Regarding the legitimacy of IKON forex brokers, it provides FCA and WikiBit, (also has a graphic survey regarding security).

Is IKON safe?

Business

License

Is IKON markets regulated?

The regulatory license is the strongest proof.

FCA Inst Forex Execution (STP)

Financial Conduct Authority

Financial Conduct Authority

Current Status:

UnsubscribedLicense Type:

Inst Forex Execution (STP)

Licensed Entity:

IKON Finance Limited

Effective Date:

2011-04-01Email Address of Licensed Institution:

info@ikonfinance.comSharing Status:

No SharingWebsite of Licensed Institution:

www.ikonfinance.comExpiration Time:

2023-04-25Address of Licensed Institution:

20-22 Wenlock Road London N1 7GUN 1 7 G U UNITED KINGDOMPhone Number of Licensed Institution:

44 02033840750Licensed Institution Certified Documents:

Is Ikon Safe or a Scam?

Introduction

In the dynamic world of forex trading, choosing the right broker is crucial for success. One such broker is Ikon, which positions itself as a provider of trading services across various financial instruments, including forex and CFDs. However, with numerous reports and reviews circulating online, potential traders often find themselves questioning: Is Ikon safe? This article aims to provide a comprehensive analysis of Ikon, evaluating its legitimacy, regulatory standing, trading conditions, and overall safety for traders.

To ensure an objective assessment, we utilized a mixed-method approach, combining qualitative analysis of user experiences with quantitative data from regulatory bodies and financial reviews. By examining various aspects of Ikon, we hope to clarify whether this broker is a trustworthy option or if caution is warranted.

Regulation and Legitimacy

The regulatory status of a broker is a significant factor in determining its credibility. Regulations are designed to protect traders and ensure that brokers adhere to strict operational standards. In the case of Ikon, the broker claims to be regulated by the Financial Conduct Authority (FCA) in the UK. However, as we delve deeper, discrepancies in its licensing status come to light.

| Regulatory Authority | License Number | Regulated Area | Verification Status |

|---|---|---|---|

| FCA | 525113 | UK | Not Active |

While Ikon was initially authorized by the FCA, it appears that its license is currently inactive. This raises serious concerns about the safety of trading with Ikon, as unregulated brokers are not held accountable to the same standards as their regulated counterparts. The lack of a valid license means that traders may not have access to investor protection schemes, which are crucial in case of broker insolvency or disputes.

Furthermore, historical compliance issues have been noted, with various regulatory bodies warning against unlicensed operations associated with Ikon. This lack of regulatory oversight leads to significant risks for traders, making it imperative to ask: Is Ikon safe? The answer leans towards caution, as trading with an unregulated broker exposes clients to potential scams and unfair trading practices.

Company Background Investigation

Ikon has a history that dates back to its establishment in 1999, initially operating as a futures commission merchant in New York before relocating to the UK. Despite its long-standing presence in the market, the broker's ownership structure and management team remain somewhat opaque. There is limited information available regarding its leadership and their professional backgrounds, which can be a red flag for potential investors.

Transparency is essential in the financial services industry, and Ikon's lack of clear information about its management team raises questions about its operational integrity. A reputable broker typically provides detailed information about its executives, including their qualifications and experience in the financial markets. Without this information, traders may find it challenging to assess the broker's reliability and commitment to ethical practices.

Moreover, Ikon's communication regarding its operations and regulatory compliance is often vague, which further complicates the assessment of its transparency. When evaluating whether Ikon is safe, potential traders should consider the company's willingness to disclose relevant operational details. A lack of transparency can indicate underlying issues that may jeopardize client funds and trust.

Trading Conditions Analysis

When evaluating a broker, understanding its trading conditions is crucial. Ikon offers various account types, each with different deposit requirements and trading costs. However, concerns arise regarding the overall fee structure and any unusual policies that could impact traders' profitability.

| Fee Type | Ikon | Industry Average |

|---|---|---|

| Spread for Major Pairs | 1.3 pips | 1.0 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | Varies | Varies |

Ikon's spreads for major currency pairs are slightly above the industry average, which could affect trading profitability, especially for high-frequency traders. Additionally, the absence of a clear commission structure raises questions about hidden fees or unfavorable terms that could be applied to trades. Traders should be wary of brokers that do not transparently disclose their fee models, as this could lead to unexpected costs.

Moreover, the overnight interest rates (swap rates) are not clearly defined on Ikon's platform, making it challenging for traders to understand their potential costs associated with holding positions overnight. This lack of clarity can lead to confusion and financial losses, further emphasizing the need for caution when considering whether Ikon is safe for trading.

Client Funds Security

The safety of client funds is paramount when assessing a broker's reliability. Ikon claims to implement various measures to protect clients' investments, including segregated accounts and investor protection schemes. However, the effectiveness of these measures is questionable given the broker's regulatory status.

Traders must understand that funds held in segregated accounts are protected from the broker's operational expenses, ensuring that client funds are safeguarded in the event of insolvency. However, without a valid regulatory license, there is no guarantee that Ikon adheres to these practices.

Additionally, the absence of a negative balance protection policy poses further risks for traders. Negative balance protection ensures that clients cannot lose more money than they have deposited, providing an essential layer of security in volatile markets. Without this protection, traders face the risk of significant financial losses, raising further doubts about whether Ikon is safe for trading.

Customer Experience and Complaints

Analyzing customer feedback is crucial in understanding a broker's reputation and the quality of its services. Reviews of Ikon reveal a mixed bag of experiences, with numerous complaints regarding withdrawal issues and poor customer support.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow/Unresponsive |

| Poor Customer Support | Medium | Limited Availability |

| Account Management Issues | High | Inconsistent Feedback |

Common complaints include difficulties in withdrawing funds, with many users reporting that their requests were either delayed or ignored. Such issues are serious red flags for any broker, as they indicate potential financial instability or operational mismanagement.

One typical case involved a trader who reported that after submitting a withdrawal request, they received no response for weeks, leading to frustration and financial strain. This pattern of complaints raises significant concerns about Ikon's operational integrity, further questioning whether Ikon is safe for traders.

Platforms and Trade Execution

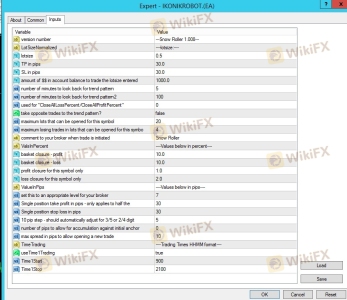

The quality of a broker's trading platform is a critical factor in the overall trading experience. Ikon offers the widely recognized MetaTrader 4 (MT4) platform, which is known for its robust features and user-friendly interface. However, user reviews indicate mixed experiences regarding platform stability and execution quality.

Many traders have reported instances of slippage and rejected orders, which can significantly impact trading outcomes. A broker's ability to execute trades promptly and accurately is vital, especially in fast-moving markets. If traders frequently encounter execution issues, it can lead to financial losses and frustration.

Moreover, there are concerns about the potential for platform manipulation, which can occur if a broker has control over the trading environment. Such practices are often associated with unregulated brokers, further emphasizing the need to question whether Ikon is safe for trading.

Risk Assessment

Engaging with any broker carries inherent risks, and Ikon is no exception. A thorough risk assessment reveals several areas of concern that traders should consider before proceeding.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated status poses significant risks. |

| Financial Risk | High | Withdrawal issues and lack of transparency can lead to losses. |

| Operational Risk | Medium | Mixed reviews on platform performance and execution. |

To mitigate these risks, potential traders should conduct thorough due diligence, including research on Ikon's regulatory status, customer experiences, and overall market reputation. It is advisable to start with a small investment or a demo account to assess the broker's services without significant exposure to risk.

Conclusion and Recommendations

In conclusion, the evidence suggests that Ikon may not be a safe choice for forex trading. The broker's unregulated status, coupled with numerous complaints regarding withdrawal issues and poor customer support, raises significant red flags.

For traders seeking a reliable and secure trading environment, it is advisable to consider alternative brokers that are fully regulated and have a proven track record of ethical practices. Some recommended alternatives include brokers regulated by reputable authorities such as the FCA or ASIC, which provide comprehensive investor protection and transparent trading conditions.

Ultimately, potential traders must exercise caution and conduct thorough research before choosing to engage with Ikon. The risks associated with trading with an unregulated broker can far outweigh any potential benefits, making it crucial to prioritize safety and security in the trading journey.

Is IKON a scam, or is it legit?

The latest exposure and evaluation content of IKON brokers.

IKON Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

IKON latest industry rating score is 1.59, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.59 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.