Is BOLD PRIME safe?

Pros

Cons

Is Bold Prime A Scam?

Introduction

Bold Prime is a relatively new player in the forex market, having been established in 2020. Positioned as a CFD brokerage, it aims to provide retail traders with access to a wide range of financial instruments, including forex, stocks, and commodities. However, the rapid growth of online trading has also led to an influx of unregulated and potentially fraudulent brokers, making it essential for traders to conduct thorough due diligence before committing their funds. This article will explore the legitimacy of Bold Prime by examining its regulatory status, company background, trading conditions, customer fund safety, user experiences, platform performance, and associated risks. The analysis is based on a comprehensive review of various credible sources, including regulatory bodies, user reviews, and financial analyses.

Regulation and Legitimacy

The regulatory status of a broker is one of the most critical factors in determining its safety and reliability. Bold Prime claims to be regulated by the Australian Securities and Investments Commission (ASIC) and the Financial Services Commission (FSC) of Mauritius. However, it is crucial to assess the validity and strength of these claims to understand the level of protection offered to clients.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | 001305306 | Australia | Verified |

| FSC | GB20025993 | Mauritius | Verified |

While Bold Prime is registered with ASIC, it operates primarily through offshore entities in Saint Vincent and the Grenadines, a jurisdiction known for its lax regulatory environment. This raises concerns about the quality of oversight and investor protection. ASIC is considered a tier-1 regulator, which typically enforces strict compliance standards, but the presence of offshore operations can dilute these protections. Moreover, the lack of a solid regulatory framework in Saint Vincent and the Grenadines means that clients may have limited recourse in case of disputes. Therefore, while Bold Prime has some regulatory oversight, its offshore operations and the associated risks necessitate caution.

Company Background Investigation

Bold Prime is owned by Bold Prime Ltd, which is incorporated in Saint Vincent and the Grenadines. The company claims to have a team of experienced professionals from both retail and institutional trading backgrounds. However, the lack of transparency regarding the management team and their qualifications raises questions about the companys credibility.

The operational history of Bold Prime is relatively short, and while it has received some accolades, such as being recognized as a "Best Forex Technology Provider" at the Wiki Finance Dubai Expo 2022, the overall trustworthiness of a broker often depends on its track record and the experience of its leadership. The companys transparency regarding its ownership structure and management team is limited, which could be a red flag for potential investors.

Furthermore, the information disclosed on its website regarding its operations and services is somewhat vague, making it challenging for traders to gauge the reliability of the broker fully. In an industry where trust and transparency are paramount, the lack of clear information can be a significant concern for traders contemplating opening an account.

Trading Conditions Analysis

When evaluating a broker, understanding its trading conditions, including fees and spreads, is essential. Bold Prime offers various account types, each with its own fee structure. The overall cost of trading can significantly impact a traders profitability, making this aspect crucial for assessment.

| Fee Type | Bold Prime | Industry Average |

|---|---|---|

| Major Currency Pair Spread | From 1.8 pips | From 1.0 pips |

| Commission Model | $0 - $7 per lot | Varies widely |

| Overnight Interest Range | Not specified | Varies widely |

The spreads offered by Bold Prime start at 1.8 pips for standard accounts, which is higher than the industry average. Additionally, the commission structure varies depending on the account type, with some accounts charging up to $7 per lot. This fee structure may deter cost-sensitive traders, especially when compared to competitors offering lower spreads and commissions.

Moreover, the lack of clarity regarding overnight interest rates and potential hidden fees raises concerns about the overall transparency of Bold Primes pricing model. Traders should be cautious and ensure they fully understand the fee structure before committing to the platform.

Customer Fund Safety

The safety of customer funds is a paramount concern for any trader. Bold Prime claims to implement various security measures to protect client funds, including segregated accounts and encryption technologies. However, the effectiveness of these measures is contingent upon the regulatory environment in which the broker operates.

Bold Prime does not provide clear information regarding investor protection schemes, such as compensation funds for clients in the event of broker insolvency. This lack of clarity could pose significant risks for traders, particularly given the broker's offshore operations. Additionally, the absence of negative balance protection means that traders could potentially lose more than their initial investment, which is a considerable risk in the high-leverage trading environment offered by Bold Prime.

Historically, offshore brokers have faced scrutiny regarding their fund safety measures, and Bold Prime is no exception. Without robust regulatory oversight, there is a higher likelihood of financial mismanagement or fraud, making it essential for traders to exercise caution when dealing with such brokers.

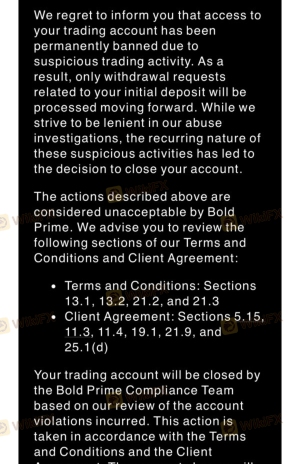

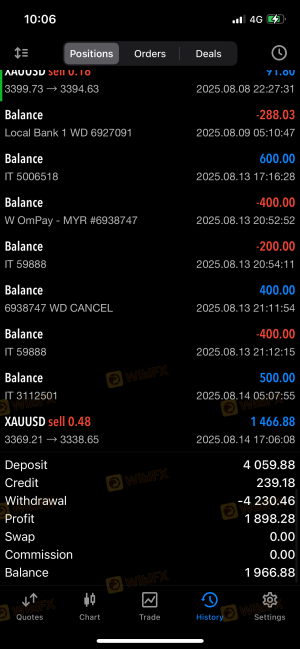

Customer Experience and Complaints

Analyzing customer feedback is crucial for understanding the overall user experience with a broker. Bold Prime has received mixed reviews from its clients, with many highlighting issues related to withdrawals and customer service.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Account Suspension | Medium | Inconsistent |

| Customer Support Quality | Medium | Limited availability |

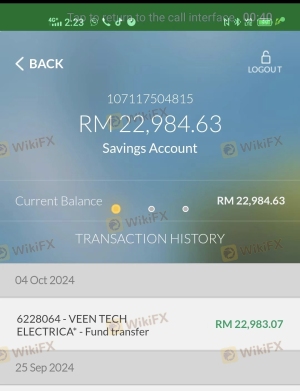

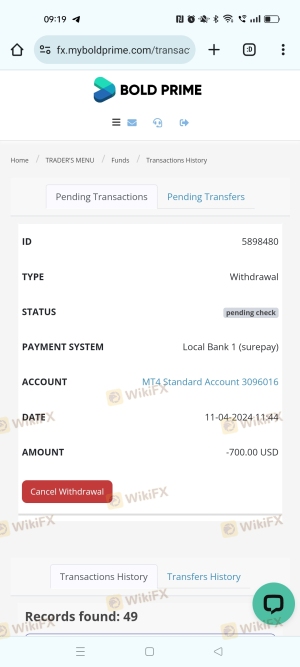

Common complaints include difficulties in withdrawing funds, with several users reporting that their requests were delayed or denied. Additionally, the quality of customer service has been criticized, with many users noting slow response times and a lack of effective support.

For instance, one trader reported that their withdrawal request of $20,000 was rejected without a clear explanation, leading to frustration and distrust in the broker. Such experiences raise concerns about the reliability of Bold Prime and its commitment to customer satisfaction.

Platform and Trade Execution

The performance of a trading platform significantly influences a traders experience. Bold Prime offers both MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, which are widely regarded for their advanced features and user-friendly interfaces. However, user experiences with platform performance and order execution have been mixed.

Traders have reported issues with order execution quality, including slippage and rejected orders, which can detract from the overall trading experience. While some users have praised the platforms for their functionality, others have expressed concerns about potential manipulation or unfair practices, particularly in volatile market conditions.

Risk Assessment

Using Bold Prime presents several risks that traders should consider before opening an account.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Operates in a lax regulatory environment. |

| Fund Safety Risk | High | Lack of investor protection and negative balance protection. |

| Withdrawal Risk | Medium | Complaints regarding delayed or denied withdrawals. |

| Platform Reliability | Medium | Mixed reviews on execution quality and platform stability. |

To mitigate these risks, traders should conduct thorough research, consider using smaller amounts for initial trades, and remain vigilant regarding their account activity.

Conclusion and Recommendations

In conclusion, while Bold Prime presents itself as a regulated broker offering competitive trading conditions, several red flags warrant caution. The broker's offshore operations, mixed user reviews, and lack of robust investor protection mechanisms raise concerns about its overall reliability.

For traders seeking a safer trading environment, it may be advisable to consider more established brokers with solid regulatory oversight and a proven track record of customer satisfaction. Alternatives such as brokers regulated by tier-1 authorities, which offer comprehensive investor protection and transparent fee structures, could provide a more secure trading experience.

Ultimately, traders should prioritize their safety and conduct thorough due diligence before engaging with any brokerage, especially those operating in less regulated environments like Bold Prime.

Is BOLD PRIME a scam, or is it legit?

The latest exposure and evaluation content of BOLD PRIME brokers.

BOLD PRIME Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

BOLD PRIME latest industry rating score is 2.34, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 2.34 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.