Equiity 2025 Review: Everything You Need to Know

Executive Summary

This complete equiity review looks at a financial services company that seems connected to educational equity programs and healthcare equity efforts. However, specific broker-dealer information stays limited in available sources. Based on information from 2022, the company appears linked to institutional equity review processes, especially in academic and healthcare settings. The University of Victoria's Equity Review program and the Office of Healthcare Equity's Impact Review Tool give some context, but concrete details about traditional brokerage services, trading platforms, and regulatory oversight are missing from current documentation.

This review aims to give potential users a realistic assessment based on available information. Still, investors should be careful given the limited transparency in core brokerage operations. The company may work better for institutional clients seeking equity-focused advisory services rather than individual retail traders looking for complete trading platforms.

Key Highlights: Limited public information about traditional brokerage services exists. The focus appears to be on equity review processes in institutional settings.

Target Audience: The service potentially targets institutional clients and organizations seeking equity-focused financial advisory services.

Important Disclaimers

Regional Entity Differences: Due to the lack of clear regulatory information in available sources, users in different areas may face varying levels of regulatory protection and oversight. The absence of specific licensing details means potential clients should verify regulatory status in their respective regions before using services.

Review Methodology: This assessment uses limited publicly available information, primarily focused on equity review processes rather than traditional brokerage services. The lack of complete broker-dealer information significantly impacts the completeness of this evaluation, and readers should seek additional verification before making investment decisions.

Scoring Framework

Based on available information, here are our ratings across six key dimensions:

Broker Overview

Company Background and History

The entity under review appears connected to equity review processes within institutional settings, particularly in educational and healthcare contexts. According to available sources from the University of Victoria, there is an established "Equity Review" program that focuses on policy analysis through an equity lens, published as of February 23, 2022.

This program emphasizes the importance of reviewing policies and procedures to identify intentional or unintentional bias towards minoritized populations. The institutional framework suggests a focus on equity impact assessment rather than traditional securities trading.

Business Model and Services

The available information shows a focus on equity review tools and educational resources rather than conventional brokerage services. The Office of Healthcare Equity's Equity Impact Review Tool represents another part of the organization's apparent focus on institutional equity assessment.

However, specific details about securities trading, investment advisory services, or wealth management offerings are not clearly documented in the available sources. This equiity review must acknowledge that the business model appears to differ from typical retail or institutional brokerage operations.

Regulatory Jurisdiction: Specific regulatory oversight information is not detailed in available sources. This creates uncertainty about compliance frameworks and investor protections.

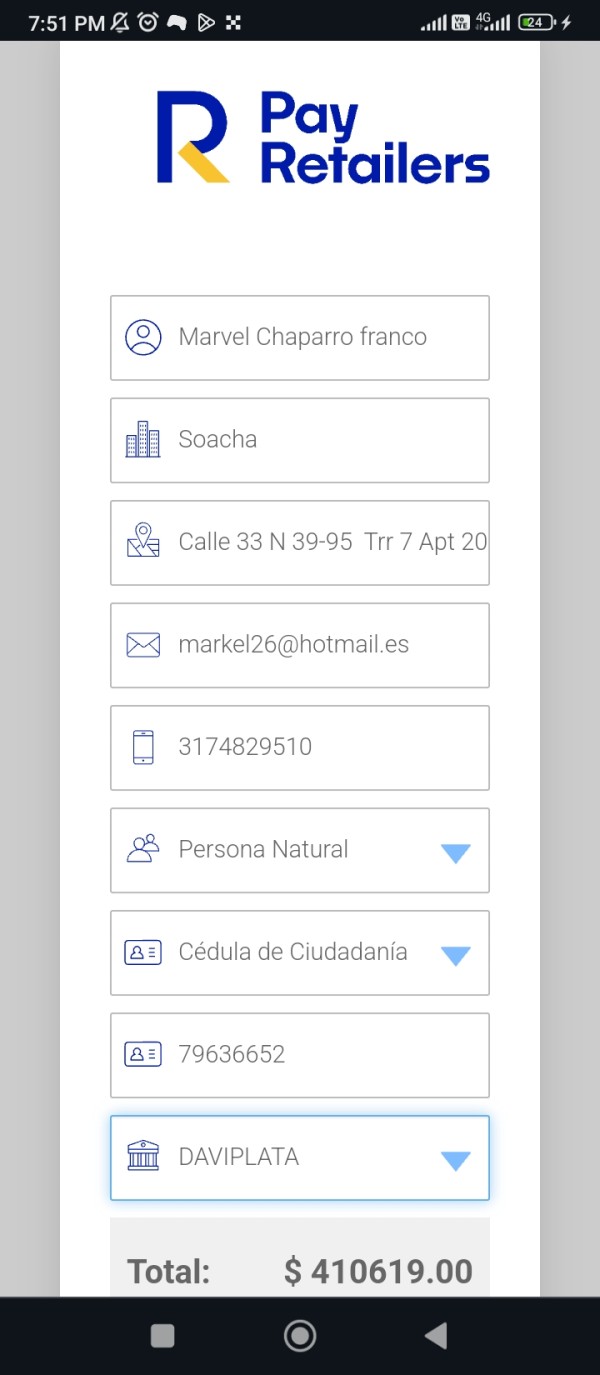

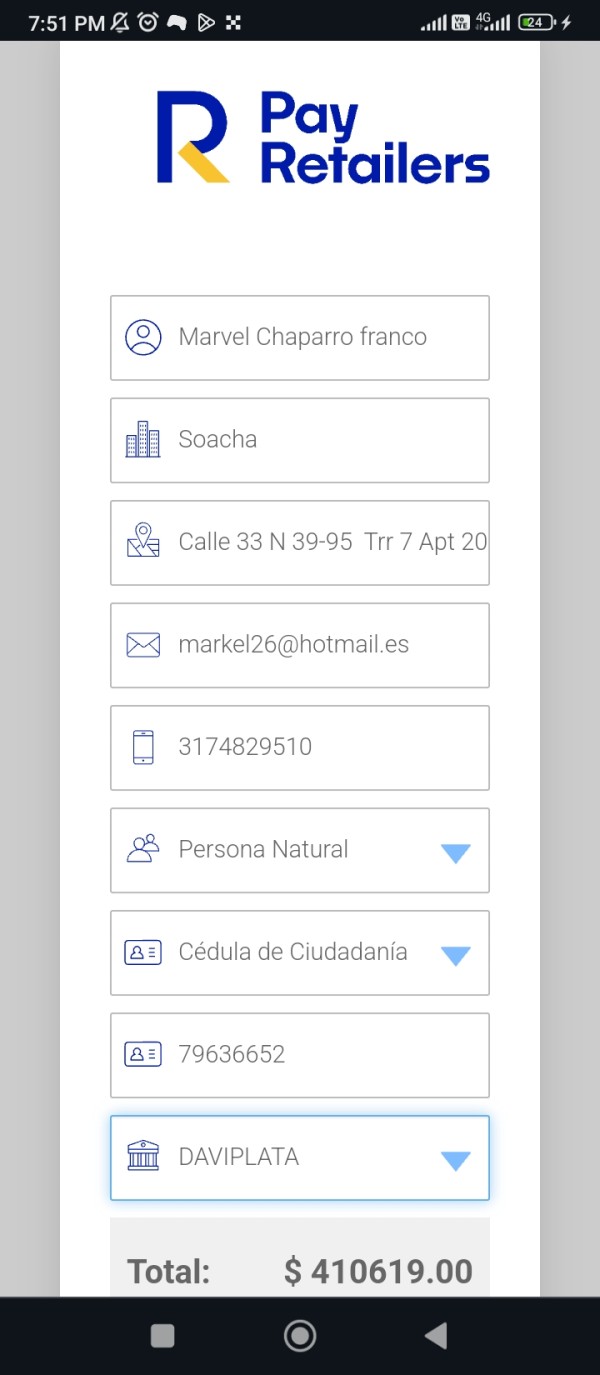

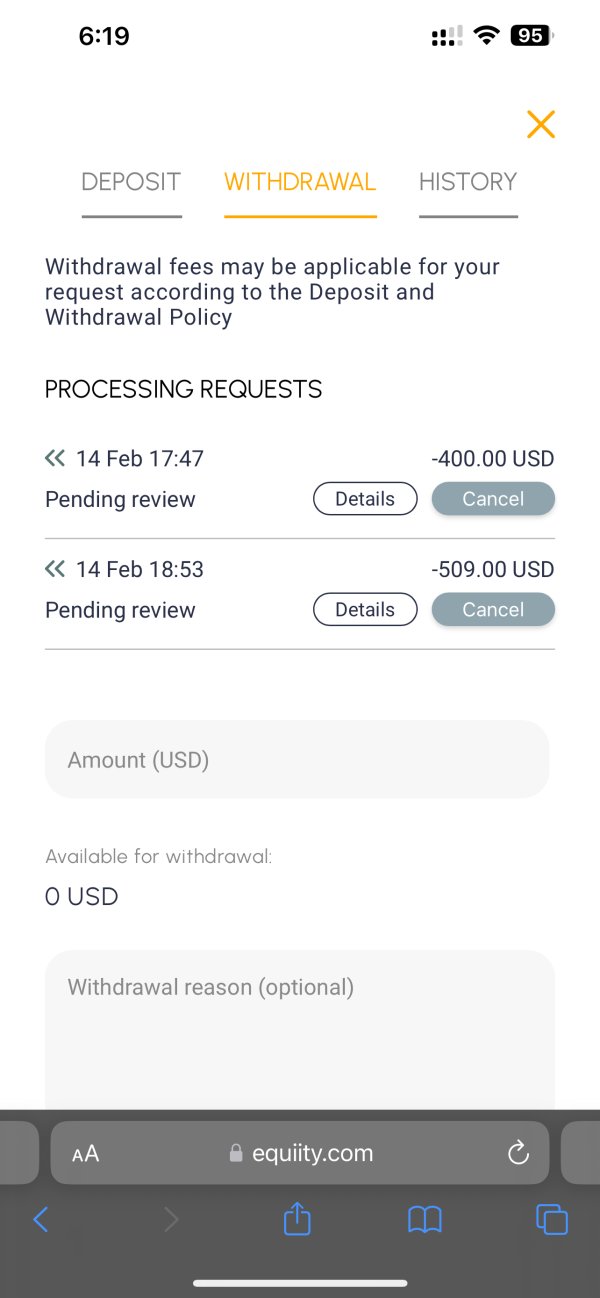

Deposit and Withdrawal Methods: No information about funding methods or account management processes is available in current documentation.

Minimum Deposit Requirements: Minimum investment or account opening requirements are not specified in accessible sources.

Bonus Promotions: No promotional offers or incentive programs are mentioned in available materials.

Tradeable Assets: The range of available securities, instruments, or investment products is not detailed in current sources.

Cost Structure: Commission rates, spreads, fees, or other cost components are not specified in available documentation. This makes cost comparison impossible.

Leverage Ratios: Margin trading capabilities and leverage options are not addressed in accessible information.

Platform Options: Trading platform specifications, technology infrastructure, and user interface details are not available.

Geographic Restrictions: Service availability by region or jurisdiction is not clarified in current sources.

Customer Support Languages: Multi-language support capabilities are not specified in available materials.

This equiity review highlights significant information gaps that potential clients should address through direct inquiry.

Detailed Scoring Analysis

Account Conditions Analysis (Score: 4/10)

The assessment of account conditions proves challenging due to the absence of specific account-related information in available sources. Traditional brokerage account features such as account types, minimum balance requirements, and account management tools are not documented in accessible materials.

The lack of transparency regarding account opening procedures, verification processes, and ongoing account maintenance represents a significant concern for potential clients seeking complete brokerage services. Without clear information about account tiers, fee structures, or special account features, prospective users cannot make informed decisions about account suitability.

The absence of details about Islamic accounts, corporate accounts, or other specialized account types further limits the assessment. This equiity review must note that the lack of account condition transparency significantly impacts the overall user experience and decision-making process.

The institutional focus suggested by available sources may indicate that account structures are designed for organizational rather than individual clients. However, this remains speculative without concrete documentation.

Available sources suggest some educational and analytical resources, particularly the University of Victoria's Equity Review materials and the Office of Healthcare Equity's Impact Review Tool. These resources appear focused on equity policy analysis and institutional review processes rather than traditional trading tools or market analysis platforms.

The educational component seems to emphasize equity lens policy review, which may provide value for institutional clients but may not address individual trader needs. The absence of information about trading tools, charting software, market research, technical analysis capabilities, or automated trading support represents a significant limitation.

Traditional brokerage tools such as economic calendars, earnings reports, analyst recommendations, or portfolio management software are not mentioned in available sources. While the institutional equity review tools may serve specific organizational needs, the lack of complete trading and analysis tools limits appeal for most individual investors and active traders seeking robust market analysis capabilities.

Customer Service and Support Analysis (Score: 4/10)

Customer service information is notably absent from available sources. This creates uncertainty about support quality and accessibility.

Essential customer service elements such as contact methods, response times, service hours, and support channel variety are not documented in accessible materials. The lack of information about phone support, email assistance, live chat capabilities, or help desk services represents a significant gap in service transparency.

Multi-language support capabilities, regional service availability, and specialized support for different client types remain unclear. Without user feedback or service quality metrics, assessing the effectiveness of customer support becomes impossible.

The absence of information about account management support, technical assistance, or educational support services further complicates the evaluation. Professional brokerage services typically provide complete customer support documentation, and the lack of such information in available sources suggests either limited service offerings or poor transparency in service communication.

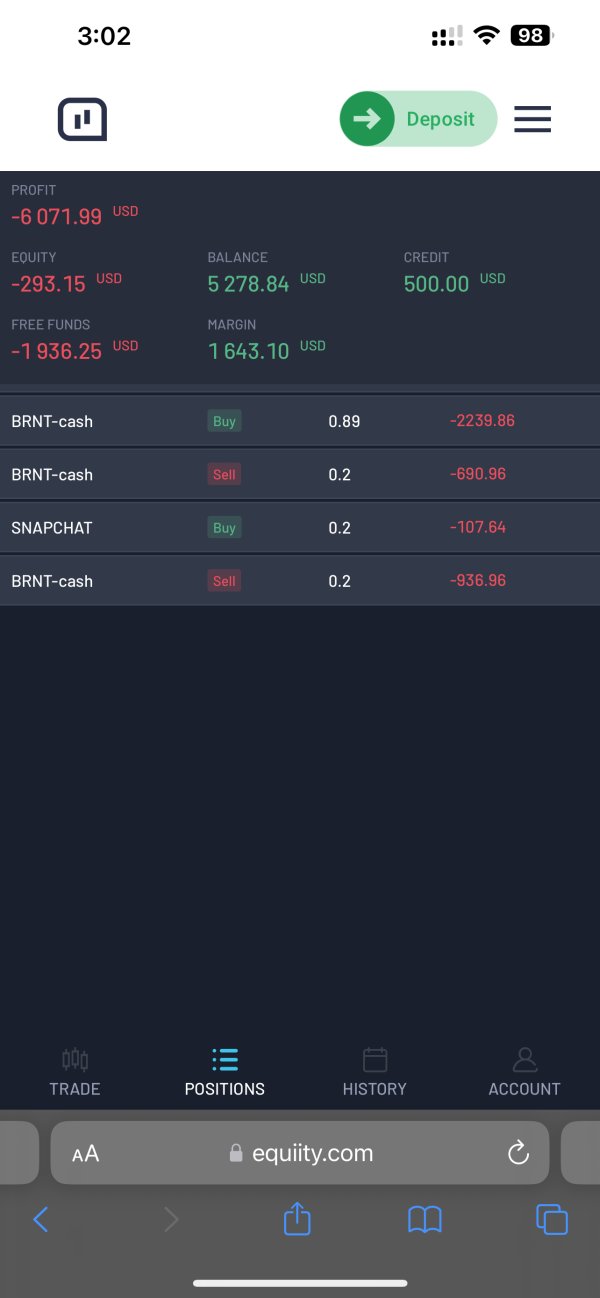

Trading Experience Analysis (Score: 4/10)

The trading experience assessment faces significant limitations due to the absence of platform information in available sources. Critical trading elements such as execution speed, order types, platform stability, and user interface quality cannot be evaluated without access to platform specifications or user feedback.

The lack of information about mobile trading capabilities, desktop platform features, or web-based trading tools represents a fundamental gap. Order execution quality, slippage rates, and trade settlement processes are not addressed in available documentation.

Advanced trading features such as algorithmic trading, copy trading, or social trading capabilities remain unspecified. The absence of information about market access, trading hours, and instrument availability further limits the assessment.

This equiity review must emphasize that without concrete trading experience data, potential clients cannot adequately assess platform suitability for their trading needs and strategies.

Trustworthiness Analysis (Score: 5/10)

The trustworthiness assessment reveals mixed indicators based on available information. The connection to established institutional programs such as the University of Victoria's Equity Review suggests some level of institutional credibility and academic backing.

However, the absence of clear regulatory information, licensing details, and compliance frameworks creates significant uncertainty about regulatory oversight and investor protection measures. Traditional trust indicators such as regulatory registration numbers, deposit insurance, segregated account policies, and audit reports are not documented in available sources.

The lack of information about company financial stability, ownership structure, and operational transparency represents a concern for potential clients seeking secure investment environments. While institutional connections may provide some credibility, the absence of standard regulatory disclosures and compliance information limits the ability to fully assess trustworthiness according to industry standards.

User Experience Analysis (Score: 4/10)

User experience evaluation proves difficult due to the absence of user feedback, testimonials, or experience reports in available sources. Essential user experience elements such as account opening ease, platform navigation, and overall satisfaction levels cannot be assessed without user-generated content or experience data.

The lack of information about registration processes, verification procedures, and onboarding experiences represents a significant evaluation gap. User interface design quality, platform responsiveness, and feature accessibility remain unspecified in available materials.

Common user concerns, frequently asked questions, and user satisfaction metrics are not documented. This makes it impossible to identify potential user experience issues or advantages.

The absence of comparative user feedback limits the ability to position the service relative to competitor offerings in terms of user satisfaction and experience quality.

Conclusion

This equiity review reveals significant limitations in available information about traditional brokerage services. Sources primarily focus on institutional equity review processes rather than securities trading operations.

While connections to established educational and healthcare institutions suggest some level of credibility, the absence of regulatory information, trading platform details, and user feedback creates substantial uncertainty for potential clients. The service may be more appropriate for institutional clients seeking equity policy review and assessment tools rather than individual traders looking for complete brokerage services.

Suitable User Types: The service may work better for institutional clients seeking equity policy review and assessment tools rather than individual traders looking for complete brokerage services.

Key Advantages: Institutional backing and focus on equity analysis processes exist.

Primary Limitations: Lack of transparency in core brokerage operations, absent regulatory information, and limited trading platform documentation create significant concerns.

Potential clients should conduct thorough due diligence and seek additional information directly from the entity before making any investment decisions.