Regarding the legitimacy of KAMA CAPITAL forex brokers, it provides CMA and WikiBit, .

Is KAMA CAPITAL safe?

Pros

Cons

Is KAMA CAPITAL markets regulated?

The regulatory license is the strongest proof.

CMA Forex Trading License (EP)

Capital Market Authority

Capital Market Authority

Current Status:

UnverifiedLicense Type:

Forex Trading License (EP)

Licensed Entity:

KAMA CAPITAL SECURITIES BROKER L.L.C

Effective Date:

2022-04-07Email Address of Licensed Institution:

info@kamacapital.aeSharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

JBR, KING SALMAN BIN ABDULAZIZ AL SAUD STREET, AL FATTAN TOWER BUSINESS HUB, 11th floor, office 1101,1102 P.O Box 211132Phone Number of Licensed Institution:

971-43942383Licensed Institution Certified Documents:

Is Kama Capital A Scam?

Introduction

Kama Capital is a relatively new player in the forex market, having been established in 2022. It positions itself as an online trading broker that offers a variety of financial instruments, including forex, commodities, and indices. As the forex market continues to grow, traders must exercise caution and conduct thorough evaluations of brokers before entrusting them with their capital. The potential for scams and fraudulent activities in the financial sector is significant, making it essential for investors to verify the legitimacy and reliability of their chosen brokers. This article aims to provide an objective assessment of Kama Capital's safety and legitimacy by examining its regulatory status, company background, trading conditions, customer experiences, and overall risk profile.

Regulation and Legitimacy

Regulatory oversight is a crucial factor in determining the legitimacy of a forex broker. Kama Capital claims to be regulated by the Financial Services Commission (FSC) of Mauritius, which is considered an offshore regulatory body. While it does provide some level of oversight, the quality of regulation in offshore jurisdictions is often questioned. The following table summarizes the core regulatory information for Kama Capital:

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FSC Mauritius | GB 22200704 | Mauritius | Verified |

The FSC is responsible for overseeing financial services in Mauritius, but it is important to note that offshore regulations typically lack the stringent requirements imposed by regulators in tier-one jurisdictions such as the FCA (UK) or ASIC (Australia). Consequently, while Kama Capital is technically regulated, the oversight may not provide the same level of investor protection as brokers regulated in more stringent environments. Furthermore, there have been no significant compliance issues reported against Kama Capital, but the lack of robust regulatory frameworks raises concerns about the broker's accountability.

Company Background Investigation

Kama Capital's history is relatively short, having been established in 2022. The broker operates under the ownership of Kama Capital Ltd, which is registered in Mauritius, and has a representative office in Dubai. However, the regulatory claims regarding its Dubai office are questionable, as the Dubai Economic Department (DED) does not directly regulate forex brokers. This can lead to confusion among potential clients regarding the level of regulatory protection they might receive.

The management team of Kama Capital has not been extensively documented, leading to concerns about transparency. A lack of detailed information about the experience and qualifications of the management can be a red flag for potential investors. Furthermore, the company's transparency regarding its operations and business practices is limited, which may hinder investors' ability to make informed decisions.

Trading Conditions Analysis

Kama Capital offers a range of trading conditions, including various account types, leverage options, and spreads. However, its fee structure appears to be somewhat higher than industry averages, which could deter potential traders. The following table summarizes the core trading costs associated with Kama Capital:

| Fee Type | Kama Capital | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | 1.2 pips | 0.6 pips |

| Commission Model | $2 per lot | $0 per lot |

| Overnight Interest Range | Varies | Varies |

Kama Capital's spreads, particularly on major currency pairs, are higher than the industry average, which may affect profitability for traders. The commission structure also raises concerns, as many brokers offer commission-free trading on standard accounts. Additionally, traders should be cautious of any hidden fees that may not be explicitly stated in the broker's documentation.

Client Funds Safety

The safety of client funds is paramount when selecting a forex broker. Kama Capital claims to implement various safety measures to protect client investments. However, it is essential to evaluate these claims critically. The broker does not appear to offer robust fund protection measures such as negative balance protection or investor compensation schemes, which are commonly found in more reputable brokers.

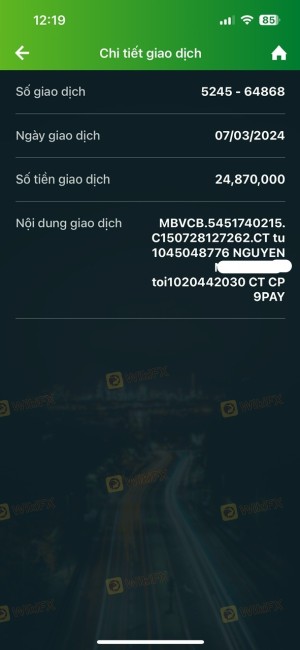

Furthermore, there have been no reported incidents of fund mismanagement or security breaches at Kama Capital, but the lack of transparency regarding fund segregation and safety protocols raises concerns. Traders should be aware of the risks associated with depositing funds with a broker that operates in an offshore jurisdiction, as recovery of funds may be challenging in the event of financial disputes.

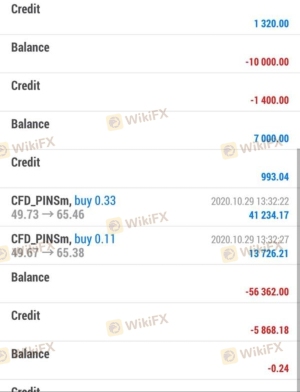

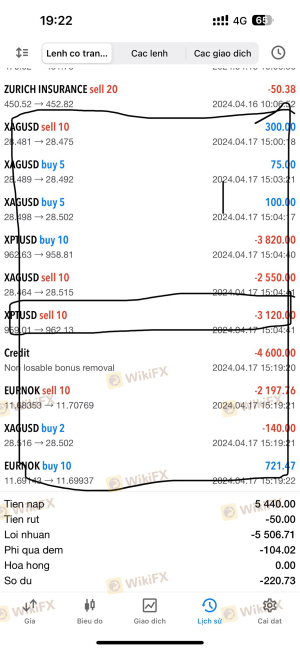

Customer Experience and Complaints

Customer feedback is a vital indicator of a broker's reliability. Reviews of Kama Capital reveal a mixed bag of experiences, with several users reporting difficulties in withdrawing funds. Common complaints include slow withdrawal processing times and issues with account management. The following table outlines the main complaint types and their severity assessment:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Account Management Issues | Medium | Fair |

| Customer Support Quality | Medium | Fair |

Several users have shared their experiences of being pressured to invest more funds before being allowed to withdraw their initial deposits, which is a common tactic used by scam brokers. These reports indicate a concerning trend that potential clients should consider before engaging with Kama Capital.

Platform and Trade Execution

Kama Capital offers the MetaTrader 5 (MT5) platform, which is widely regarded for its functionality and user-friendly interface. However, the quality of trade execution has been called into question by some users, with reports of slippage and rejected orders. The performance of the trading platform is critical for traders, as delays and execution issues can significantly impact trading outcomes.

Overall, while the platform itself is reputable, the execution quality may not be up to par, which could hinder the trading experience for users. Traders should be vigilant and conduct their own testing before committing significant capital.

Risk Assessment

Engaging with Kama Capital carries inherent risks, primarily due to its offshore regulatory status and mixed customer feedback. The following risk scorecard summarizes the key risk areas associated with this broker:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Offshore regulation with limited oversight. |

| Fund Safety Risk | Medium | Lack of robust fund protection measures. |

| Customer Service Risk | Medium | Mixed reviews on withdrawal and support. |

| Execution Risk | Medium | Reports of slippage and rejected orders. |

To mitigate these risks, traders should consider starting with a smaller investment, thoroughly reading the broker's terms, and ensuring they have a clear understanding of the withdrawal process before committing larger sums.

Conclusion and Recommendations

In conclusion, while Kama Capital is technically regulated by the FSC in Mauritius, its offshore status and mixed customer feedback raise significant red flags for potential investors. The broker's higher-than-average trading costs, lack of robust fund protection measures, and reports of withdrawal issues suggest that traders should exercise caution.

For traders seeking reliable alternatives, it may be prudent to consider brokers that are regulated by tier-one authorities, such as the FCA or ASIC, which offer greater investor protection and transparency. Overall, thorough research and due diligence are essential when evaluating any forex broker, including Kama Capital.

Is KAMA CAPITAL a scam, or is it legit?

The latest exposure and evaluation content of KAMA CAPITAL brokers.

KAMA CAPITAL Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

KAMA CAPITAL latest industry rating score is 2.24, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 2.24 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.