Is BS safe?

Business

License

Is BS Safe or Scam?

Introduction

BS Trading, an offshore forex broker based in Vanuatu, has garnered attention in the trading community for its enticing offerings and low entry thresholds. With a minimum deposit requirement of just $1 and leverage options reaching up to 1:1000, it positions itself as an attractive option for both novice and experienced traders. However, the allure of high leverage and low costs often comes with significant risks. This article aims to provide a comprehensive evaluation of BS Trading's legitimacy and safety, helping potential traders make informed decisions. Our investigation is based on a thorough analysis of regulatory information, company background, trading conditions, customer experiences, and overall risk factors associated with trading with BS.

Regulation and Legitimacy

The regulatory status of a broker is one of the most critical factors in determining its legitimacy. BS Trading claims to be regulated by the Vanuatu Financial Services Commission (VFSC), which is often viewed as a low-tier regulatory authority. While having some form of regulation is better than being entirely unregulated, Vanuatus regulatory framework does not provide the same level of investor protection as more stringent regulators like the FCA or ASIC.

Heres a summary of BS Trading's regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Vanuatu Financial Services Commission | Not specified | Vanuatu | Limited credibility |

The VFSC does not enforce strict compliance measures, which raises concerns about the safety of client funds. Additionally, BS Trading does not offer negative balance protection, meaning traders could lose more than their initial deposits. This lack of robust regulatory oversight is a significant red flag when considering whether BS is safe for trading.

Company Background Investigation

BS Trading, officially known as BS Trading Ltd., has been operational for several years. However, detailed information regarding its ownership and management structure is scarce. The absence of transparency about the company's leadership raises questions about its accountability and reliability.

The management team‘s qualifications and experience are crucial indicators of a broker’s credibility. Unfortunately, BS Trading does not provide adequate information about its executives or their backgrounds, which is concerning for prospective traders. In an industry where trust is paramount, a lack of transparency can be a significant deterrent.

Furthermore, BS Trading's website does not exhibit a professional appearance, and its contact information is limited. This raises further concerns about the company's commitment to customer service and operational integrity. Without clear channels for communication, traders may find it challenging to resolve issues or seek assistance.

Trading Conditions Analysis

BS Trading offers competitive trading conditions, including tight spreads and a low minimum deposit. However, it is essential to scrutinize the overall cost structure and any hidden fees that may affect profitability.

Heres a comparison of BS Trading's core trading costs against industry averages:

| Fee Type | BS Trading | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.3 pips | 1.5 pips |

| Commission Model | Not disclosed | Varies |

| Overnight Interest Range | Not specified | Varies |

While the spreads offered by BS Trading appear attractive, the lack of transparency regarding commissions and overnight fees is concerning. Many brokers that advertise low spreads often compensate by charging higher commissions or fees on withdrawals. Traders should approach such offers with caution and conduct thorough due diligence to understand the full cost of trading.

Client Fund Safety

The safety of client funds is a paramount concern for any trader. BS Trading claims to utilize various payment methods for deposits and withdrawals, including credit cards and e-wallets. However, the broker does not provide clear information on whether it segregates client funds from its operational funds, which is a standard practice among reputable brokers to protect client assets.

Moreover, the absence of negative balance protection means traders could find themselves in a precarious financial situation if market conditions move against them. This lack of protective measures is a significant risk factor and raises the question: Is BS safe?

Historically, offshore brokers have been associated with various financial disputes and scandals, often leaving clients with little recourse to recover their funds. Given BS Trading's regulatory status and operational practices, potential clients should be wary of the risks involved in trading with this broker.

Customer Experience and Complaints

Customer feedback is a vital indicator of a brokers reliability and service quality. Reviews of BS Trading reveal a mix of experiences, with some users expressing satisfaction with the trading conditions while others report issues with withdrawals and customer service responsiveness.

Heres a summary of the main complaint types associated with BS Trading:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service Delay | Medium | Inconsistent |

| Account Management | Low | Average |

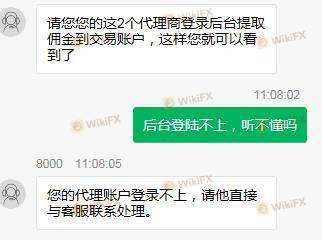

Common complaints include difficulties in withdrawing funds, which is a significant concern for any trader. Reports suggest that clients have experienced delays and lack of communication from the support team, indicating potential operational shortcomings. A lack of effective customer support can exacerbate issues, leaving traders feeling frustrated and vulnerable.

For instance, one user reported that after requesting a withdrawal, they received no response for weeks, leading to concerns about the broker's legitimacy. Such experiences highlight the importance of choosing a broker with a proven track record of customer service.

Platform and Trade Execution

The trading platform provided by BS Trading is another critical aspect of its offering. The broker uses the widely recognized MetaTrader 4 (MT4) platform, known for its user-friendly interface and robust trading tools. However, the platform's performance, stability, and execution quality are crucial for a successful trading experience.

Traders have reported mixed experiences regarding order execution speed and slippage. While some users have praised the platform for its reliability, others have noted instances of slippage during volatile market conditions, which can significantly impact trading outcomes. Additionally, concerns about the potential for platform manipulation have been raised, particularly given the broker's regulatory status.

Risk Assessment

Engaging with BS Trading involves several risks that potential clients should consider. The following risk assessment summarizes key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Operates under low-tier regulation with limited oversight. |

| Financial Risk | High | No negative balance protection; potential for significant losses. |

| Operational Risk | Medium | Reports of poor customer service and withdrawal issues. |

To mitigate these risks, traders are advised to start with a small deposit, utilize risk management strategies, and remain vigilant about market conditions. Conducting thorough research and considering alternative, more reputable brokers may also be prudent.

Conclusion and Recommendations

In conclusion, while BS Trading offers attractive trading conditions, the overall assessment raises significant concerns about its safety and legitimacy. The lack of robust regulatory oversight, transparency regarding company operations, and reports of customer service issues suggest that potential traders should exercise caution.

To answer the question, "Is BS safe?"—the evidence points to several red flags that warrant serious consideration. Traders looking for a reliable broker may want to explore alternatives that are regulated by top-tier authorities and have a proven track record of customer satisfaction.

For those seeking safer trading environments, consider brokers regulated by the FCA, ASIC, or CySEC, which offer higher levels of investor protection and more transparent operational practices. Always remember to conduct thorough research and due diligence before committing to any trading platform.

Is BS a scam, or is it legit?

The latest exposure and evaluation content of BS brokers.

BS Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

BS latest industry rating score is 1.59, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.59 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.