Is Breitling Prime safe?

Business

License

Is Breitling Prime A Scam?

Introduction

Breitling Prime is a relatively new player in the forex market, having launched in March 2023. Positioned as a trading platform offering a variety of financial instruments, it claims to provide competitive trading conditions and services for both retail and professional traders. However, the rapid rise of online trading platforms has led to a proliferation of unregulated brokers, making it essential for traders to carefully evaluate the legitimacy and reliability of any broker they consider. As the forex market can be fraught with risks, understanding the regulatory environment, company background, and customer experiences is vital for making informed trading decisions.

This article investigates whether Breitling Prime is a safe platform for trading or if it exhibits characteristics typical of a scam. By analyzing various aspects, including regulatory status, company background, trading conditions, customer feedback, and risk assessments, we aim to provide a comprehensive evaluation of Breitling Prime's safety and legitimacy.

Regulation and Legitimacy

The regulatory framework surrounding a forex broker is crucial in determining its legitimacy and safety. A regulated broker is subject to oversight by financial authorities, which helps protect traders' funds and ensures compliance with industry standards. In the case of Breitling Prime, the broker claims to be regulated by several authorities, including the Australian Securities and Investments Commission (ASIC) and the Financial Crimes Enforcement Network (FinCEN) in the United States. However, a deeper look reveals discrepancies that raise concerns about its regulatory standing.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | Not found | Australia | Unregulated |

| FinCEN | 31000239932199 | United States | Limited credibility |

Despite claiming to be registered with ASIC, Breitling Prime is not listed on the ASIC register, indicating that it is not a licensed entity under Australian law. Furthermore, while FinCEN registration is a form of compliance with anti-money laundering regulations, it does not equate to a trading license. This raises significant doubts about the broker's operational legitimacy and its ability to safeguard client funds.

The absence of proper regulatory oversight means that traders using Breitling Prime do not benefit from the protections offered by licensed brokers, such as segregated accounts and compensation schemes. Therefore, it is prudent to question whether Breitling Prime is safe for trading, given its lack of credible regulatory backing.

Company Background Investigation

Understanding the background of a broker can provide insights into its reliability and transparency. Breitling Prime's company structure is somewhat opaque, with limited information available about its ownership and management team. The broker claims to operate from London, UK, but the lack of a physical presence at its stated address further complicates the evaluation of its legitimacy.

The company's website, which was reportedly down at the time of writing, adds to the uncertainty surrounding its operations. A reputable broker typically maintains a functional website that provides essential information about its services, regulatory status, and customer support. The absence of such transparency raises red flags about the broker's intentions and operational practices.

Moreover, the management teams credentials and professional experience are not publicly disclosed, which is a significant concern for potential investors. A well-established broker usually has a team with a proven track record in the financial sector, contributing to its credibility. In this case, the lack of information about the management team further diminishes confidence in the broker's operations.

In conclusion, the limited transparency surrounding Breitling Prime's company background and ownership structure raises questions about its safety and reliability. Traders must be cautious and consider these factors when evaluating whether Breitling Prime is safe for their trading activities.

Trading Conditions Analysis

The trading conditions offered by a broker can significantly impact a trader's experience and profitability. In the case of Breitling Prime, the broker advertises high leverage ratios of up to 1:1000, which can be appealing to traders looking to maximize their potential returns. However, such high leverage also increases the risk of substantial losses, especially for inexperienced traders.

The fee structure is another critical aspect to consider. Unfortunately, Breitling Prime does not provide clear information about its trading costs, such as spreads, commissions, and overnight fees. This lack of transparency can lead to unexpected costs that may erode a trader's profits.

| Fee Type | Breitling Prime | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Not disclosed | 1-2 pips |

| Commission Model | Not disclosed | Varies |

| Overnight Interest Range | Not disclosed | Varies |

The absence of clearly stated fees is concerning, as it may indicate hidden charges that could affect a trader's bottom line. Furthermore, the lack of a demo account option prevents potential clients from testing the platform without financial risk, which is a standard offering among reputable brokers.

In summary, while the high leverage offered by Breitling Prime may attract traders, the lack of transparency regarding trading conditions and costs raises significant concerns about its safety. As such, it is essential to approach this broker with caution and consider whether Breitling Prime is safe for your trading endeavors.

Client Funds Security

The security of client funds is paramount when evaluating a forex broker. A reliable broker should have measures in place to protect traders' investments, including segregated accounts, investor protection schemes, and negative balance protection policies. In the case of Breitling Prime, there is little information available regarding its client funds security practices.

Without proper regulatory oversight, there is no guarantee that client funds are held in secure, segregated accounts. This lack of assurance poses a significant risk, as unregulated brokers can misuse or misappropriate client funds without facing legal repercussions. Furthermore, the absence of any mention of investor protection schemes raises additional concerns about the safety of deposits made with Breitling Prime.

Historical issues related to fund security can also be a red flag. While there are no widely reported cases of fund mismanagement associated with Breitling Prime, the overall lack of transparency and regulatory scrutiny increases the risk for traders.

In conclusion, the absence of robust security measures and regulatory oversight raises serious questions about whether Breitling Prime is safe for handling client funds. Traders are advised to exercise extreme caution and consider the potential risks involved before engaging with this broker.

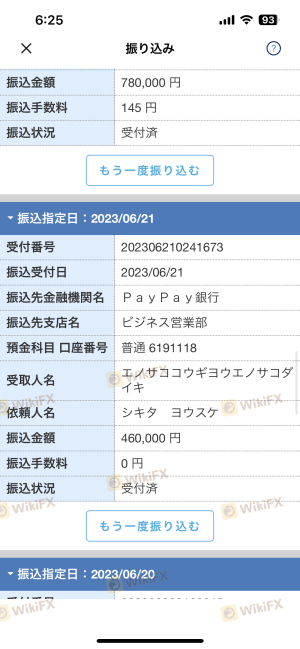

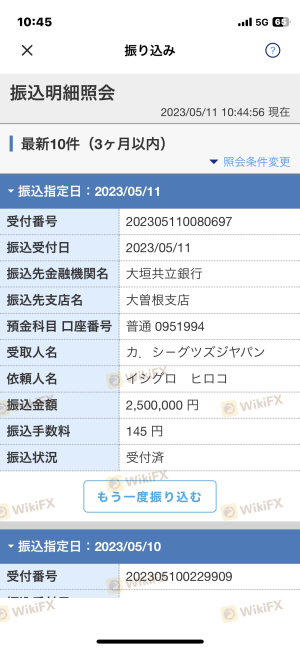

Customer Experience and Complaints

Customer feedback is a valuable indicator of a broker's reliability and service quality. In the case of Breitling Prime, there are several complaints reported by users, particularly regarding withdrawal issues. Many traders have expressed frustration over their inability to access their funds, with claims of delayed or denied withdrawal requests.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Lack of Transparency | Medium | Limited |

| Customer Support Response | Low | Inconsistent |

One typical case involved a trader who was unable to withdraw their funds after being told that they could only do so after paying a fee, which is a common tactic used by scam brokers to delay withdrawals. Such patterns of complaints are alarming and suggest a lack of accountability on the part of the broker.

The overall sentiment among users indicates a significant level of dissatisfaction with the service provided by Breitling Prime. This raises further concerns about whether Breitling Prime is safe for traders, particularly those who may be new to the forex market and unaware of the potential risks associated with unregulated brokers.

Platform and Execution

The quality of a trading platform is crucial for a trader's success. A reliable platform should offer stability, fast execution, and a user-friendly interface. In the case of Breitling Prime, details about its trading platform are scarce, and the website's downtime raises concerns about its reliability.

Additionally, the absence of popular trading software such as MetaTrader 4 or 5 may deter experienced traders who prefer these platforms for their advanced features and tools. The lack of transparency regarding order execution quality, slippage rates, and rejection rates further complicates the evaluation of the broker's performance.

Without concrete evidence of the platform's functionality and execution quality, it is challenging to determine whether Breitling Prime is safe for trading. Traders should be wary of platforms that lack proven track records and may expose them to unnecessary risks.

Risk Assessment

Using an unregulated broker like Breitling Prime inherently comes with several risks. The absence of regulatory oversight, combined with the broker's lack of transparency and history of customer complaints, creates a precarious trading environment.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Lack of oversight and protection for traders. |

| Financial Risk | High | Potential for fund misappropriation and hidden fees. |

| Operational Risk | Medium | Unreliable platform with limited customer support. |

To mitigate these risks, traders should consider the following recommendations:

- Research Thoroughly: Investigate the broker's background, regulatory status, and customer reviews before trading.

- Start Small: If you decide to use Breitling Prime, begin with a small investment to minimize potential losses.

- Diversify Investments: Avoid putting all funds into a single broker; consider using multiple platforms to spread risk.

In conclusion, the risks associated with trading through Breitling Prime are significant, and potential traders should carefully weigh these factors before proceeding.

Conclusion and Recommendations

After a thorough investigation of Breitling Prime, it is clear that the broker exhibits several concerning characteristics that raise questions about its legitimacy and safety. The lack of credible regulatory oversight, combined with a history of customer complaints and transparency issues, suggests that traders should approach this platform with caution.

In light of the findings, it is advisable for traders to consider alternative, well-regulated brokers with proven track records in the forex market. Brokers regulated by reputable authorities such as the Financial Conduct Authority (FCA) in the UK, the Commodity Futures Trading Commission (CFTC) in the US, or the Australian Securities and Investments Commission (ASIC) provide a safer trading environment.

In summary, while Breitling Prime may offer attractive trading conditions, the potential risks and lack of regulatory protection make it a broker to avoid for serious traders. Prioritizing safety and reliability should always be the foremost consideration when selecting a forex broker.

Is Breitling Prime a scam, or is it legit?

The latest exposure and evaluation content of Breitling Prime brokers.

Breitling Prime Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Breitling Prime latest industry rating score is 1.40, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.40 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.