Is BOUNDS safe?

Pros

Cons

Is Bounds a Scam?

Introduction

Bounds is a forex broker that has emerged in the competitive landscape of foreign exchange trading. Positioned as a digital currency broker, it aims to provide businesses with streamlined currency conversion and hedging solutions. However, as the forex market is rife with potential scams and fraudulent activities, traders must exercise caution when choosing a broker. Evaluating the legitimacy and safety of a broker like Bounds is crucial for protecting ones investments and ensuring a secure trading environment. This article employs a comprehensive investigative framework, drawing from various sources, including regulatory databases, user reviews, and expert analyses, to assess whether Bounds is safe or if it poses significant risks to traders.

Regulation and Legitimacy

The regulatory status of a forex broker is one of the most critical factors in determining its legitimacy. A well-regulated broker is more likely to adhere to industry standards and provide a safer trading environment for its clients. Unfortunately, Bounds has been flagged for lacking adequate regulatory oversight, which raises concerns about its operations.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| National Futures Association (NFA) | N/A | United States | Unauthorized |

Bounds operates in the United States but is not registered with any top-tier regulatory bodies such as the NFA or the SEC. This absence of regulation is alarming, as it means that Bounds does not have to comply with stringent regulatory requirements that protect traders. Furthermore, reports indicate that Bounds has received a low score of 1.39/10, reflecting significant concerns regarding its trustworthiness and operational integrity. The lack of oversight not only increases the risk of potential fraud but also means that traders have limited recourse in the event of disputes or issues with fund withdrawals.

Company Background Investigation

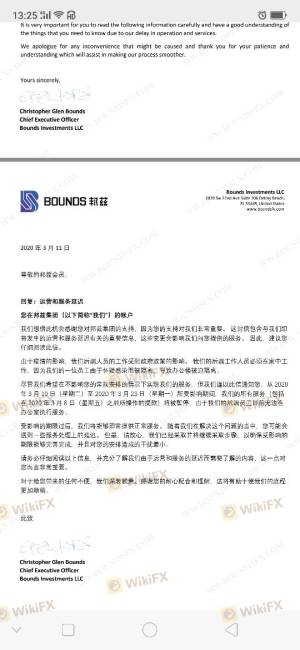

Bounds was established in 2021, making it a relatively new entrant in the forex market. The company claims to focus on providing transparent and efficient currency conversion services, yet its short history raises questions about its stability and reliability. The ownership structure of Bounds is not well-documented, which adds to the opacity surrounding the broker.

The management team‘s background is also a critical factor in evaluating the broker's credibility. While detailed information about the team is sparse, the lack of transparency surrounding the company’s leadership raises red flags. A strong management team with a proven track record is essential for instilling confidence in a broker's operations. Without clear information on the qualifications and experience of the management, potential clients may find it challenging to trust Bounds fully.

Moreover, the overall transparency and information disclosure levels of Bounds appear to be lacking. Effective communication regarding fees, trading conditions, and company policies is vital for building trust with clients. The absence of readily available information further complicates the evaluation of whether Bounds is safe for trading.

Trading Conditions Analysis

The trading conditions offered by a broker can significantly impact a traders overall experience and profitability. In the case of Bounds, the fee structure is a critical aspect that requires thorough examination. While the broker claims to offer competitive pricing, the specifics of its fee model remain unclear, leading to potential hidden costs for traders.

| Fee Type | Bounds | Industry Average |

|---|---|---|

| Major Currency Pair Spread | TBD | TBD |

| Commission Model | TBD | TBD |

| Overnight Interest Range | TBD | TBD |

The lack of transparency in the fee structure raises concerns about possible hidden charges, which could erode traders' profits. Furthermore, traders have reported issues with withdrawal processes and unexpected fees, which could indicate a lack of integrity in how Bounds conducts its business. If traders are unaware of the true costs associated with their trades, they may find themselves at a disadvantage, leading to a negative trading experience. This lack of clarity makes it imperative for potential clients to ask detailed questions before committing to trading with Bounds.

Customer Funds Security

The safety of customer funds is paramount when evaluating a brokers reliability. A reputable broker should implement robust safety measures to protect client deposits and ensure the secure handling of transactions. Unfortunately, information regarding Bounds' security protocols is not readily available, raising concerns about the safety of customer funds.

Traders should inquire about the segregation of funds, which is a practice where client funds are kept separate from the broker's operational funds. This measure is crucial in the event of financial difficulties faced by the broker. Additionally, it is vital to understand whether Bounds offers investor protection schemes or negative balance protection policies. These safeguards help ensure that clients do not lose more than their initial investment in adverse market conditions.

The absence of documented security measures raises significant concerns about whether Bounds is truly safe for trading. Historical issues with fund withdrawals and complaints about fund safety further exacerbate these concerns, indicating that traders should approach Bounds with caution.

Customer Experience and Complaints

Analyzing customer feedback is essential for understanding the overall experience of traders using a particular broker. In the case of Bounds, the reviews are mixed, with several users expressing dissatisfaction with their experiences. Common complaints include issues with fund withdrawals, lack of responsive customer support, and unexpected fees.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support | Medium | Poor |

| Hidden Fees | High | Poor |

One notable case involved a trader who reported being unable to withdraw funds after making a deposit. This situation raises serious questions about the broker's reliability and operational integrity. Furthermore, the company's slow response to complaints indicates a lack of commitment to resolving issues faced by clients. Such patterns of behavior are concerning and suggest that potential clients should exercise caution when considering Bounds as their trading partner.

Platform and Trade Execution

The performance and reliability of a trading platform are critical factors for traders. A robust platform should provide seamless execution, minimal slippage, and an intuitive user interface. However, there are concerns regarding Bounds' platform performance. Users have reported issues with order execution quality, including delays and rejections, which can significantly impact trading outcomes.

The absence of clear data on execution quality and slippage rates makes it challenging to assess whether Bounds is safe for trading. Furthermore, indications of potential platform manipulation could lead to a lack of trust among users. Traders should be wary of platforms that do not provide transparent information about their execution processes and performance metrics.

Risk Assessment

Using Bounds as a forex broker presents various risks that potential clients should consider. The following risk assessment summarizes key risk areas associated with trading with Bounds:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Lack of regulation raises concerns about oversight. |

| Financial Stability | Medium | Short operational history may indicate instability. |

| Customer Service | High | Poor response to complaints and issues reported. |

| Platform Reliability | Medium | Reports of execution issues indicate potential problems. |

Traders should be aware of these risks and take appropriate measures to mitigate them. Conducting thorough research, asking detailed questions, and considering alternative brokers with better regulatory oversight and customer feedback can help minimize exposure to these risks.

Conclusion and Recommendations

In conclusion, the evidence suggests that traders should approach Bounds with caution. The lack of adequate regulation, transparency issues, and negative customer feedback raise significant concerns about the broker's reliability. While Bounds may offer some appealing features, the risks associated with trading on this platform cannot be overlooked.

For traders seeking a safer environment, it is advisable to consider alternative brokers that are well-regulated and have a proven track record of positive customer experiences. Brokers regulated by top-tier authorities such as the FCA or ASIC provide a more secure trading environment and greater peace of mind.

In summary, while Bounds may present itself as a viable option for forex trading, the potential risks and concerns suggest that it is essential to weigh these factors carefully before proceeding.

Is BOUNDS a scam, or is it legit?

The latest exposure and evaluation content of BOUNDS brokers.

BOUNDS Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

BOUNDS latest industry rating score is 1.56, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.56 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.