Newton Global 2025 Review: Everything You Need to Know

Executive Summary

Newton Global stands as an emerging forex broker that entered the market in 2022. This company positions itself as a relatively new player in the competitive forex trading landscape. Headquartered in Mauritius with offices in Ebene, this broker operates under the regulation of the Financial Services Commission of Mauritius. The FSC provides a moderate level of regulatory oversight for its trading operations.

This newton global review reveals a broker that targets accessibility with its notably low minimum deposit requirement of just $20 USD. This low barrier makes it particularly attractive to novice traders and those with limited initial capital. The broker offers leverage up to 1:500, which provides substantial trading power for both conservative and aggressive trading strategies. Newton Global operates as an STP and ECN broker type, aiming to provide direct market access with competitive execution.

The broker primarily serves traders seeking low-barrier entry into the forex market. However, its relatively recent establishment means it lacks the extensive track record of more established competitors. While the company promotes itself with the slogan "Unlock your trading potential with Newton Global," the actual user experience and service quality metrics remain limited. This limitation exists due to the broker's nascent status in the industry.

Important Disclaimer

This evaluation is based on publicly available information and should be considered alongside the fact that Newton Global operates under Mauritian regulatory jurisdiction. Traders should be aware that the Financial Services Commission of Mauritius may have different regulatory standards and investor protection measures compared to major financial centers such as the UK's FCA, Cyprus's CySEC, or Australia's ASIC.

The regulatory framework in Mauritius, while legitimate, may offer different levels of compensation schemes and dispute resolution mechanisms compared to more established financial regulatory environments. Potential clients should carefully consider their jurisdiction's recognition of Mauritian regulation and any implications for investor protection. This review is conducted based on available public information and user feedback where accessible. Traders are advised to conduct their own due diligence before making any trading decisions.

Rating Overview

Broker Overview

Newton Global Commercial Business LTD emerged in the forex brokerage scene in 2022. The company established its headquarters in the Republic of Mauritius, specifically in the Ebene district. As a relatively new entrant in the forex market, the company has positioned itself to serve traders seeking accessible entry points into currency trading. The broker's business model focuses on providing STP and ECN execution, which suggests a commitment to offering direct market access rather than acting as a dealing desk broker.

The company's approach emphasizes unlocking trading potential for its clients. However, specific details about its founding team, corporate structure, and business philosophy remain limited in available public information. Newton Global operates in a competitive landscape where established brokers dominate. This makes its positioning as a low-barrier entry provider particularly significant for market penetration.

From a regulatory standpoint, Newton Global operates under the oversight of the Financial Services Commission of Mauritius. This commission provides the legal framework for its operations. The broker's choice of Mauritian jurisdiction reflects a common trend among newer brokers seeking cost-effective regulatory solutions while maintaining legitimate operational status. The company's office location in Ebene, a prominent business district in Mauritius, suggests a commitment to maintaining a physical presence in its regulatory jurisdiction.

Regulatory Jurisdiction: Newton Global operates under the regulation of the Financial Services Commission of Mauritius. This regulatory body oversees financial services in Mauritius and provides the legal framework for the broker's operations. However, specific license numbers are not detailed in available sources.

Deposit and Withdrawal Methods: Specific information regarding deposit and withdrawal methods is not detailed in available documentation. Traders interested in funding options should contact the broker directly for comprehensive information about supported payment processors, bank transfer options, and processing timeframes.

Minimum Deposit Requirements: The broker sets an accessible minimum deposit threshold of $20 USD. This positioning places it among the most accessible brokers in terms of initial capital requirements. This low barrier makes it particularly attractive for new traders testing the waters of forex trading.

Bonus and Promotional Offers: Available information does not specify current promotional offers or bonus structures. Potential clients should inquire directly about any welcome bonuses, deposit matches, or ongoing promotional campaigns that may be available.

Tradeable Assets: Newton Global primarily focuses on forex trading. However, the complete range of available currency pairs and any additional asset classes such as commodities, indices, or cryptocurrencies are not specified in current documentation.

Cost Structure: Specific information regarding spreads, commissions, overnight fees, and other trading costs is not detailed in available sources. This newton global review notes that cost transparency remains an area where more detailed public information would benefit potential clients.

Leverage Ratios: The broker offers leverage up to 1:500, providing substantial trading power for clients. This high leverage ratio caters to both conservative traders using lower leverage and more aggressive traders seeking maximum capital efficiency.

Platform Options: Specific trading platform information is not detailed in available documentation. This leaves questions about whether the broker offers MetaTrader 4, MetaTrader 5, proprietary platforms, or other trading software solutions.

Geographic Restrictions: Information regarding geographic restrictions or prohibited jurisdictions is not specified in available sources.

Customer Support Languages: Available customer support languages are not detailed in current documentation.

Account Conditions Analysis

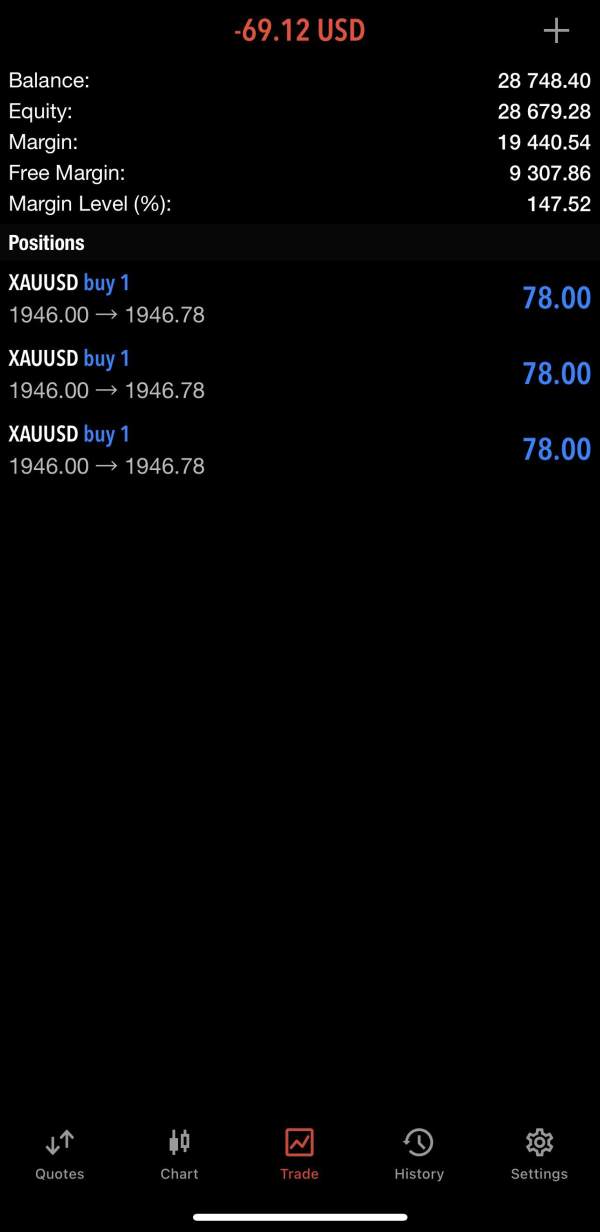

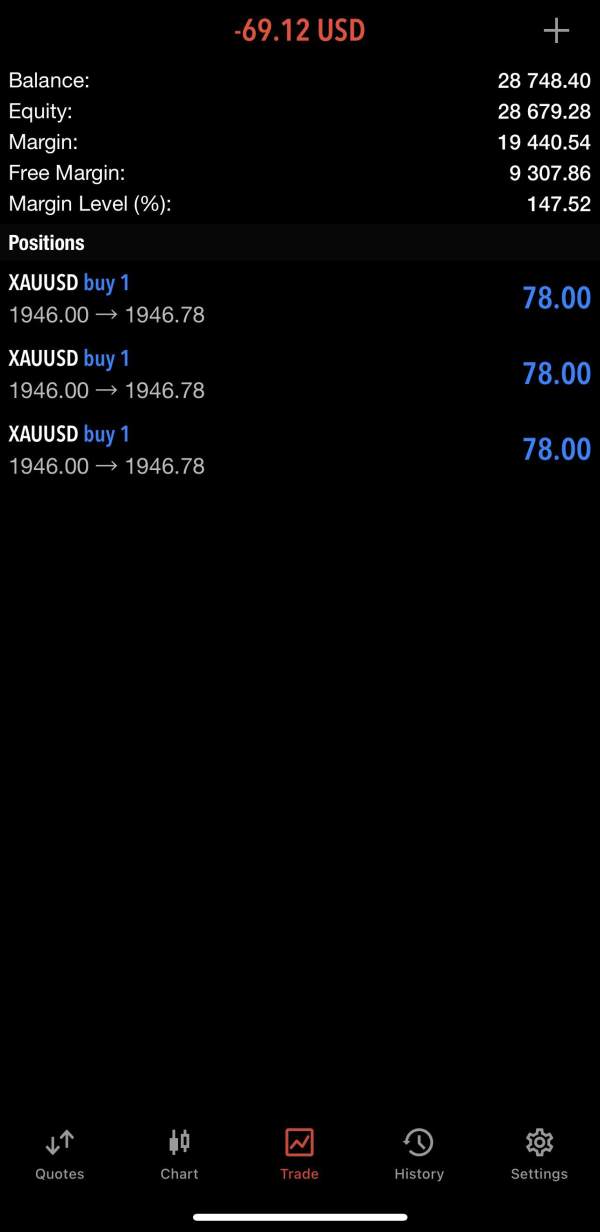

Newton Global's account structure centers around accessibility, with the $20 minimum deposit representing one of the lowest entry barriers in the forex industry. This positioning clearly targets novice traders, small account holders, and those seeking to test trading strategies without significant capital commitment. However, the lack of detailed information about different account tiers, if they exist, limits a comprehensive assessment of the broker's account offerings.

The 1:500 maximum leverage provides substantial flexibility for traders across different risk profiles. Conservative traders can utilize lower leverage ratios for risk management. Meanwhile, experienced traders can maximize their capital efficiency. This leverage level aligns with industry standards, though traders should be aware of the increased risk that comes with higher leverage ratios.

Account opening procedures and verification requirements are not detailed in available information. This represents a transparency gap for potential clients. Modern forex brokers typically require identity verification, proof of address, and sometimes financial documentation. However, Newton Global's specific requirements remain unclear from public sources.

The absence of information about Islamic accounts, VIP tiers, or professional account options suggests either these services are not offered or are not prominently marketed. For Muslim traders requiring swap-free accounts or high-net-worth individuals seeking enhanced services, this lack of clarity may be concerning. This newton global review finds that account condition transparency could be significantly improved.

The evaluation of Newton Global's tools and resources reveals significant information gaps that impact the overall assessment. Available sources do not provide specific details about the trading platforms offered. This represents a fundamental concern for potential clients who need to understand the technology they'll be using for market access.

Trading tools such as economic calendars, market analysis, technical indicators, and charting capabilities are not specified in available documentation. Modern forex trading requires sophisticated analytical tools. The absence of detailed information about these resources raises questions about the broker's technological infrastructure and commitment to trader education.

Research and analysis resources, including daily market commentary, fundamental analysis, technical analysis reports, and trading signals, are not detailed in current information. These educational and analytical resources are crucial for trader development and informed decision-making. This is particularly important for the novice trader segment that Newton Global appears to target.

Educational resources such as webinars, trading courses, risk management guides, and platform tutorials are not mentioned in available sources. Given the broker's low minimum deposit targeting new traders, the absence of comprehensive educational support represents a missed opportunity. The broker could better serve this demographic with enhanced educational offerings.

Automated trading support, including expert advisor compatibility, API access, and algorithmic trading tools, remains unspecified. As algorithmic trading becomes increasingly important in forex markets, this information gap limits the assessment of Newton Global's technological capabilities.

Customer Service and Support Analysis

Customer service evaluation for Newton Global faces limitations due to sparse available information about support channels, response times, and service quality metrics. While some user feedback suggests a Trustpilot rating around 4, which indicates moderate customer satisfaction, specific details about customer service experiences are not readily available in public sources.

The absence of detailed information about support channels such as live chat, telephone support, email response systems, or help desk ticketing creates uncertainty. This uncertainty affects accessibility when traders need assistance. Modern forex brokers typically offer multiple communication channels with varying response time commitments. However, Newton Global's specific offerings remain unclear.

Response time metrics, which are crucial for active traders who may need immediate assistance during market hours, are not specified in available documentation. Quick response times are particularly important for technical issues, account problems, or urgent trading-related queries. These issues could impact open positions significantly.

Service quality indicators such as first-call resolution rates, customer satisfaction scores beyond the general Trustpilot rating, and specific customer testimonials are not available in current sources. This lack of detailed customer feedback makes it difficult to assess the actual quality of support provided.

Multilingual support capabilities, which are important for international brokers serving diverse client bases, are not specified. Given that many forex brokers serve global markets, the absence of language support information represents another transparency gap. This gap exists in Newton Global's public information.

Trading Experience Analysis

The trading experience assessment for Newton Global encounters significant limitations due to insufficient available information about platform performance, execution quality, and user interface design. As an STP/ECN broker, Newton Global theoretically provides direct market access. This should result in competitive execution speeds and minimal conflicts of interest. However, specific performance metrics are not available.

Platform stability and execution speed data are not provided in available sources. This makes it impossible to assess crucial factors like order filling speeds, system uptime, and platform reliability during high-volatility periods. These technical performance indicators are fundamental to evaluating any forex broker's trading environment.

Order execution quality, including slippage rates, requote frequency, and fill rates at requested prices, remains unspecified in available documentation. For active traders, particularly those using scalping or high-frequency strategies, execution quality can significantly impact profitability. It also affects overall trading experience substantially.

Mobile trading capabilities and platform functionality across different devices are not detailed in current information. Modern forex trading increasingly relies on mobile accessibility. The absence of mobile platform information represents a significant evaluation gap.

The overall trading environment, including spread stability, liquidity provision, and market depth, cannot be adequately assessed based on available information. This newton global review finds that trading experience transparency requires substantial improvement. Such improvement is necessary for informed decision-making.

Trust and Reliability Analysis

Newton Global's trust and reliability assessment centers primarily on its regulatory status under the Financial Services Commission of Mauritius. While FSC regulation provides legitimate oversight, it may not offer the same level of investor protection as major regulatory bodies. These major bodies include those in established financial centers such as the FCA, CySEC, or ASIC.

The broker's establishment in 2022 means it lacks the extensive operational history that builds confidence through proven track records. New brokers face additional scrutiny from potential clients who prefer established entities. These clients want brokers with demonstrated stability through various market conditions and economic cycles.

Fund safety measures, including client fund segregation, insurance coverage, and compensation schemes, are not detailed in available information. These protections are crucial for client confidence. Their absence from public documentation represents a significant transparency concern for potential clients evaluating counterparty risk.

Corporate transparency regarding company ownership, management team, financial statements, and business operations remains limited in available sources. Established brokers typically provide comprehensive corporate information to build client trust. Newton Global's limited public disclosure may concern risk-conscious traders.

Industry recognition through awards, certifications, or professional affiliations is not mentioned in available documentation. While not essential for broker functionality, industry recognition often indicates peer acknowledgment. It also shows professional standards compliance.

User Experience Analysis

User experience evaluation for Newton Global faces constraints due to limited available feedback and interface information. The Trustpilot rating of approximately 4 suggests moderate user satisfaction. However, specific user testimonials and detailed feedback are not readily accessible for comprehensive analysis.

Interface design and platform usability cannot be adequately assessed without specific information about the trading platforms offered. User-friendly design, intuitive navigation, and efficient workflow are crucial for trader productivity. This is particularly important for the novice trader segment that Newton Global appears to target with its low minimum deposit.

Registration and account verification processes are not detailed in available sources. However, these procedures significantly impact initial user experience. Streamlined onboarding with clear requirements and reasonable processing times contributes to positive first impressions. It also enhances user satisfaction.

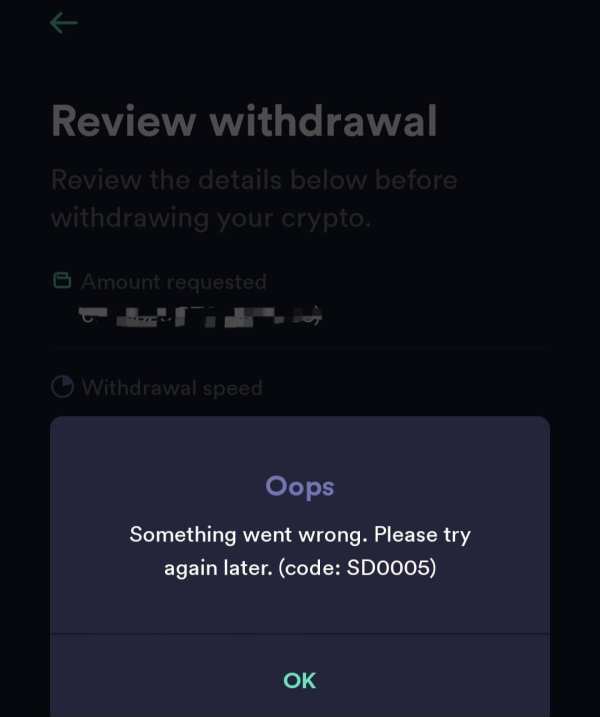

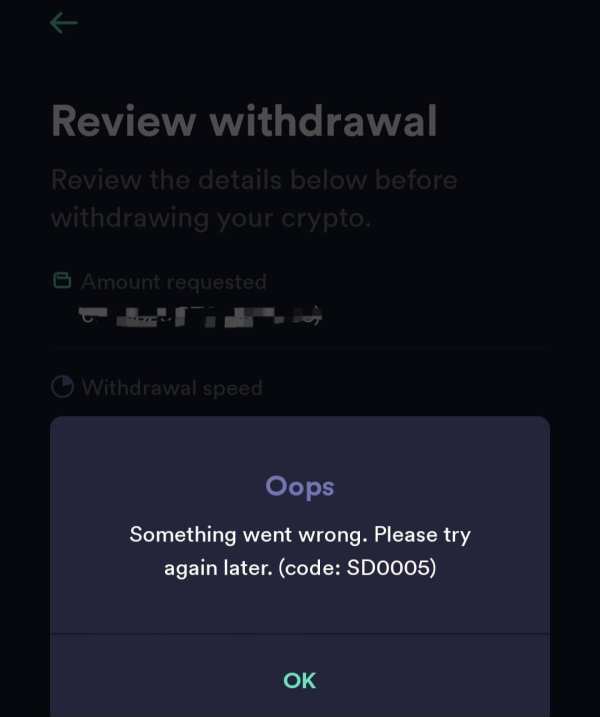

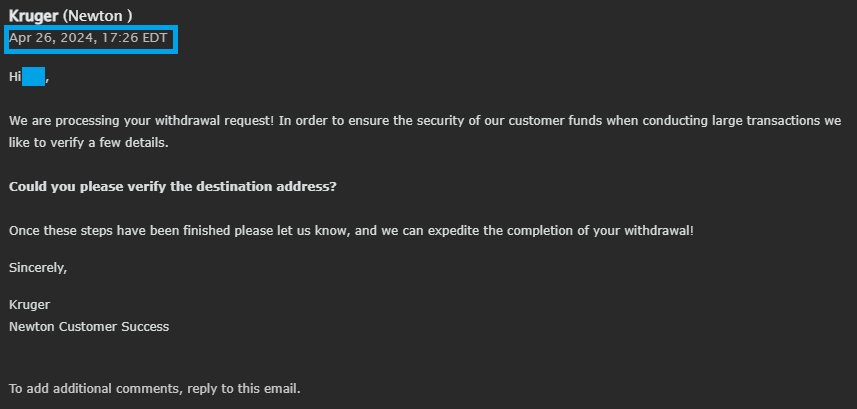

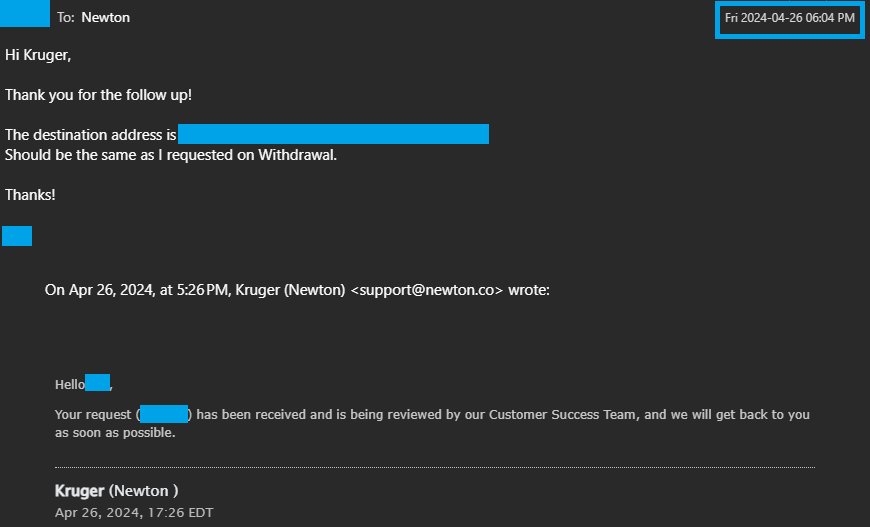

Funding and withdrawal experiences, including processing times, fees, and available methods, cannot be evaluated based on current information. Smooth money management processes are fundamental to user satisfaction. They also affect broker reliability perception.

Common user complaints or praise patterns are not available in current sources. This limits insight into recurring issues or consistently positive aspects of the Newton Global experience. User feedback analysis typically reveals operational strengths and weaknesses that impact overall satisfaction.

The absence of detailed user experience information suggests that Newton Global may benefit from increased transparency and user feedback collection. This would help better serve its target market. It would also improve service delivery.

Conclusion

This newton global review reveals a broker that presents both opportunities and uncertainties for potential clients. Newton Global's primary strength lies in its accessibility, with a $20 minimum deposit and 1:500 leverage making forex trading available to traders with limited initial capital. The broker's STP/ECN model and FSC regulation provide legitimate operational foundations. However, the regulatory framework may not match the investor protections available through major financial centers.

Significant information gaps regarding trading platforms, costs, tools, and user experiences limit the ability to make fully informed decisions. The broker's 2022 establishment means it lacks the proven track record that many traders prefer. This is particularly true for significant capital deployment.

Newton Global appears most suitable for novice traders seeking low-barrier market entry and those interested in testing forex strategies with minimal initial investment. However, traders requiring comprehensive platform features, extensive educational resources, or premium customer service may find more suitable options among established brokers. These established brokers offer transparent service offerings and proven operational histories.