landscape.

Additionally, recurring user complaints about delays, lack of proactive customer support, and the sense that vital information is heavily obscured have been noted. For traders who prioritize a seamless, well-supported trading environment, these issues are major deterrents. As such, the overall user experience remains a critical weak point, emphasizing the need for significant improvements in transparency and service delivery.

7. Conclusion

In conclusion, Rayz Liquidity Corp presents a high-risk proposition due to its lack of regulatory oversight and persistent issues in trust and support. While the broker does offer a diverse range of asset classes and employs the reputable MT5 White Label platform, these attractive features are overshadowed by undocumented account conditions, subpar customer service, and significant gaps in operational transparency. This review makes it clear that Rayz Liquidity Corp is best avoided by traders in search of secure, well-regulated environments.

The potential for fraud and the negative user experiences overwhelmingly suggest that caution is essential. Ultimately, for those who must choose a broker, it is advisable to seek alternatives with established regulatory credentials and a more reliable record of customer support.