Warren Bowie & Smith 2025 Review: Everything You Need to Know

Executive Summary

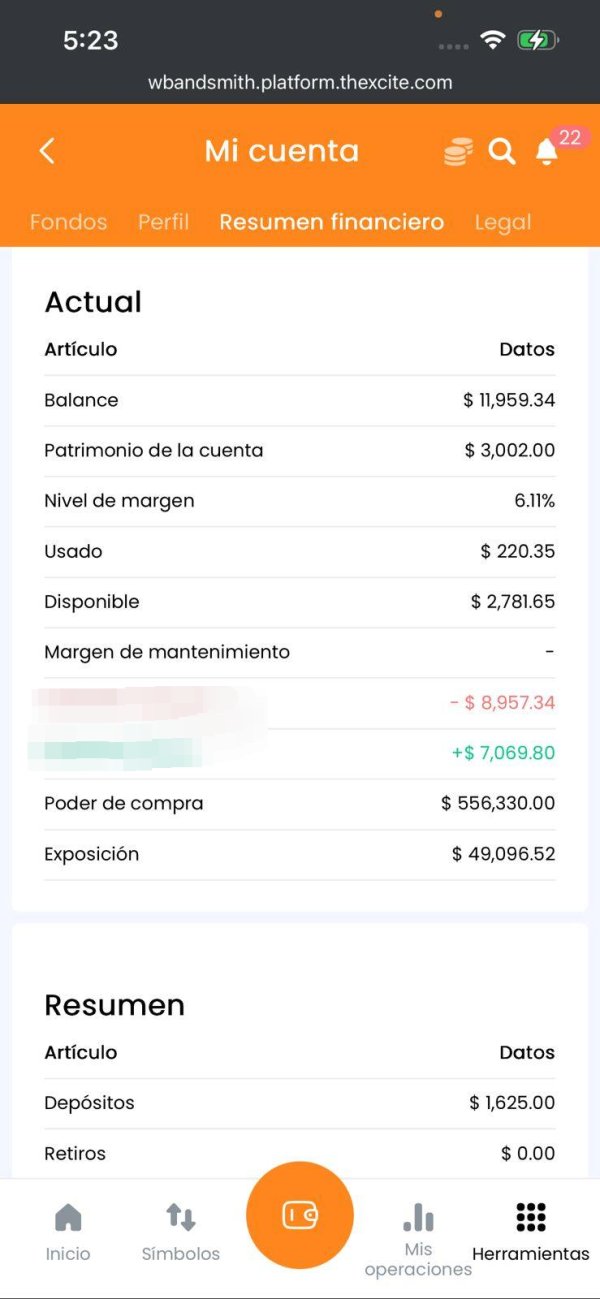

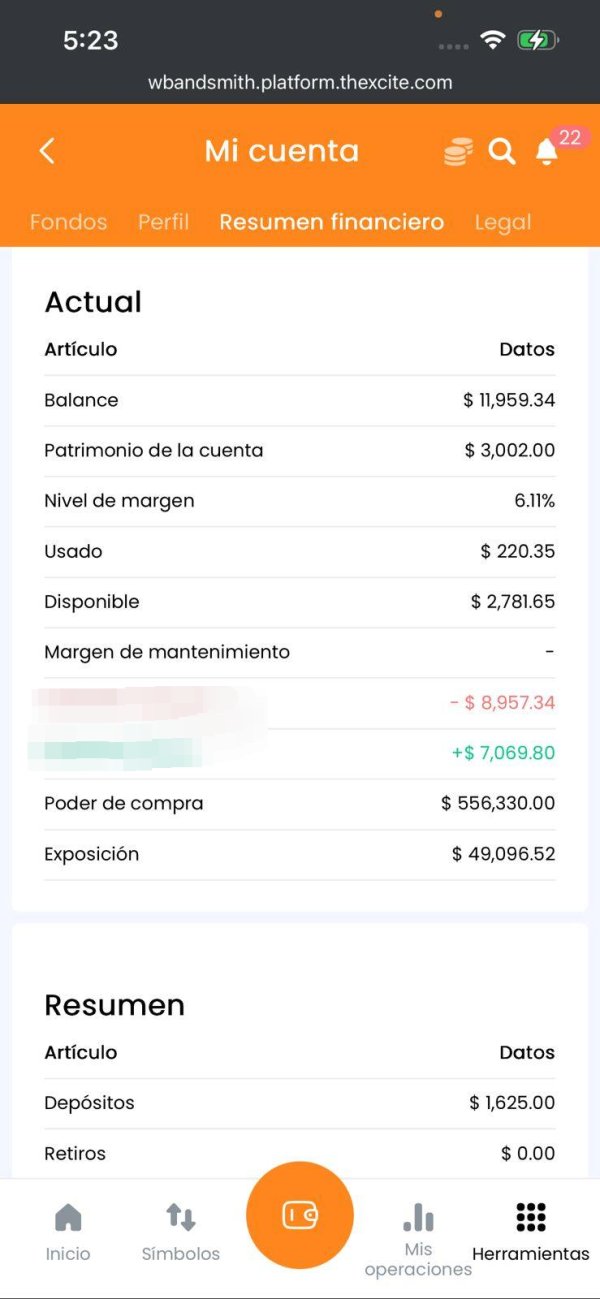

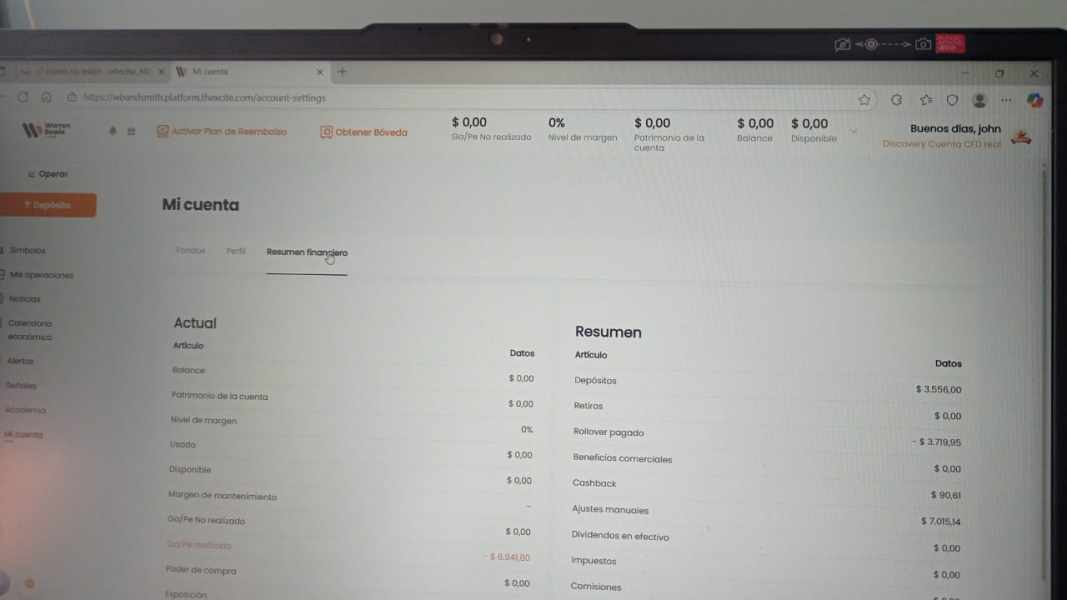

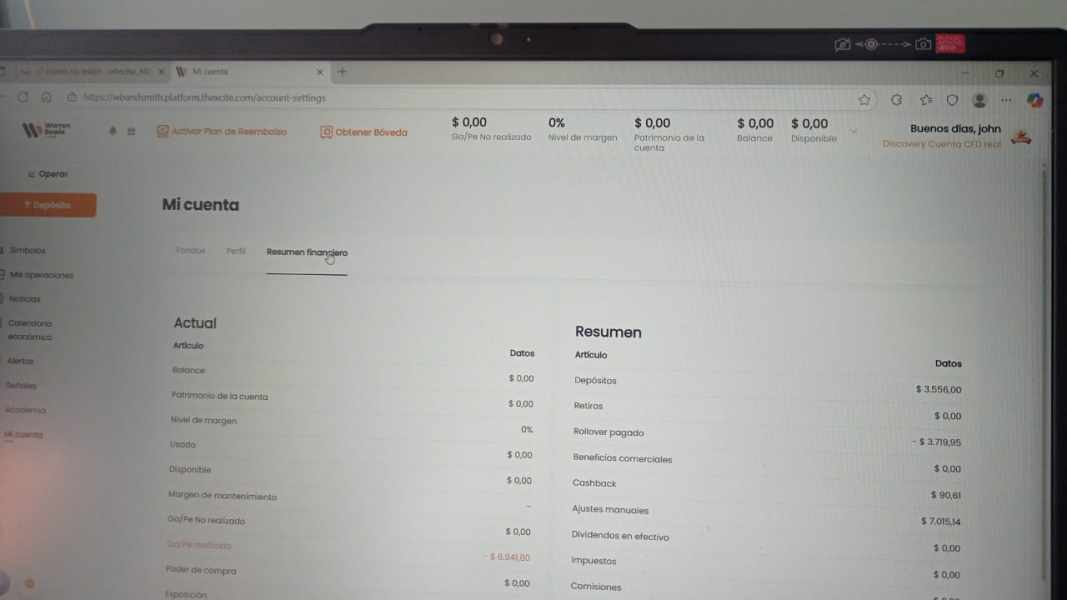

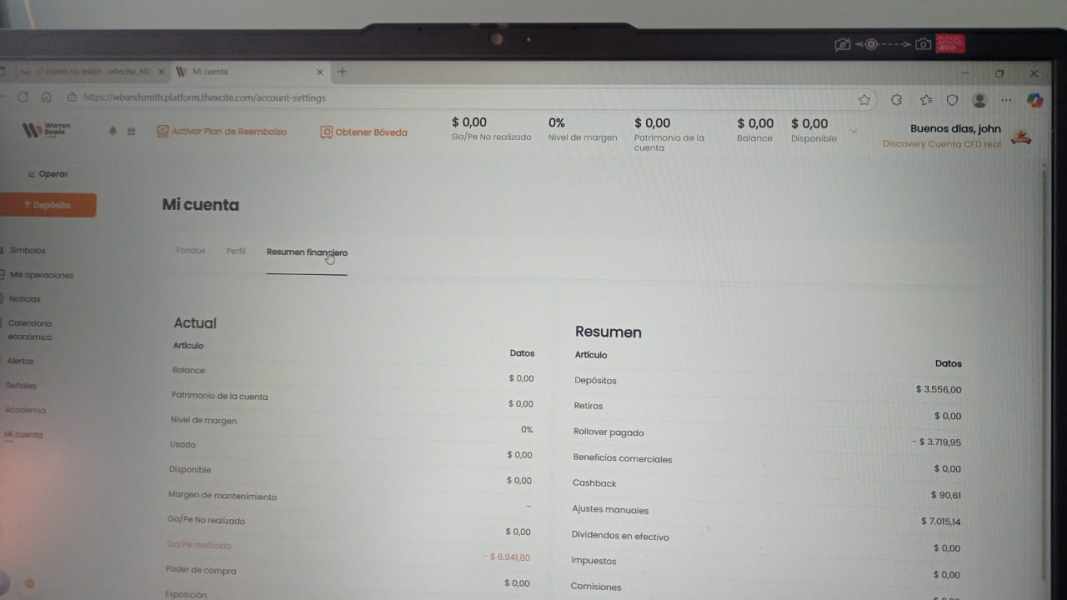

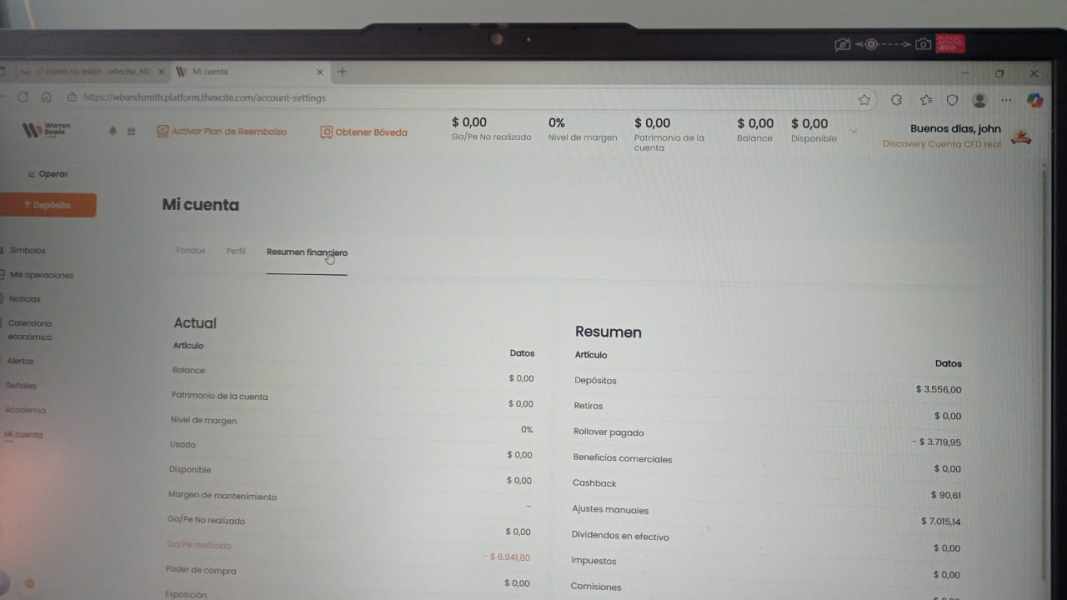

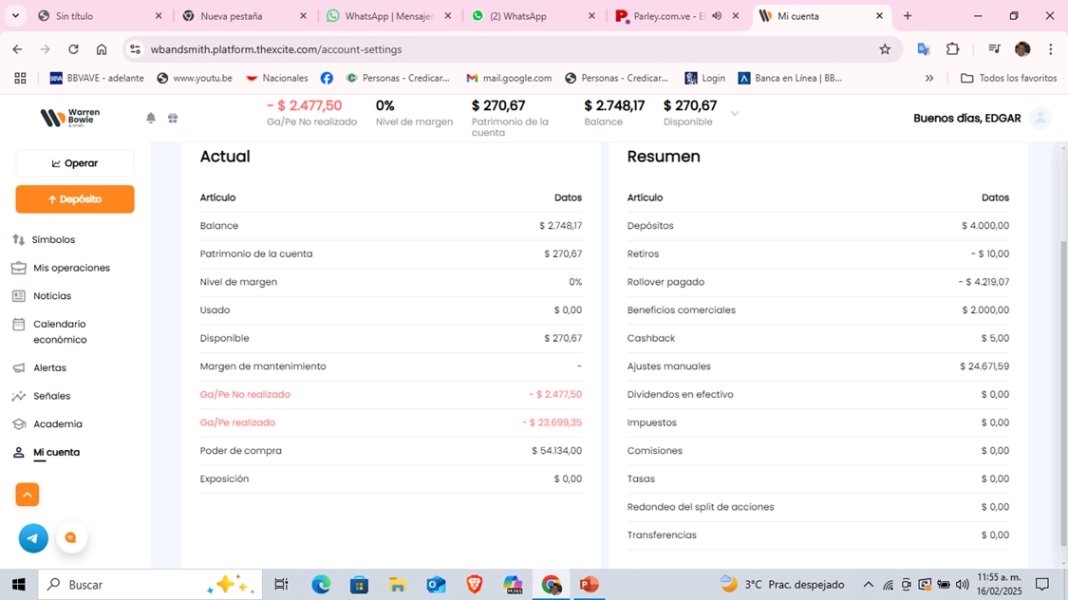

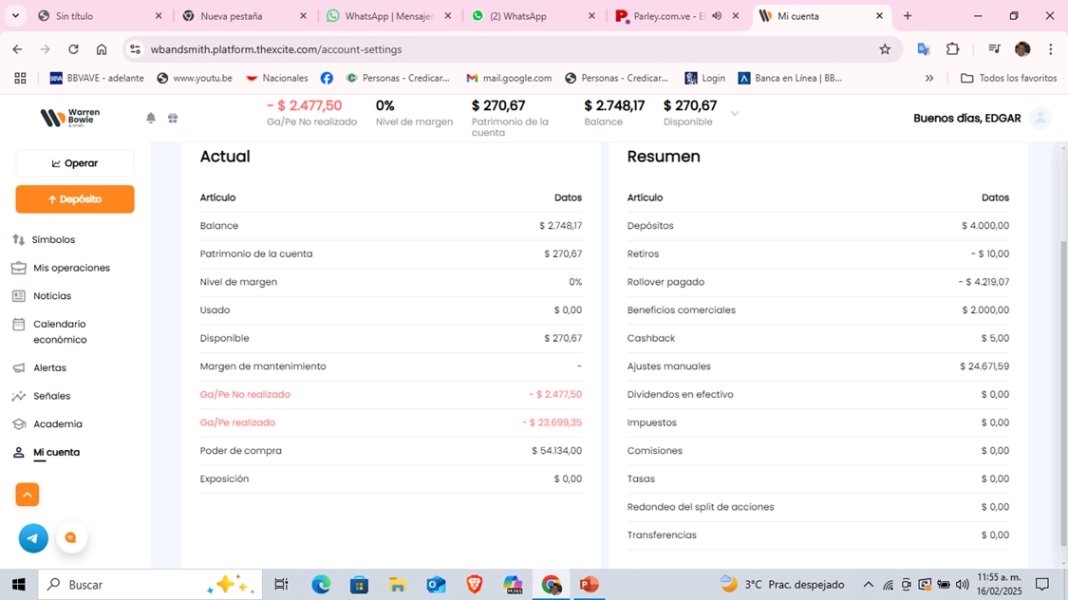

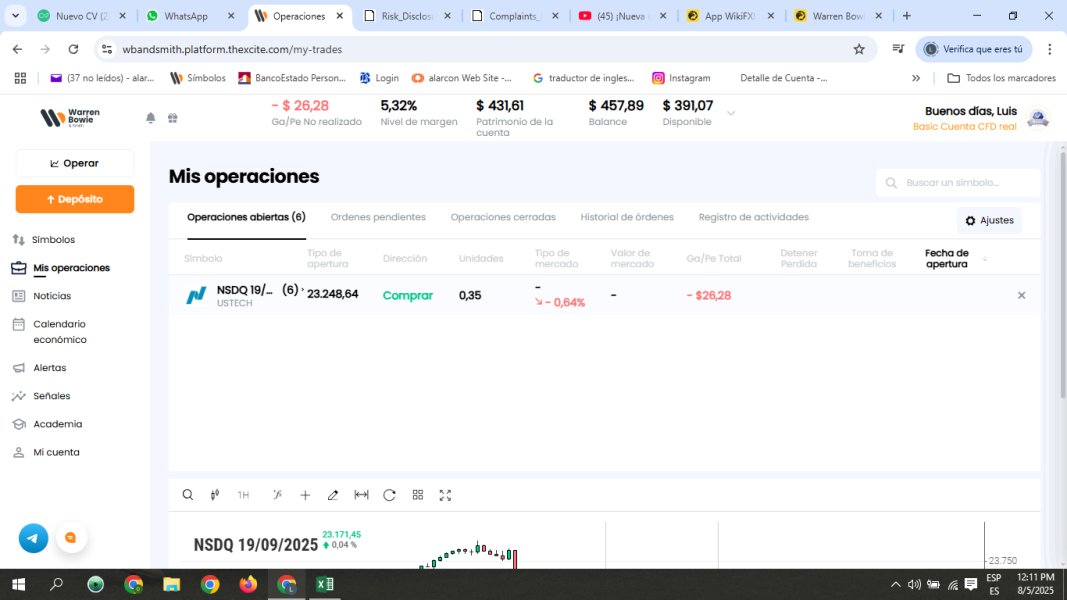

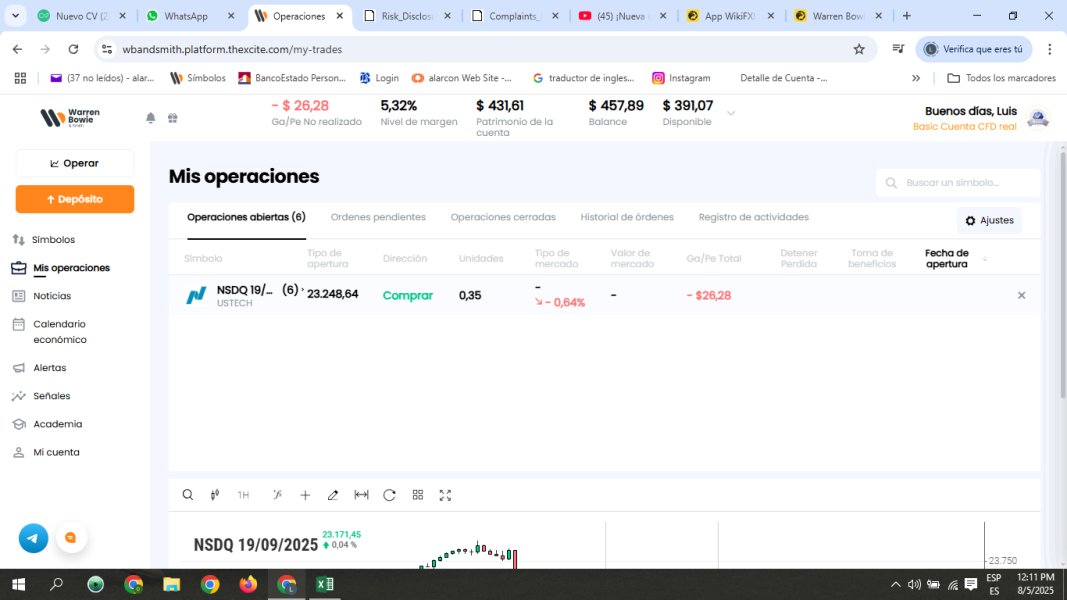

Warren Bowie & Smith is an unregulated online forex broker. It was established in 2020 and primarily offers trading services in forex, CFDs, stocks, cryptocurrencies, and commodities. According to available information, this warren bowie & smith review reveals that the broker claims to be operated by multiple companies and allegedly authorized by the Mauritius Financial Services Commission. However, users have raised questions about its legitimacy.

The broker targets retail traders seeking to engage in multi-asset trading through their Mobile Xcite and Xcite trading platforms. While some user feedback indicates satisfaction with transparent fees and withdrawal processes, the unregulated status and legitimacy concerns significantly impact the overall assessment. The company's business model spans multiple jurisdictions. This may expose users to varying regulatory protections depending on their location.

This comprehensive evaluation examines six key dimensions of the broker's services. It provides traders with essential information to make informed decisions about their trading partnership with Warren Bowie & Smith.

Important Disclaimer

Warren Bowie & Smith operates through a multi-regional entity structure. This means users in different geographical areas may encounter varying regulatory policies and protection measures. The regulatory landscape for this broker remains complex, with claims of Mauritius Financial Services Commission authorization requiring careful verification.

This review is based on publicly available information and user feedback collected from various sources. It should not be construed as investment advice. Potential traders should conduct their own due diligence and consider their risk tolerance before engaging with any trading platform. This is particularly important for those with unclear regulatory status.

Rating Framework

Overall Rating: 5.8/10

The scoring reflects limited information availability regarding specific trading conditions. It also shows concerning gaps in regulatory transparency that affect overall trustworthiness.

Broker Overview

Warren Bowie & Smith emerged in the online trading landscape in 2020. It positions itself as a multi-asset broker catering to retail traders worldwide. The company claims registration in Mauritius and operates through what appears to be a network of related entities across different jurisdictions. This warren bowie & smith review indicates that the broker focuses on providing access to diverse financial markets including foreign exchange, contracts for difference, equity markets, digital currencies, and commodity trading.

The broker's business model centers on offering comprehensive trading solutions through proprietary platforms. These include the Mobile Xcite and standard Xcite trading environments specifically. According to available information, Warren Bowie & Smith attempts to differentiate itself through claims of transparent fee structures and streamlined withdrawal processes. However, detailed verification of these claims requires careful examination of actual user experiences and regulatory compliance.

The company's target demographic includes both novice and experienced traders seeking exposure to multiple asset classes through a single trading platform. However, the broker's regulatory status remains a significant concern, with claims of authorization from the Mauritius Financial Services Commission requiring independent verification. This regulatory uncertainty forms a crucial consideration for potential clients evaluating the safety and legitimacy of their trading capital.

Regulatory Jurisdiction

Warren Bowie & Smith claims authorization from the Mauritius Financial Services Commission. However, the broker maintains an overall unregulated status according to multiple sources. This regulatory ambiguity creates uncertainty regarding client protection measures and operational oversight.

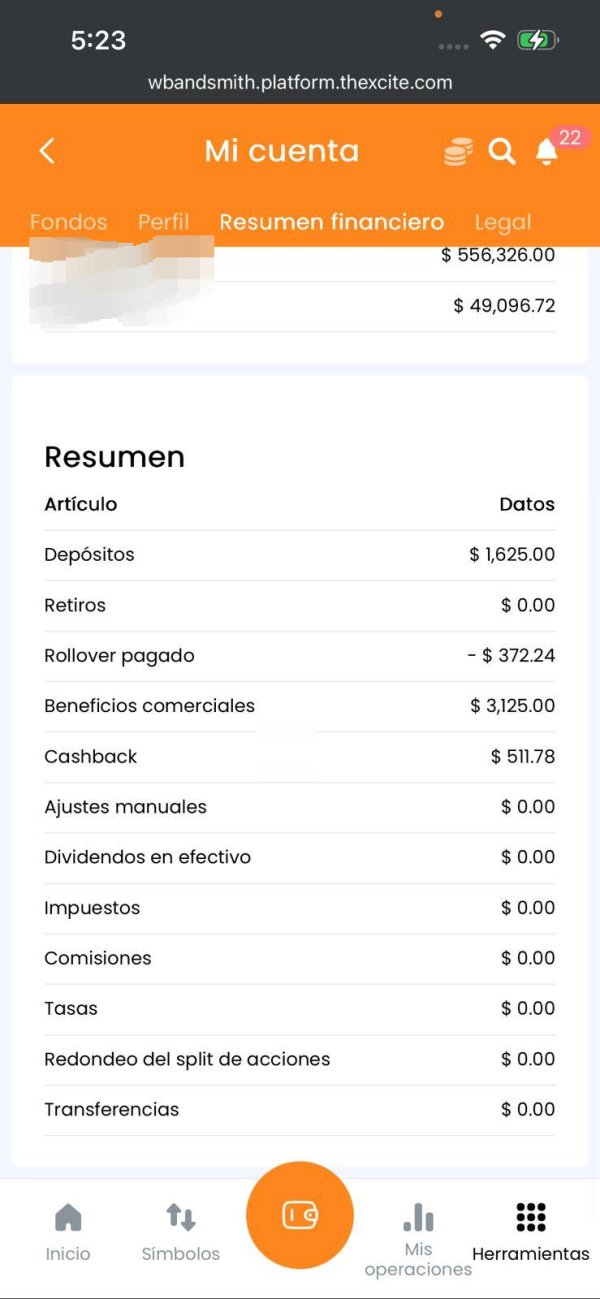

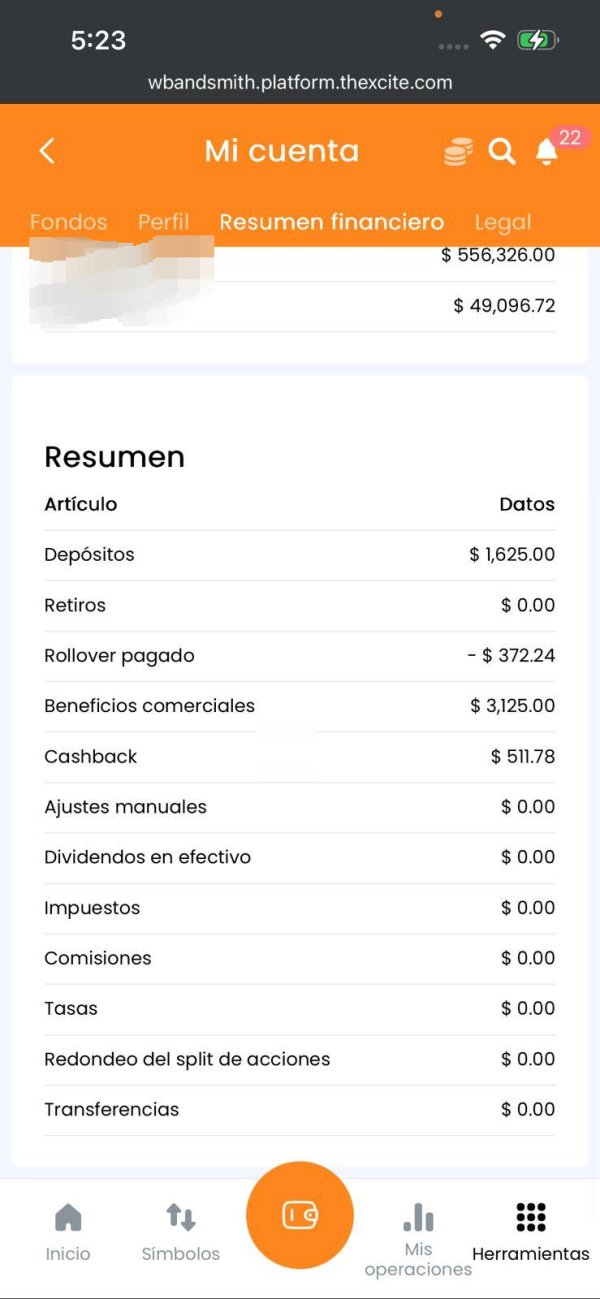

Deposit and Withdrawal Methods

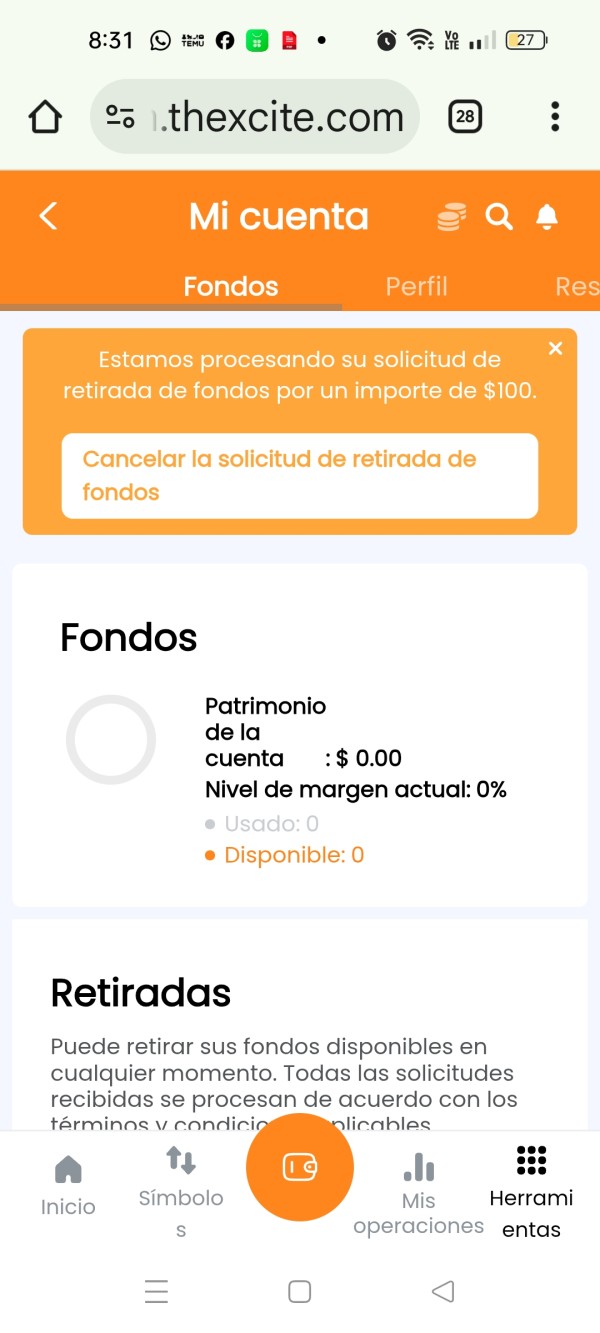

Specific information regarding deposit and withdrawal methods was not detailed in available materials. However, user feedback suggests satisfaction with withdrawal processes when successfully completed.

Minimum Deposit Requirements

The exact minimum deposit requirements are not specified in the available information. This represents a significant information gap for potential clients.

Details regarding bonus programs and promotional activities are not mentioned in the source materials. This suggests either limited offerings or inadequate disclosure.

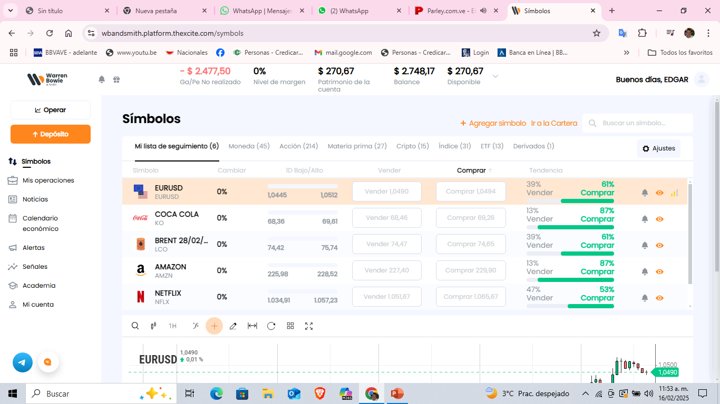

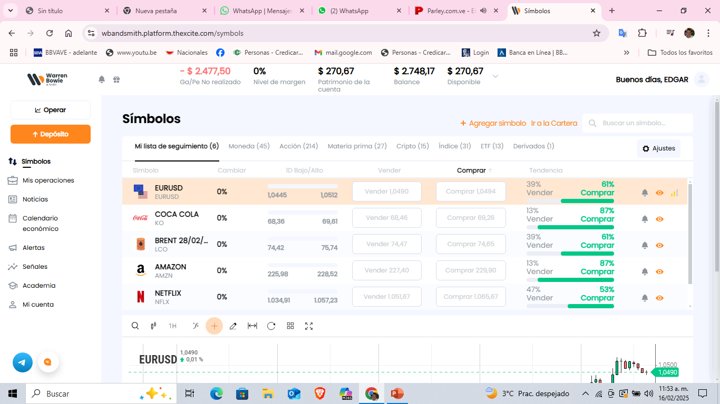

Tradeable Assets

The broker provides access to forex pairs, CFDs, stocks, cryptocurrencies, and commodities. It offers a diverse range of trading opportunities across multiple asset classes.

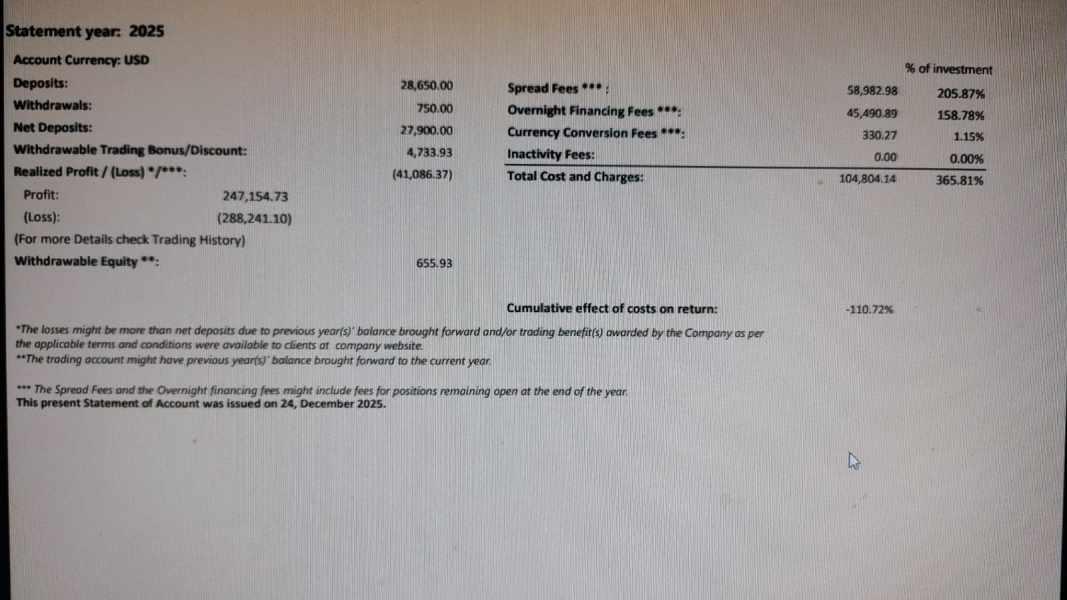

Cost Structure

Specific information about spreads and commission structures is not detailed in available sources. However, users have mentioned appreciation for transparent fee arrangements.

Leverage Ratios

Leverage ratio information is not specified in the available materials. This creates uncertainty about risk management parameters.

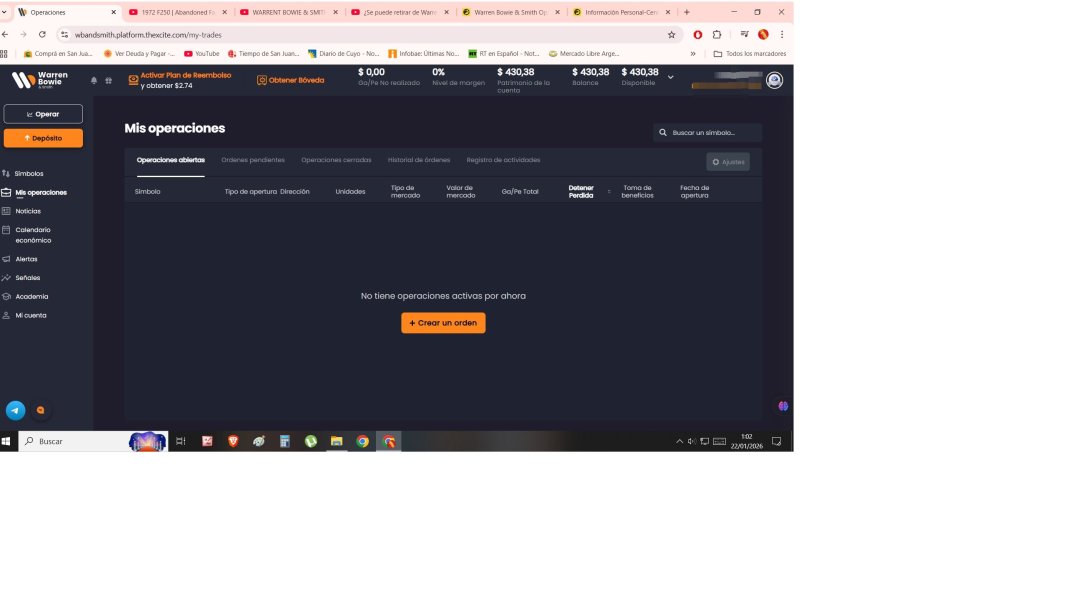

Warren Bowie & Smith offers two primary trading platforms. These include Mobile Xcite for mobile trading and the standard Xcite platform for desktop access.

Geographic Restrictions

Specific geographic restrictions are not detailed in the available information.

Customer Support Languages

The range of languages supported by customer service is not specified in source materials.

This warren bowie & smith review highlights significant information gaps that potential traders should consider when evaluating this broker.

Detailed Rating Analysis

Account Conditions Analysis (5/10)

The account conditions evaluation for Warren Bowie & Smith reveals substantial information gaps. These significantly impact the assessment. Available sources do not provide specific details about account types, their distinguishing features, or the requirements for different trading levels. This lack of transparency regarding account structures makes it difficult for potential traders to understand what options are available. It also makes it hard to see how they might align with individual trading needs.

The absence of clearly stated minimum deposit requirements represents a significant concern. Traders cannot adequately plan their initial investment or understand the financial commitment required. Without this fundamental information, it becomes challenging to assess whether the broker's account conditions are competitive within the industry. It's also hard to know if they're suitable for different trader segments.

User feedback regarding the account opening process is limited. However, some traders have mentioned that getting started with Warren Bowie & Smith was relatively straightforward. The lack of detailed information about special account features, such as Islamic accounts for Muslim traders or professional trading accounts with enhanced conditions, further diminishes the overall account conditions rating.

This warren bowie & smith review emphasizes that the broker needs to provide more comprehensive and transparent information about its account offerings. This would improve trader confidence and enable informed decision-making.

Warren Bowie & Smith demonstrates reasonable strength in its tools and resources offering. This is primarily through the provision of two distinct trading platforms: Mobile Xcite and the standard Xcite platform. This dual-platform approach suggests recognition of diverse trader preferences. It accommodates both mobile-focused traders and those preferring traditional desktop environments.

The broker's multi-asset trading capability represents a significant resource advantage. It allows traders to access forex, CFDs, stocks, cryptocurrencies, and commodities through unified platforms. This diversification potential appeals to traders seeking portfolio variety without managing multiple broker relationships.

However, the evaluation is limited by insufficient information about research and analysis resources. Critical tools such as market analysis, economic calendars, news feeds, and technical analysis resources are not adequately documented in available sources. Similarly, educational resources including webinars, tutorials, trading guides, and market education materials are not clearly outlined.

The absence of information regarding automated trading support, expert advisors, or algorithmic trading capabilities represents another limitation. Modern traders increasingly expect sophisticated trading tools and analytical resources. The lack of clear information about these offerings impacts the overall assessment.

Despite these limitations, the multi-asset platform availability and apparent ease of use contribute positively to the tools and resources evaluation.

Customer Service and Support Analysis (6/10)

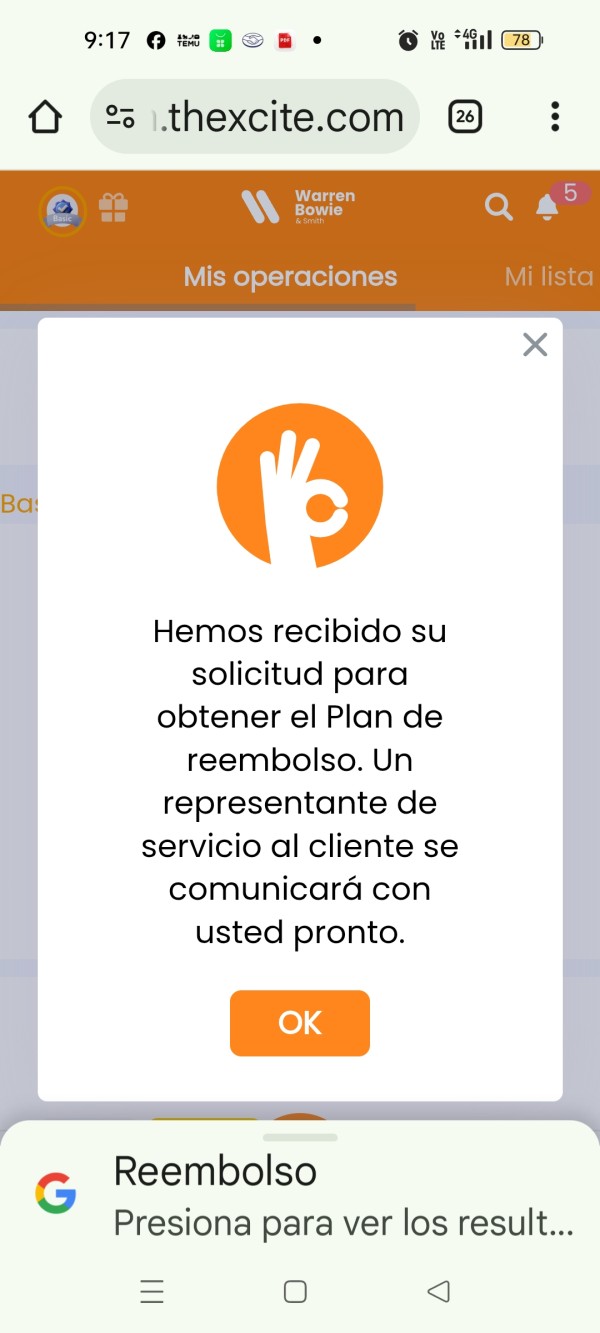

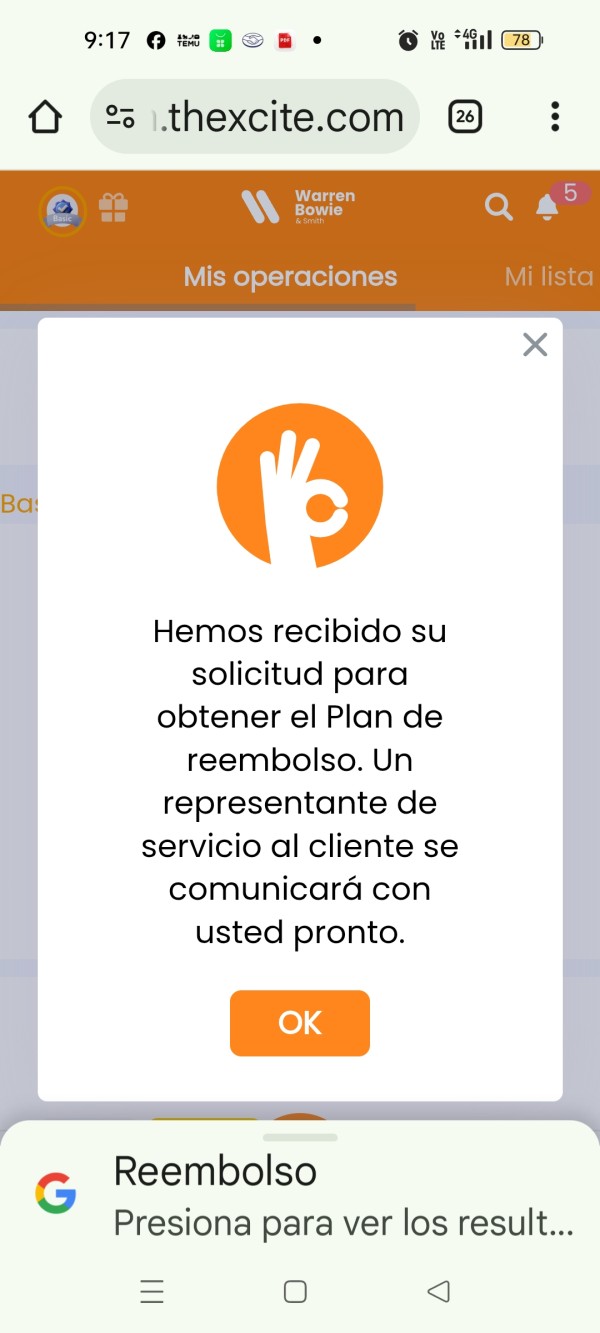

The customer service evaluation for Warren Bowie & Smith yields mixed results based on limited available feedback. User comments suggest positive experiences with certain aspects of customer support. This is particularly regarding the withdrawal process, with some traders expressing satisfaction with the assistance received during fund retrieval procedures.

However, critical information gaps significantly impact this assessment. The available sources do not specify the customer service channels offered, such as live chat, email support, phone assistance, or support ticket systems. This lack of clarity about contact methods creates uncertainty for potential clients who need to understand how they can access help when required.

Response time information is notably absent from available materials. This makes it impossible to assess the efficiency of customer support operations. In the fast-paced trading environment, prompt customer service response can be crucial for resolving urgent issues or technical problems that might affect trading activities.

The geographical coverage and language support capabilities of customer service remain unspecified. This could be particularly important for international traders. Similarly, information about customer service availability hours and whether support operates on a 24/7 basis is not detailed.

While some user feedback indicates positive experiences, the overall evaluation is constrained by insufficient information about service quality, accessibility, and comprehensive support capabilities.

Trading Experience Analysis (6/10)

The trading experience assessment for Warren Bowie & Smith faces significant limitations due to insufficient detailed user feedback and technical performance data. While the broker offers Mobile Xcite and standard Xcite platforms, specific information about platform stability, execution speed, and overall performance reliability is not adequately documented in available sources.

Order execution quality represents a critical component of trading experience. Yet details about slippage rates, requote frequency, and execution speed are not provided in the source materials. These factors directly impact trader profitability and satisfaction. Their absence is particularly concerning for this warren bowie & smith review.

The platform functionality completeness cannot be thoroughly evaluated without detailed feature descriptions. Essential trading features such as one-click trading, advanced order types, charting capabilities, and technical analysis tools are not specifically outlined. This limits the ability to assess the platform's sophistication and user-friendliness.

Mobile trading experience through the Mobile Xcite platform represents a potentially positive aspect. This is given the increasing importance of mobile trading accessibility. However, specific user feedback about mobile platform performance, feature parity with desktop versions, and overall mobile user experience is not detailed in available sources.

The multi-asset trading capability suggests a potentially rich trading environment. But without specific information about market depth, liquidity provision, and trading conditions across different asset classes, the overall trading experience evaluation remains constrained.

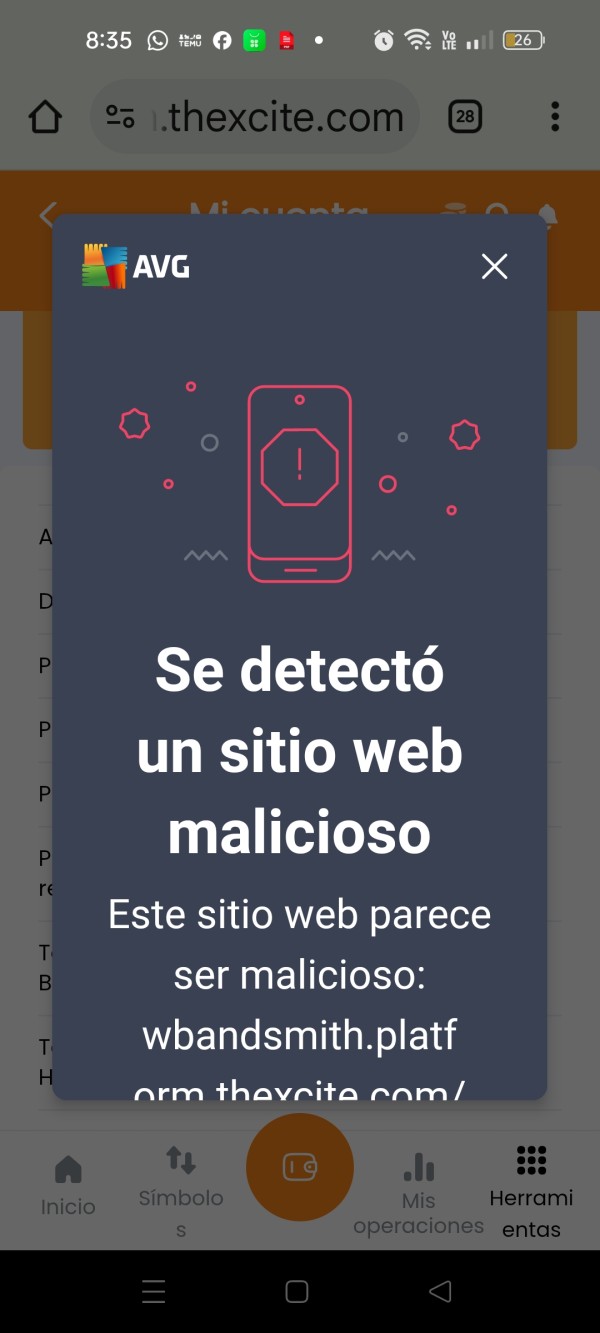

Trust and Reliability Analysis (4/10)

The trust and reliability assessment reveals significant concerns that substantially impact Warren Bowie & Smith's credibility. The broker's unregulated status represents the most critical issue. Regulatory oversight provides essential client protections and operational standards that appear to be lacking or inadequately verified.

While Warren Bowie & Smith claims authorization from the Mauritius Financial Services Commission, the overall characterization as an unregulated broker creates substantial uncertainty about the validity and scope of any regulatory oversight. This regulatory ambiguity directly impacts client fund security. It also affects recourse options in case of disputes or operational issues.

The absence of information about client fund protection measures, such as segregated accounts or deposit insurance schemes, further compounds trust concerns. Established brokers typically provide clear information about how client funds are protected and separated from operational capital. Yet such details are not available in the source materials.

Company transparency issues emerge from the limited availability of comprehensive business information, financial reporting, or management team details. User comments questioning the broker's legitimacy indicate that trust concerns extend beyond regulatory status to broader operational credibility.

The lack of verifiable industry recognition, awards, or third-party certifications that might bolster credibility represents another trust limitation. Established brokers often accumulate industry acknowledgments that serve as trust indicators. But such information is not evident for Warren Bowie & Smith.

User Experience Analysis (7/10)

User experience evaluation reveals some positive aspects despite information limitations. Available user feedback indicates satisfaction with specific operational elements. This is particularly regarding fee transparency and withdrawal processes. Traders have expressed appreciation for what they describe as transparent fee structures and hassle-free withdrawal procedures. This suggests that when the system works properly, user satisfaction can be achieved.

The multi-asset trading capability contributes positively to user experience by providing diversified trading opportunities through unified platforms. This approach appeals to traders seeking comprehensive market access without managing multiple broker relationships or platforms.

However, the assessment is constrained by insufficient information about interface design quality, navigation ease, and overall platform usability. Modern traders expect intuitive, well-designed interfaces that facilitate efficient trading activities. Yet detailed feedback about these aspects is not available.

Registration and verification process feedback is limited. However, some users have mentioned that getting started was relatively straightforward. Comprehensive information about account opening procedures, document requirements, and verification timelines is not detailed.

The target user profile appears to align with retail traders seeking multi-asset trading opportunities. However, the broker's suitability for different experience levels and trading styles requires more detailed evaluation. The combination of positive feedback regarding specific operational aspects and the availability of diverse trading options supports a moderately positive user experience rating. This is despite significant information gaps.

Conclusion

Warren Bowie & Smith presents a mixed proposition for potential traders. It offers multi-asset trading capabilities through dedicated platforms while facing significant challenges related to regulatory transparency and information disclosure. This comprehensive evaluation reveals a broker that may appeal to traders seeking diverse trading opportunities. However, it requires careful consideration of associated risks.

The broker's strengths include transparent fee structures and satisfactory withdrawal processes according to user feedback. These are combined with multi-asset trading access through Mobile Xcite and standard Xcite platforms. However, the unregulated status and substantial information gaps regarding account conditions, trading costs, and operational details create significant concerns for potential clients.

This broker may be suitable for experienced traders who prioritize asset diversity and can navigate regulatory uncertainties. However, novice traders or those seeking comprehensive regulatory protection should exercise considerable caution. They should consider alternative options with clearer regulatory standing and more transparent operational information.