GKFX Prime 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive gkfx prime review looks at a forex broker that has changed a lot in recent years. GKFX Prime started in 2012 and has its main office in the British Virgin Islands. It works as a No Dealing Desk (NDD) broker with rules from BVI FSC and SECC. TradingBrokers.com says the platform offers good trading conditions with just a $1 minimum deposit, which makes it easy for new traders to start. More experienced traders can get leverage up to 1:400.

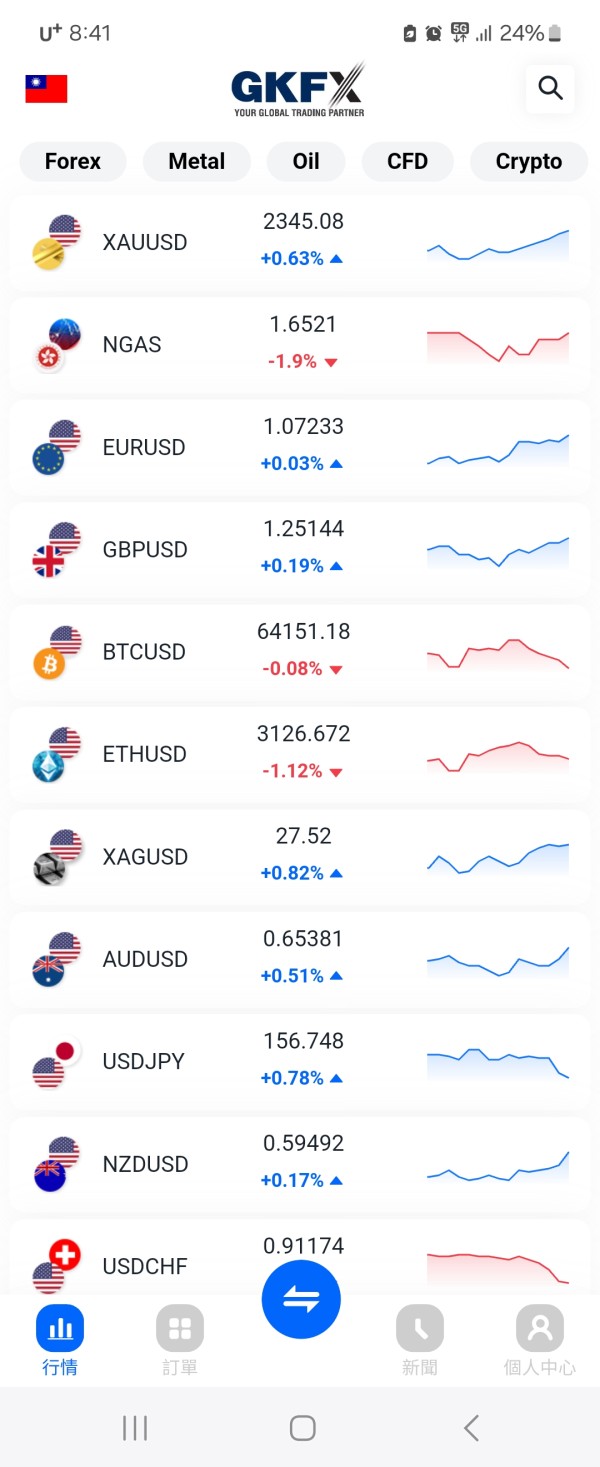

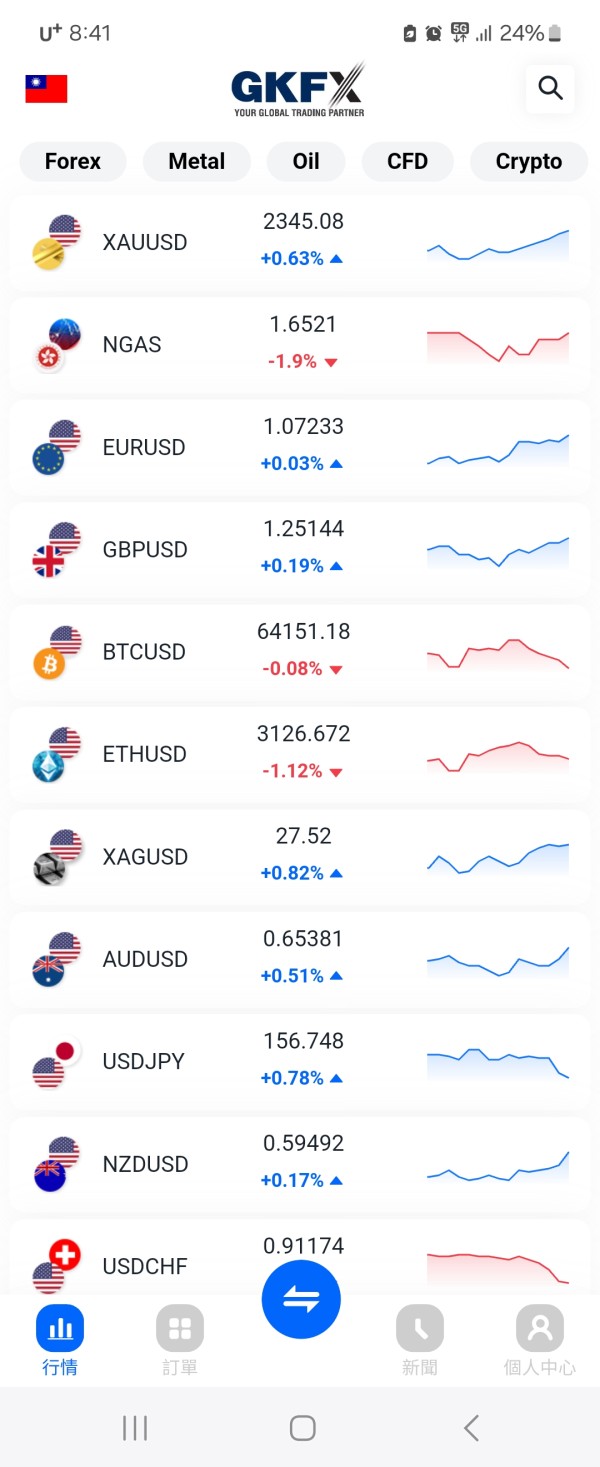

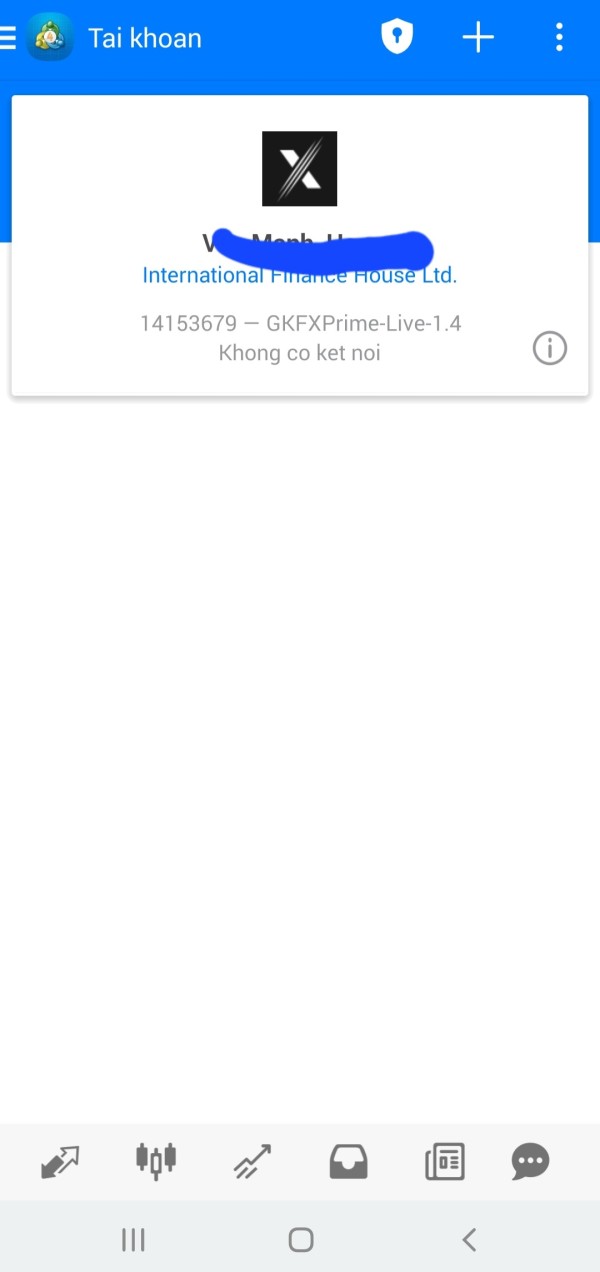

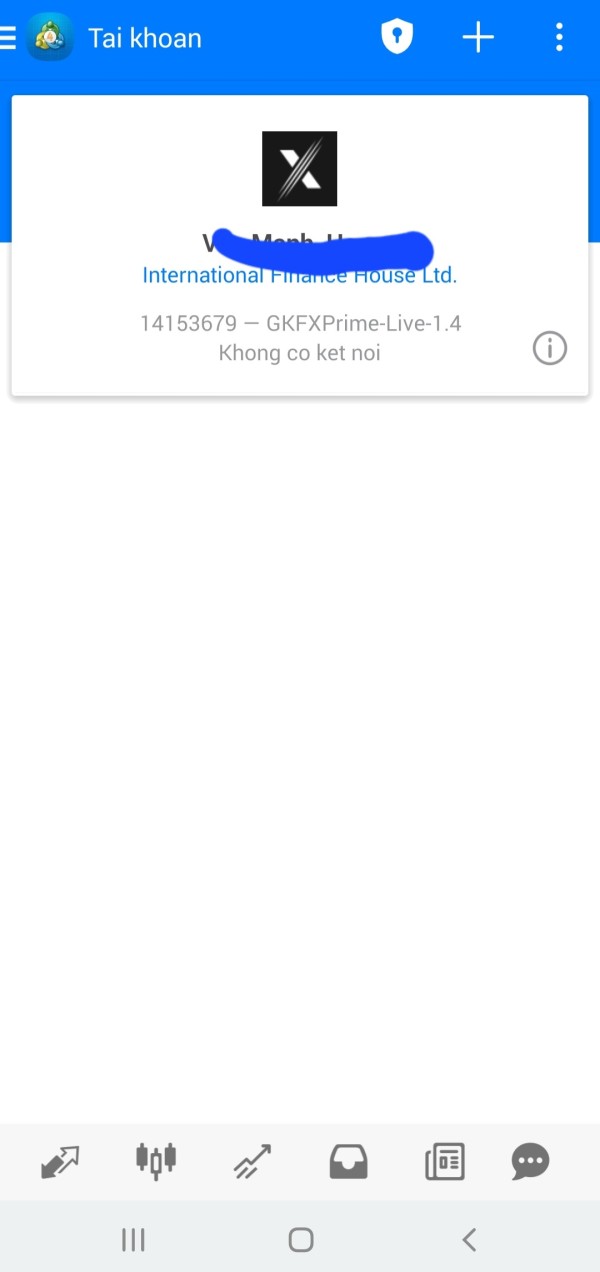

The broker stands out by offering many different assets. You can trade forex, indices, stocks, commodities, and cryptocurrencies on MetaTrader 4 and MetaTrader 5 platforms. GKFX Prime has variable spreads and commissions that start from $0, so it works well for many different trading strategies. FxScouts reports that the company recently changed its name to Trive, which might affect how it delivers services and its regulatory status in the future.

GKFX Prime mainly focuses on small to medium-sized traders who want to spread their investments across different types of assets. It especially appeals to those who like low barriers to entry and flexible trading conditions.

Important Notice

GKFX Prime operates under BVI FSC and SECC regulation, but traders should know that legal protections vary a lot between different countries. The recent name change to Trive might also affect how services continue and the regulatory status. People thinking about opening accounts should check the current regulatory standing and make sure they follow their local financial rules.

This review uses information available to the public and user feedback from 2025. It aims to give a fair assessment of what the broker currently offers and where it stands in the market. Trading involves serious risk, and past results don't promise future success.

Rating Framework

Broker Overview

GKFX Prime started working in the forex market in 2012. It focuses on technology and has its headquarters in the British Virgin Islands. TradingBrokers.com says the company uses a No Dealing Desk (NDD) model, which should give traders direct market access and reduce conflicts of interest. The broker makes money through spreads and optional commissions instead of trading against clients, so its success depends on trader success.

The company built its reputation by offering easy trading conditions. Its $1 minimum deposit requirement removes traditional barriers for new traders. This approach has helped GKFX Prime attract many different clients, from beginners learning about forex markets to experienced traders looking for more platform choices.

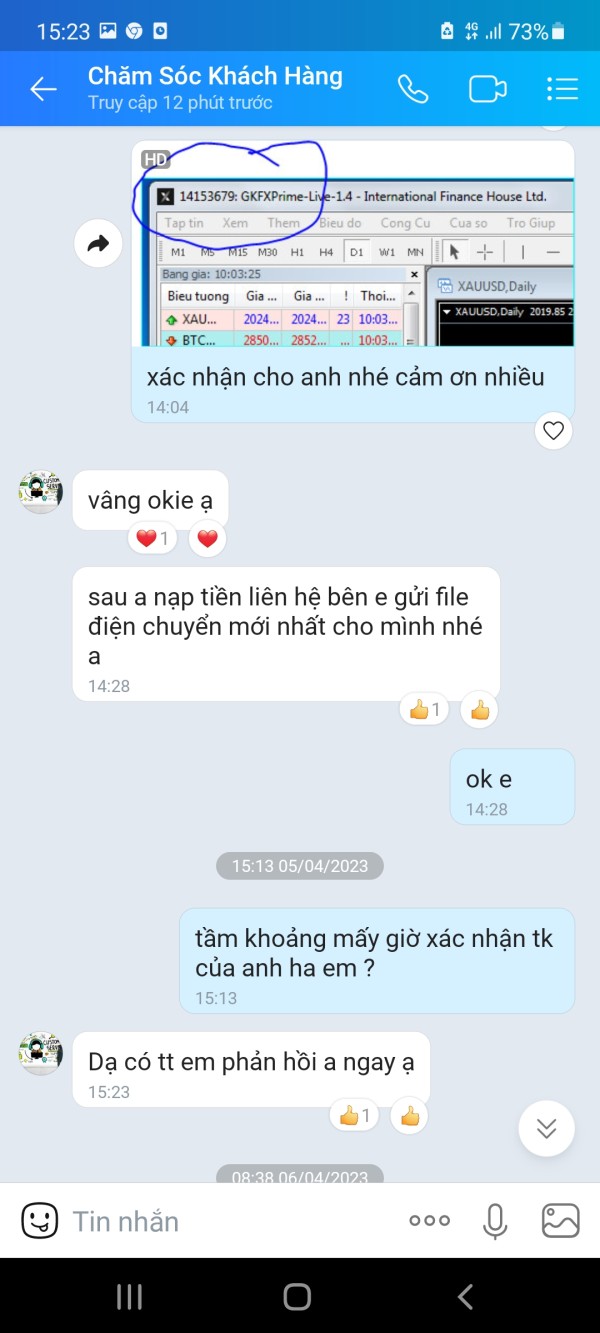

In this gkfx prime review, we see that the broker gives full market access through the standard MetaTrader 4 and MetaTrader 5 platforms. You can trade traditional forex pairs, global stock indices, individual stocks, commodities like precious metals and energy products, and new cryptocurrency markets. Various sources say there are over 400 available instruments, so traders can create complex strategies across multiple asset types. The broker follows rules from both the British Virgin Islands Financial Services Commission (BVI FSC) and the Securities and Exchange Commission of Cyprus (SECC), which provides protection for client funds and trading activities in two different areas.

Regulatory Jurisdiction: GKFX Prime follows rules from both the British Virgin Islands Financial Services Commission (BVI FSC) and the Securities and Exchange Commission of Cyprus (SECC). This setup provides oversight in different areas, though specific license numbers aren't clearly shown in available materials.

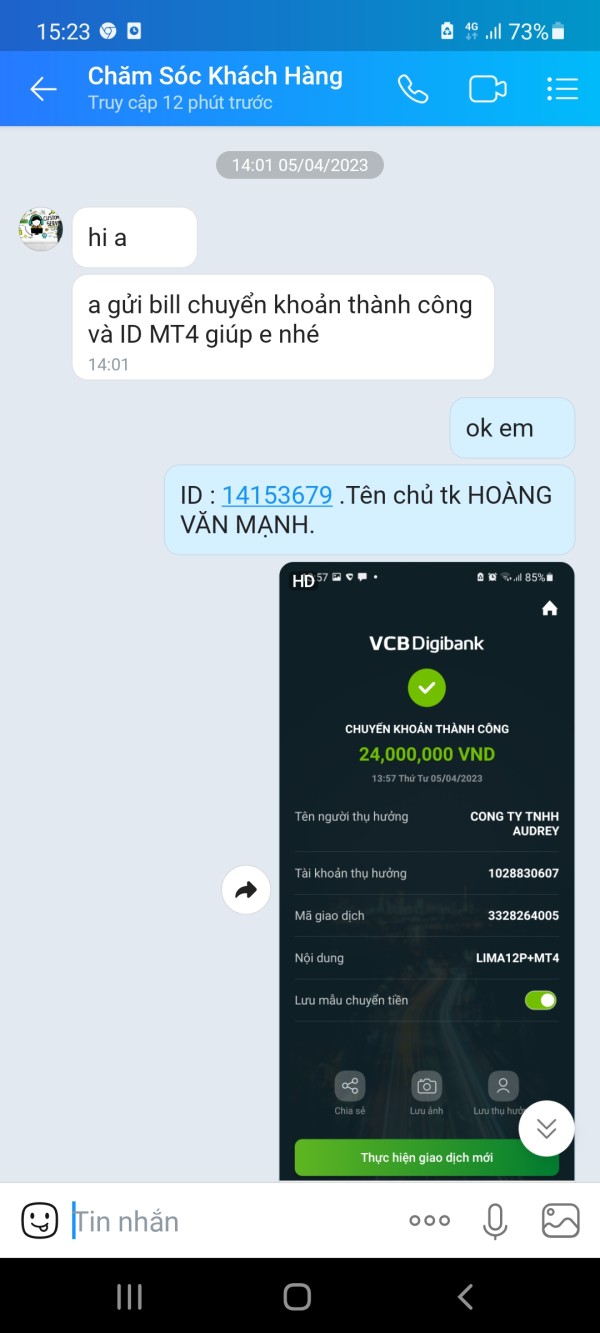

Deposit and Withdrawal Methods: The broker accepts multiple funding options like bank transfers, credit/debit cards, and various e-wallet solutions. However, specific processing times and fees for different methods aren't detailed in current available information.

Minimum Deposit Requirements: TradingBrokers.com confirms a very competitive $1 minimum deposit. This makes GKFX Prime one of the most accessible brokers for new traders with limited money.

Bonus and Promotional Offers: Current promotional activities and bonus structures aren't specified in available documentation. This suggests either limited promotional offerings or lack of current campaign information.

Available Trading Assets: The platform gives access to forex currency pairs, global stock indices, individual stocks, commodity markets, and cryptocurrency trading. This wide selection supports different trading strategies and portfolio building approaches.

Cost Structure: According to available data, the broker uses variable spread pricing with commissions starting from $0. The specific spread ranges and commission schedules for different account types aren't detailed in current materials, so you need to ask directly for exact cost calculations.

Leverage Ratios: Maximum leverage reaches 1:400. This provides significant capital increase for experienced traders but requires careful risk management because of increased potential for both profits and losses.

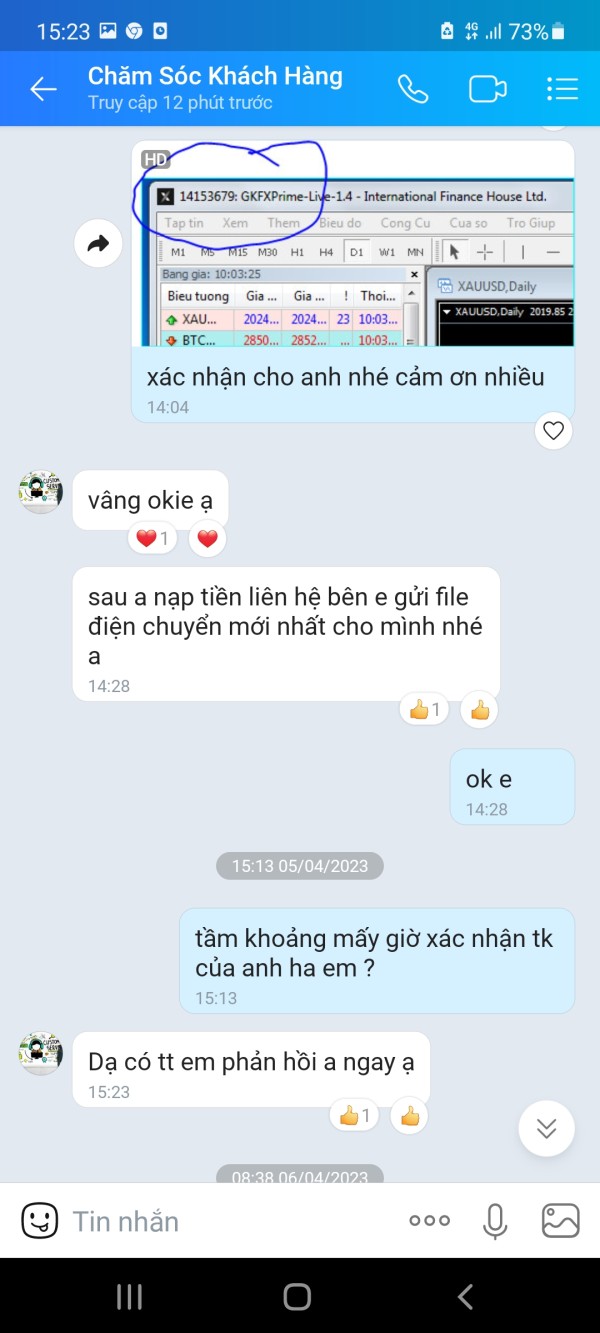

Platform Options: GKFX Prime offers both MetaTrader 4 and MetaTrader 5 platforms, meeting different trader preferences and technical analysis needs. Both platforms support automated trading and comprehensive charting capabilities.

Geographic Restrictions: Specific country restrictions and regulatory limitations aren't clearly outlined in available information. Traders in regulated areas need to verify this information.

Customer Support Languages: While multiple language support is indicated, this gkfx prime review notes that specific supported languages and availability hours aren't detailed in current documentation.

Detailed Rating Analysis

Account Conditions Analysis (Score: 8/10)

GKFX Prime does very well with account accessibility through its industry-leading $1 minimum deposit requirement. This effectively removes traditional barriers that stop new traders from entering forex markets. This approach shows the broker's commitment to financial inclusion and making markets available to everyone. TradingBrokers.com confirms multiple account types are available, though specific tier structures and benefits require direct consultation with the broker.

The commission structure starting from $0 provides cost-effective trading for volume-sensitive strategies. This especially benefits scalpers and high-frequency traders. Account opening processes appear smooth, though specific verification requirements and timeframes aren't detailed in available materials. The combination of low entry requirements and flexible cost structures makes GKFX Prime particularly attractive for traders testing new strategies or managing smaller portfolios.

User feedback suggests satisfaction with account setup procedures and ongoing account management. However, specific testimonials are limited in available sources. The broker's approach to account conditions reflects modern industry trends toward accessibility and transparency, positioning it well against traditional high-minimum brokers.

This detailed gkfx prime review notes that while basic account information is easy to find, potential traders should verify specific terms, conditions, and any restrictions that may apply to their trading area or preferred strategies.

The broker's platform offering centers on MetaTrader 4 and MetaTrader 5. These provide traders with industry-standard tools for technical analysis, automated trading, and market monitoring. Both platforms offer comprehensive charting capabilities, extensive technical indicator libraries, and support for Expert Advisors (EAs) and custom indicators. The dual-platform approach accommodates different trader preferences, with MT4 favored for forex-focused strategies and MT5 providing enhanced features for multi-asset trading.

Available research and analytical resources aren't extensively detailed in current documentation. This suggests either limited proprietary research offerings or emphasis on third-party analysis integration. Educational resources, including webinars, tutorials, and market commentary, aren't specifically mentioned in available materials, which may impact the platform's appeal to learning-focused traders.

Automated trading support through both MetaTrader platforms enables sophisticated strategy implementation. This includes algorithmic trading and signal copying services. The platforms' mobile versions provide on-the-go trading capabilities, though specific mobile app features and performance metrics aren't detailed in current reviews.

The overall tools and resources package provides solid foundation functionality for most trading approaches. However, it may lack the premium research and educational components offered by full-service brokers targeting institutional or high-net-worth clients.

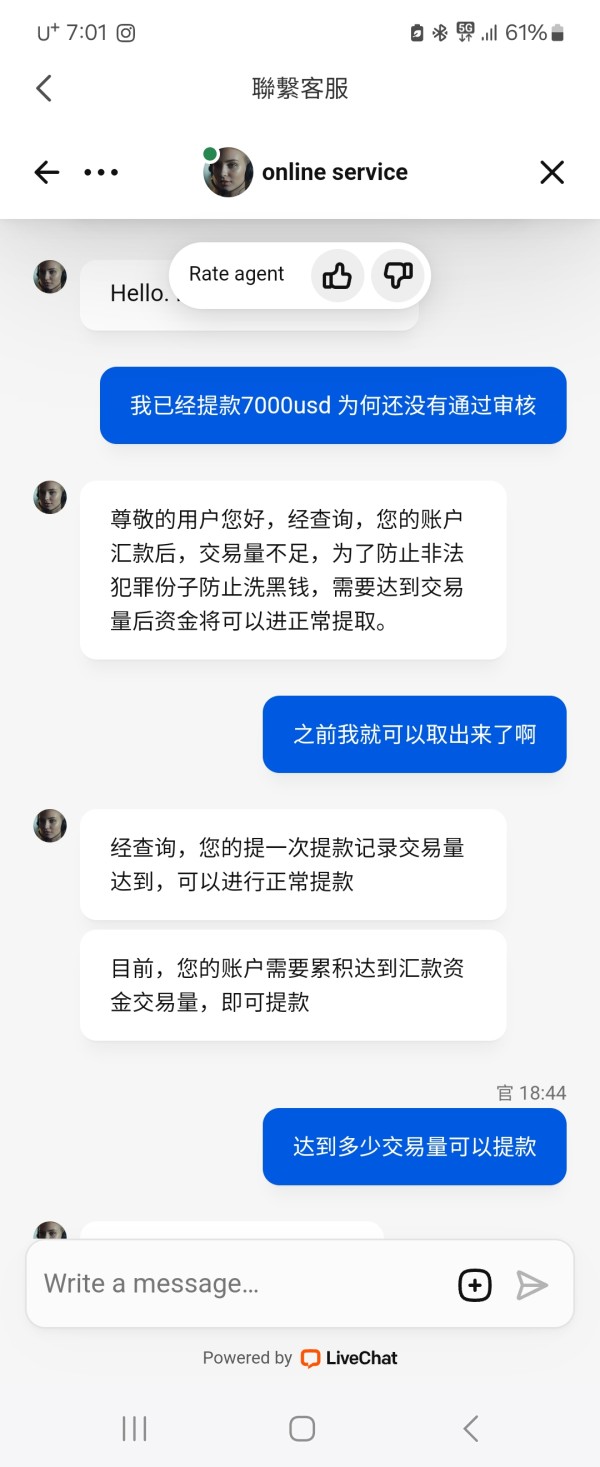

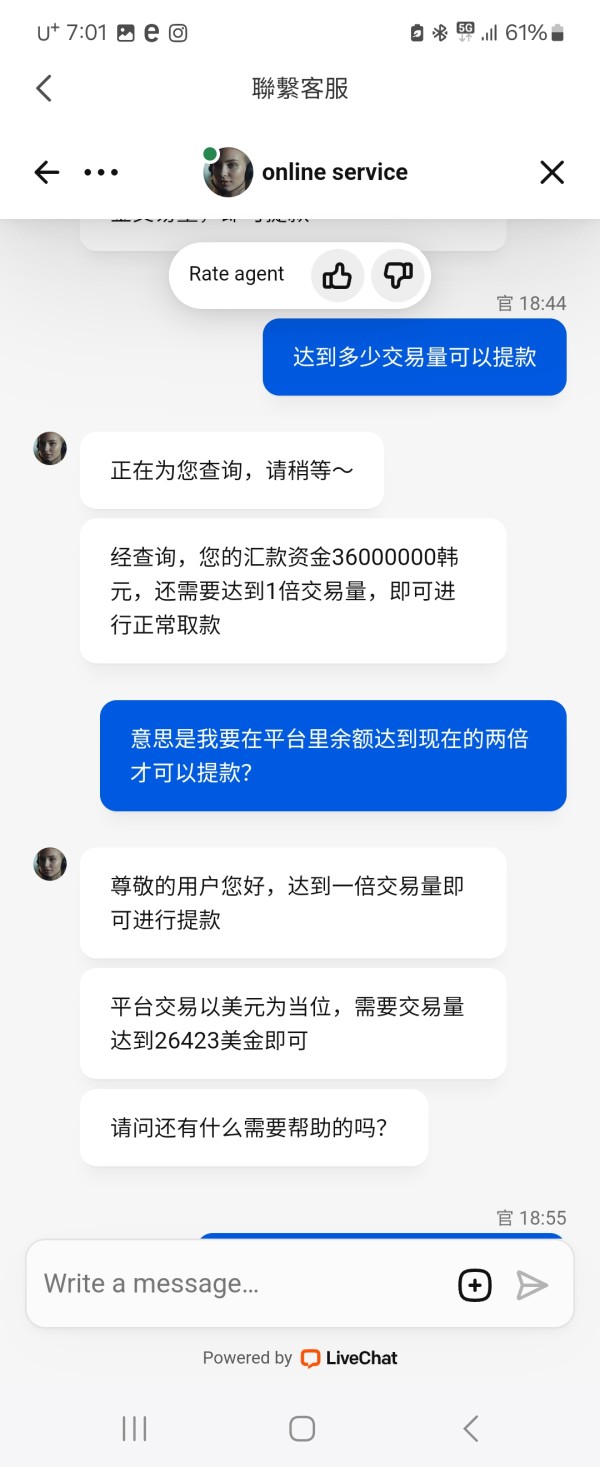

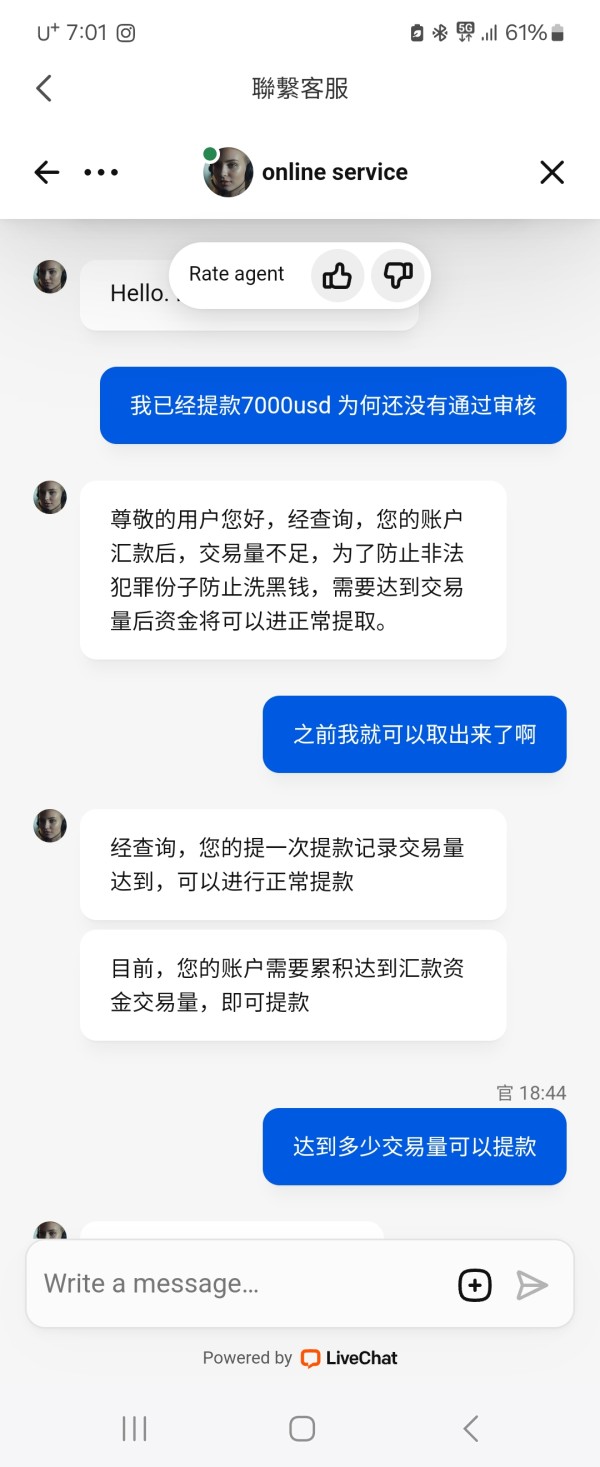

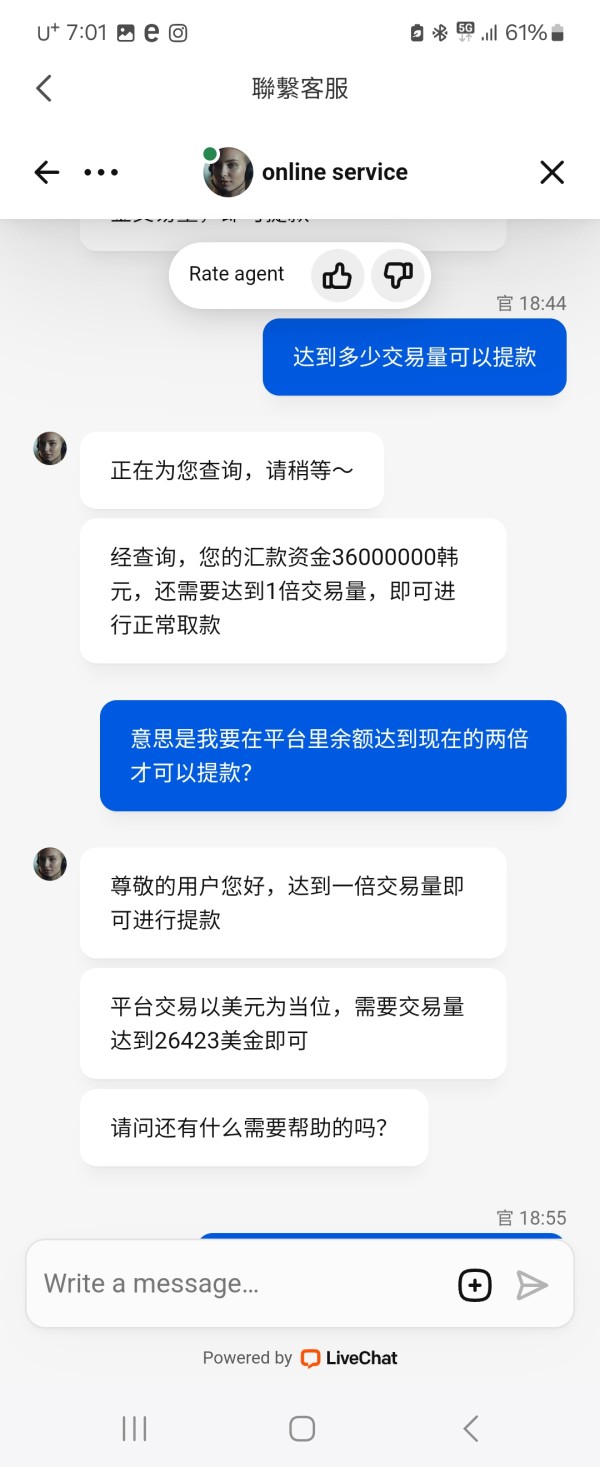

Customer Service and Support Analysis (Score: 7/10)

GKFX Prime provides multiple customer support channels including telephone, email, and live chat options. This ensures traders can access assistance through their preferred communication method. Response times appear reasonable based on available user feedback, though specific service level agreements and guaranteed response timeframes aren't published in accessible materials.

The quality of support interactions receives generally positive user feedback. Representatives demonstrate adequate product knowledge and problem-resolution capabilities. However, detailed case studies or specific problem resolution examples aren't available in current documentation, limiting assessment of complex issue handling capabilities.

Multilingual support is indicated though specific supported languages and native-speaker availability aren't detailed. This may impact service quality for non-English speaking traders, particularly during complex technical or account-related discussions.

Customer service hours and availability across different time zones aren't clearly specified. This could affect traders in certain geographic regions or those trading during specific market sessions. The overall support framework appears adequate for standard trading needs, though may require enhancement for traders requiring specialized assistance or premium service levels.

Trading Experience Analysis (Score: 7/10)

Platform stability and execution speed receive generally positive user feedback. Both MetaTrader 4 and MetaTrader 5 platforms demonstrate reliable performance during normal market conditions. The NDD execution model theoretically reduces conflicts of interest and provides more transparent pricing, though specific execution statistics and slippage data aren't published in available materials.

Order execution quality appears satisfactory based on user reports. However, detailed analysis of requotes, slippage patterns, and execution speeds during volatile market conditions isn't available in current documentation. The variable spread structure provides competitive pricing during liquid market conditions, though spread behavior during news events and market gaps requires verification through direct trading experience.

Both trading platforms offer comprehensive functionality including advanced charting, technical analysis tools, and automated trading capabilities. Mobile trading applications provide essential functionality for position monitoring and basic trade execution, though specific mobile platform features and performance metrics aren't detailed in available reviews.

This comprehensive gkfx prime review indicates that while the trading environment appears stable and functional, traders should conduct thorough testing through demo accounts. This helps verify execution quality and platform performance under their specific trading conditions and strategies.

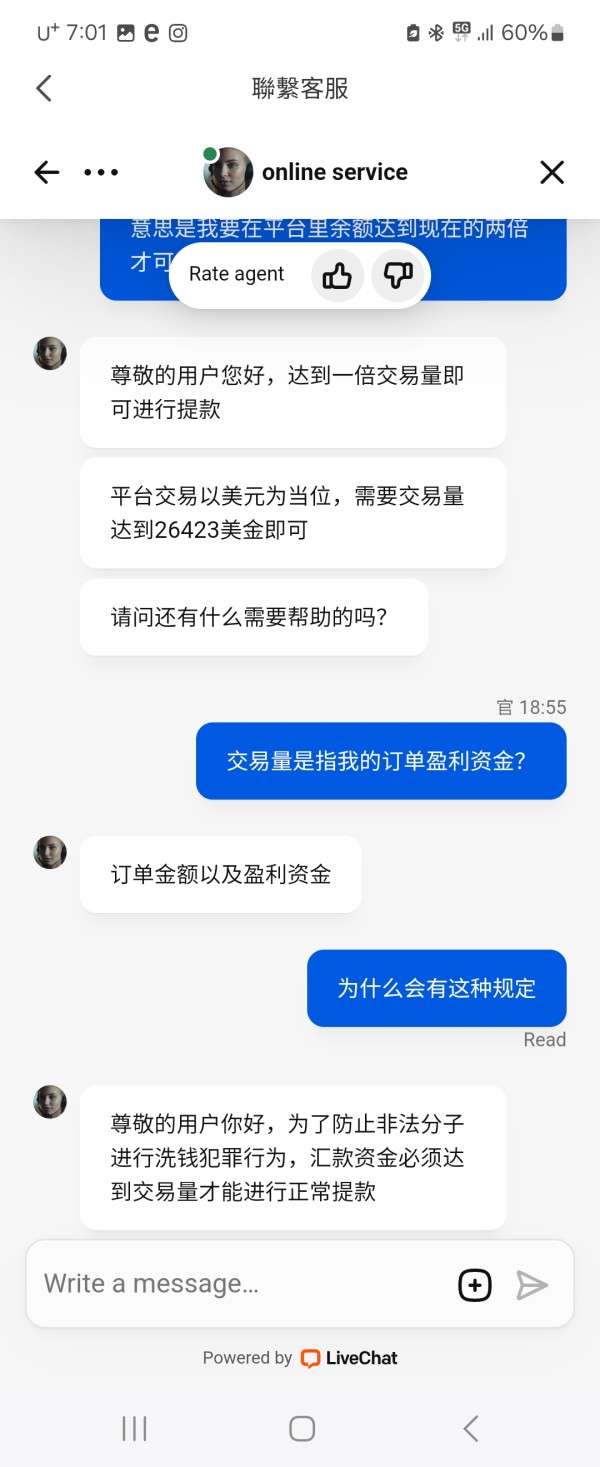

Trust and Reliability Analysis (Score: 6/10)

GKFX Prime operates under dual regulatory oversight from the British Virgin Islands Financial Services Commission (BVI FSC) and the Securities and Exchange Commission of Cyprus (SECC). While this provides regulatory framework coverage, specific license numbers and regulatory standing details aren't prominently displayed in available materials, which may impact transparency assessment.

The recent rebranding to Trive, as noted by FxScouts, introduces uncertainty regarding corporate continuity and regulatory status maintenance. This significant change may affect existing client relationships, regulatory protections, and service delivery consistency, requiring careful monitoring by current and prospective traders.

Specific fund security measures aren't detailed in available documentation. This includes segregated account arrangements, deposit insurance coverage, and audit procedures. This lack of transparency regarding client fund protection may concern security-conscious traders, particularly those managing larger account balances.

Company transparency regarding ownership structure, financial statements, and corporate governance is limited in publicly available materials. Industry reputation and recognition through awards or certifications aren't mentioned in current documentation, suggesting either limited industry recognition or minimal promotional emphasis on such achievements.

The overall trust profile presents mixed indicators. Regulatory coverage provides basic protection offset by transparency limitations and recent corporate changes requiring ongoing monitoring.

User Experience Analysis (Score: 8/10)

Overall user satisfaction appears positive based on available feedback. Traders appreciate the accessible account conditions and straightforward platform implementation. The low minimum deposit requirement and flexible cost structure create positive initial impressions for new clients, while experienced traders value the comprehensive asset access and familiar MetaTrader platforms.

Interface design and usability receive favorable comments. Both MetaTrader platforms provide intuitive navigation and comprehensive functionality. Account registration and verification processes appear streamlined, though specific timeframes and document requirements aren't detailed in current materials.

Funding and withdrawal experiences aren't extensively documented in available user feedback. This limits assessment of transaction processing efficiency and reliability. Common user complaints or recurring issues aren't prominently featured in available reviews, suggesting either limited negative feedback or insufficient user response data.

The broker appears well-suited for small to medium-sized traders seeking multi-asset exposure through familiar platforms. It particularly appeals to those prioritizing low entry barriers and cost-effective trading conditions. However, traders requiring premium services, extensive research resources, or specialized support may need to evaluate whether the current offering meets their specific requirements.

User profile analysis suggests optimal fit for beginning to intermediate traders exploring diverse markets. It also works well for cost-conscious traders prioritizing low fees, and strategy developers requiring flexible testing environments.

Conclusion

This final gkfx prime review assessment positions the broker as a competent mid-tier option for traders prioritizing accessibility and cost-effectiveness over premium services. GKFX Prime's strength lies in its exceptionally low entry barriers, competitive cost structure, and comprehensive asset access through industry-standard platforms. The dual regulatory framework provides basic protection, though recent corporate changes introduce some uncertainty requiring ongoing monitoring.

The broker appears most suitable for new traders seeking affordable market entry, small to medium-sized traders requiring multi-asset exposure, and cost-conscious participants prioritizing low fees over premium research and support services. However, traders requiring extensive educational resources, premium customer service, or specialized trading tools may need to consider alternative platforms.

Primary advantages include the industry-leading $1 minimum deposit, competitive commission structure starting from $0, comprehensive asset selection across multiple markets, and familiar MetaTrader platform implementation. Key limitations involve limited transparency regarding fund security measures, recent corporate restructuring creating uncertainty, and apparently limited educational and research resources compared to full-service competitors.