ETX Capital 2025 Review: Everything You Need to Know

ETX Capital, now rebranded as OvalX, has established itself as a notable player in the online trading landscape since its inception in 1965. This review synthesizes key insights from various sources to provide a comprehensive overview of the broker's offerings, user experiences, and expert opinions, particularly focusing on the pros and cons of trading with ETX Capital.

Summary: Overall, ETX Capital presents a mixed picture. While it offers a wide range of trading instruments and robust educational resources, user reviews frequently highlight issues with customer service and withdrawal processes. The broker operates under multiple regulatory frameworks, which adds a layer of complexity for potential clients.

Note: It is important to consider the different regulatory entities under which ETX Capital operates, as this can affect user experiences and protections based on geographical location.

Ratings Overview

How We Rated the Broker: Ratings are based on a combination of user feedback, expert reviews, and factual data regarding the broker's services and conditions.

Broker Overview

Established in 1965, ETX Capital (now OvalX) has a long-standing reputation in the trading industry. The broker is headquartered in London and is regulated by the Financial Conduct Authority (FCA) in the UK, as well as the Cyprus Securities and Exchange Commission (CySEC) and the Financial Sector Conduct Authority (FSCA) in South Africa. ETX Capital provides access to a diverse array of trading platforms, including its proprietary ETX Trader Pro and the widely used MetaTrader 4 (MT4). Traders can engage in various asset classes, including forex, stocks, commodities, and cryptocurrencies.

Detailed Breakdown

-

Regulated Regions: ETX Capital operates under the regulation of the FCA, CySEC, and FSCA, which provides a level of security for traders in these regions. However, it does not accept clients from the United States, Canada, and several other countries.

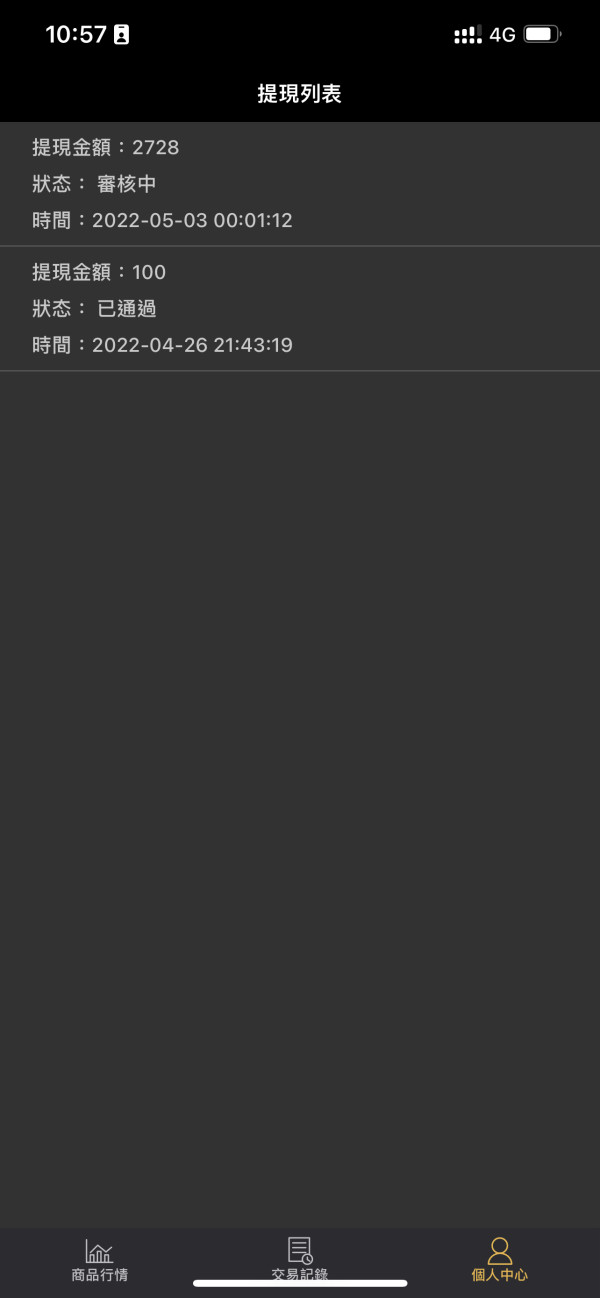

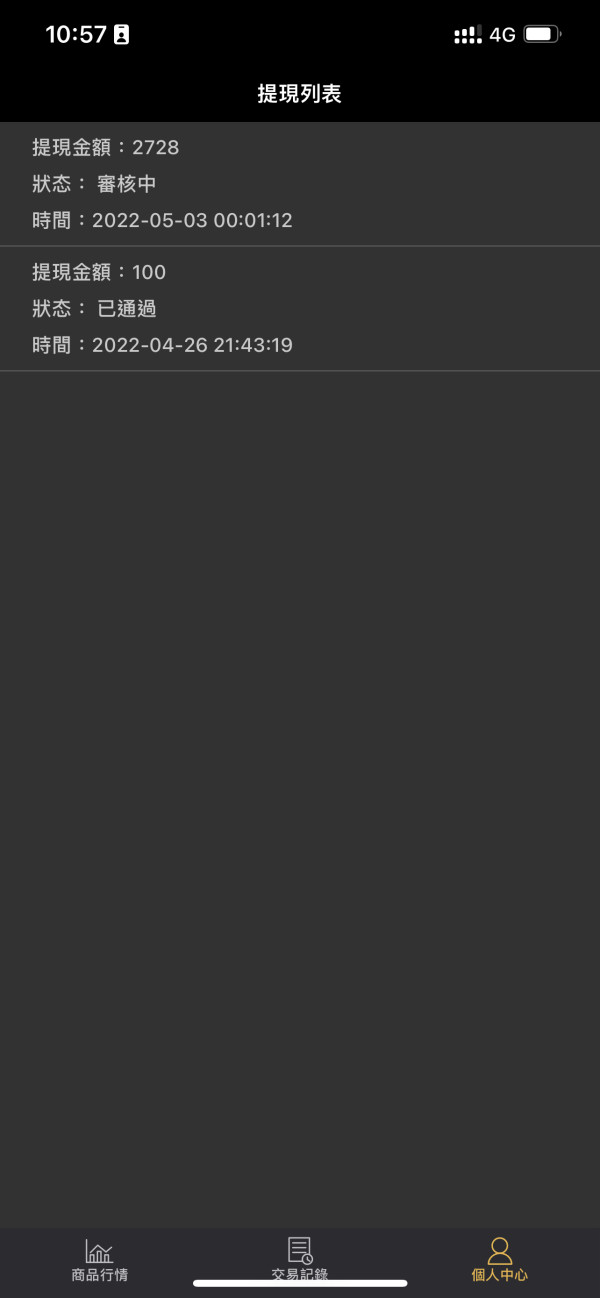

Deposit/Withdrawal Currencies: The broker supports multiple currencies for deposits and withdrawals, including GBP, EUR, and USD. Popular payment methods include credit/debit cards, bank transfers, and e-wallets like Skrill and Neteller.

Minimum Deposit: The minimum deposit to open an account with ETX Capital is £100, which is relatively accessible compared to many competitors.

Bonuses/Promotions: Currently, ETX Capital does not offer any promotional bonuses, which may disappoint some traders looking for additional incentives.

Tradable Asset Classes: ETX Capital provides access to over 5,000 instruments, including 60+ forex pairs, stock CFDs, commodities, and a limited selection of cryptocurrencies (such as Bitcoin and Ethereum).

Costs: The broker does not charge commissions but incorporates trading costs into the spreads. Average spreads for major currency pairs like EUR/USD start at 0.6 pips. However, some users have reported higher spreads during volatile market conditions.

Leverage: ETX Capital offers leverage up to 1:30 for retail traders, in line with ESMA regulations. This leverage can enhance trading potential but also increases risk.

Trading Platforms: Traders can choose between ETX Trader Pro and MT4. The proprietary platform is designed for ease of use and offers advanced charting tools, but MT4 remains a favorite for those seeking automation and customization.

Restricted Regions: ETX Capital does not accept clients from the USA, Canada, and several other countries due to regulatory restrictions.

Available Customer Service Languages: Customer support is available in multiple languages, including English, Spanish, German, and Mandarin. However, the availability of support may be limited outside of standard trading hours.

Revised Ratings Overview

Detailed Analysis of Ratings

-

Account Conditions (7/10): The minimum deposit is relatively low, and the range of account types is adequate for most traders. However, the lack of different account tiers could limit advanced traders.

Tools and Resources (6/10): ETX Capital provides a good selection of educational resources, including webinars and guides. However, the research tools are considered basic and could be improved.

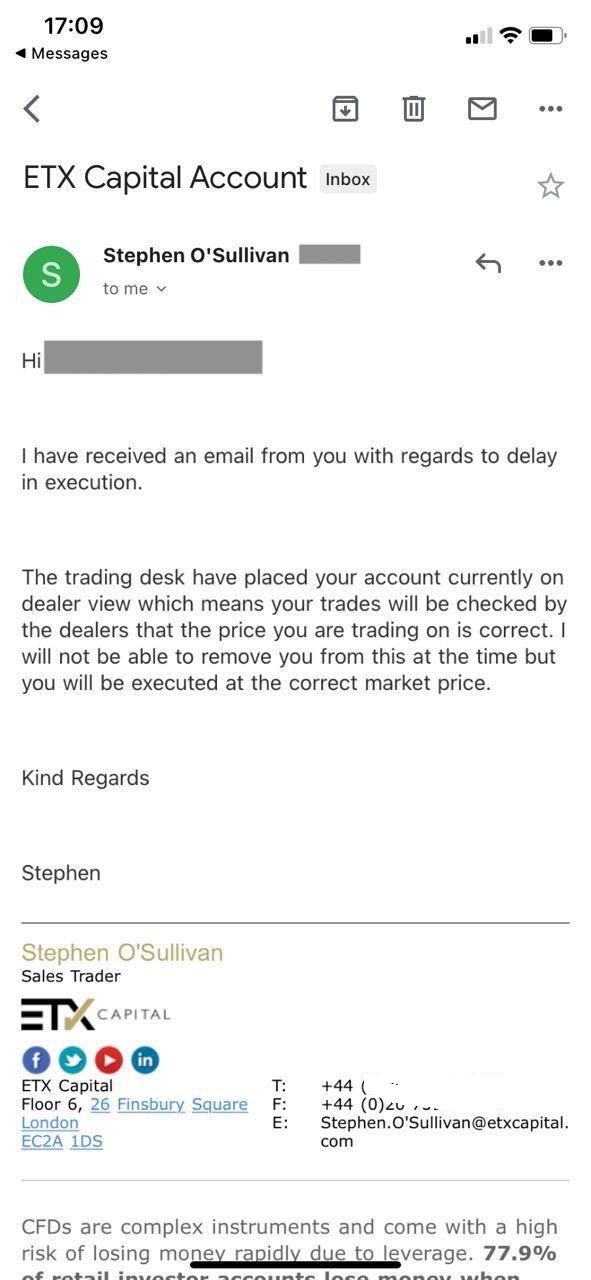

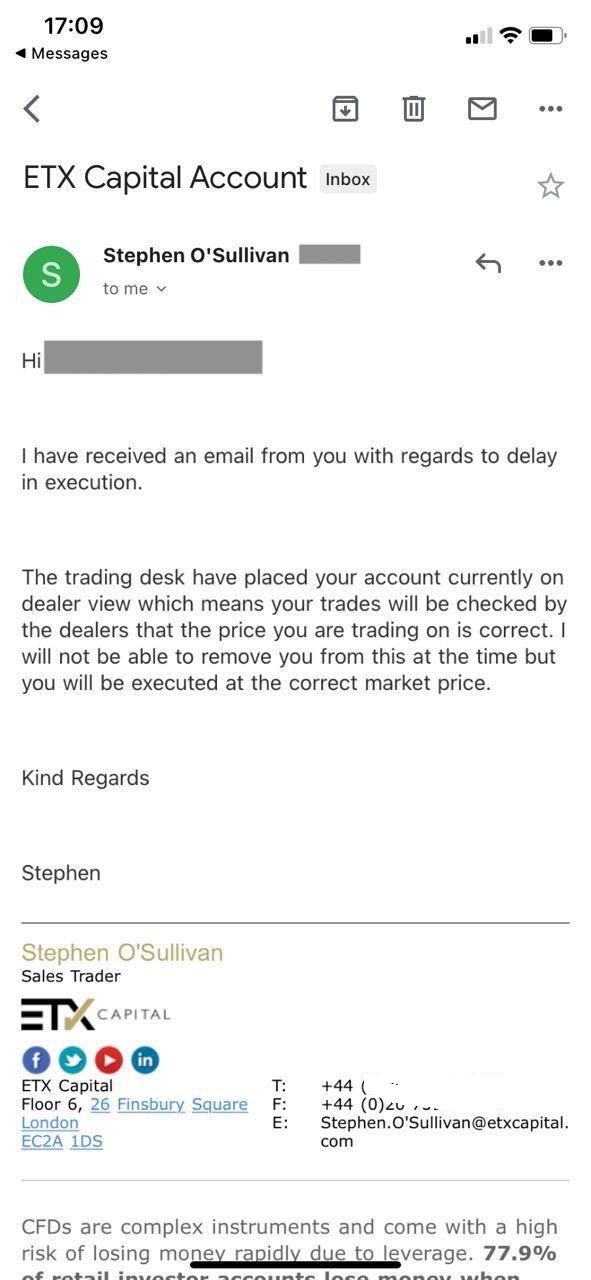

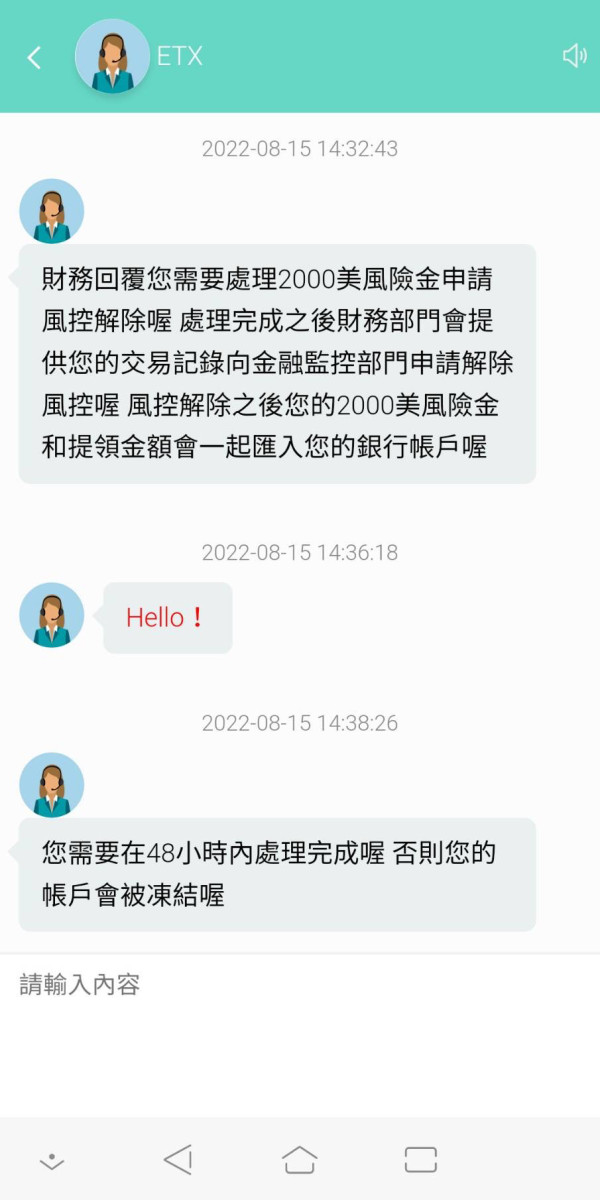

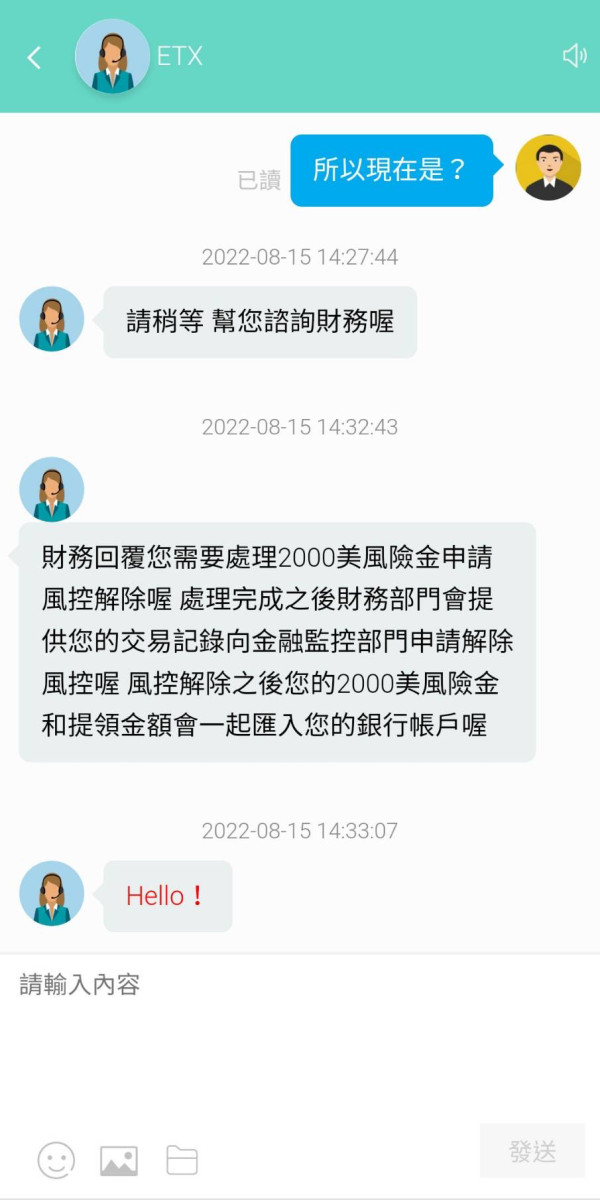

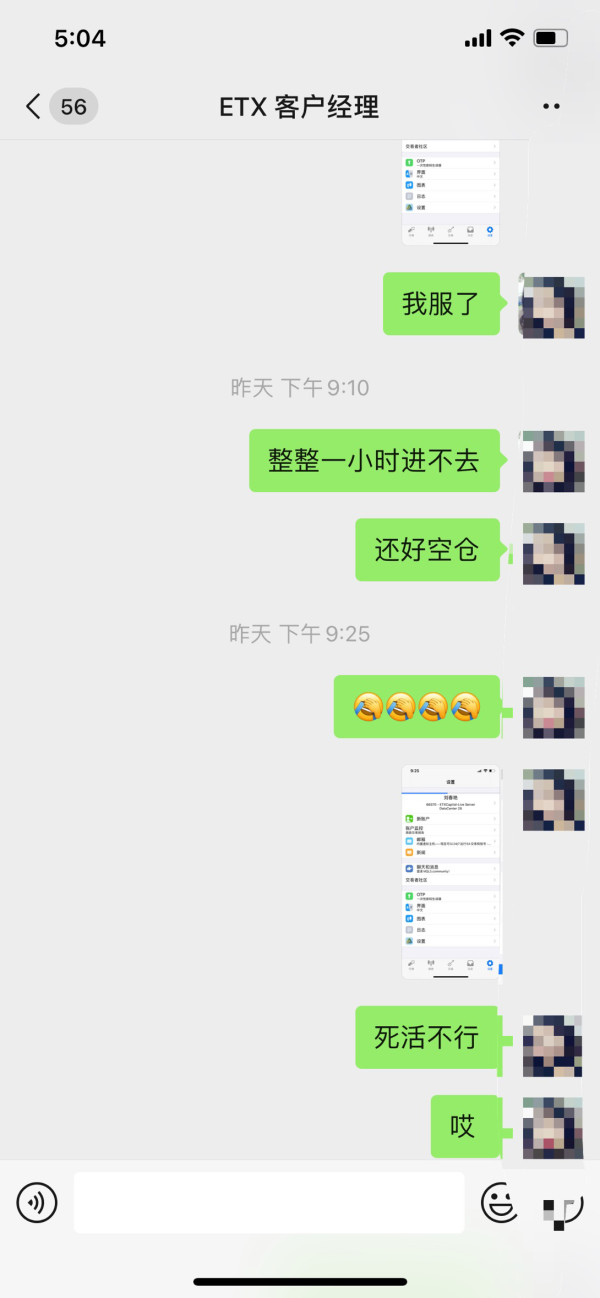

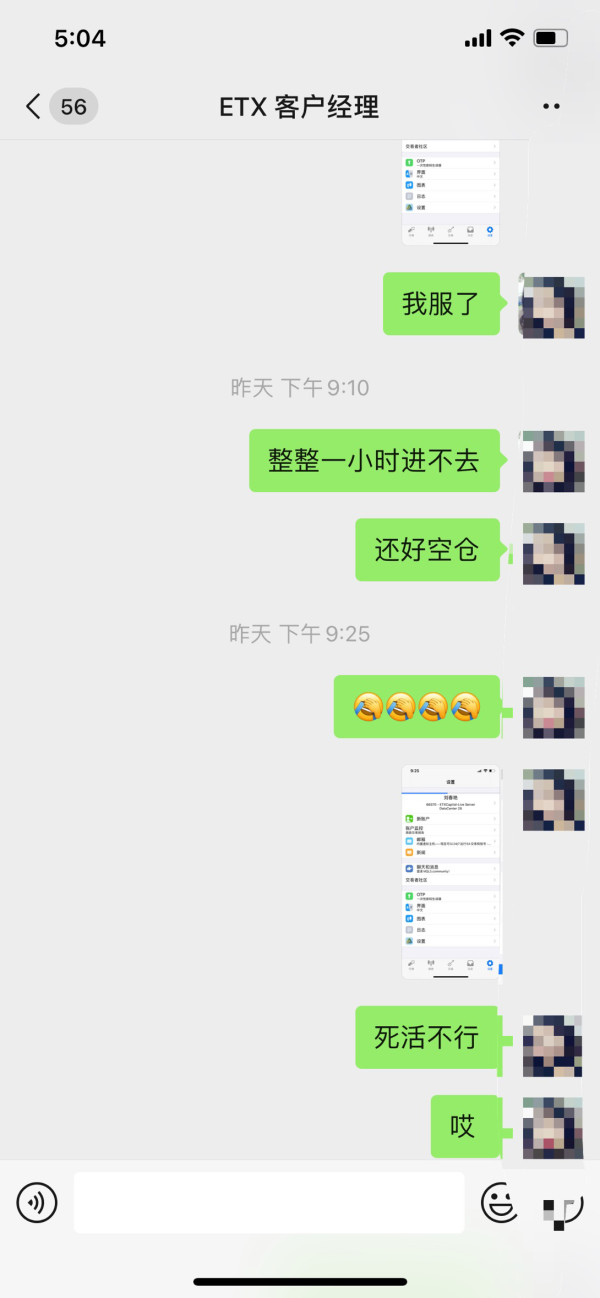

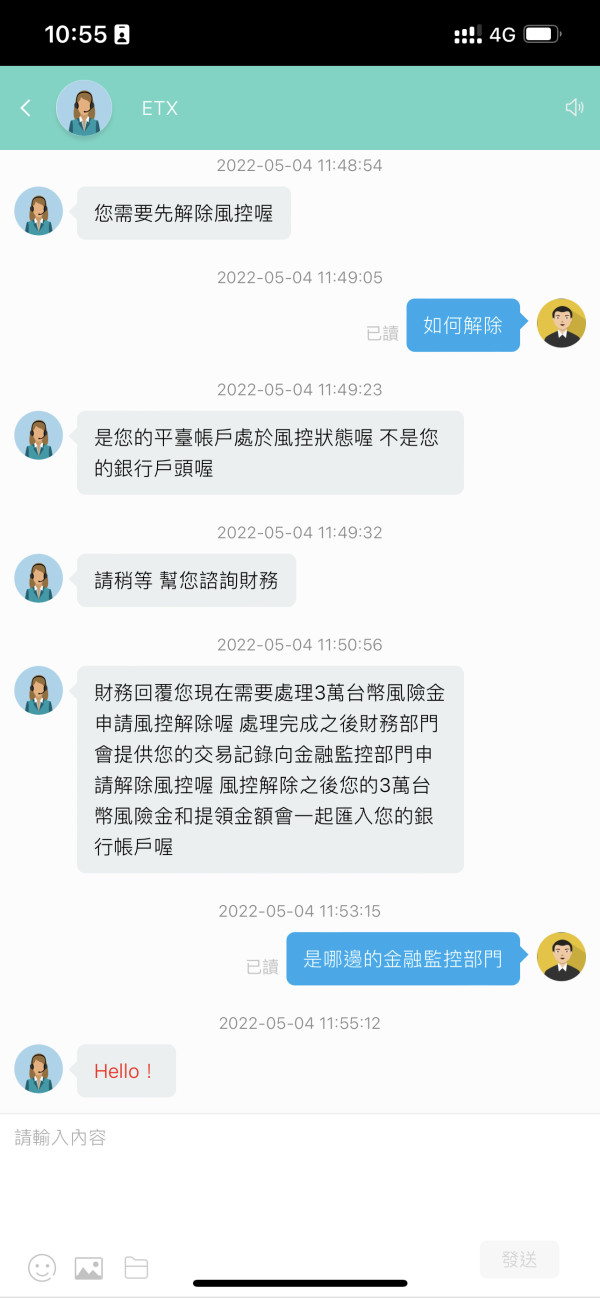

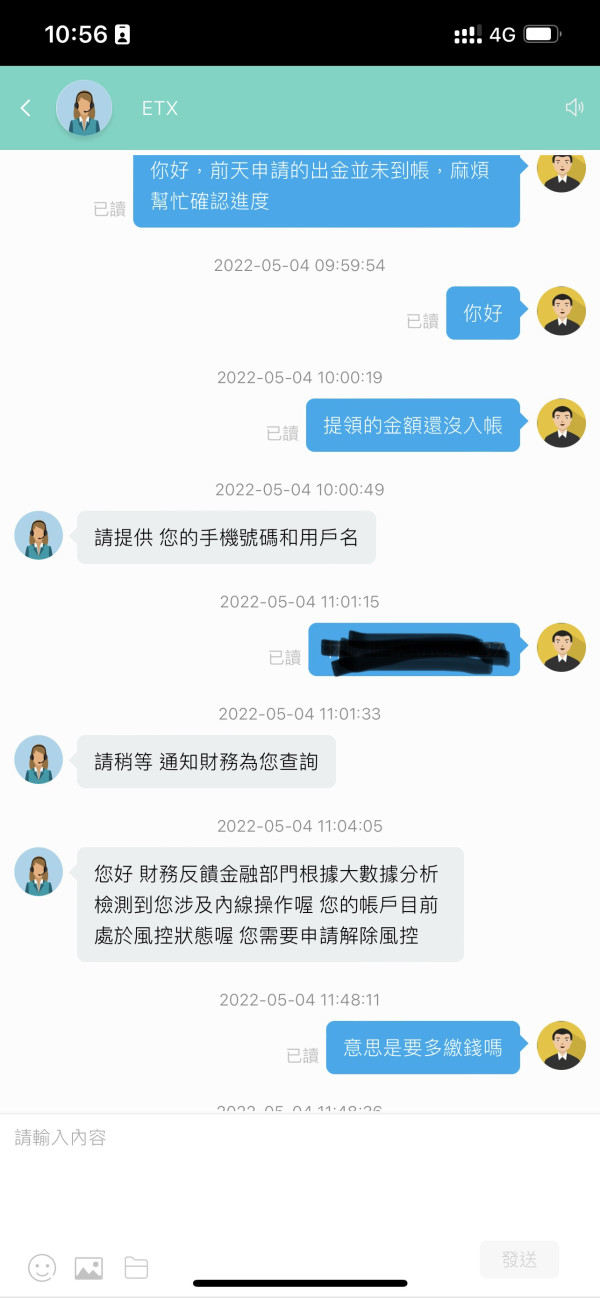

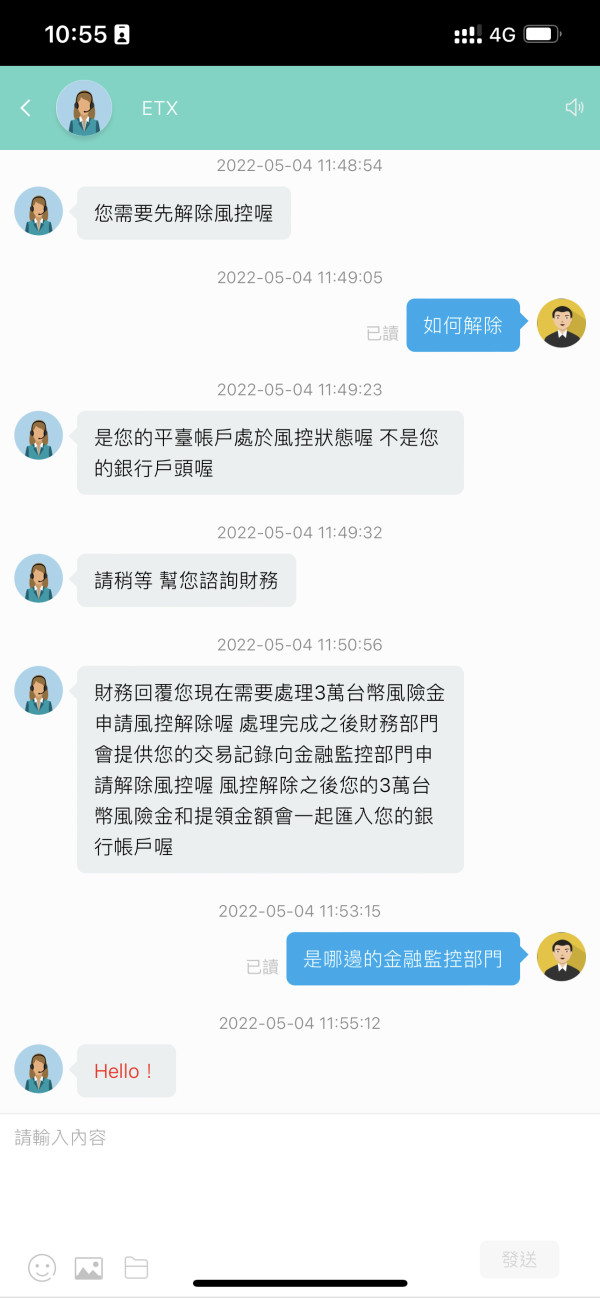

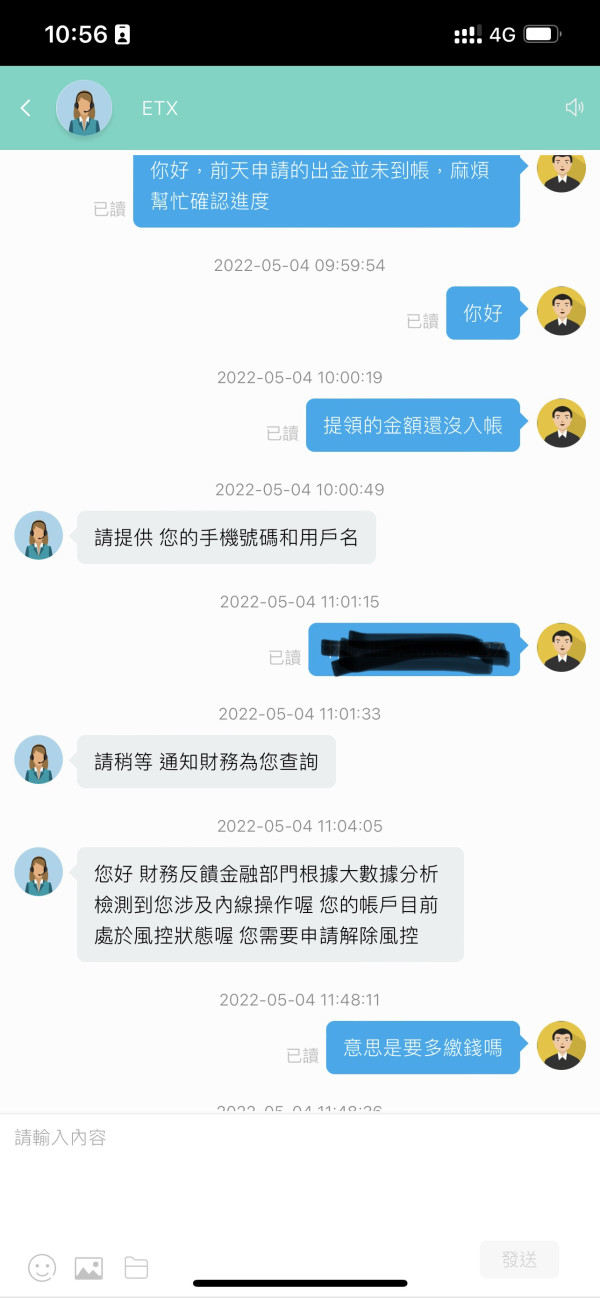

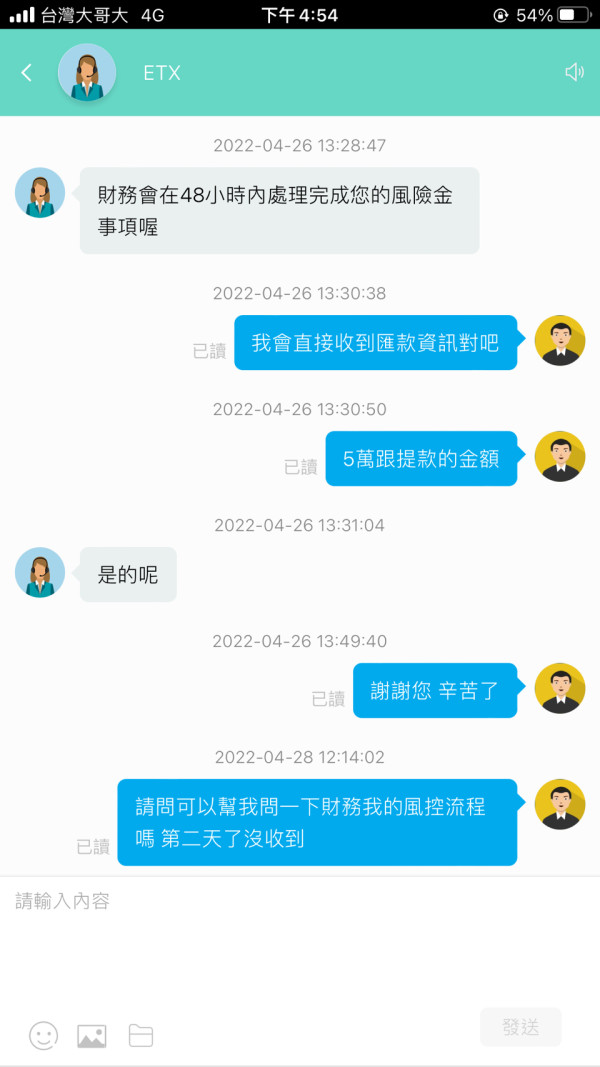

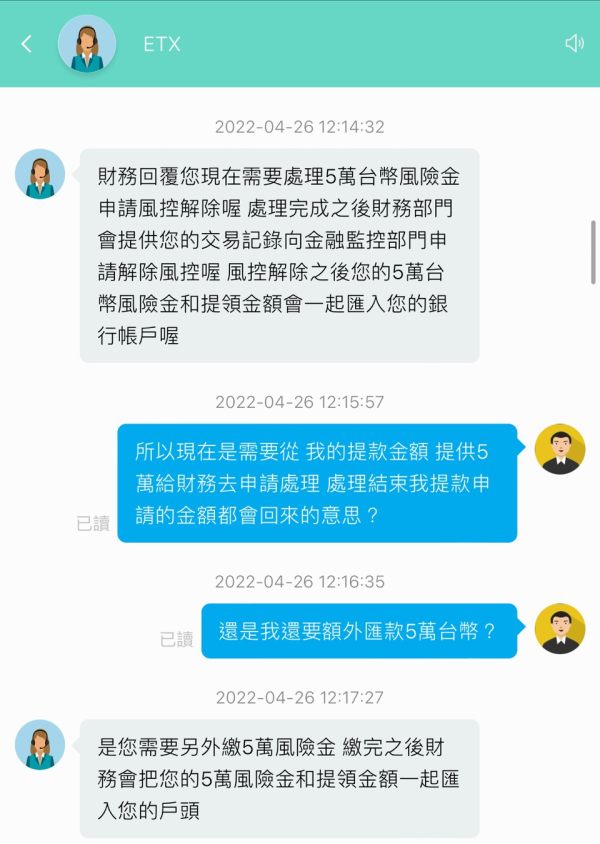

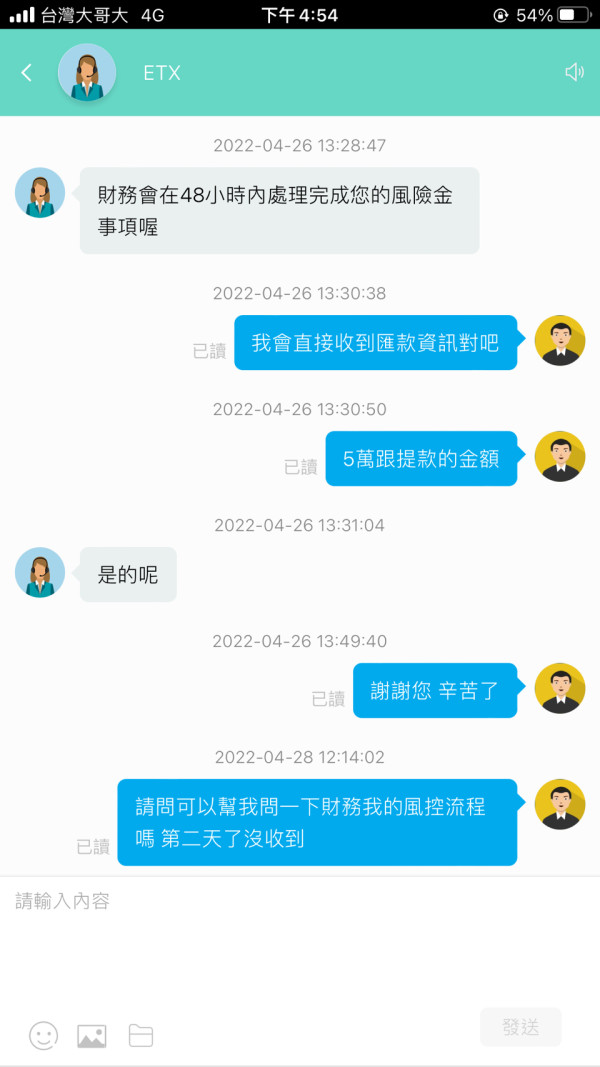

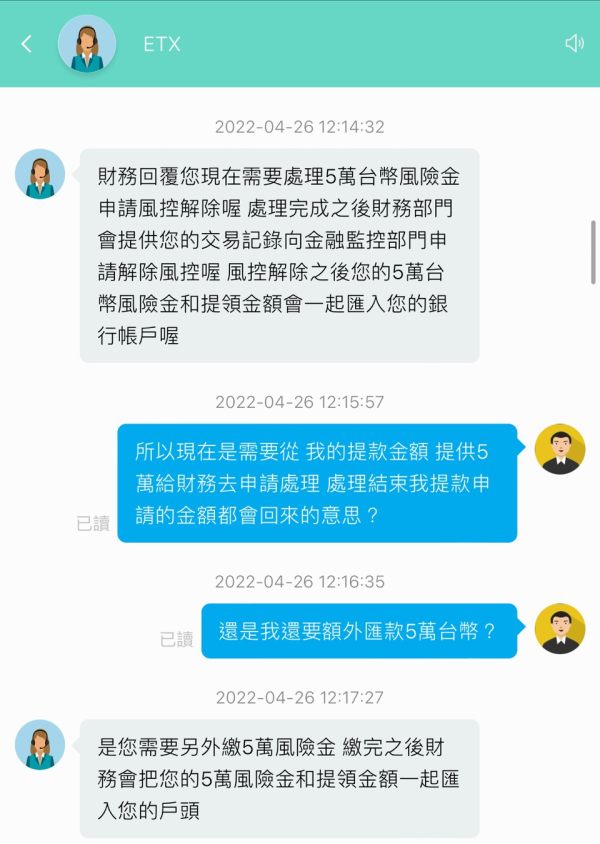

Customer Service and Support (5/10): User reviews frequently mention slow response times and issues with withdrawals, impacting overall satisfaction.

Trading Setup (6/10): The trading platforms are user-friendly, but some users have reported issues with execution speed and slippage during high volatility.

Trustworthiness (7/10): The broker is regulated by reputable authorities, which provides some assurance of safety. However, negative user experiences raise questions about reliability.

User Experience (6/10): The overall user experience is average, with many users appreciating the platform's features but expressing concerns about customer support.

In conclusion, ETX Capital offers a robust trading environment with a range of assets and platforms, but potential clients should be aware of the mixed user reviews, particularly regarding customer service and withdrawal processes. As always, prospective traders are encouraged to conduct thorough research and consider their trading needs before opening an account.