Regarding the legitimacy of MACRO MARKETS forex brokers, it provides ASIC, HKGX, FSA and WikiBit, .

Is MACRO MARKETS safe?

Pros

Cons

Is MACRO MARKETS markets regulated?

The regulatory license is the strongest proof.

ASIC Market Making License (MM)

Australia Securities & Investment Commission

Australia Securities & Investment Commission

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

MACRO GLOBAL MARKETS PTY LTD

Effective Date: Change Record

2010-08-25Email Address of Licensed Institution:

Jessica.Song678@hotmail.comSharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

SE 3002 L 30 25 BLIGH ST SYDNEY NSW 2000Phone Number of Licensed Institution:

0451913349Licensed Institution Certified Documents:

HKGX Precious Metals Trading (AGN)

Hong Kong Gold Exchange

Hong Kong Gold Exchange

Current Status:

RegulatedLicense Type:

Precious Metals Trading (AGN)

Licensed Entity:

巨富金業有限公司

Effective Date:

--Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

https://www.macrobullion.comExpiration Time:

--Address of Licensed Institution:

新界荃灣楊屋道88號PLAZA 88寫字樓28樓B室Phone Number of Licensed Institution:

27265008Licensed Institution Certified Documents:

FSA Derivatives Trading License (EP)

The Seychelles Financial Services Authority

The Seychelles Financial Services Authority

Current Status:

Offshore RegulatedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

MACRO MARKETS SOLUTIONS LTD

Effective Date: Change Record

--Email Address of Licensed Institution:

support@macromarkets.scSharing Status:

No SharingWebsite of Licensed Institution:

https://www.macromarkets.scExpiration Time:

--Address of Licensed Institution:

Office C4-R6, Second Floor, Xvision House, Providence Estate, Mahe, SeychellesPhone Number of Licensed Institution:

+248 2668677Licensed Institution Certified Documents:

Is Macro Markets A Scam?

Introduction

Macro Markets is a forex brokerage that has emerged in the competitive landscape of online trading since its establishment in 2018. Positioned as a platform for both novice and experienced traders, it claims to offer a wide range of trading instruments, including forex, commodities, and indices. However, as the forex market is known for its high risks and the prevalence of scams, traders must exercise caution when evaluating brokers.

This article aims to critically assess the legitimacy of Macro Markets by examining its regulatory status, company background, trading conditions, customer fund safety, user experiences, platform performance, and overall risk profile. The investigation is based on a thorough analysis of various online reviews, regulatory disclosures, and user feedback, providing a comprehensive evaluation framework to determine whether Macro Markets is a safe trading environment or a potential scam.

Regulation and Legitimacy

Regulatory oversight is a crucial factor in determining the safety and reliability of a forex broker. Macro Markets claims to be regulated by multiple authorities, including the Australian Securities and Investments Commission (ASIC) and the Seychelles Financial Services Authority (FSA). Below is a summary of its regulatory status:

| Regulator | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | 000363972 | Australia | Regulated |

| FSA | SD 139 | Seychelles | Offshore Regulated |

| HK GX | 229 | Hong Kong | Regulated |

While being regulated by ASIC, a well-respected authority, is a positive sign, the presence of offshore regulation from the Seychelles raises concerns. Offshore regulators often have less stringent oversight, which can lead to potential risks for traders. Furthermore, there have been reports of negative disclosures from the Seychelles FSA, indicating that certain websites associated with Macro Markets were flagged for unauthorized activities. This discrepancy highlights the importance of verifying the legitimacy of the broker and its claims.

Company Background Investigation

Macro Markets has a relatively short history in the financial markets, having been established in 2018. The firm operates under the name Macro Markets Solutions Pty Ltd and is based in Australia, with additional regulatory presence in Seychelles and Hong Kong. The ownership structure is not clearly disclosed, which could be a red flag for potential investors seeking transparency.

The management team behind Macro Markets has not been extensively detailed in available sources, making it difficult to assess their qualifications and experience in the financial industry. Transparency regarding the company's leadership and operational history is crucial for building trust with clients. A lack of clear information can lead to skepticism about the broker's intentions and reliability.

Trading Conditions Analysis

The trading conditions offered by Macro Markets are essential for evaluating its overall value to traders. The broker claims to provide competitive spreads and a variety of account types, but the specifics can often be unclear. Below is a comparison of key trading costs:

| Fee Type | Macro Markets | Industry Average |

|---|---|---|

| Major Currency Pair Spread | From 1.0 pips | 1.0 - 1.5 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | High | Moderate |

While the spread for major currency pairs appears competitive, the lack of clarity regarding commission structures and overnight interest rates can be concerning. Traders should be wary of hidden fees that may not be clearly disclosed, which could impact their overall profitability.

Customer Fund Safety

The safety of customer funds is paramount when choosing a forex broker. Macro Markets states that it utilizes segregated accounts to protect client funds, ensuring that they are kept separate from company funds. This practice is standard in the industry and adds a layer of security for traders. Additionally, the broker claims to offer negative balance protection, which prevents clients from losing more money than they have deposited.

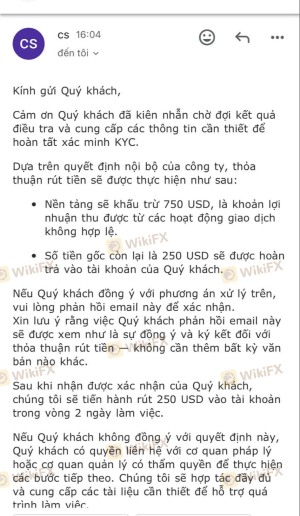

However, the history of any past security issues or disputes regarding fund safety is crucial for assessing trustworthiness. There have been reports of delayed withdrawal requests and complaints about the handling of client funds, which could indicate potential problems with fund management.

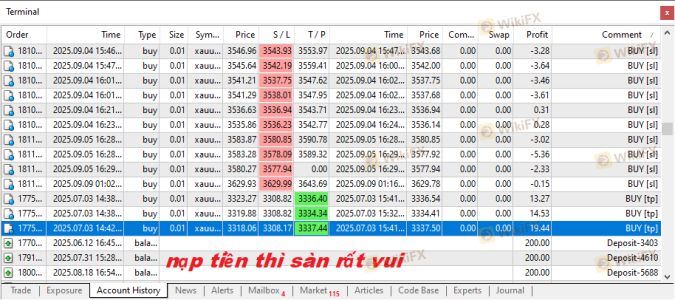

Customer Experience and Complaints

Analyzing customer feedback is vital in understanding the overall experience of trading with Macro Markets. Many users have reported negative experiences, particularly regarding withdrawal processes and customer support. Common complaint patterns include:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Lack of Customer Support | Medium | Inconsistent |

| Misleading Promotions | High | Unresponsive |

For instance, one user reported making a withdrawal request that was not processed for over eight days, leading to frustration and a lack of trust in the broker. Such complaints suggest that while the trading platform may offer attractive conditions, the execution of services may fall short of expectations.

Platform and Execution

The trading platform is a critical component of the trading experience. Macro Markets offers the widely used MetaTrader 4 (MT4) platform, known for its user-friendly interface and extensive features. However, the performance of the platform, including order execution quality, slippage, and rejection rates, is equally important.

Users have expressed mixed feelings about the platform's reliability, with some reporting instances of slippage during volatile market conditions. If a broker's platform experiences frequent issues, it can significantly affect a trader's performance and profitability.

Risk Assessment

Utilizing Macro Markets comes with inherent risks that traders should be aware of. Below is a summary of the key risk areas associated with this broker:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | Medium | Offshore regulation may lack stringent oversight. |

| Fund Safety Risk | High | Reports of withdrawal issues raise concerns. |

| Execution Risk | Medium | Potential for slippage and order rejections. |

To mitigate these risks, traders should conduct thorough research, maintain realistic expectations, and consider diversifying their trading activities across multiple platforms.

Conclusion and Recommendations

In conclusion, while Macro Markets presents itself as a regulated forex broker with various trading options, several red flags warrant caution. The combination of offshore regulation, negative user experiences, and issues related to fund safety raises significant concerns about the broker's legitimacy.

Traders should approach Macro Markets with a degree of skepticism, particularly those new to forex trading. For those seeking safer alternatives, it may be advisable to consider brokers with strong regulatory oversight from top-tier authorities and a proven track record of positive user experiences.

Ultimately, the decision to trade with Macro Markets should be made with careful consideration of the risks involved and a thorough understanding of the broker's practices and reputation in the industry.

Is MACRO MARKETS a scam, or is it legit?

The latest exposure and evaluation content of MACRO MARKETS brokers.

MACRO MARKETS Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

MACRO MARKETS latest industry rating score is 7.70, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 7.70 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.