Is NEWTON GLOBAL safe?

Business

License

Is Newton Global Safe or Scam?

Introduction

Newton Global, a forex broker founded in 2022 and based in Mauritius, has entered the competitive landscape of online trading. As with any trading platform, it is essential for traders to carefully assess the credibility and reliability of the broker before committing their funds. The forex market is rife with opportunities, but it also presents significant risks, making it imperative for investors to conduct thorough due diligence on their chosen brokers. This article will explore the safety and legitimacy of Newton Global by examining its regulatory status, company background, trading conditions, customer fund security, user experiences, and overall risk profile.

Regulation and Legitimacy

A broker's regulatory status is a critical factor in determining its safety. Newton Global operates without any significant regulatory oversight, which raises concerns among potential investors. The absence of regulation means that the broker is not held to the stringent standards that regulated entities must adhere to, such as maintaining client fund segregation and ensuring transparency in operations. Below is a summary of the regulatory information concerning Newton Global:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | Mauritius | Unverified |

The lack of a valid regulatory license indicates that traders engaging with Newton Global may expose their investments to higher risks. Without regulatory oversight, there are no guarantees regarding the protection of client funds or adherence to ethical trading practices. This absence of regulation can lead to potential issues, such as the inability to recover funds in case of fraud or insolvency. Therefore, it is crucial for traders to consider these risks when evaluating whether is Newton Global safe for their trading activities.

Company Background Investigation

Newton Global was established in 2022, making it a relatively new player in the forex brokerage industry. The company is registered in Mauritius, a jurisdiction known for its lax regulatory environment. The ownership structure and management team of Newton Global have not been extensively documented, which raises questions about the transparency and credibility of the broker. A thorough investigation into the management's background and professional experience is necessary to assess the broker's reliability.

The company's website does not provide detailed information about its founders or key team members, which is a common practice among reputable brokers. Transparency in ownership and management is vital for building trust with clients. Potential investors should be cautious when dealing with brokers that do not disclose such information, as it may indicate a lack of accountability. As traders ponder is Newton Global safe, they should weigh the importance of company transparency and the potential risks associated with investing in a broker with limited disclosure.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is essential for evaluating its overall value. Newton Global presents an attractive trading environment with low minimum deposit requirements and high leverage options. However, the absence of a demo account and the lack of clear information on commission structures may raise red flags for potential clients. Below is a comparison of key trading costs associated with Newton Global:

| Fee Type | Newton Global | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Starting from 1.5 pips | 1.0-2.0 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | Varies | 1.5%-3.0% |

While the spreads offered by Newton Global may appear competitive, the absence of a commission structure and the variability of overnight interest rates can complicate the overall cost of trading. Traders should be aware that while low spreads are appealing, they may not reflect the total cost of trading when considering other hidden fees. As such, assessing whether is Newton Global safe requires a careful examination of these trading conditions and their implications for profitability.

Customer Fund Security

The security of customer funds is a paramount concern for any trading platform. Newton Global's approach to fund security is crucial in determining its safety. The broker claims to implement various measures to protect client funds; however, the lack of regulatory oversight raises questions about the effectiveness of these measures. A detailed analysis of the broker's fund security measures is necessary to assess its reliability.

Traders should inquire whether Newton Global practices fund segregation, which involves keeping client funds separate from the company's operational funds. Additionally, the existence of negative balance protection policies is crucial in safeguarding clients from catastrophic losses. The absence of documented security measures or historical incidents of fund mismanagement could indicate potential risks for traders. As they ponder is Newton Global safe, investors should critically evaluate the broker's fund security policies and their implications for their investments.

Customer Experience and Complaints

Customer feedback plays a significant role in assessing the credibility of a broker. Analyzing user experiences and complaints can provide valuable insights into the quality of service offered by Newton Global. While some traders may report positive experiences, it is essential to consider common complaints and the company's responsiveness to them. Below is a summary of common complaint types and their severity:

| Complaint Type | Severity | Company Response |

|---|---|---|

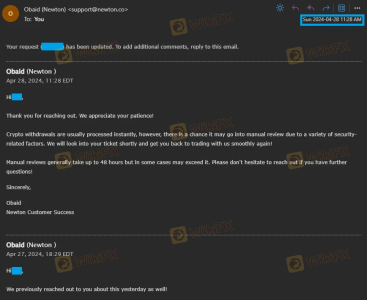

| Withdrawal Delays | High | Slow response |

| Lack of Customer Support | Medium | Inconsistent |

| Platform Stability Issues | High | Unresolved |

Typical complaints from users include withdrawal delays and inadequate customer support, which can significantly impact the trading experience. The company's response to these complaints is equally important, as prompt resolution can indicate a commitment to customer satisfaction. As traders consider is Newton Global safe, they should weigh user experiences against the broker's commitment to addressing concerns and improving service quality.

Platform and Execution

The performance and reliability of a trading platform are critical factors for traders. Newton Global offers the widely used MetaTrader 5 (MT5) platform, which is known for its user-friendly interface and advanced trading capabilities. However, the stability of the platform and the quality of trade execution are equally important. Traders should assess the order execution quality, slippage rates, and any indications of platform manipulation.

If users experience frequent slippage or rejected orders, it could signal potential issues with the broker's execution practices. A high rejection rate may indicate that the broker is not effectively managing liquidity, which can adversely affect trading outcomes. As potential clients evaluate is Newton Global safe, they must consider the overall performance of the trading platform and its implications for their trading strategies.

Risk Assessment

Investing with any broker carries inherent risks, and evaluating these risks is crucial for informed decision-making. Newton Global presents several risk factors that traders should take into account. Below is a summary of key risk areas associated with this broker:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Lack of oversight |

| Fund Security Risk | Medium | Unverified security measures |

| Customer Support Risk | High | Inconsistent responsiveness |

Traders should be aware of the elevated risks associated with engaging with an unregulated broker like Newton Global. To mitigate these risks, it is advisable to start with a small investment, utilize risk management strategies, and remain vigilant about market conditions. As traders contemplate is Newton Global safe, they should prioritize risk assessment and take proactive measures to protect their capital.

Conclusion and Recommendations

In conclusion, the evidence gathered raises significant concerns regarding the safety and legitimacy of Newton Global. The lack of regulatory oversight, combined with limited transparency and documented security measures, suggests that traders should proceed with caution. While the broker offers competitive trading conditions, the potential risks associated with investing in an unregulated entity cannot be overlooked.

For traders seeking a reliable and secure trading environment, it may be prudent to consider alternative brokers that are regulated and have demonstrated a commitment to customer protection. Reputable options include brokers with established regulatory frameworks and transparent operations. As potential clients evaluate their options, they must weigh the risks and benefits carefully, particularly when considering is Newton Global safe for their trading activities.

Is NEWTON GLOBAL a scam, or is it legit?

The latest exposure and evaluation content of NEWTON GLOBAL brokers.

NEWTON GLOBAL Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

NEWTON GLOBAL latest industry rating score is 1.41, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.41 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.